Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Yen intervention is the main near-term risk; BoJ and/or New York Fed action could spark a carry-trade unwind and weigh on equities and crypto.

- Fed meeting likely a non-event; Rates will stay unchanged, with dovish repricing more likely later in Q2 under a new Chair.

- Bitcoin remains soft short-term; ETF outflows, LTH selling, and weak retail activity suggest continued consolidation or downside.

- Pullbacks favoured for accumulation; BTC dips toward $70k-$80k are viewed as attractive ahead of a stronger Q2/Q3.

Topics covered:

- Yen Intervention And Its Effect On Risk Assets.

- This Week's Fed Meeting.

- Bitcoin Forecast.

- Cryptonary's Take.

Yen Intervention And Its Effect On Risk Assets:

On Friday, the Japanese Yen was approaching the 160 level (160 Japanese Yen to 1 Dollar). In recent years, the 160 level has been where the Bank of Japan has intervened in its currency, i.e., to protect its currency from weakening (against the Dollar) further. The reason the Japanese do not want their currency to devalue beyond the 160 level (160 Yen to 1 Dollar) is that it leads to higher inflation. Historically, a country dealing with higher inflation would hike interest rates, tightening monetary policy, which would result in inflation eventually coming down.However, in the case of Japan, they’re reluctant to do this (hike interest rates) - despite needing to - otherwise Japanese Government Bonds would sell off drastically. Why buy JGB's now when you can buy them later at a higher yield? This is why the BoJ is so reluctant to increase interest rates. So, as an alternative to rising inflation, they choose to defend their currency.

Historically, the BoJ has chosen to defend the Yen at the 160 level by buying Yen and selling Dollars. On Friday, however, the Japanese Ministry of Finance asked the US Treasury for help i.e., for the New York Fed to sell Dollars to buy Yen. The New York Fed contacted dealers and asked for a rate check, and this in itself showed the willingness on the US side to 'help out', despite the New York Fed not actually intervening yet, but the willingness being there.

The result of this was that the Yen strengthened aggressively against the Dollar, and this risks another 'Yen carry trade' unwind, i.e., traders who borrowed Yen at cheap borrowing costs, who then bought higher yielding foreign assets, have to unwind that position - often meaning they sell US equities (the higher yielding foreign assets).

This is shown in the below chart - when the Yen strengthens (red line) against the Dollar (Yen reversing down from 160), this can be a short-term headwind for risk assets (the Nasdaq). When the Dollar strengthens (yellow line) against the Yen (Yen reversing up from 140), this is supportive for US tech (the Nasdaq).

This is shown below:

- Red Line: Yen strengthening against Dollar = headwind for risk assets.

- Yellow Line: Yen weakening against Dollar = positive for risk assets.

Despite the BoJ and the New York Fed not intervening late last week, the willingness spooked markets and the Yen strengthened aggressively, whilst the Nasdaq sold off slightly. However on Monday, the Nasdaq moved higher in pre-market trading on the news that neither the BoJ or the New York Fed intervened. Despite the 'Yen carry trade unwind' being more prominently known now, it is still a risk (a risk of unwinding) going forward for risk assets. This potential unwinding, and therefore a pull back in US equities, is the big risk we see this week - should the BoJ and particularly the New York Fed intervene in the USD/JPY.

This Week’s Fed Meeting:

We covered this in greater detail in last Friday's Market Update report, so there isn't substantial need to go into the micro details again, but we will cover this from our viewpoint.Going into the meeting, there is a 97.2% chance the Fed keeps rates unchanged, with the next rate cut not being priced in until June - the first meeting of the new Fed Chair. So in our view, the market isn't expecting any excitement (for rate cuts) anytime soon, and we do think that's right. However, the market is pricing in just 2 rate cuts for 2026, and we expect a new uber-dovish Fed Chair that is loyal to President Trump going into the mid-terms, to cut rates by more than what the market is currently pricing.

So, even though we don't expect it at this meeting, should we see a more dovish tone from Powell or dovish dissents, the market will start to price in more cuts in 2026. We don't think this plays out at Wednesday's Fed Meeting, but we do think it plays out in the Meetings to come, particularly the late-April meeting.

Bitcoin Forecast:

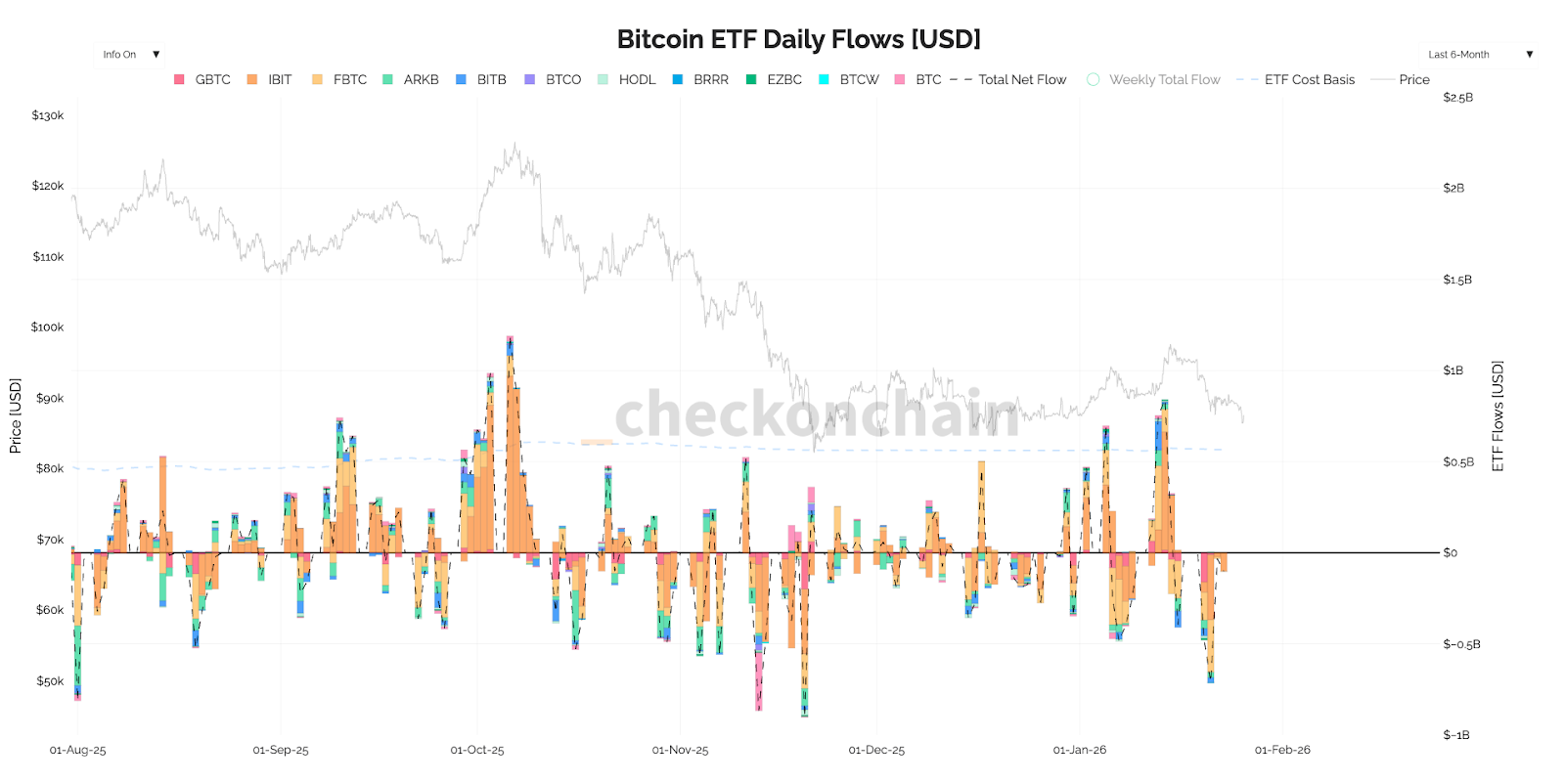

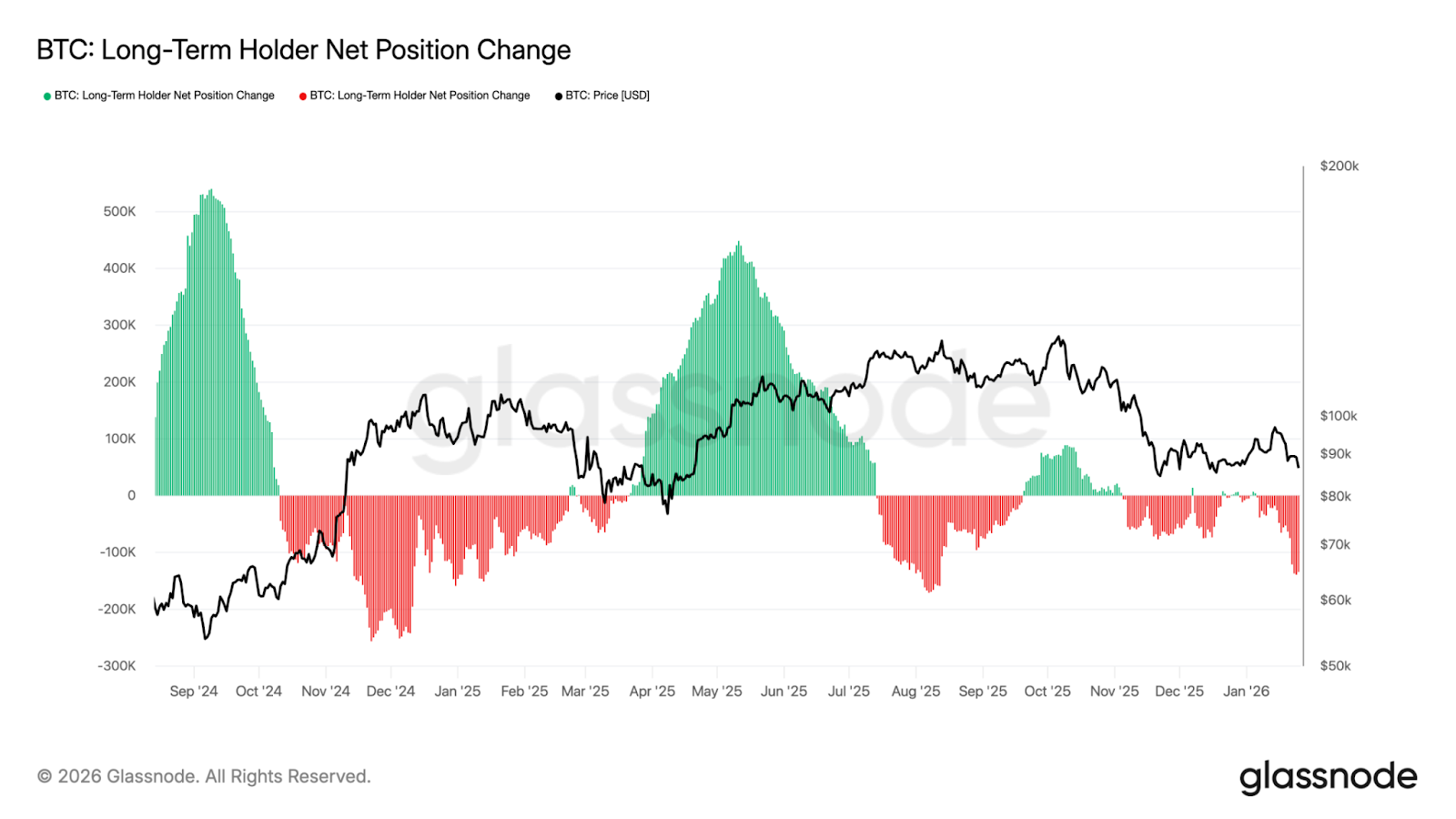

The environment for Bitcoin hasn't changed much. We're still in a period where we're seeing negative ETF flows, and Long-Term Holders selling down their supply, with this metric spiking lower again.BTC ETF Flows:

Long-Term Holder Net Position Change:

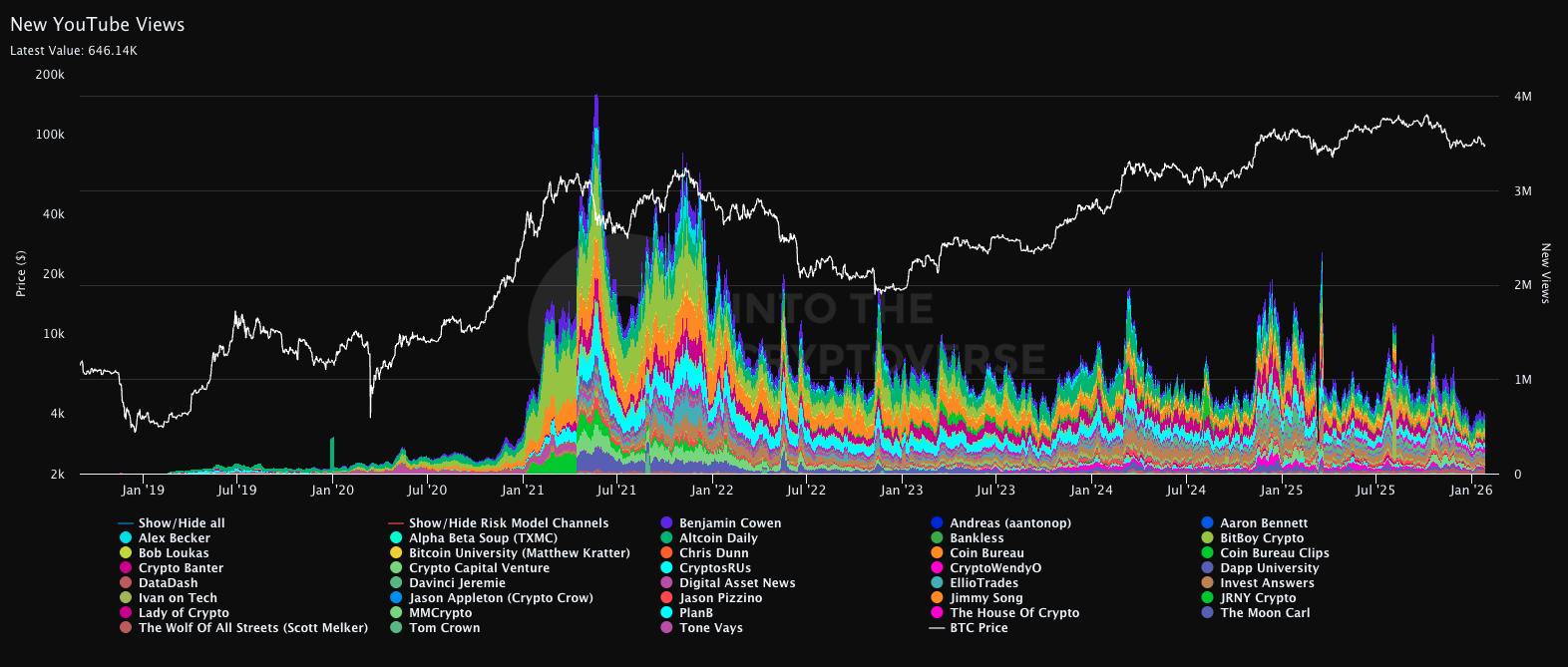

The metrics above show distribution without much to really match it, and we can see this in just the general participation. One of the best metrics for general participation, but probably more targeted at the retail audience is 'New Youtube Views'. We can see in the below chart that views (of Crypto Youtube channels) have been down trending, and they're at levels not seen since 2020.

New Youtube Views:

In some ways, this can be seen negatively: low participation, and animal spirits are nowhere near etc. But in all honesty, these are the times you want to be most attentive to what is going on. Low participation, low activity and just general lack of interest have all preceded great buying opportunities.

Now, that time might not be yet, but it's probably not as far away as many think - many are calling for a 12-18 month bear market, something we just don't agree with. We have covered buying zones in prior reports, but it might be worth highlighting again in reports in the coming weeks.

In our view, rates are on hold until a new Fed Chair comes in mid-May, where a friendly Trump Chair is likely to do what they can to bring rates down going into the mid-terms. The market will likely get excited about that before May, not upon a mid-May rate cut, but well before that; late-March, maybe early-April.

So to us, this says the following: another quiet and lacklustre few months (February and March), but should we see substantial weakness in that period, it's an opportunity to be buying in for what we expect to be a much more positive late-Q2 going into the second half of the year.

We wouldn't be surprised to see the $70k-$80k area be tested in the next 1-2 months only for BTC to head back to north of $100k by some time in Q3. Our job now is to just navigate the next few months, but to be active, and to accumulate on the meaningful pull backs, rather than log off, and come back showing interest when BTC is back to $100k.

Cryptonary's Take:

The risk for equities, Bitcoin and Crypto in the short-term is a Yen intervention by the Bank of Japan and even possibly the New York Fed. Should this happen, the Yen would significantly strengthen against the Dollar and it would potentially cause a carry trade unwind, which could see risk assets pull back. In our view, a Yen intervention is inevitable due to the fiscal deficits being run in Japan, consistently weakening their currency. Whether that intervention is imminent or not is the question, but something we're paying close attention to this week.This is also running alongside a Fed Meeting this week, although we are not expecting fireworks, and for the Fed to continue indicating that they expect to keep rates unchanged at the next few meetings. And to be clear, we, and the market are not expecting a rate cut at this Wednesday's meeting.

Looking at BTC, it continues to trade in a lacklustre manner, having broken below its bear flag pattern, with flows remaining supportive of further downside in the coming weeks. However, should BTC move down to the low $80k's and below (only a 10% move down), we'll become increasingly interested in buys that we'd look to hold into year-end. Should price dip into the $70k's, our buys will become more aggressive.

As everyone else becomes more pessimistic and fearful in the coming weeks and months, we'll become more and more interested in buys.

Stay alert, stay active; we're not as far away as everyone thinks.

Peace!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms