Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Video Analysis

Technical Analysis

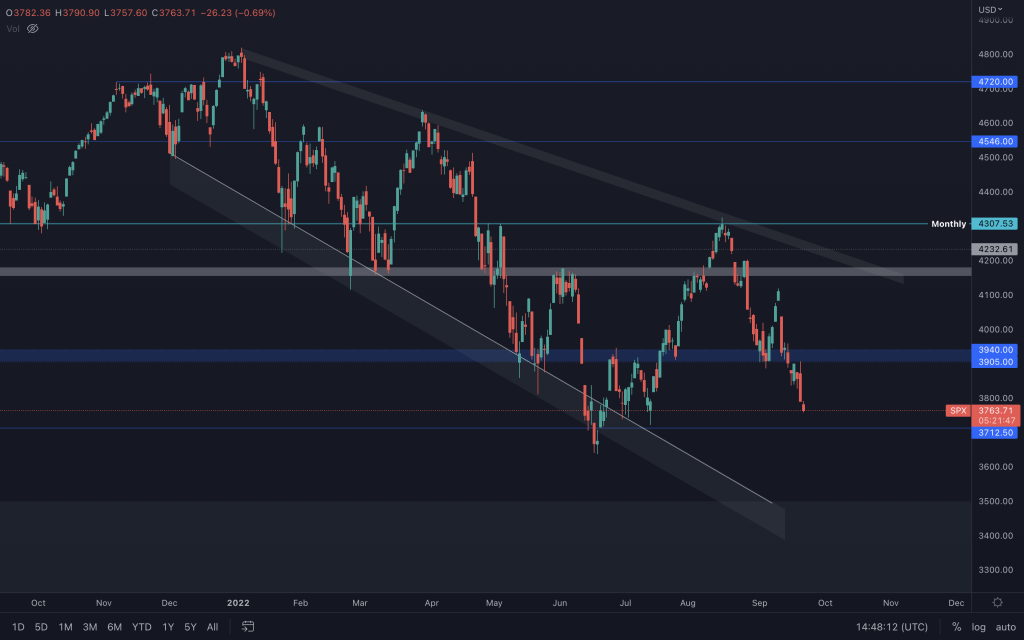

S&P 500 Index

After a bearish weekly closure last week and an FOMC meeting where the interest rate hike was as expected, Jerome Powell touched on the chances of further pain points to the market (more restrictive interest rate levels needed, limited economic growth, a cooling off of the housing market etc.) and pointed to the unlikeliness of the soft landing that he was so certain was achievable in the first quarter of the year. With that, SPX reacted and continued downward over the course of the day yesterday. It's likely that SPX heads down to retest $3,700 at some point in the future, but these periods around the FOMC meetings are well-known for their volatility.

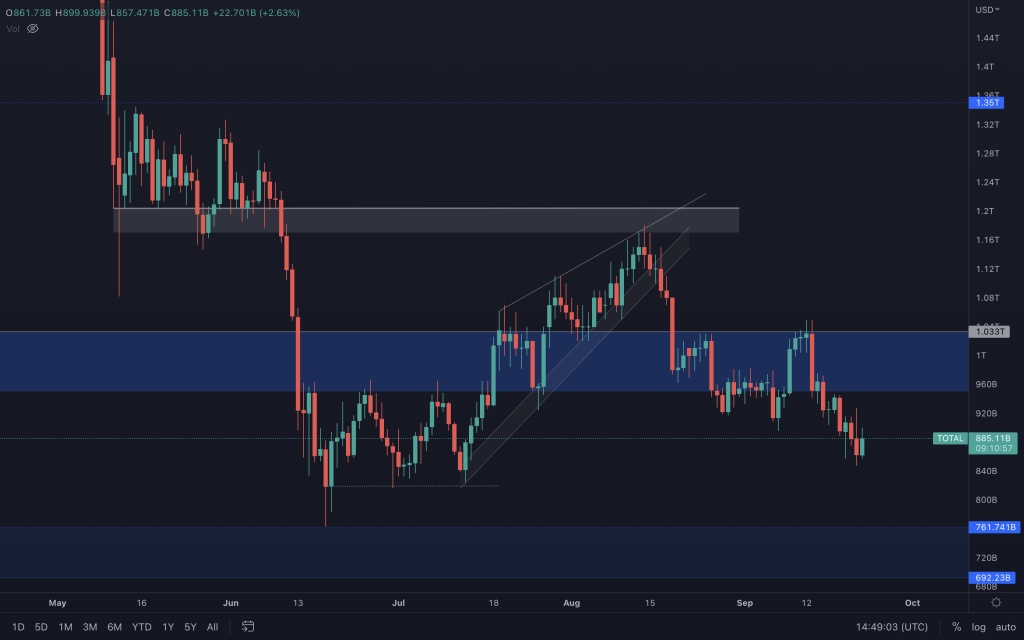

Total Market Cap

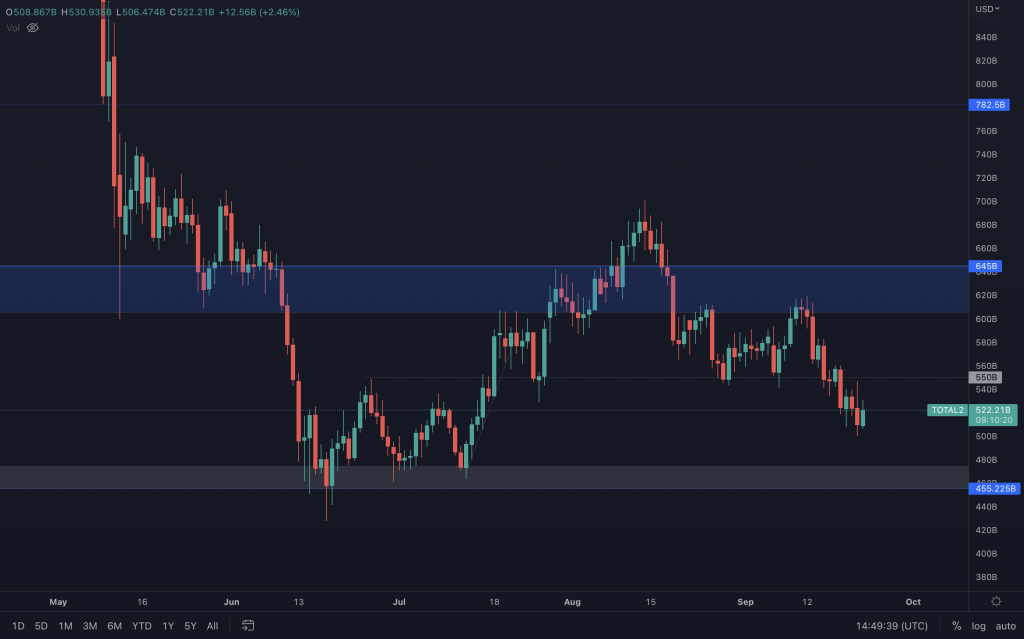

Altcoin Market Cap

The Altcoin Market Cap experienced an equally poor day and still sits below $550B. Whilst that remains the case, and we've seen no bullish momentum coming in to suggest otherwise, $455B is still on the cards. Today's candle may be a bullish engulfing at the moment, but whilst it is a running candle, we can't consider it a part of the daily analysis.

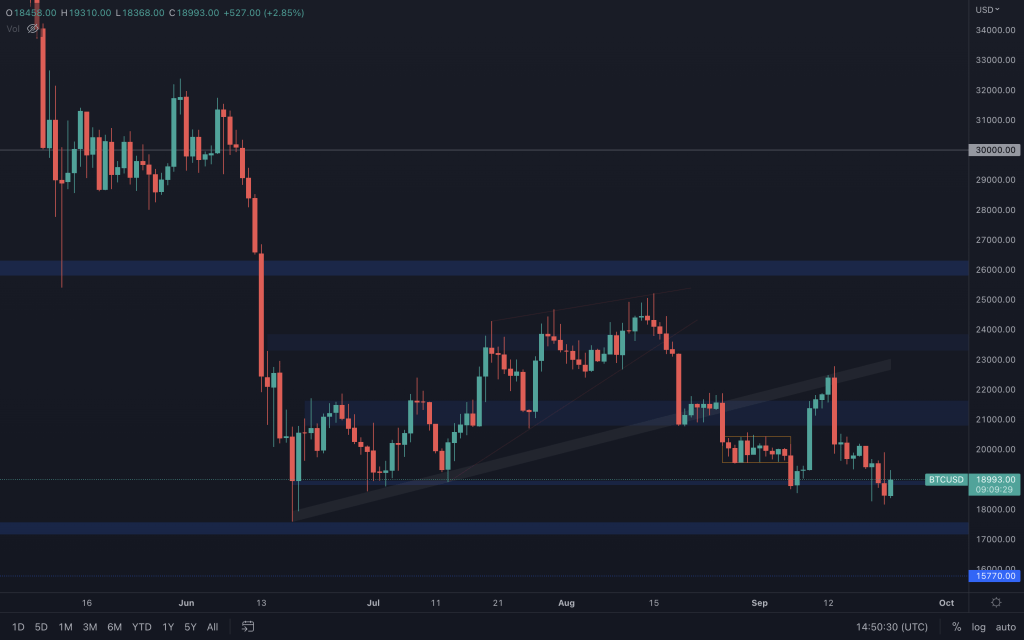

Bitcoin

As mentioned yesterday, this is why we wait at least 24 hours. Yes, Bitcoin closed below $18,800, but it can easily be invalidated the following day. If it was to close below support for a second day, then we could use that as confirmation of a lost support level and expect to see lower prices. Right now, Bitcoin is experiencing a pullback from yesterday's move. If this results in a close back above $19,000 (bullish engulfing candle at support), we may see relief from this level once again.

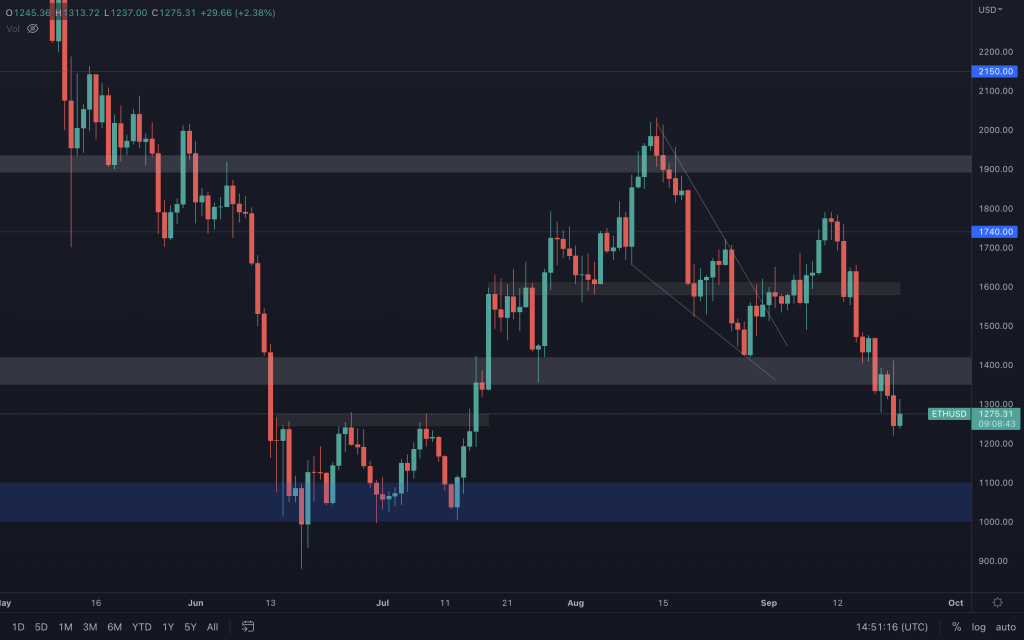

Ether

Ether is still below $1,400, which is a level that we'd need to see reclaimed, certainly by a weekly closure, for a potential sign of a shift from its bearish momentum. Yesterday, Ether closed above its intermediate support ($1,245), and we've now seen Ether push up from there. Momentum, however, continues to be with lower prices, and only a reclamation of $1,400 can begin to alter that.

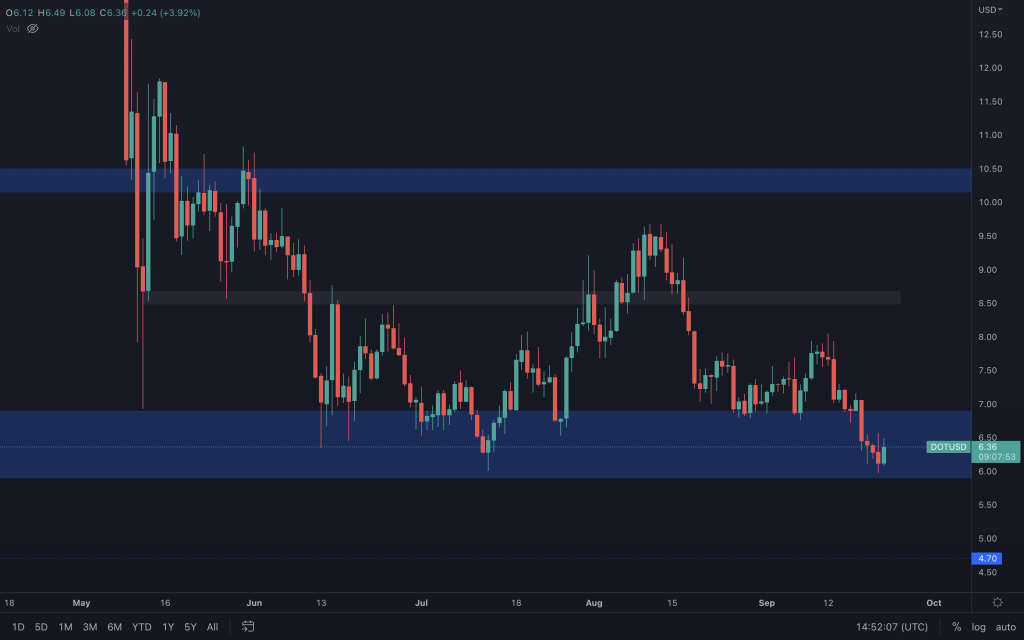

Polkadot

A bearish weekly close for DOT didn't provide the clearest outlooks. It shows us that the bears won that week, but they didn't win it convincingly as DOT was still above its support. However, the bearishness continued and pushed DOT down to test the lower end of its support range, but we're currently seeing a strong reaction from it. If DOT achieves a strong closure today, we can expect it to continue to push up to $7. But we really want to be on the lookout for DOT turning this back into support. So, the levels to watch are $6 (lower support for a loss) or $7 (for closure back above support with a change to the daily market structure).

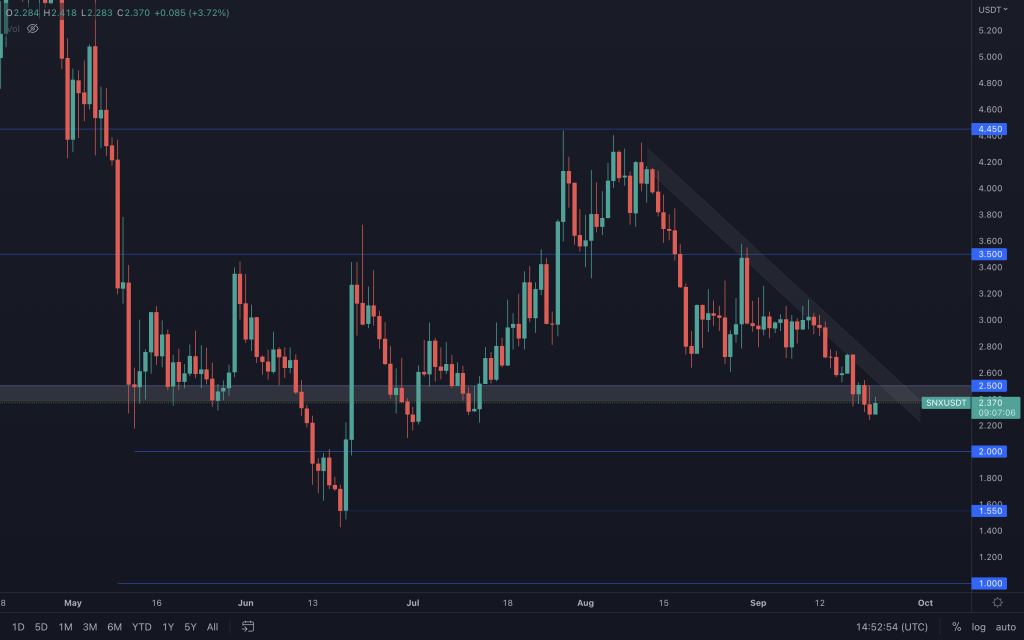

Synthetix

There's no doubt that SNX's price action doesn't look great, especially with it losing $2.50. As it is below $2.50, it will be more susceptible to Bitcoin's price action as there are very limited data points to take from, only psychological levels. A weekly closure back above $2.50 is needed to invalidate downside.

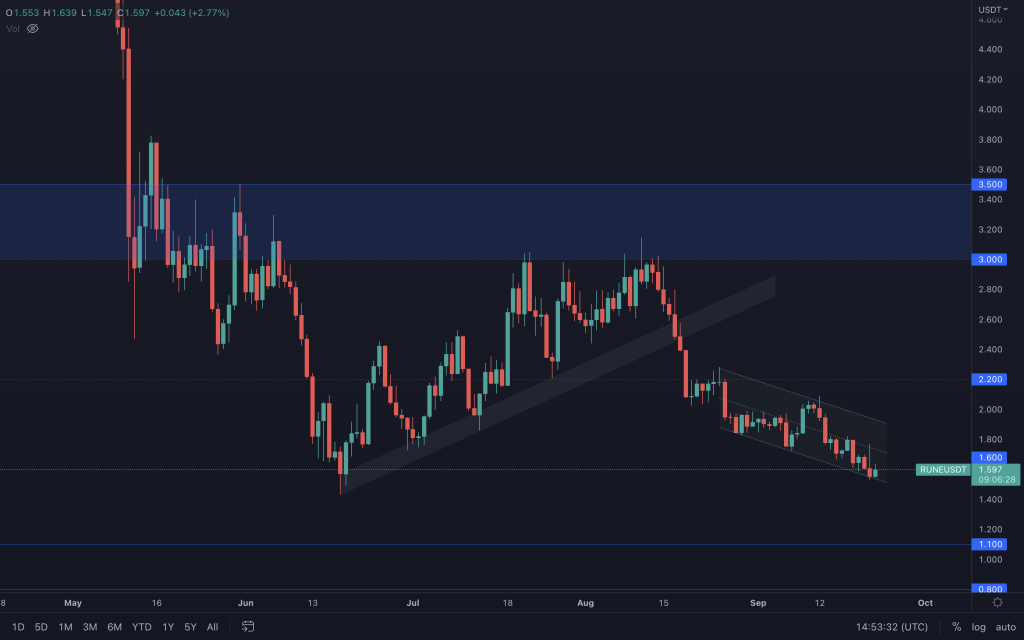

THORChain

RUNE is moving with the majors, and that's what we expected, whilst RUNE/BTC is at support. It did close below $1.60 yesterday but still holds onto the channel's support.

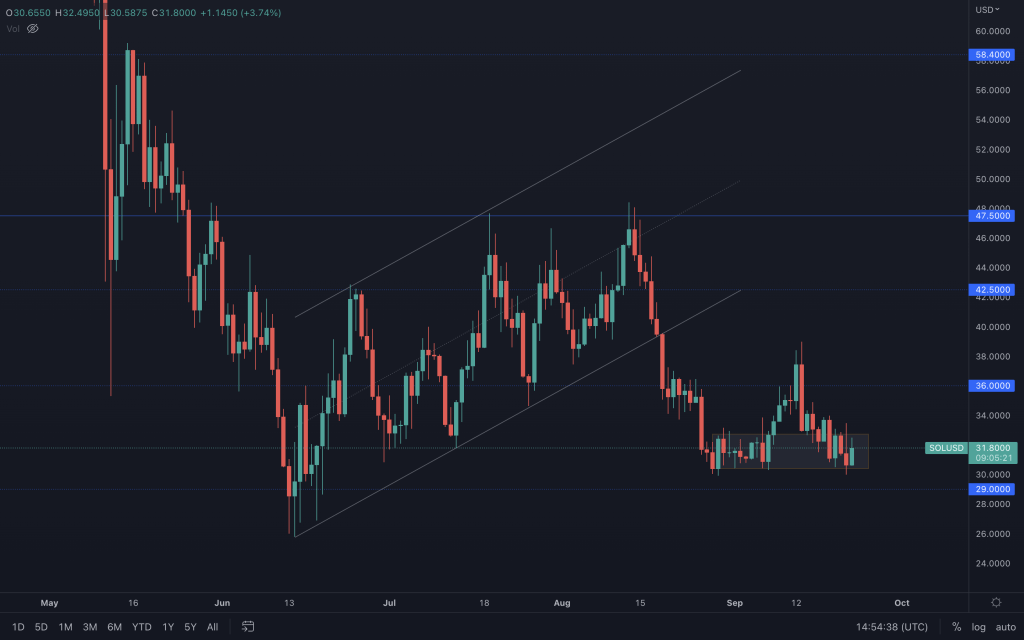

Solana

SOL looks to be in a better condition, as it has held up better than other alts of late. I also have one eye on SOL/BTC for a direction of a breakout. Right now, all it's doing is following BTC.

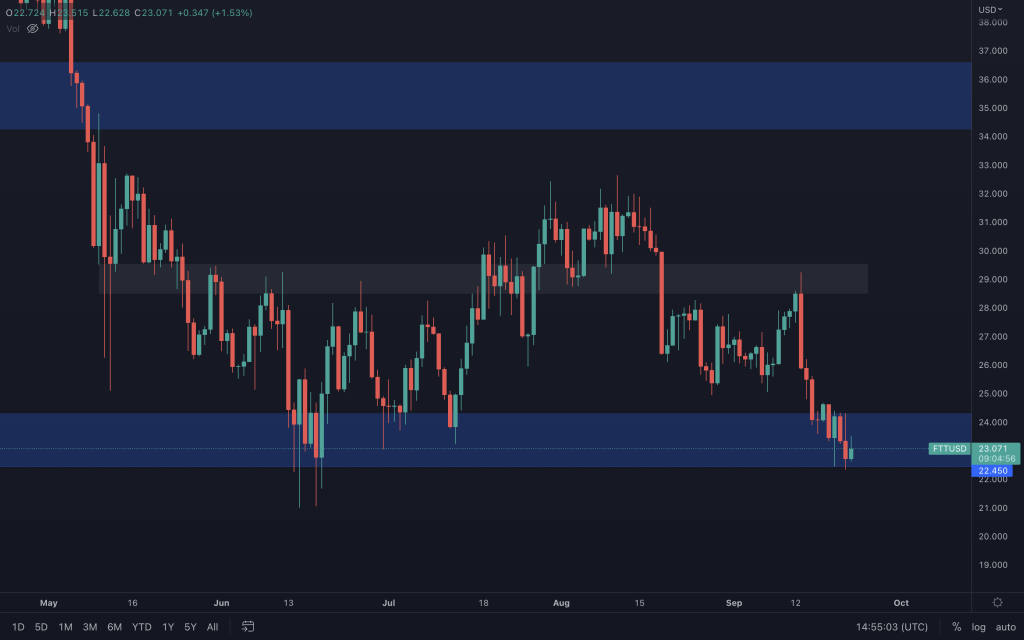

FTT

Last week's candle was heavily bearish. But, similar to DOT, it didn't manage to close below the support level, something that we require to validate further downside. Although FTT is showing some weakness, as buyers fail to convincingly step in to protect the support level, we can only look at lower prices if $22.45 is lost as support.

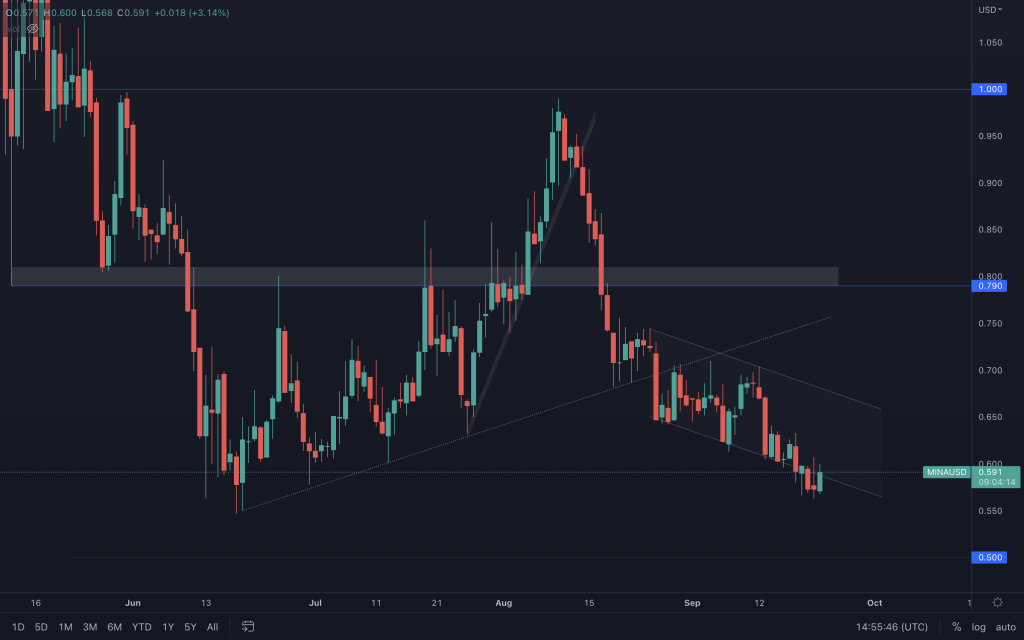

MINA

MINA's battling with the channel it lost two days ago. If it manages to reclaim it with today's candle, there is also the potential of a morning star formation. It's advisable to watch the majors for their respective closures before a long is even considered.

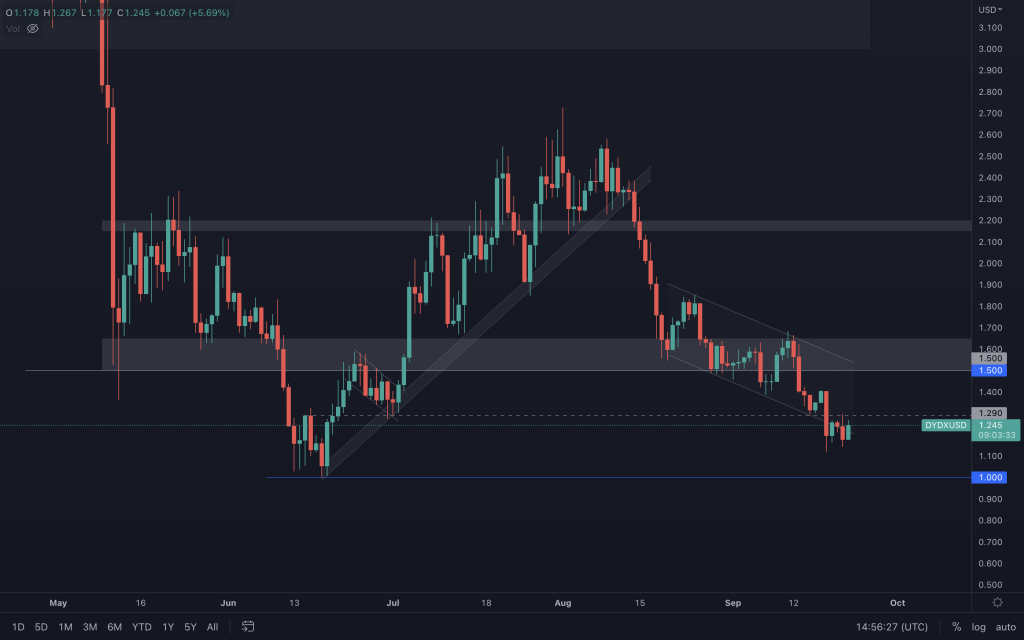

dYdX

dYdX is in a similar position to MINA, although it hasn't got the potential candle pattern. $1.29 acted as support before eventually being turned into resistance. Whilst dYdX is below $1.29, we cannot rule $1 out. If BTC manages to reclaim its support and dYdX is above $1.29, we may see another retest of $1.50. But that is conditional on daily closures, not what dYdX is currently presenting.