Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Labour data is expected to remain resilient, which should support a modest bounce in risk assets.

- Gold and Silver sold off on Warsh fears; Gold’s long-term bull case remains intact, while Silver looks more fragile.

- Bitcoin is heavily oversold, with sentiment, positioning, and momentum favouring a near-term relief rally.

- BTC could bounce toward $83k-$84k, with a break below $74k invalidating the setup.

- Positioning: tactically long for a relief rally, with plans to reassess near resistance.

Topics covered:

- Labour Market Data & Its Potential Impact on Markets.

- Gold and Silver Implode.

- Potential Path for Bitcoin.

- Cryptonary's Take

Labour Market Data & Its Potential Impact on Markets:

This week, markets will be focused on the labour market data. We have Job Openings on Tuesday, with Payrolls and the Unemployment Rate on Friday.The consensus is for Job Openings to come in close to unchanged at 7.1m, whilst the Unemployment is also expected to come in unchanged at 4.4%, with Payrolls showing an increase of 70k jobs added on last month.

Should the consensus numbers come in as expected, our view would be that risk assets would move slightly higher. A stronger labour market would effectively price rate cuts out even further. However, rate cuts aren't expected until a new Fed Chair (likely to be Warsh should he pass the Senate) replaces Powell, and we don't think that a resilient labour market, at least in the short-term, affects this i.e. pushes this out further than what's already priced - June. Therefore, we would expect risk assets to react positively to a stronger labour market.

Should the data come in much weaker (lower or even negative jobs growth and rising Unemployment Rate), then risk assets might sell-off a tad as the market might run with the narrative that the Fed is behind the curve.

Ultimately, we expect the data to come in showing a resilient labour market and for risk assets to move slightly higher off the back of this.

We will fire out a Market Pulse immediately after the major data is released on Friday.

Gold and Silver Implode:

In 2025 and 2026, both Gold and Silver have soared to new all-time highs, however last Thursday, this trade began unravelling upon the leak that Trump's new Fed Chair nomination was going to be Kevin Warsh. Trump confirmed Warsh on Friday morning, and we saw a risk-off attitude across the board, which then resulted in a flight to safety move.This saw the Dollar (DXY) rebound, whilst US Bond Yields also came down.

DXY 1D Chart:

DXY 1D Chart:

However, it's possible that in the coming days, we see the Dollar consolidate, or even pull back a touch, and this enables risk assets to have a small relief rally.

For Gold and Silver, the fundamental drivers behind Gold going higher (central bank buying) hasn't gone away, and therefore we expect Gold to move higher again, although it might consolidate in the short-term. Silver on the other hand is a much more speculative asset, and therefore a relief rally higher is possible, but we expect that to be a right-shoulder (on the chart) that is then sold into and Silver pulls back more substantially from there.

The question to us is: is this liquidity going to spill over into Crypto?

We don't expect it to. We had that setup in 2025, but it didn't follow through in Q4 2025. In early-2025, we had Gold moving higher, whilst Crypto struggled. Gold then consolidated between May and August, to which BTC performed well to the upside - the 'catchup trade'. However, Gold then broke out in September 2025, and BTC began to stall, before then pulling back. Gold then consolidated and soared higher, but BTC continued to lag even when Gold consolidated. For this reason, we view the correlation as having broken down.

Gold with BTC overlaid - in periods where Gold consolidated BTC went up. However in late 2025, that correlation broke down. BTC went down when Gold consolidated, only for Gold to break out to the upside again, and for BTC to continue its grind lower.

Gold with BTC overlaid - in periods where Gold consolidated BTC went up. However in late 2025, that correlation broke down. BTC went down when Gold consolidated, only for Gold to break out to the upside again, and for BTC to continue its grind lower.

Potential Path for Bitcoin?

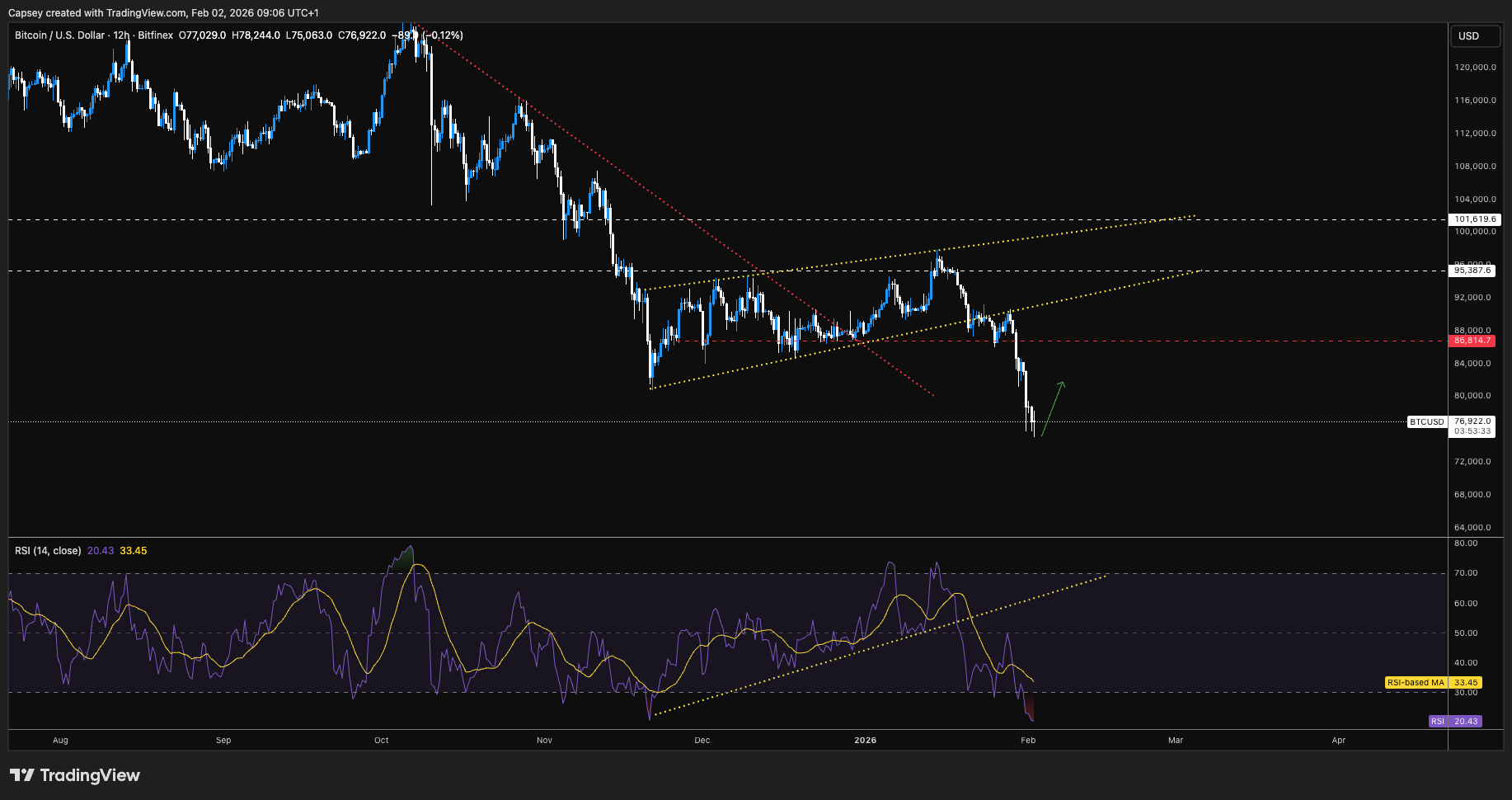

Now, just because the Gold/BTC correlation has broken down, or just didn't play out in late 2025, doesn't mean that BTC can't go higher in the immediate term. In fact, we expect near-term upside for the following reasons:- Bitcoins Fear & Greed index is in 'extreme fear' on three different short-term timeframes.

- Open Interest falling from $66b to $52b since the $97k local high. The leverage has been flushed out.

- Funding Rates are negative, Shorts are getting confident and therefore are vulnerable to a squeeze.

- Coinbase Premium is very negative, but it's trending higher, closing towards neutral. This is supportive of prices moving higher.

- Warsh fears are overblown, and dovish comments from him this week could see the market quickly reprice higher.

- Oil is down on geopolitical tensions easing between Iran and the US.

- Bitcoin's RSI has only been this oversold in 11 days in the last 2 years, although these occurred in 5 distinct clusters. Looking back at the last 4 times this has happened, here are the forward returns that BTC has seen on a 7-day, 14-day, 30-day and 60-day time horizon.

BTC's Forward Returns when the RSI has been this low - last 2 years:

BTC's Forward Returns when the RSI has been this low - last 2 years:

If we now look at this on an average expected returns basis, we get the following:

- 7-Day: 6.76%

- 14-Day: 2.42%

- 30-Day: 4.49%

- 60-Day: 9.85%

BTC 1D Chart:

BTC 1D Chart:

Cryptonary's Take:

Bitcoin has broken down from its rising wedge with price pulling back 16.4% since last Thursday. However, this hasn't been an isolated incident in Bitcoin and Crypto, and in fact we've seen a risk-off move across all assets. But we expect risk assets to see a relief rally and we've laid out a plethora of reasons as to why Bitcoin should take part in that.With the current conditions (again as we've laid out above), it's possible that BTC gets a relief rally to the $83k-$84k level.

This would be a 5% bounce from the current $78k level. The market will also be paying close attention to the labour market data this week, although we do expect it to be a bit of a non-event, whilst there's the potential tailwinds of Warsh commenting dovishly, alongside easing geopolitical tensions between the US and Iran.

For now, we're positioned Long at least for a relief rally. Should price retest $83k-$84k, we'll reassess the metrics again then to see if we hold these Longs or take profit. An invalidation of our thesis would be a breakdown below $74k.

Cryptonary, OUT!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms