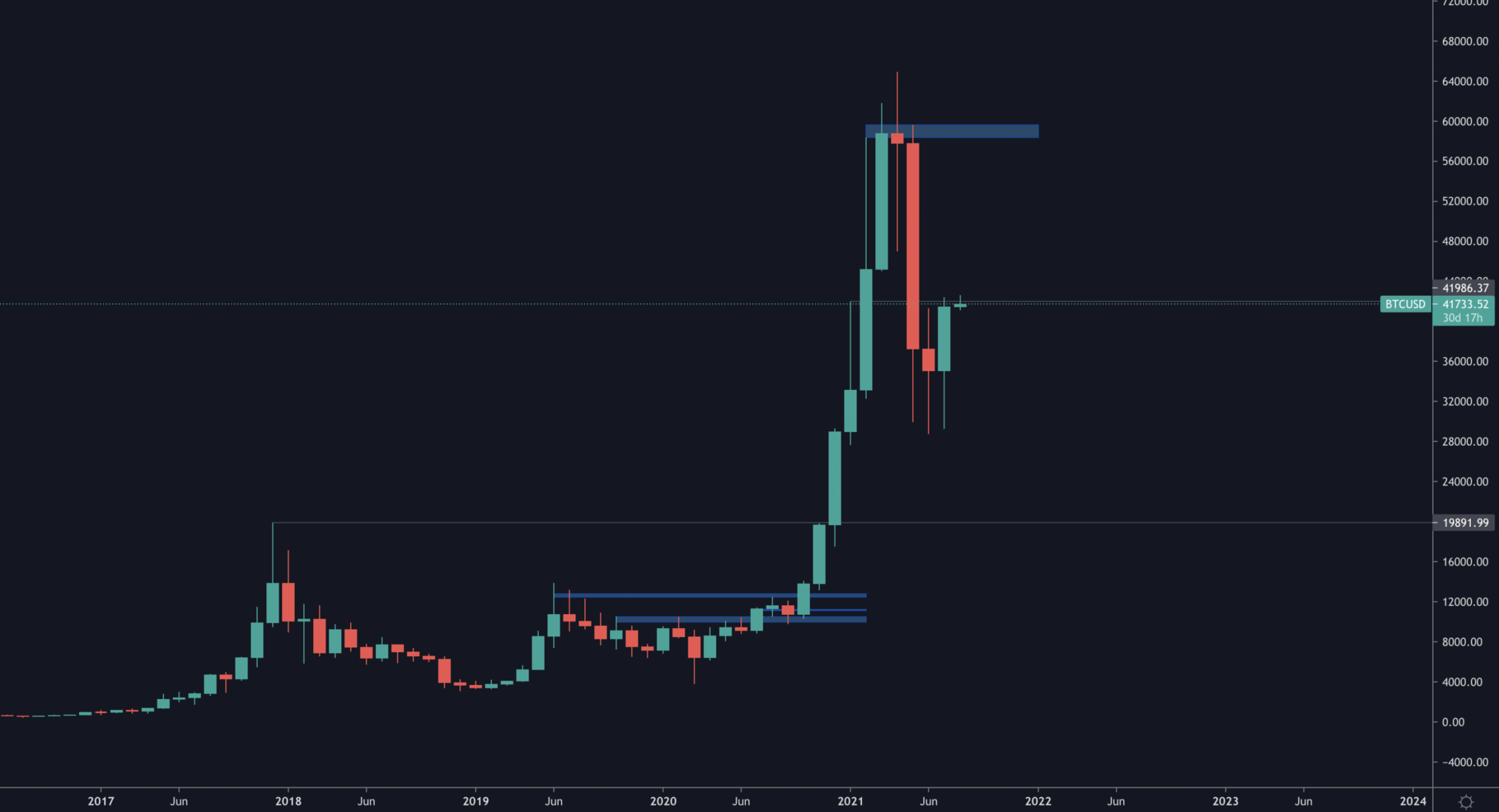

BTC

Bitcoin's monthly candle communicates demand from the $30,000 key level just like the previous two months have. The candle itself did not advance enough ground to argue that the downside caused in May would be recovered next month and will likely take a bit more time. Though we must not that the candle is a bullish engulfing candlestick which is a reversal sign.

ETH

Ether's monthly closure also communicated, for the third month in a row, strength from $1,750. Price did not close a bullish engulfing candlestick like Bitcoin but ETH has less ground to recover in terms of candle closures as a monthly closure above $2,800 would represent a new monthly closure high which can occur in August.

ETH is in a bullish monthly market structure consisting of higher highs and higher lows.

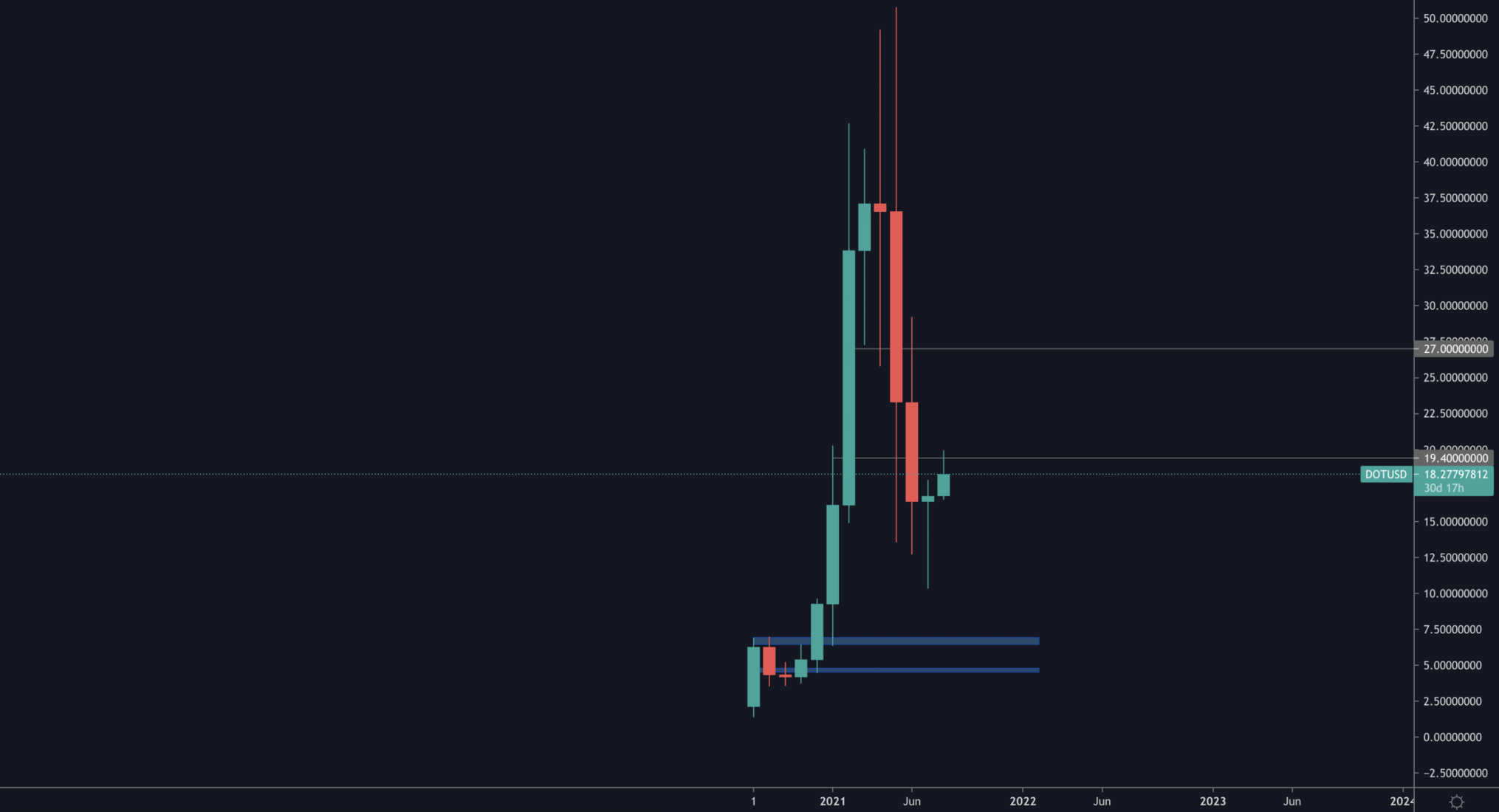

DOT

DOT also had a bullish candle closure dubbed: bullish hammer - this signaled demand from the $10 psychological level. Though that does not call for immediate recovery of prices since there are two key levels that first must be reclaimed for a possible run towards new ATH: $19.40 & $27.

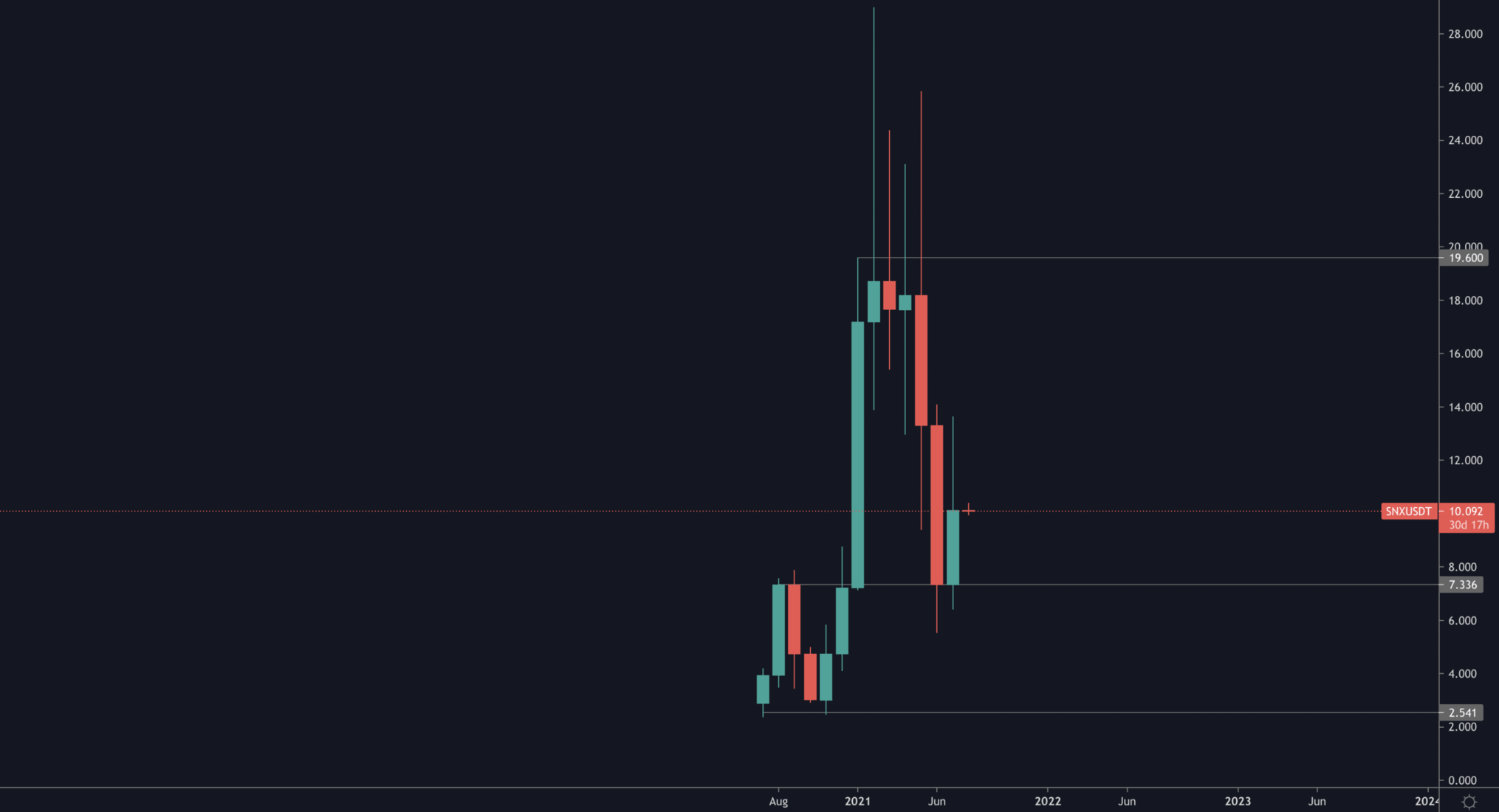

SNX

SNX has respected monthly levels and did not close a candle under $7.336 which is the DeFi summer 2020 high. We saw a significant advance over the month of July with the news about L2 implementation. Next monthly level for SNX is $19.60.

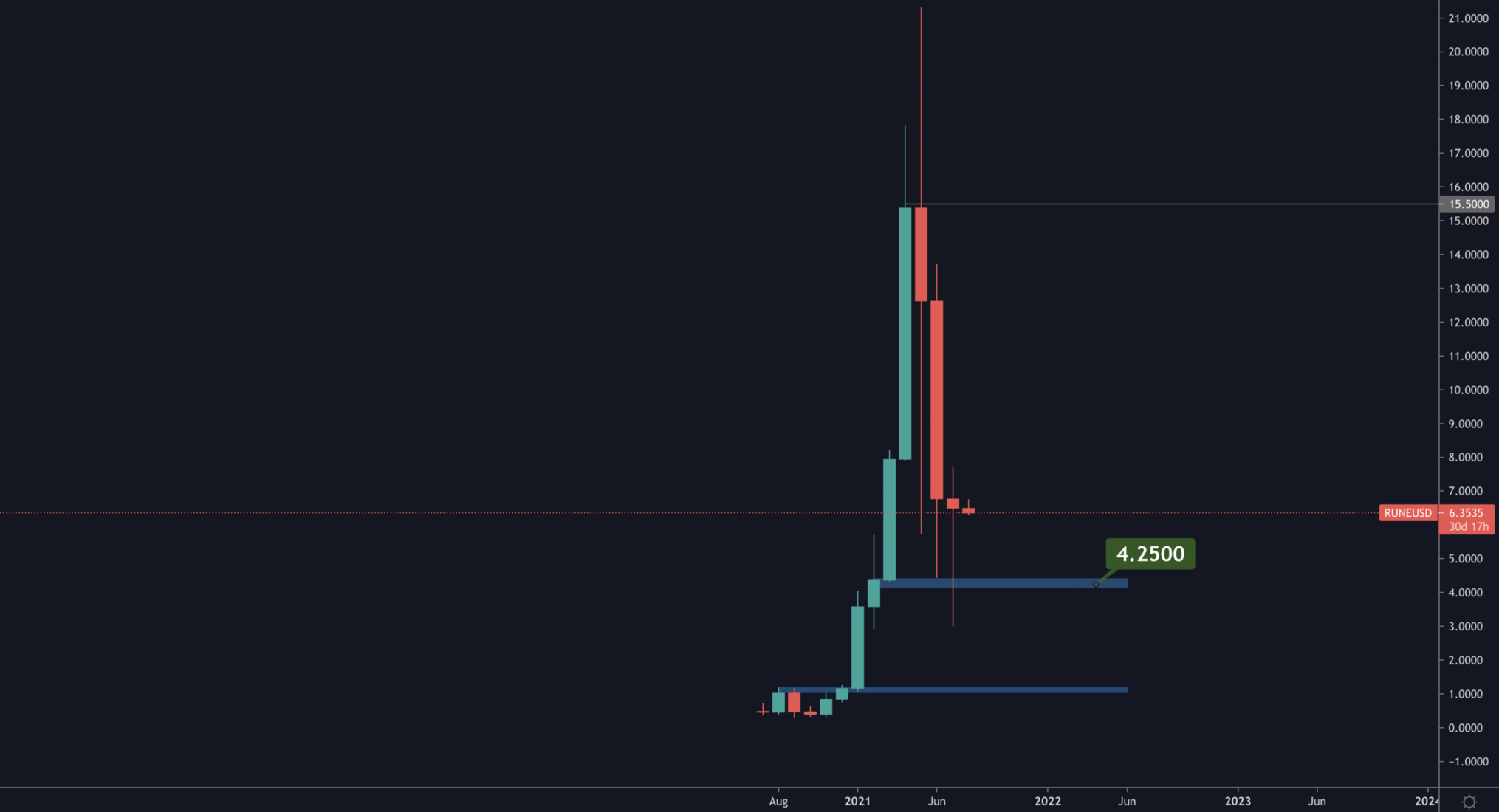

RUNE

RUNE dipped to the annotated support of $4.25 and rose higher. There was a slight dip under it caused by the attacks on the THORChain network. Similar to DOT, it has closed a bullish hammer candlestick but there's still uncertainty on this chart which will be resolved over the coming months which we speculate remain "boring" until Q4.

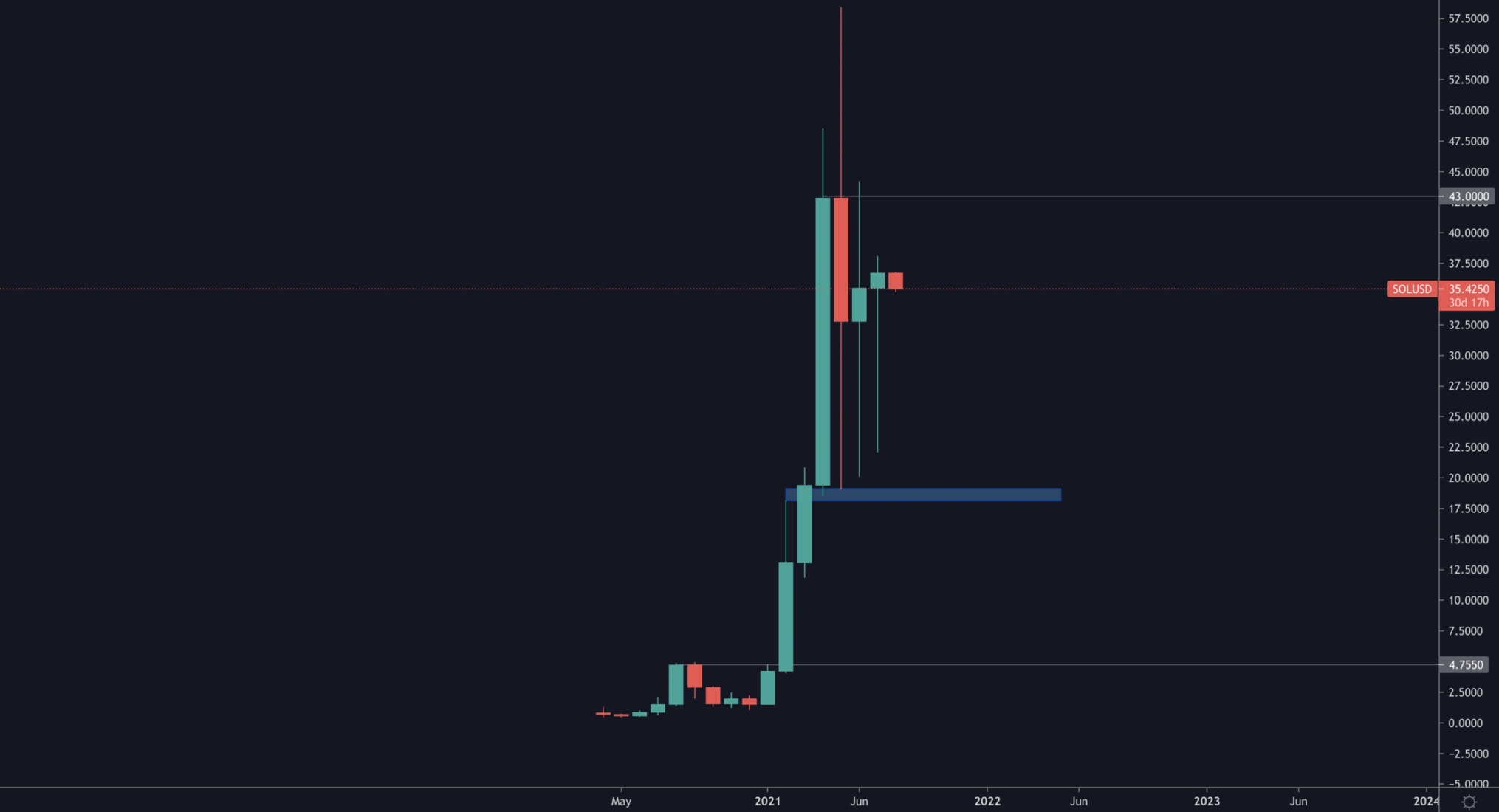

SOL

Another month and another bullish candle closure from SOL with an extreme bullish hammer. SOL is very close to $43 and may be crossing it soon relative to the remainder of the market. Should there be a candle closure above it, SOL would be geared towards fresh ATHs.

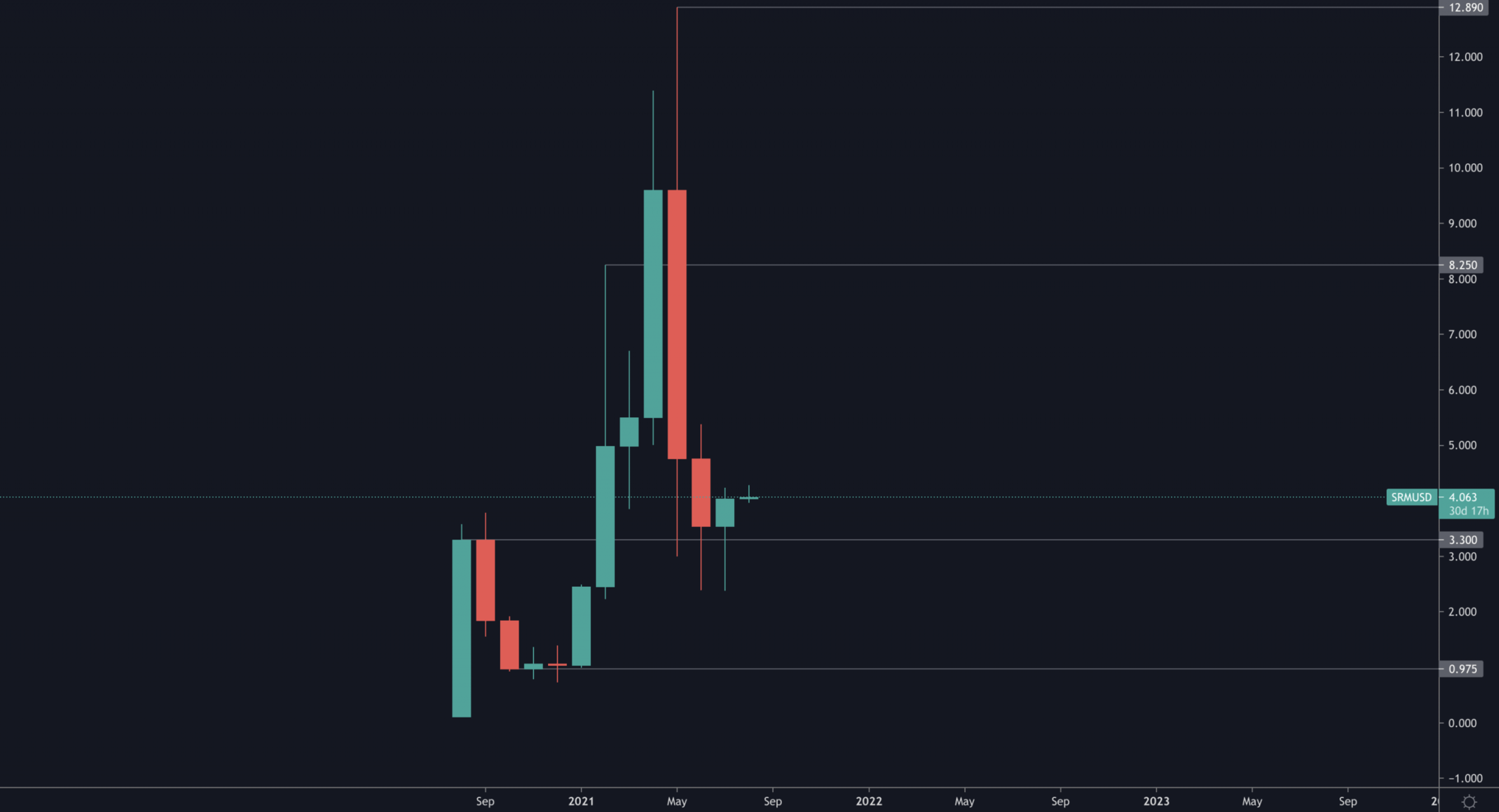

SRM

SRM respected the monthly levels just like SNX and is following a very similar pattern. A notable aspect is that we did see a daily candle closure above $3.79...finally.

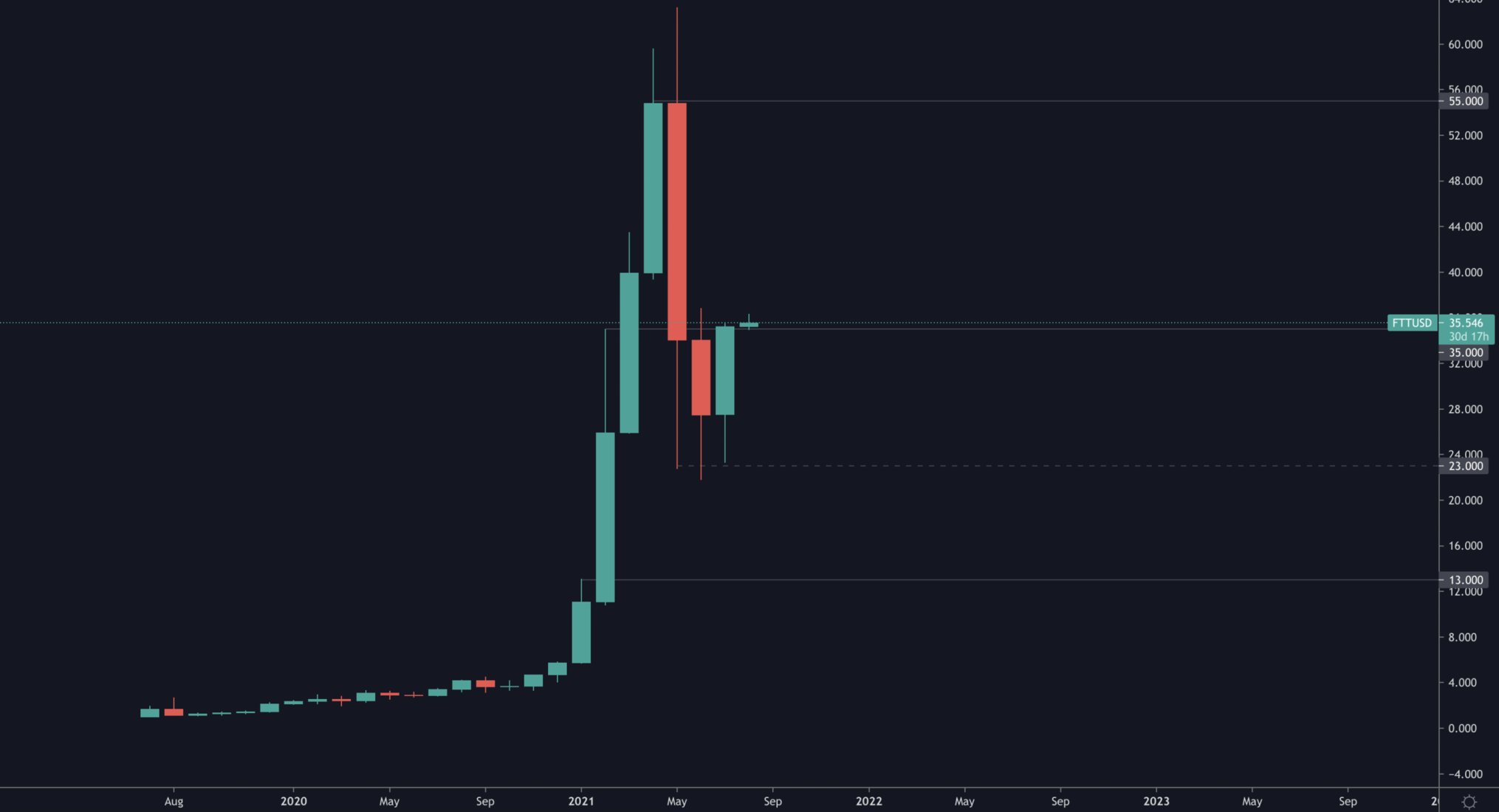

FTT

Bullish engulfing candle for the exchange that has the prime spot in the exchanges race as other competitors deal with regulatory pressures. $35 has been turned from resistance into support for this one.

Summary

The last few days have been filled with upside but we cannot make assumptions that full recoveries will be happening right away as there's a lot of indecision on most of crypto-charts.