Market Update: Supreme Court Tariff Decision Could Reshape 2026

We’re entering one of those rare windows where politics, macro, and crypto collide. It’s not just about the Fed anymore. On-chain flows and the Supreme Court are now part of the equation. Curious to know why? Here’s how it all connects...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Trump Tariffs: Supreme Court reviewing legality; 70-80% odds of being struck down. Refunds ($150B) could lift consumer stocks but hit bonds.

- US Data: Job cuts surged to 153k; markets see 66% chance of Dec rate cut. Yields, DXY dipped slightly.

- BTC Flows: Institutions and holders selling; ETF outflows persist. BTC may retest $92k-$97k.

- Outlook: Short-term caution (1-3 weeks). Expect bullish setup in 2026 with easier policy and fiscal support.

Topics covered:

- Trump's Tariff Ruling and its Potential Effects on Markets.

- Weaker Data and the Market's Reaction.

- Update on BTC's Flows.

- Cryptonary's Take.

Trump's Tariff Ruling and its Potential Effects on Markets:

On Wednesday, the Supreme Court began hearing arguments on Trump's "reciprocal" tariffs and whether or not President Trump was legally allowed to implement these tariffs under the 'International Emergency Economic Powers Act". President Trump declared a "state of emergency" based on the $1.2trillion US trade deficit, which allowed him to implement these tariffs. The Supreme Court will now determine as to whether he was overreaching on this "state of emergency", and therefore, should the tariffs stand.Should the Supreme Court find that President Trump went over the limit of his executive power, then the tariffs would be completely unwound, unless the administration can find another way to implement them. It's expected that the administration will be able to apply the tariffs again (just in other ways), even if the Supreme Court finds them to be illegal in their current form. However, a decision from the Supreme Court is not expected until December at the earliest, but more likely coming in the new year. Prediction market Kalshi, is currently predicting a 70-80% chance that the tariffs will be struck down.

Potential Effects on Markets:

If the Supreme Court determines that the tariffs are legal, then the market will likely remain unchanged as for now as the effects of tariffs are priced in, and no change would mean that the status quo remains.

However, should the Supreme Court deem that the tariffs are illegal, the result would be that the $150b (approximately) that has been collected in tariffs so far, would need to go back to businesses and consumers. The result of this would be positive for consumer stocks, however, the Bond market would likely react negatively to the outcome. The reason being is Bonds are priced against the US balance sheet and the fiscal setup. If the tariff income (priced at $300-$400b per year in income for the US) is taken away (repaid to businesses and consumers), US government Bonds will likely demand a higher term premia (the extra yield investors require for holding longer-dated debt when fiscal outlook worsens), meaning Yields up substantially, and risk assets will likely sell-off as a result of that.

For now, we're monitoring this situation, even though it's not something we expect to have the outcome of in the immediate term. But it's important to monitor the developments in case potential outcomes begin to get priced into asset markets.

Weaker Data and the Market's Reaction:

Due to the ongoing government shutdown, we're still without the major economic data. However, we're still able to get independent data, which is what we got yesterday. On Thursday 6th November, we had the release of the Challenger Job Cuts in the US. This showed that US-based employers laid off 153k people in October 2025, the highest total since March, and well north of September's 54k.

US Challenger Job Cuts

This shows that US-based employers are laying-off an increasing number of employees, which further emphasises the weakening trend that we're seeing in the labour market in the US.The market initially reacted to this with an increase in the odds for an interest rate cut at the December Fed Meeting. However, more hawkish Fed speak pulled those odds back again. All-in-all, the market is pricing a 66.0% chance that the Fed cuts interest rates again at December's Fed Meeting - up from 63.0% from a week ago.

Target Rate Probabilities for Dec 10th Fed Meeting

As a result, the US2Y Bond Yields came down a tad, along with the Dollar Index ($DXY). However, TradFi Indexes also pulled back, although this is more likely to be due to AI capex worries - chatter around OpenAI asking the government for loan guarantees.Chart Title:

Nasdaq 1D Timeframe

Ultimately, we're still expecting a Fed interest rate cut at December's Meeting, but it will be hugely dependent on the US government reopening (not expected to reopen for another 1-2 weeks) and for the data to come in showing increased weakening in the US labour market.It's our view that the US government will reopen by the December 10th Fed Meeting, and the Fed will cut rates by 25bps.

Update on BTC's Flows:

In recent week's, we've been paying close attention to the flows. In monitoring this, we saw that institutions and DAT's (Digital Asset Treasuries) have become net sellers of BTC, with the first warning sign coming when the net buying was less than the daily amount of coins (BTC) mined. Alongside this, Long-Term Holders were continuing to offload coins - something that has been a concern since mid-year. Overall, this was a recipe for us to become more cautious on the market particularly recently as net institutional fell below the amount of total daily coins mined.

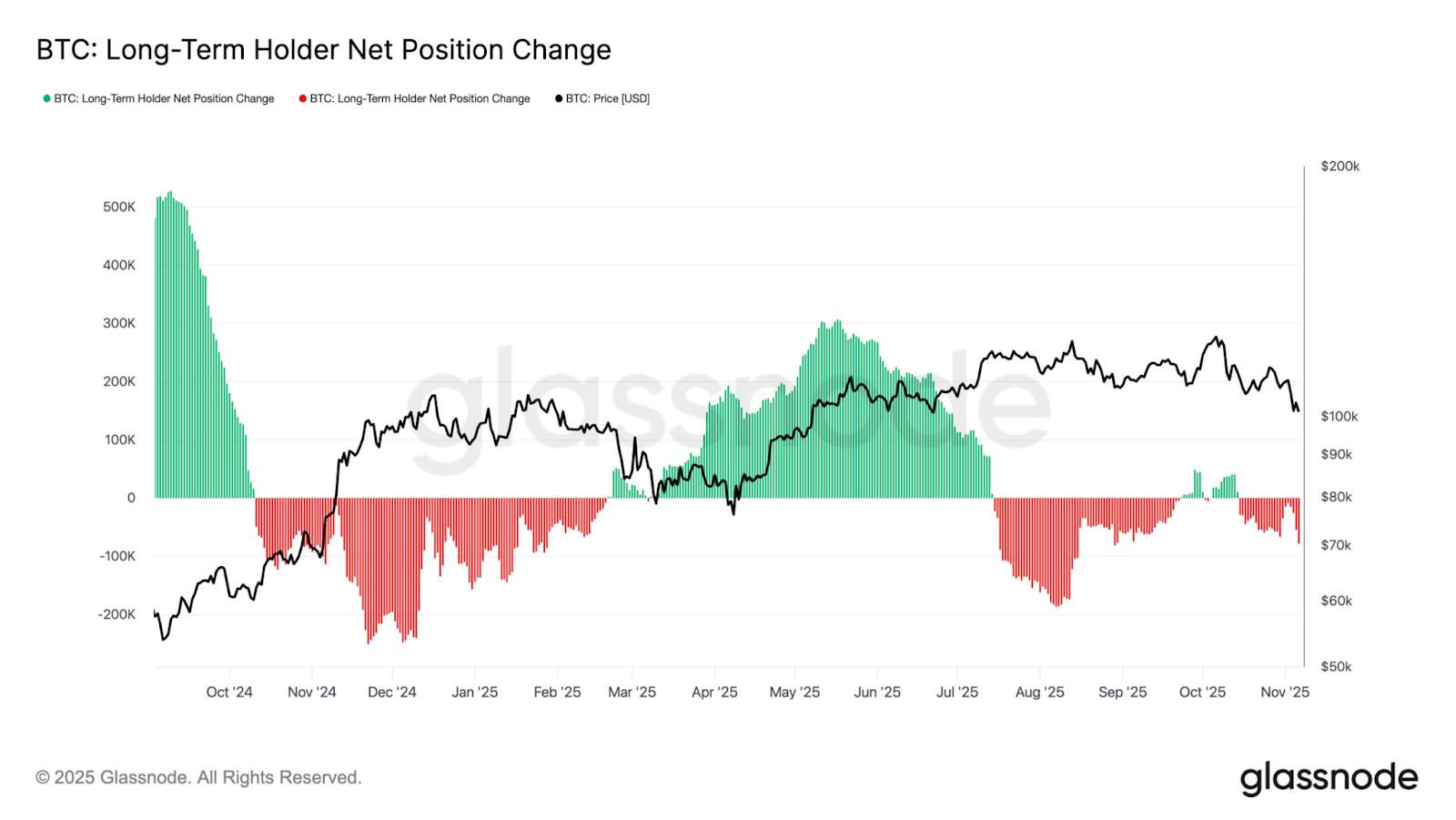

Unfortunately, we continue to see Long-Term Holders selling down their supply. The selling did ease, however as BTC bounced from $99k into the $104k level, the selling increased again.

Long-Term Holder Net Position Change

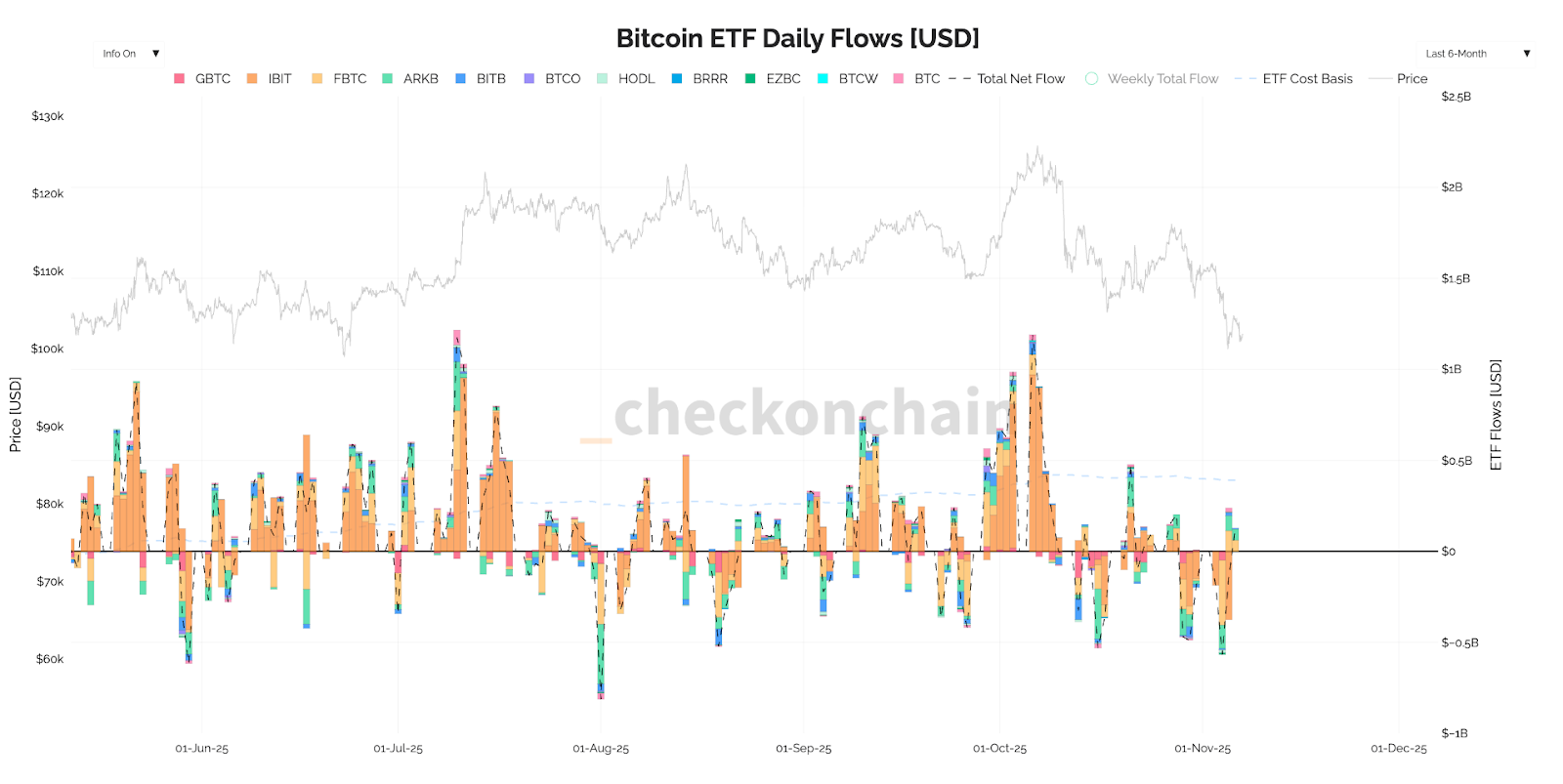

Adding to this, the ETF flows were poor (substantial net outflows). We have seen this ease in the last 2 days to small net inflows, although IBIT (the Blackrock ETF) has still shown outflows. But this is an improvement. We do need this metric to improve much more materially though to change our stance, and with the current macro uncertainty, we don't see this as likely in the immediate term (next 1-2 weeks).Chart Title:

Bitcoin ETF Daily Flows

Until this setup turns around, we're expecting the market to remain in risk-off mode. As a result, BTC likely retests the $92k-$97k zone, and we expect that BTC can fill the bottom of that zone ($92k).

BTC 1D Timeframe

If our forecast is correct, and BTC fills down to $92k, then we'd also expect BTC.D (Bitcoin Dominance) to move up to 62.0%- 62.5%.

BTC.D 1D Timeframe

In terms of forming a local bottom, we'd be looking for BTC to put in a new price low and for the RSI to be in oversold territory on the Daily, and for higher lows to form on the oscillator - bullish divergence. This is the setup we saw back in April (tariff tantrum), where Bitcoin bottomed.An invalidation of our thesis would be if we started to see large net inflows into the ETF's and for Long-Term Holders to stop reducing their supply and start adding their supply. But until we get that, we're expecting a risk-off environment to continue.

Cryptonary's Take:

BTC continues to trade in a weak fashion as the underlying flows remain poor with the 2025 marginal buyers (DAT's, and ETF's) now becoming the marginal sellers, whilst Long-Term BTC holders continue to reduce their supply with little signs of them stopping anytime soon. However, should we see lower prices, we'd expect the sell-side pressure to ease.We're expecting continued weak price action over the coming weeks (1-3 weeks) as the market navigates a poor liquidity environment with the US government remaining shut down. However, a retest of the low-to-mid $90k range should attract buyers - we'll be monitoring flows data closely for confirmation of this shift.

Our stance: Remain cautious short-term, but use substantial pullbacks as strategic buying opportunities. We maintain conviction that 2026 will be a positive year for Crypto, supported by:

- More accommodative monetary policy (likely a new dovish Fed Chair)

- Accommodative fiscal policy (Bill buying as the Fed runs off its MBS holdings)

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms