Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

We're seeing the rippling effect across the market of the announcement of a military operation in Ukraine. It goes without saying that at times like this that the market will see increased volatility. We'd also like to mention that we're not looking to trade the assets that we hold in our portfolio. These are assets where we have invested in the fundamentals and plan on holding long term unless their fundamentals were to change. If we believed that the fair value of the whole of the crypto market was worth the same as/less than 1 company, then maybe. But, we don't, and so our long term vision remains unchanged.

Market Sentiment

We've not seen too much indication of market bias from the Funding Rate or Open Interest. The Funding Rate remains somewhat neutral as it flips back and forth between positive and negative. Still, it does not go to any extremes, which reflects somewhat neutrality amongst market participants on the market's next move. The Open Interest continues to move sideways within a set range, reinforcing the neutrality mentioned above. It is very much complimenting the movements of BTC rather than showing a bias. What is fair to assume when looking at the Funding Rate and Open Interest together is that we are seeing a closure of long positions as price revisited $45,000, but again, not to any extremes as they have moved organically.

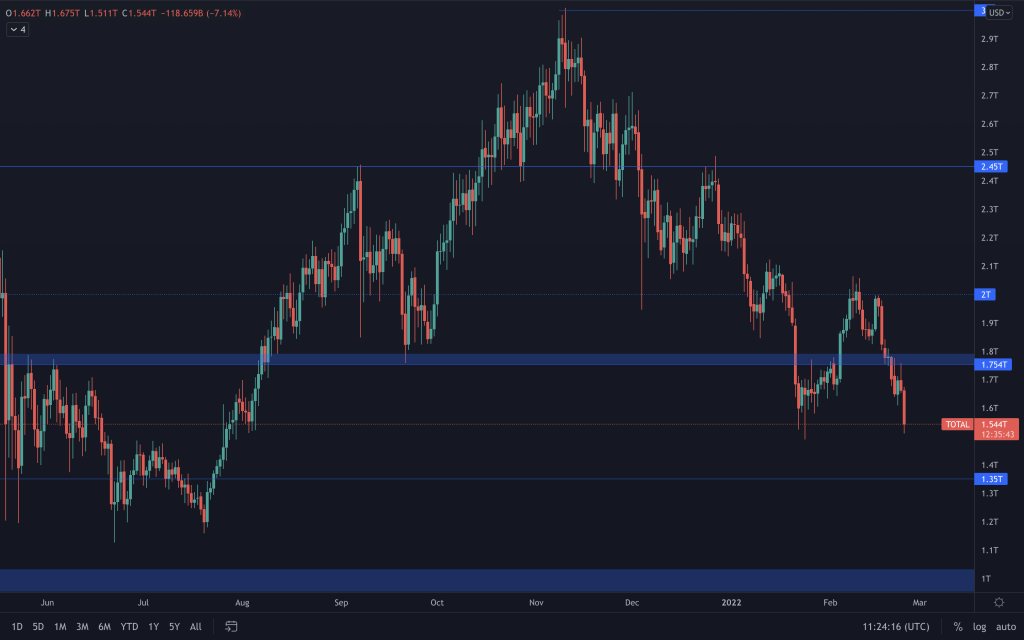

Total Market Cap

At this time, the Total Market Cap continues to remain bearish and make lower-lows and lower-highs on all timeframes. We were observing the potential of a lower timeframe change (8H) yesterday, which should have offered some relief, as the Total Market Cap advanced towards $1,75T, but it failed to 'cross the line' and alter its structure. At the same time that we saw this run at $1.75T occur, the US announced that an 'attack on Ukraine' was imminent and the FED stated that there may be more than 4 rate hikes needed, causing the market to react negatively across the board once again. Of course, there has since been an announcement of an active 'military operation' in Ukraine, which many believed would not happen. So it's fair to assume that this will be priced in and the market, for now, reacting, to some extent, according to developments on what has been mentioned above. With this, should this index head towards the bottom of the range, we look towards key levels being respected. The Total Market Cap remains between $1.35T and $1.75T, and it remains the case that we believe $1.35T to be a high-value area which, should the index head there, offer, at least, some relief to the market.

Bitcoin

Bitcoin's daily structure remains bearish and we continue to look out for indications of a change to that structure and for BTC to reclaim $40,000. It is only at this point, should it happen, that we would consider taking a swing long position with a target of $53,000. Why $40,000 and why long? Well, the weekly timeframe still has the higher-high in play and it has yet to be invalidated, regardless of what is going on outside of the market. Creating a higher-low and reclaiming a key level would show strength and have a higher probability of success than going short without a confirmed weekly bearish structure in place. Had this high not have occurred, we would have entertained going short with a target of around $30,000. We accept that there's the possibility of the above not coming to fruition, for nothing is certain in the financial market. It could simply be invalidated, especially given the geopolitical events going on and it's something that we would accept as we look for the next opportunity.

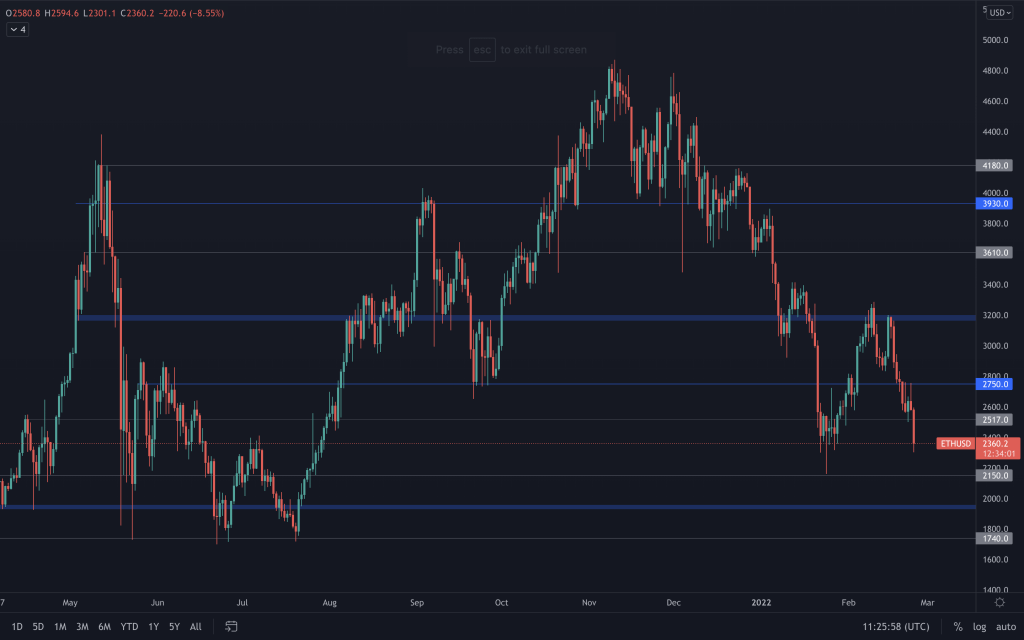

Ether

Ether remains bearish across all timeframes up to the monthly, and it will likely continue to do so until Bitcoin finds support/alters structure. Just like Bitcoin, ETH tested its resistance ($2,750) yesterday but failed to cross it. Had it done that, we'd have seen a break to the intraday bearish structure (8H), likely offering Ether some relief from the downside pressure. This didn't happen and ETH remains under $$2,750, keeping the possibility of a $2,000 ETH on the table.

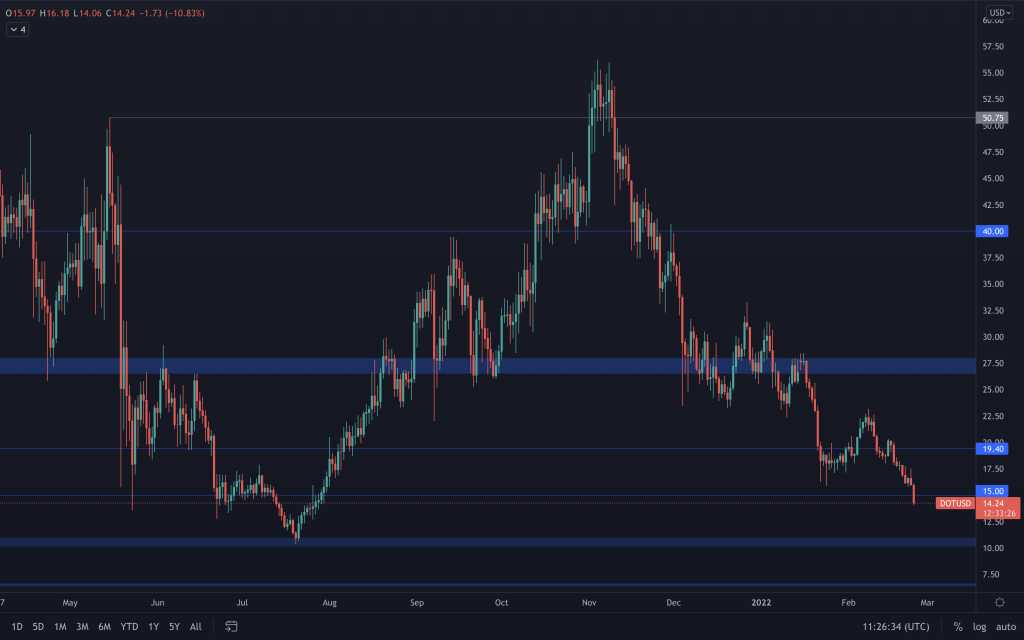

DOT

DOT remains in its bearish structure. Although DOT has yet to close a daily candle below $15, a loss of this level would make a $10 DOT very likely. We would expect to see some relief around the $10 level should it get there as it's a more established level of support (and a psychological level).

SNX

We're currently seeing SNX trading under $3.60. Should we see this support level lost by a daily closure, it is fair to expect the price to head towards $2.50 relatively quickly.

RUNE

RUNE is currently at a level that it has historically seen liquidity sourced from, so we wait to see if that is the case again. A close below $3 would not look great for RUNE and, on the weekly timeframe, makes even $1 a possibility. Of course, only if it loses $3, we'd monitor RUNE on the daily timeframe for potential signs of strength (as there are established daily supports).

SOL

SOL has finally tested support at $75 but, for now, it remains within the $75-$125 range. Should it lose this level then there's a risk that makes a $50 SOL a possibility, especially given the loss of support on SOLBTC.

SRM

SRM was unable to reclaim $2 which, as mentioned in yesterday's analysis, downside was the more likely outcome. SRM has $1.40 as support and $2 as resistance.

FTT

With the inability to reclaim the intermediate level at $43.50, what we mentioned yesterday for FTT also seems to be playing out, as FTT has headed back towards the lower end of its range. It still remains within the $35-$50 range and should it lose $35 as support, it would bring $22.50 into play.

MINA

MINA's bearish structure remains intact as we now see it trading below $2.10. Should this level be lost, it does have support at $1.40, but it would be fairer to expect to see MINA eventually trading close to $1.

dYdX

dYdX's downtrend continues. We're now within our area of interest where members of the team have started to accumulate dYdX by means of DCA.