Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Powell signals QT ending soon, hinting at Fed concerns over market liquidity rather than a bullish pivot.

- Repo rates spiking above Fed Funds highlight liquidity stress, prompting risk-off behaviour across assets.

- Markets reacting negatively: Crypto, equities, and bond yields are lower, while Gold surges past $4,300.

- BTC key zones: $100k–$107k as support; deeper value seen at $90k–$95k if pressure persists.

- Cryptonary’s take: Short-term risk-off phase due to repo stress, but Fed likely to respond with rate cuts and liquidity injections, setting up potential for a renewed risk-on rally later.

- Powell Ending QT, and What It Means.

- Risk-Off Across All Assets.

- Key Levels for BTC From an On-Chain Perspective.

- Cryptonary's Take.

Powell Ending QT, and What It Means

On October 14th, Powell said "our long-stated plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions. We may approach that point in the coming months".This would be the Fed ending its balance sheet run-off, quantitative tightening (QT). We've seen a lot of chatter on our X timelines saying how bullish this is, however, we're not sure we agree.

The Fed announcing this suggests that they're more worried as to whether banking reserves are ample enough for the repo markets to continue operating efficiently, the end of QT will ease the liquidity strains on the markets' reserves.

Repo markets are where financial institutions lend to each other, if one party needs short-term liquidity (cash). When the rates paid for these borrows spike, that suggests that the liquidity in the repo markets is less. This causes concerns as to the health of overall liquidity in the markets, pushing participants to risk-off in other areas of their portfolio to "sure up" their books. This is in case there is a liquidity crisis in markets, that would then result in a big sell-off in markets as other participants sell assets in a scramble for liquidity (cash).

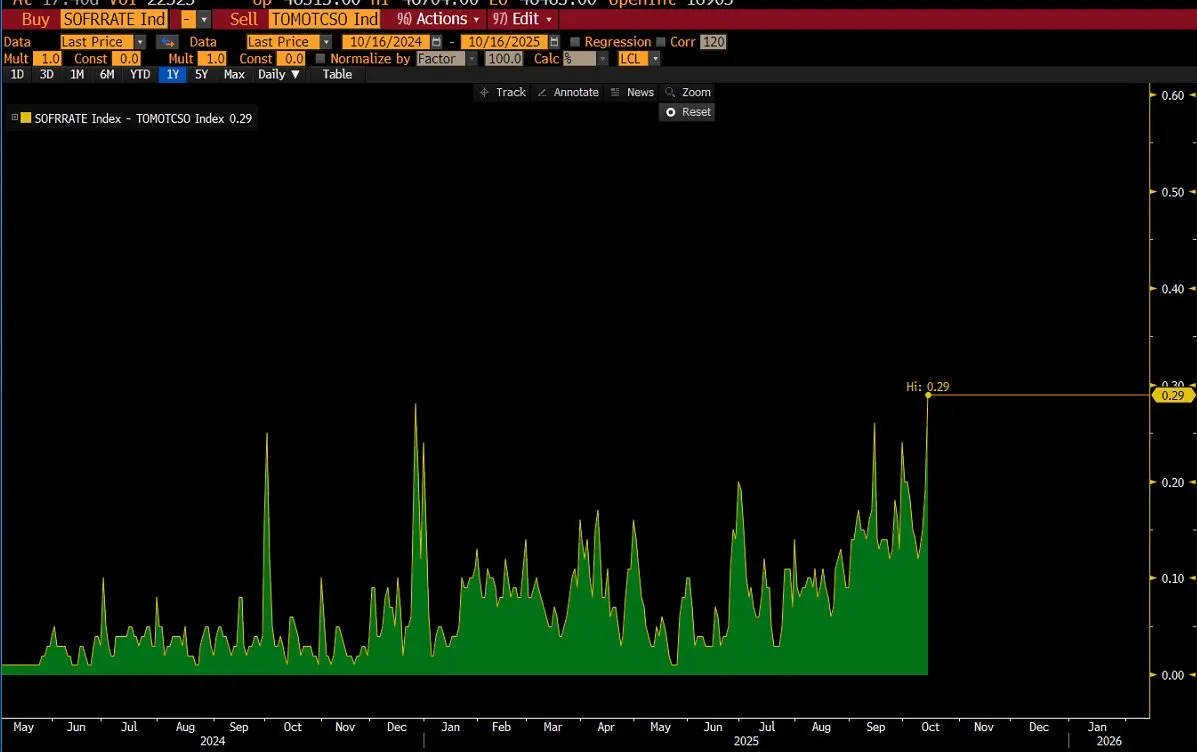

SOFR (Secured Overnight Financing Rate) Spiking Higher

Here we can see repo rates spiking above the Fed Funds rate. This confirms our thesis of liquidity concerns in the repo markets.

SOFR Spiking Above Fed Funds Rate:

This spike higher in repo rates will alarm some advanced market participants who might now suspect that overall market liquidity is less abundant, and they might respond by selling other assets in case of a blow up which would result in a drastic sell-off for risk assets - as participants risk off.

The Fed forward guiding a future end to QT helps put less of a strain on liquidity, but it's a precautious measure, rather than a "bullish boost".

We believe this could be the reason for the recent sell off. For a past example of a repo market crisis, look to September 2019. BTC went from $10,400 down to $7,300, with the S&P going from $3,030 down to $2,820, before the Fed stepped in and injected billions into the repo markets.

Should this happen again, risk assets would likely pull back hard, but eventually the Fed would come to the rescue. This would mean a short but potentially volatile crash. It's possible the crypto market has started to partially price this in before equity markets. TradFi are likely to sell Crypto, before their stock positions, as it’s further down the risk curve. This has resulted in a risk-off attitude in most assets.

Risk-Off Across Assets

As a likely result of the above, we've seen risk-off across most assets.- Crypto has moved lower.

- Stock indexes have moved lower.

- Front-end Bond Yields have moved lower (the Fed needs to cut more).

- Gold (safe haven asset) has continued its march, now up to $4,300.

Gold soaring higher shows the market flocking to safe haven assets.

Alongside this, the US2Y Bond Yield has broken below its range lows. This is the market suggesting that more Fed cuts are needed in 2026, along with the two expected for the remainder of 2025.

US2Y Bond Yield Breaks Range Lows:

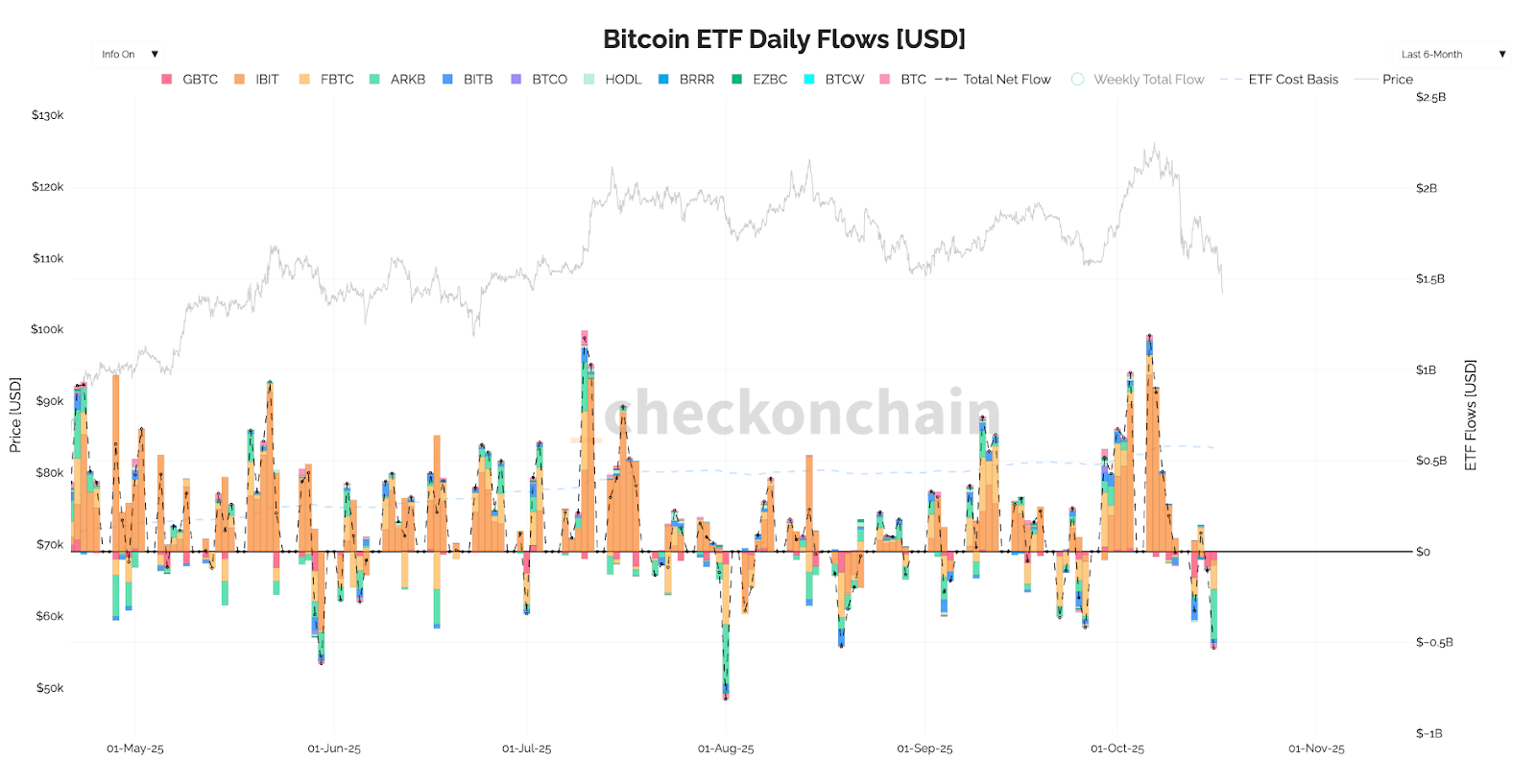

The risk-off sentiment is further reflected in Crypto also as we have seen prices come down substantially over the last week, with ETF flows also being negative.

BTC ETF Flows

If we continue to see funding stresses in the repo markets, risk assets could continue to sell down. Let’s now look at BTC to identify some key levels from an on-chain perspective.

Key Levels for BTC From an On-Chain Perspective

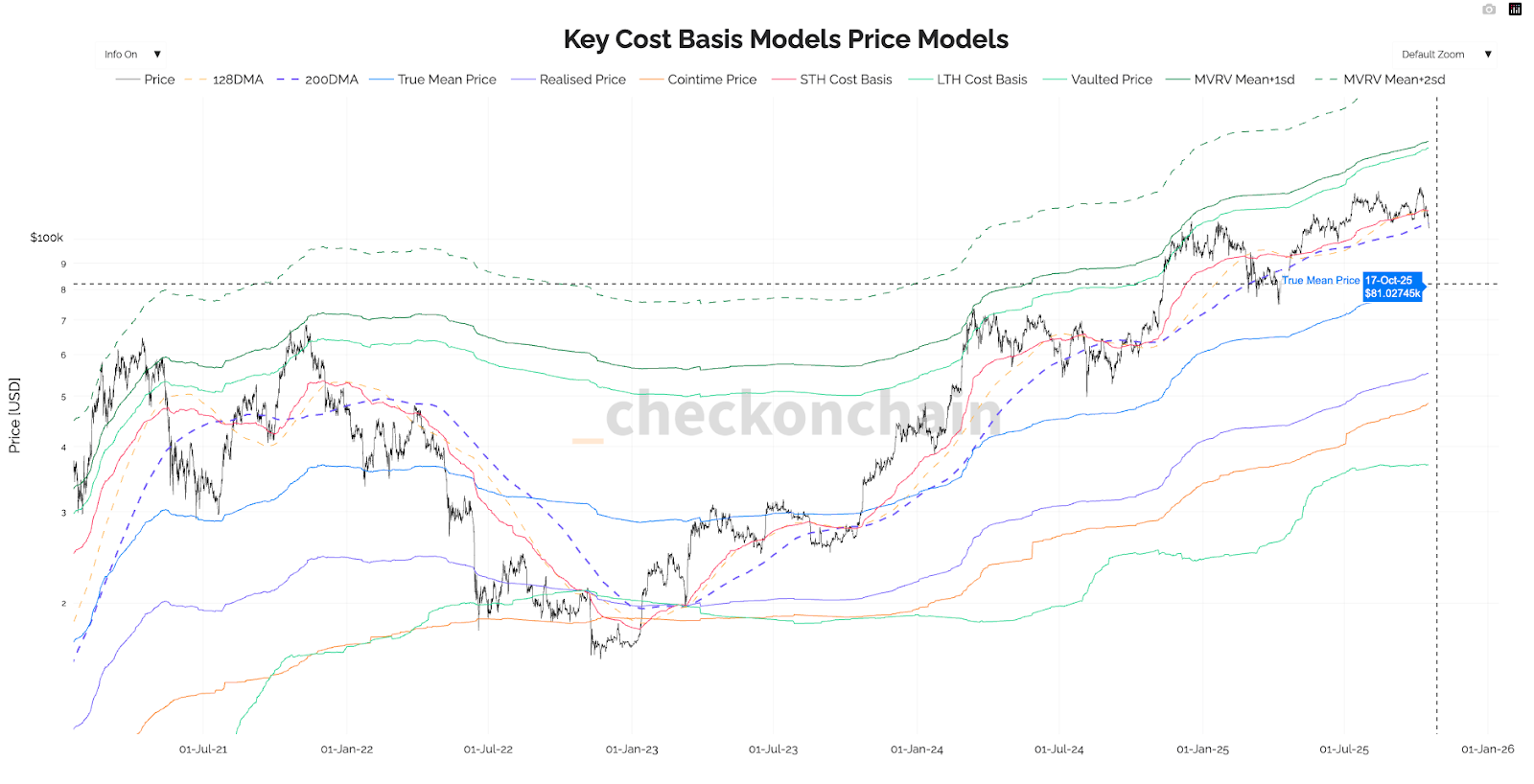

From an on-chain perspective, $100k-$107k is a key area. $100k is the MVRV mean, and $107k is the 200DMA. In the 2024 chop, and the 2025 tariff sell-off, BTC bottomed between these key levels (the MVRV mean and the 200DMA). The MVRV is the market value to realised value, it’s a key on-chain indicator that’s used for gauging market momentum. The 200-day moving average is a long-term technical indicator used by traders. Generally, if the price is above it, it’s bullish, and if the price is below it, it’s bearish.If BTC breaks below this $100k-$107k zone, we would look for bids between $90k-$95k. $95k is a key on-chain level as that is where 62% of the USD invested, cost basis is. Therefore, should the price dip below $95k, we would see that as strong value territory.

The True Market Mean Price is at $81k, however, we don't expect this area to be tested. The time we see a retest of the True Market Mean Price as likely, would be the next bear market, for now, we're not expecting one in the near-term.

Key On-Chain Cost Basis Models

Cryptonary's Take

The markets are risk-off due to higher rates in repo markets rather than trade war tensions between the US and China following a softer tone from the Chinese administration (the market now expects a trade deal to be reached.)But higher rates in repo markets have led to risk-off positioning in risk assets, as there are worries about the overall level of liquidity. The Fed will likely have to continue cutting interest rates and stabilise market liquidity by injecting liquidity into the repo market should there be a blow up.

This is a big short-term risk for Crypto. However, the Fed likely comes to the rescue with more rate cuts and liquidity injections into the repo markets, which might be the start of a new bullish trend in risk assets that then sees Gold pull back, and liquidity move further down the risk curve. We see this as a short-term issue, but it can bring the market back further. However, a proactive Fed that will continue cuts particularly now that we're seeing these constraints in repo markets. The Fed will also be placing even greater focus on this whilst we're in this data blackout period (the Fed not getting the economic data) whilst the US government remains shut down and with no signs of reopening soon.

We remain patient and proactive, with positioning in quality Spot holdings, plus aggressively buying BTC dips into the $90k-$100k region.