Market Update: FED Meeting Looms, Rate Cut Uncertainty Weighs on Crypto

Markets are on edge this week as a slew of economic data and the pivotal FED meeting could reshape rate cut expectations. Read on for our risk assessment and strategy—and what it all could mean for your holdings.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Topics covered:

- Big Week of Macro & Wednesday's FED Meeting.

- Further Potential Risks.

- Summarising the Above, and Our Plan for This Week.

- Cryptonary's Take.

Big Week of Macro & Wednesday's FED Meeting:

This week, we have a plethora of important macro data, along with a FED Meeting. Let’s break it down by day:

- Tuesday: JOLTs Job Openings.

- Wednesday: Treasury Refunding Announcement, FED Meeting, GDP Growth Rate.

- Thursday: PCE, Personal Income and Personal Spending.

- Friday: Jobs Data, ISM Manufacturing, and Inflation Expectations.

On the jobs front, expectations are for JOLTs to come in slightly lighter, and for Non-Farms to come in at 100k (slightly fewer jobs added than last month's 140k), while the Unemployment Rate is expected to rebound slightly higher to 4.2%.

If the jobs data were to come out in line with the above expectations, the market would likely react slightly positively, as it would still show a labour market more than hanging in there; however, it would potentially result in a reduction in the odds of an Interest Rate cut for the September FED Meeting. This is potentially the biggest risk for risk assets (Crypto) currently. That is, the labour market remains resilient, whilst Inflation potentially locally uptrends again. This would then push Interest Rate cuts out to the October, or potentially even the December FED Meeting.

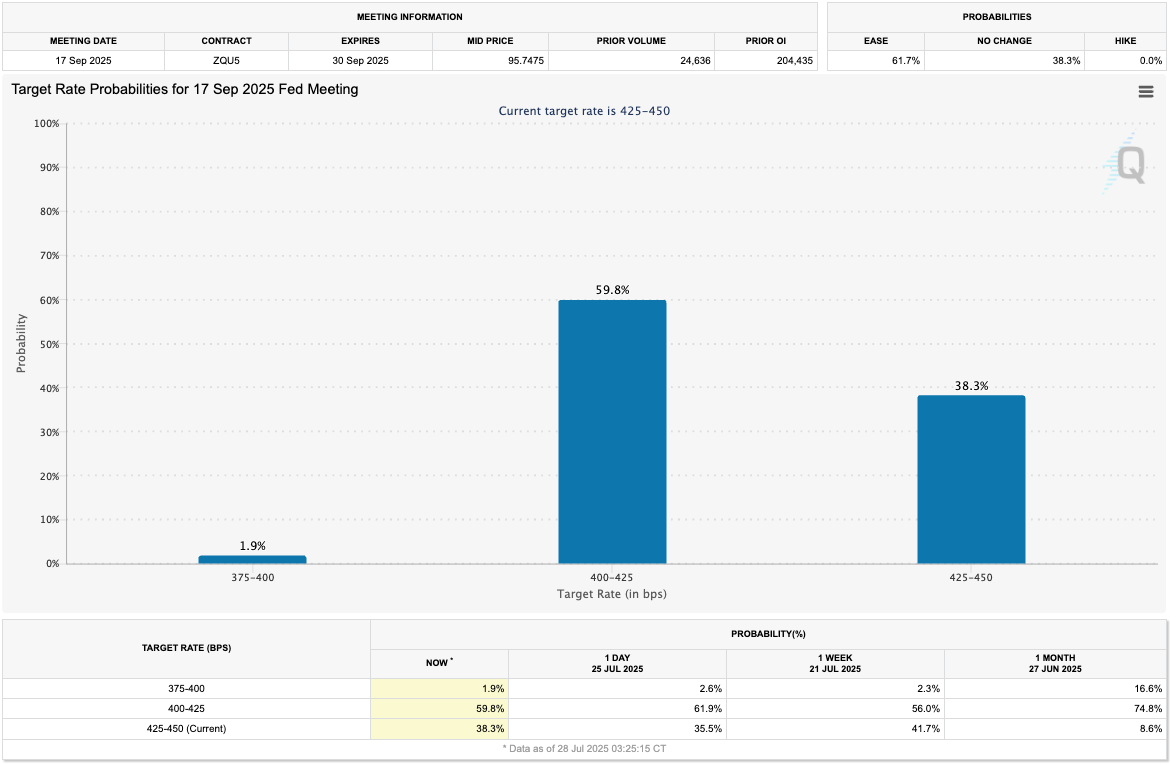

However, the odds for a cut in September remain at 59.8% for now.

Target Rate Probabilities for 17 Sept 2025 FED Meeting:

This, therefore, makes Wednesday's FED Meeting very important, as we'll gauge from Powell how likely he sees a cut at the September Meeting. Firstly, in September, the FED will hold rates (no cut), which is close to guaranteed with the market pricing this at 97.4% likelihood. But it is possible we see two FED members (Waller and Bowman) dissent, i.e., they vote for cutting rates in July and not holding on pause - dissents in the FED are relatively rare, so two members dissenting would be somewhat considerable.

At these FED Meetings (where Powell is trying not to commit), it's typical of Powell to keep his cards close to his chest, commit to being data dependent and not commit to cutting or pausing at the following meeting. And remember, in mid-August, there is Jackson Hole. This isn't a FED Meeting, but previously it's been a place where the FED (Powell) has used to make more meaningful policy pivots. So, say Powell doesn't commit to much in July's Meeting (on Wednesday), he has Jackson Hole in mid-August to forward guide a cut at September's Meeting, should he feel a cut in September is right.

As we mentioned above, this is perhaps the biggest risk we see to risk assets currently - that rate cuts are pushed right out to say the December Meeting, due to resilient labour market data, and inflation beginning to tick up, whilst markets are at all-time highs and financial conditions are very easy. But on the other hand, if Powell forward guides to a cut at September's FED Meeting, expect risk assets to rip higher.

Wednesday will be very telling as to how the next 1-3 months is likely to play out.

Further Potential Risks:

In this section, we're going to explore a few potential risks to this risk asset (Equities and Crypto) rally. The two we see currently are.

- trade deals being done at higher rates than the market expects,

- and Powell caving to Trump's pressure to cut rates (through either resigning or being sacked) and therefore threatening FED independence.

Yesterday, we saw the announcement of a trade deal between the US and the EU, which saw a 15% baseline tariff on European goods, with a big commitment to spend: $750b in Energy, and $600b on top of existing investments. However, it isn't guaranteed that these investments will follow through.

The risk to markets is that other trade deals don't get done, for instance, it's gone very quiet in the negotiations with Canada and Mexico. Should "market acceptable" trade deals not be done with the US's two biggest trading partners, this would negatively impact corporate profit margins (as companies pay the higher tariff rates due to no trade deals), and as a result, credit spreads would increase.

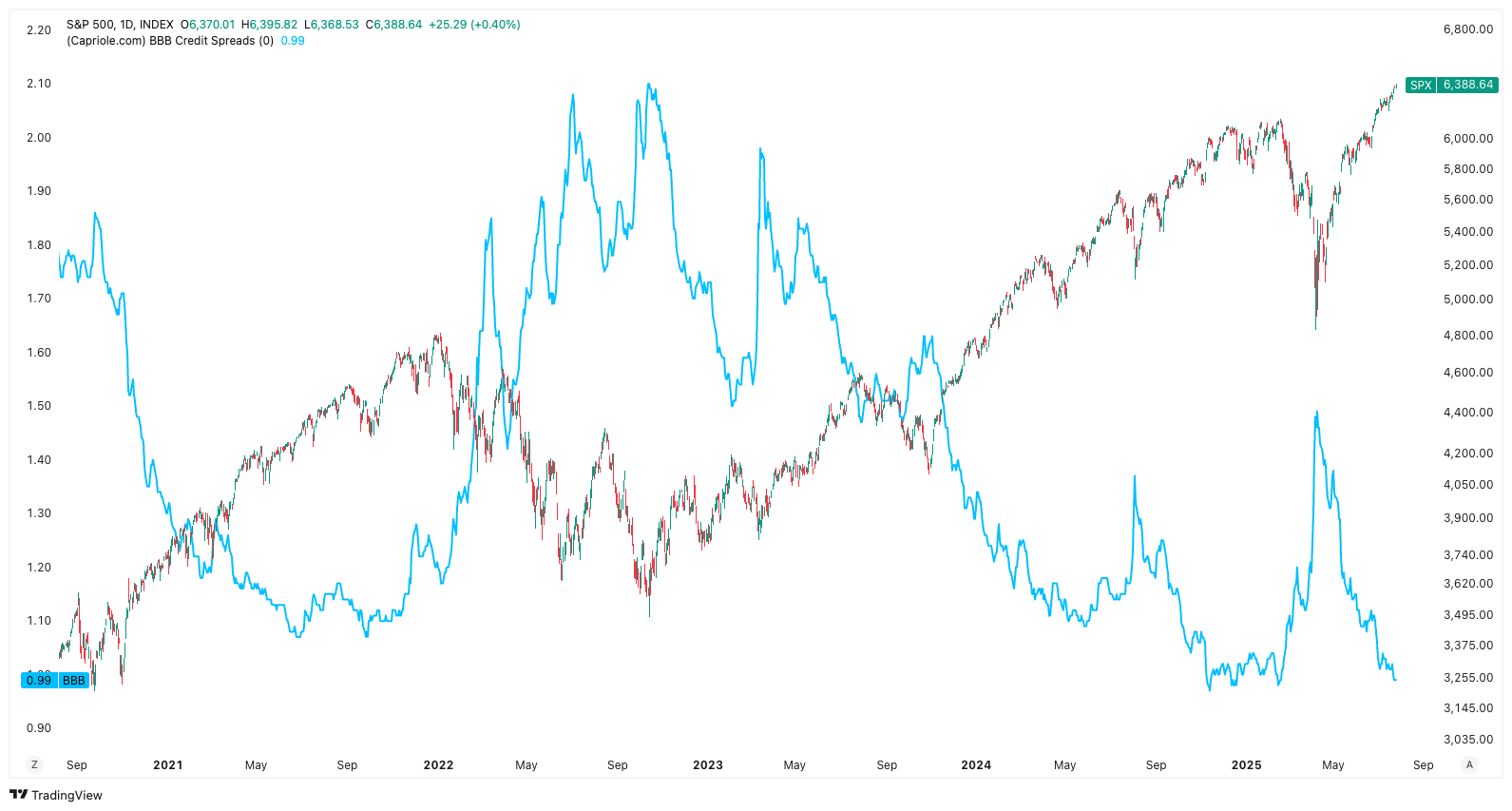

As we can see in the chart below, credit spreads are currently at lows, and in this environment, risk assets (Stocks, Crypto) perform. But should we see a meaningful increase in credit spreads, due to no trade deals, then risk assets can get a more meaningful pullback.

SPX Against BBB Credit Spreads 1D Timeframe:

Chart Credit: Capriole

The second major risk we see is the pressure President Trump is putting on Chair Powell to cut rates. Firstly, this is moronic. It's not a one-person decision; there are 12 voting members, and whilst we may see two members dissent at the July Meeting, it would still mean that 10 members vote for no cut at Wednesday's Meeting.

Should this pressure on Powell lead to him resigning, or worse, President Trump firing Powell, and replacing him with a more dovish FED Chair (a more dovish Chair would mean a greater bias to cut rates), the Bond market would likely see a significant sell off and a major spike higher in Yields - this would be very bearish for risk assets. The reason for this would be that FED independence would essentially not just be under threat, but somewhat lost completely. The Bond market would puke on this.

The above isn't our base case by any stretch, but it's something that the markets aren't pricing in currently, and should it happen, it would be a major shock to markets, so it's something we're paying close attention to.

Summarising The Above, And Our Plan for This Week:

In the above, we have outlined several risks to the market, with the key one being Interest Rate cuts getting pushed out to either the October or even the December FED Meeting. This week will be pivotal in assessing this as we'll get a better gauge from Powell as to whether a September cut is likely or more unlikely, whilst we'll also get labour market data. Strong labour market data would strengthen the argument for holding Interest Rates higher for longer (no cut).

Plan For This Week:

Usually, we would maintain our positioning going into a FED Meeting; however, it's our view that we might see a slightly more hawkish Chair Powell this week off the back of strong macro data and a bit of a push back to the pressure being put on him by the Trump administration to cut rates.

Alongside the above, the market is at all-time highs ,and financial conditions are quite easy. Also, the market is pricing for a 59.8% chance of a cut at September's FED Meeting, which might be high should we see strong macro data this week. So, we see the risk being that an Interest Rate cut is pushed out to October rather than in September's Meeting, should we get a more hawkish Powell and strong data this week. This might result in markets pulling back or consolidating over the next few weeks.

Therefore, it might be wise to lighten up on some positioning going into Wednesday's FED Meeting and the macro data on Thursday and Friday. We would look to lighten up on positions that have moved up substantially over the last 1-2 months, so that would be Majors like ETH and SOL. We'd hold BTC, HYPE and AURA.

Please note, when we suggest lightening up, it might be just trimming 10-25% of your ETH and SOL positions (the positions that have run higher and are overbought on the indicators), with the view to buying the dip with that capital should the dip come off the back of a hawkish Powell and strong data later this week.

For those who are more passive, it's worth not even trading this event and just maintaining your positioning.

Cryptonary's Take:

Markets have performed phenomenally over the last weeks, mostly due to market expectations of a new Interest rate-cutting cycle beginning. Whilst we still expect an Interest Rate cutting cycle to begin sometime this year, it is possible that stronger macro data, lagging effects of inflation, and markets at all-time highs, give the FED more flexibility and therefore potentially pushing the start of cutting rates beyond September.

Going into this week, we'd therefore suggest to the more active traders (if you're passive, it's best to just remain positioned for the upcoming 12 months) to slightly de-risk some of their positions that have run more considerably in the last month; plays like ETH and SOL. The capital (USDT/USCD) gained from these sells should be used to buy any meaningful dips, should we get this.

The reason we're suggesting this approach is because we expect a trickier next few weeks, particularly if we do see the odds of a September cut priced down and pushed into October.

However, despite the above, we remain incredibly bullish on the medium and long-term, and we're holding core positions. BTC remains structurally strong, even after Galaxy sold 80k BTC last week. This confirms strong Spot demand beneath the surface.

For those who are more active or for those looking to increase exposure, the next few weeks might provide some great buying opportunities for the long-term.

Peace!