Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Quiet data week; September figures unlikely to move markets.

- Powell speaks Monday but he is likely neutral during the blackout.

- Hawkish cut expected Dec 10th; may catalyse move to $77k-$82k.

- ETF flows neutral; first sign of bottoming process.

- Buy zone: $77k-$82k with bullish divergence confirmation.

Topics covered:

- This Week's Data.

- Powell Speaks on Monday Evening.

- Flows and Positioning.

- Bottoming Formation?

- Cryptonary's Take.

This Week's Data:

This week, we have a plethora of data being released, but once again, it's September's data, so it's likely that it won't be market moving simply because it's so dated.Anyhow, we have PCE, Michigan Sentiment and Personal Income and Spending data out on Friday. It's expected that the Year-on-Year PCE figures are going to come in slightly softer than August's data, with the Month-on-Month figures coming in unchanged. This would be a positive print for the Fed and markets, who are looking for inflation to turn down, rather than higher.

Personal Income and Spending are expected to come in positively, with forecasts suggesting a 0.4% increase in both, whilst the Michigan Consumer Sentiment survey is expected to show an improvement from 51 to 53.

But away from the official government data, perhaps the more important data this week is the ADP and Challenger data on Wednesday. ADP (a private data company) is expected to show that the US added 15k jobs in the month of November. Even though this is low, it's an improvement on the two negative months of August and September. The market will also be watching Challenger Job cuts on Thursday. The previous figure was 153k jobs lost. November's figure is expected to show a 98k loss.

In our view the market is more likely to react to these figures (from ADP and Challenger) rather than the official government data, because it's so outdated. However, our expectation is that this week's data won't be hugely market moving despite it likely to show a continuation in labour market weakness.

Powell Speaks on Monday Evening:

Powell is speaking in a panel discussion at Stanford University on Monday evening, despite the Fed being in a "blackout window" (no Fed members speaking before a Fed Meeting). However, a discussion panel is allowed during the blackout window but it's likely that the event will cover broad topics, and should the event veer into sensitive territory, Powell would likely stick to neutral comments that wouldn't give much away in regards to the December Meeting.Is A Hawkish Cut Coming?

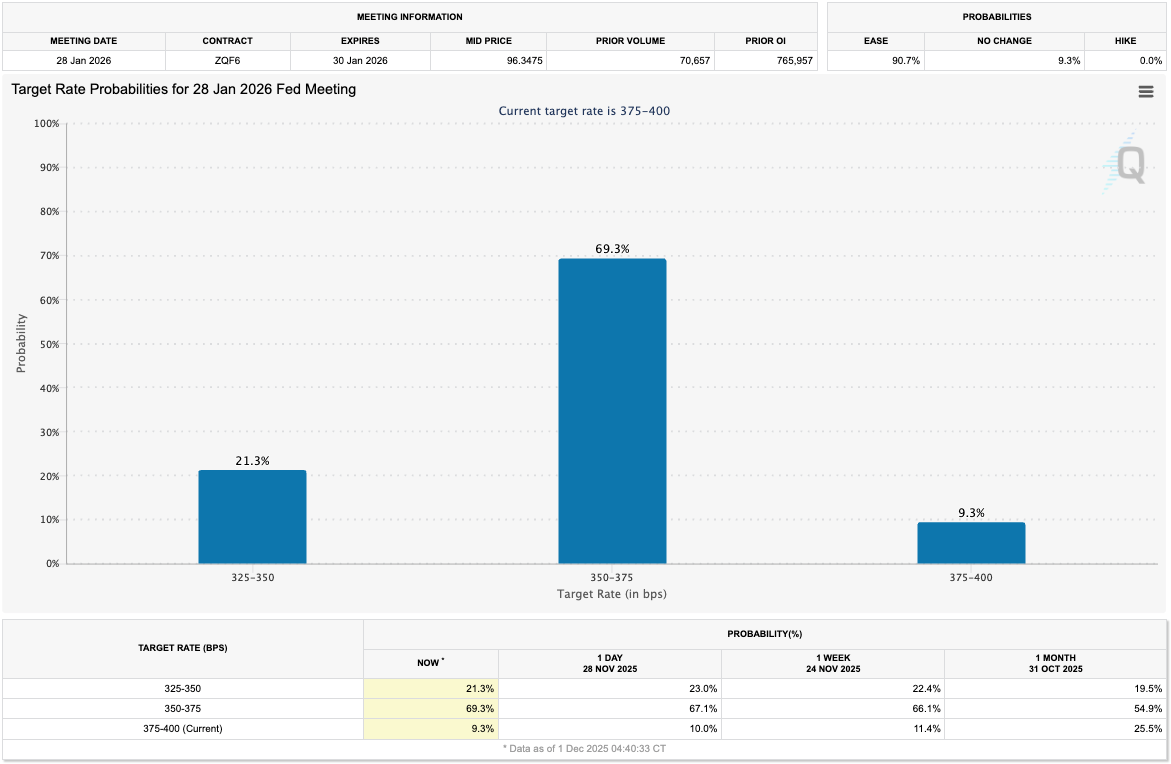

The market is currently pricing an 87.6% chance that the Fed cuts at their December Meeting, but they're also pricing a 69.3% chance that the Fed remains on hold at the January Meeting (no cut in January) - with the January Meeting also having a 9.3% chance of the rate remaining on hold i.e., no cut in December nor in January.Target Rate Probabilities for 28th January 2026 Fed Meeting:

This suggests that Powell might deliver a hawkish cut at the December Meeting. This would be an interest rate cut, followed by hawkish commentary, and potentially even a hawkish Dot Plot - Fed members showing that they expect less than 2.5 cuts in 2026 that the market is currently pricing.

We're more neutral on the Dot Plot, which historically isn't a good predictor of future interest rate policy, but we're more confident in a hawkish Powell in terms of his comments in the Press Conference that immediately follows the rate decision. A hawkish Powell would likely result in the market pulling back, and we think this might be the catalyst that sends BTC to new lows in the coming 2-3 weeks. But, we view that as a potential formation of a bottoming pattern in Bitcoin.

Note:

Market expectations for 2026 are for the Fed to deliver 2-and-a-half cuts. However, with the labour market weakness that we're seeing and we expect to worsen, we see it as more likely that the market is underpricing the amount of rate cuts for 2026. So, we think this can be a tailwind for risk assets in 2026 i.e., getting more rate cuts than what the market is currently pricing today.

Flows and Positioning:

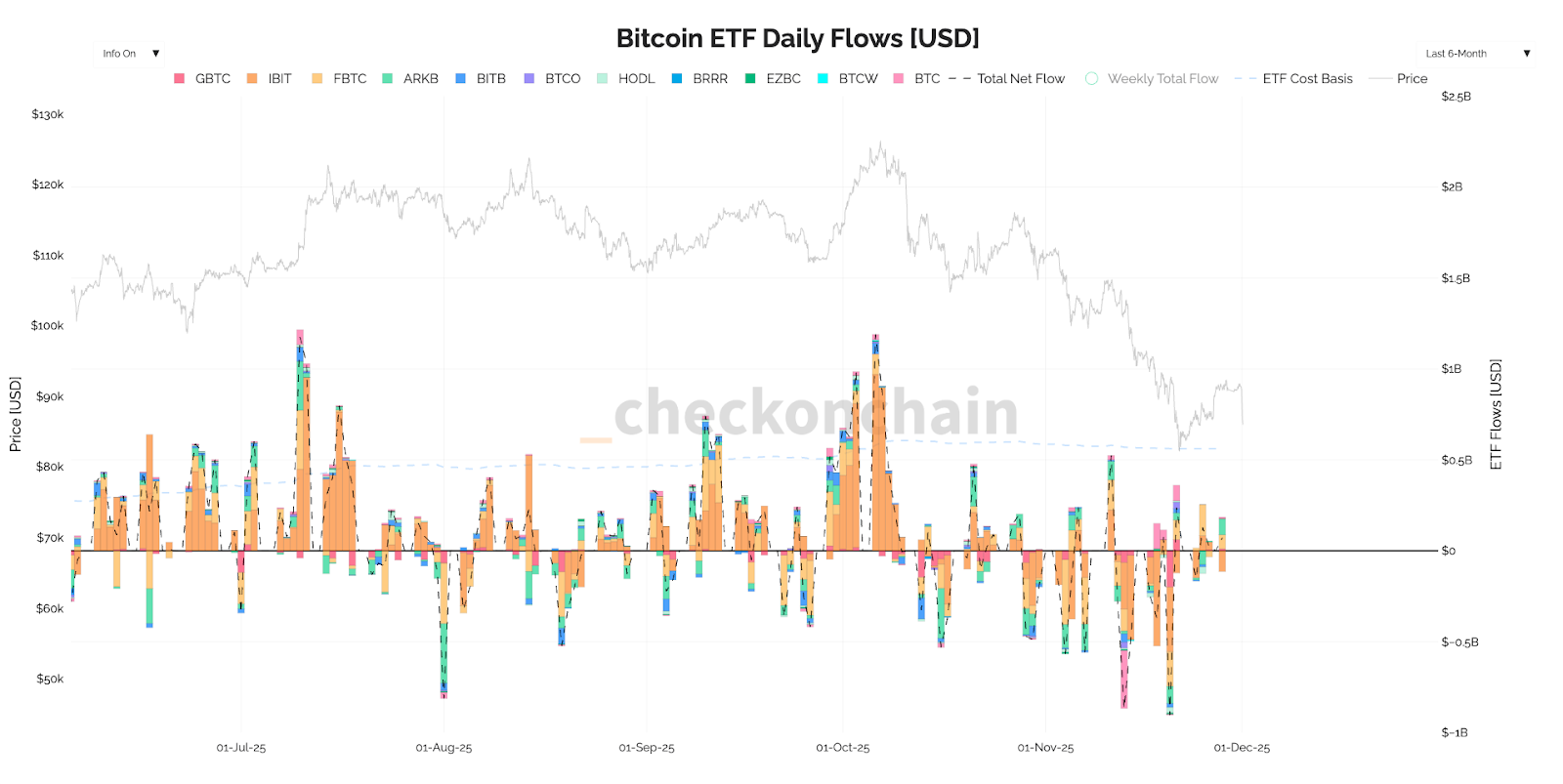

From a flows perspective, we've begun to see some improvements, finally. The ETF's had a more mixed week last week, with outflows having previously been dominant.ETF Flows:

This is one of the first signs that we wanted to see for a bottoming process to begin forming. Large outflows eventually become neutral, before turning into sustained inflows. It seems the large outflows have stopped and we're now in the "neutral" zone.

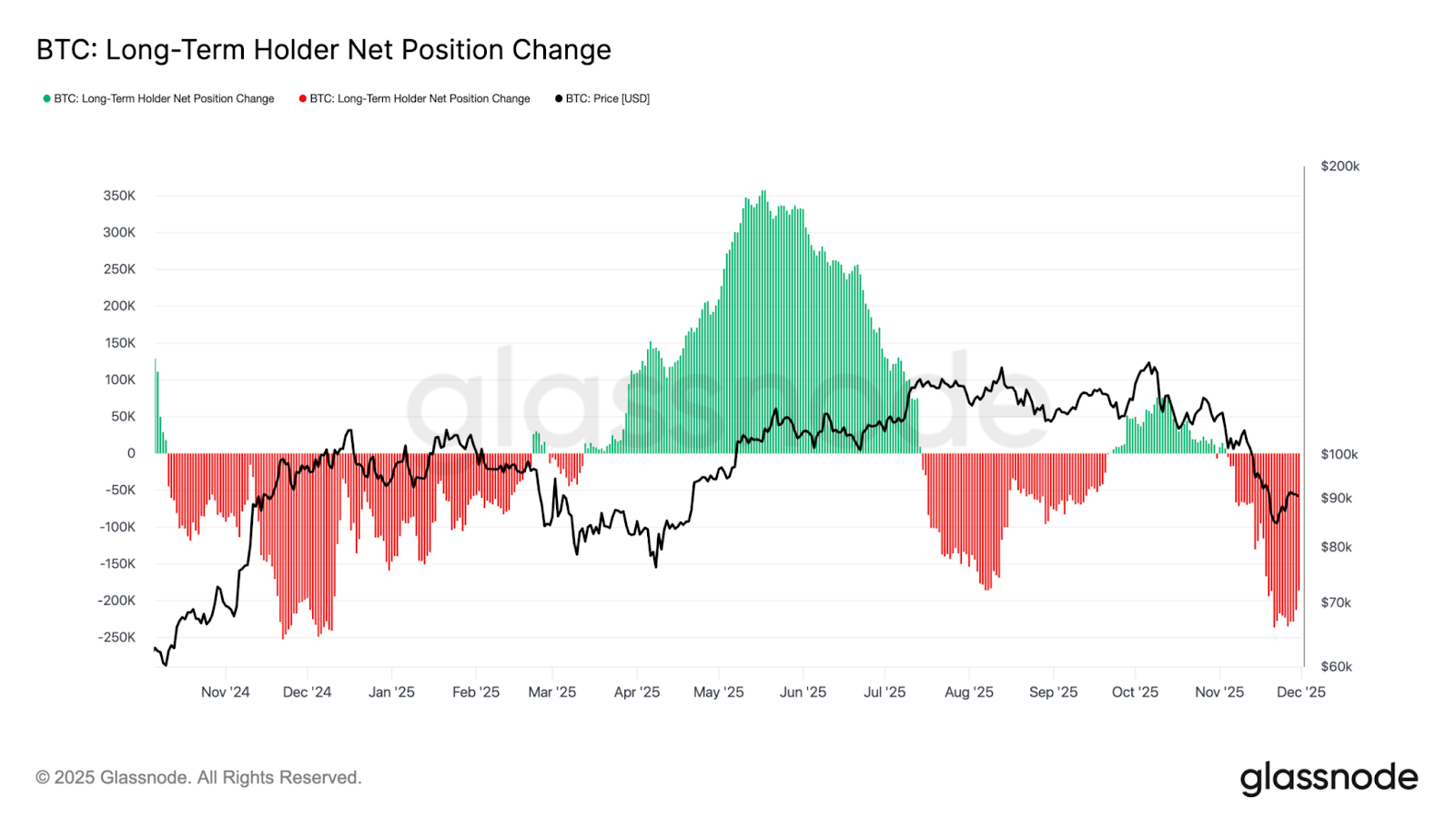

However, on the other side of the coin, Long-Term Holders are continuing to sell down their size. Perhaps this is still "4-year cyclers" selling, but the lower the price goes, the more likely this is to ease and even turn positive.

Long-Term Holders Net Position Change:

Should BTC retest the high $70k's/low $80k's as we have been calling for, then we'd like to see the above metric flip from selling to neutral, hopefully even accumulating.

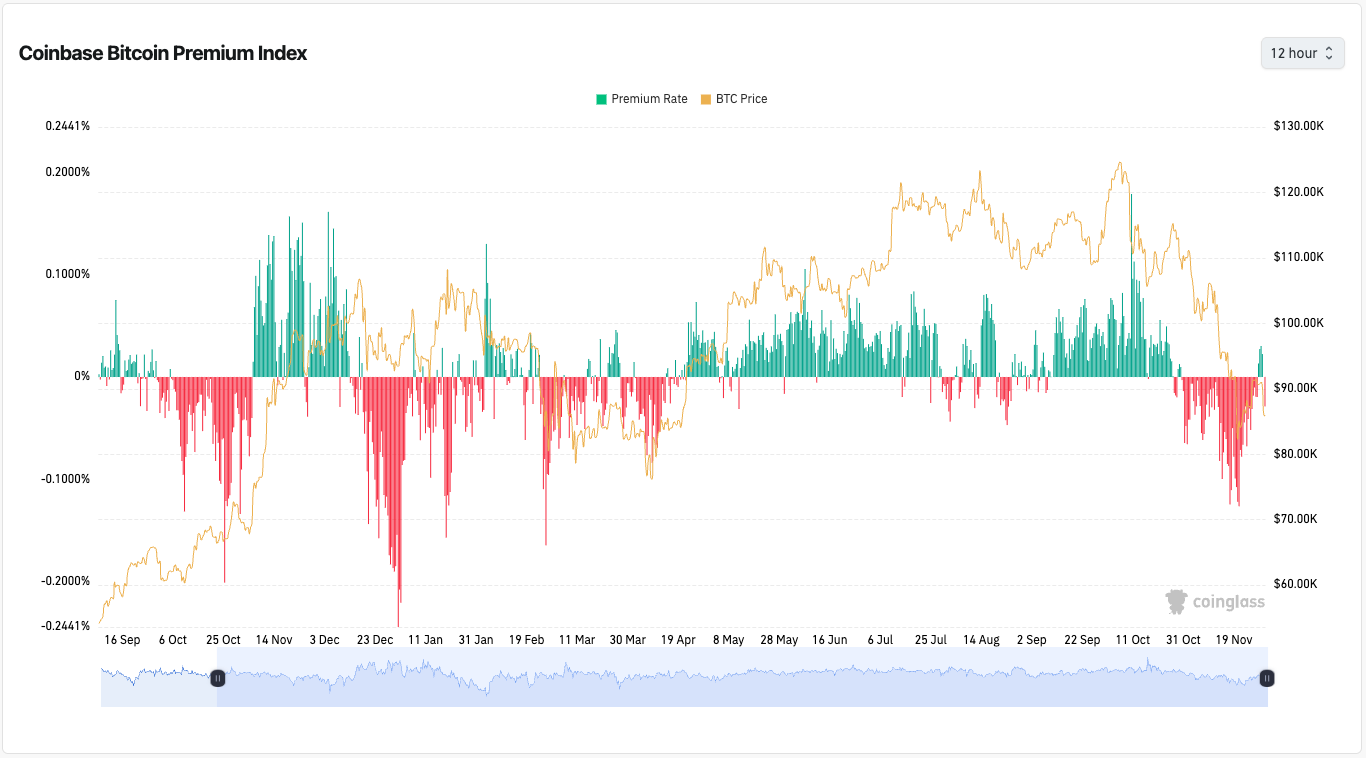

Alongside the above, we have seen bouts of negative Funding Rates whilst last week we did see the Coinbase Premium turn positive for the first time since October 29th when BTC was $113k. The Coinbase Premium measures the price difference between Bitcoin traded on Coinbase and the global market average. A positive Coinbase premium suggests strong US buying which has often been positive and supportive for higher prices.

Coinbase Premium Index:

Unfortunately, the Coinbase Premium has once again turned negative this morning. But, we'll continue to monitor this over the coming 1-2 weeks. The fact it's now chopping between negative and positive, rather than being outright negative, is the first sign of a turnaround.

There are signs that the capitulation/selling is slowing:

- ETFs were neutral last week rather than huge outflows.

- Coinbase Premium returned last week.

Bottoming Formation?

The poor flows (ETF outflows and LTH selling) was what led us to a more cautious stance when BTC was at $111k. Price has since pulled back 27.4% (to the local bottom at $80,400), and 23.1% to the current price at $85,500. However, the ETF outflows have now flattened and last week we saw a neutral week. Long-Term Holder selling is yet to ease up, but we did get the return of the Coinbase Premium last week even though it has turned negative again this morning.Ultimately, this does suggest that the meat of the move down has been had and we believe that we're now in a choppy, bottoming process where BTC can find a new low in price but a higher low on the oscillator (preferably in oversold territory) - bullish divergence.

This would provide a similar setup to the April "tariff tantrum", but this process can take time, again similar to April.

BTC 1D Chart:

For now, we're looking for BTC to break down and put in a new low between $77k and $82k. Should the bullish divergence confirm, this would be a "BUY" for us, and we'd look to add BTC at that zone ($77k-$82k).

Cryptonary's Take:

Despite today's sizable move lower, we're not expecting fireworks this week as the economic data that we're getting is mostly outdated data. This is paired with a Fed blackout period before next week's Meeting.However, the market is looking ahead to next week so we expect range-bound, choppy price action as we go into next week, where we expect Powell and the Fed to deliver a hawkish cut. Our expectation is that this is what catalyses the next move lower for prices i.e., a break below the current low at $80k.

Should we see price fill the late $70k's (buy zone between $77k-$82k) and form a bullish divergence (lower low in price, with a higher low on the oscillator) in oversold territory, then we'd be an aggressive buyer at that level with a view that BTC can bounce back to at least the low $90k's. This should represent a 10-15% move higher as a minimum target.

In the meantime, we'll exercise patience and let the market come to us.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms