Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Hotter-than-expected PPI (+0.9% vs. +0.2%) spooked markets, raising concern tariffs are feeding into consumer prices.

- September Fed cut is still likely (85% odds), but Powell’s Jackson Hole tone could derail expectations.

- BTC technicals weakening: lost $116.6k support and uptrend; ETH/BTC at resistance; BTC dominance may bounce.

- Institutional flows (Treasury companies) driving BTC; ETF demand fading.

- Base case: Powell open to a Sept cut if jobs soften; Crypto remains risk-on in Majors and select memes but fragile near term.

Topics covered:

- Last Week's Data.- Jackson Hole and the Possibility of a Powell Pushback?

- Charts.

- Cryptonary's Take.

Last Week's Data:

Last Thursday, the markets were shocked by a far 'hotter' than expected PPI (Produce Prices Inflation) print. The month-on-month figure came in at 0.9%, well above the 0.2% forecast and the 0.0% prior months' print.The market reacted negatively to this with risk assets selling off, particularly Crypto, whilst the US2Y Yield bounced from 3.65% to 3.75% by the end of the following days' session.

The reason for the negative reaction in markets was that this was the first time we saw a meaningful upside surprise in inflation data due to the tariffs. The upside surprise in PPI was driven by both Goods and Services. Previously, it was thought that producers wouldn't pass much of the costs onto consumers, out of fear that a weak (weaker) consumer wouldn't be able to bear the cost of these price increases, and therefore the tariff would be eaten by the Producer. However, there is now concern that Producers will start passing some of the costs onto the Consumers, meaning that inflation will now show up in CPI (rather than just PPI) and that could de-rail the FED's newly expected Interest Rate cutting cycle.

Despite this hotter PPI print, the market is still pricing for an 85.1% chance that the FED will cut rates at the mid-September FED Meeting.

Target Rate Probabilities for 17 Sept FED Meeting:

What could potentially derail a September FED cut is a hawkish FED and most importantly, a hawkish Powell. It's possible we see this on Friday at the Jackson Hole Symposium.

Jackson Hole and the Possibility of a Hawkish Powell?

Jackson Hole has previously been a place where Chair Powell has made big policy pivots with 2022's "pain" speech perhaps his most notable.

In recent communication, Powell has shown a hesitancy to commit to lowering rates in the immediate term due to analysts' expectation that we'll see a meaningful uplift in inflation over the summer months due to tariffs. As of last Thursday’s PPI data, we hadn't seen it, but now with Thursday's hot PPI data, we're now seeing it and Powell looks somewhat justified in his stance. However, there remains a delicate balance between inflation that's moving higher (and perhaps in a transitory manner) and a labour market that is tightening further, and close towards outright weakening.

Our expectation for Friday is for Powell to suggest that he's open to cut in September should we see the data corroborate that i.e., further weakness in the jobs data that we get in the first week of September, and for the inflation data to remain somewhat subdued - what he won't want to see is for PPI to carry over into CPI.

Should Powell suggest he's open to cut in September, then we expect risk assets to stabilise and potentially move higher, even though a September cut is richly priced, hence we don't see major upside for Crypto/risk assets in the immediate term. The risk is that Powell emphasises his original stance and justifies his actions to remain on hold following the recent PPI data. Should that happen, the odds of a September Interest Rate cut will substantially decrease, and risk assets will likely sell down. We see the chances of a hawkish Powell as being unlikely, but we think the market isn't pricing the odds of it happening adequately - under-pricing it currently.

Charts:

With that being said, we are seeing some further risk off in markets to begin the week, perhaps as there is some nervousness at a potential pushback from Chair Powell at Jackson Hole this Friday.

If we look at BTC, should the price not recover today, then BTC will have lost the main horizontal support of $116,600 and the main uptrend line which has been intact since the early April lows.

BTC 1D Timeframe:

Alongside the above, the Bitcoin Heater chart from Capriole did show some overheating in the leverage market which suggested some caution. Although, this indicator has pulled back to mid-levels following the price pull back from $123k to $115k. However, this isn't an indicator that would encourage us to majorly risk off, but rather to not substantially risk-on going into overheated conditions.

BTC Heater:

In the short-term, two concerns we have is that the ETH/BTC chart looks ready to pull back slightly or at least consolidate following a move into a major horizontal resistance, whilst the Bitcoin Dominance chart structure suggests that a bounce is possible should it reclaim above 60.0%.

ETH/BTC 1D Timeframe:

BTC.D 1D Timeframe:

From a technical perspective, the above suggests that a short-term pull back is possible with BTC Dominance looking like it can bounce, even as BTC looks to be breaking down (losing its uptrend line). This could also be substantially compounded this Friday should Powell toe a hawkish tone that prices out a September FED cut - we still expect a September cut. But we expect the FED to cut just twice this year (Sept, and Dec), in the form of maintenance cuts.

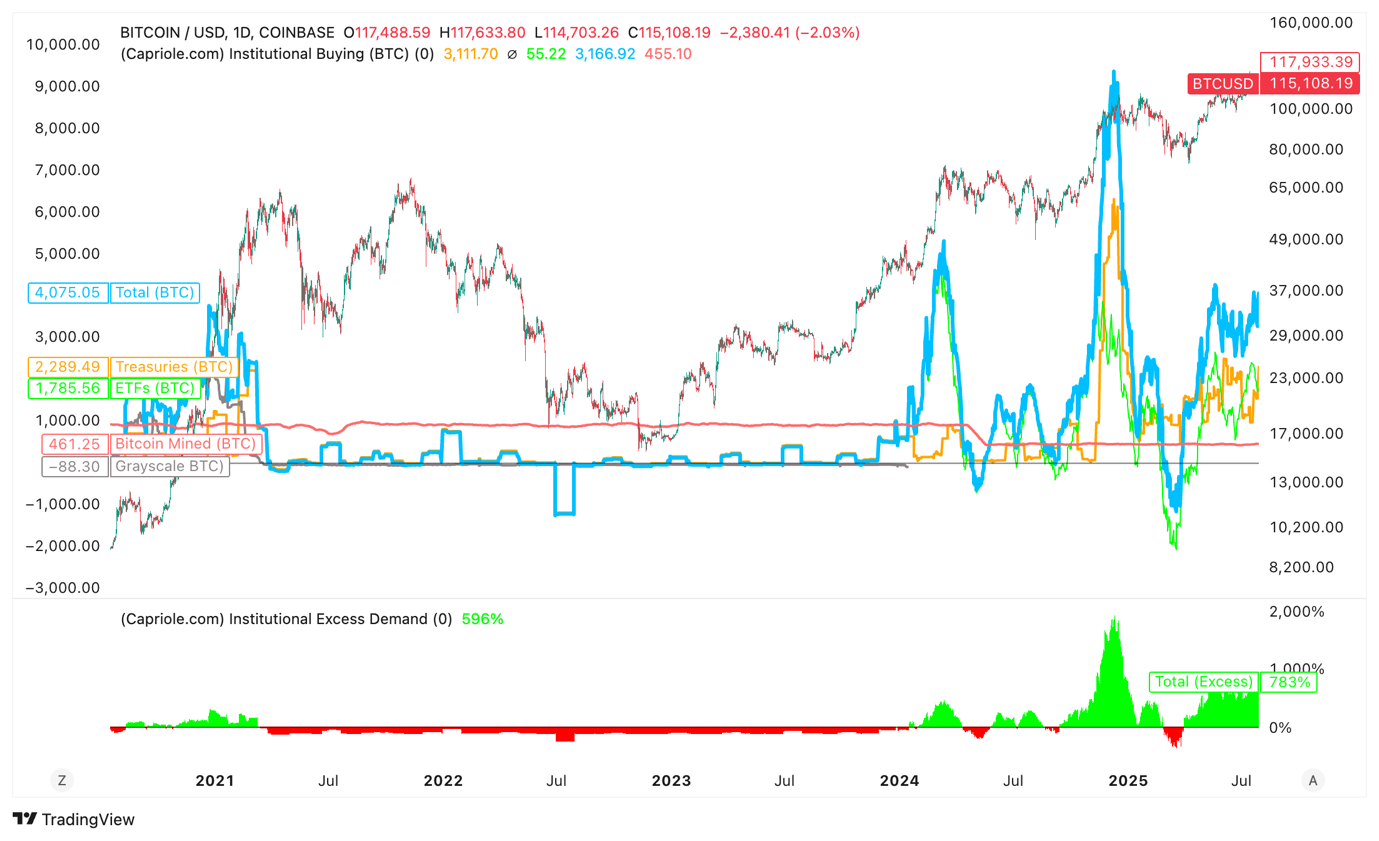

Overall, the recent rally higher has been mostly driven by Treasury companies. In the below, we can see that they have been responsible for much of the bid with the ETF bid waning.

Institutional Buying (in BTC):

Perhaps the most major cause for concern is a hawkish Powell. But should we see that paired with a reduction in Treasury company bids (which we can see have been responsible for keeping the market at highs), then these might be the two converging themes that catalyse a new downturn.

Cryptonary's Take:

In recent weeks, the market has been somewhat perfectly priced in terms of a September Interest Rate cut being close to fully baked in. This Friday, Chair Powell can push back on a September cut (should he want to) following last weeks' hotter than expected PPI data. With the charts recently losing some key levels (BTC losing the $116,600 horizontal support and the uptrend line) and with the BTC Dominance chart structure suggesting it can also bounce, BTC and Crypto is at a short-term key inflection point here.Should Powell be more hawkish than what the market thinks, then a September Interest Rate cut can be priced back out. Should that happen, risk assets would sell-off dramatically.

However, it is our base case that Powell will be open to a September cut, but we suspect he'll say it's dependent on a continued softening in the labour market, which we'll get the next set of data in the first week of September.

For now, we remain mostly risk-on, but in Majors and select memes. We're not looking to really broaden out beyond those assets yet, but we may look to should we get into a rate cutting cycle that favour a more "everything up" environment.

Peace!

Cryptonary, OUT!