Market Update: FED Delivers Rate Cut, Markets Price in More Easing

Yesterday we saw the FED deliver a 25bps rate cut as had expected. We’ll now dive into the nuances in yesterdays’ FED Meeting and what it means for markets, and our positioning going forward. Let's dive in...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- FED: 25bps cut; growth & inflation projections higher. Powell cautious, citing labour market risks.

- Markets: Choppy on Powell’s remarks; ended slightly higher on expectations of more cuts toward 3%.

- Risks: Stronger jobs/inflation data in Oct could derail cuts and trigger pullback.

- TradFi & Crypto: Broader equity participation (Russell 2000 > Mag 7); BTC dominance down, alts/memes gaining.

- Positioning: Base case “Goldilocks” backdrop; holding majors & memes, wary of deep pullbacks.

Topics covered:

- Breaking Down Yesterday's FED Meeting.

- What Could Invalidate the Macro Bull Case in the Short-Term?

- The Markets' Reaction.

- Cryptonary's Take.

Breaking Down Yesterday's FED Meeting:

In this section, we'll cover the key components of the Meeting and then we'll address some of Chair Powells' more notable comments and what this all suggests moving forward.Yesterday, the FED cut by 25bps whilst their Summary of Economic projections showed both growth and inflation increasing over the coming 12 months. Markets initially rallied on this even though the Dot Plot showed less cuts than what markets expected, but it showed more cuts than the prior Dot Plot from June. As we know, the rationale for cutting rates is due to the weakening labour market, which Powell emphasised in his comments several times saying; "new data suggests that there is meaningful downside risk to the labour market" and "our policy had been skewed toward inflation".

Interestingly, we had only 1 dissent, and that was from Governor Miran, who is "Trumps pick" and called for a 50bps cut. The fact there was only 1 dissent was interesting because, Bowman and Waller didn't dissent. Remember, both dissented at Julys' Meeting, calling for 25bps cut, but both suggested a 25bps cut at yesterday's Meeting rather than a 50bps cut.

Mostly, markets took the above as positive, although Powell gave off an uncertain and lacking in confidence kind of tone in the Press Conference. We saw this in a few of the statements:

- "we can look at this cut as a kind of insurance cut".

- "we're in a meeting-by-meeting situation".

- "there is no risk-free path" i.e., there's risk to lowering rates now and inflation upticking, and there's risk to not cutting and the labour market more meaningfully deteriorates.

Markets were whip-sawed throughout the rate decision and the Press Conference, but they ultimately ended up slightly higher following the Press Conference on the expectation that further rate cuts are coming as the FED moves the rate towards neutral (3.00%), growth remains positive, and the FED expect inflation to come down over the long-term. We expect this "Goldilocks" environment to result in risk assets continuing their grind higher.

What Could Invalidate the Macro Bull Case in the Short-Term?

What's notable to us is Powell's lack of confidence in the forward guidance and his (and the FED's) continued "data dependence" stance. Should we see the jobs and inflation data (in early and mid-October) come in showing stronger jobs and higher inflation, this may lead the FED to skip a rate cut at the late-October FED Meeting. We would expect markets to pull back upon this should it happen. The way this would happen would likely be the market beginning to price out an October cut (should the jobs and inflation data both come in higher than expected), and then FED speak in the lead up to the Meeting begin to suggest a no cut in October's Meeting.This is something we'll continue to monitor, and we'll be willing to adjust our positioning should we begin to see the pricing moving in that direction.

For now, though, our base case is that we see consecutive Interest Rate cuts into year-end, so rate cuts at the October and December Meetings.

The Markets' Reaction:

In terms of the markets' reaction, we have some significant divergences. In TradFi, we have the US2Y Yield up 7bps since yesterday's opening, but we have the Nasdaq pushing up to new highs, all while the S&P remains flat. It's notable also that the Russell 2000 broke out to the upside, and the 493 stocks (that make up the S&P500) outperformed the 'Mag 7'. This suggests to us that markets are choosing to run with the positive rate cuts narrative, even though to us, the thesis of consecutive cuts is fragile, and will need to be supported by the incoming data.S&P500 1D Chart:

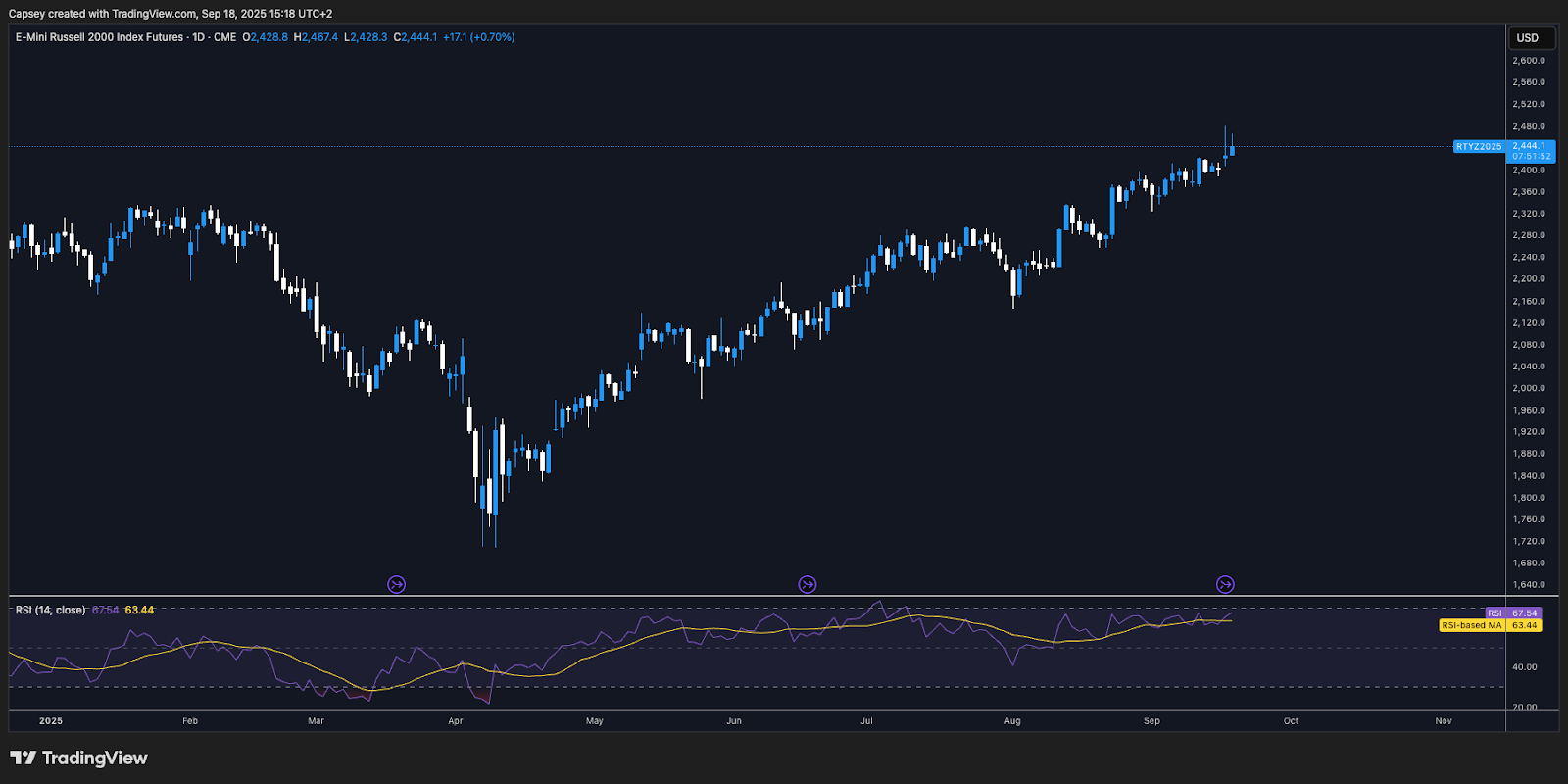

Russell 2000 1D Chart:

The Russell 2000 outperforming the weighted S&P suggests a broadening out in the market, which is a signal that for now, the market is pricing in positive rate cuts - a reduction in the rate towards neutral, rather than cutting rates because something has broken.

If we now turn to Crypto, we can see that a similar type of broadening out is also occurring. Bitcoin Dominance is generally down trending, whilst TOTAL3 has broken out to the upside.

BTC.D 1D Chart:

TOTAL3 1D Chart:

The above suggests to us that we're seeing a broadening out in the Crypto space, meaning a capital rotation away from BTC and into other Majors, or even further out the risk curve.

We therefore want to be positioned for that, meaning that we remain in Spot positions of Majors and select memes. We expect, that if BTC can stay above the $115k-$117k support zone (it's currently $117,400), then this opens the door for a retest of $120k and then $123k. This would also provide a supportive environment for alts and memes to outperform in the coming weeks, particularly if we see BTC breakout to $120k and then consolidate there. But above $117k, we remain constructive on the market.

BTC:

Cryptonary's Take:

The FED Meeting delivered a 25bps cut and a Dot Plot that showed more cuts in the near future. Markets took this optimistically although somewhat cautiously as well over a FED Chair (Powell) that seemingly lacks conviction for the forward path of rates over the coming quarters. To us, this suggests a greater degree of data dependence over the coming months. Should we see the inflation data and the labour market come in stronger than expectations, this'll likely result in the market pricing out cuts, and risk assets pulling back upon this.Ultimately, markets are seeming to climb a wall of worry, which is fine for now, assuming the data continues to corroborate - inflation data remains contained, whilst the labour market data continues to weaken but without outright job losses.

Our base case is that markets can climb this wall of worry and therefore we expect the 'Goldilocks' environment to remain and to be supportive for risk assets. We therefore remain positioned in Majors and select memes. At this point in time, price pull back levels that we'd be interested in being buyers of, we'd also be sceptical to buy at. We're midway through a local rally and should prices pull back to what we consider attractive zones; we would also have to consider whether our bull case still stands should prices revisit these "attractive" zones.

These zones would look like:

- BTC: $108k-$110k

- ETH: $3,970-$4,340

- SOL: $200-$220

- HYPE: $49.00-$52.00

- AURA: $0.098-$0.116

Therefore, our stance is clear. We remain positioned in Majors and select memes, whilst we're also sat on a small amount of cash, but we're not looking to allocate it anytime soon. We're therefore comfortable leaving it on the side for now. Should we see prices pull back (to the zones mentioned above), we'll reassess our bull case and why prices have pulled back as significantly as that.

For now, we're positioned, and we expect more upside going into month-end.