Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Video Analysis

Total Market Cap

The market is coming to an important point. The chart that we say is 'the one chart to rule them all' is very close to support. We also can't ignore the monthly bearish engulfing candle on many assets within this analysis (even this index), and the market is reminding us of that right now. For the Total Market Cap, a weekly closure below support ($1.65T) is something we must certainly watch out for. A loss of this level would put $1.28T next.

Altcoins Market Cap

Much of the same stated above in the Total Market Cap analysis is reflected in the Altcoins Market Cap, but the level to maintain here is $935B. A loss of that would bring $645B into play and further pain to altcoins.

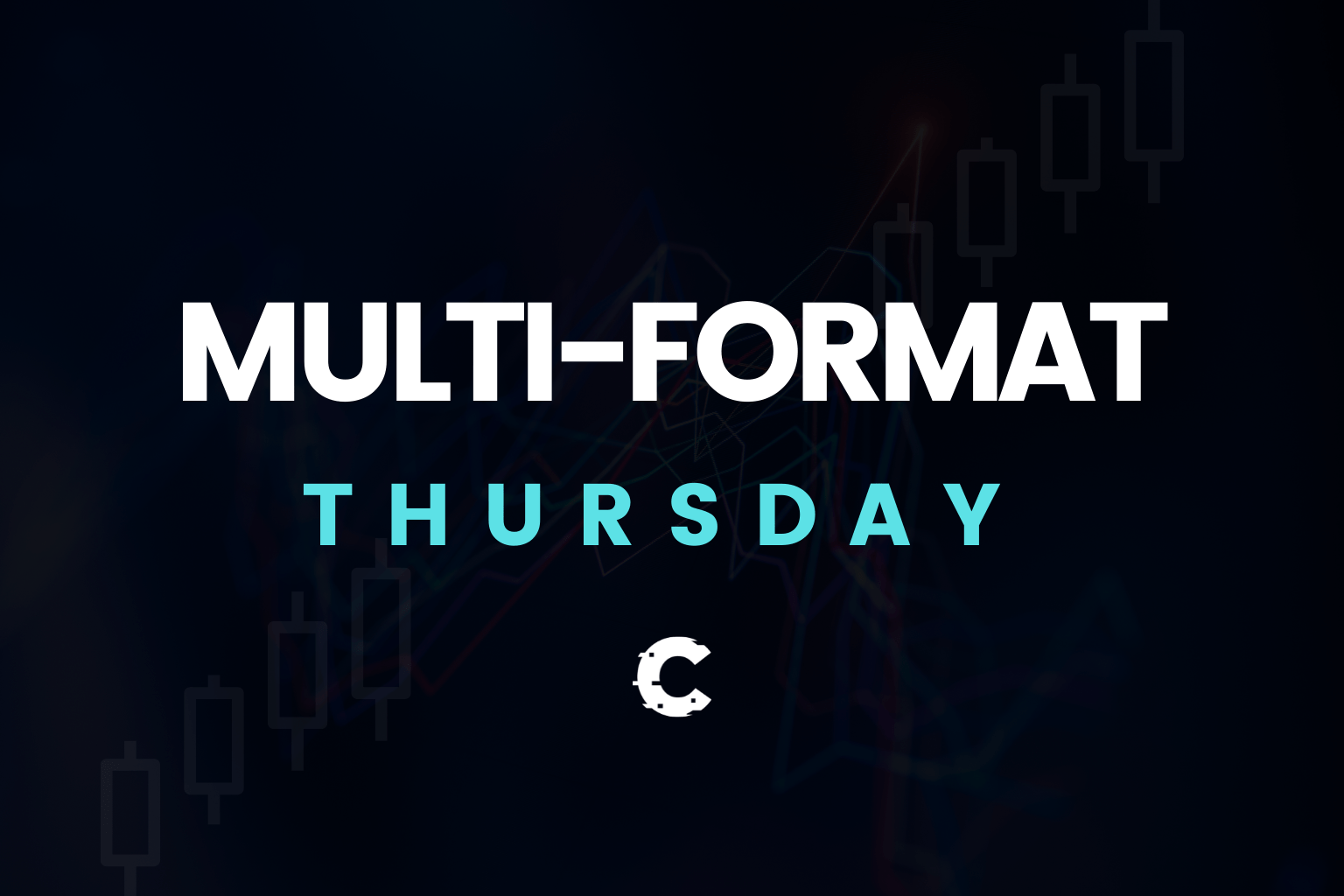

Bitcoin

Bitcoin broke out from the descending triangle, mainly due to a FED effect, going straight into Bitcoin's resistance (the final target of the broken triangle was $42,000). As we mentioned in our daily technicals, the volume wasn't impressive on the breakout, but the bullish divergence on the RSI was there. Either way, it was a good bullish engulfing candle yesterday, but it didn't manage to break through resistance. Today's candle looks the opposite, and bearish engulfing candles from resistances tend to be far more reliable. We can also note a trend with the volume increasing as Bitcoin's price has moved down - a bearish development. We are still watching out for the Total Market Cap closing below $1.65, as that would signal to us that there's a likely continuation of the downside, putting $30,000 on the cards.

Ether

Ether also showed strength, breaking the counter trendline with a bullish engulfing candle that created a daily higher low. This set it up for a move towards the top of its range ($3,200) with the psychological $3,000 level in its path. With ETHBTC bullish (see chart below), we've seen a slightly better (or less bad) performance from ETH today. However, if ETH closes below $2,725 in this way (yes, another bearish engulfing), the next support would come in at $2,517.

ETH/BTC

DOT

A good close for DOT yesterday, and, as we said in yesterday's analysis, altcoins just needed a positive reaction from the majors. Bullish moves at the bottom of the range, such as we see here, can be good indicators of a bottom being formed. The one thing that made me question its legitimacy was the lack of volume for that daily candle. Anyway, there was no chance of a bullish move for DOT to follow up with due to the market conditions. If DOT were to close below $14.50 (the previous lowest closure) with a bearish engulfing candle, it would increase the bearish pressure. Although DOT/BTC (see below) is at support, it does have room to fall (-10%) without losing its support there.

DOT/BTC (1w)

SNX

We could talk about yesterday's solid closes all throughout this analysis, but it will undoubtedly get repetitive. SNX has already spiked to the top of its range, but it needs a close above $5.50 as a loss of $4.45 will likely see it headed further down ($3.60). There are no real indications of strength on SNX yet, as the volume has continued to decline, even on yesterday's bounce from support.

RUNE

RUNE's candle pierced through (and closed above) $6.75. At the old local support level, it found some resistance at $7.50. We need to see $6.75 hold today for RUNE to stand a chance of upside towards $8.85. We can see that the larger daily structure is bearish, and if it can't hold onto $5.70, more downside is likely in store. Of course, any bullishness seen in charts would require more favourable market conditions than what we have seen today.

SOL

Not much to say for SOL. It would need to reclaim $105. Until then, $75 remains the more likely route.

SRM

SRM closed slightly above $2, but not with an overly convincing amount of volume. Nothing was immune to today's market movements. The safest bet is waiting for a break from the tight range that SRM is in - $1.75-$2.00.

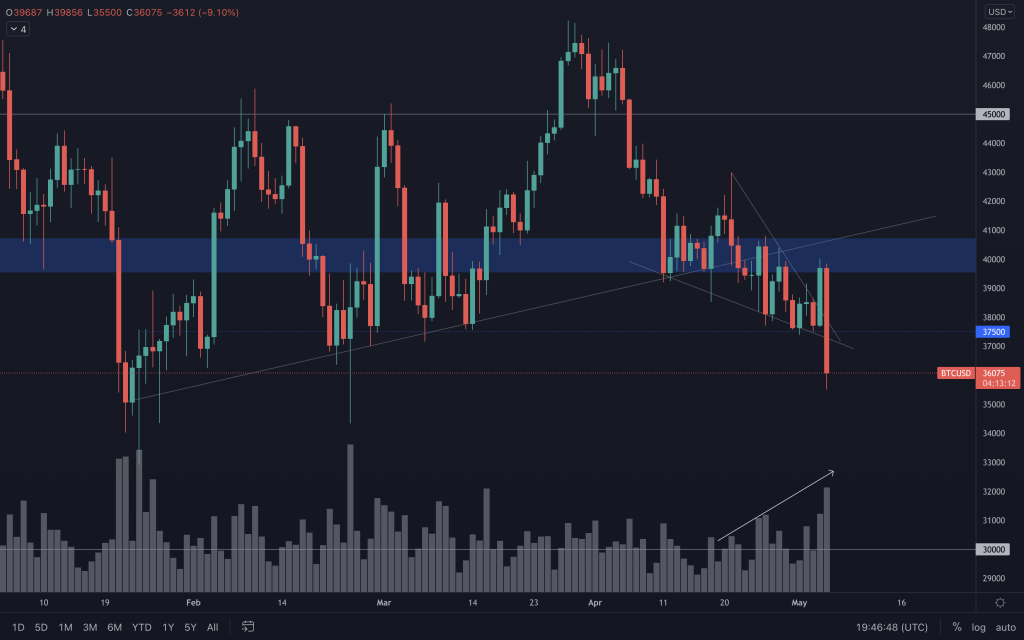

FTT

FTT is nearing the lower end of the never-ending range. If it breaks down, $22.50 is on the cards.

MINA

MINA's currently trading in the middle of its $1.50-$2.26 range, so there's not much to comment on at this moment in time. A break below the previous lows would likely lead it to $1. Although it's unlikely any time soon, from a weekly perspective, MINA needs to reclaim $3 to indicate a more considerable move upside (towards $6).