Market Update: The Pullback Arrives Exactly as Expected

The pullback we’ve been warning about has finally arrived. A reopened government, missing economic data, and a hawkish shift from the Fed have all lined up to pressure markets, just as our thesis suggested. BTC and macro indices are retracing, but this move brings us closer to the levels we’ve been waiting to buy. Let's dig deeper...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- US government reopens; but key October data may be delayed or missing; clarity expected closer to December.

- Fed turns more hawkish; slashing odds of a December cut; markets now expect a January cut instead.

- Risk assets fall; as rate-cut expectations fade, with BTC, Nasdaq, and Russell all pulling back.

- ETF flows and LTHs remain bearish; with continued BTC outflows and selling pressure.

- Medium-term outlook still positive; with choppy weeks ahead but attractive BTC buying levels approaching.

Topics covered:

- US Government Reopening & Economic Data.

- Hawkish Fed Speak Pairs Back Rate Cut Odds.

- ETF Flows and Long-Term Holders.

- Cryptonary's Take.

US Government Reopening & Economic Data:

Late Wednesday evening, President Trump signed a bill that allowed the US government to reopen. Over the last few days, government workers have begun coming back to work. However, this doesn't mean that we should expect a flurry of economic data to start coming out in the next week. It'll take time for workers to return and to restart the data collection process that then results in obtaining the final numbers that are then released.On Wednesday, White House Press Secretary, Karoline Leavitt said that the key inflation and jobs data for October will "likely never" be released due to the government shutdown, as it may have been "permanently impaired". Whilst Leavitt's case can be supported, it's likely that the numbers are not favourable to the administration, and therefore they're not being released because of that.

There is still a lack of clarity as to what economic data we're going to get and when we're going to get it. It's expected that the key labour market data we'll get on the first Friday of December (the same as usual) - and just a few days before the 10th December Fed Meeting.

Hawkish Fed Speak Pairs Back Rate Cut Odds:

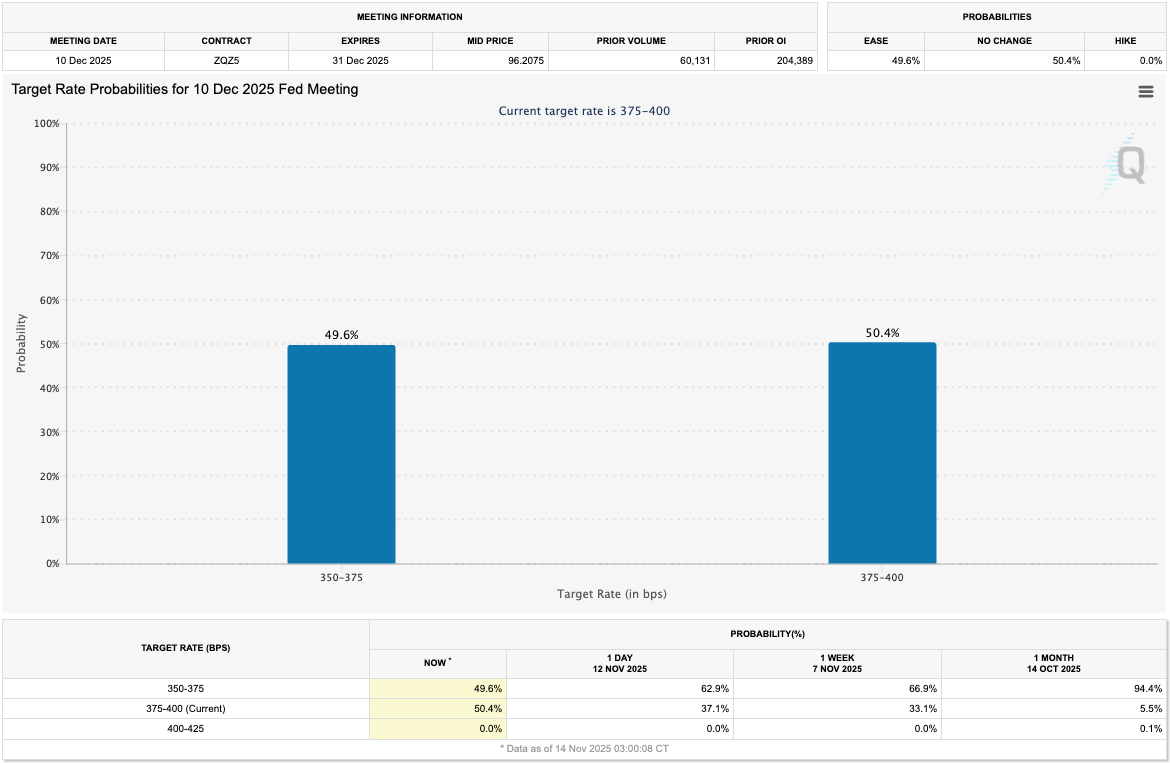

We've had a plethora of Fed speak over the last two days, with the main takeaway being the general hawkish tilt. They include Susan Collins of the Boston Fed, who said that "rates should stay at their current level for some time" due to inflation being at the 3.0% level. She is now alongside Austan Goolsbee (who has also recently made a more hawkish tilt), Jeff Schmid (who dissented for no cut at the October Meeting), Beth Hammack, and Lorie Logan.This has resulted in future's markets pricing in reduced probabilities of an interest rate cut at the Fed's December 10th Fed Meeting, with a cut now priced at 49.6%. This is down from 94.4% chance of a cut just a month ago, and down from 66.9% from a week ago.

Target Rate Probabilities for 10 Dec 2025 Fed Meeting:

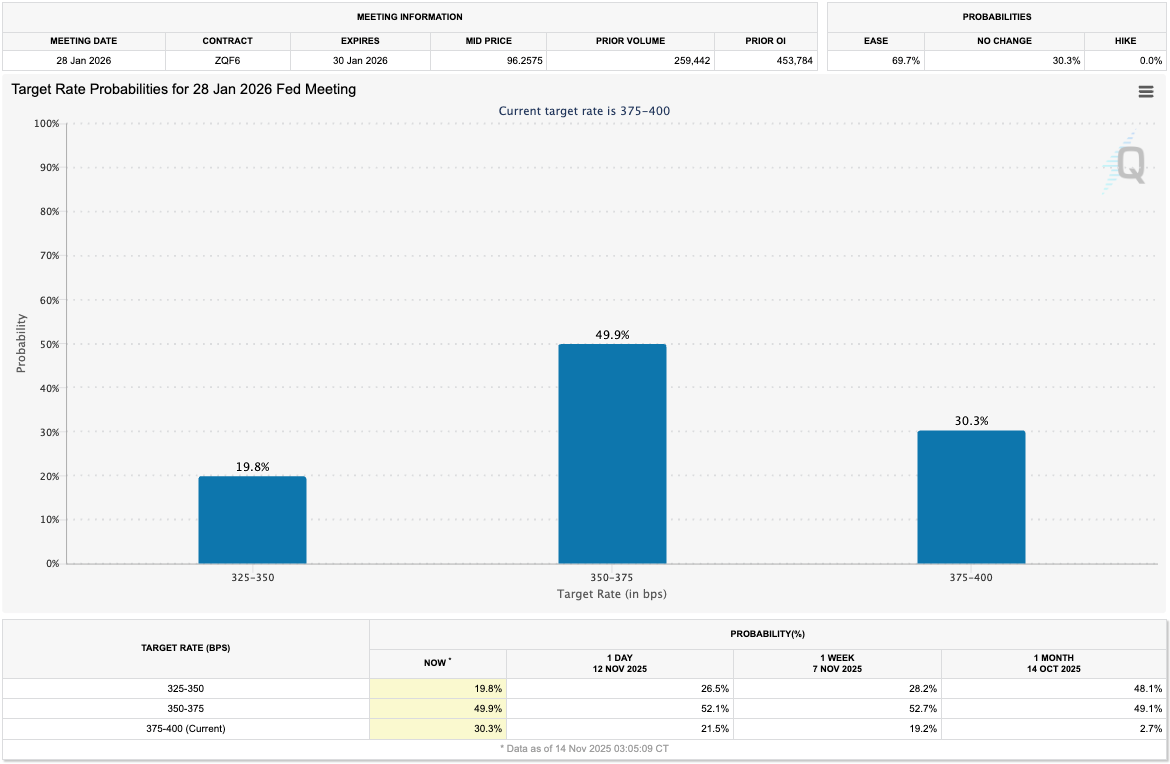

However, the market is looking at this Meeting (December 10th's Meeting) to be a "skip", rather than an outright "pause" in cutting rates. This means that the market is expecting the Fed to keep rates on hold in December, and to then cut again at the January 28th Fed Meeting. For the January 28th Fed Meeting, another hold in rates is priced at just 30.3% - suggesting a 69.7% chance of a cut.

Target Rate Probabilities for 28 Jan 2026 Fed Meeting:

But, as a result of decreased odds of a December interest rate cut, risk assets have pulled back - although this is also tied to some capital expenditure worries in the AI names as well.

The Nasdaq has pulled back 3.10% since Monday's relief rally, whilst the Russell 2000 has also been hit (to be expected considering it's sensitivity to interest rate cuts), down 3.85%. Bitcoin has not been immune to this, and it has traded down considerably, down 9.10%.

All three are shown in the below chart, with BTC outperforming to the downside.

- BTC: Orange

- Nasdaq: Blue

- Russell 2000: Green

Overall, we're highly likely to still be in an interest rate cutting cycle, but with the rate being significantly lower than it was 18 months ago, Fed members have grown cautious over continually lowering rates, particularly with inflation still at 3.0% and well above their mandated 2.0% target. This has led Fed members to lean more hawkishly recently, with a December interest rate cut now looking unlikely.

However, it's our view that we're going to see a continued weakening in the labour market (when we start receiving the data again) and that's going to lead the Fed to cut more in 2026, and likely cut multiple times. If you put this alongside a new Fed Chair in May, who is likely to be more dovish, this sets up an accommodative 2026 as the administration will do what they can to 'juice' markets going into the mid-terms.

To be clear, our view is now as follows:

- December 2025: no rate cut, but dovish forward guidance (will depend on the data though).

- January 2026: the Fed cuts rates.

ETF Flows and Long-Term Holders:

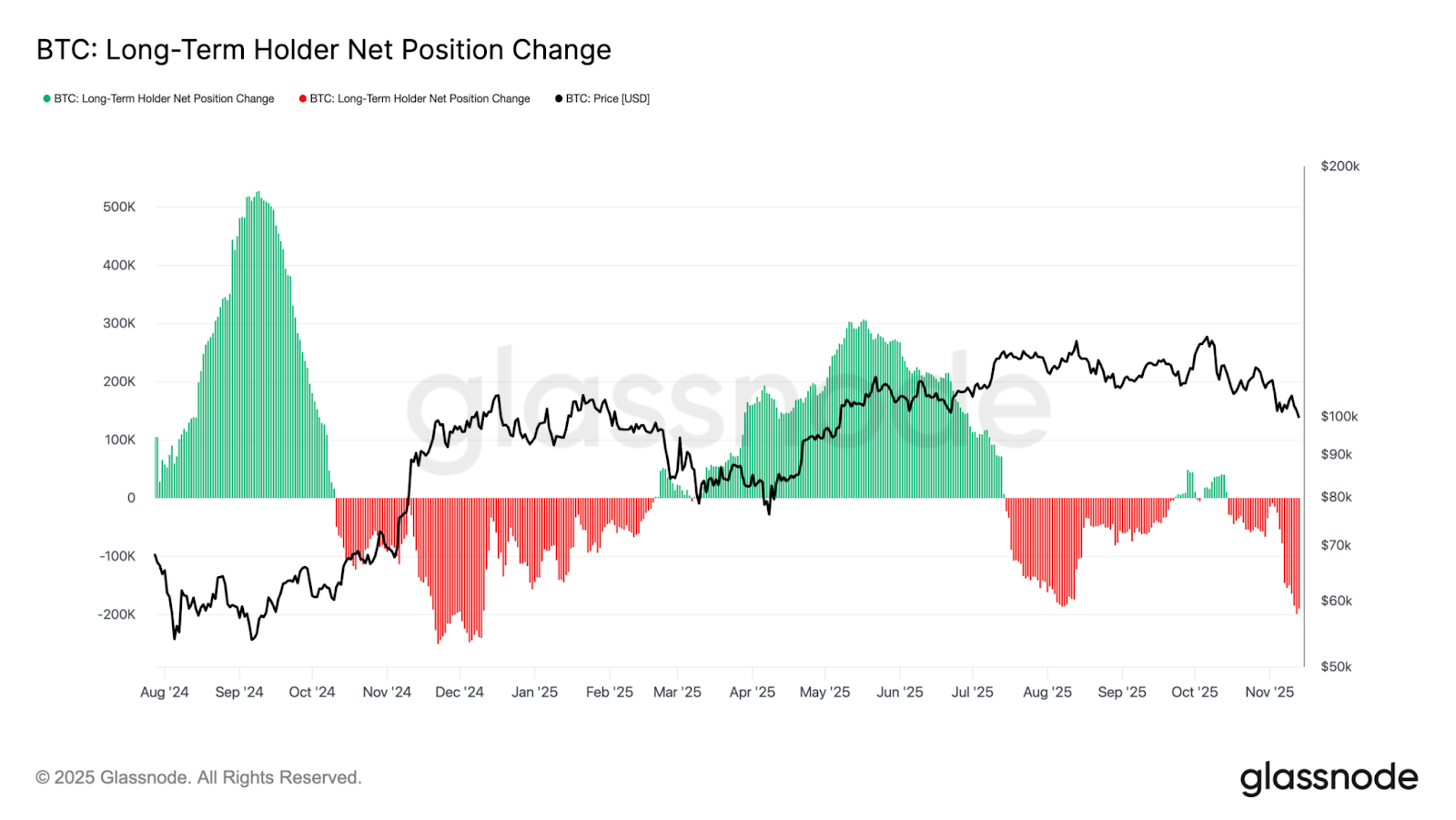

Two key metrics we've been tracking are the ETF flows and the Long-Term Holder selling. They have led to our more cautious stance recently due to large selling from the LTH's and large net outflows from the ETF's.For now, neither of these metrics have changed, and we continue to see the same pattern - Long-Term Holders continuing to reduce their supply and in a relatively big way, and the ETF's continuing to see significant outflows.

Long-Term Holder Net Position Change:

Long-Term Holders continue to sell down their size - shown by the large downwards red spike on the far right hand-side of the chart.

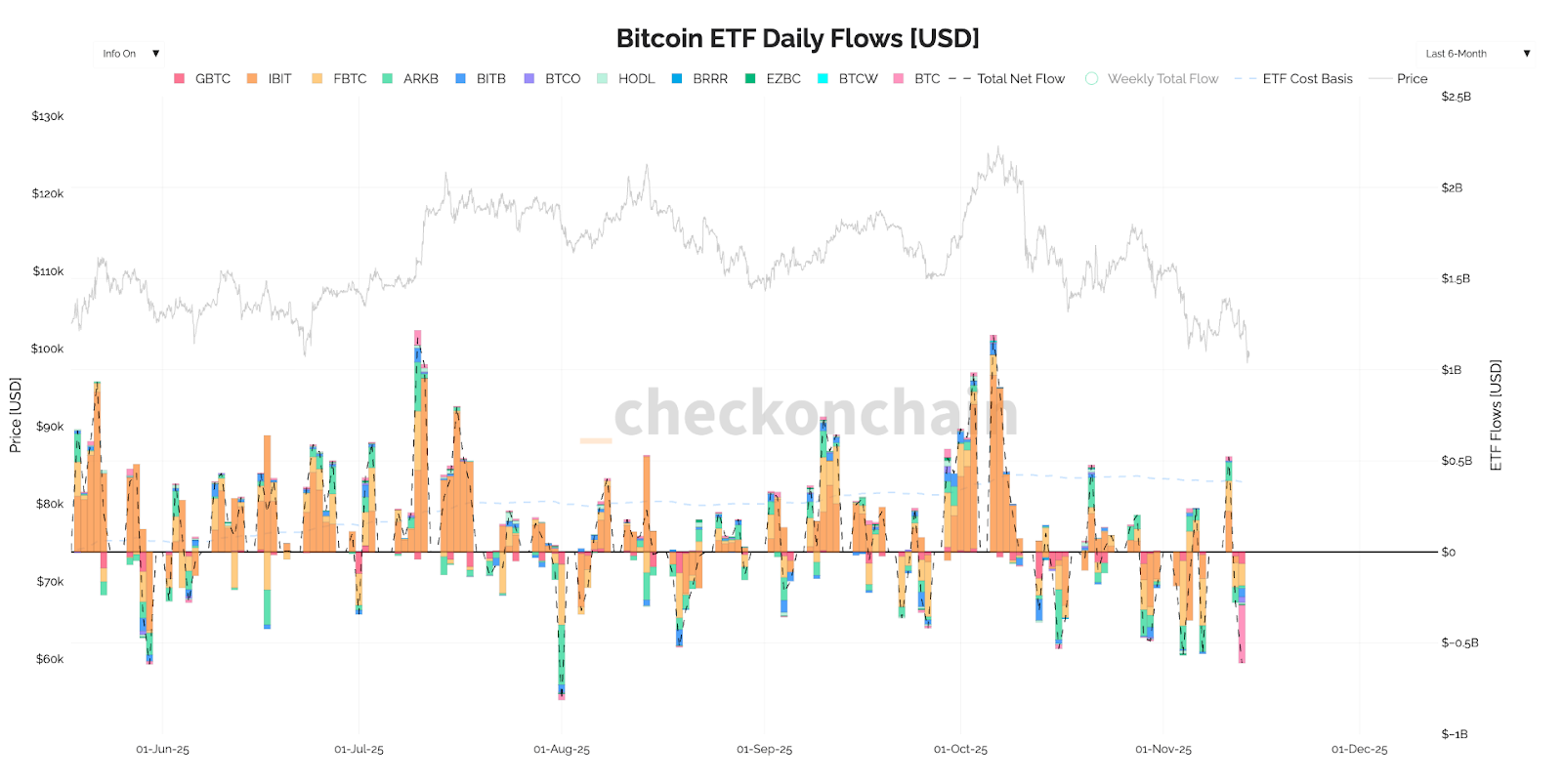

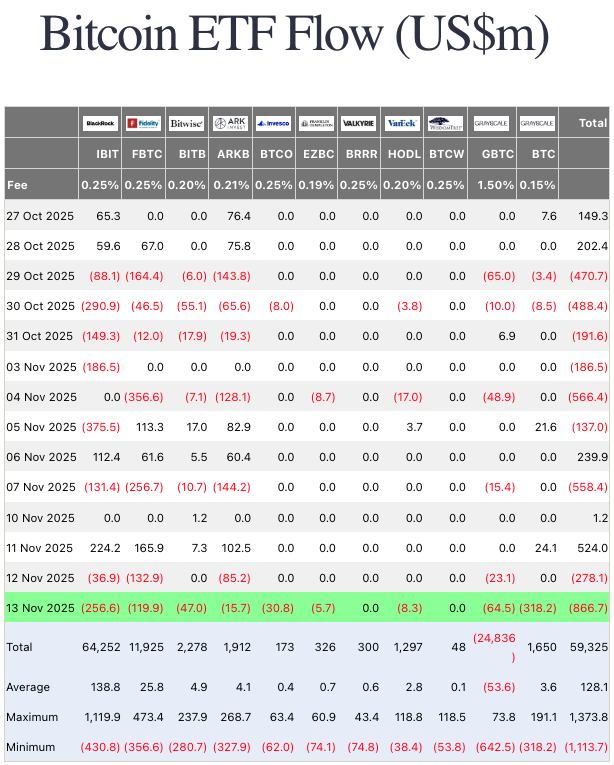

ETF Flows:

ETF's continue to be net sellers of BTC and with relatively large size.

Perhaps the below chart is a better reflection of how significant the ETF outflows have been over the last few weeks. Look at the furthest right column on the below chart which shows 'Total Inflows or Outflows' into the BTC ETF's each day.

Bitcoin ETF Flows:

Cryptonary's Take:

Looking at the macro, we've had a recent reduction in the odds for a rate cut at December's Fed Meeting due to slightly higher inflation, a consumer that's still hanging in there (somewhat), and a Fed that would prefer to be cautious given the data blackout. If we compare this to one month ago, we had the market pricing in a 95% chance that the Fed cuts rates at the October and December Meeting's. We're now seeing that be priced out, and risk assets are being punished off the back of it.Our expectations are that these headwinds will remain for a few more weeks, at least until we start to get the economic data again which might not be until month-end/early-December. However, should we see weaker labour market data in early December, it's possible that the Fed still cuts in December, but more likely, it sets the Fed up to do a 'dovish skip'. This would be the Fed not cutting rates in December, but forward guiding a January cut. This would likely be a tailwind for risk assets going into early 2026, which we expect to be a positive first few quarters for Crypto.

Therefore, it's possible that we have a few more choppy week's ahead of us, as current headwinds remain. However, with prices pulling back like they have and the fact we expect late December and Q1 and Q2 2026 to be positive for Crypto, the price weakness should provide us with attractive buying opportunities. No, we're not expecting 2026 to be a bear market.

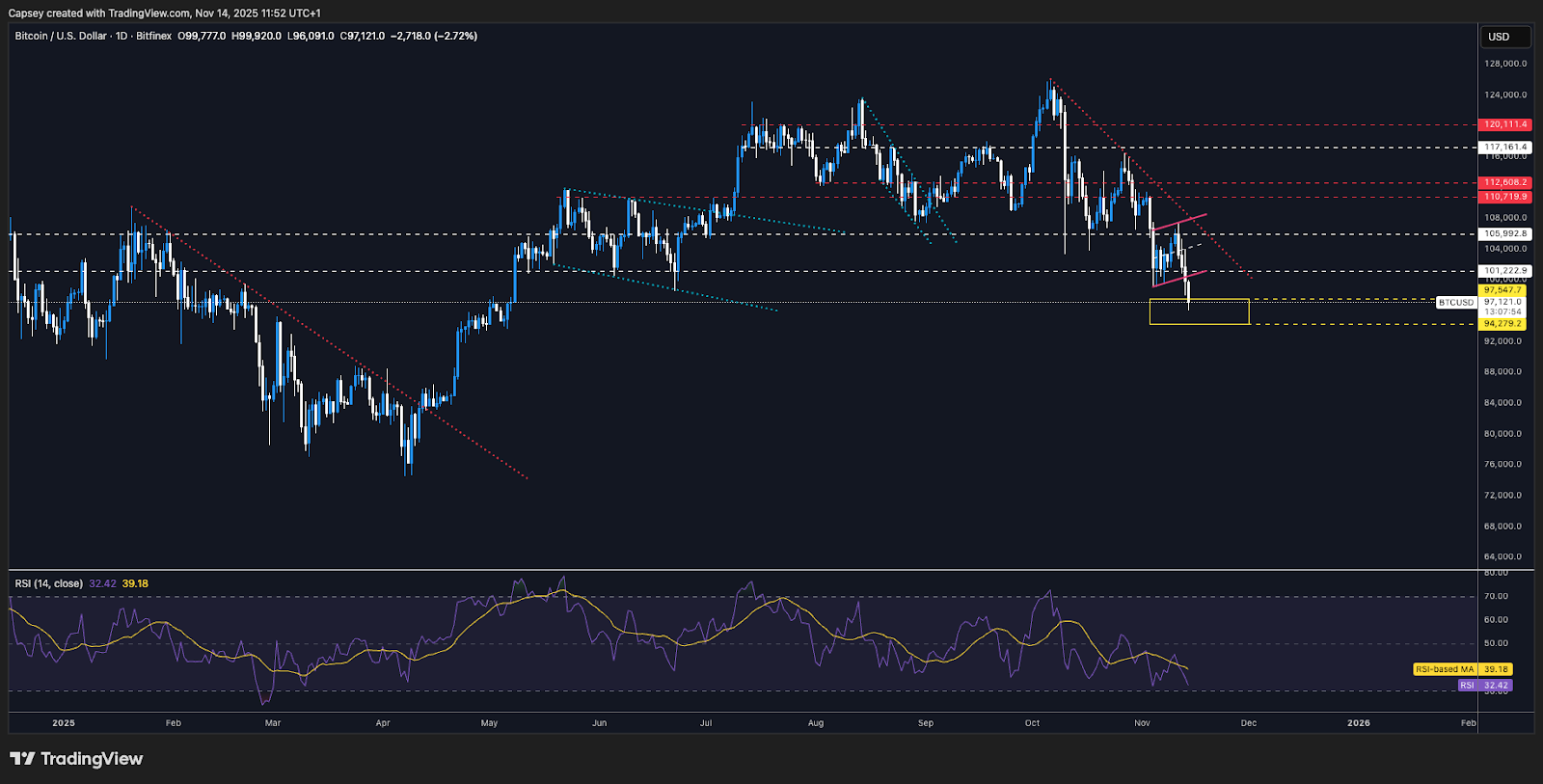

BTC has pulled back to the Yellow Box between $94k and $97k as we predicted, and there's no reason why the mid-to-late $80k's can't be tested - especially with the poor flows we're currently seeing. However, there will come a point in time, where prices go lower enough, that they're seen as attractive buying opportunities again, and it's possible that we're not too far away from that.

With price at $97k, this isn't the time to start getting bearish, the time to do that was several weeks ago. We wouldn't be sellers at these prices, our attention here is starting to tilt again to "ok, when can I start becoming a value buyer again"? But, we will want to see this paired with an improvement in the flows data as well.

Therefore, going forward, we'll be turning our attention to the levels to be buying at and once we're beyond the current weakness that we expect can last a few more week's, we'll be actively putting capital back to work, and in a meaningful way.

Our message here is this: Don't start getting bear'd up here at these prices. Not yet, but soon, the time will come to start getting greedy again (buying).

BTC 1D Timeframe:

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms