Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

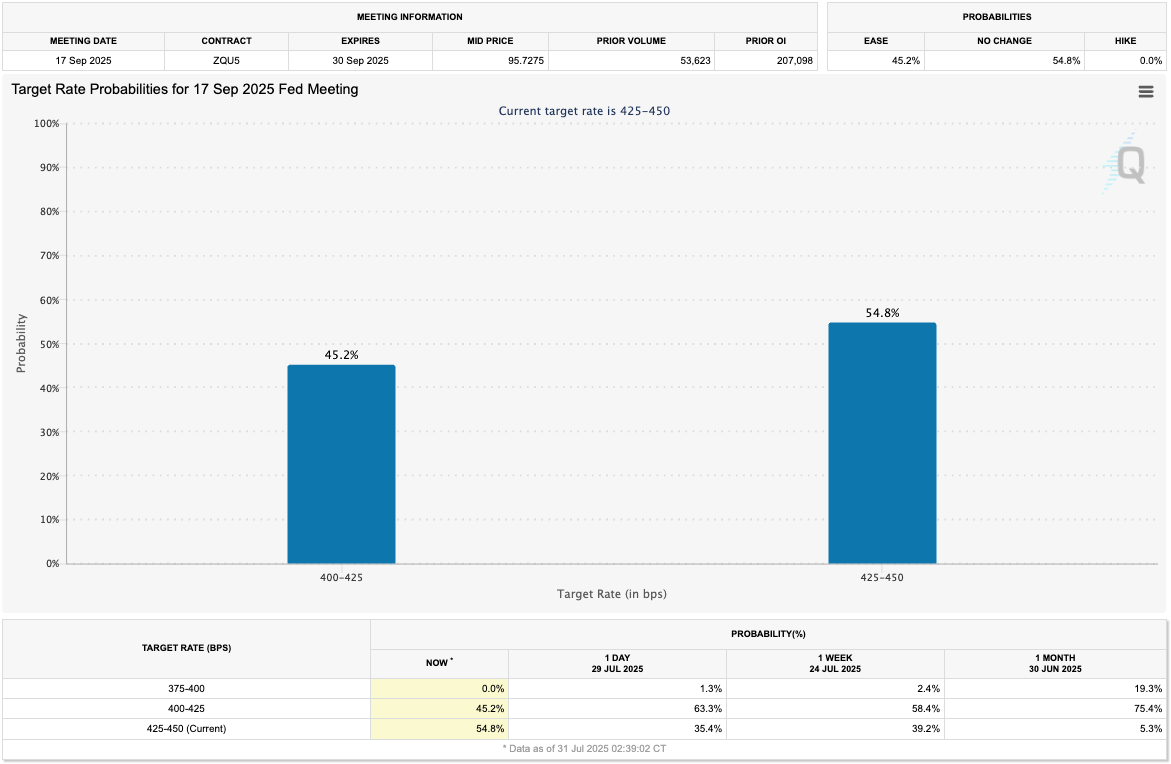

- FED holds at 4.5%; signals no cut soon; September cut odds drop to 45%.

- Meta & Microsoft beat; boost AI capex; Nasdaq rallies.

- Markets mixed: Big Tech up, small caps hit by rate outlook.

- Jobs data ahead may delay cuts, but 2025 and 2026 cuts still priced in.

- Outcome of the FED Meeting & the Markets' Reaction.

- Big Tech Earnings.

- Tomorrow's Labour Market Data.

- Cryptonary's Take.

As we and the market expected, the FED kept the Interest Rate at 4.5%, whilst we had two FED member’s dissent. This is somewhat notable, especially FED member Waller, who is seen as an excellent and very reputable economist, having a great track record at calling monetary policy correctly. So, it's notable that he dissented, and would have opted for cutting Interest Rates at yesterday's Meeting. But we should also take these dissents with a small 'pinch of salt', as some FED members may look to tilt more drastically dovishly in hope of looking to be a more credible to President Trump, for them to become next FED Chair.

However, the rest of the FED voted for to keep rates unchanged, whilst Powell also struck a more hawkish tone in the statement, and in answers to the journalists' questions. Below are a few examples of these hawkish comments:

- "inflation remains elevated and above target"

- "the labour market is near maximum employment"

- "by many statistics, the labour market is still in balance"

- "inflation expectations remain in line with their goal, but if they move too early, they risk inflation expectations moving higher"

- "the effects of tariffs might take more months - we're still a way away from seeing where things settle"

Following the Press Conference and Powell’s comments, the odds of an Interest Rate cut in September fell from 63.3% likelihood to now 45.2%. And should we see a strong labour market report this Friday, it's possible that we see that 45.2% figure drop further. The market is currently pricing for just 1.5 Interest Rate cuts in 2025 (so a 50/50 chance of an October cut, and a very strong likelihood of a December cut), but for more cuts to come in 2026.

However, it should be noted that between today and the September FED Meeting, we'll get two sets of inflation and labour market data. So, it's possible that we see the below odds go through more volatility over the coming 6 weeks.

Target Rate Probabilities for 17 Sept 2025 FED Meeting:

The Markets' Reaction:

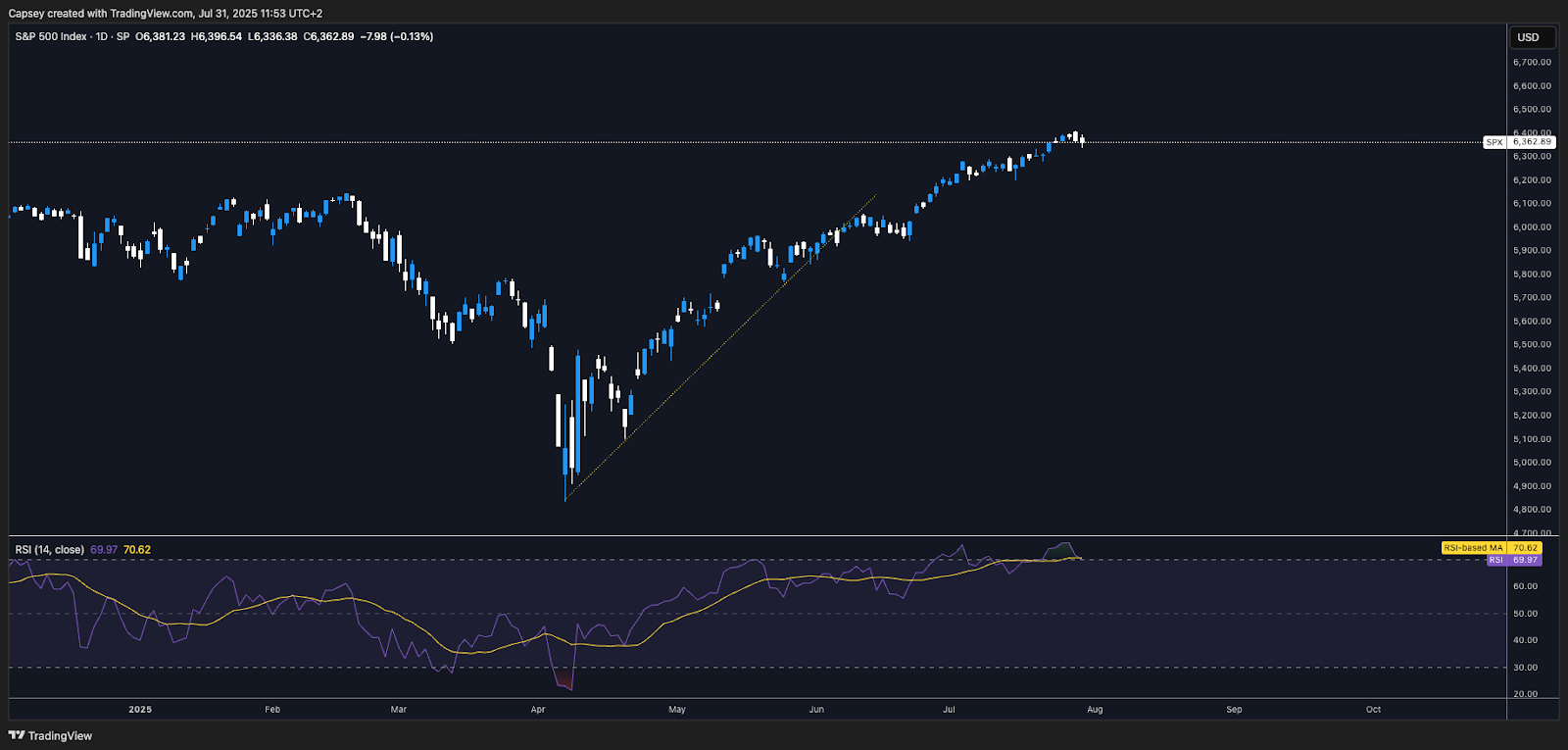

As the market priced out a September Interest Rate cut, we saw risk off in stocks, with the Dollar (DXY) and Bond Yields moving higher. The move in the Dollar, Yields and the S&P stuck, however, positive Earnings from some of the big tech companies late yesterday, saw the Nasdaq reverse back higher.

DXY 1D Chart:

US2Y Bond Yield 1D Chart:

S&P 1D Chart:

As a result, this also saw BTC recover the days' losses.

BTC 1D Chart:

Big Tech Earnings and Breadth:

Yesterday, after the bell, we began to see Big Tech companies report Earnings, with Meta and Microsoft reporting. Both beat considerably and forward guided to increased capital expenditure for the AI race in 2026. Risk assets rallied off the back of this, particularly the Nasdaq.

Today, we have Apple and Amazon reporting. The expectations are for more positive forward guidance and increased capital expenditure going into 2026.

The result of this is that the Indexes can remain pushing higher as Big Tech increases earnings and then capital expenditure, whilst they're also more immune to the tariffs. Remember, Big Tech now accounts for over 31% of the S&P which means strength here props up the entire Index.

Yesterday we saw the different effects in the Indexes. We saw positive reports out of the Big Tech companies, but we saw a hawkish FED - that likely means Interest Rate cuts are pushed out. So, when we look at the breadth of the market, we see the Nasdaq rally, but the Russell (small cap companies) down.

Note: small cap companies are hurt by higher rates, and they don't benefit as greatly as Big Tech when it comes to AI.

Nasdaq 1D Chart:

Russell 2000 1D Chart:

Tomorrow's Labour Market Data:

From the macro perspective, the market will have its eye on Big Tech Earnings, and tomorrow's Labour Market data.

The expectation for tomorrow's data is for Non-Farm Payrolls (the number of jobs added in the US) to come in at 110k, which would be relatively strong, particularly as the forecasts are for Private Payrolls to come in stronger than last month. The Unemployment Rate is expected to uptick to 4.2%, however this remains low, and within the FED's acceptable range. Should it start to meaningfully uptick to 4.4% and beyond, and that would likely get the FED much more worried and closer to cutting Interest Rates. But for now, the rate is forecasted to be contained at 4.2%.

The market can react positively to the above - should the labour market data come in as projected.

Cryptonary's Take:

Last night, we saw a more hawkish Powell, which resulted in Interest Rate cuts being priced out of the upcoming Meetings. However, the market rebounded after hours following positive Earnings out of Meta and Microsoft, with both showing a willingness to continue a significant capital expenditure going into 2026.

Assuming we continue to see positive Earnings out of Big Tech, and a labour market that remains robust, then the markets can continue to grind higher, even if there's bouts of volatility. Yes, Interest Rate cuts being pushed out is a short-term headwind. But, cuts aren't being priced out altogether, they're just being pushed further out, with more cuts now being priced into 2026. As long as that expectation remains, the market can remain constructive as it knows the cuts are coming despite them being pushed further out.

We therefore remain constructive and positioned. We continue holding full exposure in BTC, HYPE and AURA. We de-risked ETH and SOL into the highs in recent days by 10-25% as we noted in recent updates. However, should we see a more meaningful pull back, we'd look to re-deploy that capital back into the market, and into whatever looks attractive at the time of pull back. We'll of course update this at that time.

Majors still look very strong, but smaller cap coins will likely more materially outperform as and when we re-enter the Interest Rate cutting cycle. This is all to come, it’s just been pushed out in the short-term.

This week was macro heavy, so our focus remained there. Next week we’ll reassess on chain flows once the dust settles.