Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Video Analysis

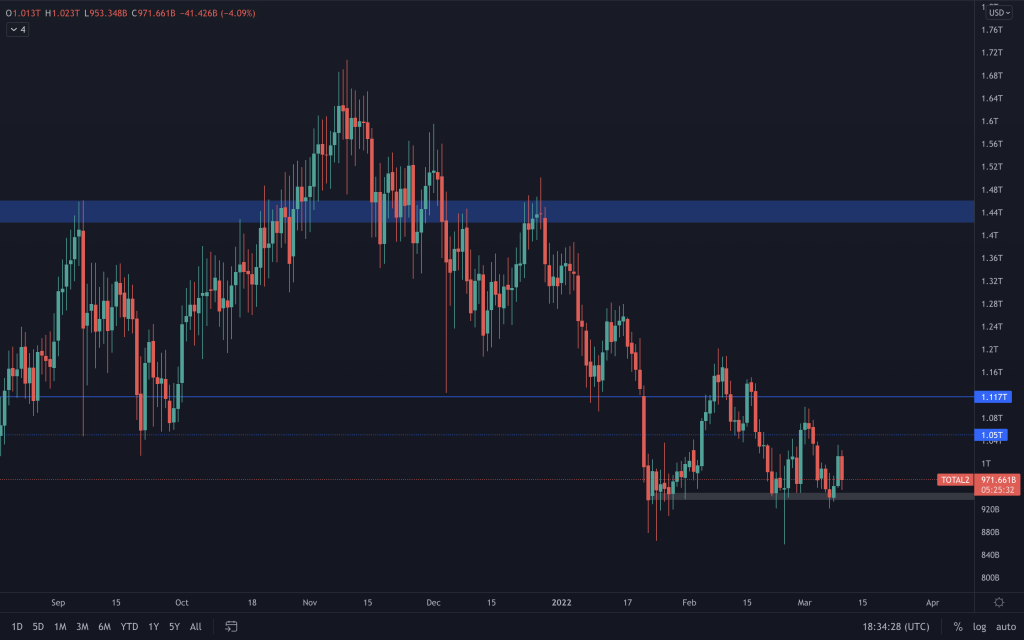

Total Market Cap

Market volatility is evident across the market as there’s a concentration of multiple fundamental events ongoing that can instantly impact the market. What is visible on the daily timeframe is that the Total Market Cap has continued to produce lower highs but also higher lows. A break of this structure may signal the market’s next move.

Altcoins’ Market Cap

The altcoins market cap still hasn’t managed to make any headway with reclaiming $1.117T. It is supported by $940B on the daily timeframe but continues to make lower highs, pushing the index down. We’re looking for a break above $1.117T to alter its structure, or a loss of $940 to then continue down.

Bitcoin

At this moment in time, Bitcoin has given up most of the gains made yesterday. There are still 5 hours left in the day, though. Whilst the higher lows remain intact, our eyes are on a break above $45,000 for higher odds of upside. It’s interesting seeing how the $45,000 level has become increasingly significant as time has gone on. Obviously, any break of the higher lows could lead us to further downside. The first area of interest for a downside move would be around $35,000, with any break below bringing $30,000 into play.

Ether

Ether failed to close above $2,750 yesterday, immediately moving down towards support today. A break below $2,500 would open the door to the low $2,000s. Its structure is more bearish than that of Bitcoin, so it has a little more work to do. One thing to note is that the ETHBTC chart is now at support, so, unless that level is lost, we should begin to see Ether outperform Bitcoin.

DOT

There’s also not a lot going on for DOT as it trades in the middle of 2 levels. The bearish daily structure would only be broken should it close above $19.40. Until then, bearish structure intact.

SNX

SNX is currently retesting broken resistance, turned support at $4.45. Holding this level as support by the daily close, given the upside momentum, may help it to push up towards $5.50.

RUNE

The recent positive move that we’ve seen on RUNE can be attributed to the recent dev. announcements regarding THORChain. The introduction of synths and LUNA bring even more liquidity to the network. We have a confirmed change in the daily structure from bearish to bullish. Our eyes are now on RUNE closing a week out above $6.

SOL

SOL’s bearish structure continues as it moves down through its range. It does have $75 as support, so to avoid further downside this level would need to hold. SOL also looks very bearish in its BTC and ETH pairings, so, at the very least, we’d expect both ETH and BTC to outperform SOL in the short/medium term.

SRM

SRM’s continuing its move down towards $1.40. All timeframes and pairings continue to be bearish.

FTT

Another perfect touch and rejection of the intermediate resistance, keeping it in the lower half of the $35-$50 range. Another weekly close below $43.50 should see FTT revisit the bottom of the range once more.

MINA

MINA is still looking relatively weak at the moment and we’re still expecting to see it heading down towards $1.50, possibly even $1.

dYdX

With its bearish structure still intact, even though it's slowed down, the downward movement continues within our region of interest ($3-$5). We will continue to look for signs of bullishness.