Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Video Analysis

Total Market Cap

The Total Market Cap is trading within our resistance range. For bears, this is the level they'd expect to see the market reverse from, which is reasonable given that we are in a bear market where supports are flipped into resistance. So, now's the time to observe for a sign of weakness. After all, most of the world is in the midst of a recession (even though world leaders may choose not to call it such), where inflation continues to spiral out of control and measures taken so far are proving ineffective. The ECB will announce their rate hike today, and we're six days away from the next FOMC meeting, where we can expect additional volatility as each announces the next round of rate hikes. Yesterday's candle slowed the upside momentum. As it takes place at the top of a range, it could signal the start of a potential reversal of the preceding trend. What we'd want to see follow it is a strong move in either direction. Upwards, and it'll signal that it has more legs left. Downwards, and we could have ourselves a top. The problem with this approach is that on a tradeable asset, a strong move can often take the price to the point that it is undesirable to enter a trade. But, at this point, we can use this index to help us with the overall market bias at a pivotal point before looking at what charts better align with what's conveyed here.

Altcoins' Market Cap

We're at that point where the altcoins' market cap is approaching the top of its range with resistance at $645B. As the index has met where it previously wicked on the way down, we could see a reversal without achieving the entire move. One thing we'd watch out for to indicate any downside is a break of the supporting trendline. Without that being broken, $645B remains on the cards.

Bitcoin

Not the strongest of closes after news of Tesla's Q2 earnings, where it was revealed that it had sold 75% of its Bitcoin holdings (almost $1B) and, as such, we saw an increase in volatility for the last few hours of the day. We'll possibly see the true effect of this, whatever its extent, over the next 24 hours, so make sure that any trades that you are already in have good risk management. As mentioned above, the ECB will also choose between 25bps and 50bps for the Eurozone, which will only add to the volatile start of the day. Back to the chart, Bitcoin's broken upside out of the rising wedge but needs to close above $23,850 to signal that there's more left in this move. If it achieves that, $26,000 is next in line. Without it, it's simply retested the top of its range with a failed breakout attempt, which would have us looking for a closure back inside the ascending wedge.

Ether

Ether's appreciation has slowed, but as long as it remains above $1,350, $1,740 remains possible (not that we'd enter a trade at this point). The lower timeframe is moving sideways within a $100 range. A closure out of this range may help to identify its next move.

Polkadot

Daily timeframe-wise, DOT is in a bullish market structure after its breakout. But it still needs Bitcoin onside as it's not supported by volume or the DOT/BTC chart. With it unable to reclaim support on the DOT/BTC chart, any downside in Bitcoin will hurt DOT more.

DOT/BTC

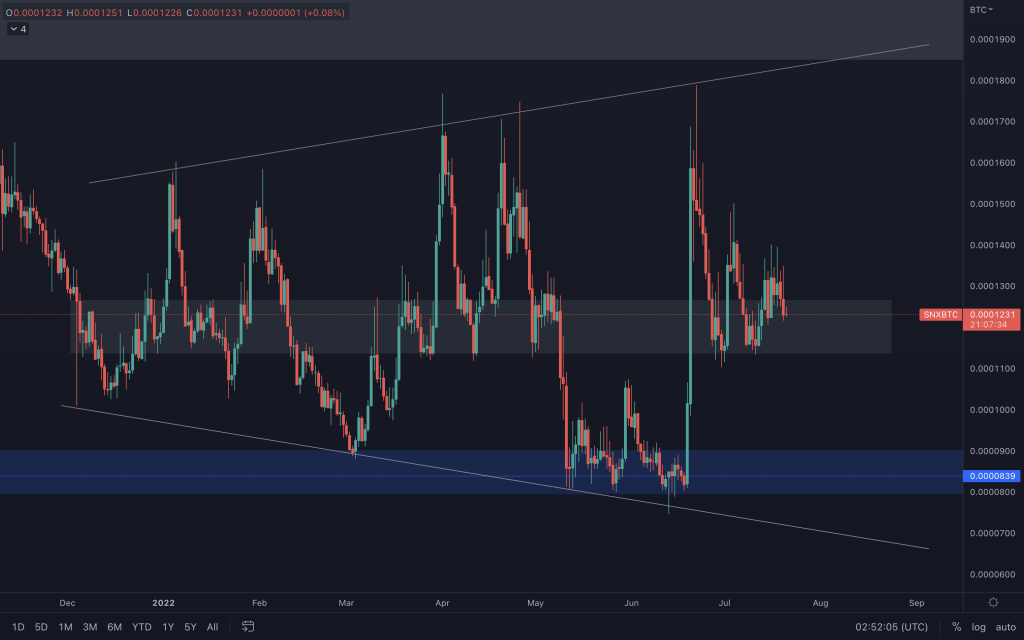

Synthetix

SNX is continuing with a higher high, higher low structure which keeps $3.60 on the table. But as you already know, it will need a steady Bitcoin to achieve that. SNX/BTC is creating a series of lower highs around the mid-point of its broadening wedge, so if it loses that support, we'd expect to see BTC be the better performer again.

SNX/BTC

THORChain

RUNE is still moving positively in a daily bullish market structure. $3-$3.50 is its resistance and, although unlikely given the condition of the market at the moment, a weekly candle close above $3.50 is needed to signal higher prices.

Solana

After touching $47.50, SOL closed as a bearish engulfing from its resistance yesterday. This points to a retest of its supporting trendline. From there, we'd have to see if it can hold because another loss of that as support and it may not be so forgiving.

Serum

A poor closing for Serum yesterday. A heavily bearish candle that will surely have it testing its support. A loss of support by a daily closure, and we'd be looking at $0.74 once again.

FTT

After closing below $29, FTT has invalidated the setup with the target of $35. It's not immediately turned bearish from a daily perspective, but the lower timeframe chart may have some insight after losing a supporting trendline. (I'll cover this in the video)

MINA

Two failed attempts at closing above $0.79 keep MINA in bearish territory. Its price action has closely resembled that of Bitcoin over the past month, so it is worth keeping one eye on that for any significant changes, as it will reflect here.

dYdX

Although Bitcoin is giving signs of weakness, dYdX just doesn't care at the moment. Of course, any significant change in the orange one will impact dYdX's price action, but downside can only be expected should it close below $2.15.