BTC

Bitcoin faced heavy resistance from $40,000 which is the upper-bound of the range. We must state that this price action remains range-bound in [$30,000-$40,000] with no changes thus far. Given the strength of the bounce off the bottom and that the funding rate remains negative, it seems likely that BTC reclaims $40,000 from resistance into support. This doesn't mean it will happen today but rather over the next few days/weeks - timing the market is not an accurate endeavour.

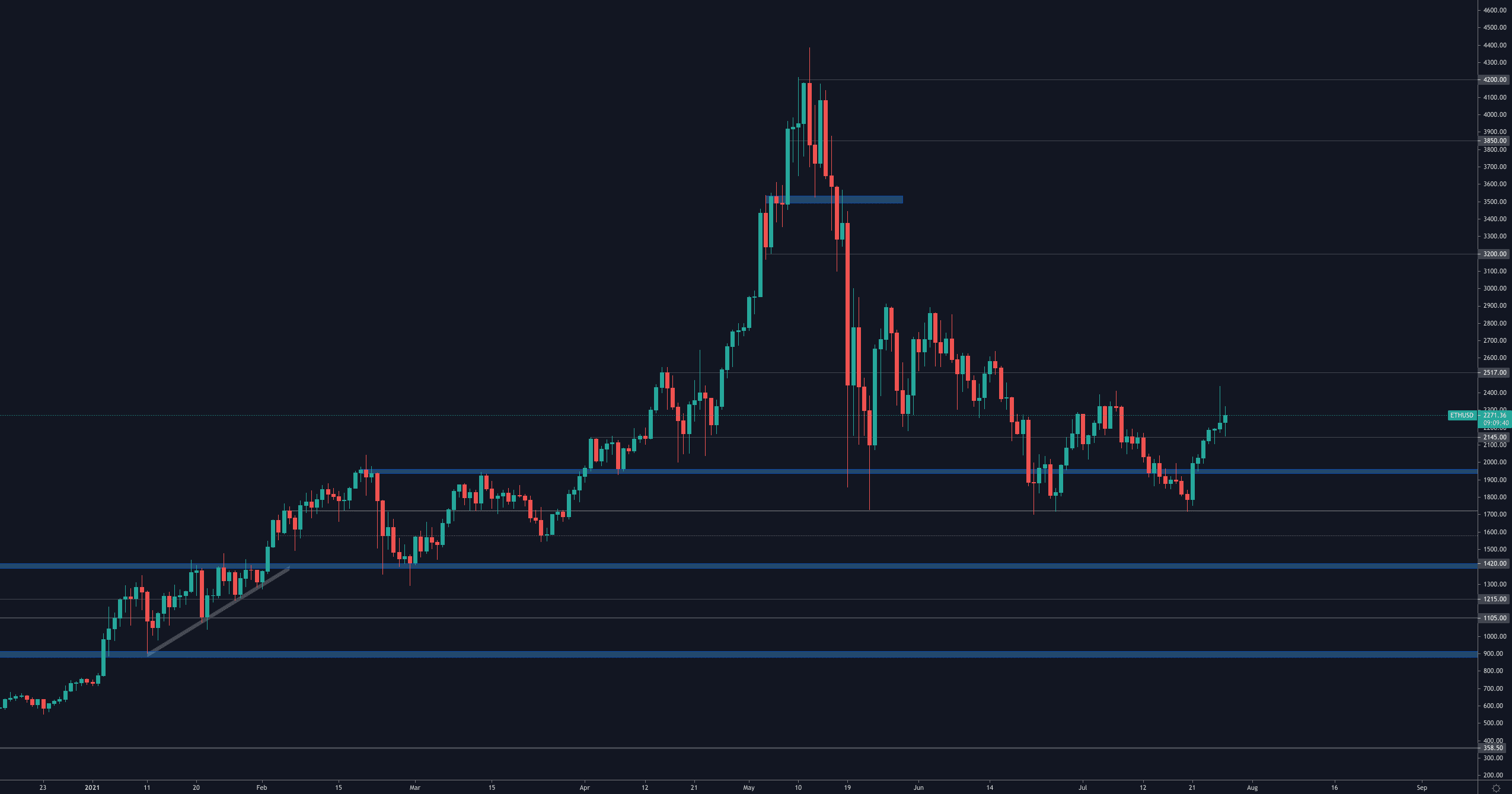

ETH

When Bitcoin rejected the $40,000 resistance, the entire market took a hit and resulted in very large upside wicks on the majority of the coins/tokens. Ether was no exception, nonetheless price remains above the $2,150 level of support which maintains the same "next target" of $2,500.

DOT

DOT has not yet reclaimed $15 but we did close our hedge yesterday given the market-wide advance at breakeven. Purely based on DOT, it is still in a bearish market structure with a likely bearish outcome but this market responds to Bitcoin and if it breaks out then so will altcoins.

SNX

SNX has rallied towards the ~$11 liquidity area with a timed rejection with bitcoin. As of this moment, SNX is in mid-air and no good R:R can be derived from any trade unless it heads back towards support ($7.50) or resistance ($11).

RUNE

State of indecision in the [$3-$4] range. Once more clarity arises about the network, RUNE would breakout.

SOL

SOL, just like all altcoins and unlike the two majors, is showing weakness on the chart as the recovery is being led by BTC and ETH. Currently, price is playing around the $28.50 key level with no clear decision on whether it'll use it as support or resistance. This is an indecisive moment for SOL.

SRM

Irrelevant in a high-risk zone unless price reclaims $3.79.

FTT

FTT's rally towards $35 was limited by bitcoin's rejection of $40,000 but the road and target remains the same despite the detour.

MINA

MINA's reclaim of $1.03 is pushing it towards a test of $2.