Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Shortened trading week with mostly backward-looking US data; the Bank of Japan decision on Friday is the key macro risk.

- Fed Chair uncertainty is lifting bond yields and pressuring risk assets; Kevin Warsh leads, with markets sensitive to any clarity.

- Renewed Trump tariff threats add policy uncertainty, reinforcing a cautious near-term backdrop.

- Bitcoin lost its $95k support and risks a pullback toward $86k-$88k unless $95k is reclaimed quickly.

- Overall stance remains cautious: patience until yields ease, policy clarity improves, or BTC regains resistance.

Topics covered:

- Data This Week.

- Fed Chair Race.

- President Trump's Tariffs.

- Bitcoin Technicals.

- Cryptonary's Take.

Data This Week:

This week, the key economic data isn't out until Thursday and Friday. On Thursday, we have:- GDP Growth Rate.

- PCE and Core PCE.

- Personal Income.

- Personal Spending.

Whilst Thursday will deliver a plethora of data, it is somewhat old data, and therefore, we expect the market reaction will be minimal.

Perhaps the most likely market-moving event this week is the Bank of Japan and its interest rate decision in the early hours of 23rd January (Friday morning). It's widely expected that the BoJ will hold rates at 0.75%; however, should they signal a likelihood to raise rates further at future meetings, this could result in a strengthening of the Yen. This would particularly be the case if the BoJ hints or suggests that currency intervention may be needed to defend the Yen. The result of this would be Yen strength (against the USD), which would likely see risk assets sell off. This is something we'll be closely paying attention to.

Fed Chair Race:

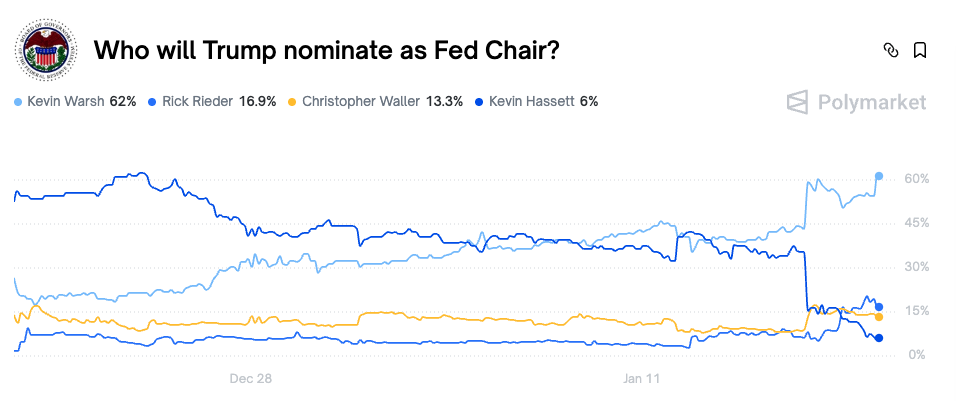

On Thursday, President Trump interviewed Rick Rieder (BlackRock's CIO for Global Fixed Income) for his new Fed Chair nomination. Rieder has been vocal about interest rates being too high and that the Fed should be using their balance sheet to support financial conditions and market plumbing - which would be supportive for markets, and Rieder's view generally aligns with Scott Bessent and President Trump's views. Following this news, Rieder's odds of becoming Fed Chair rose sharply, as seen on prediction platform Polymarket (below).Odds for Trump's Fed Chair Nomination:

Friday's meeting with Rick Rieder followed a press conference where President Trump stated that he'd prefer to "keep" Kevin Hassett in the White House. This essentially removed Hassett from consideration, and his odds plummeted to just a 6% likelihood that he'll be Trump's nomination.

Meanwhile, the odds for Rieder (to become Trump's Fed Chair nominee) have increased to 16% (they were around 4% a week ago), and the odds for Kevin Warsh have increased dramatically to 62%, making him a clear front-runner. This is somewhat baffling, though. Kevin Warsh has mostly always been a hawk, and he's had a relatively poor track record when it comes to calling monetary policy. On the other hand, and baffling again, Christopher Waller's odds (of becoming Trump's Fed Chair nominee) remain in the 13-16% range, despite him being a dove and also having a more accurate track record on monetary policy, and arguably the most likely to be able to steer the committee, as Powell does now.

When President Trump made his statement about Kevin Hassett, Bond Yields rose. This is the market pricing out some forward-looking interest rate cuts. Higher Yields also result in risk assets pulling back. The market will closely watch the race for the Fed Chair over the next 1-2 weeks, with an announcement of Trump's nominee expected in that time. For now, the clear leader looks to be Kevin Warsh, although Waller and Rieder have outside chances.

Should the nomination be Warsh, risk assets might sell off slightly initially on the news, but might rally off the back of it as it's a market-clearing event.

President Trump's Tariffs:

Risk assets will be looking for Bond Yields to settle, otherwise a more meaningful pullback for risk assets is possible. Over the weekend, President Trump reignited tariff threats on Denmark, Sweden, Norway, France, Germany, the Netherlands, Finland and the UK, over a deal for the US to buy Greenland. This is likely to be a negotiation tactic rather than something that actually materialises. However, just the uncertainty it provides is an uncertainty for risk assets in itself.Increasing Bond Yields on the back of Hassett likely being withdrawn from the Fed Chair nominee - now meaning a potentially less dovish Fed Chair - alongside increased tariff threats, provides uncertainty at least in the short-term. This headwind may result in limited upside for risk assets in the immediate term.

A sign that the market is pricing in these risks abating would be the US2Y Yield pulling back from 3.60%. Should the US2Y Yield break out of 3.65%, this would likely result in risk assets selling off more materially. Hence, we're now taking a more cautious view.

US2Y Yield 1D Chart:

Bitcoin Technicals:

Last week, Bitcoin broke out of the key technical horizontal resistance of $95k, although the price was rejected at $97,900. This is just shy of the resistance zone of $98k-$105k (that we determined using key on-chain levels) that we have laid out for several weeks. This is despite ETF flows being very positive last week and Long-Term Holders reducing their sell pressure.In the early hours of Monday morning (late Sunday night depending on timezone), a large amount of BTC was sold during an illiquid time - note, selling a large amount of BTC into an illiquid Sunday night is peculiar. We can see this in the tick down in Aggregated Spot CVD. This move shook out late Longs (who looked to buy the dip from $98k to $95k).

BTC Mechanics Chart:

This has unfortunately pushed price back below the key $95k level, with $94k-$95k now likely to be resistance again. Price can bounce from here, but we would have expected $95k to hold, or at least to be quickly recovered if lost, and unfortunately, a bear flag structure does still remain with the RSI now resting on its uptrend line.

Unless $95k is recovered in the coming days, we'd be of the view that BTC can break down and retest the $86k-$88k region again.

BTC 1D Chart:

Cryptonary's Take:

Whilst the market will look ahead to Thursday's economic data and Friday's Bank of Japan decision, perhaps the more significant headwind for risk assets in the immediate term is just the unpredictability around President Trump. This may be in the form of geopolitical tensions (Iran), tariffs, or Fed Chair candidates. Either way, all of this provides headwinds for risk assets, particularly when it is paired with rising Bond Yields, which likely puts off investors from taking excessive risk until these events are cleared.Therefore, in the short-term, we're of the view that Bitcoin can pull back to the mid-$80k's ($86k-$88k), especially if the key resistance level of $95k isn't reclaimed in the coming days.

An invalidation of our view would be if clarity over a Fed Chair nominee is given, and tensions around tariffs (on EU countries regarding Greenland) ease, and this results in BTC reclaiming $95k. This could then lead to BTC having another go at breaking out of $98k.

In the last few weeks, we have been relatively active with putting trades out (SOL Long, BTC Long etc), however, this week may be better to see how price action develops. Therefore, and at least for the next few days, we'd advocate for patience and 'sitting on your hands'.

Cryptonary, OUT!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms