Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Good Thursday, CPro fam. This week has certainly been a rollercoaster of emotions for those invested in crypto and, most certainly, with funds stored on FTX. We hope you've come out of it relatively unscathed or as well as you possibly could have. As for the future of FTX, we don't know. That's in the hands of the FTX team and any potential creditors. Sam has said that FTX has the assets to pay its users, but it's not instantly accessible funds. Let's hope he's telling the truth here. Also, they will be holding raises over the next week(s). There will likely be volatility for days/weeks as the true story and situation unravel. And it's a story that we'll keep each one of you up to date with. The initial impact of the news breaking was sheer panic across the board, but FTX hasn't completely disappeared, for now. Deposits are halted, as well as any withdrawals. However, Sam is exploring his options. Whilst that's the case, there's still hope of limiting any lasting impact across the market. Will FTX pull through? We don't know. Of course, we certainly hope so, if only for the traders with funds locked up on the platform. If this is achieved, we must then consider investors' fallout. What effect will they experience? Another area of uncertainty. This is all but over. What it will drive, though, is users demanding to see an exchange's audited proof of reserves. Another option - De-Fi. In the meantime, ensure that you store your funds on a Ledger. This is the only way that you have complete control of the assets you hold. We even have our Ledger tutorials here and here.I'm going to go with a little twist this week and reduce the assets covered in the write-up but include a little on-chain metrics from our very own Tom Capsey.

For the remaining assets, simply watch the video.

Video Analysis

On-Chain Market Indicator Metrics

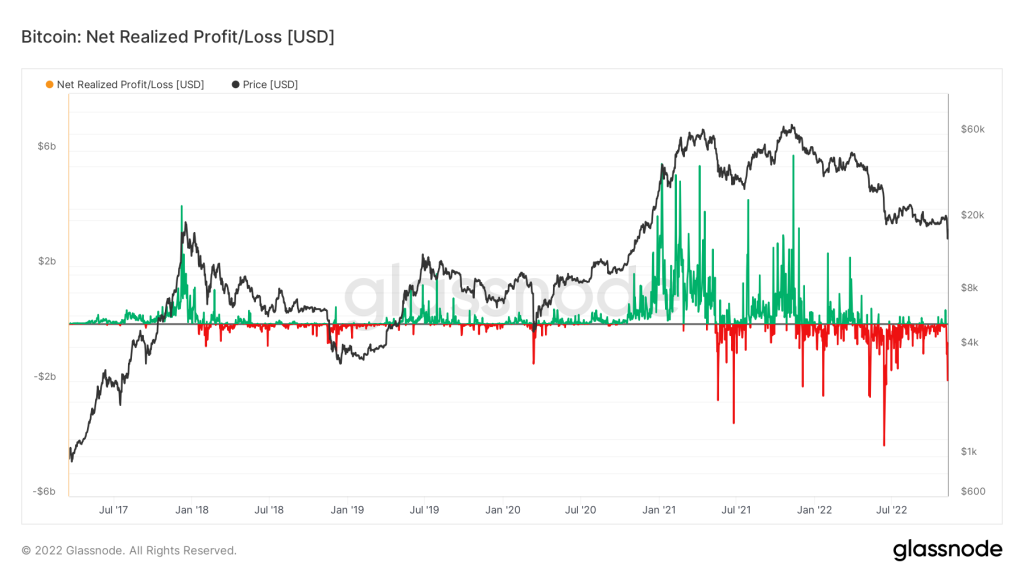

Metric 1 – Net Realised Profit/Loss

Capitulation events have defined latter-stage crypto bear markets. We can see that the last 48 hours have seen some significant loss-taking from investors.

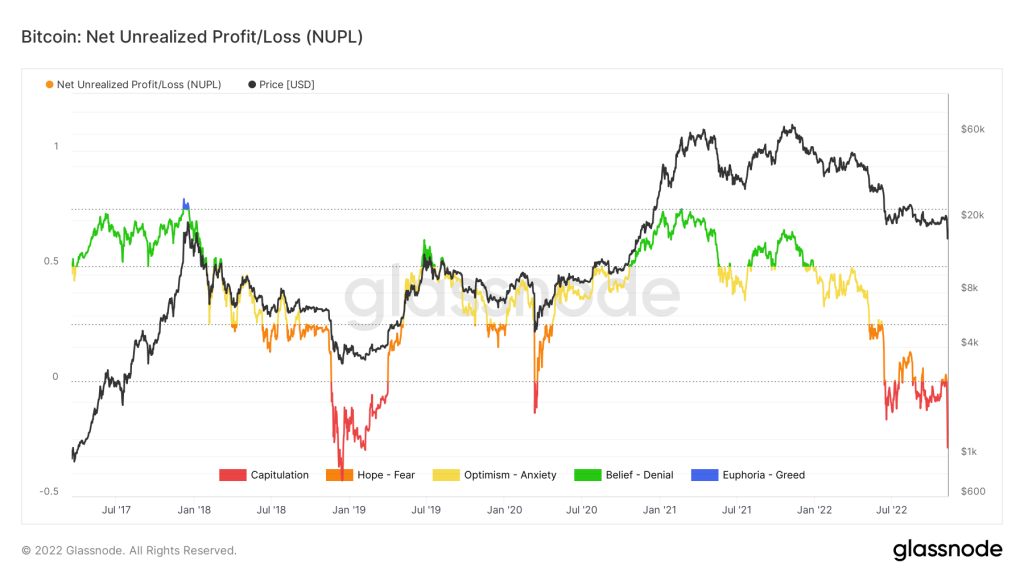

Metric 2 – Net Unrealised Profit/Loss

The Net Unrealised Profit/Loss also shows that investors have been plunged into significant unrealised losses, not seen since the late 2018 crash, where Bitcoin lost 50% of its value in 4 weeks. We may see a further move down, but these metrics suggest that Bitcoin is in deep value territory.

Metric 3 – MVRV Z-Score

The MVRV Z-Score shows when Bitcoin is over or undervalued relative to its "fair value". The green zone has historically been an excellent place to accumulate Bitcoin, as seen by the late 2018 crash and the 2020 covid crash. This metric has once again reached its lowest value since December 2018.

Technical Analysis

Dollar Currency Index

With today's CPI print coming in at 7.7% (YoY), lower than the expected 7.9%(YoY), an instant reaction in the decline of DXY is taking place. Don't forget, the level we're watching to ease an element of price suppression is 108.

S&P 500 Index (SPX)

This index is usually correlated with the crypto market. Of course, the FTX saga has seen a decoupling of sorts. Nevertheless, its price action will reflect in crypto on the calmer days. With CPI coming in lower than expected, investors instantly saw the light at the end of the tunnel with regard to a Fed pivot/rate hike freeze. Whether or not that happens remains to be seen. However, it resulted in an instant pump into resistance. SPX needs to close above $3,940 to indicate further relief across stocks. Lower timeframe weakness may see $3,700 tested again, but the CPI data should be viewed as positive news for the markets. One thing to note is that we have one more CPI release (December 13th) before the next FOMC meeting (December 13th-14th).

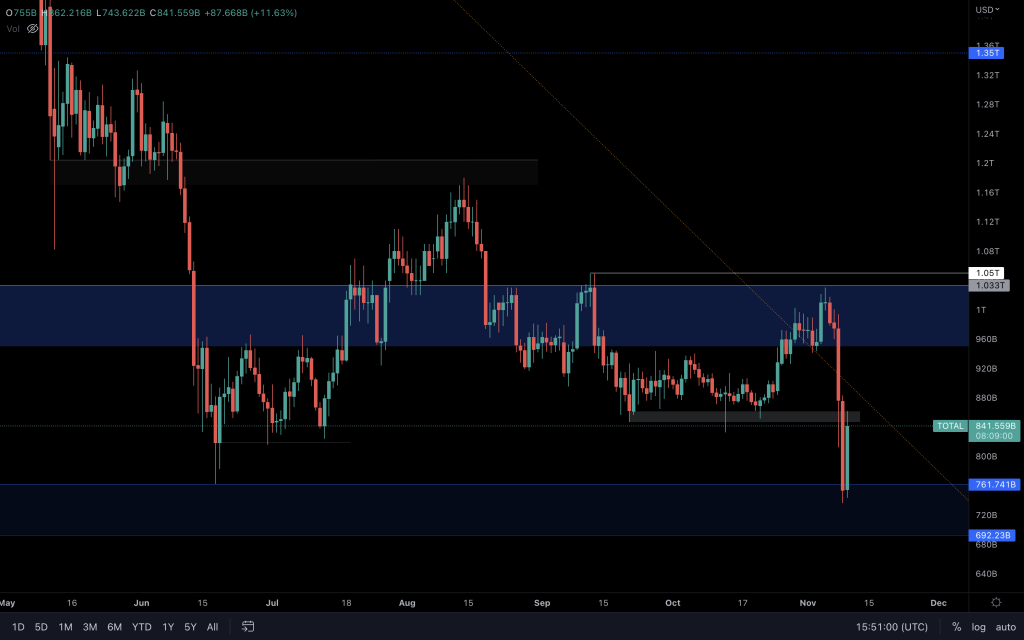

Total Market Cap

After briefly dipping below the highs of 2017/2018, the Total Market Cap quickly recovered today after Sam's Tweet and the positively viewed CPI. However, this could still be temporary as questions remain regarding the FTX situation and the funds it says it has. Expect this situation to be fluid and the market to react as and when details emerge. The Alameda dip has only been partially recovered to date, and the Total Market Cap is still in the bearish zone, only retesting $860B as resistance. If $860B is recovered today/$850B by the week's closure, it lends itself to an interesting week. If not, a retest of the lows is possible and with that comes a threat of the market dipping even further.

Altcoin Market Cap

I promise I won't write about FTX again. It's fair to say that yesterday's closure didn't look great for altcoins, but The Total Market Cap, BTC and ETH all hung onto their respective supports. With the quick recovery of $475B, additional downside below $455B has been invalidated. To see altcoins recover further, $510B needs to be reclaimed.

Bitcoin

In short, BTC needs to reclaim $18,600 for the more extensive range moves. Higher timeframes continue to display a bearish market structure, with yet another low created yesterday. It wasn't far off a retest of the old counter-trendline, stopping at our intermediate support before retracing upwards. It is sitting in an awkward region between $15,770 and $17,600. Only lower timeframes will help to identify any weakness incoming as price action here has been minimal.

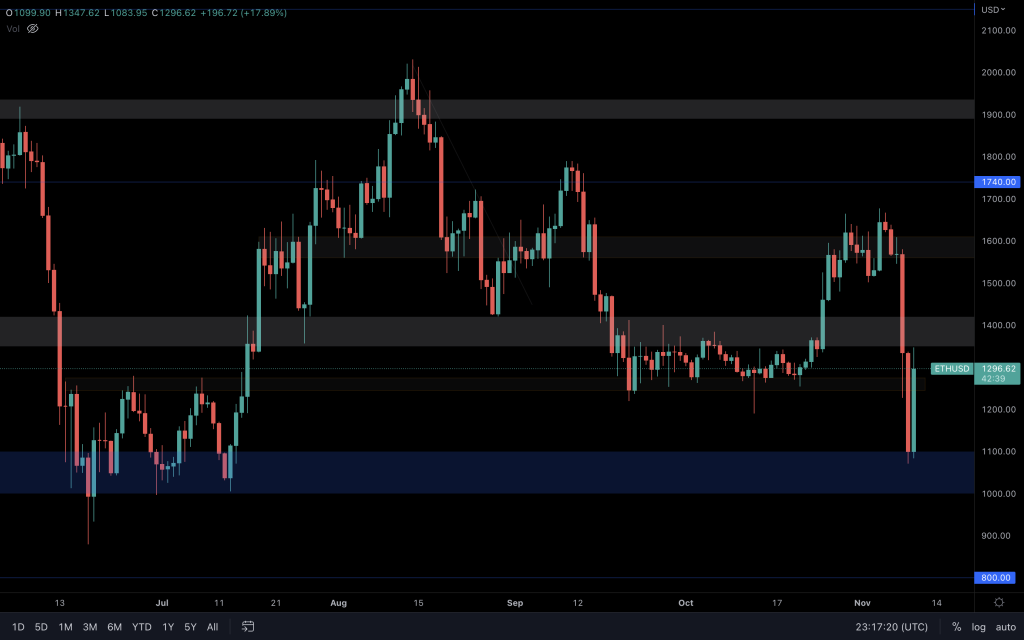

Ether

Ether came down to retest our significant support range yesterday, as expected. With the rest of the market correcting very quickly, today has seen a complete range move, with Ether sitting right back in the old tight range it found itself in for over a month. In keeping with Ether's overall bearish market structure (lower highs), this level should be a resilient resistance as long as closes remain below $1,420. Again, lower timeframe market structures will help identify weaknesses in today's move up.