Market Update: How Low Can BTC Go?

While US jobs and inflation are clearly cooling, bond markets and central banks are sending a more cautious message about how quickly policy support may arrive. Against that backdrop, risk assets remain fragile, Bitcoin flows stay weak, and price continues to range rather than trend. This report breaks down what the latest data actually means, where the real risks remain, and why patience is still required in the near term.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- US jobs and inflation; are softening, but messy data and bond market signals make a January Fed cut unlikely.

- US 2Y yields; aren’t confirming lower inflation, keeping near-term macro support for risk assets limited.

- The BoJ hike; was less hawkish than feared, easing carry trade concerns and removing a near-term risk.

- Bitcoin flows; remain weak: ETFs are neutral and long-term holders continue to sell.

- BTC range-bound; with downside risk, with a likely bottom in the $77k–$82k range into late December or January.

Topics covered:

- This Week's Data.

- Bank of Japan Outcome.

- Update on the Bitcoin Flows.

- Chart Technicals Suggestive of a Bottom?

- Cryptonary's Take.

This Week's Data:

From the data perspective, the major focus this week has been on the delayed labour market data and inflation data, which we received on Tuesday (jobs data) and Thursday (inflation data).On Tuesday, we saw the Unemployment Rate tick up to 4.6%, which is above the Fed's 4.5% year-end projection; however, this is due to an increase in the participation rate, i.e., more people coming into the labour force rather than to an increase in layoffs. October's Nonfarms numbers were ugly at -105k, but November's data showed a rebound to 64k.

On Thursday, we received November's inflation data, which showed a 2.7% YoY Headline number and a 2.6% Core YoY number. However, the report was somewhat messy, with key components (that make up the inflation number) being missed or just marked at 0.

With this kind of downside surprise in inflation, you'd expect risk assets to rally off the back of it, due to inflation being less of an issue, and therefore the Fed can focus on the labour market and cut rates, which is supportive for risk assets. We initially saw risk assets pop higher on the print, but the gains weren't sustained, particularly in Crypto, with BTC rising to $89,300, before finishing the day at $85,400.

With that, what's notable to us is that the US2Y Yield wasn't "buying" the lower inflation print. As mentioned above, falling inflation should result in more rate cuts (in the current scenario that the market is in). However, the US2Y Yield initially sold off before rallying back, with it now being higher than yesterday's open.

US2Y Yield 1D Chart:

The US2Y Yield remaining basically unchanged suggests that the Bond market wasn't "buying" the inflation data, and therefore, more rate cuts weren't being priced in, which you would have expected following a large downside surprise in the inflation data.

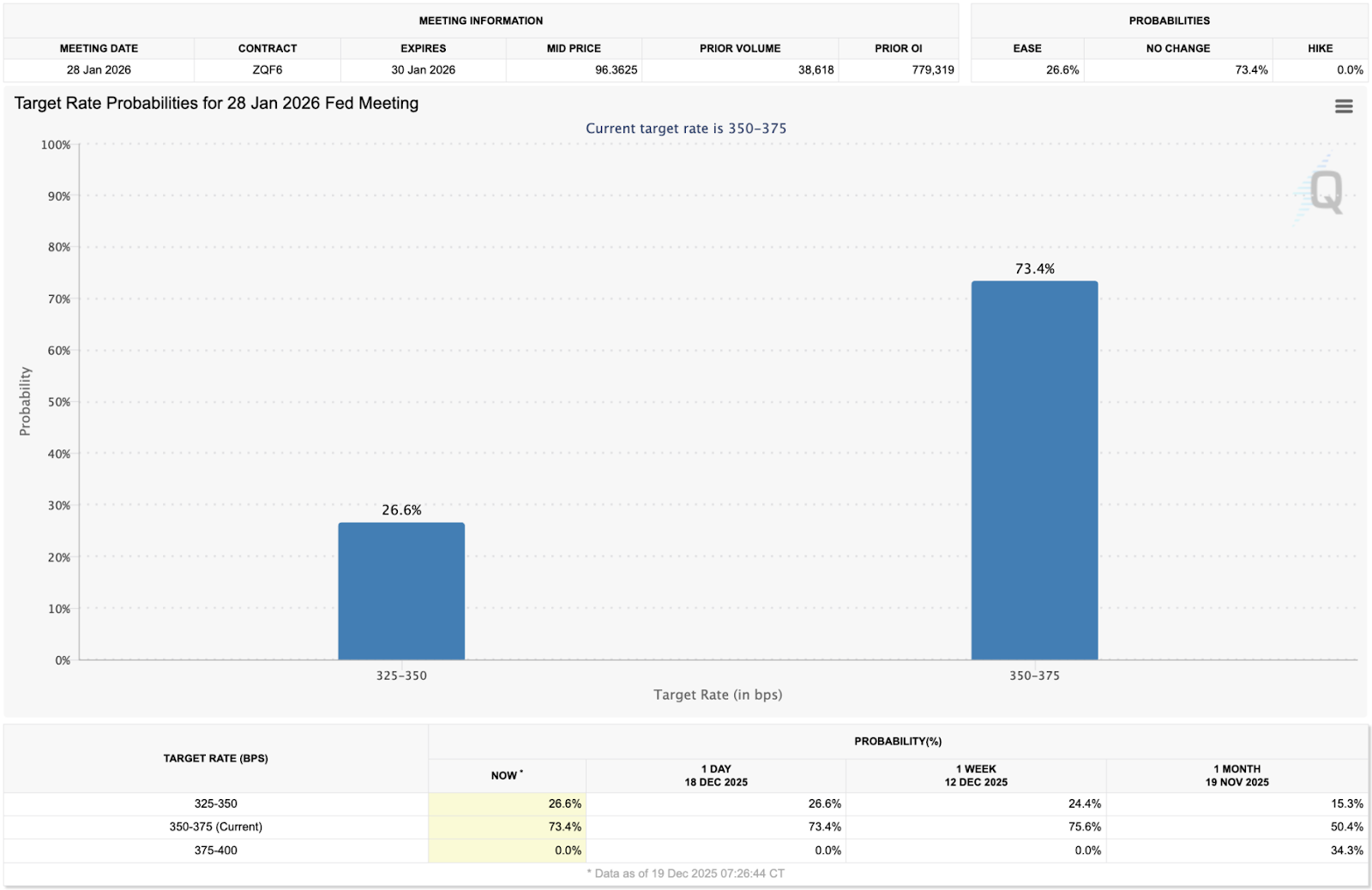

We can also see this reflected in the CME pricing. One week ago, the market was pricing a January cut at a 24.4% chance, with this only increasing to 26.6% following yesterday's data.

CME January Fed Meeting Rate Cut Probabilities:

Data Summary:

Overall, we're not seeing outright job losses, but the pace of hiring has drastically slowed, whilst the Unemployment Rate is moving higher due to more people coming back to the labour force i.e., looking for work - likely because they need the income. Alongside this, inflation is coming down, but the recent data is messy, and therefore the Fed and markets will want to see more data to confirm that labour market weakness should be prioritised over elevated inflation.

So for now, a January rate cut is unlikely, but should we see softer inflation in January, then markets will begin to price in more cuts, which would be a tailwind for risk assets = positive for Crypto. But, we’re not of the view that the next rate cut comes as quickly as the January Meeting.

Bank of Japan Outcome:

In the early hours of Friday morning (UK time), the Bank of Japan announced a 0.25% increase in their interest rate, taking the rate up to 0.75%. This was widely expected to happen as it has been forward guided and, therefore, mostly priced in.But, going into this week, the focus for markets around the BoJ Meeting was on the forward path for rates and the potential for a further unwind in the "carry trade" - (borrow Yen, and buy higher yielding assets) should we see a fast rate hiking cycle.

However, Governor Ueda didn't give much forward guidance, which isn't uncommon with the BoJ, but in not committing to consecutive hikes, this was a less hawkish outcome than the market was expecting. This is despite Governor Ueda saying that further rate hikes would be "data dependent", but that they were "far away from neutral".

It's possible that we see more rate hikes in the future (potentially in March). But what we care about (for risk assets) is that we're not going to see a Yen carry trade unwind. That is now unlikely even if the BoJ commits to more rate hikes in the future. Governor Ueda's lack of hawkishness, despite him being as hawkish as he could have been, was enough to calm the market and for risk assets to be bid off the back of it.

The market has now cleared past this event, and we don't expect this to be a headwind in the near-term.

Update on the Bitcoin Flows:

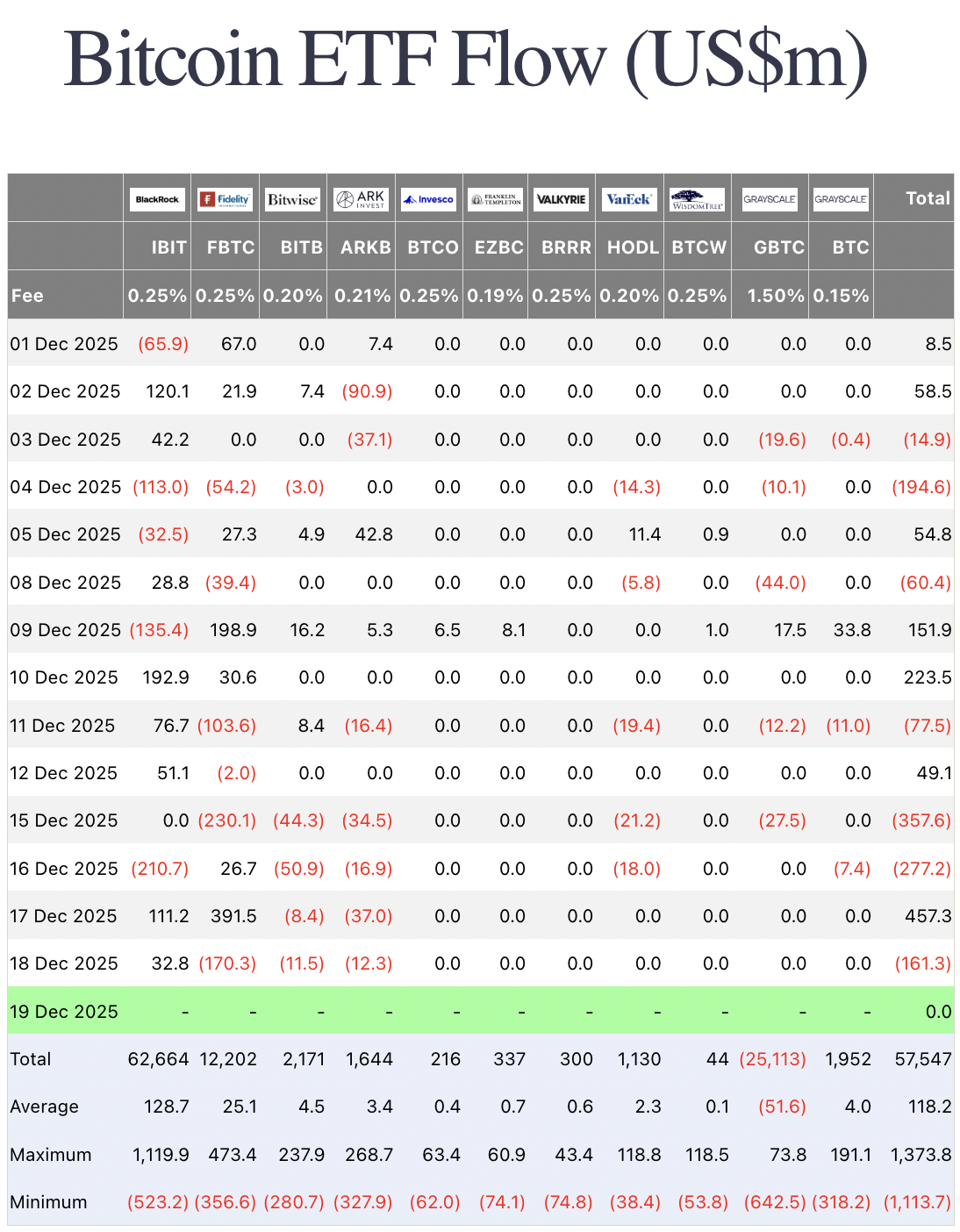

In recent weeks, we've paid close attention to the ETFs and the Long-Term Holders, as the strong net selling was a clear indicator of why the price was moving lower and was likely to continue to.The ETFs are now more neutral. There's still a bias to sell into rallies, and therefore, we're not seeing consistent inflows. But the overall flows are more 'neutral' than they were in early to mid-November. This is positive, but not yet supportive of prices moving higher.

BTC ETF Flows from Farside Investors:

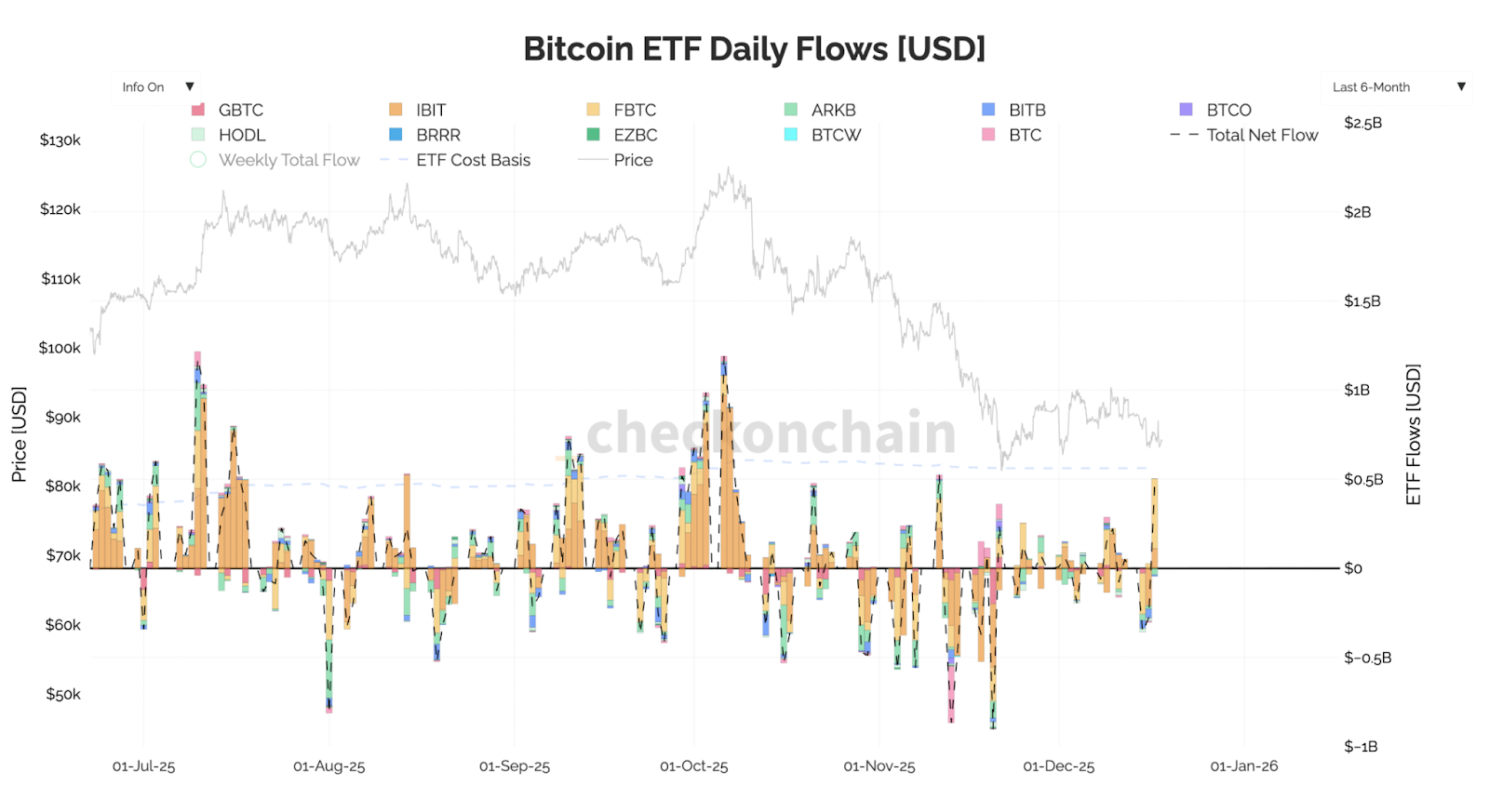

The reason we've shown the above chart, and not our usual chart from 'CheckOnChain' is that the 'CheckOnChain' chart was last updated on the 17th, so it doesn't show the large net outflow from yesterday. We'll add this chart below, but note, the recent large inflow day is followed by a large outflow day - the chart just hasn't updated yet.

BTC ETF Flows from CheckOnChain:

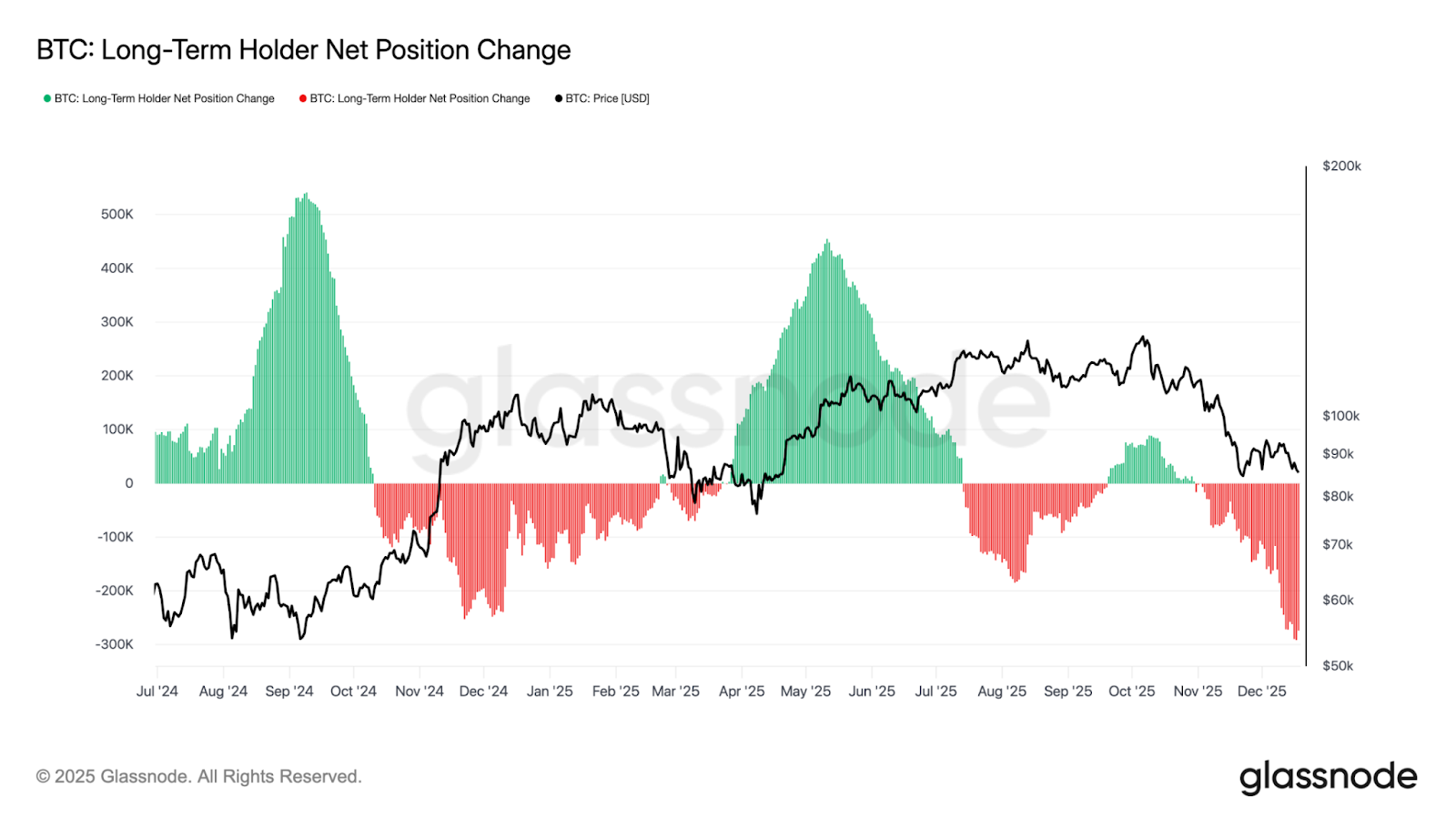

So, whilst ETF flows are neutral at best, Long-Term Holders are then able to more heavily influence price action. Unfortunately, they remain large sellers of BTC, particularly on retests of $90k.

Long-Term Holders Net Position Change:

Until this changes, i.e., the selling pressure eases off and ideally becomes accumulation rather than distribution, it's hard for us to see prices maintaining more meaningful upside.

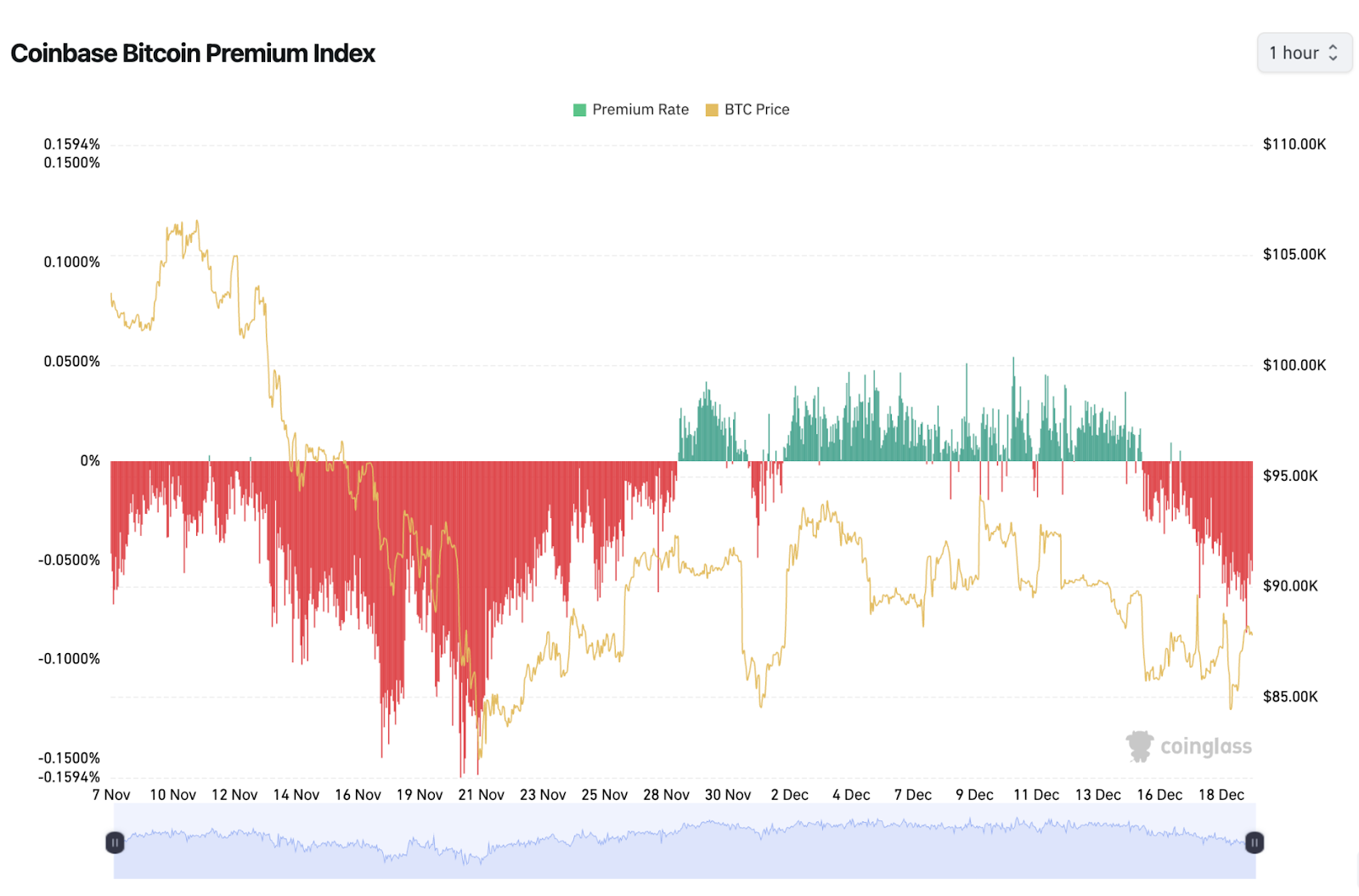

Alongside this, we have the Coinbase Premium turning negative again, suggesting that sellers are dominant during the US trading sessions. Again, this isn't conducive to higher prices.

Coinbase Premium turning negative:

Chart Technicals Suggestive of a Bottom?

If we look at BTC from a technical perspective, we have had a large drawdown from the all-time high (-36%), and in the last month, BTC has been mostly range-bound in a bear flag formation, with price now below the flag and retesting the underside of it as resistance.Alongside this, we haven't had any bullish divergences as yet, which were a strong indicator for marking the lows back in April 2025. We have highlighted these on the chart below in orange - lower lows in price, higher lows on the oscillator.

BTC 1D Chart:

Cryptonary's Take:

Despite this week's data showing a continued weakening in the labour market and inflation data coming in softer, the odds of a January interest rate cut have only marginally increased. However, risk assets have been spurred following a less hawkish than expected rate hike out of the Bank of Japan, even though it's likely that the BoJ will raise rates again over the coming months.Bitcoin remains range-bound under lacklustre flows with monetary policy stimulus unlikely in the immediate term. However, going into 2026, we do expect more interest rate cuts than what the market is currently pricing for, particularly when Powell is replaced from mid-May onwards.

But for now, we remain of the view that BTC can retest the lows and find a bottom somewhere between $77k and $82k, which is where we'd become interested buyers again.

Our view is that we bottom out sometime in late December or January, before the market starts looking ahead at the fiscal and monetary policy stimulus that's likely to come in 2026, and this is then a significant tailwind to risk assets.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms