Market Update: What We're Watching This Week?

This is where patience pays. Macro conditions are slowly aligning, but price action is still trapped in a choppy, risk-off environment. We’re likely past the worst of the drawdown, but now comes the time capitulation phase. Here's everything you need to know...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- First Fed cut still expected around June/July, with three cuts as the base case, though stronger labour data raises a small delay risk.

- BTC’s relief rally failed near $71k, driven mostly by leverage, while ETF outflows and weak US demand continue.

- Long-term holders are accumulating, and leverage has reset, but price action likely remains slow and choppy.

- Key levels: $65k support, $71k-$72k resistance; downside risk toward $60k–mid-$50ks.

- Strategy unchanged: patiently layer buys between $50k-$63k using 80% of cash.

Topics covered:

- Odds of Cuts Following Last Week's Economic Data.

- Relief Rally and the Setup for Bitcoin.

- What We're Watching This Week?

- Cryptonary's Take.

Odds of Cuts Following Last Week's Economic Data:

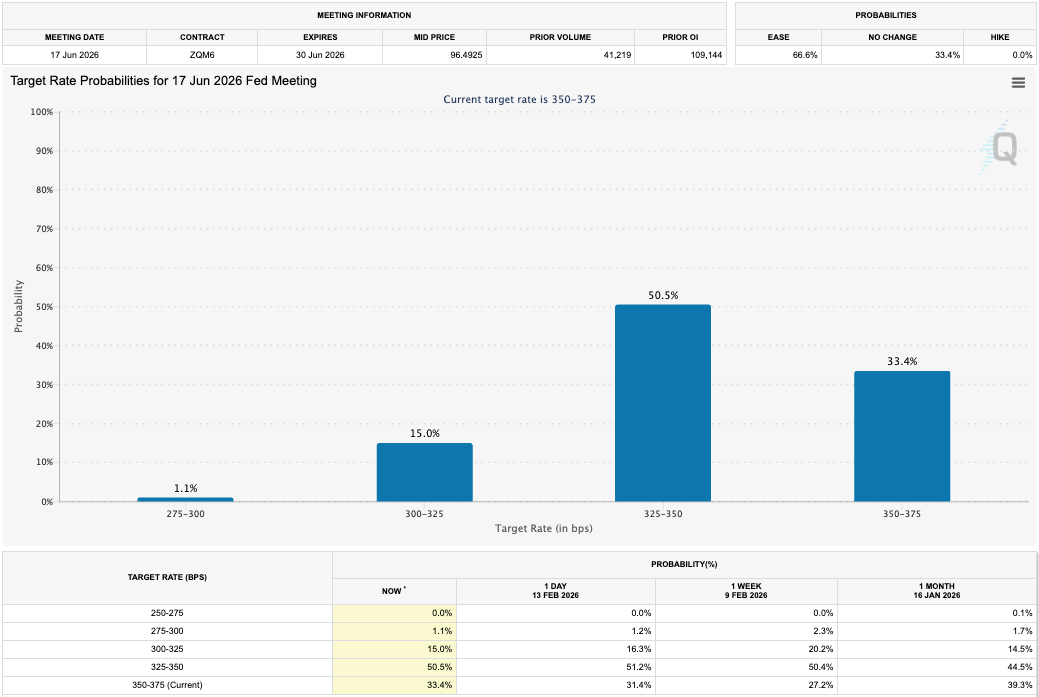

Last week's economic data was mostly viewed positively, with Payrolls adding 130k jobs in the month of January and the Unemployment rate ticking down to 4.3%. This is despite 2025 revisions marking down the number of jobs added by 1 million jobs. However, the market doesn't particularly care about revisions, as it's old data, and the economy has held up in the meantime, hence the focus is on the new monthly reporting. Alongside the labour market data, the year-on-year inflation data came in lower than last month's reading, with Headline inflation coming down to 2.4% from 2.7%.As a result of the data, the next interest rate cut is still priced for the Fed's June meeting. But, there is a 33.4% chance that the Fed remains on hold, and this increased from 27.2% from a week ago. The reason being, stronger payroll data - stronger labour market, means less reason to cut interest rates, despite inflation continuing to trend lower.

Target Rate Probabilities for 17th June 2026 Fed Meeting:

For now, this is fine. But should we see inflation remain in the mid-2 per cent area, and the labour market remain resilient (despite there being some cracks beneath the surface of the data), then it's possible that the next interest rate cut is pushed back to July. We don't see this as likely or a risk, but we're paying attention to it should it happen.

It remains our base case that the Fed will deliver at least 3 interest rate cuts this year, with them beginning in June or July at the latest.

Relief Rally and the Setup for Bitcoin?

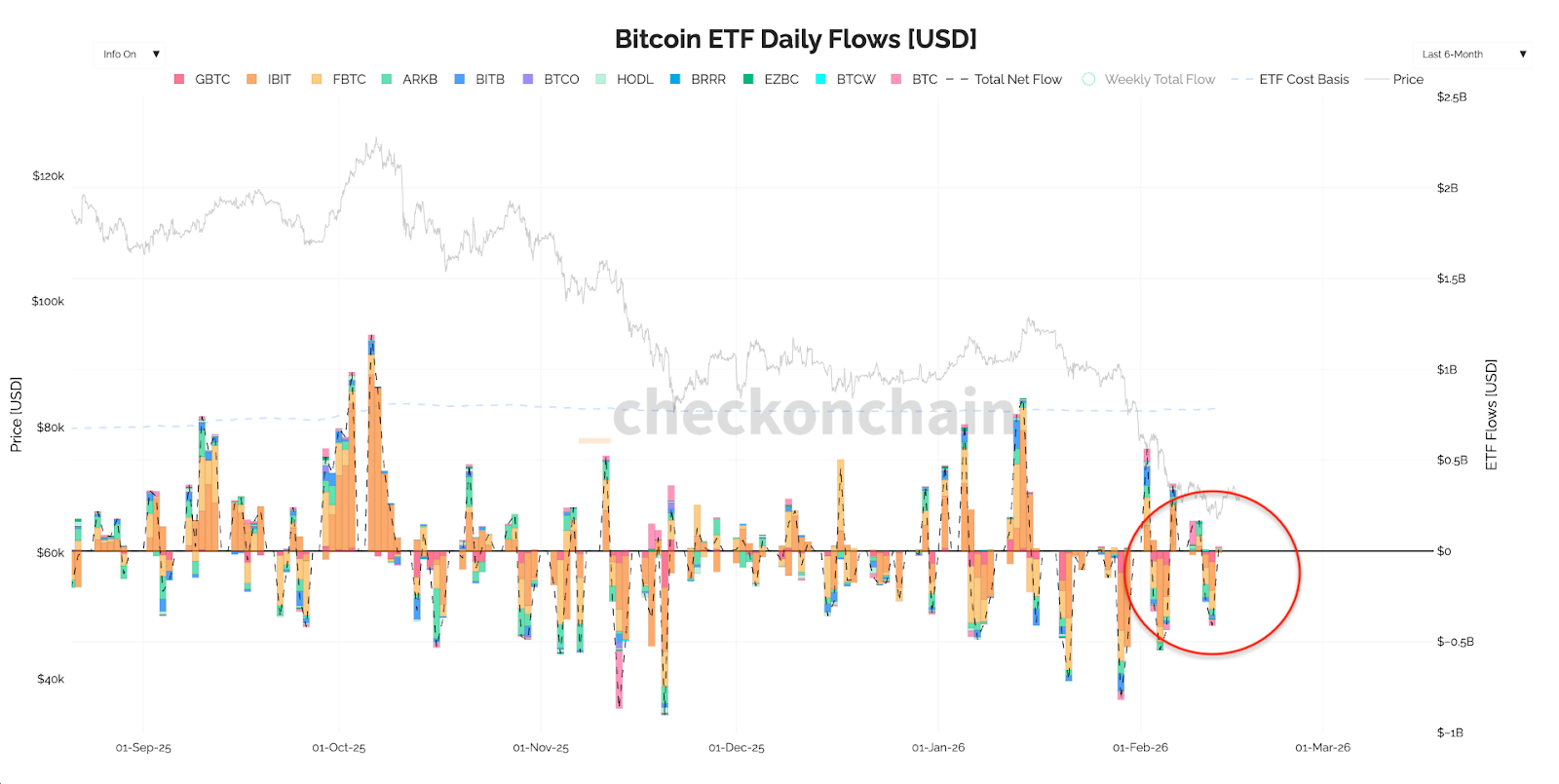

Over the weekend, Bitcoin attempted a relief rally that ran into the resistance at $71k, and the price has since pulled back to $68k. This weekend’s rally was mostly driven by futures (leveraged Longs) rather than outright Spot buying, which is potentially why we've seen the rally stall into resistance - as levered Longs take their trades off.This comes after a week of negative ETF flows (-$360m of outflows).

Bitcoin ETF Flows:

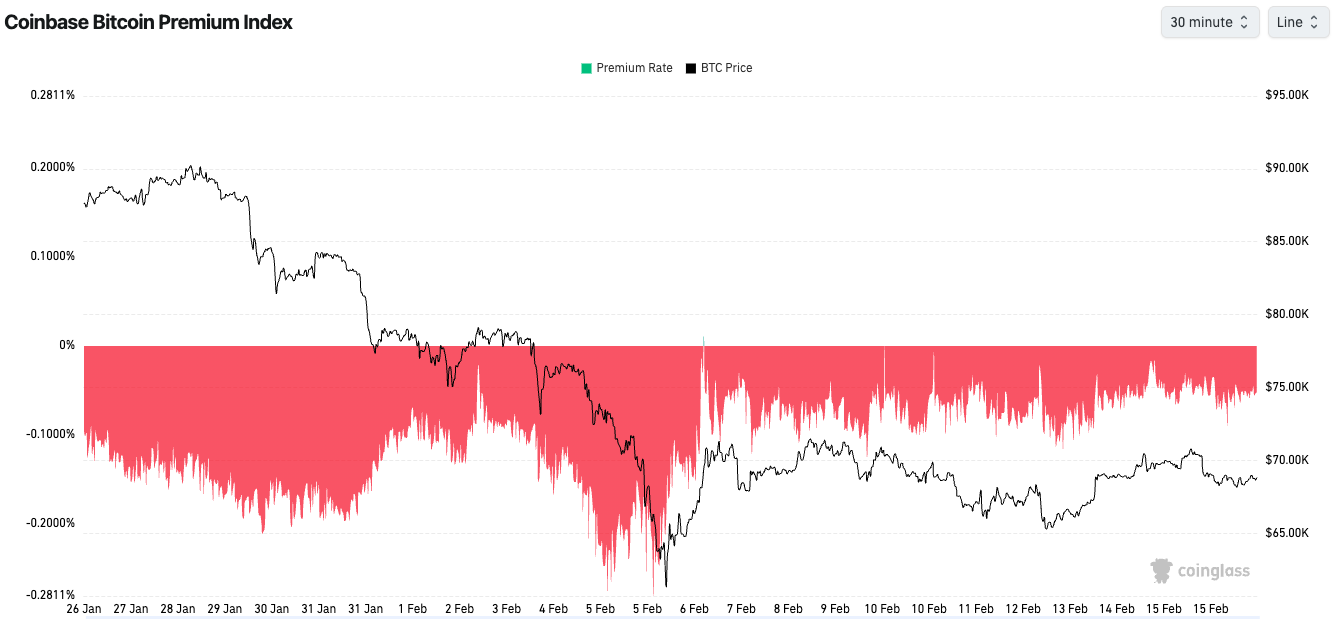

Alongside this, a negative Coinbase Premium was maintained throughout the week, i.e., prices trading at lower levels on Coinbase in comparison to non-US exchanges. A lack of US demand has historically resulted in lower prices.

Negative Coinbase Premium:

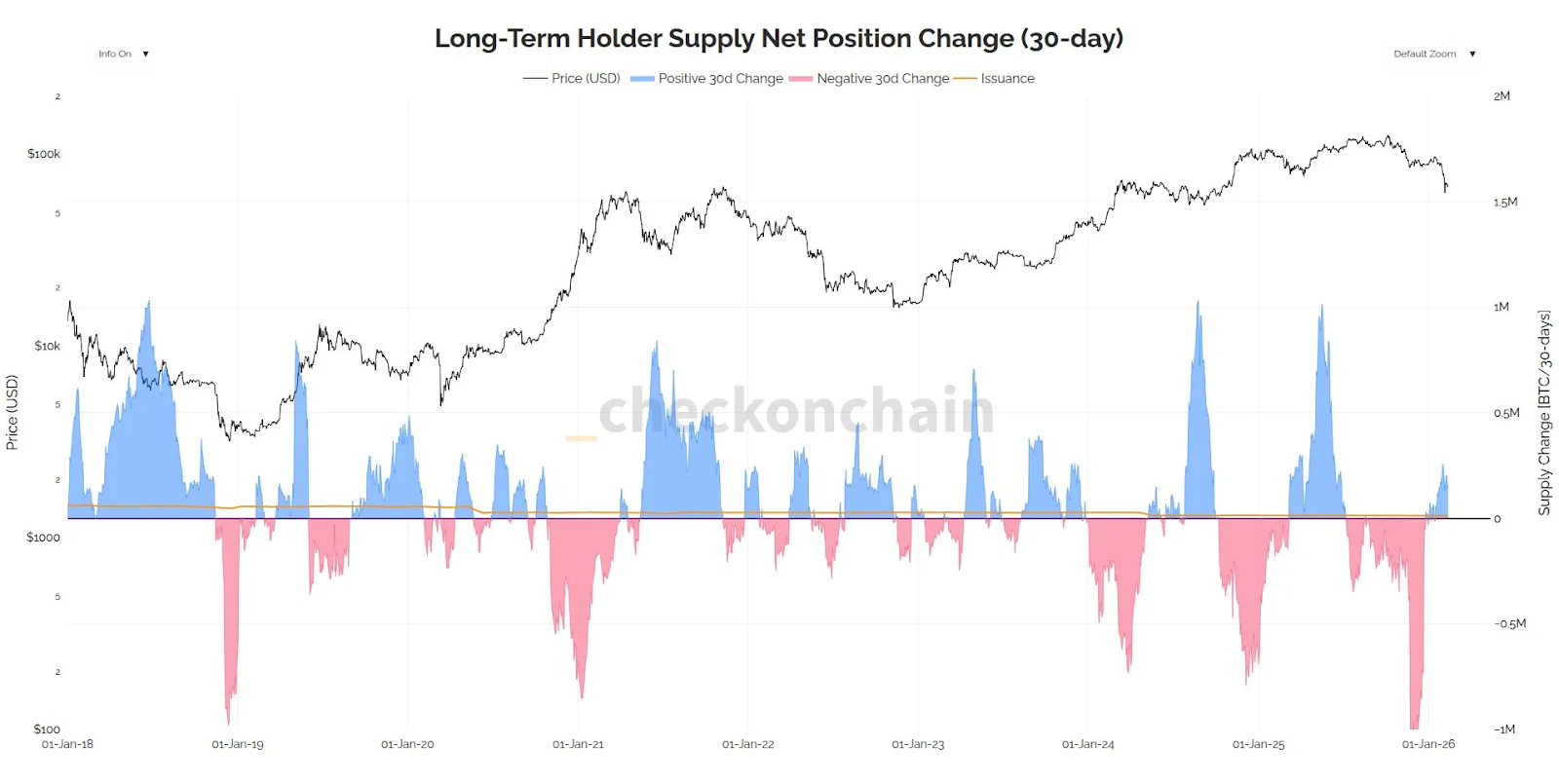

However, one positive is that Long-Term Holders have begun accumulating again. Going forward, we'll be using 'CheckOnChain' for this metric, rather than Glassnode, as there have been queries recently over the LTH Net Position Chart and its accuracy.

Long-Term Holder Net Position Change:

But we do note that periods of Long-Term Holder accumulation can last a long time, and therefore, it needs to be paired with other metrics.

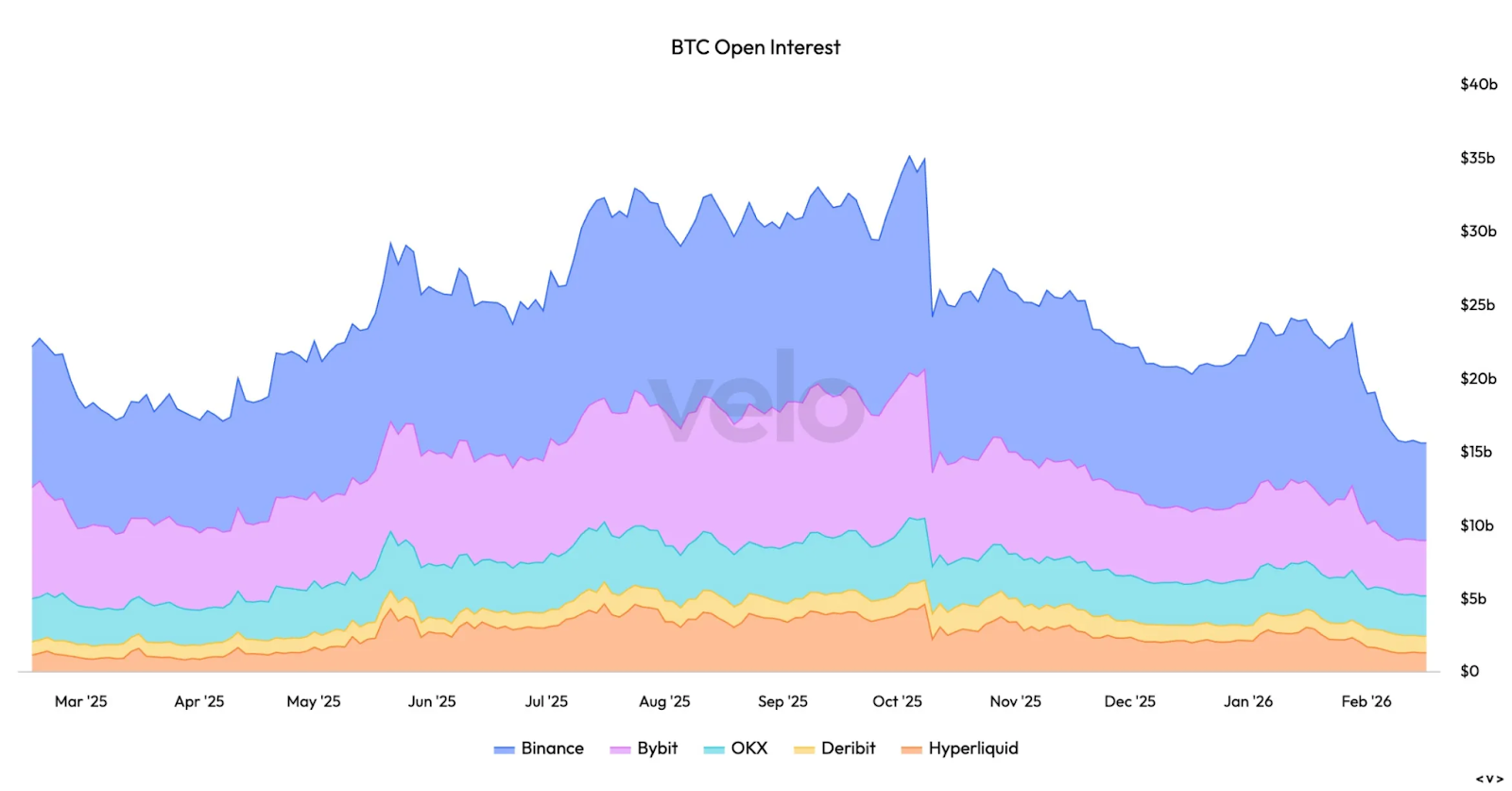

In the last 1-2 months, we have noticed that the general level of Open Interest has pulled back significantly, whilst Funding Rates are mostly flat, and even in a lot of cases at the moment, are negative. That's likely the negative sentiment creeping in (which we can see in the Fear & Greed Index hitting record lows), leading traders to short, despite this likely not being the optimal time to short with many altcoins currently down 60%-80%. To us, this is a healthy resetting to see the excesses flushed out of the system, and unfortunately, that does, and has taken time.

BTC Open Interest:

We're likely through the worst of this drawdown price-wise (we’re likely 4 months into what could be called a 6-9 month bear market), and what's ahead of us is likely the time capitulation part, i.e., a slow and choppy market.

Our view remains the same.

We expect BTC to retest the $60k lows as a bare minimum, and likely fill the mid-$50ks.

Our strategy remains the same = layered buy orders between $50k-$63k with 80% of our cash, and in the meantime, patience.

What We're Watching This Week?

For Bitcoin, the key levels are the $65k support and the $71k-$72k resistance zone. A breakout of $72k would likely see Bitcoin move swiftly up to $75k, whilst a breakdown of $65k would likely see a retest of $60k. However, we wouldn't be surprised to see a continued chop within the range, as this local bear flag formation continues.BTC 1D Chart:

Alongside the above, we're paying attention to the US Bond Yields, which have recently come down, with front-end Bond Yields breaking below their range lows. The US economy has shown signs of weakness, but also signs of re-acceleration in some pockets. The bid in Bonds (and the decline in Yields) suggests that investors are sceptical, especially of the AI names. We can see this with the S&P pulling back, whilst the Equal-weighted S&P has moved up to new highs. Should we see this continue, and with Crypto still correlated to US tech, this may signal more downside ahead for Bitcoin and Crypto.

Cryptonary's Take:

Bitcoin rejected into $71k over the weekend, whilst the price fluctuates within a bear flag. Whilst it's possible that Bitcoin can break out to the upside and test $75k, we don't have strong conviction in this view. We prefer to remain patient on the sidelines.Our strategy: we maintain that the market is in a risk-off environment, but that prices have come down close to deep value areas. Therefore, we're layering bids between $50k to $63k with 80% of our cash, with a view to accumulating for the long-term.

No change to this plan.

Peace!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms