Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Video Analysis

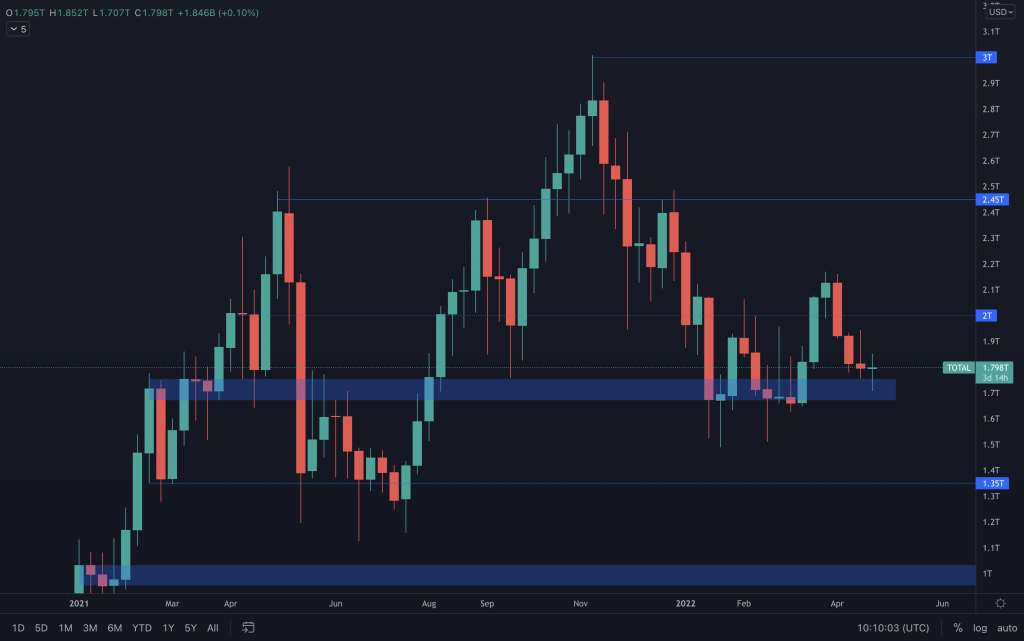

Total Market Cap

The Total Market Cap has seen a slowdown in its depreciation as it has approached support. As the market moved up over the course of last week towards $2T, the bears took back control and began selling once again. Our eyes remain focused on the lower end of the range ($1.65T) being maintained as support, and whilst that remains the case, the weekly market structure is still bullish.

Altcoins Market Cap

It's not entirely the same story for the Altcoins Market Cap. Yes, the structure is bullish, but $1.117T has to be reclaimed as support for any further upside to altcoins.

Bitcoin

Bitcoin's closure yesterday has yet to show much strength in response to the previous daily bearish engulfing candle. From a daily perspective, it is trying to reclaim the support level, whilst the weekly timeframe will be trying to maintain it. It's fair to expect increased volatility across the market as the weekly & monthly closings are only one day apart, which is then closely followed by the meeting of the FOMC and confirmation of what the basis point rise will be. It's fair to expect that the majority of a 50bps rate rise will have been factored in. After all, the FED had been shouting about it enough over the last few weeks. So, should it surprisingly be any lower, like 25bps again, we could see relief across the markets once again. Naturally, we'll have to wait for that announcement to see what's decided - the meetings are scheduled for the 3rd and 4th of May.

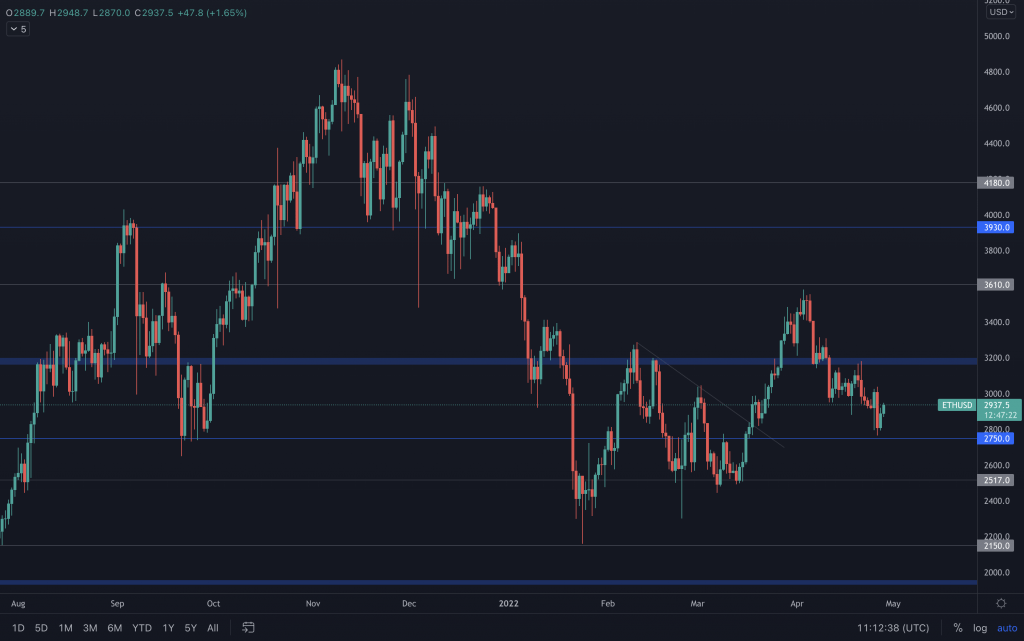

Ether

Over the past two weeks, Ether has tested both ends of its range ($3,200 and $2,750). It is still trending down but has managed to hold support at $2,750. Our eyes remain on ETH changing its market structure and reclaiming $3,200, which would be a good case for further bullishness. Losing $2,750, certainly on the weekly timeframe, would risk further downside, towards the low $2,000s.

DOT

DOT's having a bit of a hard time turning things around. Despite creating a (not overly convincing) higher low after a higher high, it continues to trade under $19.40. Bulls would need to see it maintain the bullish weekly structure and close back above $19.40. Until then, the road to $15 remains the most likely route.

SNX

As mentioned in the previous daily technicals, this is why, even with such a bearish daily candle that pierced through support and gave SNX a daily lower high, we wouldn't have looked to short it. It would have been increasingly risky whilst the weekly and monthly timeframes still show a bullish structure. There's also bullishness in the BTC and ETH pairings, which shows a +8.3% increase in SNX's price yesterday compared to BTC's 3%.

As mentioned in the previous daily technicals, this is why, even with such a bearish daily candle that pierced through support and gave SNX a daily lower high, we wouldn't have looked to short it. It would have been increasingly risky whilst the weekly and monthly timeframes still show a bullish structure. There's also bullishness in the BTC and ETH pairings, which shows a +8.3% increase in SNX's price yesterday compared to BTC's 3%.

RUNE

It was not a great end to the week last week for RUNE, but it did perform better than the majors over the week. The daily price action isn't overly convincing of late, and, without a reclaim of $8.85, RUNE does have lower to go. $7.50 provides some local support, so a loss of that will likely see it head to the bottom of the range ($6.75), probably lower eventually, towards $5.70. On the flip side, looking at the BTC and ETH pairings, there is potential there for RUNE to do well too. We'd need to see their respective resistances break, as it has historically declined from where it is now (we'll talk more about this in the video).

SOL

SOL is chopping around the $100 mark, but ultimately it lost it as support two days ago. Suppose it can reclaim it by the week's end. In that case, it does have the potential to create a weekly higher low (although probably not convincing) and avoid a monthly bearish engulfing candle. That's the likely best-case scenario. But, if it can do that, then we'd be watching the daily timeframe for the market structure to turn around. Without any of that happening, $75 remains on the cards. The majors are leading it, and so these are a few things that we'll be watching.

SRM

The last chance saloon to create a higher low for SRM's weekly change in structure is fast approaching. This is the $2 level, where losing $2 wouldn't look good and will likely see it sweep below the previous low, bringing $0.90-$1.40 into play. SRM would only then be in the clear if it goes on to reclaim $3.

FTT

FTT continues within (what seems like) the 'forever' range of $35-$50, so there's nothing new there. We'll await a solid breakout to indicate its next direction.

MINA

MINA could not reclaim $2.26, resulting in a move down below $2. $1.50 is likely incoming unless MINA somehow manages a recovery beforehand that reclaims $2.26.

dYdX

The slowdown in price depreciation continues, and dYdX finds itself back within our expected bottoming region ($3-$5) once again. It does look like dYdX has lower to go since losing $4.50, currently retesting this level as resistance.