Disclaimer: Not financial nor investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Summary for November ’22

- Total Market Cap – -15.50%

- Altcoins Market Cap – -15.01%

TLDR

- Due to the collapse of FTX, users have begun to take self-custody of coins rather than leave them on Exchanges.

- There has been large loss taking in the recent weeks which is typical of late-stage bear markets.

- The Hash Ribbon indicates that Miners are coming under increasing stress, and inefficient miners are likely turning off rigs… another characteristic of late-stage bear markets.

- The 1K BTC Wallet holders remain in risk-off mode.

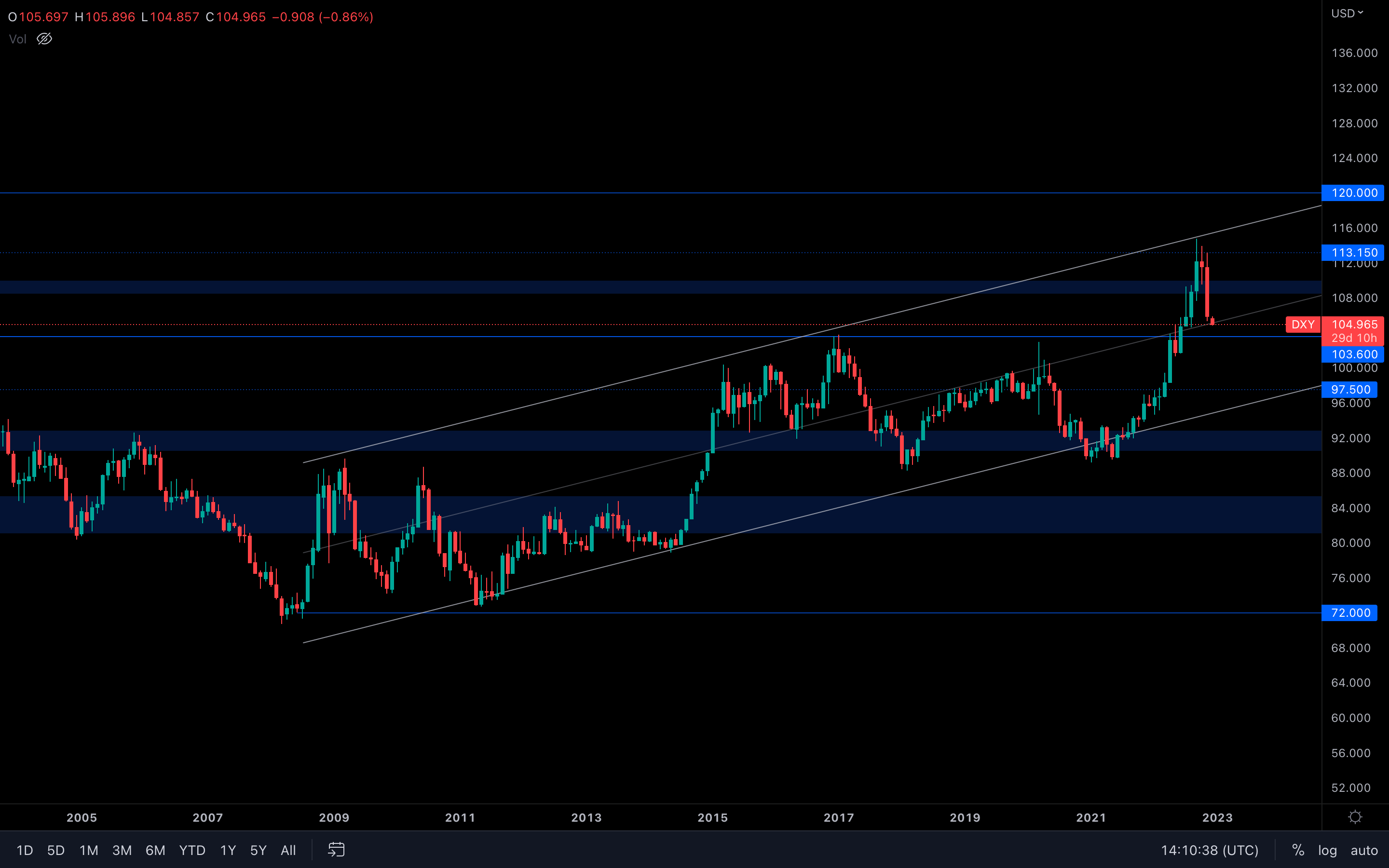

DXY (U.S. Dollar Currency Index)

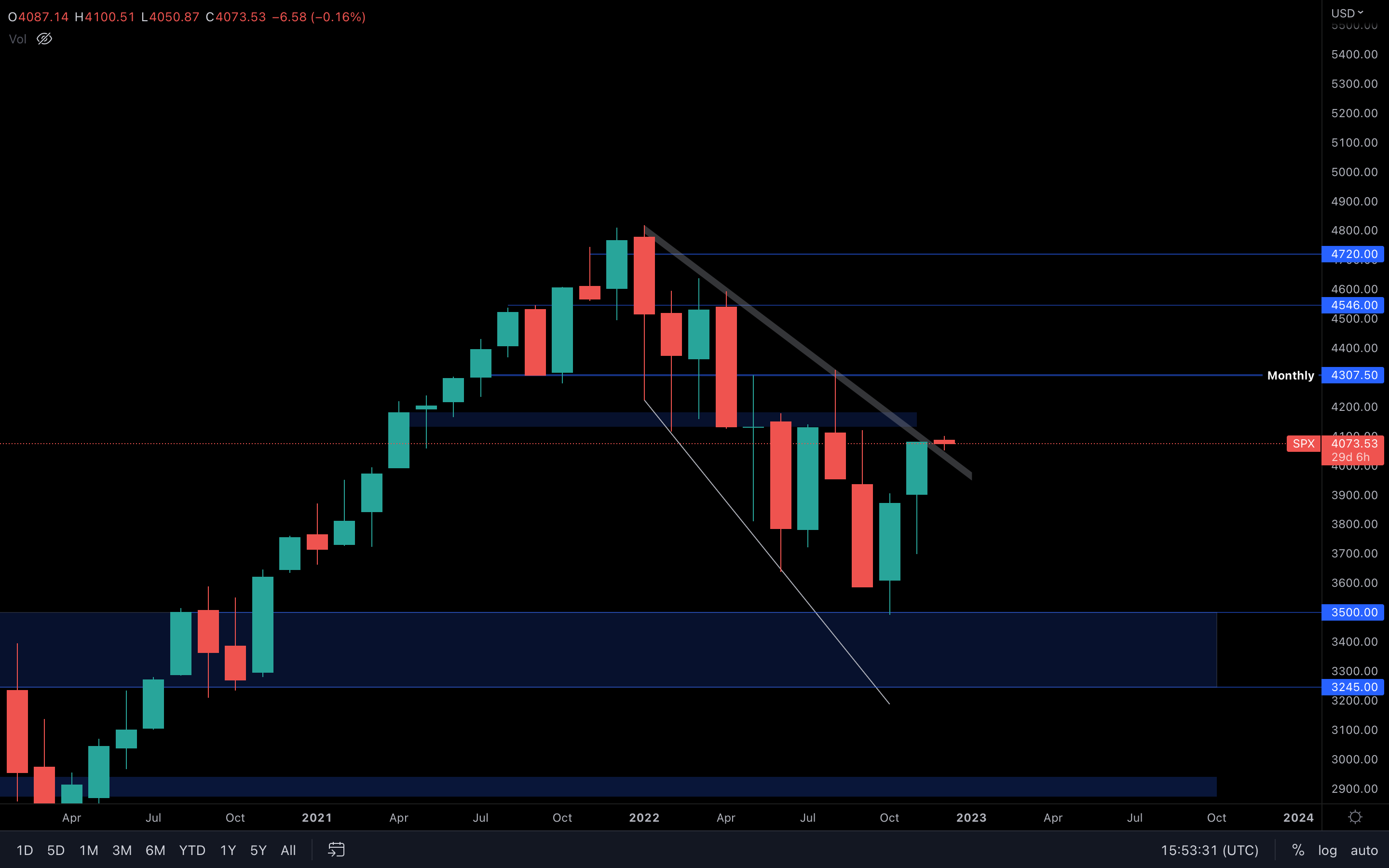

S&P 500 Index

Total Market Cap

Altcoins Market Cap

Bitcoin - Technical & On-Chain Analysis

(Weekly chart was used)

(Weekly chart was used)

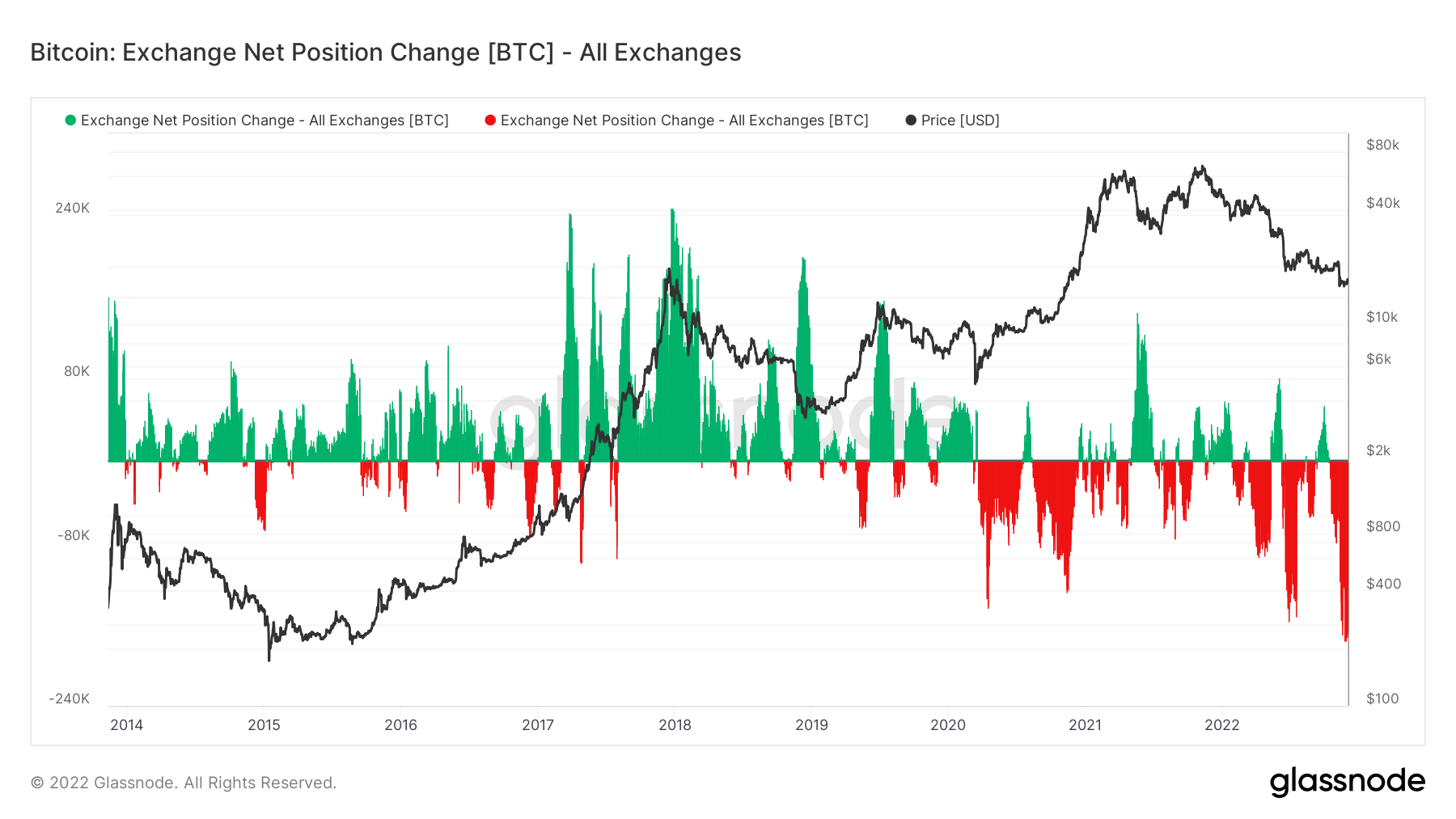

Metric 1 – Exchange Net Position Change

Perhaps one of the most significant changes we can see on chain in the past month is the transition of custodianship of coins from users keeping them on Exchanges to users now more opting for cold storage wallets. The Exchange Net Position Change now shows the deepest decline in the 30d change of the supply held in Exchange wallets (red spikes). This is users opting to move coins out of Exchanges and storing them in cold storage.

Bitcoin – Exchange Net Position Change

Metric 2 – Net Realised Profit/Loss

Metric 2 – Net Realised Profit/Loss

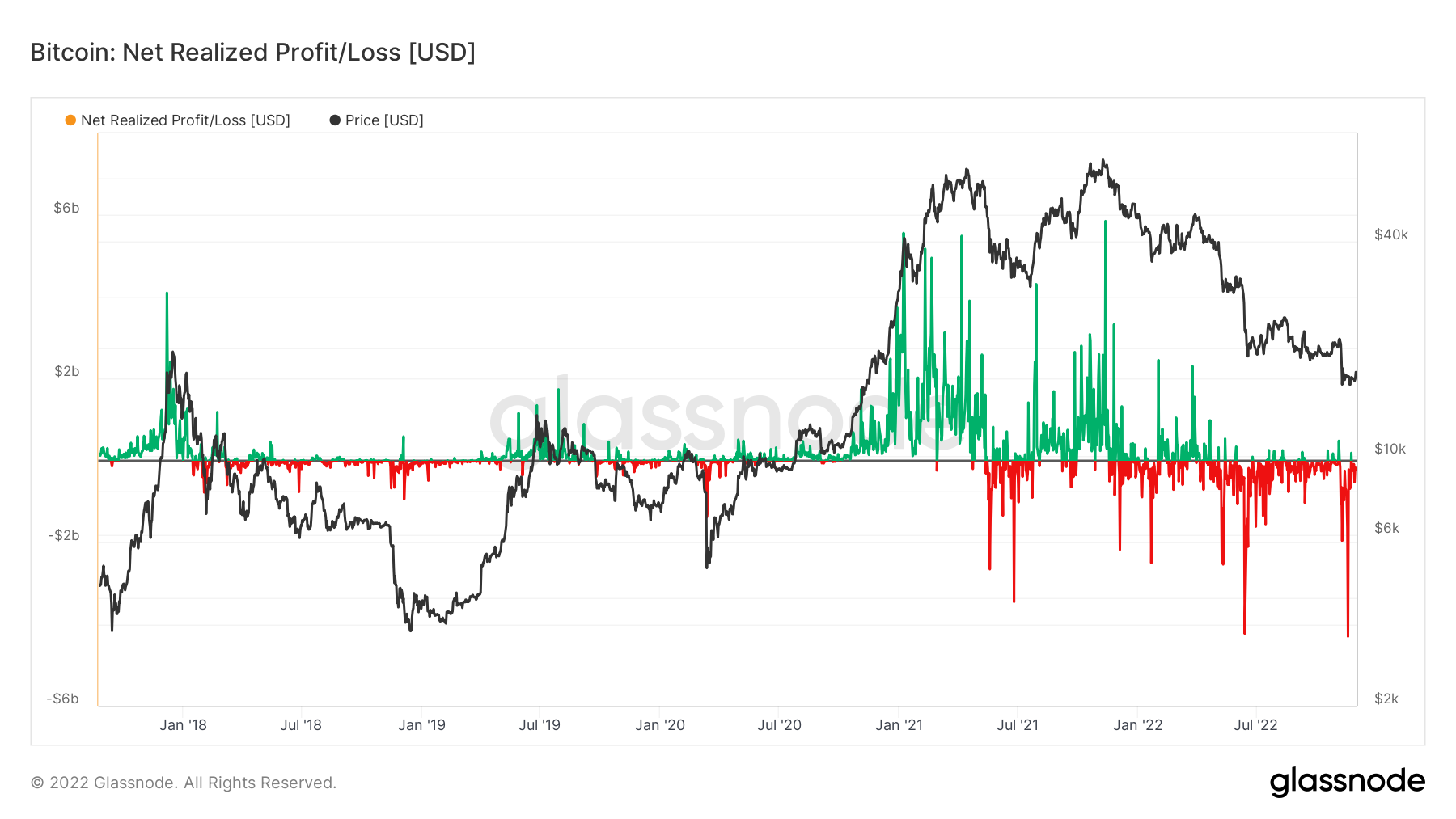

In the past weeks, we have seen a record amount of loss taking on-chain in USD terms. Large loss taking events are signs of capitulation and are typical during late-stage bear markets. It may be the case that we’ve just witnessed the last capitulation event of this bear market.

Bitcoin – Net Realised Profit/Loss

Metric 3 – Miners

Metric 3 – Miners

The Hash Ribbon assumes that Bitcoin tends to reach a macro low when miners capitulate. When the 30d MA (green) crosses above the 60d MA, it can be suggested that the worst of the miner capitulation is over (switch from light red to dark red to white). We now look as if we’re entering another light red phase, so watching this for a move to dark red and then to white will pivotal in assessing when miner capitulation may be over and the potential macro bottom may be in.

Bitcoin – Hash Ribbon

Metric 4 – 1K Wallet Addresses

Metric 4 – 1K Wallet Addresses

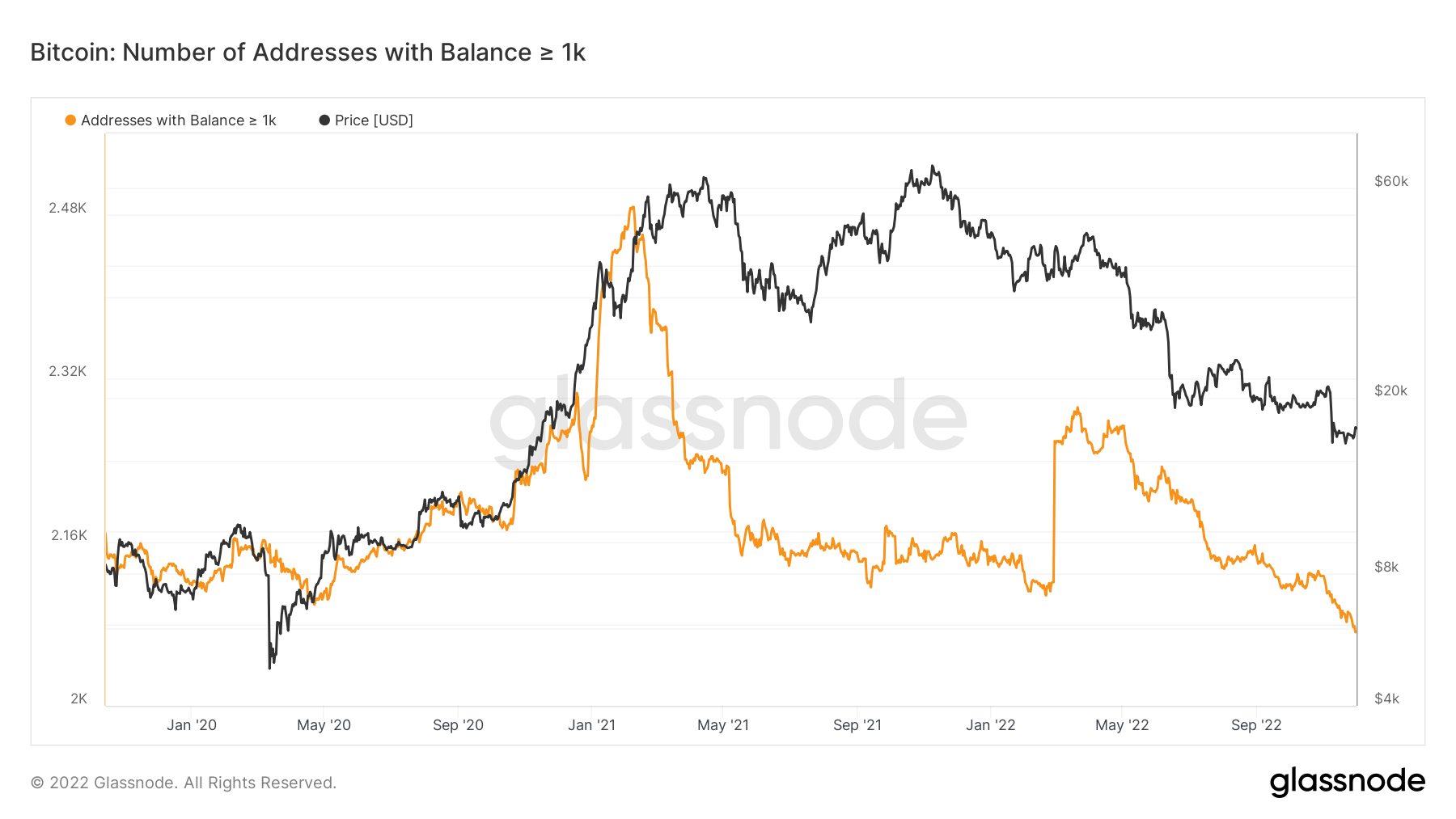

The 1K BTC Wallet holders have historically been the best at predicting when to risk-on (buy more coins) and when to risk-off (sell coins). We can see in the below that the number of wallets holding more than 1K BTC, continues to decline, suggesting a risk-off sentiment.

Bitcoin – 1K Wallet Holders

Note: The large increase in late February was not a misprint, but it wasn’t organic. Created from Exchanges opening up new wallets. This was confirmed by the data provider Glassnode.

Note: The large increase in late February was not a misprint, but it wasn’t organic. Created from Exchanges opening up new wallets. This was confirmed by the data provider Glassnode.

Ether - Technical Analysis

(Weekly chart was used)

(Weekly chart was used)

Ether will likely take a swing at $1400 soon, but we can see continous weekly lower highs since June. This leaves us with the following question - has anything changed?

DOT

(Weekly chart was used)

(Weekly chart was used)

We've also used the weekly timeframe here to show why a retest of $6 will likely occur in the next weeks. After losing the $6 level four weeks ago, DOT was heading toward $4.70 but never actually got there. $4.70 will be tested at some point, but until then, a $6 retest will likely occur due to Bitcoin also showing signs of a potential rise in the short-term.

SNX

(Weekly chart was used)

(Weekly chart was used)

Quite disappointed in SNX's performance - but it's all due to last month's events. Although we were expecting a $3 SNX in November and the asset never reached that level, the technicals were there to support the move.

RUNE

(Weekly chart was used)

(Weekly chart was used)

RUNE will retest its next resistance level ($1.45 - $1.50), after which the asset will likely continue to fall to its $1.10 level. Whether the resistance will be broken remains to be seen, but until now, RUNE has been perfectly following Bitcoin's price action. This leaves the asset purely in the hands of the major.

SOL

SRM

(Weekly chart was used)

(Weekly chart was used)

SRM is just not worth the risk at this point as there are better opportunities out there right now. The asset is in downside price discovery, and without proper bullish reasons to support a move up, a retest will likely not occur here. We're talking hundreds of percentages, after all.

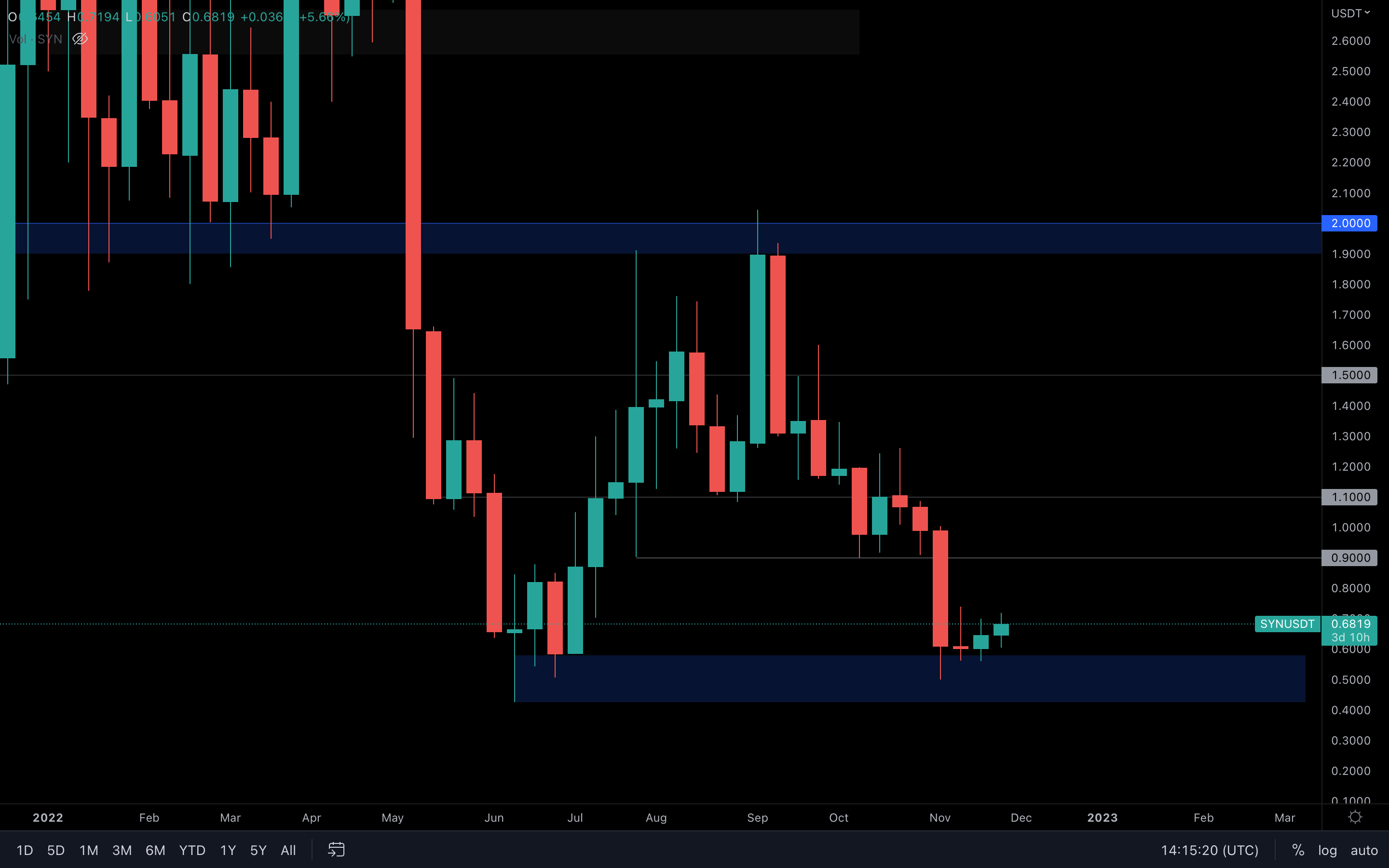

SYN

(Weekly chart was used)

(Weekly chart was used)

Clean chart, even though it is bearish. Synapse has been holding this support area and is now experiencing a buying impulse. If this continues, then a $0.90 retest will likely occur in December.

MINA

Currently battling with $0.58 - once that's out, then $0.70 can follow. If MINA is unable to break above $0.58, then we are going to see constant ranging during December, between that level and the bottom channel that has acted as support for the past months.

Currently battling with $0.58 - once that's out, then $0.70 can follow. If MINA is unable to break above $0.58, then we are going to see constant ranging during December, between that level and the bottom channel that has acted as support for the past months.

DYDX

Same as most other assets and Bitcoin, dYdX will likely experience an early December rise. Keep in mind that last month, dYdX's volumes have increased drastically which makes it one of the few assets that a day-to-day or a swing-trader might be interested in.

Same as most other assets and Bitcoin, dYdX will likely experience an early December rise. Keep in mind that last month, dYdX's volumes have increased drastically which makes it one of the few assets that a day-to-day or a swing-trader might be interested in.

$1.50 is dYdX's closest support, $2.20 is the closest resistance level. Based on the fact that a short-term rise can occur, dYdX will likely take a swing at $2.20 in the coming weeks.