Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Video Analysis

Market Sentiment

The Fear & Greed Index hasn't moved out of extreme fear for a month. Historically, this has proven to be a reliable buying opportunity. But in the current financial climate, any buying you do, you need to ensure that you're not over-exposed in the event of downside.

Total Market Cap

The Total Market Cap has remained in a relatively tight range since the 13th of May. The only way to suggest its next direction is by either a break above 1.35T or below $1.17T.

Altcoins Market Cap

The $645B level continues to prop up the Altcoin Market Cap. If there were to be any relief, it would make sense to see it from here, as closing below risks a -30% drop down to $455B.

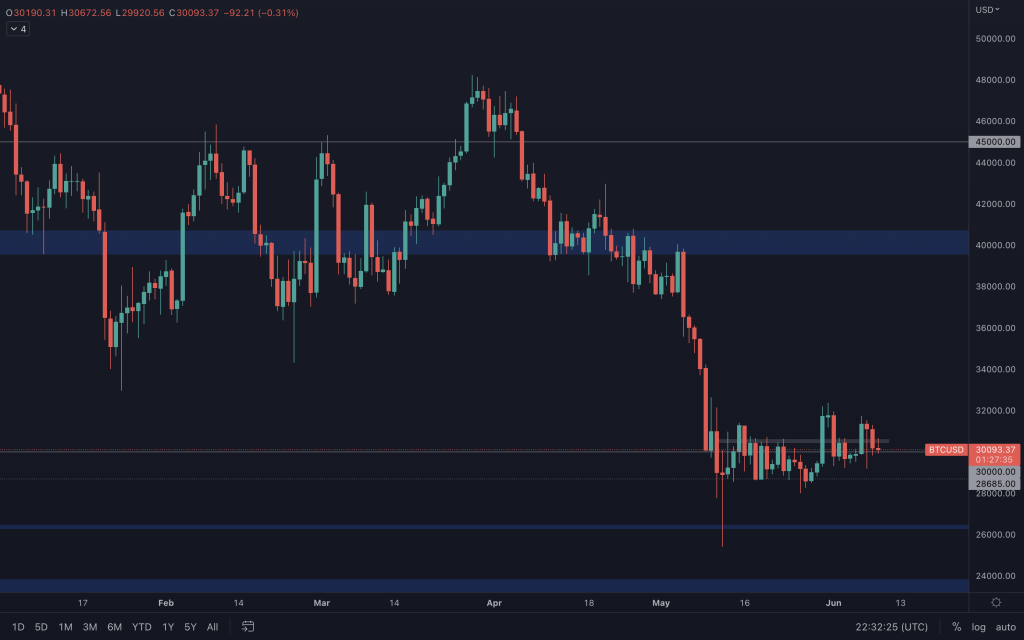

Bitcoin

Bitcoin is still in the same range it has been in for almost 30 days. Whilst it may seem tedious, waiting for a break out from the range is the safest play. Although the Fear & Greed index may hint toward relief, we can't forget the overall bearishness of the market as low volume is ever-present.

Ether

Ether is still trading above its primary support level ($1,740), which protects it from a move down to $1,350 (the old 2018 high). The bearish structure remains in place all the way down to the daily timeframe. It has seen multiple retests of $1,740, which will undoubtedly weaken this level as support. But, the vital thing to remember is that we can't presume it will be lost unless we see a break below. Sell volume has declined on each move down since the end of May, so a relief rally certainly is possible. We just need to see Ether reclaim $1,950 and create a higher high first.

ETH/BTC

This chart is also at an interesting point, but we'll need to see how the weekly closes first. Should the weekly candle close above 0.06BTC, Ether will likely have a little more strength than BTC over the short term. This only applies if we see positive price action across the market.

DOT

DOT has spent sooooo long below $10 that I don't know how $7 hasn't been tested again. Its BTC chart is still below support, and its ETH chart is actually around all-time lows. With that said, the resistance by DOT not to move down too much in price with all of the volatility seen by Bitcoin should allow it to perform well if we see a green market. In that case, the requirement remains that a closure above $10.25 is needed first.

SNX

Many altcoins are displaying a state of indecision purely because of Bitcoin's movements over the past month. Once BTC chooses a direction out of its range, only then will we see it reflect in altcoins. SNX is one of the few assets with some impressive volume on its green weeks, even though the market is bearish. This points to it performing well if/when the market turns around. Right now, all it needs to do is hold on to $2.50, as any weekly loss of it would see SNX lose its final support and enter ATLs.

RUNE

RUNE is in a sticky situation where we need to see a weekly close above $3.50. Unless that happens, RUNE is wide open to moving lower.

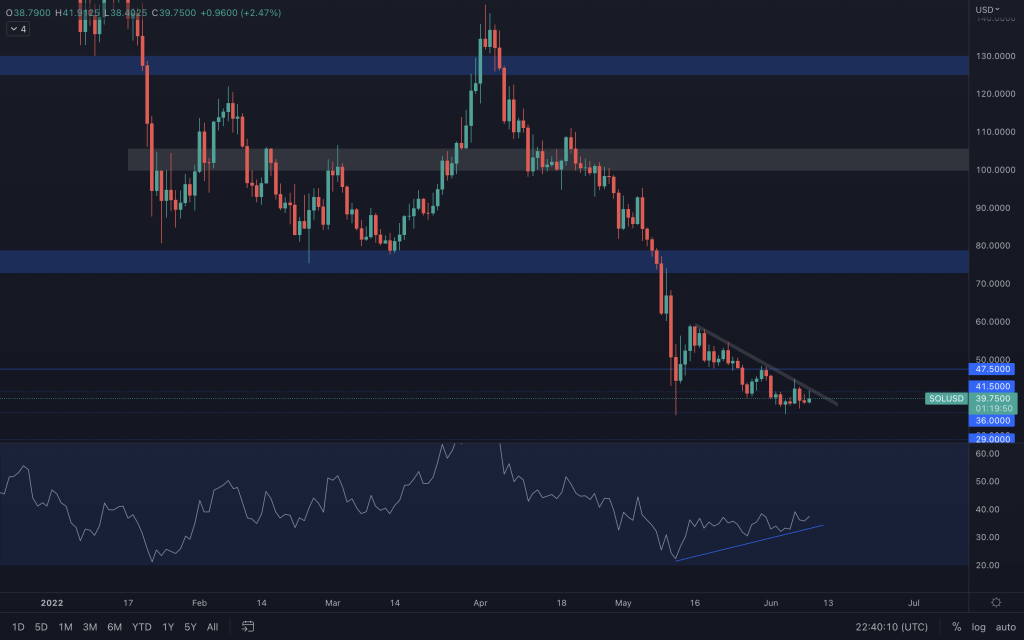

SOL

We've not yet seen any indication on the daily chart candles that suggests SOL is about to change direction. SOL has a counter trendline in play, and the RSI also indicates a bullish divergence, so we're going to watch this one closely.

SRM

SRM is another one that hasn't been able to alter its bearish structure with multiple attempts at knocking down its support. $1 is a psychological and technical level, but there's only so long that it can hold. Is it due a relief rally? Sure, given where its price now is. But it will only see a rally if BTC does, as SRM's volume is much lower than average.

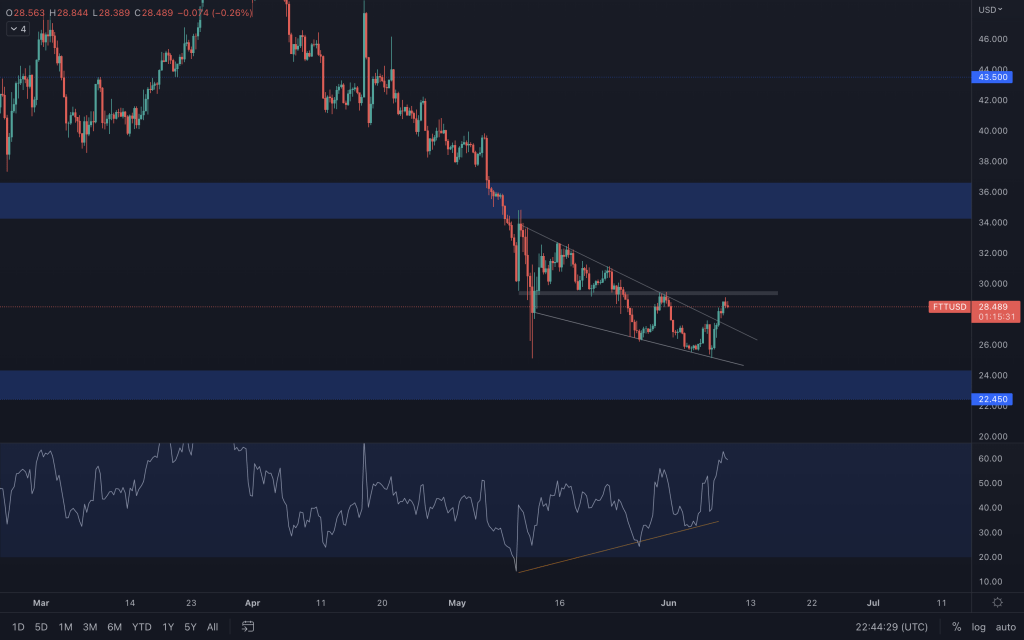

FTT (8 hour)

FTT has seen that break out and push to $29 that we'd mentioned in our daily analysis. With low volume on this move up, and the chart still in a bearish structure, it does urge caution. We need to see FTT reclaim $29.50. If it manages that, a move up towards $34 is on the cards.

MINA

MINA continues to trade below its $1 psychological & technical support level. Unless we see that reclaimed, we have to be prepared to see it continue lower.

dYdX

dYdX is another asset that has been unable to alter its bearish market structure. It finds itself creating a series of lower highs but has support around $1.50-$1.60. Therefore, a break below $1.50 and we would have our eyes set on $1, but above $2.20, we'd be looking toward $3.

THOR

THOR is still in the old consolidation box range that it was in back in March. We have a daily structure change, but that alone isn't enough unless it closes above $0.45.

Watch the video for a brief analysis of additional altcoins.