Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Video Analysis

Market Sentiment

What we can take away from the above chart is that Open Interest is outperforming the price appreciation. This tells us that there's increasing confidence in the market by market participants.

Total Market Cap

With the announcement of a 25 basis point increase by the US Federal Reserve, the Total Market Cap has broken above resistance once again. The market had likely factored in an expected 50 basis point rise, but the FED took a less hawkish approach. With the market cap above $1.75T, we're looking for it to hold and eventually push up towards $2T.

Bitcoin

Reclaiming $40,000 brings BTC back into the $40,000-$45,000 range. Waiting for either a break of structure and longing a retest of support or a break above $45k with targets of $53k and $57.5k.

Ether

As we expected, ETH is continuing to outperform BTC for the time being. It has reclaimed $2,750 and, to couple its higher low, ETH has now created a daily higher high. From here, the odds favour a move up to $3,000 (psychological) and $3,200.

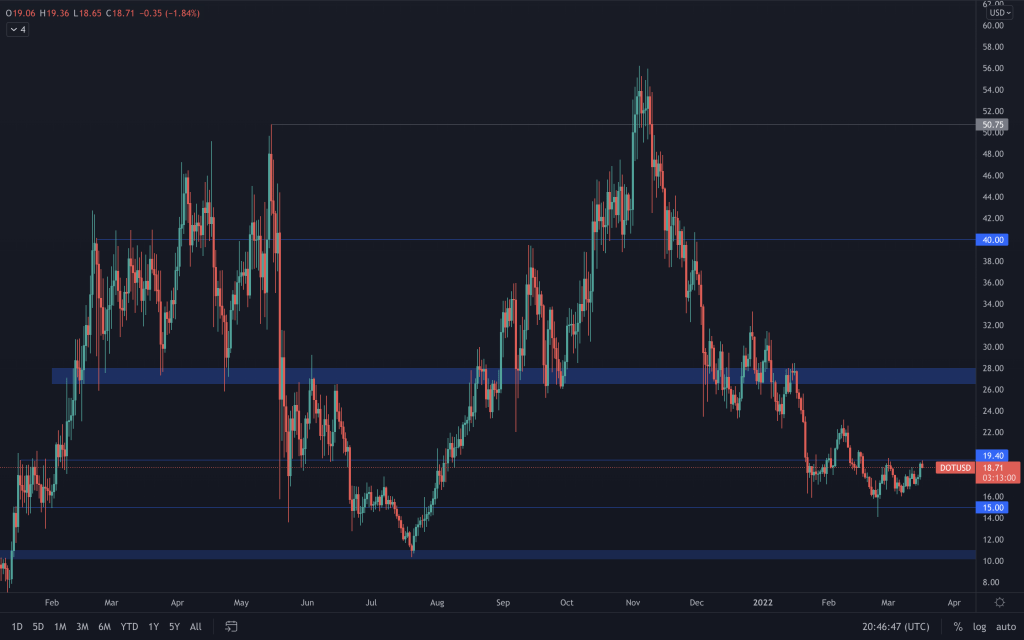

DOT

DOT has edged up through its range but is yet to trade over $19.40, only rejecting it today. Should it get that daily close above $19.40, we could then see DOT pushing up towards $27.

SNX

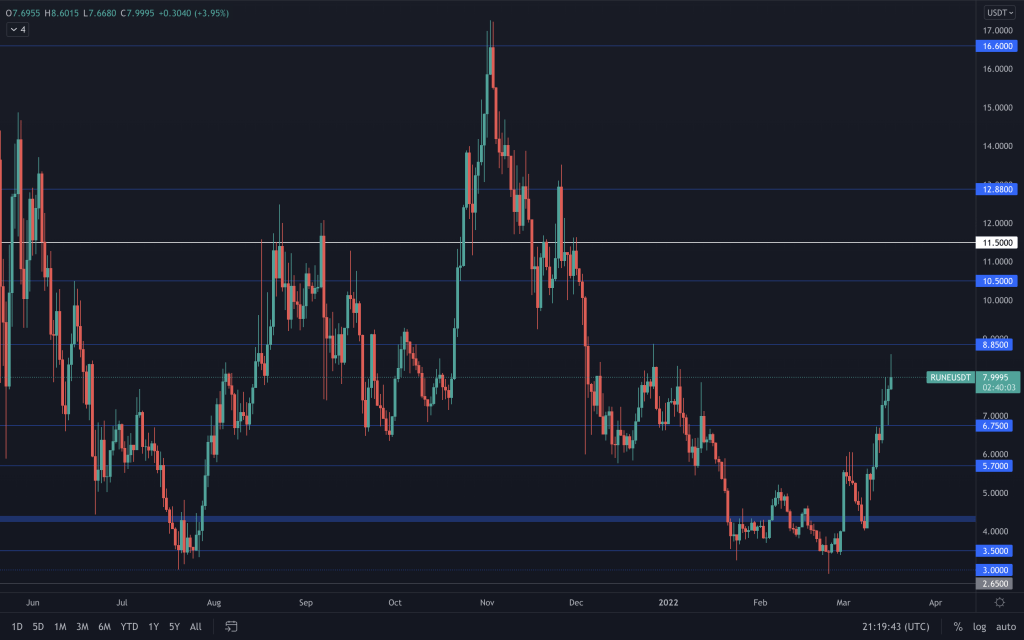

RUNE

As we'd mentioned this morning, RUNE and RUNE/BTC were coming up to their resistance (in fact, the RUNE/ETH chart too). With the majors being relatively stable today, we see the price appreciation slow as all of the charts approach their respective resistances.

SOL

SOL continues to inch up on low volume from the lower end of its $75-$125 range.

SRM

SRM is gradually appreciating along with the rest of the market, moving towards $2. For now, though, it does remain in a bearish structure.

FTT

FTT remains in the $35-$50 range, with $43.50 as an intermediate pivot level. We're still waiting for a breakout from the range.

MINA

MINA's pump can be attributed to the announcement that it has raised $92M from FTX Ventures and Three Arrows Capital to aid the ecosystem's growth. Whilst this is positive news, and we're seeing the largest volume since the end of November, we'll have to see how this develops as it remains below $2.10 and in an unbroken downtrend.

dYdX

dYdX's is still in our $3-$5 region of interest, where the team are gaining further exposure over and above the airdrop through DCA.