We are all eager for the bull to make its triumphant return, and trust us, we can feel your excitement building up. We know you can’t wait to get out bear territory and start heading back to the moon! That’s the thrilling moment we’ve all been craving, right? 👀

However, the bear still has some tricks rolled up its sleeve. Yep, it’s not quite done with us just yet. Brace yourselves because there’s more downside to come.

“Hey, Cryptonary, how much more exactly are we talking about here?”

Well, you’re about to find out today. So let’s buckle up and dive right into it!

TLDR 📃

- Most assets closed bearish last month. The bear’s wrath is not over.

- Bitcoin is on track for $25,150? Our take? The market will test this level in June.

- As a result, the altcoins market will experience more downside.

- Our potential star performer closed bullish last month. Get your gears in motion; more upside is likely.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

Total Market Cap

The Total Market Cap (TOTAL) index represents the entire cryptocurrency market. We track this index to understand where the overall market is now and predict where it will go next.

Altcoins Market Cap

The Altcoins Market Cap index represents the evaluation of the altcoins market - all coins other than BTC.

Cryptonary's Portfolio

BTC | Bitcoin

ETH | Ethereum

ETH’s in a rocky spot…

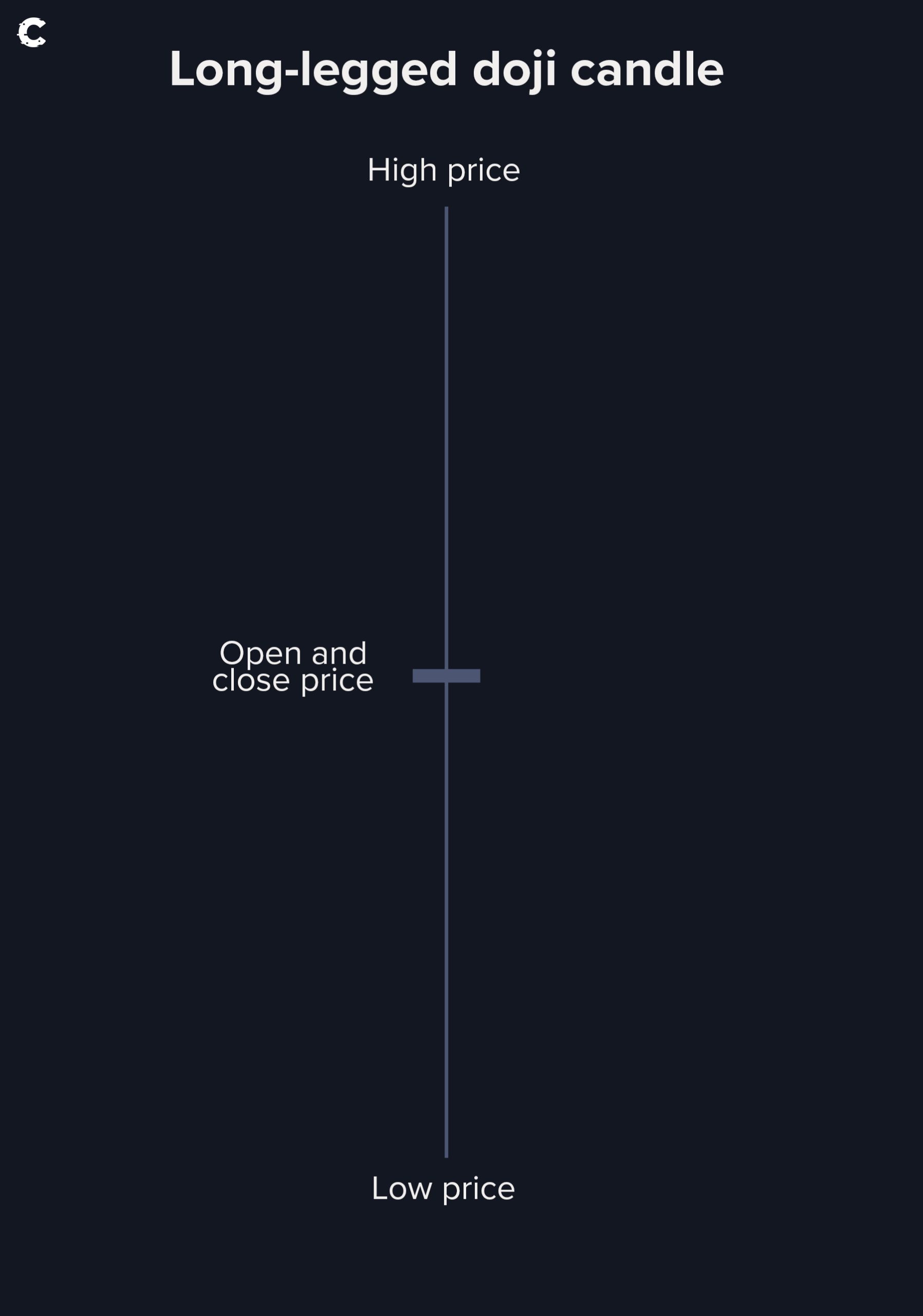

Last month’s candle closed as a “long-legged Doji.” Now, this fancy term simply means that the market is in a state of indecision. Neither the buyers nor the sellers seem to have a firm grip on things. For an even better example of how a long-legged Doji candle looks like, have a look below:

So, buckle up because figuring out what’s coming next for ETH might not be as easy as you’ve hoped. We’re looking at a potential range between $2,000 and $1,740. Fortunately, though, we know that BTC influences the rest of the market, so tracking BTC’s price action will help us understand where ETH is going throughout June.

So, buckle up because figuring out what’s coming next for ETH might not be as easy as you’ve hoped. We’re looking at a potential range between $2,000 and $1,740. Fortunately, though, we know that BTC influences the rest of the market, so tracking BTC’s price action will help us understand where ETH is going throughout June.

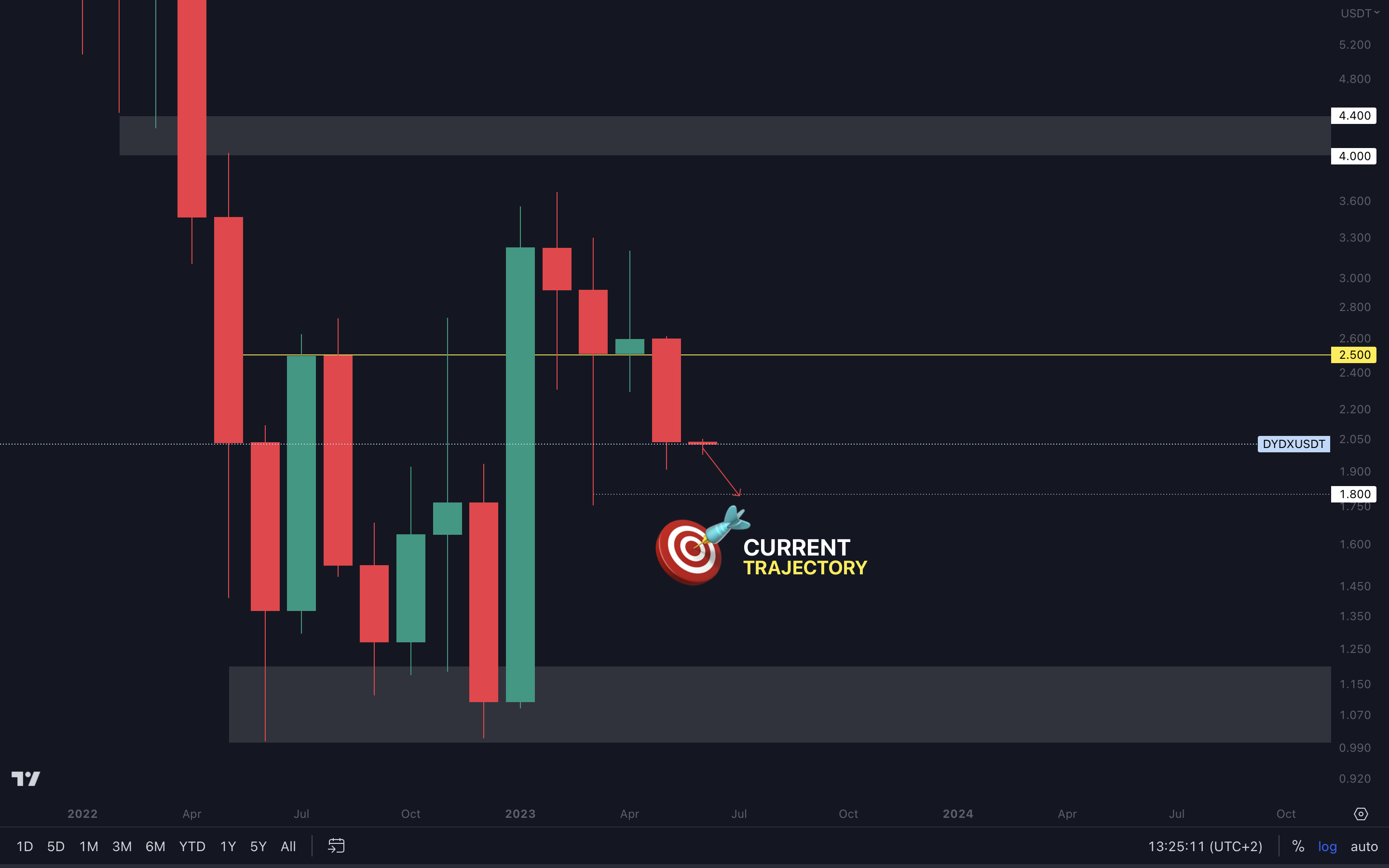

DYDX | dYdX

HEGIC | Hegic

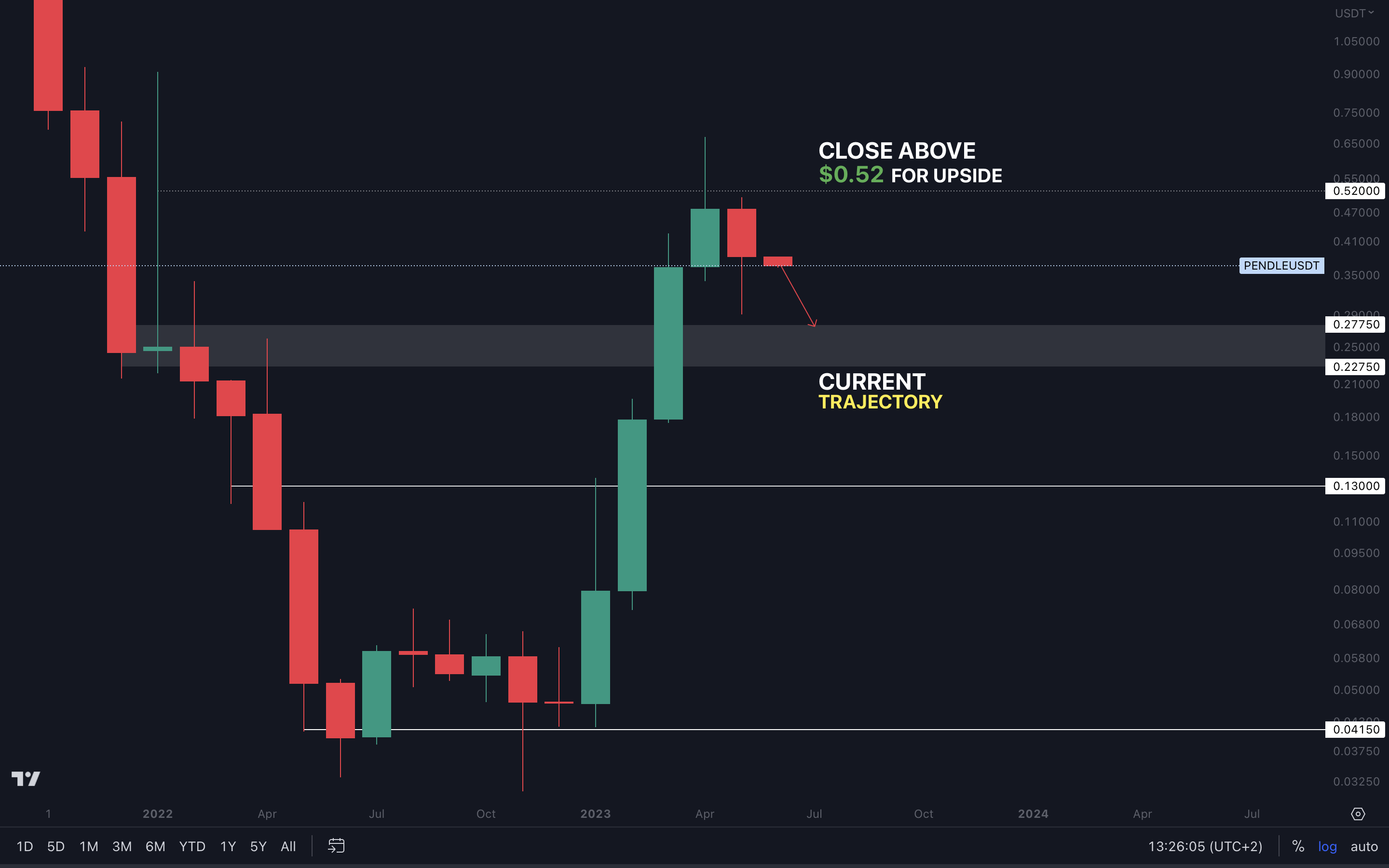

PENDLE | Pendle

Cryptonary's Watchlist 🔎

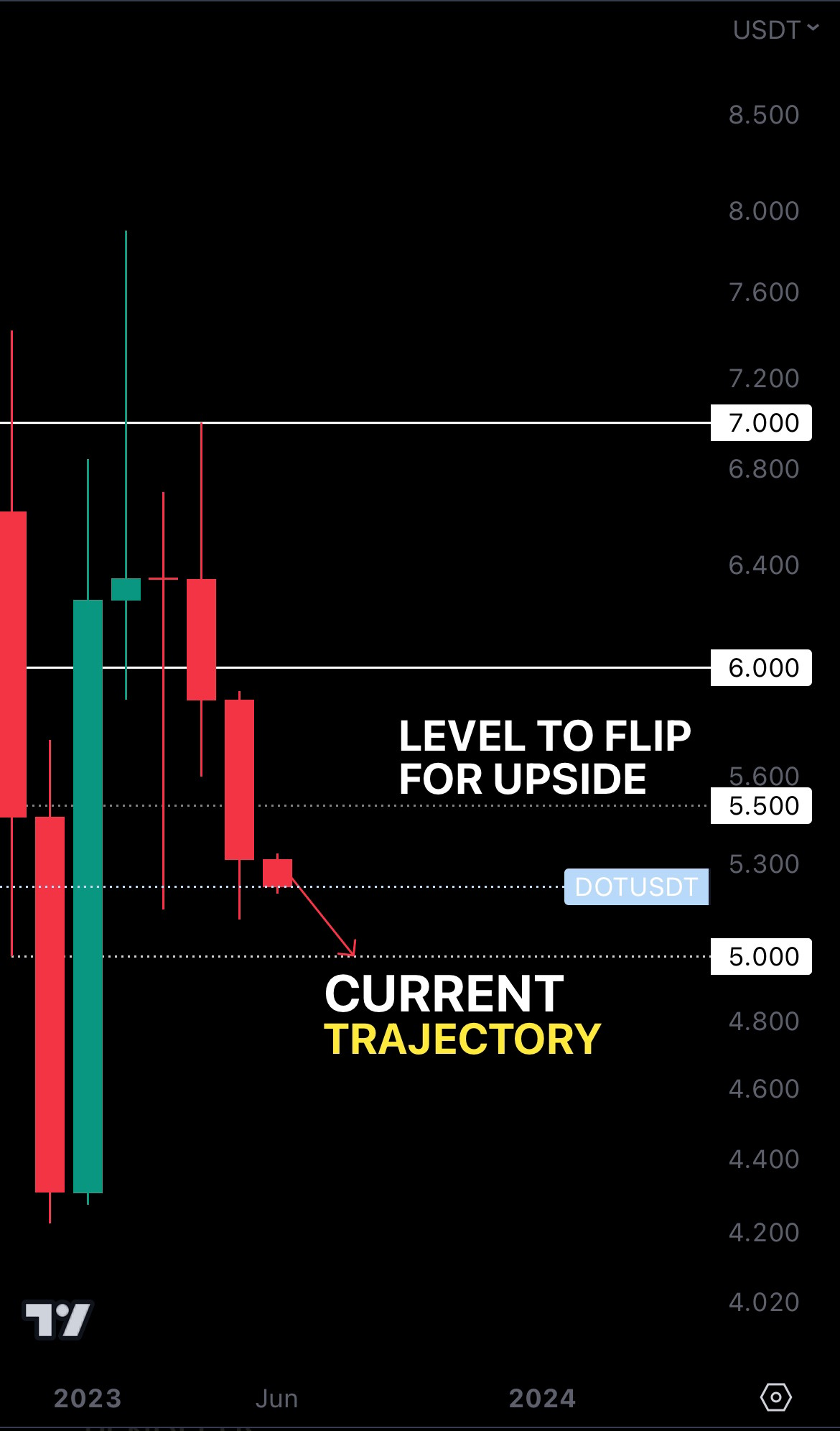

DOT | Polkadot

RUNE | THORChain

SOL | Solana

SYN | Synapse

MINA | Mina Protocol

Astar Network | ASTR

THOR | THORSwap

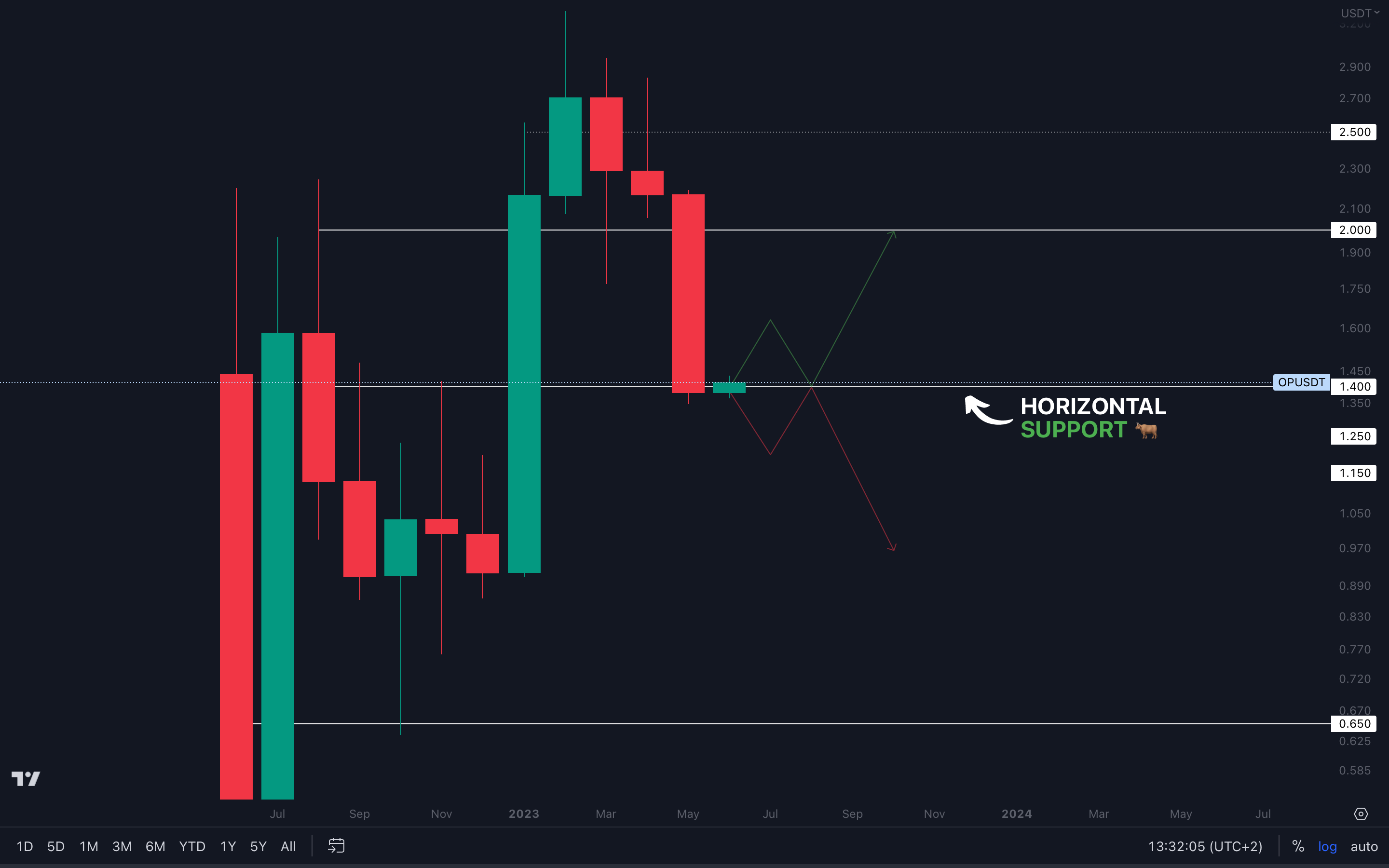

OP | Optimism

LDO | Lido DAO

Our potential star performer is ready…

LDO closed above support last month. What’s next?

LDO closed above support last month. What’s next?

Well, we believe the answer to that is… more upside. Not only did LDO close above support, but it is also trading in a bullish market structure on the monthly timeframe. In a bear market, that’s very rare to come by.

As long as $1.85 holds as support, we’re on track for $3.10 here.

Cryptonary’s take 🧠

Brace yourselves - there’s potentially more downside in the short term. We recommend that you avoid buying anything unless you’re an investor and your plan is to HODL. If you’re a trader, your only goal should be protecting your capital. So, if you’re not quite confident in your trading skills, you are better off sitting this one out - it’s as simple as that.In the meantime, let the market do its thing and prepare for lower prices because…

They’re inevitable.

Action points 🎯

- Keep your exposure minimal. More downside is very likely, and you surely won’t enjoy losing money.

- If you decide to invest, a dollar-cost average (DCA) approach is your best bet. Use it - it’s literally a superpower 🦸.

- Got questions? Hit us up on Discord in the Technical Analysis channel. We’ll make sure to reply!