Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Video Analysis

Technical Analysis

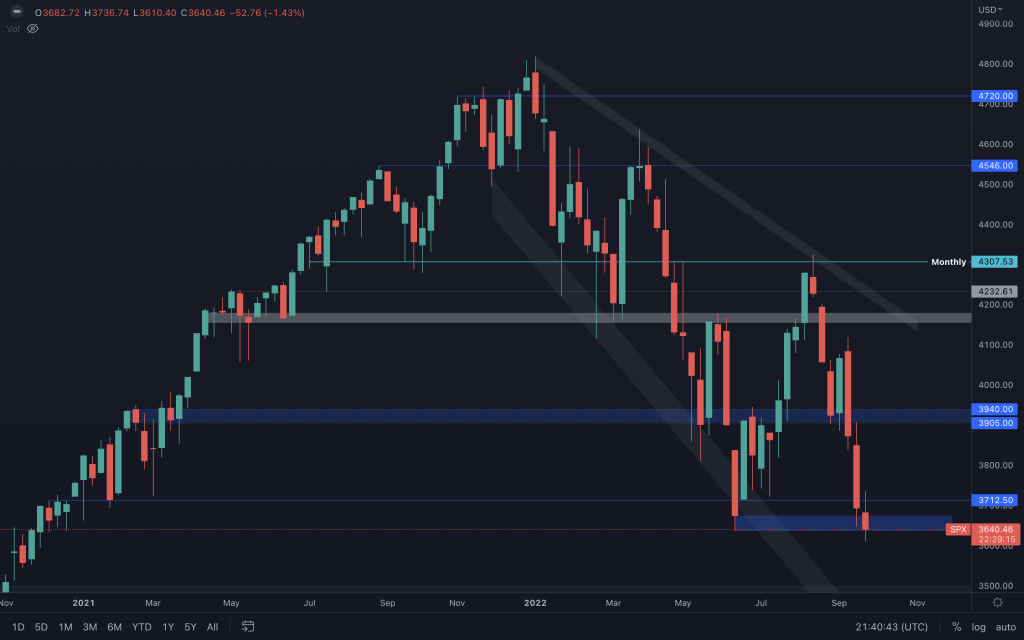

S&P 500 Index

Even though we've seen this index trading lower than June's lows, its closures continue to be within the support range, so it's too early to consider the level lost. What we need to see is a closure below $3640. Sure, it's hanging on by a thread, but there are several factors to consider.

Today will see the release of the U.S. Core PCE. You'll have heard us talk a lot about CPI lately, the most widely used measure of inflation/deflation, as it considers a wide range of goods and services. PCE stands for Personal Consumption Expenditures, which captures inflation/deflation across a wide range of consumer expenses. Core PCE excludes food and energy and therefore reflects changes in consumer behaviour regarding non-essentials. When people are more freely spending, it generally means that the economy is doing well. When they cut back on spending, it suggests that there may be economic issues or, in this case, that Quantitative Tightening is working. If these figures show a percentage of around 0.5%, it may indicate that the Fed has room to continue tightening concerning Core PCE.

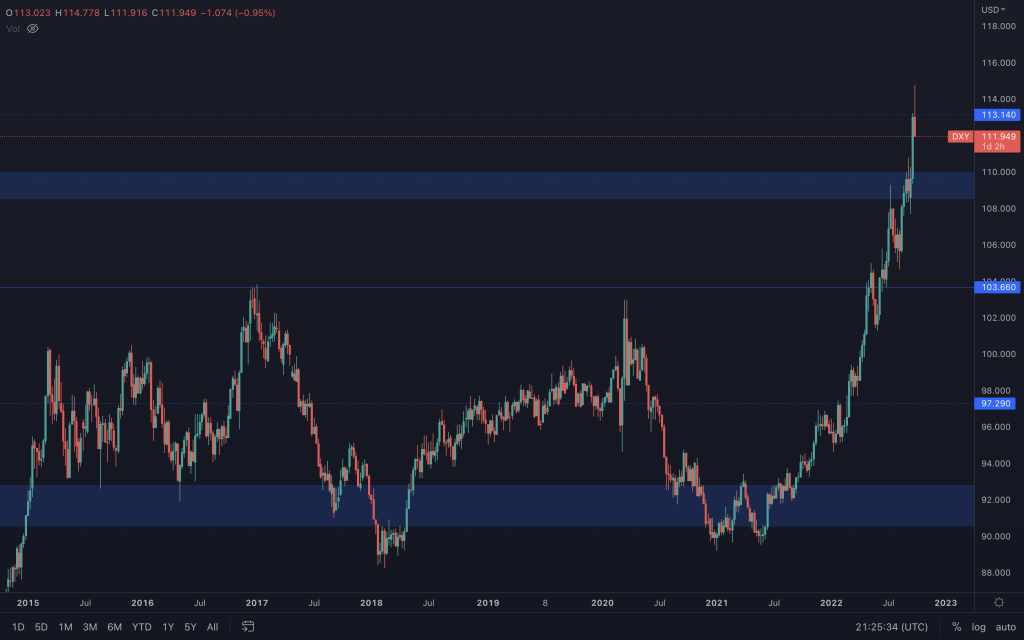

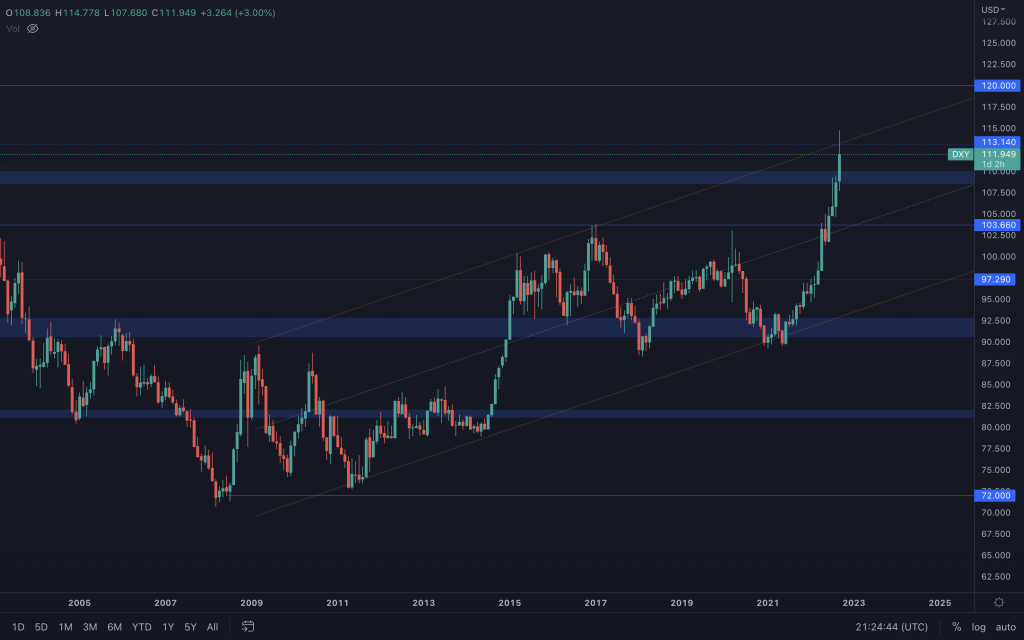

U.S. Dollar index (DXY)

Weekly chart

The U.S. dollar currency index is a chart we sometimes touch on in our videos but rarely include in the write-up. As some of you already know, this shows the dollar's strength relative to six other foreign currencies. DXY has been 'running hot' for over a year as investors have flocked to the world reserve currency in times of trouble, valuing capital preservation over capital growth. The weekly timeframe shows a rejection from one of our resistance levels around $113, so it's worth continuing to monitor this as Bitcoin, more often than not, has an inverse relationship with DXY. Whilst it doesn't immediately suggest a reversal is on the cards, it is at a significant point. Why? The monthly provides a better view of the channel (below).

We can see that DXY has now met the top of the channel, and with the weekly timeframe showing a possible sign of weakness, there is a potential of seeing some downside. We couple this with the fact that Japan has sold a large number of its dollar reserves to prop up the Yen this week, and now China is exploring a similar intervention for the Yuan. It's worth noting that the amount of its reserves being considered is currently unknown.

DXY Monthly chart

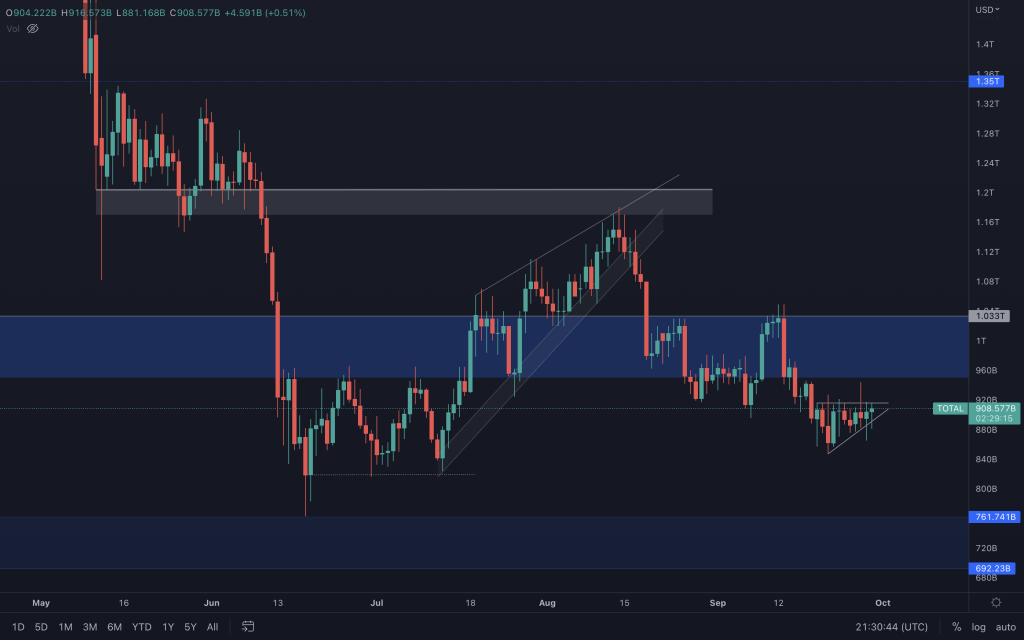

Total Market Cap

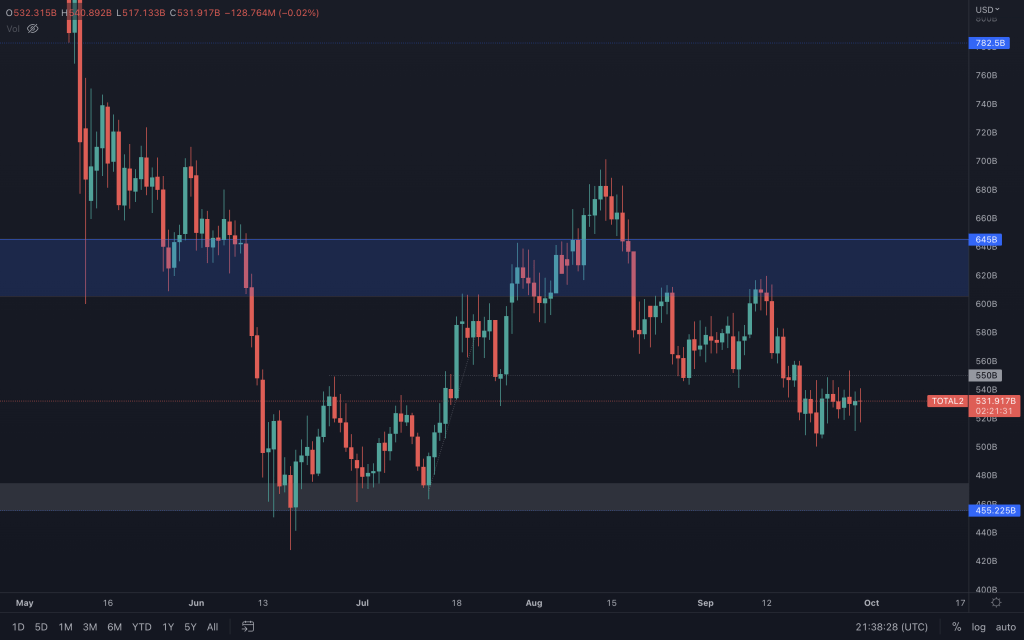

Altcoin Market Cap

There's no indication of a direction from the altcoins market cap. Whilst it sits just below $550B, there remains a greater threat of downside.

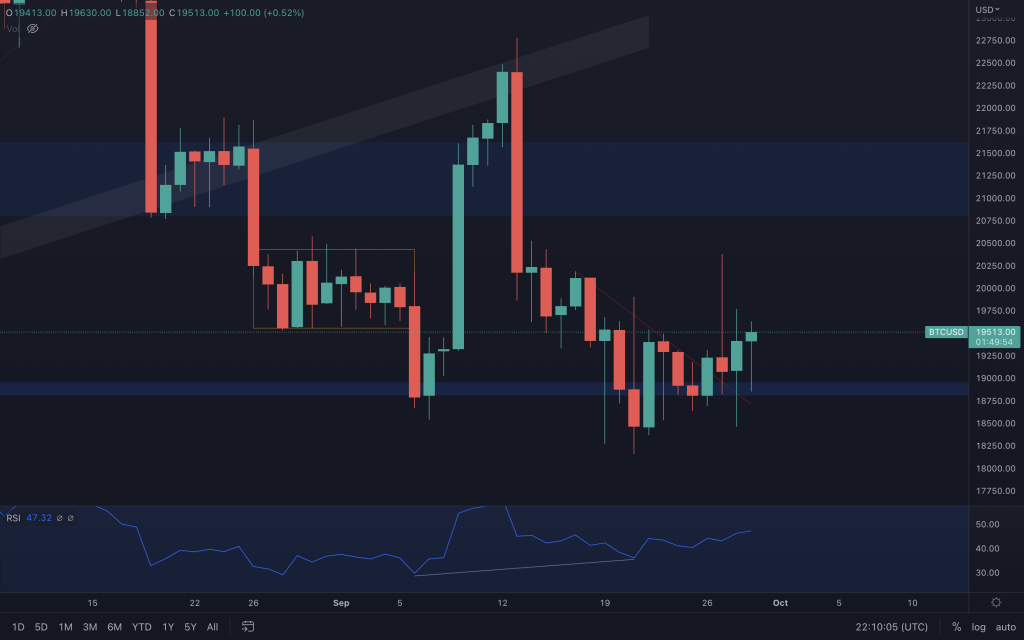

Bitcoin

Tomorrow, all eyes will be on the monthly closure, and the Core PCE data could play a part in price action, so we may see additional volatility again. The market hasn't performed too poorly since September is generally a red month. Some bullishness is trying to creep in as the price has maintained $18,800 as support, and there are longer downside wicks as buyers step in. We're not sure how many retests $18,800 can take, as you know by now what multiple retests of a support level do. But we can see bullish divergence on the RSI coupled with a break above the counter trendline.

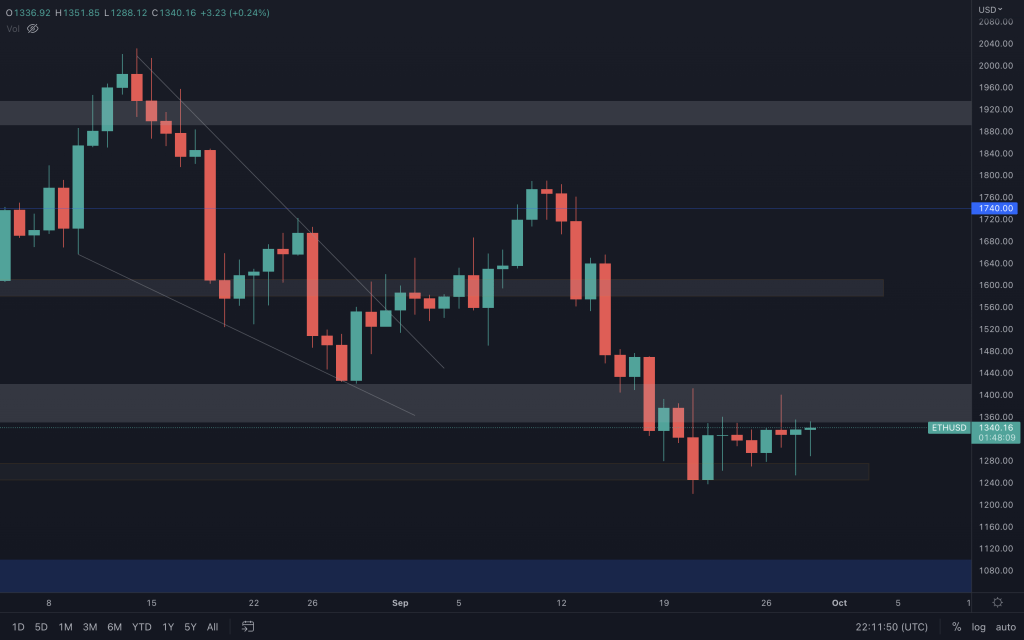

Ether

Ether's price action has been limited to a relatively small range. Identifying a break from this range should indicate ETH's next direction.

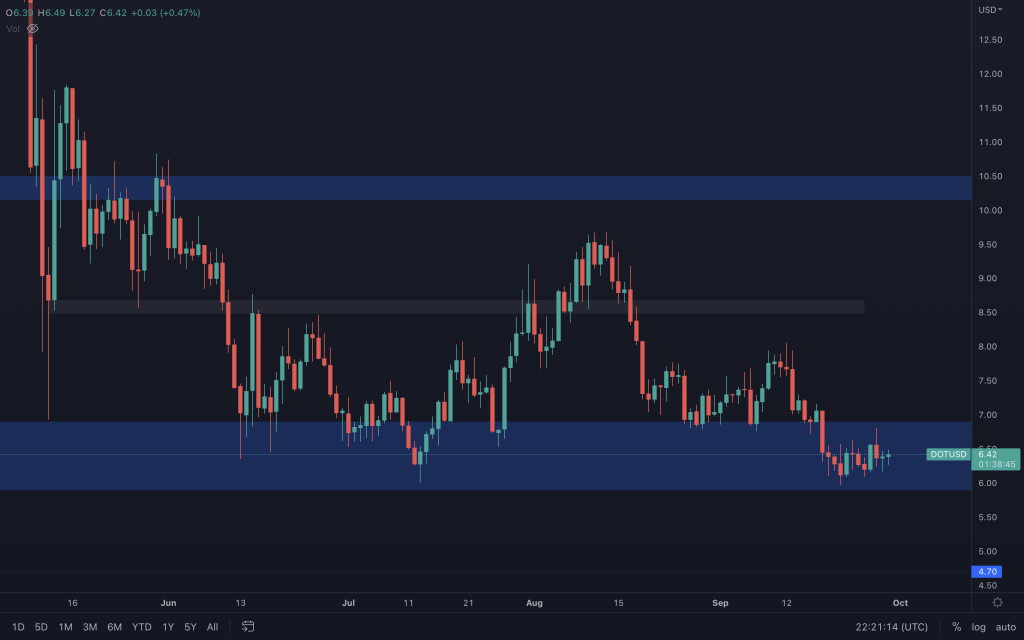

Polkadot

Polkadot is in a similar situation to ETH, where it is stuck inside a range. It's seen two bullish engulfing candles to aid price up, so buyers are present, but it's still in the range. Reclaim $7 or lose $6. That's what we're watching for.

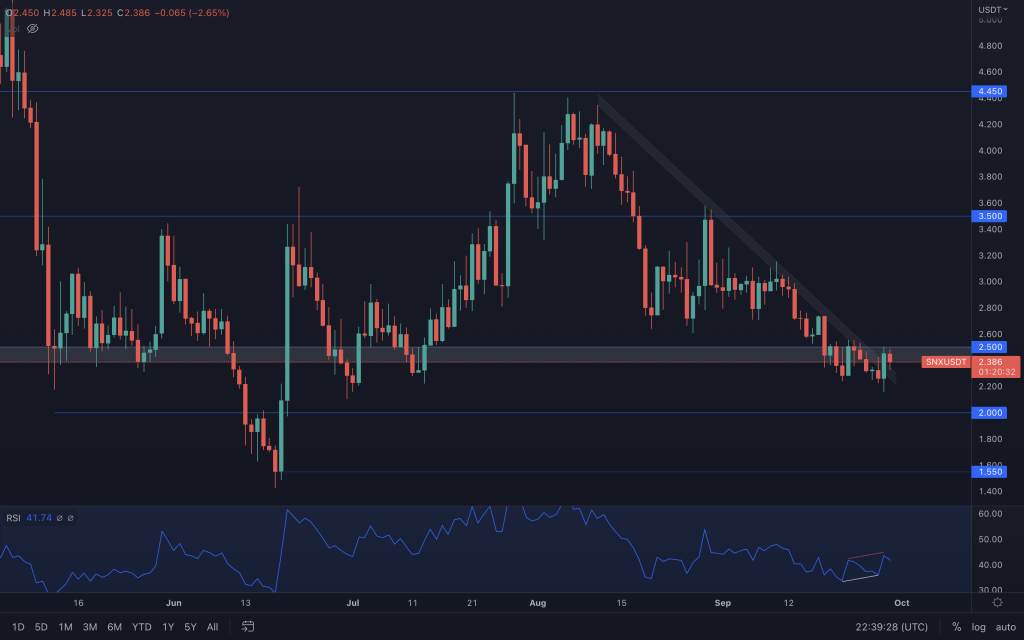

Synthetix

It's worth watching SNX here. It's achieved a break of the counter trendline. At first, the RSI agreed with the break with a bullish divergence, but now it's showing a bearish divergence. So, we'll let the price action do the talking. The daily counter-trendline has been broken, but SNX is still below $2.50. If it can achieve a closure above $2.50, $3.50 is back on the table. A clear rejection from here and $2, even $1.50, is in play.

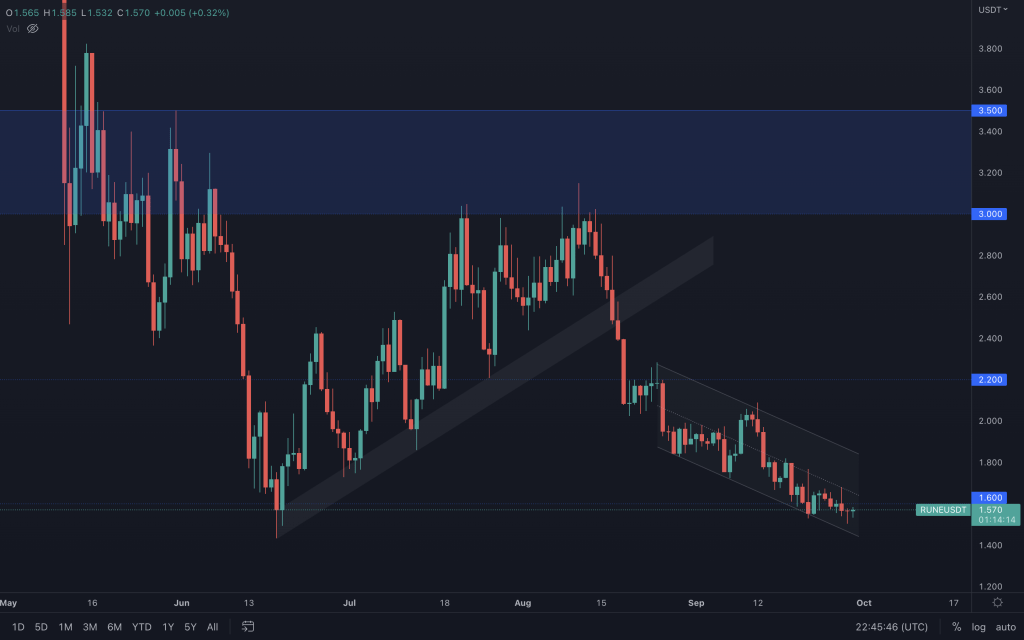

THORChain

RUNE continues to move down within the channel. It's come close to testing the weekly support, so it's worth looking out for a reversal. Right now, though, RUNE doesn't look particularly strong.

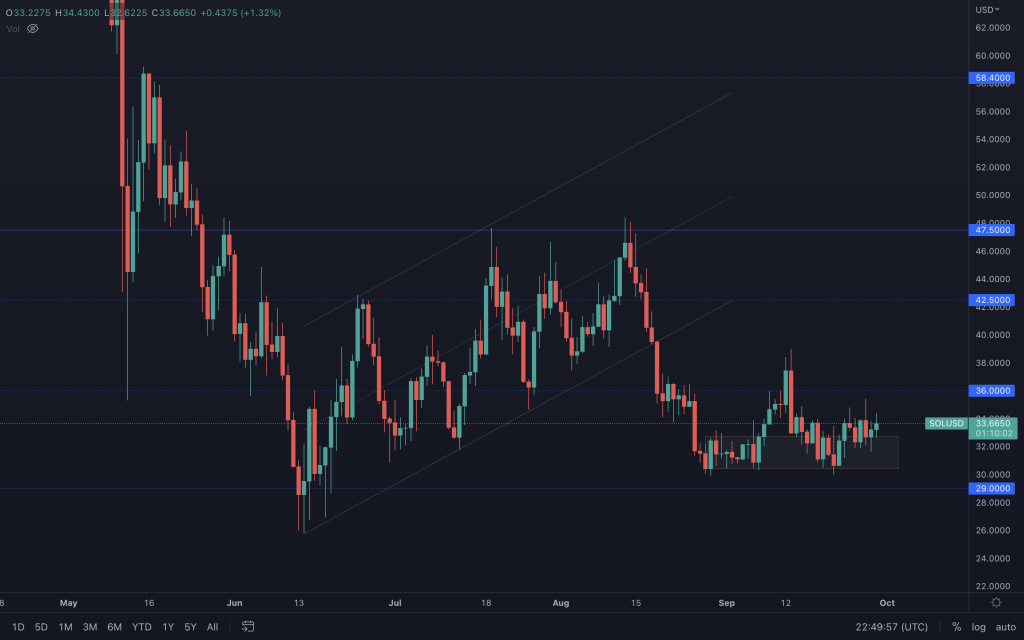

Solana

Solana still has the potential to move up from here as SOL/BTC can also support positive price action. Of course, this considers that the majors also maintain their crucial support levels.

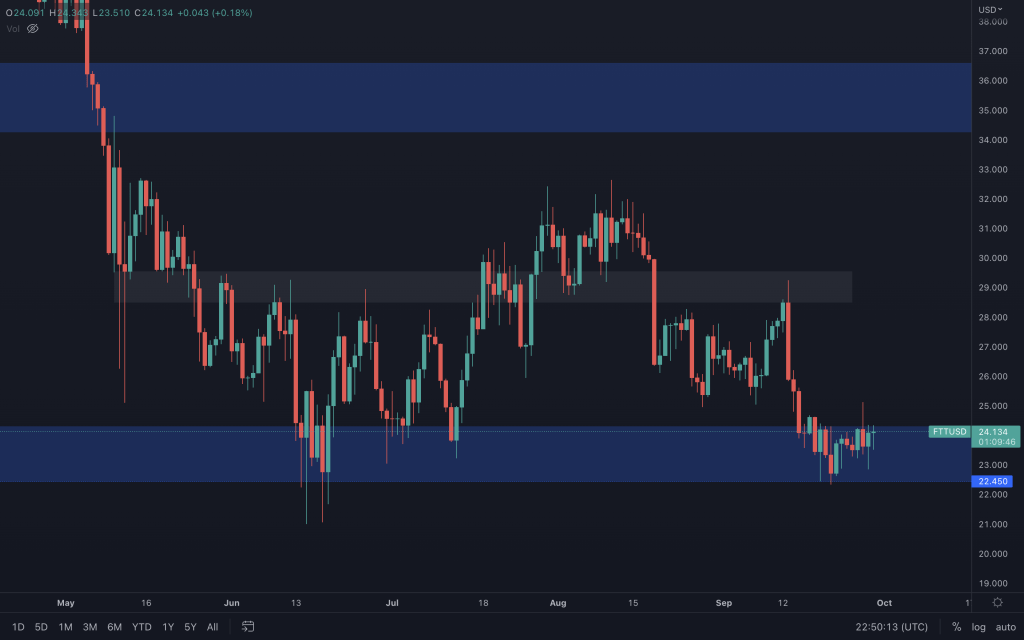

FTT

FTT is another one of those stuck in a range. $22.45 has offered support multiple times and is yet to be lost. It's having a tough time getting back above $24.30, but reclaiming it should help it see further upside moves.