Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Video Analysis

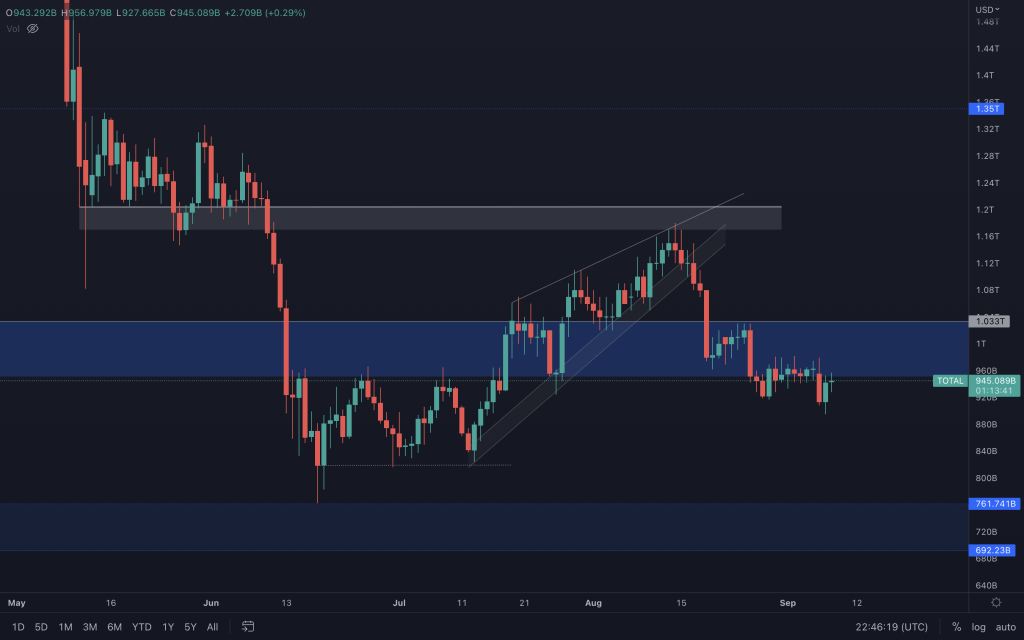

Total Market Cap

The Total Market Cap captures the total value of the top 125 cryptocurrencies, giving us an overview of how funds flow in and out of them. The main takeaway is that the chart still sits below $1T ($1.03T, to be exact). Not only that, but there's yet to be enough confidence to alter the market structure. We see investors further risk-off into relief, eventually leading the market cap to another low. So, although the odds may be on the side of further market cap decrease, it doesn't mean we'll stop looking for signs of a change.

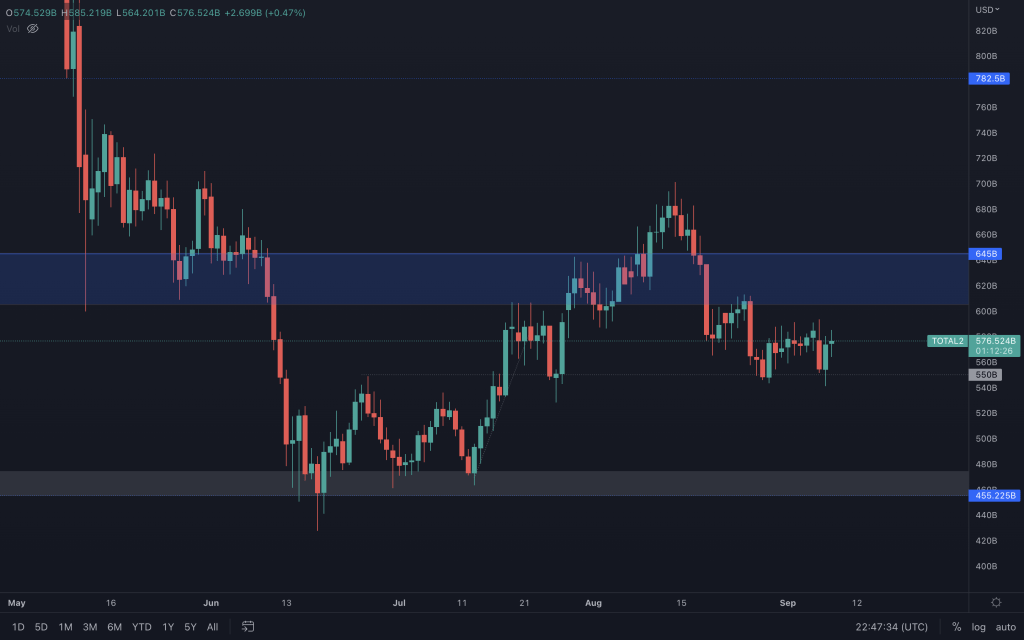

Altcoin Market Cap

There's no doubt that if the Total Market Cap takes a hit, we'll see it here too. The bearish structure is intact, as it will be on many charts in this analysis, and invalidation to the downside only comes in if $645B is reclaimed. So far, $550B is holding as support, and that's the level we'd need to see lost to likely lead this index to the bottom of the range.

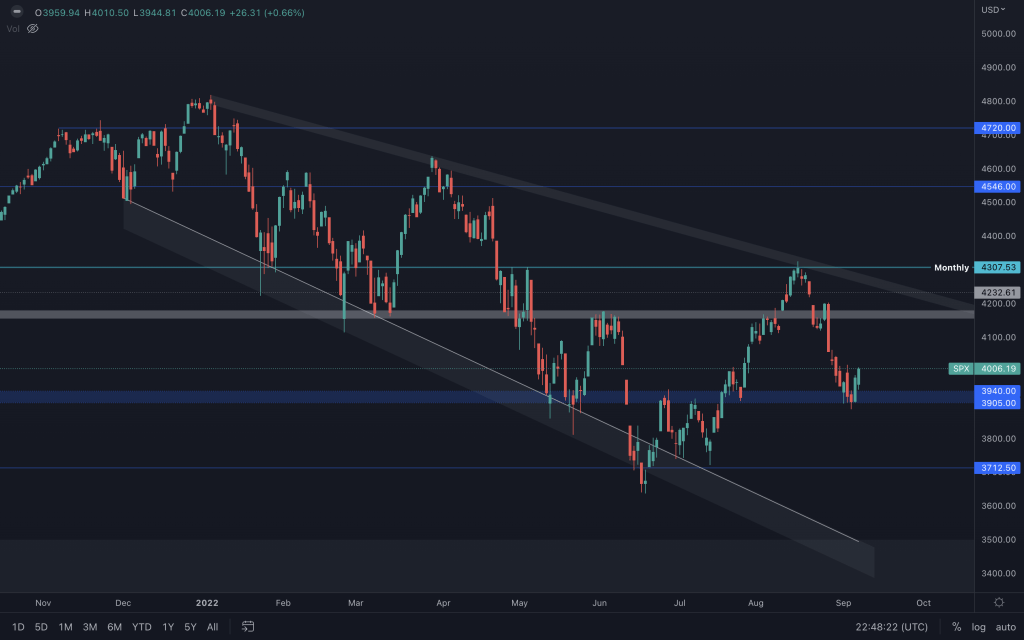

S&P 500 Index

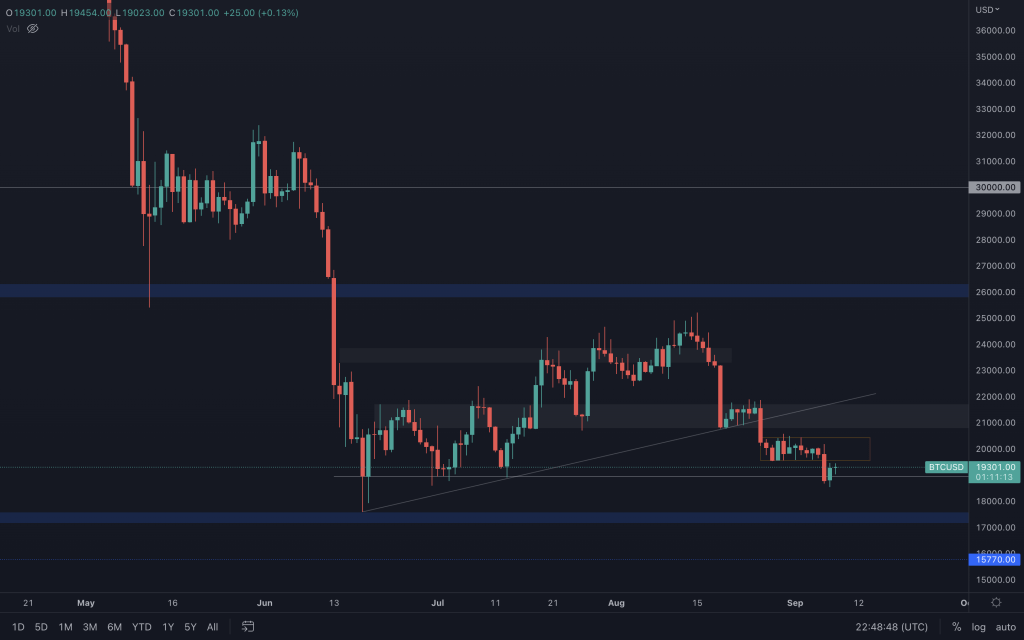

Bitcoin

After reaching our $19,000 rising wedge target, Bitcoin briefly lost it as support but reclaimed it just a day later, putting a visit to $17,000 on hold for now. After such a move, and with BTC returning to its 2017 highs, it makes sense to let Bitcoin breathe a little. It could go on to form a bottom here with SPX moving up, but a clearer indication may come from the weekly closure.

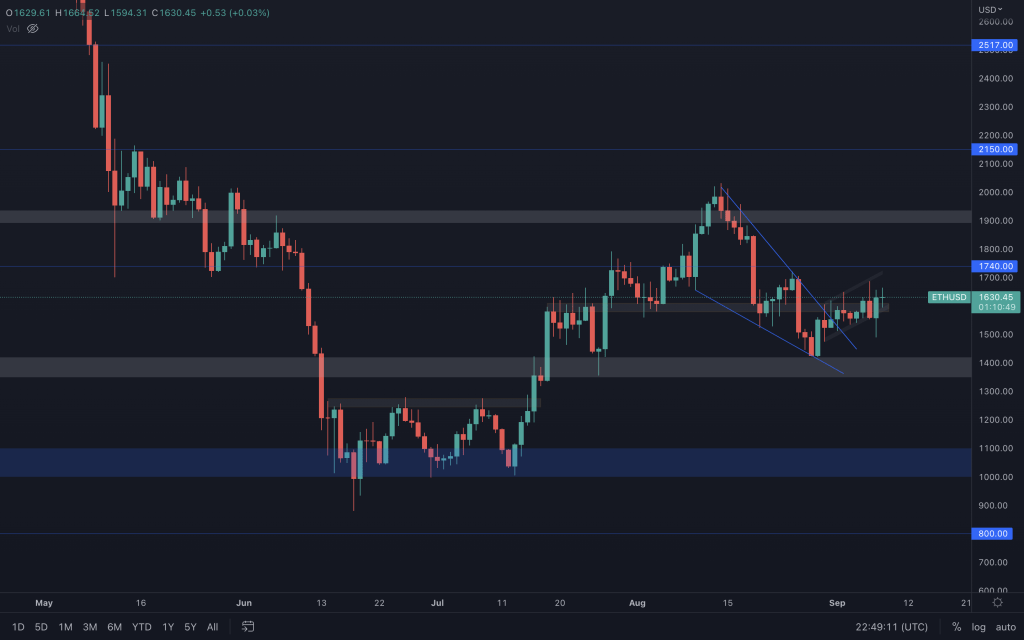

Ether

Ether's answer to a bearish engulfing candle closing below support? A bullish engulfing candle reclaiming lost support. Choppiness is evident as both Dominance charts are at their respective range limits, ETHBTC at its upper range limit and Ether's market cap at $200b resistance, so trades do not come without an acceptance of additional risk. But with Ether showing the strength to invalidate the bearish engulfing candle the very next day, $1,740 is certainly within reach.

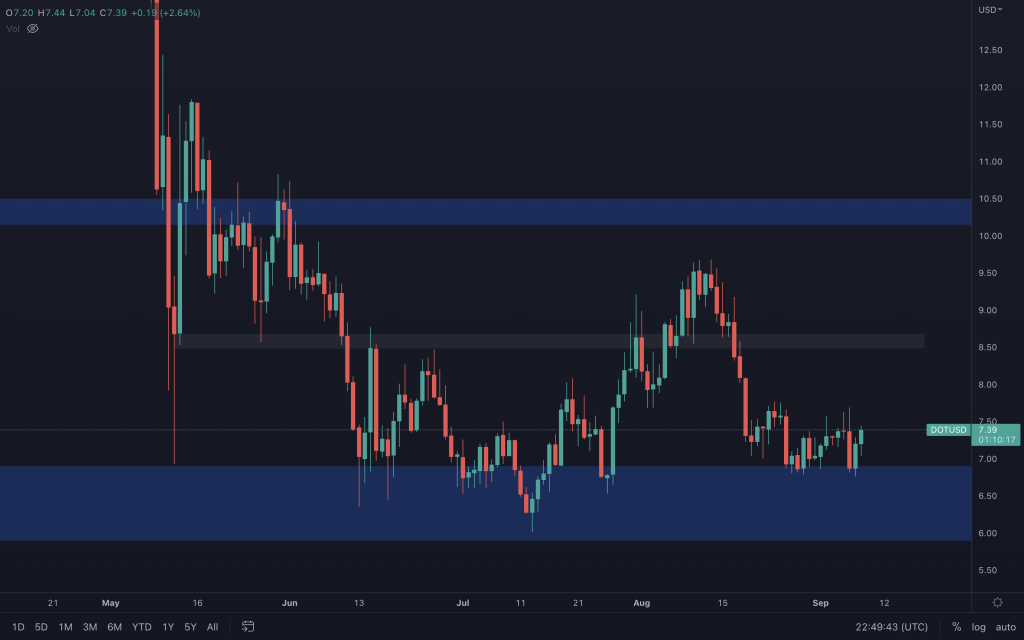

Polkadot

We're waiting for a clearer indication from DOT's price action. Its lower highs are intact, with $7 acting as support. Volume is still low, and there isn't too much room above it on the DOTBTC chart, so positive price action from here would rely more on Bitcoin performing well.

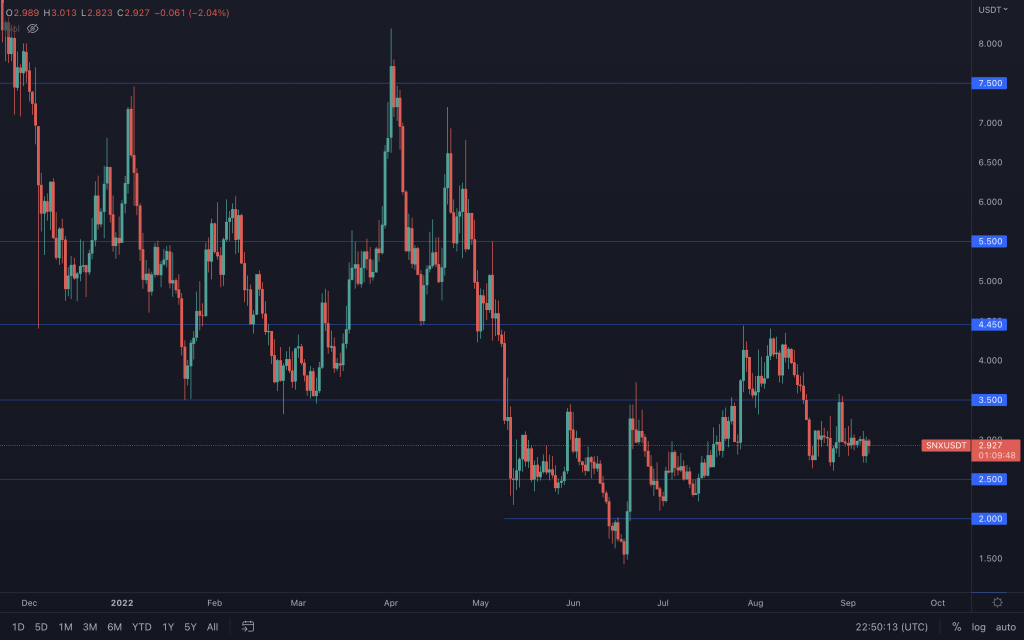

Synthetix

There comes a time when the chart gives away no indications of its next move, and SNX is there too. Last week's candle closed as a Doji, and it's been rangebound for over 20 days. So it's a case of waiting for that indication.

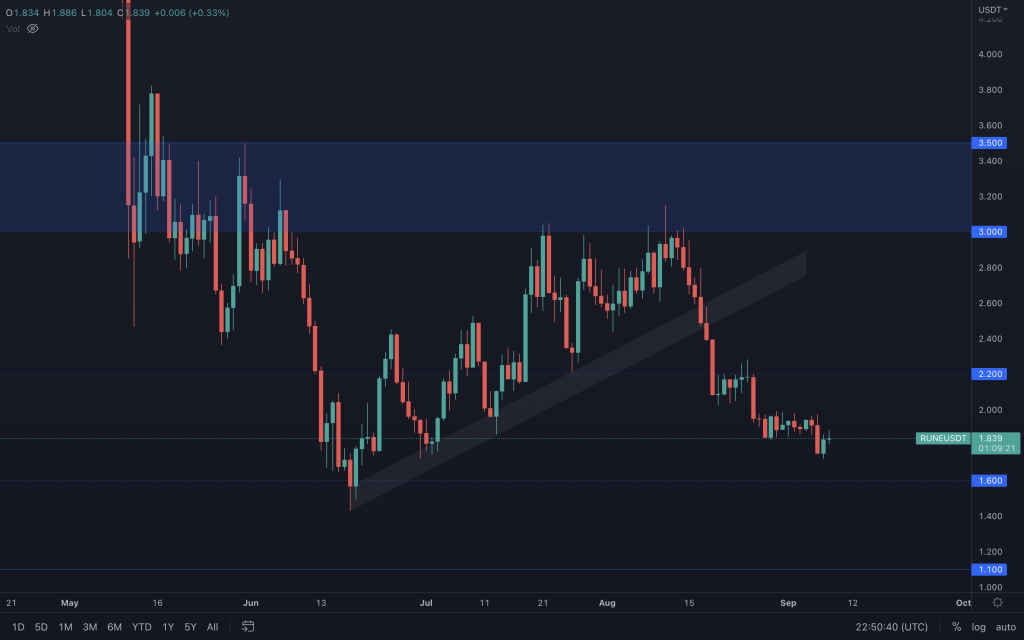

THORChain

RUNE's chart is undoubtedly bearish, and whilst that remains the case, $1.60 isn't ruled out.

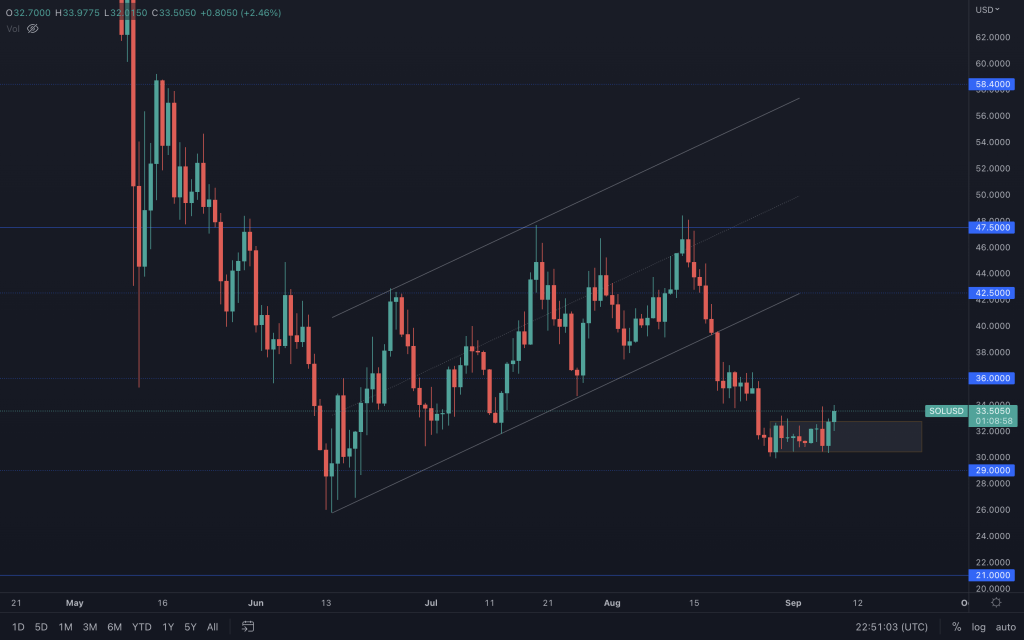

Solana

SOL has popped up out of the range, but it will need to hold it for the daily closure. Although it doesn't change the market structure, a $36 retest becomes possible, especially given that SOL/BTC (below) has also reclaimed its support.

SOL/BTC

FTT

A few of these assets are just at that awkward mid-range, waiting-for-something-to-happen point. FTT may have found demand at $25 before, but it's not been met with the same demand this time. Lower lows and lower highs intact plus low volume still leave $22.50-$24 on the table.

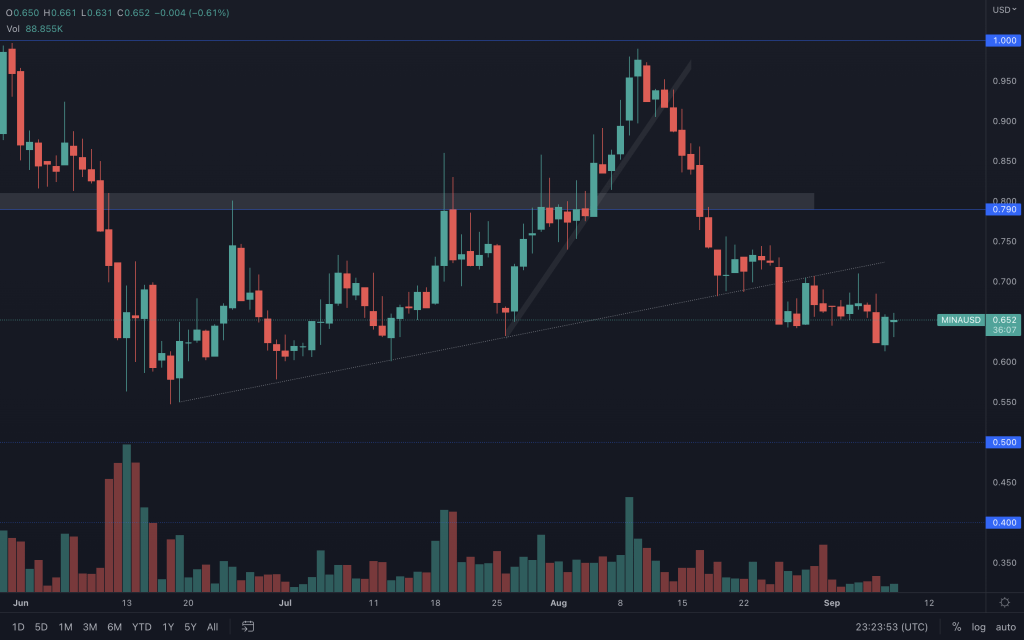

MINA

Okay, MINA recovered a lot of the previous day's losses yesterday, but look at that volume, or lack of it! It doesn't show a flurry of buyers, so I'm still leaning toward a revisit of $0.55.

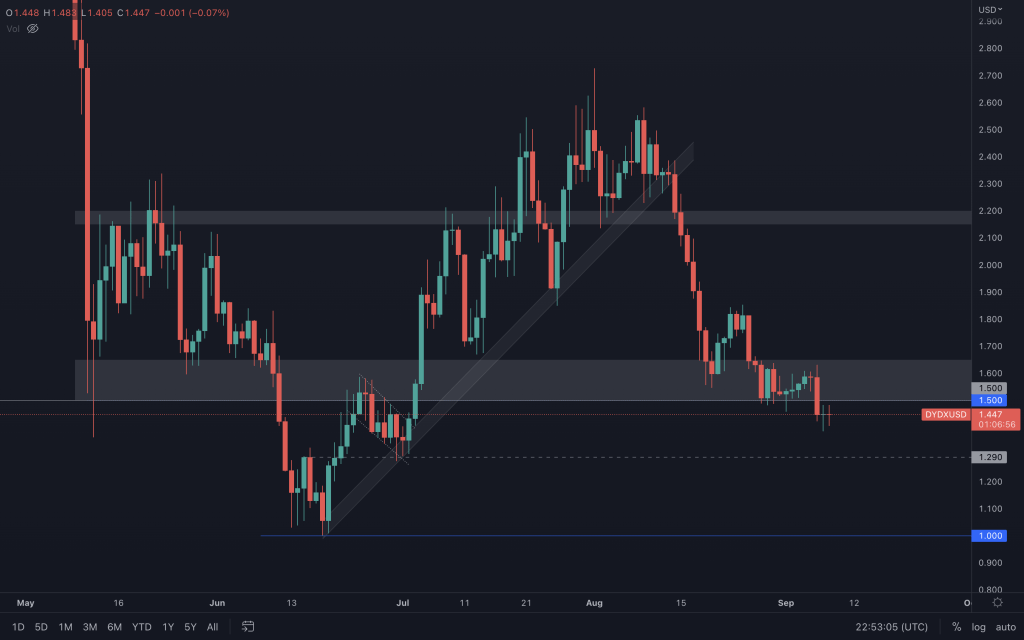

dYdX

Indecisive candles, and the price is still below $1.65 (I use the top of the range as the level that needs to be reclaimed after the lower end of the support range is lost). Of course, having a weekly closure below $1.50 would help to confirm the loss of support. So dYdX needs to see buyers step in soon, and the likely way that will happen is if the majors perform well.

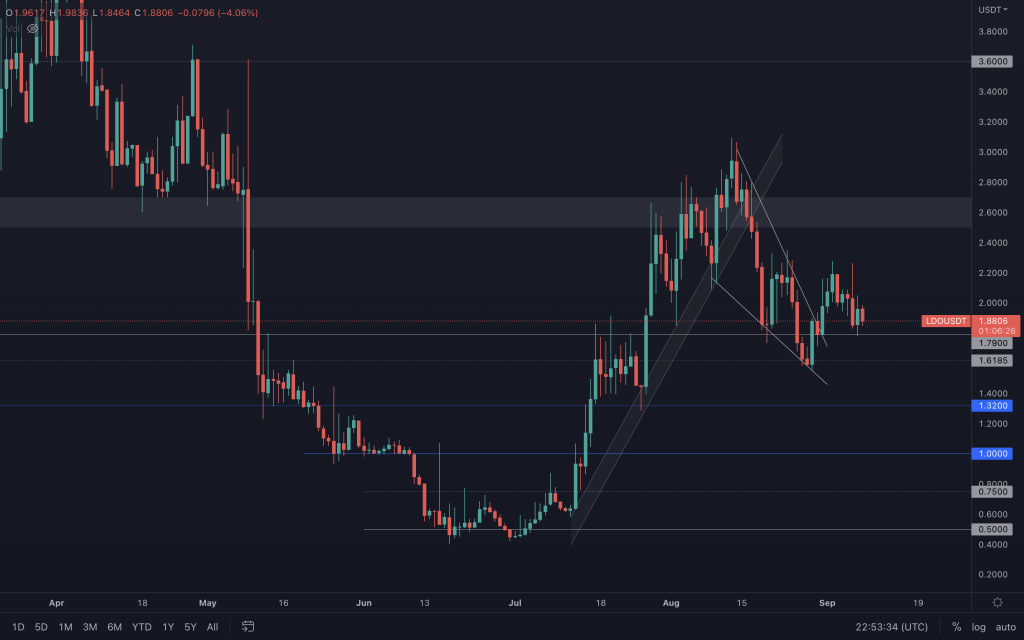

Lido

Lido is not yet out of the woods. After failing to make a higher high from the breakout, losing $1.79 would further show a lack of buyers, invalidating the falling wedge setup. So that's the level to watch.

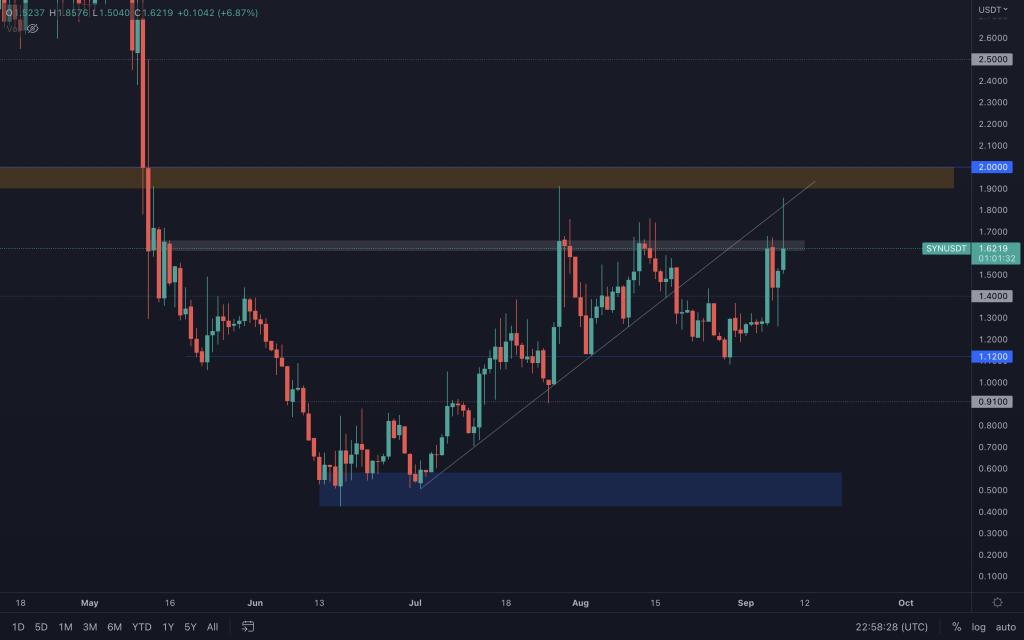

Synapse

It didn't hang around the old trendline very long, but a retest would have offered a nice short down to $1.57. The things that make a short riskier here is the time it took to retest the trendline and a peak in volume. It's also more of an organic move where the price decreased to support before the retest. Nevertheless, it is still valid, and invalidation was nearby - above $2. Lower prices aren't ruled out if SYN closes below the grey resistance. That said, we can also prepare for the opposite, whereby closing a week out above $2 would give SYN a considerable range of $2-$4.