Disclaimer: Not financial nor investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Summary for June ’22

- Total Market Cap – -33.06%

- Altcoins Market Cap – -29.49%

TLDR

- Both indexes, as well as Bitcoin and Ether have closed the monthly candle for June just above their 2017 - 2018 all-time highs.

- Ether has experienced a more aggressive descent compared to most altcoins. This led to altcoins dropping more slowly & steadily throughout June, forming somewhat of a strength against Ether's influence (ETH Dominance going down significantly).

- The Altcoins Market cap is due to range between $475B and $645B in July.

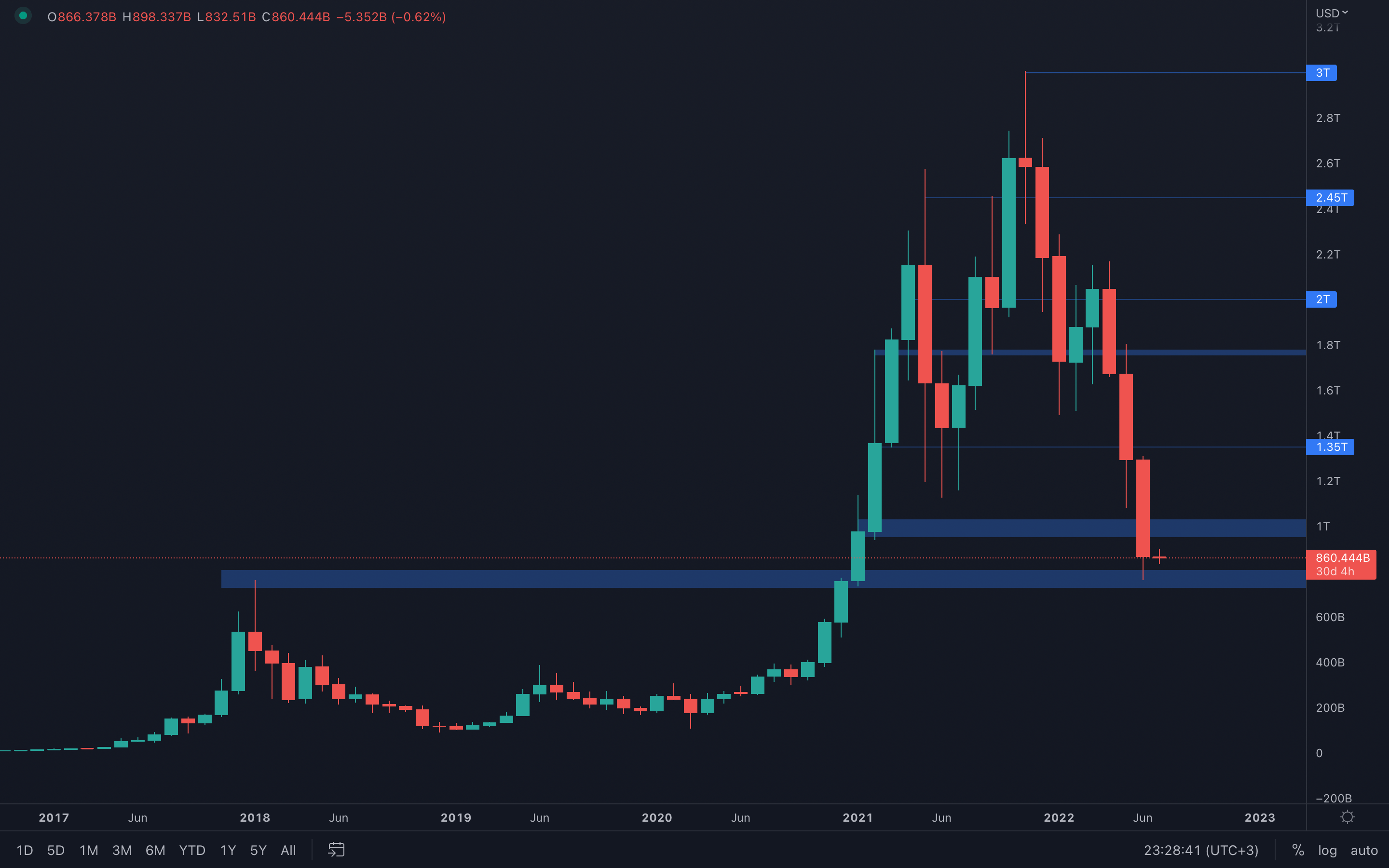

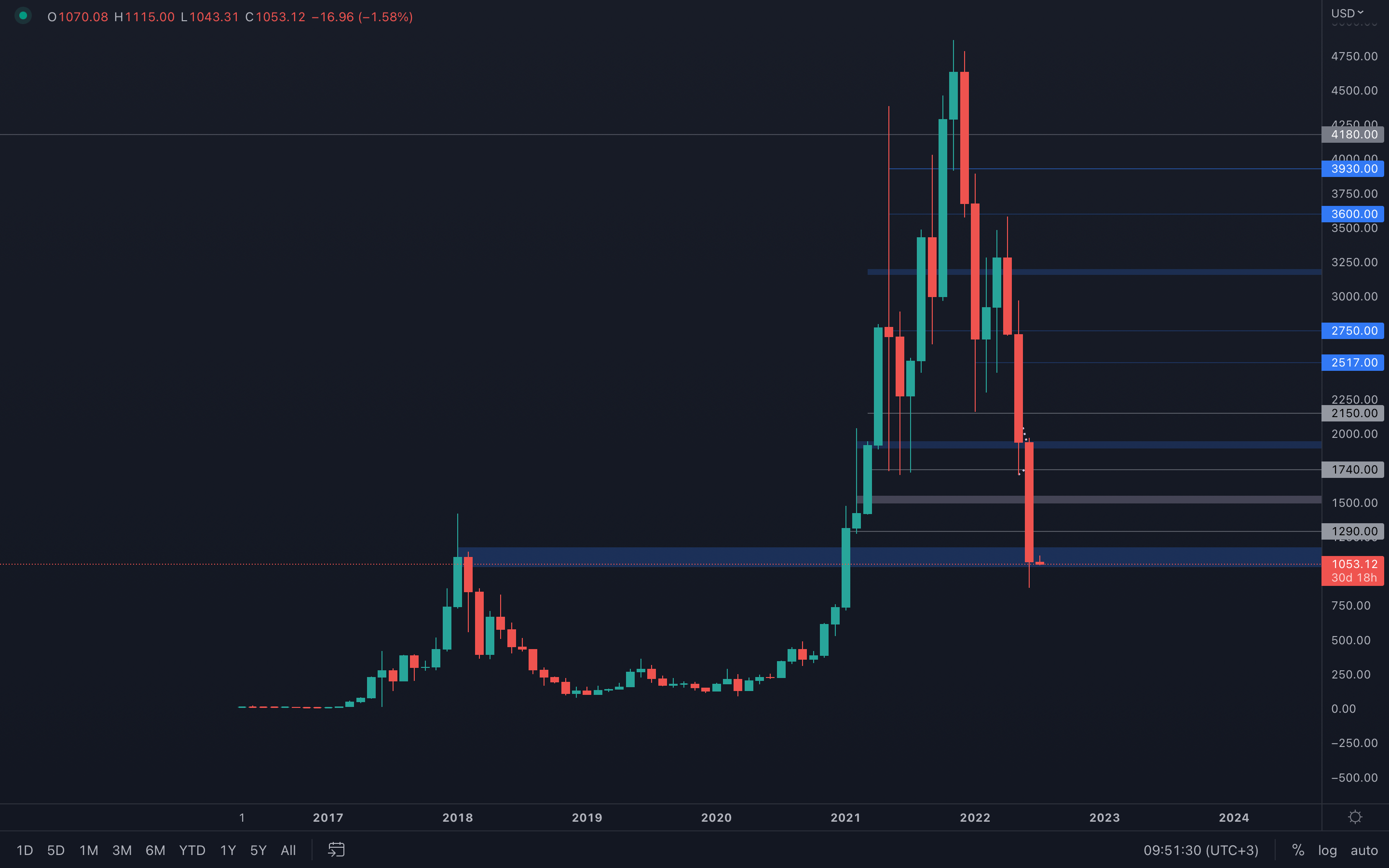

Total Market Cap

June absolutely crushed our expectations. With a decrease of over 30% last month, the Total Market Cap visited its 2018 all-time high and luckily, managed to close its monthly candle above it. There’s no denying that the macro environment is getting worse by the day, but we also have to stick with what data we’ve been given. A monthly closure above a previous all-time high is as bullish as it can get, which can suggest that July’s selling pressure might be exhausted, with buyers trying to desperately hold this extremely important area.

Of course, there are no guarantees in crypto, so keeping an open mind for all possible outcomes is the healthiest thing you can do.

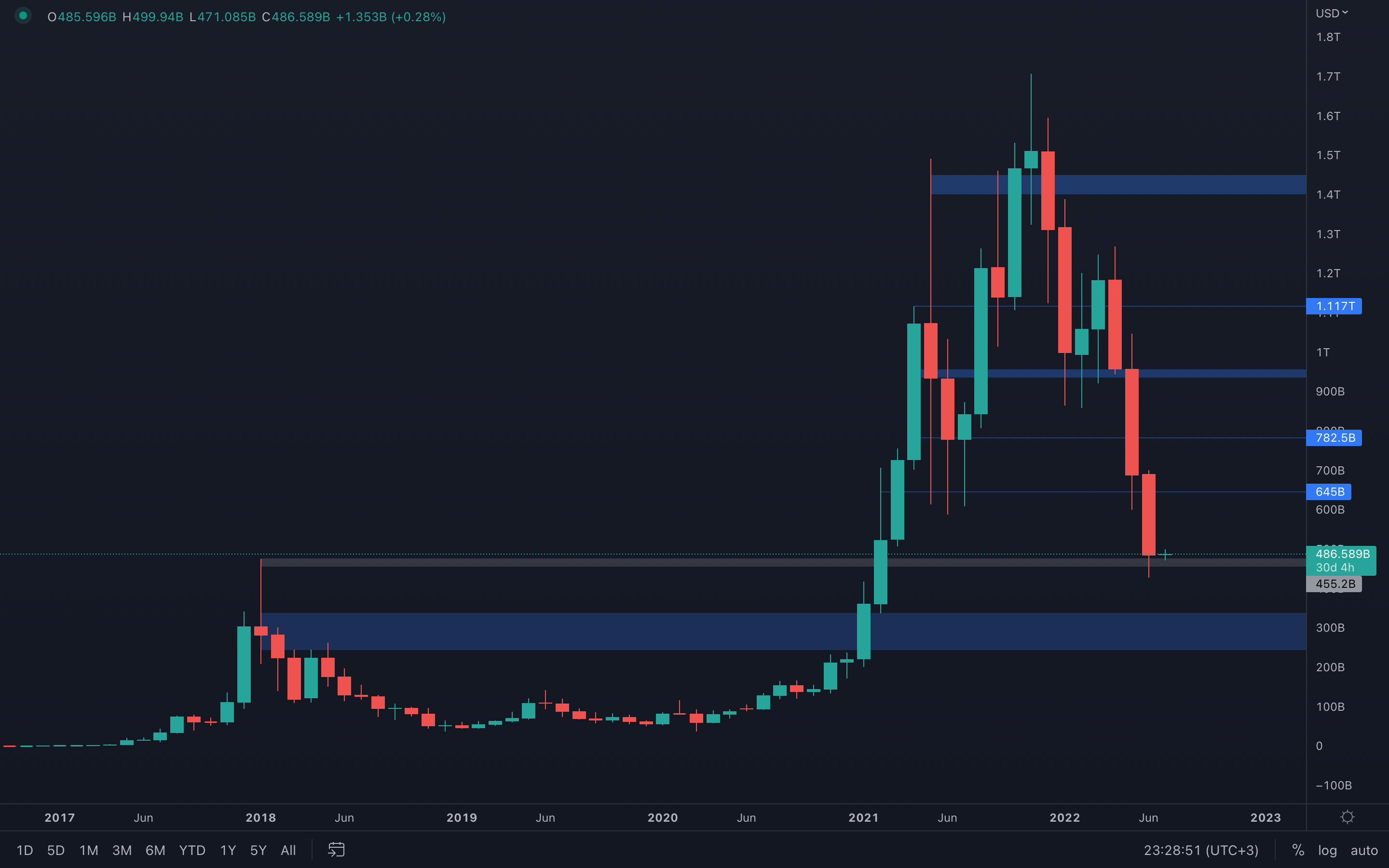

Altcoins Market Cap

There’s really no difference between the two indexes at the moment - the Altcoin Market Cap can be seen trading just above its 2017 all-time high, an extremely important level that needs to hold to keep us from not investing every penny we got into the market - it's addictive.

For July, assuming the $475B level holds (2017 all-time high), we can expect it to range between $475B and $645B.

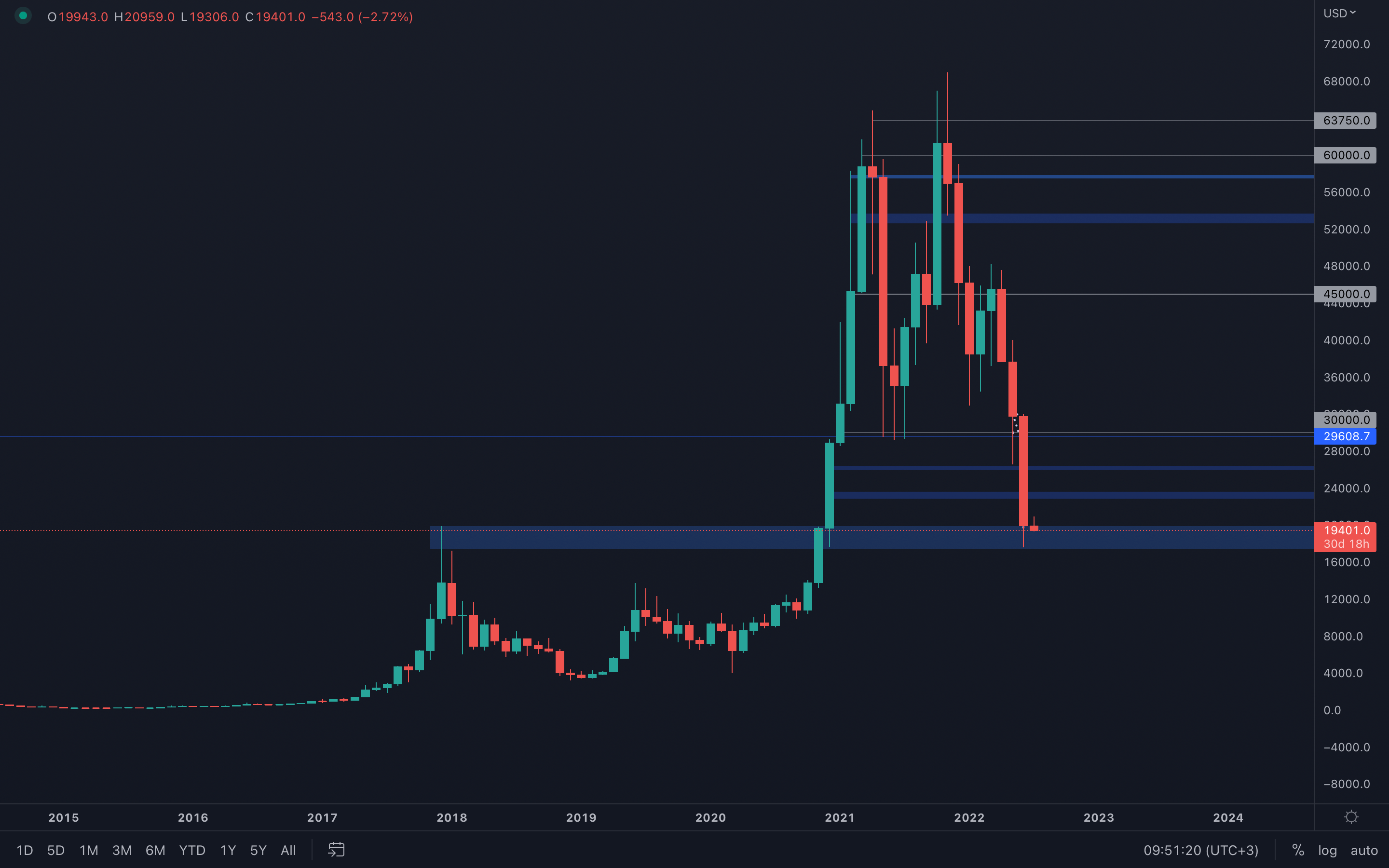

Bitcoin - Technical Analysis

For BTC, June also marks the month of the 2017 all-time high test. Same as we’ve seen on the Total Market Cap, Bitcoin also managed to close last month’s candle above the previous all-time high. We’ve seen some odd volatility in the last 48 hours, both buyers and sellers have been in control, and Bitcoin managed to raise over $2000 in just two hours. We’re no strangers to price manipulations, so maybe something is cooking behind the scenes. As always, we will continue to monitor Bitcoin’s price movements at all times, but it does look like we’re going to experience an interesting early-month change of pace for July.

Ether - Technical Analysis

June has been an impressive month for ETH - at least for bears 🐻. In June, we saw a 44.85% decrease in Ether’s price, that’s over both April & May combined. It’s obvious that Altcoins are getting hit way harder compared to Bitcoin, and that’s totally fine. Should we be expecting this to continue? Absolutely. While this presents a huge risk for holding altcoins in our portfolios, it also serves as a huge opportunity, because when prices do start to rise, altcoins will rise faster - of course, fundamentally sound altcoins, not all of them.

Ether has also found itself just above its 2018 all-time high, the difference here being that its price has actually closed a monthly candle under the previous all-time high. Because Ether doesn’t share the same history as Bitcoin, there’s no need to worry about Ether closing under its previous all-time high, as long as Bitcoin doesn’t break that pattern. As always, Ether’s price will continue to be strongly influenced by Bitcoin’s price, so it’s best to monitor both throughout July.

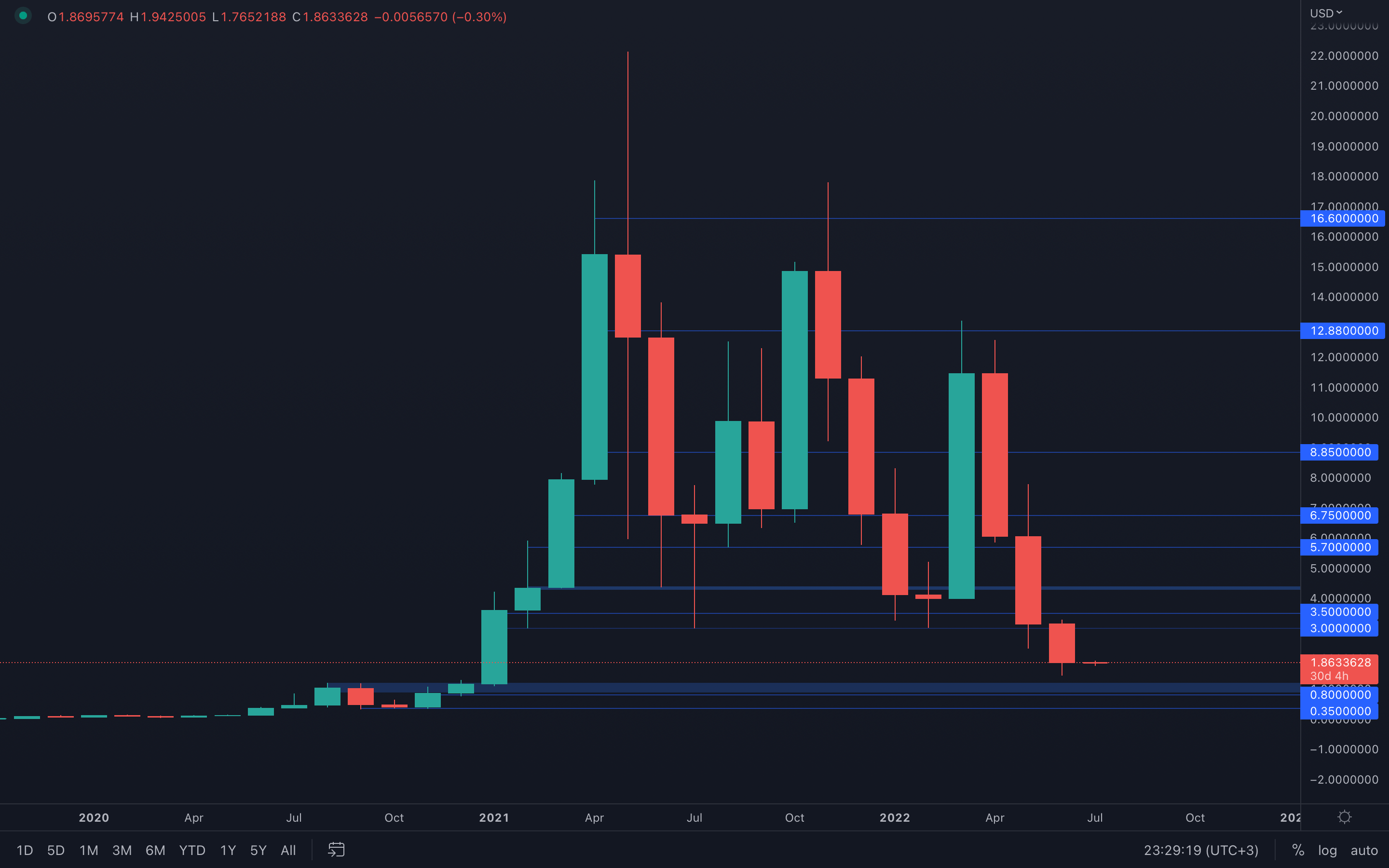

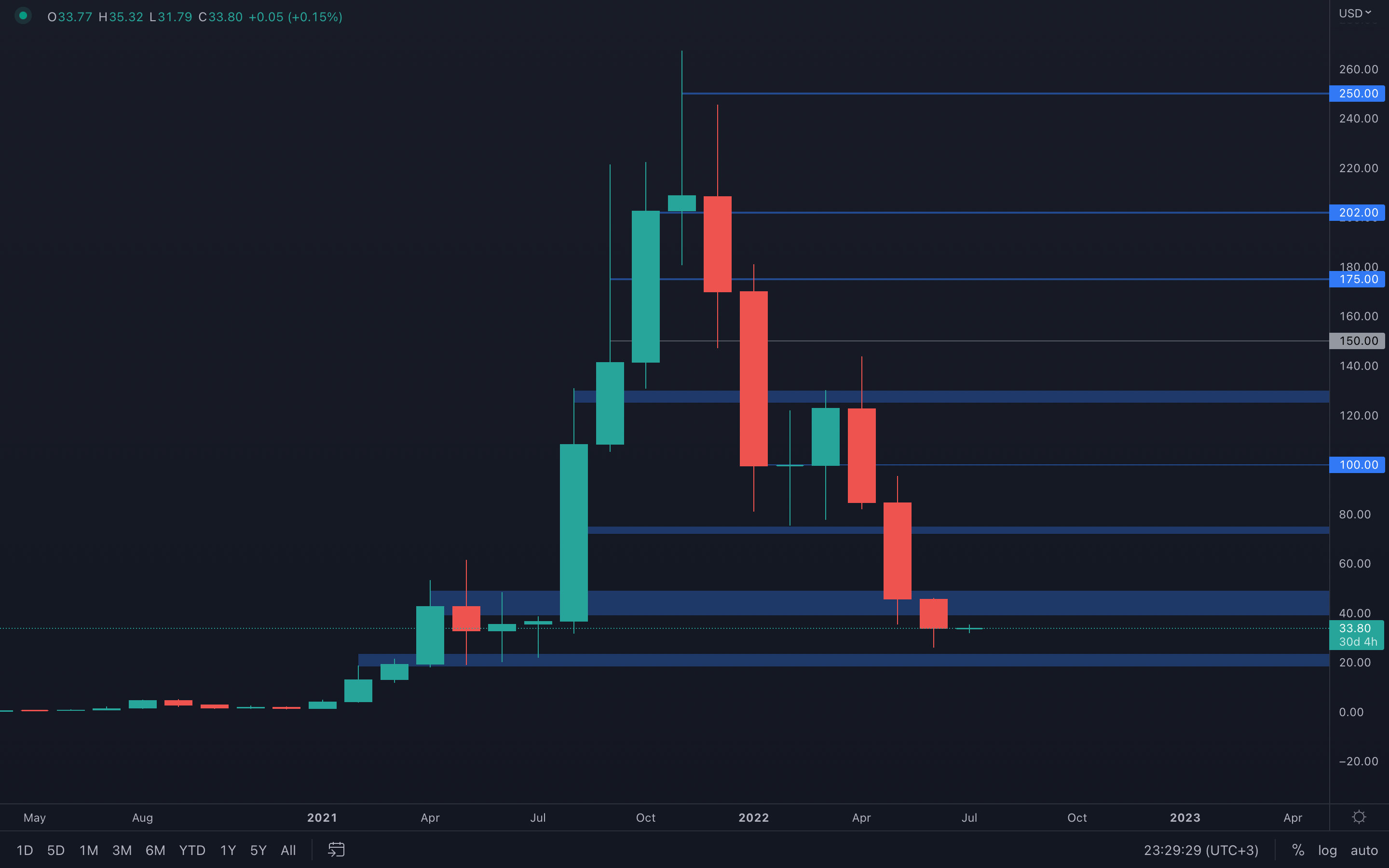

DOT

All things considered, DOT actually closed quite hopeful. With the monthly closure just above an important support area, we can only assume buyers are going to step in and save the day this time. We've never seen more than three red months on DOT, will this time be a first? Highly unlikely.

All things considered, DOT actually closed quite hopeful. With the monthly closure just above an important support area, we can only assume buyers are going to step in and save the day this time. We've never seen more than three red months on DOT, will this time be a first? Highly unlikely.

It's also worth mentioning that Bitcoin, the same as DOT, is currently testing an extremely important level, its 2018 all-time high. We can only look at this from an objective perspective - the odds of Bitcoin closing under its previous all-time high are quite lower compared to Bitcoin finding some strength in July, even with everything that's been going on in the macro picture. The influence Bitcoin has over altcoins is already known, so where Bitcoin goes, DOT will follow.

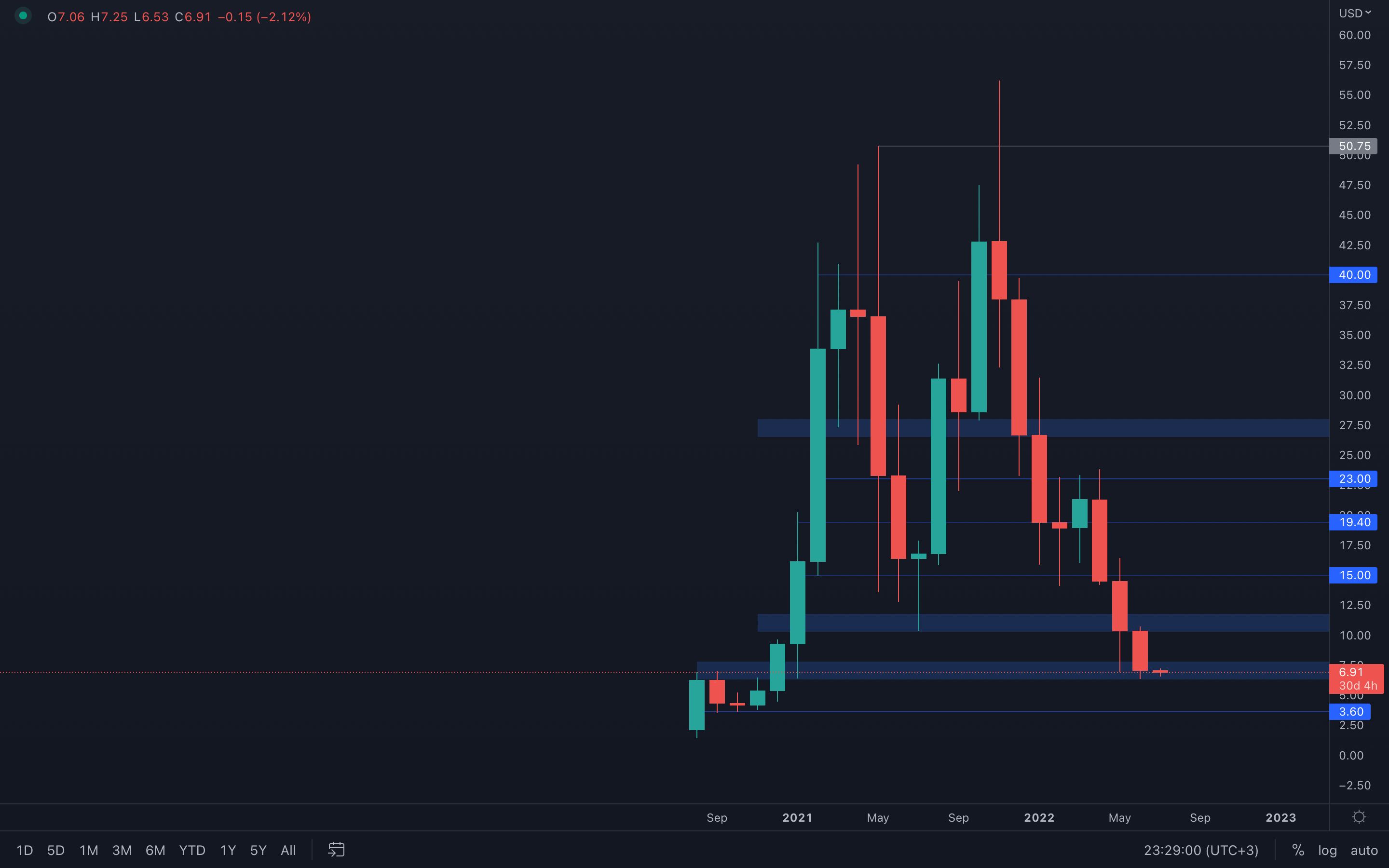

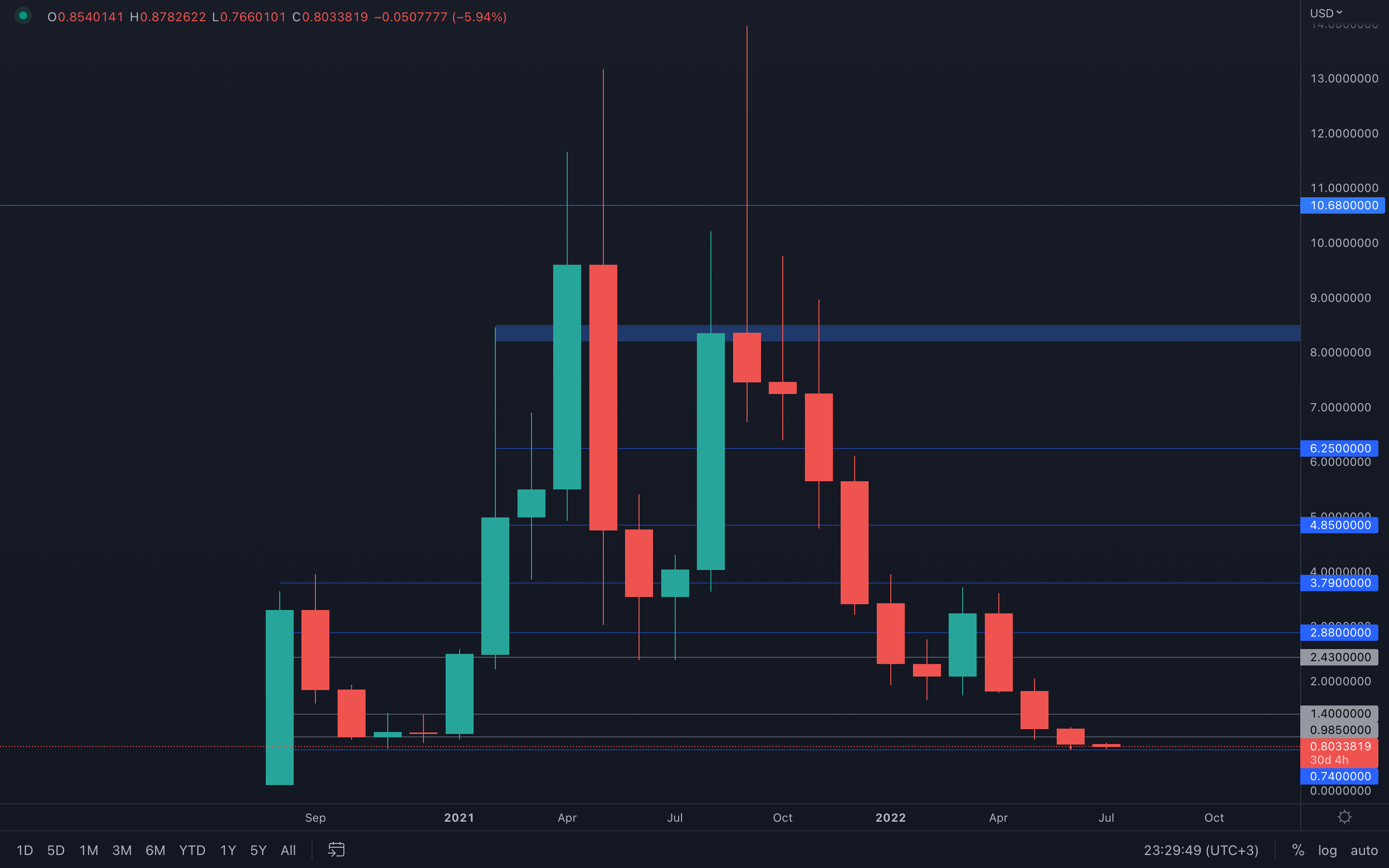

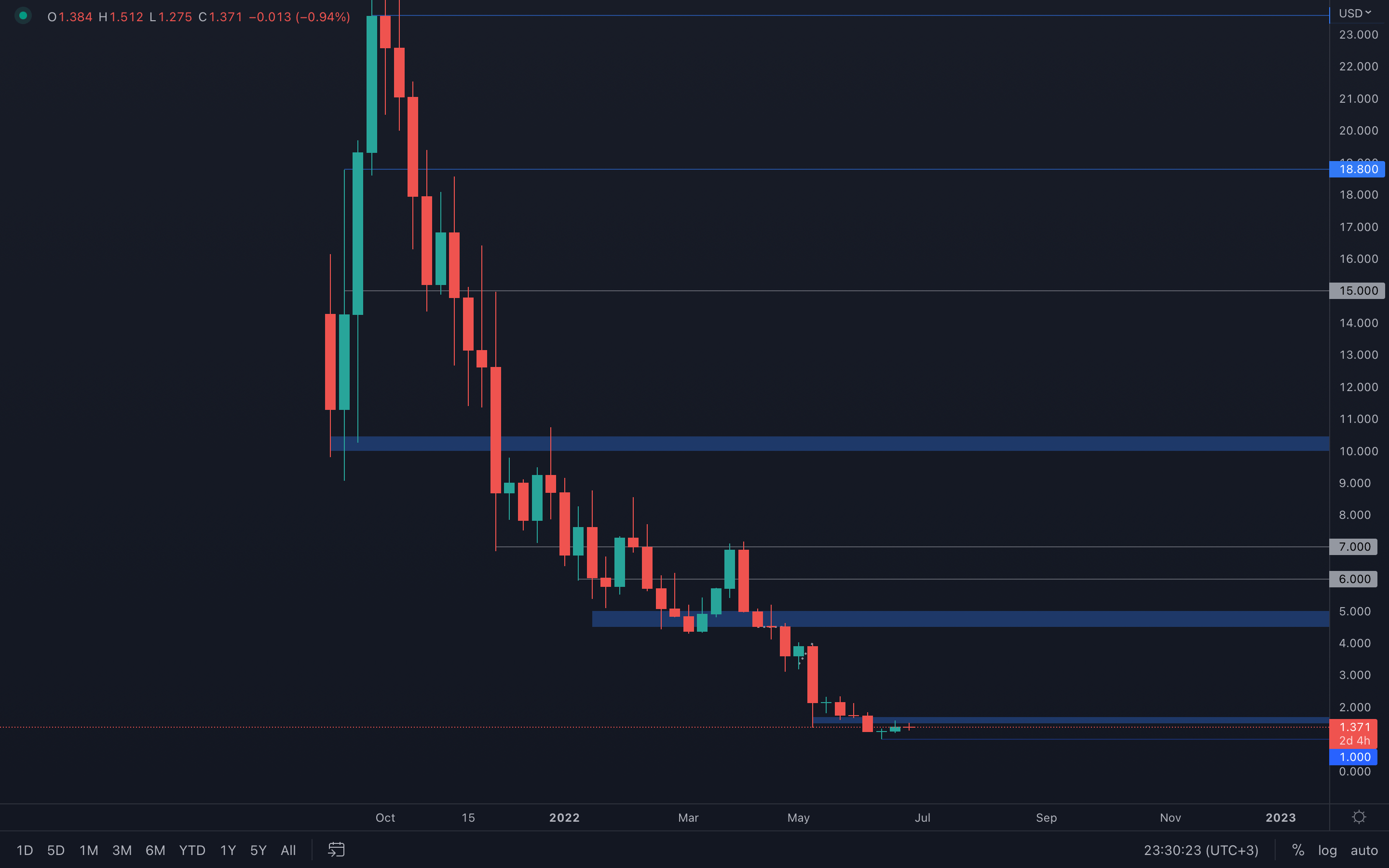

SNX

SNX also closed above one of its support levels, but not one that can actually reverse SNX's price anytime soon. The $2 level acts more like an intermediate level, in the middle of the $3.60 - $1 range, with $1 still yet to be tested, so we shouldn't expect any significant changes from SNX in July unless both Bitcoin & Ether perform well. A monthly closure above $3.60 would definitely suggest bullishness, so that's what we'll be looking for this month.

SNX also closed above one of its support levels, but not one that can actually reverse SNX's price anytime soon. The $2 level acts more like an intermediate level, in the middle of the $3.60 - $1 range, with $1 still yet to be tested, so we shouldn't expect any significant changes from SNX in July unless both Bitcoin & Ether perform well. A monthly closure above $3.60 would definitely suggest bullishness, so that's what we'll be looking for this month.

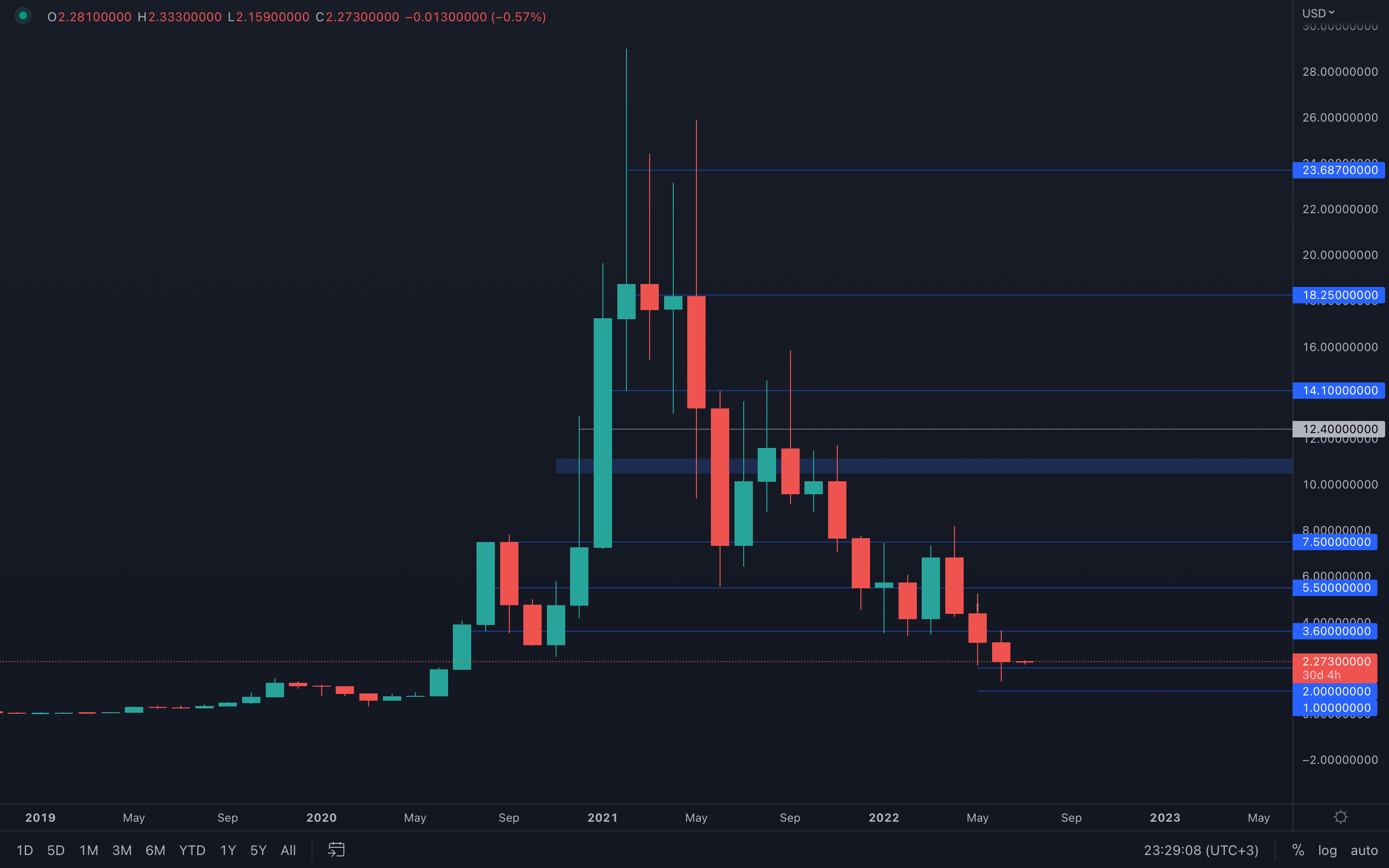

RUNE

With no actual demand areas in proximity, RUNE now risks testing the long-awaited, yet the scary psychological level of $1. When it comes to fundamentals, RUNE is one of our most loved projects, so $1 may seem like a second opportunity to greatness. The risk/reward ratio is obviously high at that level, so this particular project will most likely raise interest within the crypto community and make waves in the future. For July, however, we shouldn't expect prices to go above $3, as there's not enough volume to sustain a move higher.

With no actual demand areas in proximity, RUNE now risks testing the long-awaited, yet the scary psychological level of $1. When it comes to fundamentals, RUNE is one of our most loved projects, so $1 may seem like a second opportunity to greatness. The risk/reward ratio is obviously high at that level, so this particular project will most likely raise interest within the crypto community and make waves in the future. For July, however, we shouldn't expect prices to go above $3, as there's not enough volume to sustain a move higher.

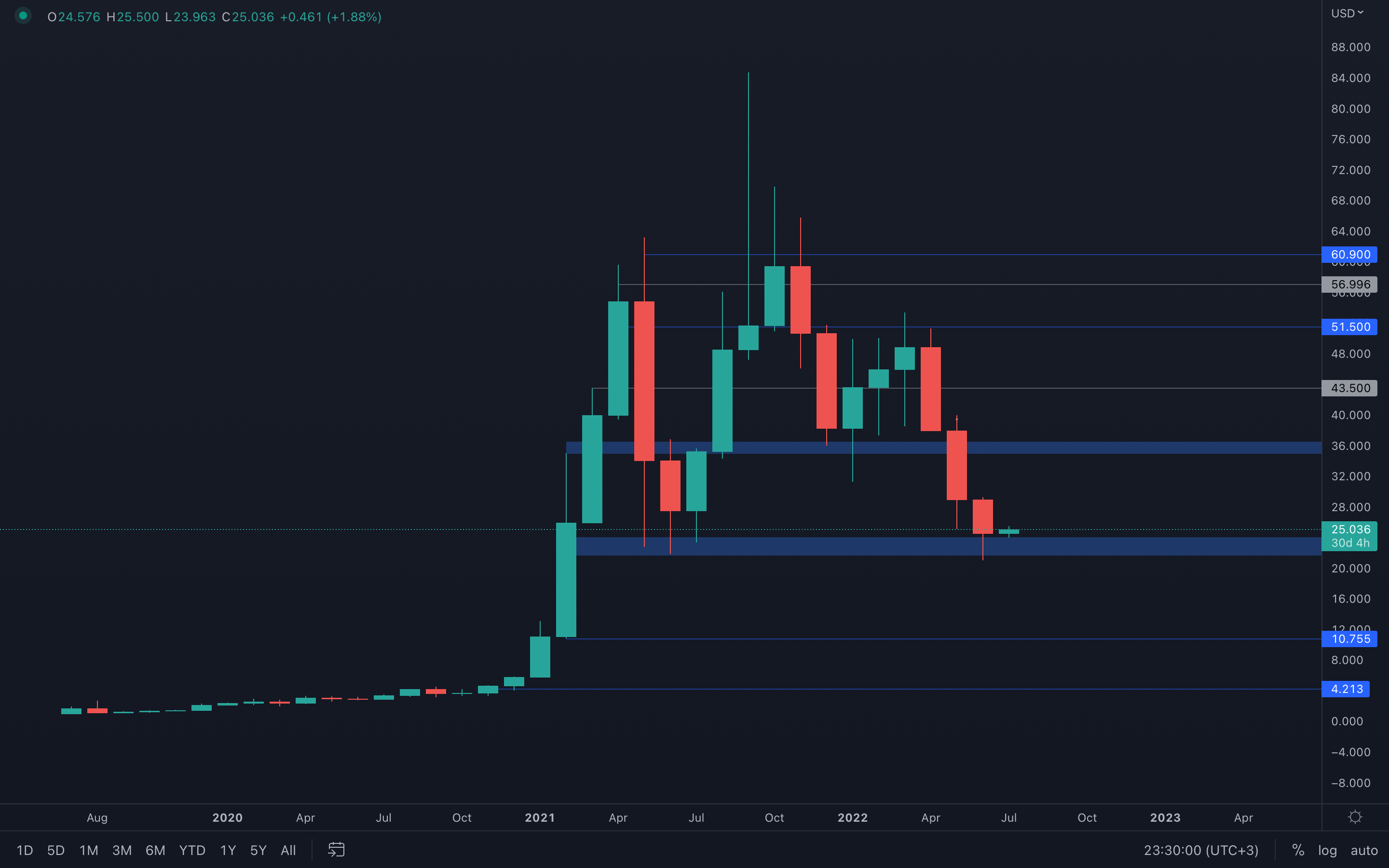

SOL

Quite surprising performance from SOL, and actually many altcoins from within this report. Even if Ether has experienced an extremely aggressive descent in June, SOL only dropped by 26%, which sure, might still be considered much, but not really when compared to ETH. What does that tell us? - it tells us that most altcoins have developed somewhat of a strength to Ether’s influence upon the altcoins market. Instead of a sudden descent, prices have dropped steady and slow, indicating both buyers and sellers are present, but buyers cannot resume complete control due to the selling pressure that Ether and Bitcoin have been experiencing.

On a more technical note, SOL is forming a bearish engulfing candle on the weekly timeframe, which if successfully closed, can indicate a $23 SOL in the coming weeks. We’ll make sure to keep you updated in both our daily analysis and the weekly reports in case any sudden changes occur.

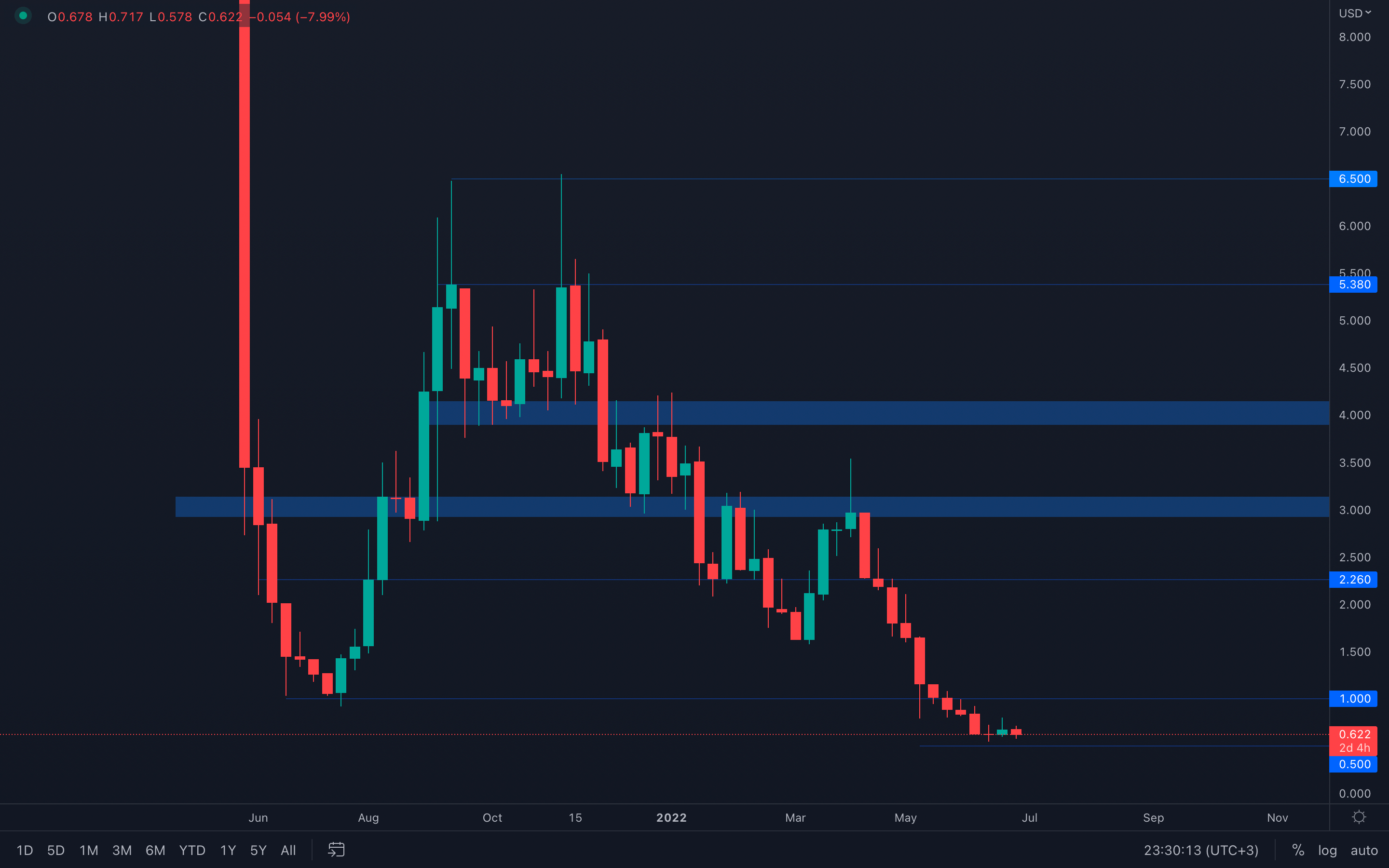

SRM

SRM is starting to descend slowly, steadily, with $0.74 acting as a threshold between upside movement or the start of an all-time low chain. Based purely on how we believe Bitcoin can perform this month, given that it is, after all, above a really solid support area, SRM might not choose the all-time low path, but rather rise and test its resistance levels.

SRM is starting to descend slowly, steadily, with $0.74 acting as a threshold between upside movement or the start of an all-time low chain. Based purely on how we believe Bitcoin can perform this month, given that it is, after all, above a really solid support area, SRM might not choose the all-time low path, but rather rise and test its resistance levels.

FTT

FTT experienced some interesting fluctuations in June, fluctuations that could've benefited traders by a lot when compared to other altcoin's price action. On another note, FTT managed to close its previous monthly candle just above the $24 - $22 support area, which when also backed by a well-performing Bitcoin, can help us assume July might have something in store for FTT. As long as FTT doesn't register a weekly closure under $22, then the $24 - $22 support area remains in effect, protecting the price from dropping further.

FTT experienced some interesting fluctuations in June, fluctuations that could've benefited traders by a lot when compared to other altcoin's price action. On another note, FTT managed to close its previous monthly candle just above the $24 - $22 support area, which when also backed by a well-performing Bitcoin, can help us assume July might have something in store for FTT. As long as FTT doesn't register a weekly closure under $22, then the $24 - $22 support area remains in effect, protecting the price from dropping further.

MINA

(Weekly chart was used)

Indecisiveness at its peak - MINA has been steadily dropping for weeks, in a form that mirrors selling exhaustion, as the candles become thinner and smaller. There's no telling how long this can last, but at some point, MINA has to form a range, a range that will serve as a potential bottom and accumulation zone, which we'll most likely take advantage of. Any updates regarding this will always be shared with the community.

(Weekly chart was used)

Indecisiveness at its peak - MINA has been steadily dropping for weeks, in a form that mirrors selling exhaustion, as the candles become thinner and smaller. There's no telling how long this can last, but at some point, MINA has to form a range, a range that will serve as a potential bottom and accumulation zone, which we'll most likely take advantage of. Any updates regarding this will always be shared with the community.

For July, MINA might not perform in a spectacular manner, but rather continue to range between $1 and $0.5, which has yet to be tested as it acts as the closest psychological level to MINA's current price.

DYDX

(Weekly chart was used)

The similarity between MINA & DYDX is definitely there, which is why the same thing can be said for dYdX - selling pressure seems to have been exhausted, as candles become much more indecisive, confusing, and small. It's best to wait until a range has been formed, where we'll have to observe all-important levels in order to identify either a breakout or a breakdown from the range.

(Weekly chart was used)

The similarity between MINA & DYDX is definitely there, which is why the same thing can be said for dYdX - selling pressure seems to have been exhausted, as candles become much more indecisive, confusing, and small. It's best to wait until a range has been formed, where we'll have to observe all-important levels in order to identify either a breakout or a breakdown from the range.

Summary

June has been quite an aggressive month for the crypto market, but we're already familiar with that at this point. With the indexes, Bitcoin, and Ether trading just above their 2017 - 2018 all-time highs, we can only assume that a change of pace might take place, and that bulls will finally have their chance to show the strength they've been unable to show for months. In other words, we should be expecting a rise this month, but not to the biggest extent - the current macro environment still remains dangerous for the crypto market and for the world's economy, so it's best to view this as nothing more than it is - a potential short-term change of pace.All in all, let's hope for a profitable July for everyone here at Cryptonary. 🥂