Layer-1s are leading the wayWelcome to Multi-Format Thursdays where we analyse the cryptocurrency market in both text & video formats.

Bitcoin

Let's wind the clock back and review what has been happening on Bitcoin since August.

Price bounced hard off of the $30,000 key level, crossed $40,000 and came back for a retest that then propelled it to $67,000. Now BTC is retesting $60,000 as support after a breakout and the market structure is obviously bullish as it consists of higher highs and higher lows. For those reasons, we are expecting further price discovery in the coming weeks.

Ether

ETH has flipped $4,200 from resistance into support. We remain positively bullish on it while awaiting for $10,000 as long as $4,200 holds.

DOT

DOT is in price discovery and $50 is now acting as support. Parachain auctions are kickstarting soon and they will swallow large amounts of DOT only to lock them up for ~2 years. Price discovery and supply reduction, what do we call it? Yes, we refer to this as a bullish outcome.

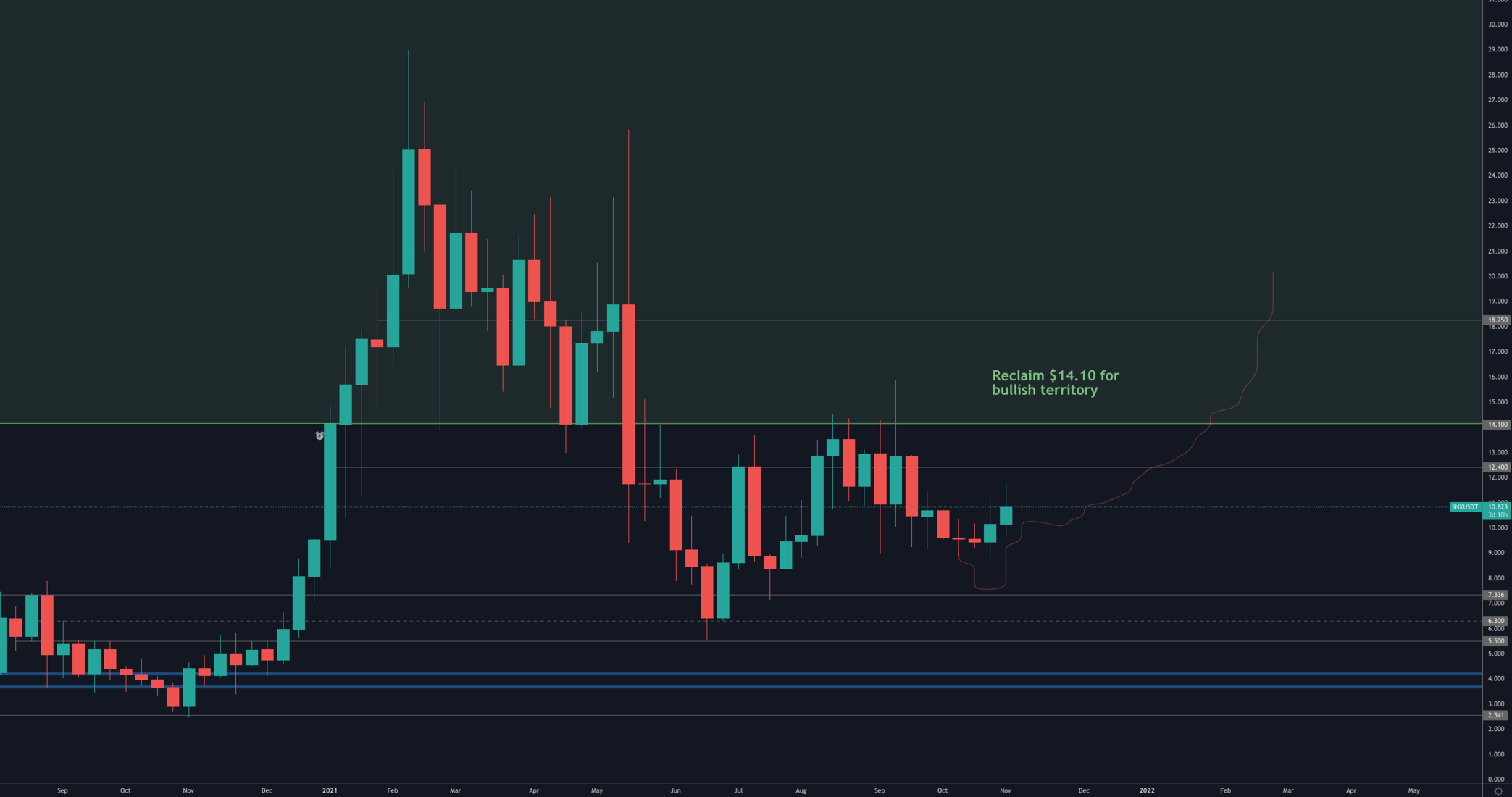

SNX

There have been no changes to our view on SNX, we are still awaiting one of the following events to peak our interest:

- $7.50 retest

- $14.10 weekly reclaim

RUNE

RUNE reclaimed bullish territory with the weekly closure above $11.50 and we hence target the previous high now at $21. We expect the route to be a test of ATH, followed by a consolidation near $16.50 only to be continued by price discovery entering into the new year.

There has been an unfortunate event happening with the THOR IDO where Thorchain came back to the audience very transparently - we'll be posting about it in Discord by tomorrow evening as soon as fuller details are provided.

SOL

SOL is once again in price discovery and that maintains the doors wide open for $300.

SRM

SRM closed a daily candle above $8.50 representing a breakout. This must now hold for SRM to move towards $10.50.

MINA

Zero-knowledge proofs are slowly seeing increased interest around them which means that it would benefit MINA in the next few months. From a technical perspective, MINA remains under resistance which it must cross to put $10 once again back on the cards.

FTT

FTT has support at $60 which primes it for $85 and $100 - our targets for end of year.

DYDX

While we're targeting $36.50 by EOY for DYDX, in the short-term it must reclaim $18 to prove that the bottom has been locally set - otherwise it can fall back towards low $10s.