Market Update: Risk Assets Signal Caution

This week could set the tone for how markets finish the year. Delayed US data, a key Bank of Japan decision, and growing risk-off signals are converging at a moment where price, flows, and sentiment are no longer aligned. In this update, we break down what actually matters, and how we’re positioning around it...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- US labour data is the main catalyst: Weak payrolls may revive rate cuts, but cuts driven by weakness are typically negative for risk assets and BTC.

- Inflation is less important: Expected near 3.0% YoY and unlikely to shift markets unless there’s a surprise.

- BoJ hike is expected: A move to 0.75% is priced in; only strong hawkish guidance risks a sell-off.

- Risk-off backdrop: Equity weakness and gold strength point to a possible BTC retest of the low $80k’s.

- Long-term bullish: The $74k-$82k zone is viewed as an attractive buying area ahead of a potential 2026 rally.

Topics covered:

- Data This Week.

- Bank of Japan Raising Rates?

- Charts.

- Cryptonary's Take.

Data This Week:

This week, markets will be intensely focused on the delayed jobs and inflation data that weren't released previously due to the US government shutdown.On Tuesday, we'll receive October's (estimated to be 55k) and November's (estimated to be 25k) Non Farm Payrolls, alongside November's Unemployment Rate (estimated to be 4.6%. So we'll get all the data except October's Unemployment Rate.

Should the figures come in as expected, then it would suggest that the labour market is weakening in a more material way, particularly with Powell himself saying that "Payrolls are likely overstated by approximately 60k jobs". So, should we see October's estimated 55k print, and November's estimated 25k print, would the Fed look at these as actually negative months, as a 60k reduction in each would mean each month resulted in job losses rather than gains?

Should this be the case, and particularly if the numbers come in weaker (less) than expected, would this put a January rate cut back on the table? We'd say that it would certainly improve the odds of a January rate cut, which would help the Fed get "closer to neutral". To put this in perspective, the Fed thought the Unemployment Rate would end the year at 4.5%. Should it come in at 4.6% or higher, another rate cut in the near-term is likely to bring the Fed closer to neutral rather than maintaining policy in its currently restrictive stance.

Would BTC and risk assets move higher off the back of this? i.e. another rate cut in either January or March?

In short, no. The reason we believe this is that if another rate cut comes due to more pronounced labour market weakness, then that's not a cut to "move closer to neutral" but rather a cut to offset weakness, i.e., the Fed is behind the curve. Risk assets historically don't respond well to this.

Lastly, on the data front, on Thursday, we're expecting Inflation data. It's expected that the Year-on-Year figures come in at 3.0% for both Core and the Headline numbers. We don't see the inflation figures changing the rate cut outcome much, and therefore, we don't expect the market to significantly react to it. But in short, the market can move up slightly should we see lower numbers (than expectations), and the market can move down should we see the numbers come in greater than 3.0%.

Conclusion: To summarise, we expect the labour market data to be the key market driver this week. A strong print and it likely confirms no more rate cuts in the short-term (likely until June when we have a new Fed Chair), and should we see low/weak numbers, then the Fed can cut again but we don't expect risk assets to react too positively to it as the Fed will be cutting due to labour market weakness rather than a 'Goldilocks' environment.

Bank of Japan Raising Rates?

This Friday, the Bank of Japan is expected to raise rates from 0.50% to 0.75% to counter high inflation, which has been above the BoJ's 2.0% mandated target for well over 3 years now. The rate hike is priced in. What's not priced in is the potential hawkishness from the BoJ and the potential for them to signal further rate hikes that closes the rate differential between them and the Fed.Historically, the BoJ raising rates has led to BTC pulling back.

The BoJ began normalising policy in 2024 after ending negative interest rates. They previously raised their rates in:

- March 19, 2024

- July 31, 2025

- January 24, 2025

The last three times the BoJ has raised rates, BTC has pulled back by:

- March 19, 2024 = 9% the next day, although price was higher a week later.

- July 31, 2024 = 25% 6 days later, and it took approximately 10 weeks for price to get back to the level it was at pre-hike.

- January 24, 2025 = 5% pullback 1 week later, and price was down 27% 5 weeks later.

Ultimately, a rate hike from the BoJ is highly expected, so we don't anticipate the market reacting significantly on the back of that. However, should the BoJ strike a hawkish stance, perhaps signalling that they plan to raise rates several times more, the market can sell-off on this.

But, the market is very aware of these risks now, i.e., Yen carry trade unwind, so the over-leveraged positions have mostly unwound, and hence we don't expect a market pullback (should the BoJ be very hawkish) to result in a major pullback for risk assets. We believe the more likely catalyst for that is if we get much weaker labour market data this week.

Charts:

Last week, we saw clear evidence of the market becoming more jittery over AI concerns. This was mostly reflected in names like Oracle, however, it did result in the indexes pulling back on Friday's session, with the Nasdaq hit the hardest, down 2.3%.Nasdaq 1D Chart:

Alongside this, we're seeing a move into safe-haven assets, particularly Gold.

Gold 1D Chart:

This suggests a risk-off nature going into year-end, which could see weakness in Crypto continue, especially as it's the asset that could be most vulnerable to tax-loss harvesting.

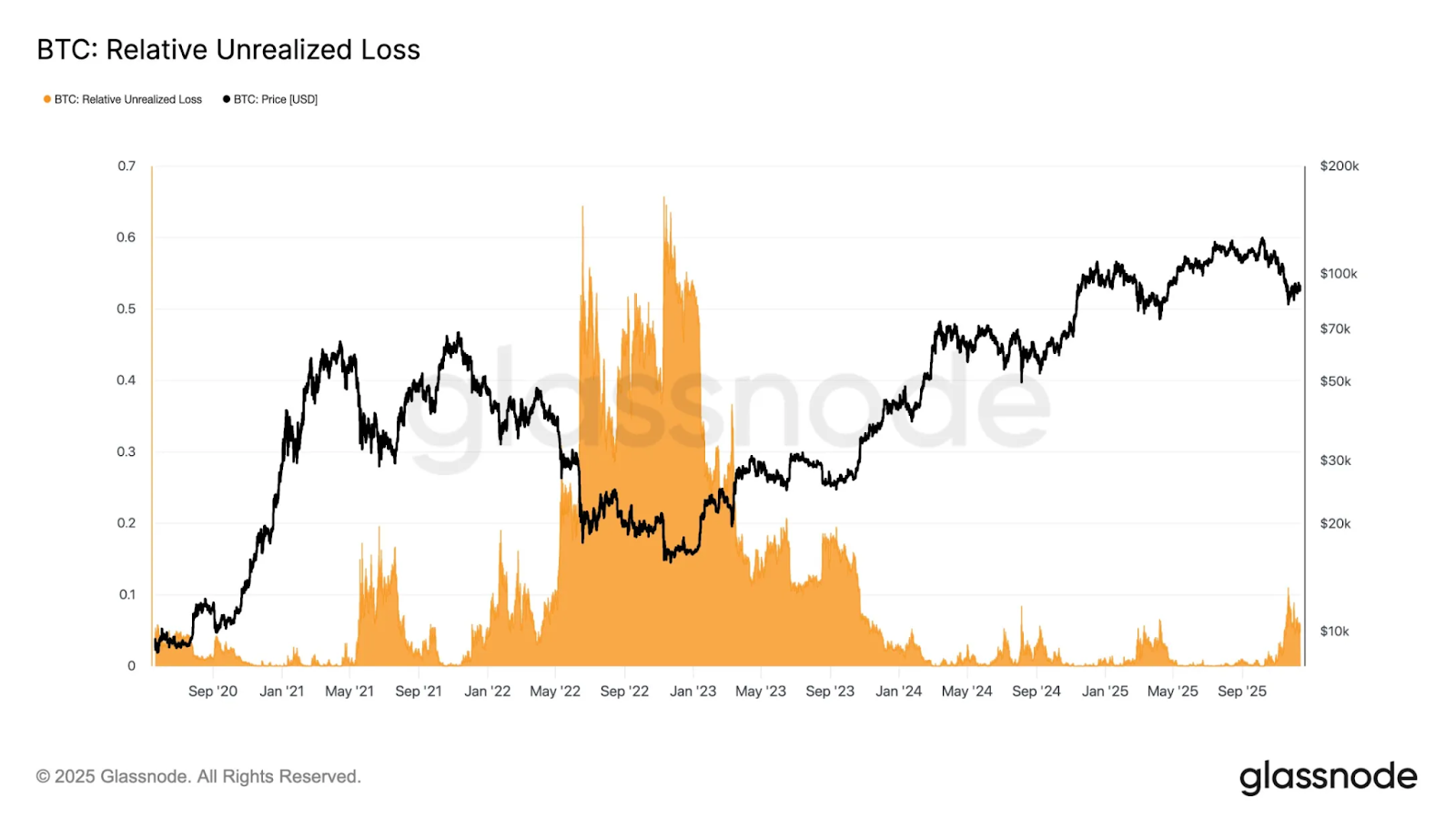

We can also see that despite the move down to $80k a few weeks back, this didn't put BTC investors into large unrealised losses. To us, this would suggest that we haven't yet seen a capitulatory move, and a retest of key cost basis levels (True Market Mean = $82k, and ETF Cost Basis = $82k) can be a very realistic outcome.

BTC: Relative Unrealised Losses are minimal still.

Alongside this, Saylor's cost basis (Strategy's cost basis) is at $74k. Should price retest the low $80k's - it's our base case that it will - then that brings Saylor's $74k cost basis into view. At this point, we'd expect fear in the market to be elevated, and we'd see the $74k-$82k zone as a long-term attractive buying level, particularly if this is paired with significant fear from market participants.

Cryptonary's Take:

This week, there are a plethora of macro events for the market to navigate through. Our view is that the most significant of these is Tuesday's labour market data. We see there as being a real risk that the data is weaker than what the market expects, and this can bring the Fed back to the cutting table, but not in the way that risk assets would celebrate. Therefore, it's possible that the data this week sees risk assets sell-off, and with BTC still having unsupportive flows, we see there as being a meaningful chance that weaker data this week catalyses a BTC sell-off to the lows $80k's.Going into 2026, there are a plethora of positive catalysts for risk assets, including supportive fiscal policy and likely more monetary easing that we believe markets are currently underpricing. Therefore, should we see further weakness from BTC, we would see that as a long-term buy. If price were to test into the key cost basis levels between $74k and $82k, we'd be aggressive buyers of BTC in this zone, with the expectations that price can revisit $120k in the first half of 2026.

We've had a period of patience, and we might soon be entering a period of activity again = buys, which we expect to reap significant rewards by mid-2026. An invalidation of our thesis would be if we saw a change in the flows - Long-Term Holders accumulating rather than selling, and ETFs adding more considerable size again. The macro backdrop becomes more supportive again into 2026, but we do expect more weakness in the immediate term before this. An improvement in the flows is what would change our immediate view.

We will provide 'Market Pulse' updates following Tuesday and Thursday's data, with a larger Market Update to finish the week on Friday.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms