Home

Research

Analysis

Community

Market Analysis

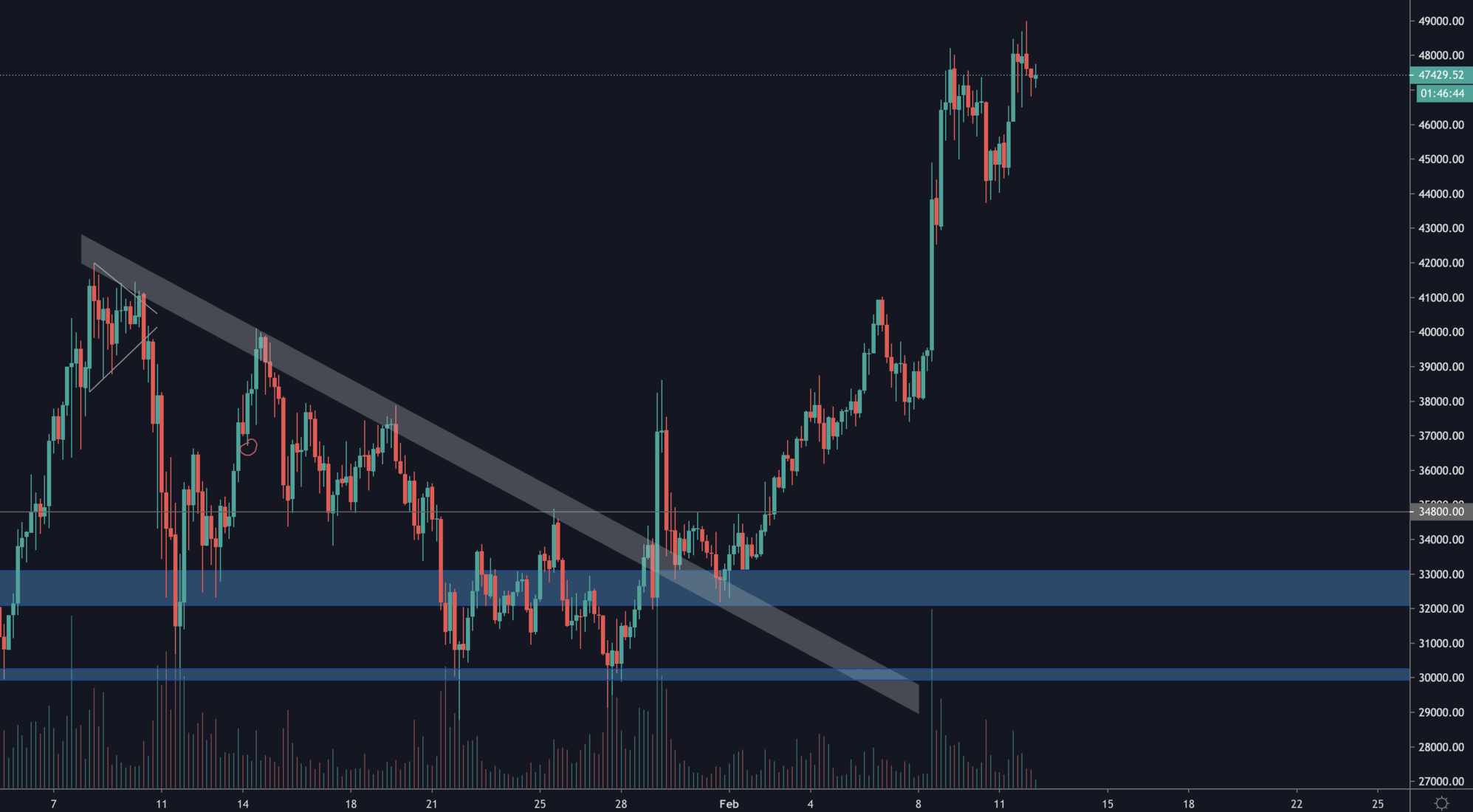

Bitcoin

Last leg to the upside had decreasing volume which indicates weakened momentum. This can lead to a pullback towards [$42,000-$42,500].

REMINDER (before we continue): If the profits you have made are very significant to you, then it is DEFINITELY worth taking 5-10% off in profits and cashing some of it out. We are investing for at least 18-months, so for us we are mentally prepared to go through market fluctuations but this may not be everyone's plan. Do not do what we do, we are all different. Do what is best for you and what is in your own personal best interest.

Disclaimer: This is for informational purposes only. None of this constitutes financial advice nor any sort of recommendation.

ETH

Over-complication lead to analysis paralysis - we despise them. We always take a simple approach to markets and it has highly paid off.

One line to rule them all:

- Over $1,420 = Bullish

- Under $1,420 = Bearish

Literally as simple as it gets. $1,420 is support and should price get there from Bitcoin dropping, the noise in the market about a correction starting will be loud, there will be blood and we would long that blood. Staying cautious with the market because volumes are beginning to slow down, they need to pick back up for continuation.

To clarify, the trend is still immaculate and so is the market structure of HHs & HLs. The slight worry comes from declining volumes but they could pick up if attention drifts away from BTC (Elon brought it there).

TLDR:Still bullish ETH but there is a ~20% (intuitive) chance we see $1,420

DOT

SNX

RUNE

DOT, SNX & RUNE: one aspect we really like about those charts is the fact that they have not moved straight up with pure green candles, they saw pullbacks - significant ones - and this gives sustainability. Whenever things turn too vertical without pullbacks, sustainability becomes questionable. Why? Because then absolutely everyone is in profit and more FOMO builds up, no one is liquidated and in the end price reaches a tipping point where all the buyers already bought and a correction starts. We don't believe we are there yet.

Get started for free

Create your free account or log in to read the full article.

By signing up, you agree to our Terms & Conditions

Recommended from Cryptonary

PRO

Market Pulse

3 min read

Feb 13, 2026

PRO

Market Pulse

3 min read

Feb 11, 2026

PRO

Market Direction

10 min read

Feb 10, 2026

PRO

Market Direction

12 min read

Feb 17, 2026

PRO

Market Updates

7 min read

Feb 16, 2026

PRO

Market Direction

10 min read

Feb 13, 2026

PRO

Market Pulse

3 min read

Feb 13, 2026

PRO

Market Pulse

3 min read

Feb 11, 2026

PRO

Market Direction

10 min read

Feb 10, 2026

PRO

Market Direction

12 min read

Feb 17, 2026

PRO

Market Updates

7 min read

Feb 16, 2026

PRO

Market Direction

10 min read

Feb 13, 2026

PRO

Market Pulse

3 min read

Feb 13, 2026

PRO

Market Pulse

3 min read

Feb 11, 2026

PRO

Market Direction

10 min read

Feb 10, 2026