Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Video Analysis

[embed]https://youtu.be/IuUTFjNoMWQ[/embed]Technical Analysis

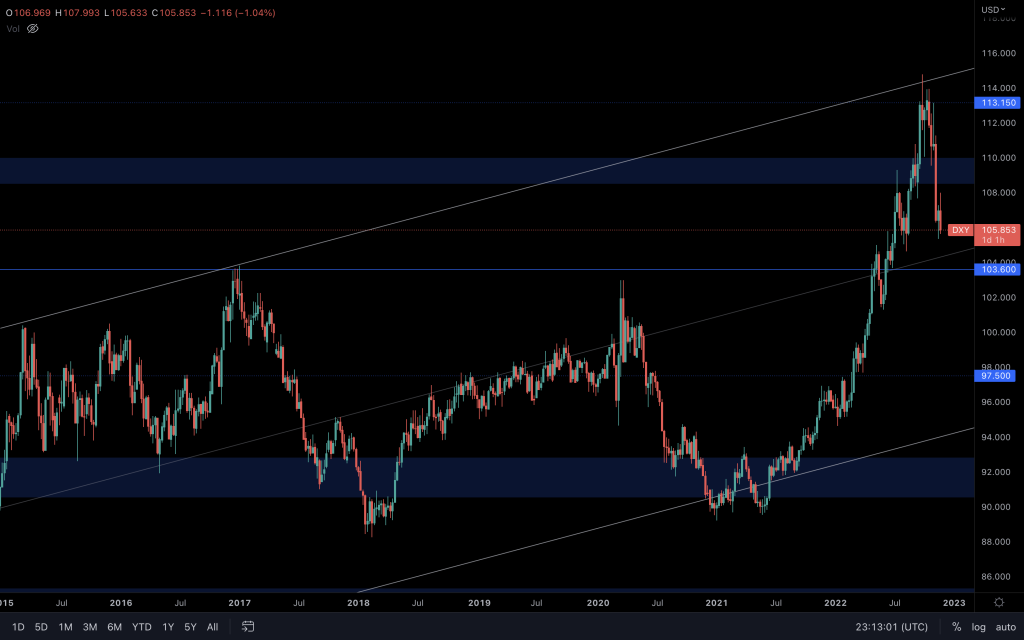

Dollar Currency Index (Weekly chart)

After a move towards resistance, DXY fell slightly short (as mentioned in last week's video may happen). Should the week close like this, we expect a retest of $103 next, easing downward pressure on the market.

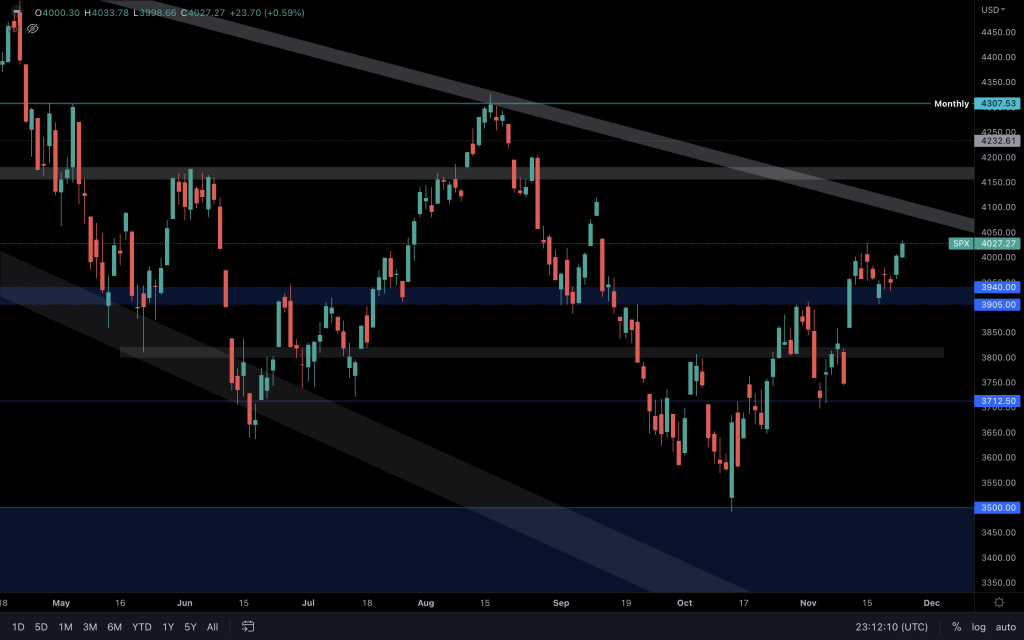

S&P 500 Index (SPX)

SPX has continued to push up after retesting support. A test of the counter trendline remains the likely route, which would tie nicely in with DXY's decline.

Total Market Cap

The Total Market Cap index is seeing relief, but it's off the back of weekly and daily lower lows. The daily timeframe doesn't signal strength from support, so I'm wary of the sustainability of this move for now. However, the weekly closure may provide clarity. The index currently sits at a mid-point of its daily range, where it is worth monitoring action for a flip of this level into support where we could look to $850B next or rejection and retest of the lows.

Altcoin Market Cap

With higher timeframe supports left visible in this chart, it's clear that the Altcoins Market Cap is living on the edge after making consecutive daily lower lows below $455B, with its weekly closure doing the same. For any chance of further upside, $475B needs to be reclaimed, but it only leads us to $500B-$510B in the short term.

Altcoins Market Cap (exc Ether) Log. Chart

I haven't included this chart before, but it helps to show how close altcoins (exc. Ether) are to a 50% loss. Bearish market structures are intact, and it will take time to change that. But it's a level that is worth monitoring for a show of strength, even though we're yet to see that. If the above three charts align and lose their respective supports, we should be prepared to see further downside. Eyes will be on the monthly closure next week.

Bitcoin

After showing indecision yesterday and failing to advance, Bitcoin remains at the mid-point of its range. Above $16,800, Bitcoin should be able to push up into resistance. But, with the daily chart still bearish, we'll still need a loss of $15,770 to indicate the next downside move.

Ether

Similar to Bitcoin, Ether is mid-range. Closing above $1,220 should see Ether push towards its range resistance. A lower timeframe rejection here and a loss of $1,170 should take it back to support.

Polkadot

It's another lower high for DOT, keeping $4.70 on the cards.

Synthetix

Yesterday's Gravestone Doji points to SNX retesting support once more. A loss of $1.70 on the lower timeframes would support this.

THORChain

RUNE needs to close above $1.23 to have its next impulsive move upwards. Until then, it's simply ranging between $1.10 and $1.23.

Synapse

Synapse ranges between $0.74 and support. Above $0.74, we can expect a $0.90 test. The bearish pressure is still evident, and SYN has yet to show the same strength at this support as its previous visit.

Solana

Although not accompanied by increasing volume, SOL is back above the weekly $14 level. Although a positive move, it's not in the clear as the bearish market structure remains unaffected at the moment. This is another asset where the weekly close could provide clarity.

Serum

There was a very little fight between buyers and sellers as Serum dropped below $0.74 with hardly an increase in volume. I'm watching this ascending triangle for a breakout to indicate its next direction. The current range is $0.12-$0.48.

MINA

MINA continues to trade between the supporting trendline and $0.58. The market structure has remained bearish since falling into this range, so we should continue to expect retests of support until it either breaks or indicates strength.

dYdX

There was no quick reclaim of $2.20. In fact, dYdX experienced a sell-off. It has now created a daily bearish market structure which suggests that $1.50-$1.60 will be retested soon.

Stargate

STG needs to reclaim $0.465 before we can begin to look at positive price action. With the low-volume slow grind up, we should expect $0.465 (if met) to offer rejection.

Lido

Lido is at a pretty simple stage. Being mid-range, we need to see it lose $1 or close above $1.30. The weekly chart points towards higher odds that we'll see lower prices.