Market Update: Relief Rally Potential Hinted by Sentiment and Flows

After a quiet holiday period, markets are slowly finding their footing again, though activity remains muted for now. With liquidity still thin and most major participants yet to fully return, this update focuses on where positioning, flows, and sentiment stand as we head into the first meaningful trading week of January...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Quiet markets and low liquidity; Markets remain quiet into year-end, with low liquidity and little macro data until early January; meaningful activity likely resumes next week.

- Weak Bitcoin flows; Bitcoin flows remain weak: long-term holders are still selling and ETF flows remain slightly negative, limiting upside.

- Bearish sentiment; Sentiment is deeply bearish (Fear & Greed in extreme fear), which historically can precede short-term relief rallies.

- Relief rally possible; If ETF selling eases and the Coinbase premium improves, BTC could see a relief move toward $93k-$95k in early January.

- Cryptonary’s Take; cautious short-term optimism, with a potential relief rally driven by positioning rather than fundamentals.

Topics covered:

- This Week's Data.

- BTC Flows and Positioning.

- Cryptonary's Take.

With how the dates fall - New Year's Day tomorrow - markets will be closed and therefore most traders will take Friday off also. The market will kick back into gear next Monday (05/01/2026) where we have JOLTs data out on the Tuesday, and Payrolls and the Unemployment Rate out on the Friday. For context, expectations are for an increased Unemployment Rate and for a very low Nonfarms number.

It's highly likely that the big traders (those with the volume that really move the price) took last week and this week off, and they're likely to return next Monday (05/01/2026).

Therefore, our focus for now is on market positioning and the flows to help us determine price action for right now, and going into next week.

This Week's Data:

Perhaps the only notable data point we received this week was the Fed Minutes. Essentially, many members saw further rate cuts in the future but some participants "suggested under their economic outlooks it would likely be appropriate to leave rates unchanged for some time after the December cut".Ultimately, this week's Fed Minutes didn't change the markets outlook and only what we (market participants) already knew: the Fed are likely to be on pause for the coming months with rate cuts likely beginning again in late Q2.

We'll now move on to assessing Bitcoin from the positioning and flows perspective as we believe that should be our focus considering the lack of macro data this week.

BTC Flows and Positioning:

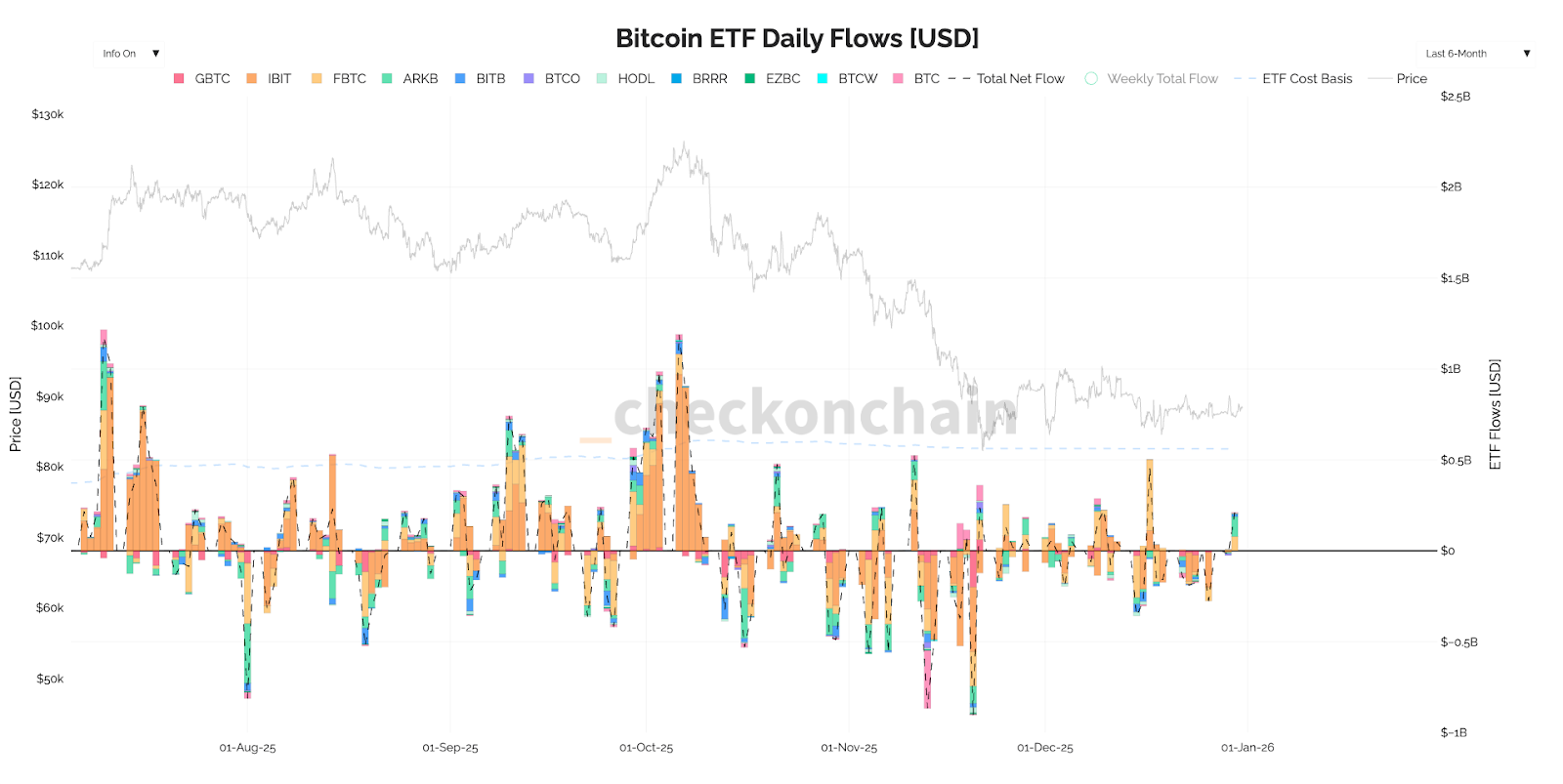

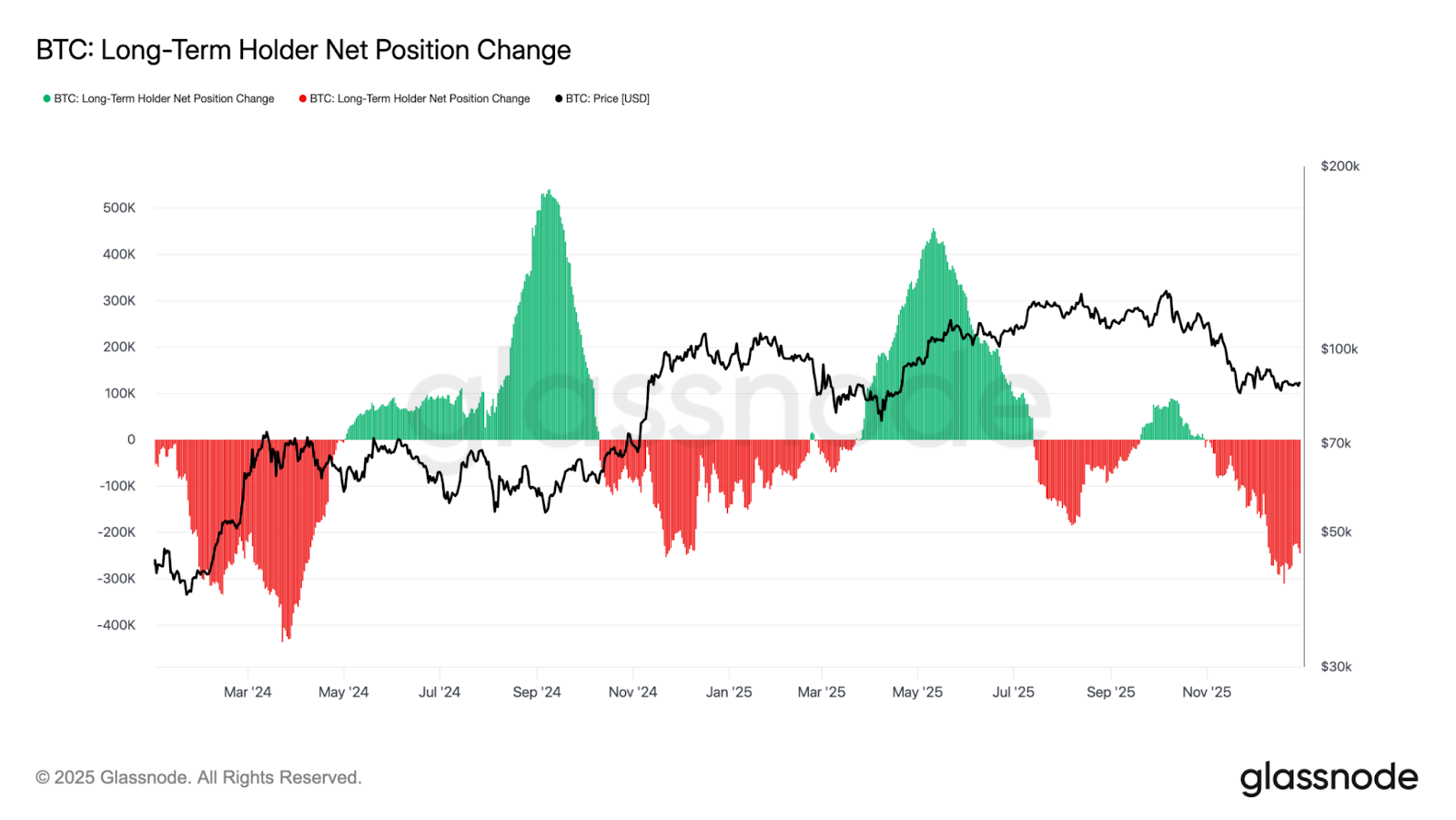

The two key metrics we've tracked over the last 1-2 months have been the ETF flows and the Long-Term Holder selling. In short, Long-Term Holders have been selling and in significant size, and the ETF's haven't been able to absorb the sell pressure, having also been net sellers themselves.Since late November (when we saw those large net outflows from the ETF's), the ETF's have been mostly neutral/slightly skewed towards net outflows. For now, this still remains the case. It's good that we're not seeing huge outflows days anymore, but we're not seeing huge inflows either, and whilst we're still slightly skewed towards outflows, it'll likely be tricky for price (BTC) to see a sustained rally.

ETF Flows:

As for the Long-Term Holders, they're still distributing their supply (selling). The daily amount of sell side has decreased, but they're still relatively large net sellers.

Long-Term Holder Net Supply Change:

So overall, the setup hasn't changed much. We still have Long-Term Holder selling with the ETF's unable to absorb the selling. Perhaps this dynamic changes once we get into the new-year and we have 'tax-loss harvest' selling behind us, but for proof of this, we'd need to see price move higher, and for it not to be sold into, which is essentially what we've seen in recent weeks.

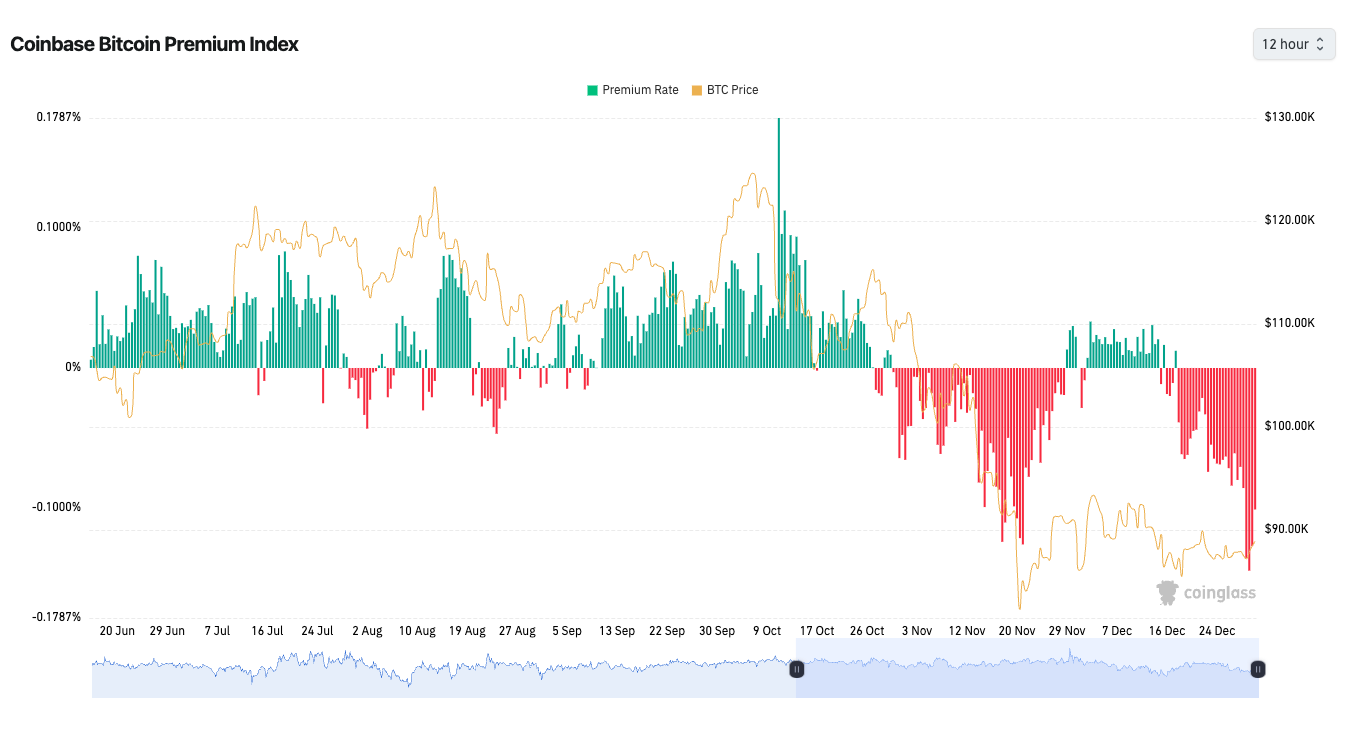

Alongside this, the Coinbase Premium remains negative. A negative Coinbase Premium has historically capped upside with the market trading lower in the weeks that follow.

Coinbase Premium Index:

However, should we see the Premium slant upwards (i.e., the largest downside candle is in, and the negative Premium closes), this could help aid a relief rally for price over the next week.

If we then look at this from a sentiment point of view, just going off one of the most basic metrics (the Fear & Greed Index) we can see that the sentiment has been in 'extreme fear' for the last month now. Hated, counter-trend relief rallies usually come off the back of these setups.

Fear & Greed Index:

If we then pair this with a Nasdaq than has just pulled back and filled it's gap, alongside the US2Y Yield also pulling back to its local lows at 3.44%, we have the conditions for risk assets to move up here in the short-term (next 5-10 days) and for Crypto to see some relief.

Nasdaq 1D Chart:

For BTC, and now looking at it from a technical perspective, we can see that price is in a larger bear flag. These tend to have price breaking to the downside but it doesn't always happen and the chart setup can be invalidated. We can also see that price is attempting to breakout from its main downtrend line from the all-time high. Should we see a meaningful breakout of this downtrend, and price did attempt a breakout on 29/12/2025 and failed, then it's possible that we see a retest of $93k-$95k in the coming 1-2 weeks.

BTC 1D Chart:

Cryptonary's Take:

Without any significant economic data until later next week, the market has had little in the form of macro catalysts and therefore price has mostly traded on flows and positioning. The flows still show a slight skew towards outflows with Long-Term Holders continuing in their selling, although the magnitude of the selling is beginning to decrease. This dynamic has remained, and it may be due to 'tax-loss harvesting' (people selling BTC in a loss to offset against their taxes before they buy it back in the new-year). But, once we're into the new-year, we'd hope to see this dynamic change.If the flows do improve going into the new-year - and we believe they can due to tax-loss harvesting no longer taking place - then the market might be set up for a relief rally in the first few weeks of January. Should we see the negative Coinbase Premium close, selling from ETF's and Long-Term Holders begin to subside (there's evidence that we're at the beginning of this), then we could see a counter trend rally. This is particularly the case when sentiment is as low as it is, and has been as low as it is for the last 1-2 months.

Overall, we think a small relief rally is possible in the first few weeks of January due to positioning and poor sentiment reversing. This might result in BTC heading back to $93k-$95k as a minimum target. However, the play we'd make (just from a charting perspective) would probably be SOL. Current price is $125-$126. We believe a move back to $136-$144 is possible.

For now, that's our thinking, but we'll be open to reviewing and assessing this outlook as we get into next week and the important labour market data.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms