Monthly Technicals Pro – April Fools?

With the geopolitical events going on in the world, it would be reasonable if one were thinking how on earth the markets are surviving, let alone making gains. Yet here we are. It’s another green month for the Total Market Cap as crypto continued to attract further investment throughout March. This month also saw the transition of the Total Market Cap’s bearish weekly structure confirm bullishness, lining the market up for what looks like a bullish Q2.

Disclaimer: Not financial nor investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Summary for March '22:

- Total Market Cap - +9%

- Altcoins Market Cap - +11.75%

Total Market Cap

Bitcoin

Bitcoin not only managed to maintain $40,000 as support but made a further positive appreciation in price. The beginning of March saw the most volatility, with Bitcoin at one point closing a daily candle almost 8% down. Since then, it was a slow and steady grind up, closing the month out close to five and a half percent up. This lack of volatility in Bitcoin gave many altcoins the breathing space they so desperately needed to outperform Bitcoin, closing their market cap 12% up.

Ether

Ether outperformed Bitcoin, seeing over 12% gains for the month of March. The ETHBTC and BTC Dominance charts suggest that this is not over and will continue for the foreseeable future. The bullishness in ETH is clear to see just by comparing today's gains to that of BTC.

DOT

SNX

Now this one looks good! A monthly bullish engulfing candle is often a reliable sign that a bottom has been set, especially when supported by an impressive volume, such as March's candle.

RUNE

So, the performer of the month has to go to the THORChain ecosystem. The highest gains RUNE has seen since Jan 2021. Both RUNE and THOR made impressive returns driven by more favourable market conditions and fundamentals. RUNE’s price increased by a huge 186%, and THOR’s was over 315%!!! It’s certainly worth keeping up-to-date with the developments on THORChain over the coming months as they embark on the road to mainnet and beyond.

SOL

SOL closed last month bullish, and we'll likely continue to see further upside in April. With the daily candles now seeing an increase in volume, coinciding with green candles, it is looking likely that we'll see $150 pretty soon (taken from the daily chart).

SRM

SRM has closed below the monthly resistance ($3.30), but it looks like it's at a turning point. Since revisiting the lows below $2 in the middle of March, the move up has been supported with impressive volume, where it was almost non-existent before. But that is what you want to see when price action turns a corner. Volume decreasing as the price moves down shows decreasing support/sell pressure for the bearish move, eventually giving way to a shift in momentum, as we now see happening here.

FTT

Monthly higher highs and higher lows. Need we say more? FTT performed reasonably well when the market corrected, holding up whenever the market experienced volatility. Its price has appreciated steadily over the past few months, with the weekly structure also showing bullishness. Volume hasn't been plentiful. However, if it attempts to break $60, we'd look for (and expect to see) it increase, supporting a breakout. The $60 level is key for FTT. Reclaim that, and ATHs would be on the horizon.

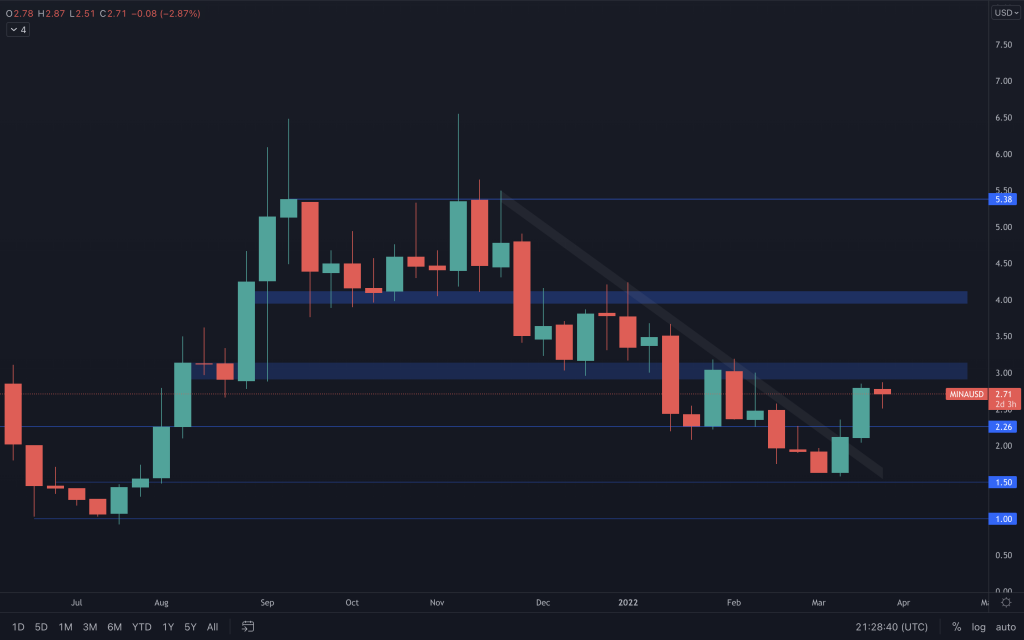

MINA

The weekly chart is used here, but the monthly hints towards a possible higher low. We caught the breakout and retest of the counter trendline, and now we look to whether MINA can sustain this move. The next hurdle in MINA's way is reclaiming $3.15 to begin to alter the weekly structure. There's no indication to suggest that it can't, as the volume remains consistently higher than average.

dYdX

The weekly chart is used here.

On the daily chart, we mentioned that the RSI was showing a bullish divergence from the low $4s, and this is the result, price tapping $7. The last two monthly candles are dojis, which, whilst they have slowed dYdX's price depreciation, do indicate indecision. On the flip side, the weekly candles look good as they also have increasing volume accompanying them. If anyone did trade this, taking some profits at each 1$ increment until it sees a change in the bearish weekly structure wouldn't be a bad idea. For hodlers, it looks like those $3-$5 range buys were sweet!