Market Update: Majors Show Signs of Recovery

Markets are trying to find their footing after one of the most brutal shakeouts in crypto’s history. Last Friday’s liquidation wave wiped nearly $20B in leverage positions, marking the largest single-day flush ever recorded. Now, as traders pick up the pieces and TradFi steadies on Trump’s tariff comments, the big question this week is simple: can the bounce hold?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

This Week’s Setup: Can the Bounce Be Sustained!

Good afternoon all,We're beginning this week with a market-wide bounce following a horrid end of the week last Friday, which saw what was likely the biggest liquidation event in the history of Crypto. Those in Spot positions were damaged, particularly the portfolios positioned further down the risk curve. However, the real damage was done in the leverage market, where losses were huge. This damaged many across the board. To put last Friday into perspective, it’s expected that single-day liquidations were at $1.2b during the Covid crash, $3.0b on the Luna crash, and $1.6b on the FTX crash. Last Friday, it’s estimated that single-day liquidations were at $19.5b.

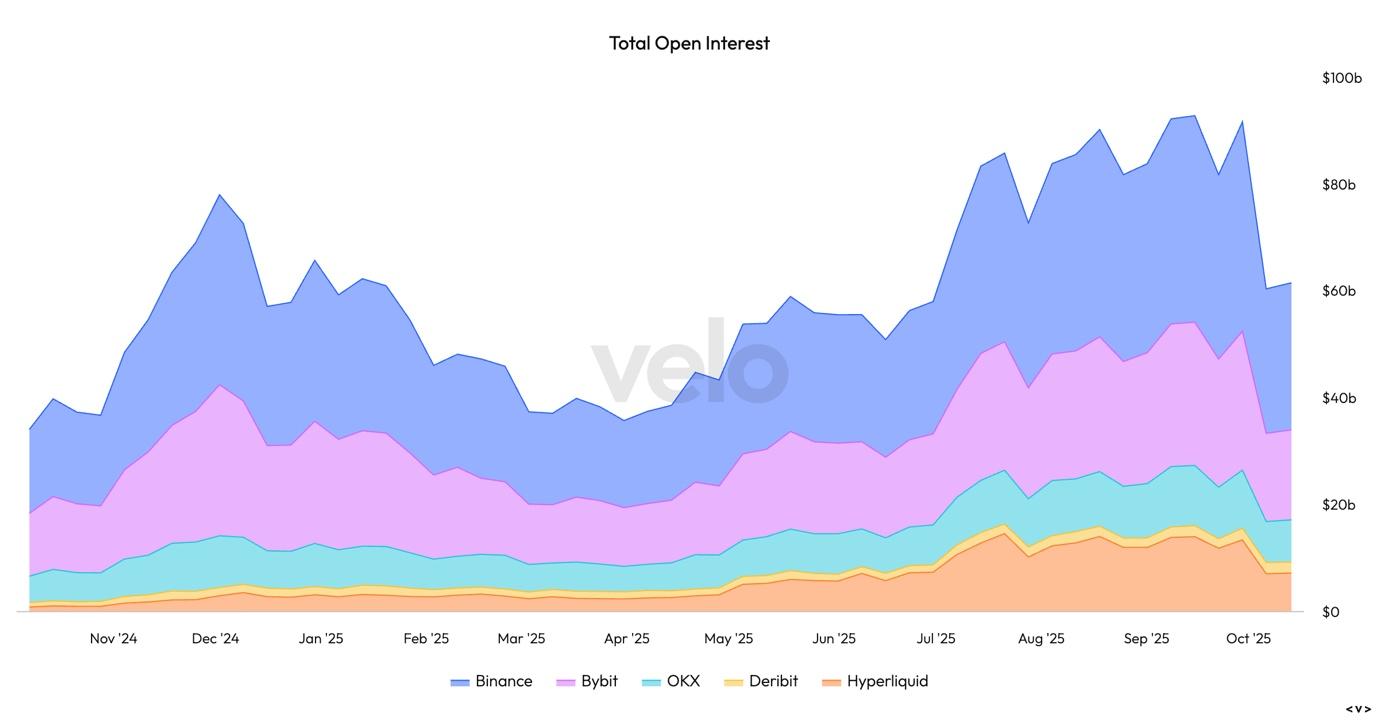

We saw roughly a 35% drawdown in total Open Interest; this was the same in BTC as well as ALTS.

BTC Open Interest Drawdown:

When we look at all coins Open Interest added together, we can see that the drawdown in Open Interest was from $91.4b on September 29th, to $60.3b by October 11th.

Total Open Interest (all coins):

However, for those positioned just in the Majors, you wouldn’t have experienced much drawdown. The strong portion of the drawdown was mostly outside of the Majors and in the leverage market.

Trade Escalations:

The above was sparked from a Trump social post where he said that he'd be adding a further 100% tariff on China, following China's expansion on rare earth restrictions, which were one of the US key exports out of China as these rare earths would be used for military equipment (radars for instance) and other key sectors, like electric car batteries, and chips.However, Trump made comments on Sunday to try to diffuse the situation: "everything will be fine with China" and "I have a great relationship with President Xi".

This gave TradFi markets the chance to stabilise before the Futures market opened on Sunday evening, so really it was Crypto that took the brunt of the hit, rather than TradFi. Majors have mostly bounced back; however, most ALTS remain 30%-40% below their price from last Thursday.

What We're Watching This Week:

Whilst the US government remains shut down, and with a resolution for this week looking highly unlikely, we'll continue not to receive macro data. We were due to get inflation (CPI) data on the 15th, but that has now been postponed to the 24th. Therefore, we'll be watching even more closely the talks from Fed members this week to gauge their thinking on the path of rates over the coming weeks and months.Last week, New York Fed President, John Williams - who is held in high regard and is one of the more important voices on the Fed - signalled that he'd be comfortable cutting rates further as he's becoming increasingly focused on the slowdown in the labour market. This comes alongside the fact that Fed members are also more comfortable that the fears of higher inflation from tariffs may have been overstated.

Odds markets now have an October and December cut priced at 97.8% and 89.3%. So, the expectation here is that there is a high likelihood that the Fed cuts rates at both the October and December Meetings.

Target Rate Probabilities for 29th October 2025 Fed Meeting:

Alongside watching the Fed speak this week, we'll continue to monitor the trade war tensions and comments out of the Trump administration and out of Xi's administration.

The last thing we'll be watching closely is price action. Are bounces sustained? Do we get a V-shaped recovery? Do we reject into key resistance levels and turn over? For this, we'll monitor flows this week (ETF's etc) and we'll report back on this on Friday, as that'll hopefully give us a better zoomed-out picture that can give us a better forecast for the weeks ahead.

Cryptonary's Take:

Should we continue to get a de-escalatory tone out of both administrations, then we'd expect a slow but V-shaped recovery on the Majors. Alts/memes might take more time, as the amount of damage done might have really hit some traders/investors, and therefore, it may take more time for confidence and, therefore, capital to begin coming back into these assets. But should we see a strong bounce in the Majors (which looks like we're potentially seeing), then we may see capital quickly move back down the risk-curve, and last Friday is put down as a volatility shock that took out over-leveraged participants, rather than something that is more systemic long-term.We expect that the bounce in the Majors can be sustained, as we did see positive ETF flows into the Majors pre-Friday's crash, and now with this large leverage flush out, this will likely encourage larger players back into the market, as that flush-out risk has been removed. Remember, we suggested for some time that the total Open Interest in the market was very high and likely needed to be flushed out for Majors to have a meaningful breakout beyond all-time highs. It now looks like we've got that.

This opens the door for larger players to step in and buy up the assets that have been the best performers, but just at much cheaper prices. Our initial view is that this is a leverage flush-out that has reset positioning before what we still expect to be a much more bullish Q4.

The lesson in this is that in big pull-backs, there can be great opportunities, particularly as we continue to move into an interest rate-cutting environment that should be supportive for risk assets.

Peace!