Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

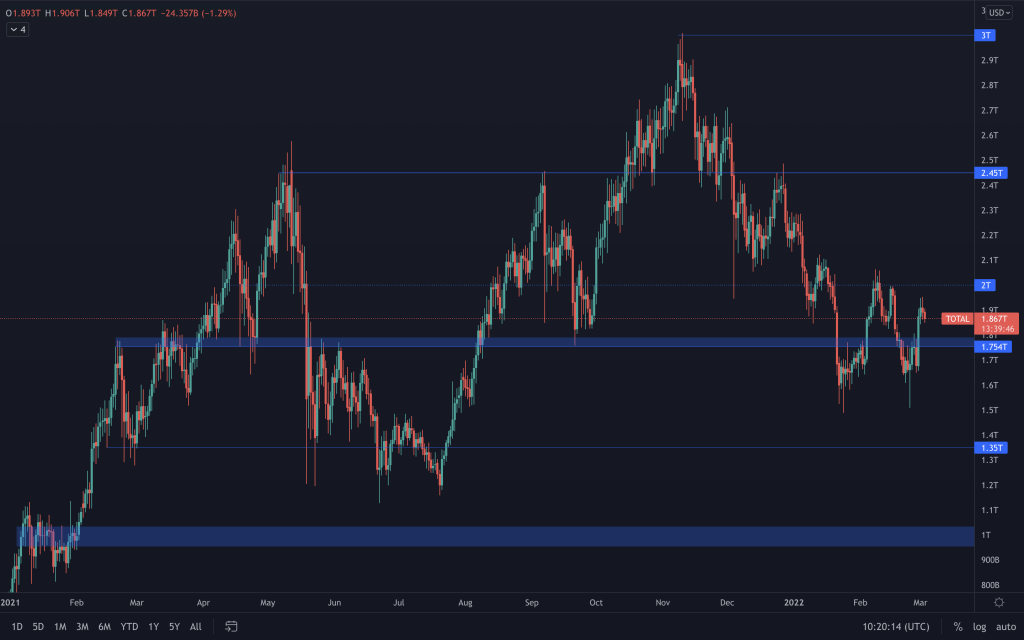

Total Market Cap

This week the Total Market Cap saw its largest daily gain since September, reclaiming $1.75T in the process. It's important to note that the bearish structure remains intact, and to alter that at this moment in time, the Total Market Cap would need to reclaim $2T.

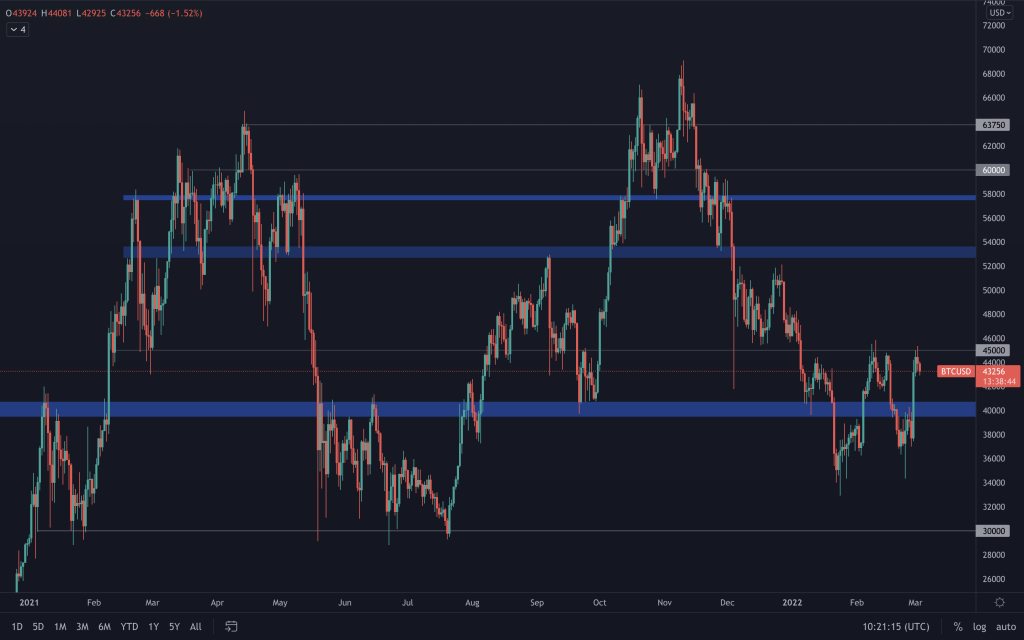

Bitcoin

To recap, BTC has begun to alter its bearish structure by printing a higher high. We look towards that being confirmed by Bitcoin closing this week green (a higher low). $45,000 is proving to be an obstacle once again, and breaking above that would open the door back up to $53,000 and possibly even higher.

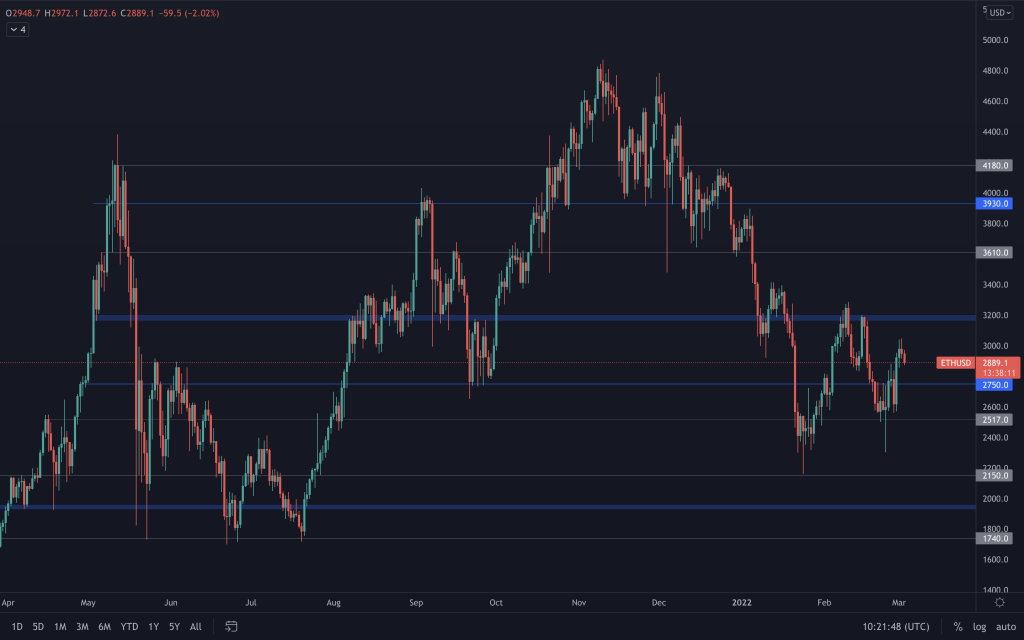

Ether

ETH is one step behind Bitcoin, where, as no higher high was created, its bearish structure remains intact on the weekly timeframe. So we're looking to whether it can create a higher low to begin to alter that.

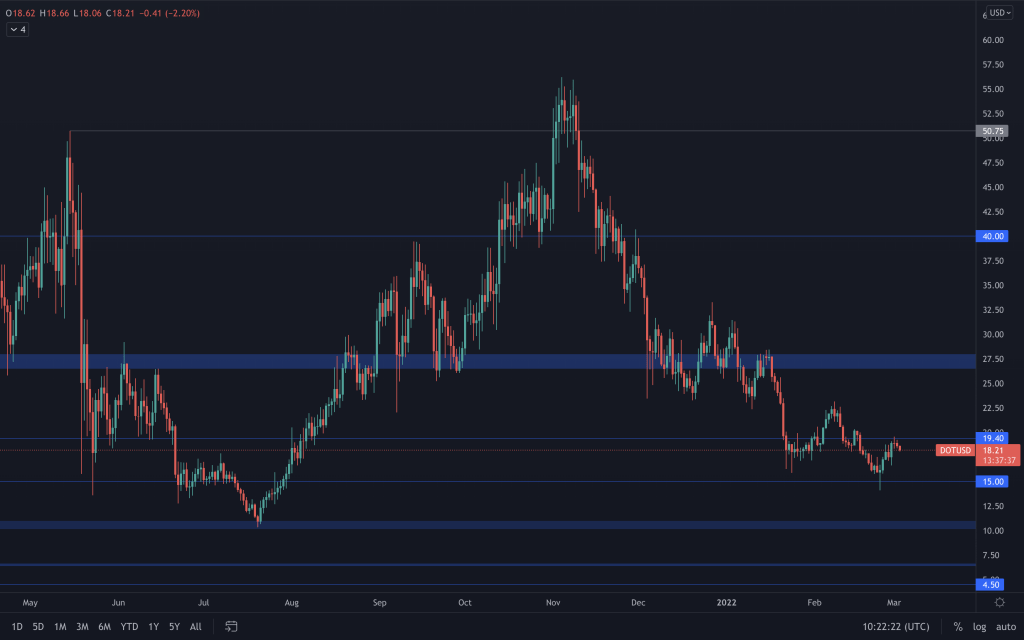

DOT

DOT's downtrend is still intact, and all we see at the moment is price retesting resistance at $19.40. $15 is currently support and, until we see a structure change/sign of strength, $10 is its support below that.

SNX

Three days ago, SNX printed a bullish daily engulfing candle but had failed to capitalise on it. It has found support at $3.60, but it's not a level that we would consider trading from at this moment in time, given the number of tests that it's seen.

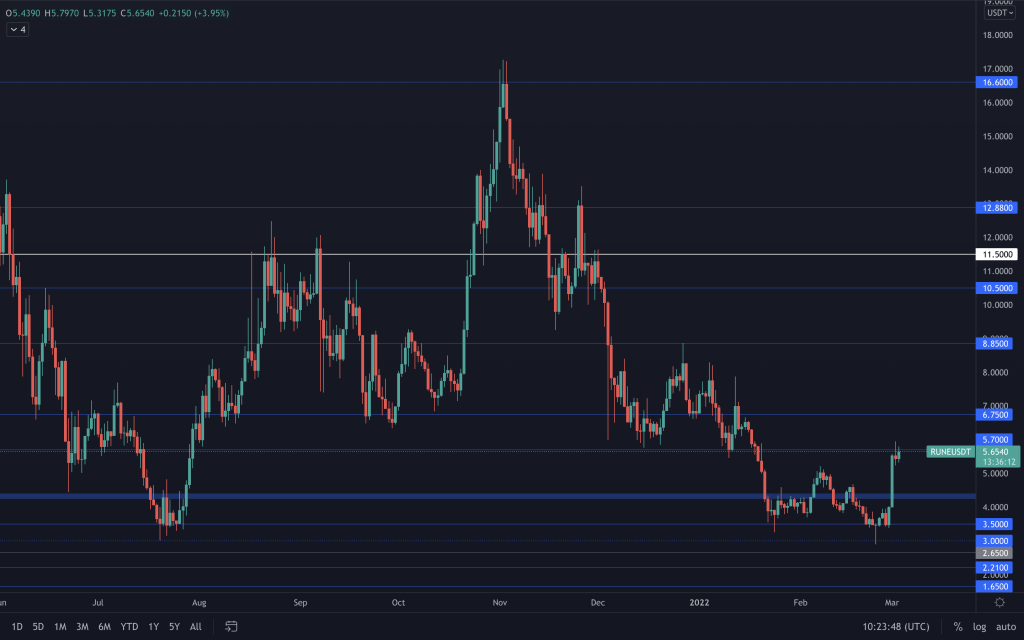

RUNE

$3 was tested and served as a good source of liquidity once again. Any close below that wouldn't have looked good. $6 remains an important level that we really want to see it reclaim. But it is positive to see that RUNE could very well be beginning to break its bearish structure here.

SOL

SOL also saw a good move to complement Bitcoin's gains on Feb 28th. This has brought it up to the psychological $100 level, meeting resistance once more. Its bearish structure remains intact, and the safest bet at this time remains to see a reclaim of $125.

SRM

Even with a slight change in daily market structure (HL) and reclaim of $2 by a bullish engulfing candle, SRM still has a fair bit to go to alter its market structure. The safest play is waiting for a weekly reclaim of $3.

FTT

FTT remains within the $35-$50 range. It did close back above the intermediate pivot level, positioned at $43.50 with a daily bullish engulfing, and it looks like it may be coming back to retest it as support. As long as this level holds, we may well be seeing a move back up to $50.

MINA

MINA continues to move downwards. Although we have seen it reclaim $2.10 with a bullish candle, the downtrend remains pretty much intact on all timeframes, making it risky to trade until $3 is reclaimed.

dYdX

dYdX's downtrend continues, but with no historical price action around these levels, it is slightly different to MINA. We've seen two bullish engulfing daily candles from the $5 level, which could indicate a short term bottom that could well see its price move back towards $7.50 once again.