Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Video Analysis

To look at intraday charts for THOR, you can visit Hoo.com To look at SHDW charts, you can visit Raydium, Aldrin and others.

Market Sentiment

Last week, when Bitcoin was under $41,000, we mentioned that the Open Interest outperformed Bitcoin's price appreciation, suggesting that confidence was returning to the market. Today, the price is $44,000, and the Open Interest has continued to increase, so much so that it's back in all-time-high territory. The Funding Rate has turned slightly negative once again, highlighting that more short positions are being opened than long as the price approaches $45,000 once more. It's reasonable to expect an increase in short positions, as $45,000 has proven to be a worthy resistance of late.

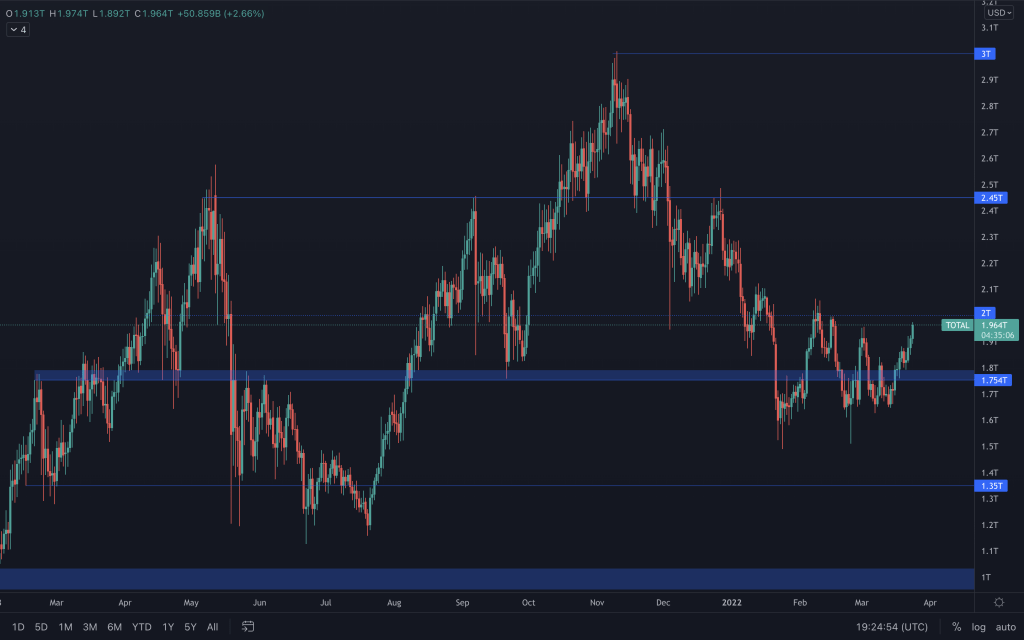

Total Market Cap

The Total Market Cap continues to advance towards $2T. It's a significant level because if we couple this index trading over $2T, with Bitcoin above $45,000 with two bearish-turned-bullish market structures, we would have the start of market-wide relief and, for this index, that is in the direction of $2.45T. Hold your horses. We did say if.

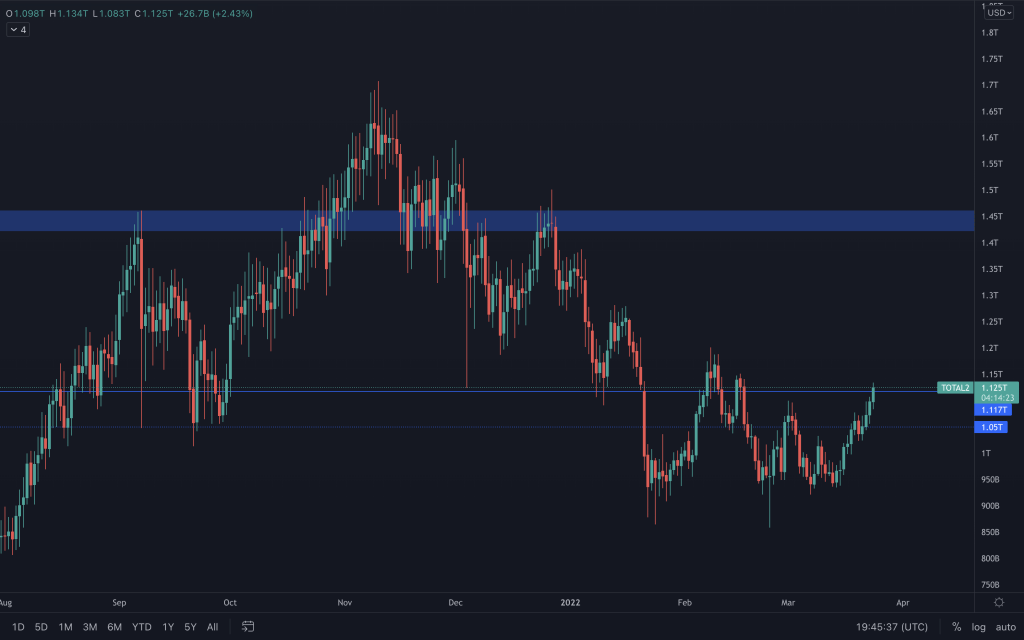

Altcoins Market Cap

The Altcoins Market Cap is also nearing a potential turning point. The daily timeframe is clearly bullish, but there are overhead resistances, and that is at $1.117T (yes, we're currently trading above it, but we need that close) and then also the previous high at $1.2T.

Bitcoin

All signs on this chart continue to point towards Bitcoin heading for $45,000 once more. Higher lows have been consistent, and that's where Bitcoin's resistance is. We saw a potential structure change back at the beginning of February, and it has yet to be invalidated. So we're just waiting to see if we get that breakout.

Ether

It's very much the same scenario across the board. For Ether, we've seen a reclaim of $2,750, an altered daily structure, and a counter trend line break. Pretty good, right? So, a slight change of plan. The ETH trade taken last week in Multi-Format Thursday (not the Alpha DAO one) was meant to be fully closed at $3,150. 20% will be kept open for a possible break above $3,200, and invalidation is by creating a new daily low.

DOT

DOT's remained bullish and continues to move nicely after breaking above $19.40. It may find resistance around $23 as this is the previous weekly lower-high, but pushing above that sets $26.50 in its sights.

SNX

SNX is currently finding resistance at $5.50. The volume continues to increase on the up moves, even though it may be slightly reduced. It's still possible for SNX to retest the broken $4.45 level (which is also the broken counter trend line) and keep its bullish structure intact. Any reclaim of $5.50 puts a potential weekly structure change on the table.

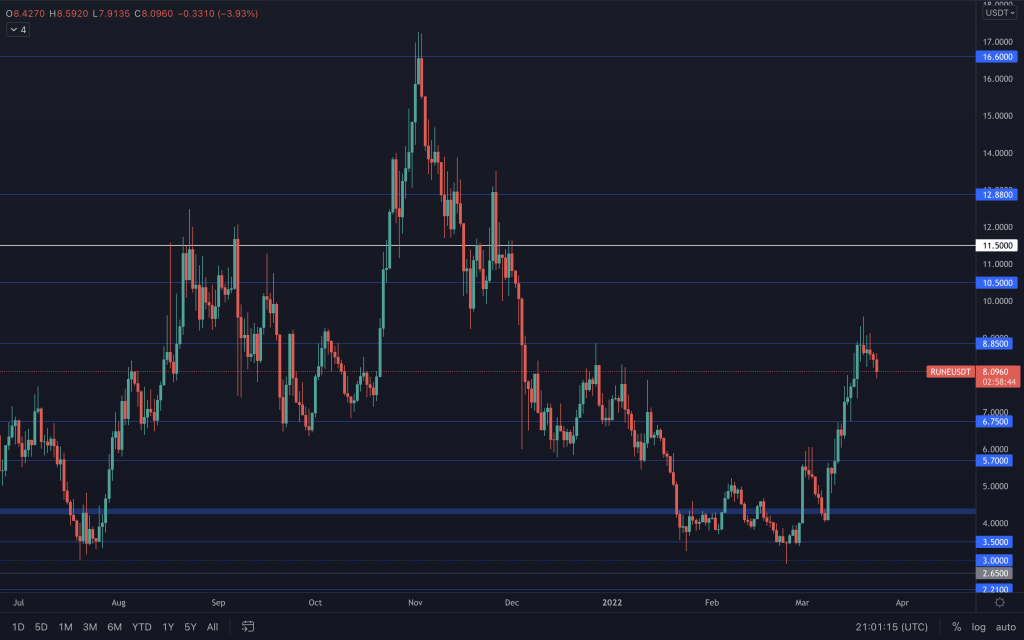

RUNE

RUNE does look impressive, but after multiple failed attempts at closing above $8.85, RUNE is now seeing a pullback of sorts. It's something that became increasingly likely as RUNE was at resistance across the three major pairings (USD, BTC & ETH) without managing to make any progress after several chances. Lower timeframes may want to be used by traders to look for possible inter-range reversal points. Otherwise, daily support comes in at $6.75.

SOL

With the bullish RSI divergence, change in daily structure, a broken counter trend-line, coupled with a retest of said counter trend-line, SOL has now bounced nicely. $120 next?

SRM

A beautiful retest of $2.43 and a bounce from there to reclaim $3 with a daily candle close, putting $3.79 up next. SRM also continues to see volume on a green day, which is what we want to see with positive price action.

FTT

$43.50 has been a reliable pivot level once again, and we're now seeing that move towards the $50 that we mentioned. We'll have to wait for any break above, but do that, and $57.50 would be next.

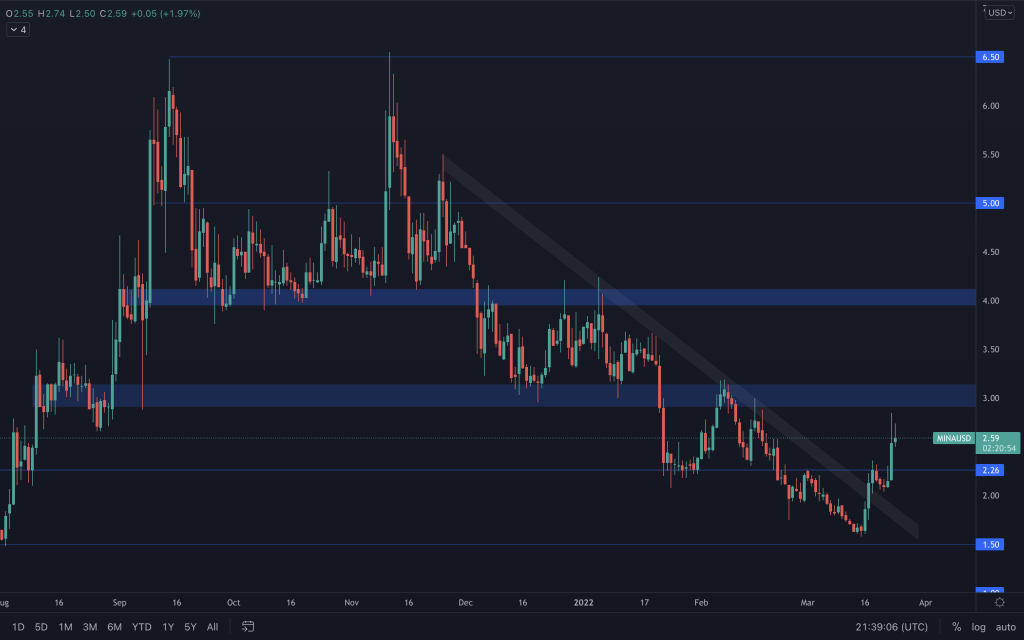

MINA

The $92m raise by Three-Arrows and FTX has brought about renewed interest in MINA that saw it, too, break its counter trend-line with volume. Since then, it has retested the counter trendline and continued to move in on $3. As we've mentioned previously, it's above the $3 resistance range that its weekly structure would begin to change.

dYdX

dYdX continues to move up, making slow and steady progress. We've decided to make our levels whole numbers as, with little historical price action, simple psychological levels will work best. So, with its subtle structure change, reclaiming $5 should mean that $6 is next, $6 to $7 etc.