Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Powell’s dovish Jackson Hole speech lifted Sept rate cut odds, though rallies faded fast.

- Seasonality weak (Aug–Sept) with BTC ETF outflows; $105k–$110k key support zone.

- BTC broke trend but is consolidating near support; ETH/Alts stronger.

- This week: GDP, Jobless Claims, Core PCE — mostly expected stable.

- Trump pressure on Fed raises independence concerns, pushing long yields higher.

- Cryptonary’s view: patient, accumulating BTC on dips to $105k–$110k.

Topics covered:

- Powell and Jackson Hole Round-Up.

- Seasonality & On-Chain.

- BTC and Indexes.

- This Week's Data and Macro.

- Cryptonary's Take.

Powell and Jackson Hole Round-Up:

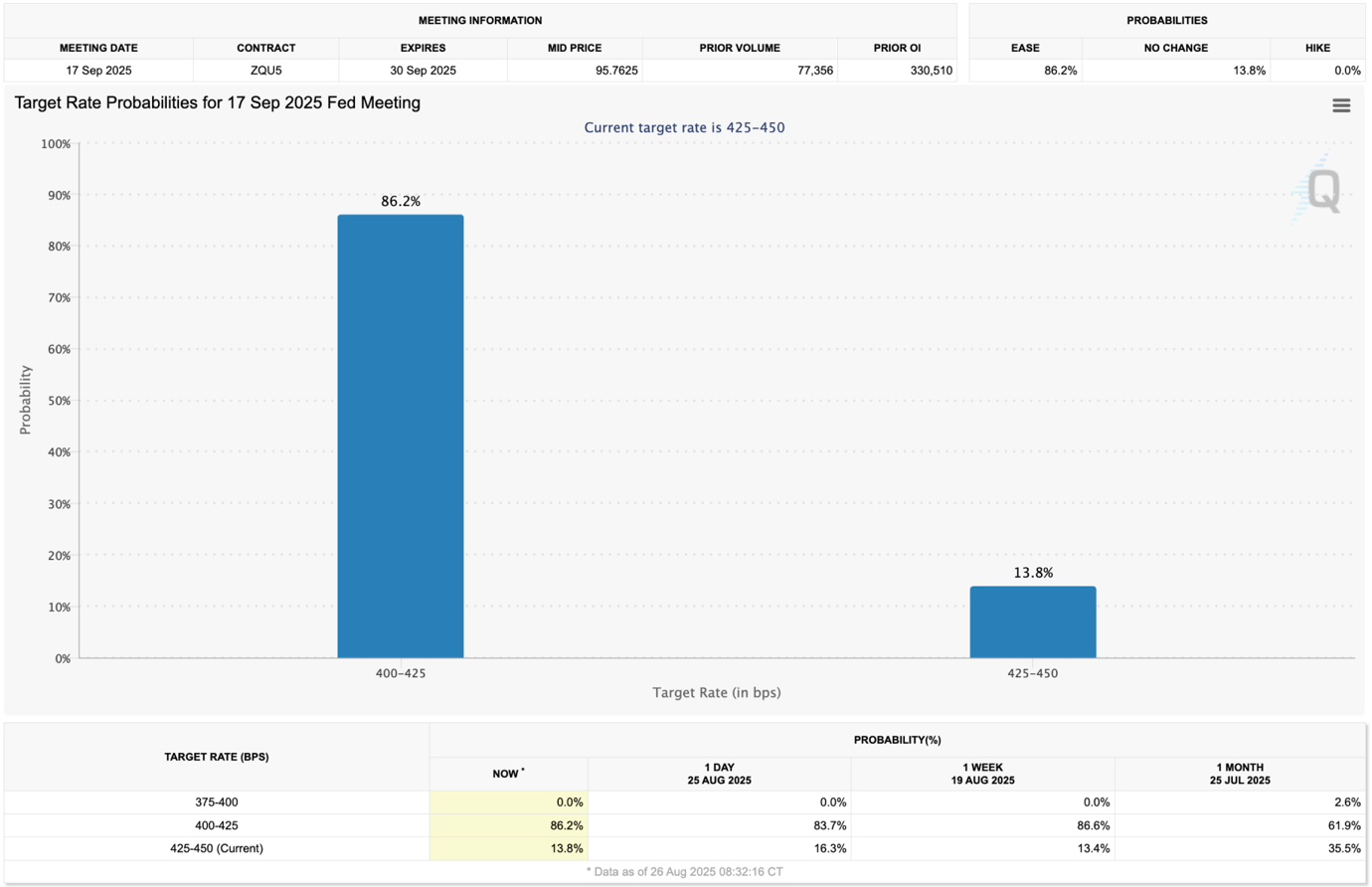

Markets were whipsawed last week off the back of a week of de-risking going into Powell's Jackson Hole speech on late Friday, as markets were anticipating a more hawkish Powell following the recent hotter-than-expected PPI data. However, Powell ended up delivering a more dovish speech than markets anticipated, where he opened the door to a potential Interest Rate cut at September's FED Meeting. He cited that this was due to an unexpected softening in the labour market, following the recent data and the large downside revisions to the prior month’s jobs numbers.As a result of this, risk assets bounced, and Bond Yields plummeted as the odds of an Interest Rate cut for September bounced back up to near 86%. This reversed the trend in the odds, which were declining (for a September Rate cut).

Target Probabilities for a September Interest Rate Cut:

As we noted above, risk assets bounced dramatically higher on Friday, but the move up has been sold into, with BTC now putting in a new low post-Powell speech. Although this wasn't our base case, it's also not uncommon to see profit booking into a low-volume, late summer environment. Many large TradFi players won't be looking to hold huge risk positions during this period, where seasonality isn't favourable.

Seasonality & On-Chain:

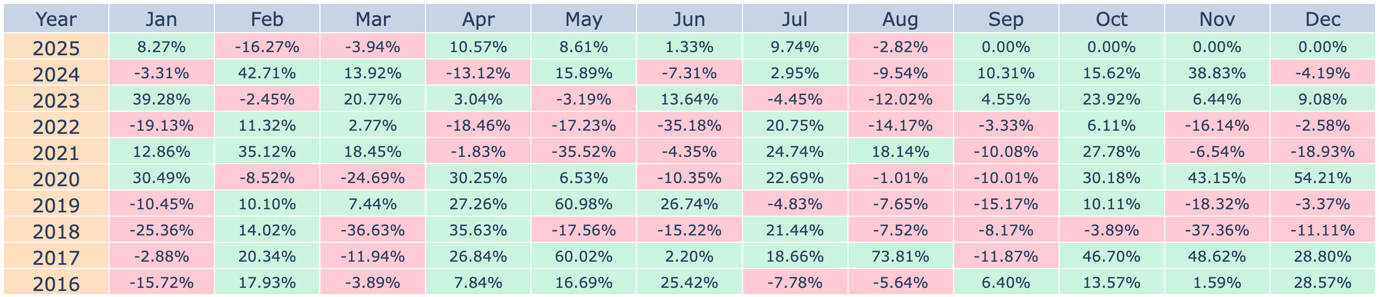

We can see in the below that August and September are usually poor performing months for the S&P, whilst BTC has also performed negatively in the same months. Alongside this, BTC is coming off the back of 4 positive months, so it might be expected that we see 1-2 months of pullback or consolidation.S&P Performance - Negative Seasonality in August & September:

Chart credit: Check-on-Chain.

BTC Performance - Negative Seasonality in August & September:

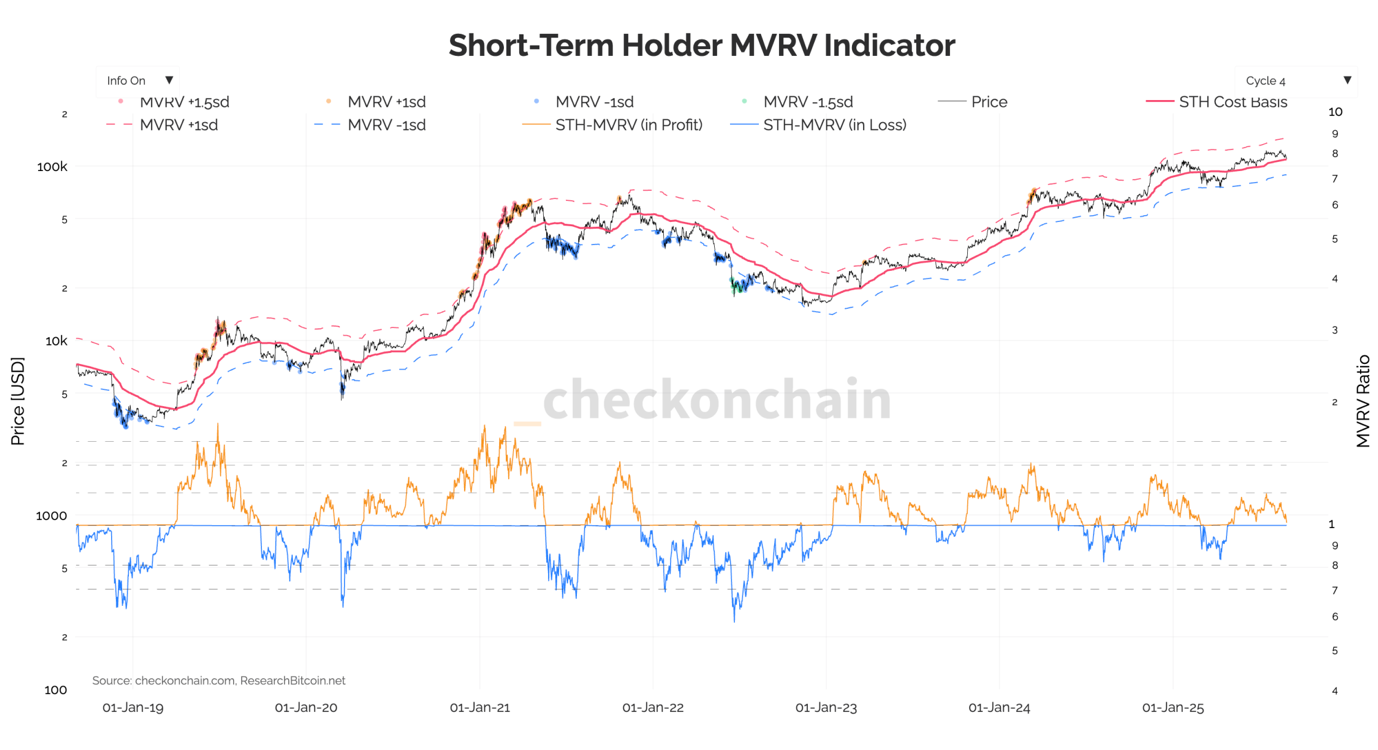

If we look at the ETF flows, we can see that for BTC, we saw consecutive days of outflows last week, with BlackRock also having consecutive outflow days. Over the last 6 months, IBIT (the BlackRock ETF) has had consecutive days of outflows, which has been a bottom signal, so this may have just occurred.

BTC ETF Flows:

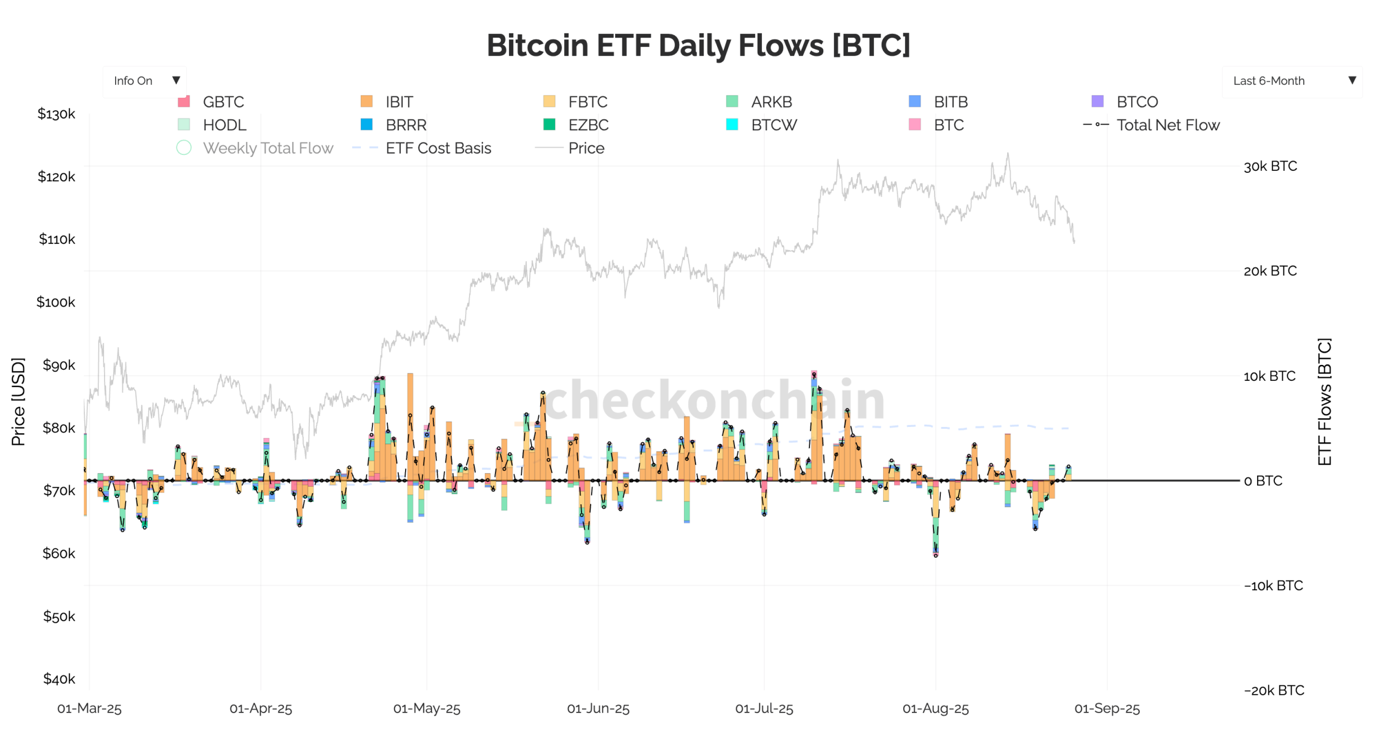

But we do also note that the Short-Term Holder Cost Basis lies at $108,000. The STH Cost Basis has historically been a 'line in the sand' level for bulls in a bull market, so we would expect the price to be defended at that level. However, it is also not impossible that we see a move below $108,000.

Should we be given $105,000-$110,000, we'd be aggressive buyers of BTC in this zone. $110,000 is a technical level on the chart.

Short-Term Holder Cost Basis for BTC:

BTC and Indexes:

In the above, we can see that we've had ETF outflows, with Bitcoin pulling back to its Short-Term Holder Cost basis. This is normal for a bull market, and this wouldn’t concern us.BTC has broken below its uptrend line with price pulling back close to its Short-Term Holder Cost Basis, along with the strong support zone of $108,000-$112,000.

BTC 1D Chart:

Meanwhile, Bitcoin Dominance has continued to trend lower, whilst ETH/BTC has continued to climb, and TOTAL3 has remained range-bound around its highs.

This, a general setup, is positive, despite how negative price action has felt in recent days.

BTC.D 1D Timeframe:

ETH/BTC 1D Timeframe:

TOTAL3 1D Timeframe:

Ultimately, we see this as a consolidation period for Bitcoin as it is in a weaker seasonal environment. However, the rest of the market is holding up (again, regardless of how negative price action has felt in recent days) as we can see in the charts above, with ALTS being led by ETH.

This Week's Data and Macro:

This week, we have a plethora of macro data releases. On Thursday, we have GDP and Jobless Claims. GDP is expected to come in at a strong 3.0%, whilst Jobless Claims are expected to remain at the 235k mark. Neither of these is expected to be market-moving, but we'll still have an eye on them. Should Jobless Claims pick up substantially, that would worry the market slightly, but it would have to be a large number, not what we're predicting.The data point that may be more market-moving is Core PCE on Friday. The forecast is for a 0.2% MoM print, which the FED and the markets will like. But should we see an upside surprise (0.4% or higher), then the market may sell off slightly, as it would likely result in a decrease in odds of a September Interest Rate cut.

Our base case is that the data should be relatively smooth sailing this week, and therefore, we're not expecting any major surprises.

Macro:

Although not majorly market-moving, Trump's pressure on FED Governor Lisa Cook to fire her could escalate into a further issue. Trump has essentially fired (or tried to fire) Lisa Cook for 'false statements' on mortgage agreements. Trump is putting maximum pressure on the FED in the hope that seats are given up before the end of their term, which allows Trump to appoint his own people. Should Lisa Cook lose her seat, and Trump puts in "his" candidate, that would give Trump a 4-person majority on a 7-seat board. This majorly increases concerns around the FED's independence, and as a result, long-end Bond Yields have moved higher, steepening the Bond curve.For now, this isn't much of an issue. But, with large Bond issuance coming on the horizon, and a big question over FED independence (because of Trump), this will result in the long-end Bond Yield remaining high. The issue with this is that if the FED cuts rates, it might not help lower the long-end Bond, meaning mortgages and longer-term debt rates won't come down, and therefore bringing rates down won't have their intended effect, i.e., helping the consumer.

As we said, for now, this isn't an issue. But it will become an issue if the FED lowers rates, and the long-end Bond Yield remains high. This would somewhat defeat the point of lowering rates, and we would therefore see a stronger reaction in the Bond market (which may severely affect risk assets at that time). This is a problem for 6-12 months' time, but we're monitoring this as one of the issues that could be a catalyst for the next macro bear market.

Cryptonary's Take:

We're expecting a quieter week on the macro front this week. There is data being released, but we're not expecting it to be market-moving.Bitcoin, Crypto, and just risk assets in general are in a weak seasonal environment throughout August and September, and therefore, it's possible we see a continuation in the consolidation for BTC. But, with ETH showing strength, and with it being fuelled with a strong narrative (ETH Treasury companies), we can see the rest of Crypto perform, even if BTC continues to consolidate for a few more weeks as we move closer to a potential Interest Rate cut in mid-September.

We're remaining patient, and we're not looking to trade this market in an aggressive way. However, we are looking to take advantage of pullbacks, and we view a Bitcoin price pullback to $105k-$110k as a value level to accumulate Bitcoin for the long-term.

Should price retest the low $100k's, we would need to re-evaluate our thesis on the market; however, it is our current base case that Bitcoin will bottom between $105k-$110k.