Market Update: US Government Shutdown and BTC Range-Bound

The US government shutdown is limiting data flow, yet markets are already pricing in two rate cuts. Bitcoin, meanwhile, continues to consolidate just below key resistance. Here's what the data is telling us, and how we’re interpreting the risk.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- US Government Shutdown: Markets largely unmoved so far, but prolonged deadlock could trigger negative reaction.

- Labour Market Data Impact: Shutdown halts BLS release; only ADP data available, showing -32k jobs lost. Markets now pricing October and December Fed cuts.

- BTC Market Outlook: Bitcoin trading in range $110k–$117.5k; indicators suggest risk of a deeper flush-out, but upside case supported by potential Fed cuts and gold consolidation.

- Cryptonary’s Stance: Cautiously positioned in majors and select memes; waiting for confirmation via BTC > $118k, ETH > $4.5k, and SOL > $230 before increasing risk exposure

Topics covered:

- Government Shutdown.

- Government Shutdown Affecting the Labour Market Data?

- Current State of the Market from a BTC Perspective.

- Cryptonary's Take.

Government Shutdown:

Last night, the US government officially shutdown after Democrats and Republicans couldn't reach a deal for a new funding package. Currently, both sides seem to be in a deadlock, but the longer this drags out, the more pressure there will be on a deal being struck.We expect that this might roll into early next week before a deal is reached. This means the market will be focused on the ADP data that came out today, as that’s the only data the markets will be given – until the Democrats and Republicans reach a deal and the government is back working again.

For now, markets have mostly shaken this off, as we expected they would. But should this spill into next week, and should it look like a deal still isn't close, then markets might react more negatively at that point. This is a situation we're monitoring, but it's still our base case that we don't expect it to have much of a negative impact on markets.

Government Shutdown Affecting the Labour Market Data?

The government shutdown does affect markets in another way, though - it prevents the release of the data. Markets are focused this week on the labour market data, with the key BLS data coming out on Friday (Unemployment Rate and Non-Farm Payrolls). But should the US government remain shut down, this would mean that Friday's data won't be released. The result of that means that the only jobs data markets will get is ADP Employment Change today. This data was just released, and it came out at -32k jobs. Minus yes, so ADP predicts that jobs were lost last month.

The market reaction to this has been a slight uptick in risk assets and a small move down in Bond Yields. This gives ammunition to the rate-cutting argument. But these are job losses rather than a decrease in the number of jobs added. We're probably surprised here to see risk assets move higher on this print. Low jobs added is a 'Goldilocks' environment, where risk can do well under this. But risk assets have historically come down in a majorly deteriorating labour market.

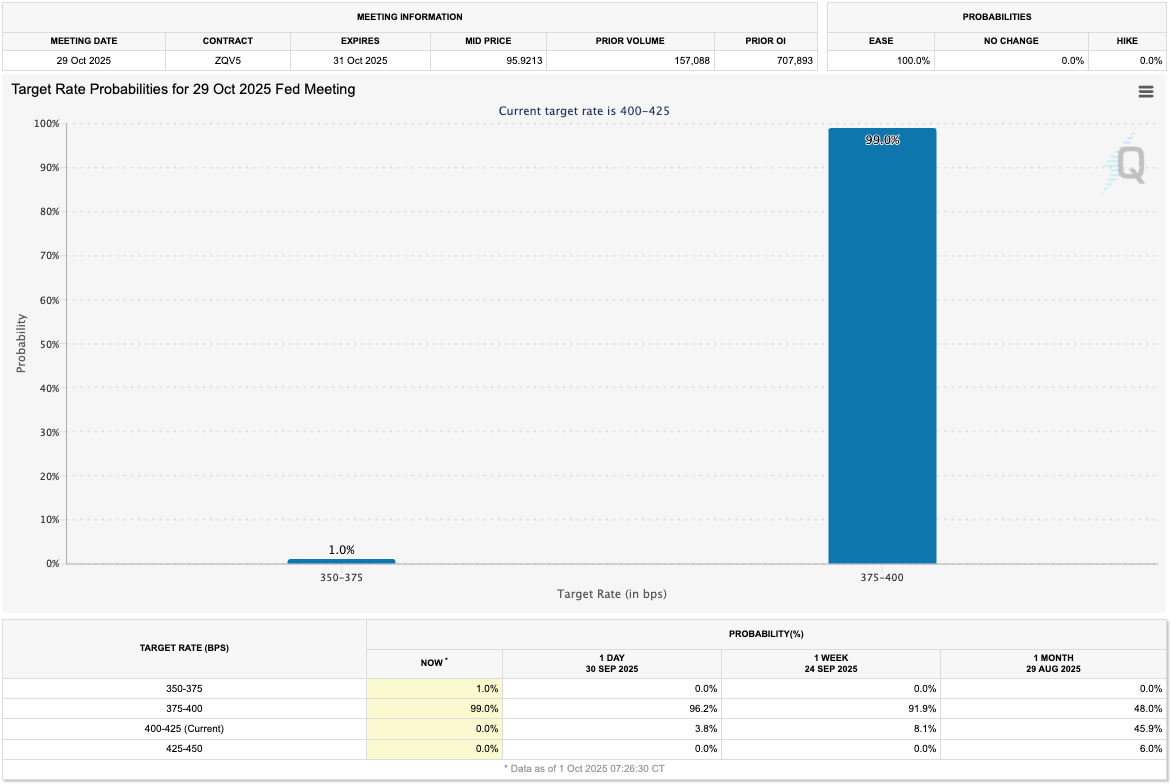

The result of today's negative ADP print is the market pricing in a 99.0% chance of an October interest rate cut (1.0% chance of a 50bps cut), and an 88% chance of another cut in December as well.

Target Rate Probabilities for 29th Oct 2025 Fed Meeting:

Current State of the Market from a BTC Perspective:

BTC is range-bound between the key levels of $110,000-$111,800 (support zone) and $116,600-$117,500 (resistance zone). Price briefly dipped below $110,000 into $109,000, but it quickly recovered back into the support zone, with price now bouncing, but potentially putting in another lower high - the next few days' price action will be important in invalidating or confirming this.Last week, we assessed the "leverage flush out" that wasn't much of a flush out at all, whilst we've also seen Short-Term Holders go briefly into small unrealised losses ($111,800 is the STH cost basis). However, this wasn't an outright flush out to the downside that saw a full positioning reset.

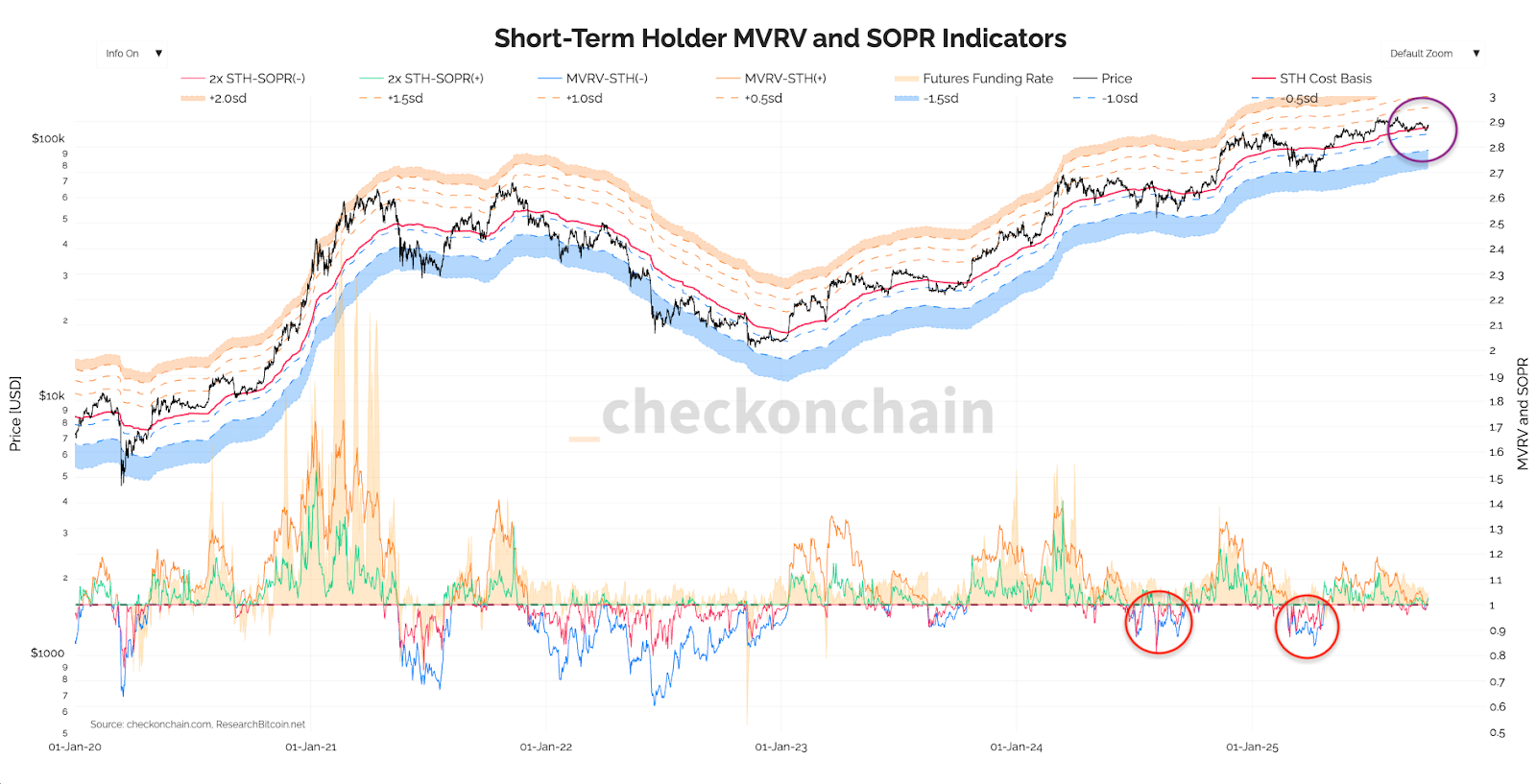

Below, we have the Short-Term Holder MVRV and the SOPR indicators. We use them as they give a great signal of momentum and exhaustion to the upside and downside, which can help us in determining when to add or lighten up on positioning.

Short-Term Holder MVRV and SOPR Indicators:

In the above, we can see that the price dipped slightly below the STH cost basis, which didn't cause large unrealised losses, nor was the price close to any meaningful negative standard deviations. -1.0 and -1.5 standard deviations have previously been fantastic buying opportunities. -1.0 standard deviation is $105,300, and -1.5 standard deviation is $91,500. We saw flushes down to these levels in July 2024 and April 2025, and with Majors having broken key uptrends, and still below key horizontal resistances, we think it's possible that we can see a flush out in the near-term.

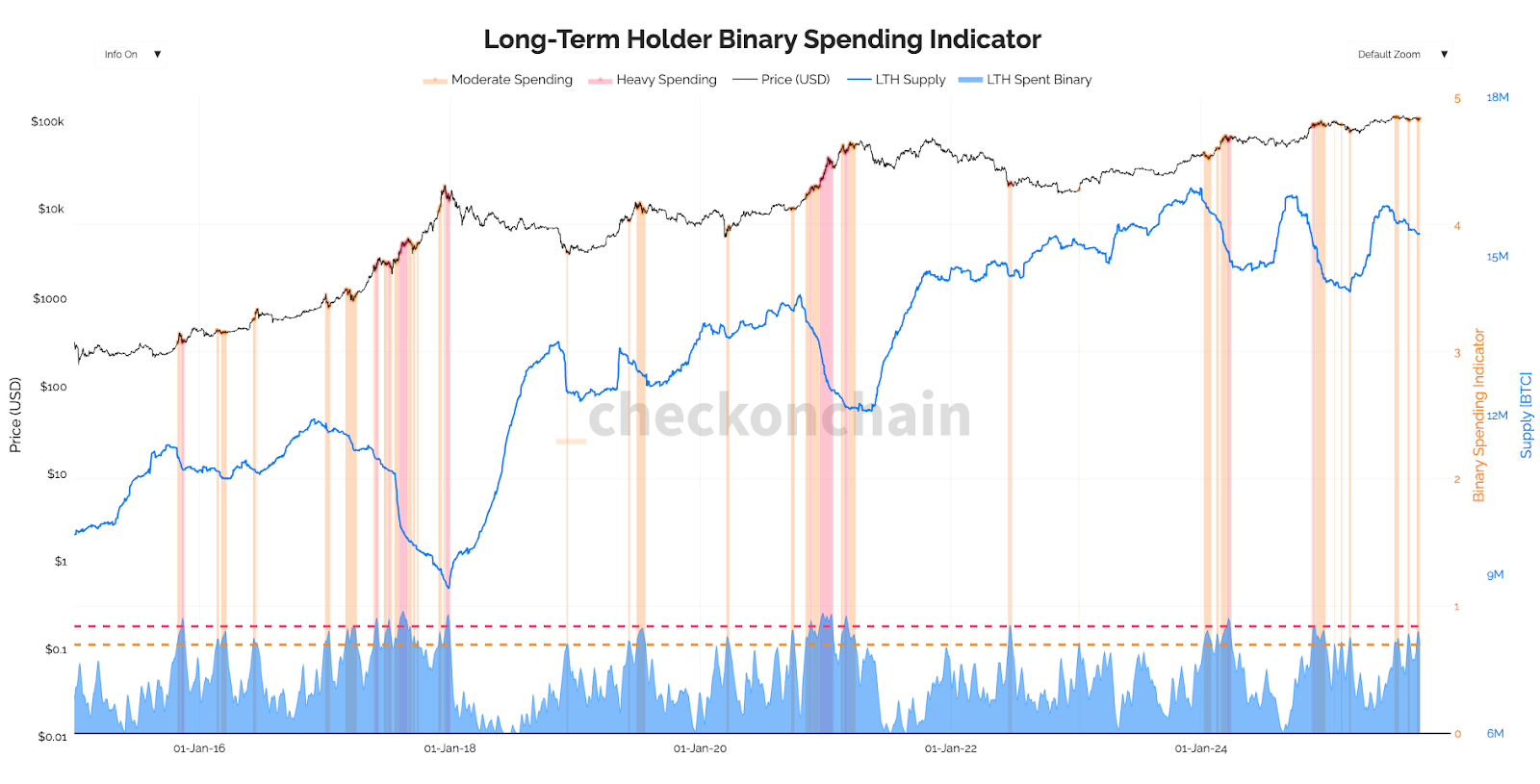

Alongside the above, we have the Long-Term Holder Binary Spending Indicator at a high level, having just put in its third highest peak on lower price highs. This is an interesting divergence that has historically resulted in prices coming down to new lows in the weeks that follow.

Long-Term Holder Binary Spending Indicator:

We have this above setup as TOTAL3 remains range-bound below its horizontal resistance of $1.1t, and Bitcoin Dominance is up trending and potentially setting up for a move to the 60.0% line.

BTC.D 1D Timeframe:

On the other side of the coin, if we look at some of the bullish arguments, the main two we see currently are continued interest rate cuts - assuming the job market can continue to thread that fine line of 'Goldilocks' - and Gold slowing down and consolidating that then passes the batten over to BTC to have its rally, as we have seen in prior instances.

Cryptonary's Take:

Following today's ADP data, which shows negative job growth, markets are pricing for October and December interest rate cuts. This has resulted in risk assets moving higher and the US2Y Bond Yield moving lower. This is positive, but markets and the data are trying to walk a tight line here, i.e., the data continues to weaken, which allows the Fed to cut rates but not weaken enough that it signals outright mass job losses (economic weakness).We remain positioned in Majors and selective memes, despite our calls for a market pullback. However, we emphasise a cautious approach until we get more clarity - this might come with a convincing breakout above $118k. In recent weeks, we've had risk-on periods for the Majors, but that hasn't materialised in the more "risk-on" assets further down the risk curve. This does concern us about a wider "alt season" and therefore we'd look for more confirmations before moving further down the risk curve. That might look like a breakout of $118k for BTC, a reclaim of $4,500 for ETH, and $230 for SOL.

Ultimately, our base case is that we’re in a dip-buying environment, so we wouldn’t be looking to add to current positions at today’s prices, but should we see a more substantial pullback, then we’d look to put more capital to work.