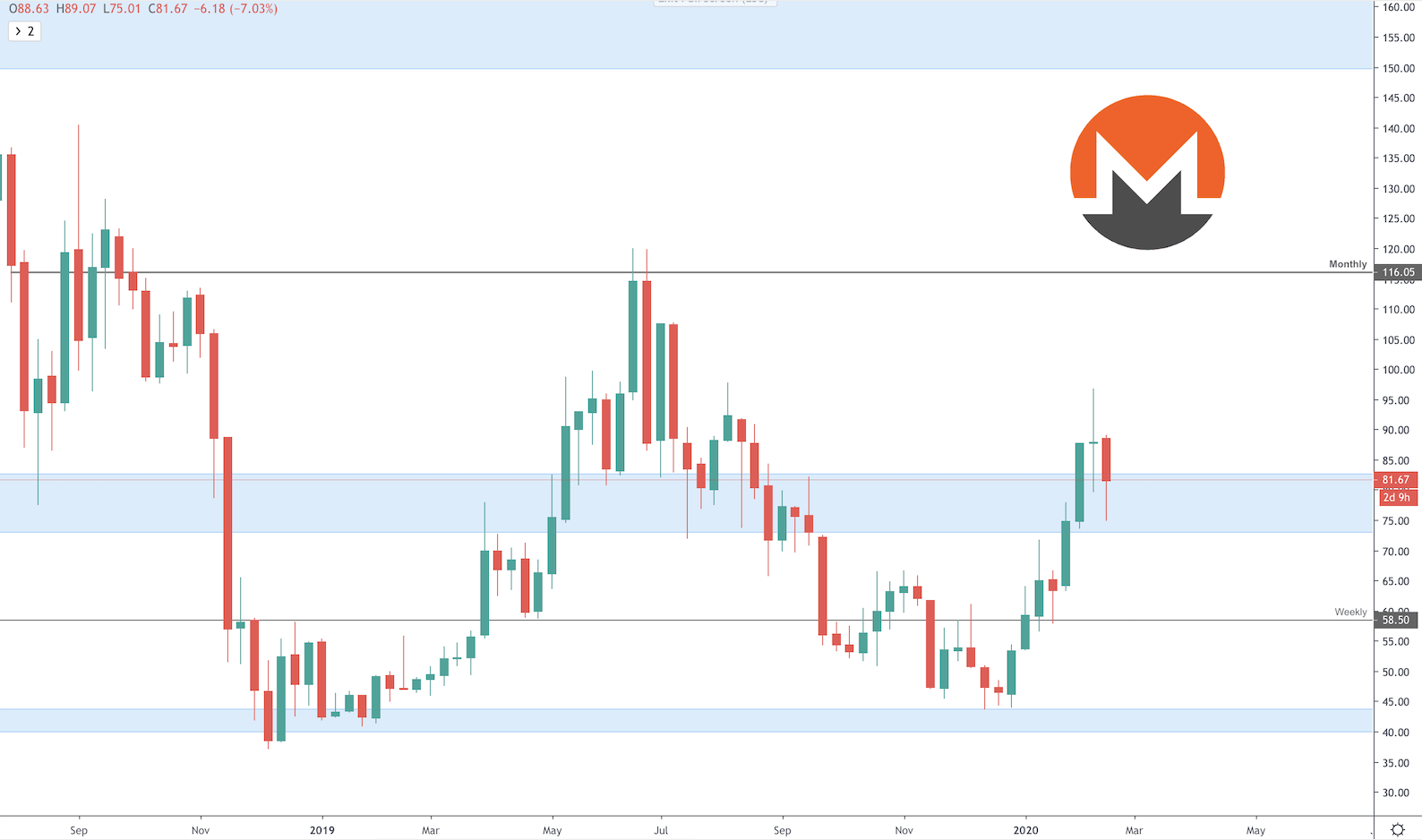

As price topped out $120 in 2019 and started its descent, demand was found near the [$40-$45] area. The demand was significant enough to push the price higher by over 100%. The weekly candle (3 Feb) closed above the [$73-$83] liquidity area and has since retested it for support for two consecutive weeks. If that area holds, then XMR/USD's next level of interest is $116 (+40%).

Looking at a lower timeframe, this case the 1D, gives further details that are not apparent on the weekly.

[caption id="attachment_13850" align="aligncenter" width="2880"] XMR/USD [1D][/caption]The support is holding similar to the 1W TF, however the addition is the hidden bullish divergence that has built with this recent retracement. Potentially, we'd be interested in taking an XMR swing trade as price closes a daily candle back above $82.75 to target $115, with an invalidation price of $72. This makes it a 3:1 (Reward:Risk) setup.

XMR/USD [1D][/caption]The support is holding similar to the 1W TF, however the addition is the hidden bullish divergence that has built with this recent retracement. Potentially, we'd be interested in taking an XMR swing trade as price closes a daily candle back above $82.75 to target $115, with an invalidation price of $72. This makes it a 3:1 (Reward:Risk) setup.

As the cryptocurrency market is flooded with publicly available information, looking only at the USD pairing could possibly make our judgement incomplete. The next step is to look at the Bitcoin pairing.

[caption id="attachment_13852" align="aligncenter" width="2880"] XMR/BTC [1W][/caption]Since the 2017 bull-run, XMR has been severely underperforming against Bitcoin. Every small bullish rally has been registering a lower high followed by a lower low. For the first time ever, price has retested the previously set lower high after having found demand at a significant long-term support. If the demand is sufficient for XMR to register the first higher high, then a new cycle may begin.

XMR/BTC [1W][/caption]Since the 2017 bull-run, XMR has been severely underperforming against Bitcoin. Every small bullish rally has been registering a lower high followed by a lower low. For the first time ever, price has retested the previously set lower high after having found demand at a significant long-term support. If the demand is sufficient for XMR to register the first higher high, then a new cycle may begin.

Considering that most Altcoins have been bullish recently with the Bitcoin Dominance dropping, how would XMR's performance compare to other Altcoins? This is when we look at the Ether pairing.

[caption id="attachment_13853" align="aligncenter" width="2880"]![XMR/ETH [1W]](https://cryptonary.com/cdn-cgi/image/width=3840,quality=90/https://cryptonary.s3.eu-west-2.amazonaws.com/wp-content/uploads/2020/02/XMRETH.png) XMR/ETH [1W][/caption]Right away, we notice an interesting relationship between Ether and Monero, one that is rarely seen in the cryptocurrency market: sideways/ranging correlation. Ever since 2017, Monero has been ranging non-stop against Ether. Considering that technical analysis employs past data to find future price setups, we assume that this relationship will hold for the time being; unless radical changes occur.

XMR/ETH [1W][/caption]Right away, we notice an interesting relationship between Ether and Monero, one that is rarely seen in the cryptocurrency market: sideways/ranging correlation. Ever since 2017, Monero has been ranging non-stop against Ether. Considering that technical analysis employs past data to find future price setups, we assume that this relationship will hold for the time being; unless radical changes occur.

Currently, XMR/ETH is nearing the bottom of that range where support has been found for years. This communicates (given support holds) that XMR may start outperforming Ether in the near future as well.