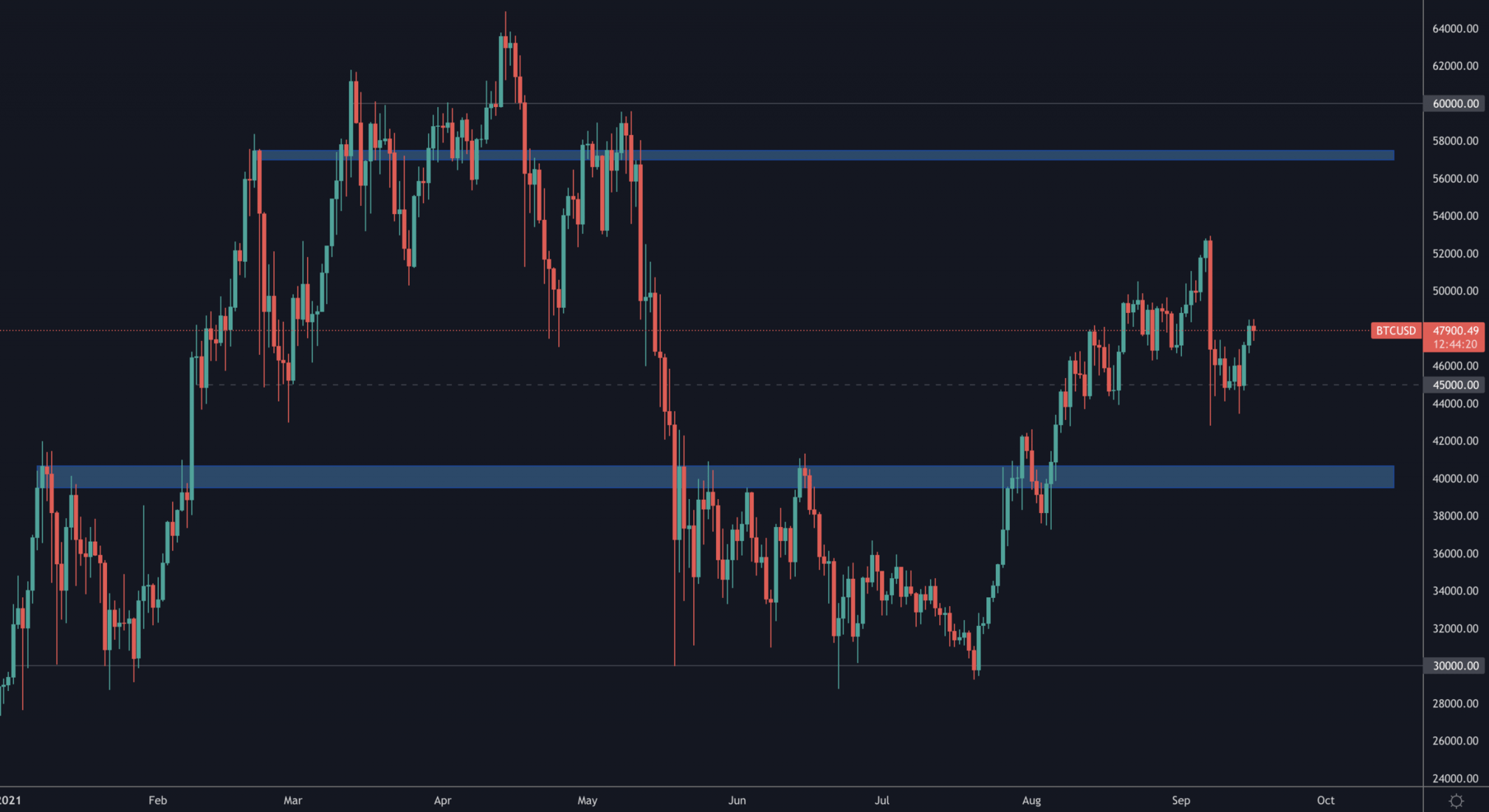

Bitcoin

Bitcoin held $45,000 and still has a $57,000 target. The break in bullish market structure gets invalidated by a daily closure above $50,000 which would increase the odds of the target being achieved.

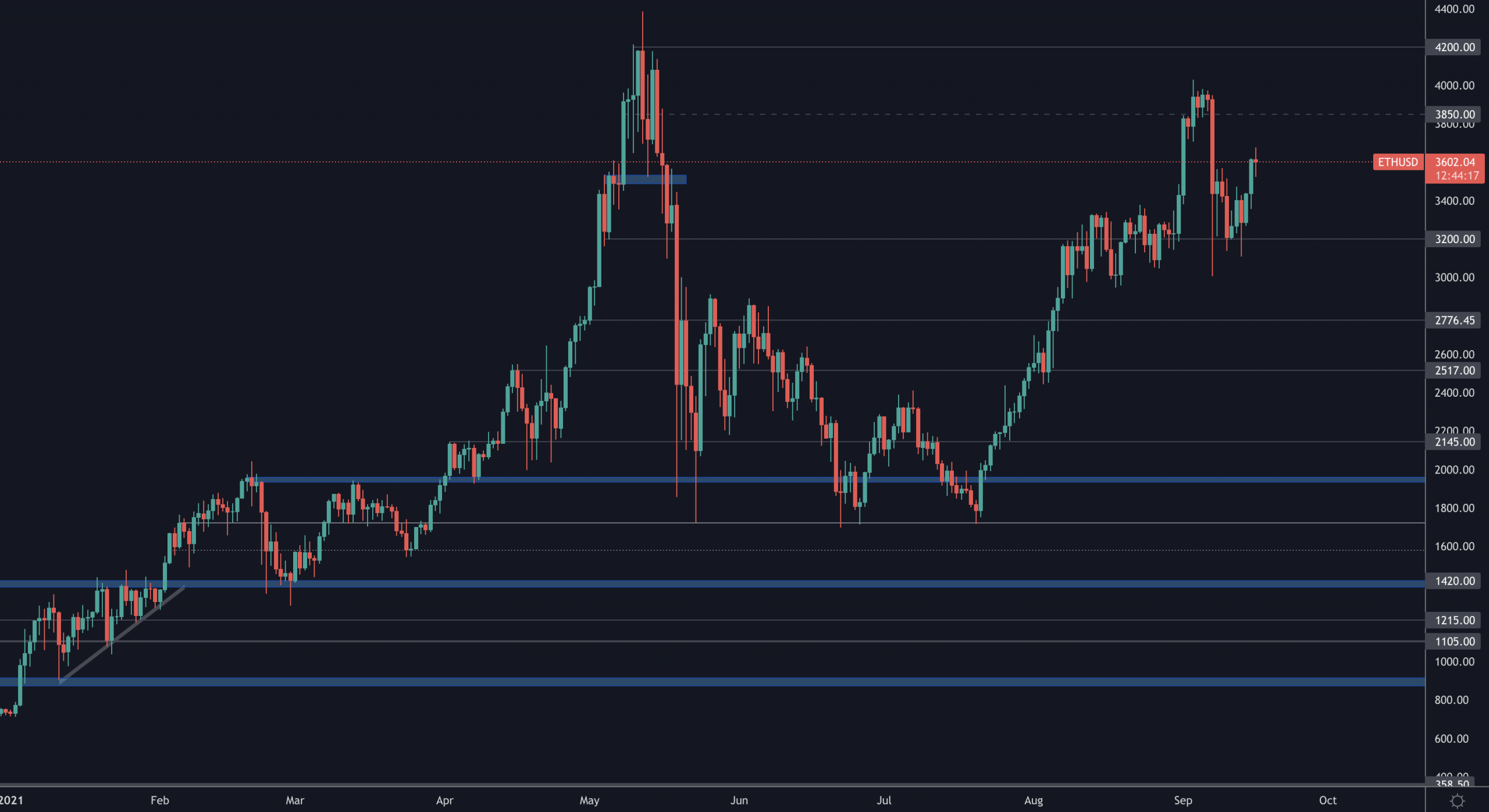

Ether

ETH on track as well. We simplified the process and stated that $3,200 holding as support maintains a target of $4,200.

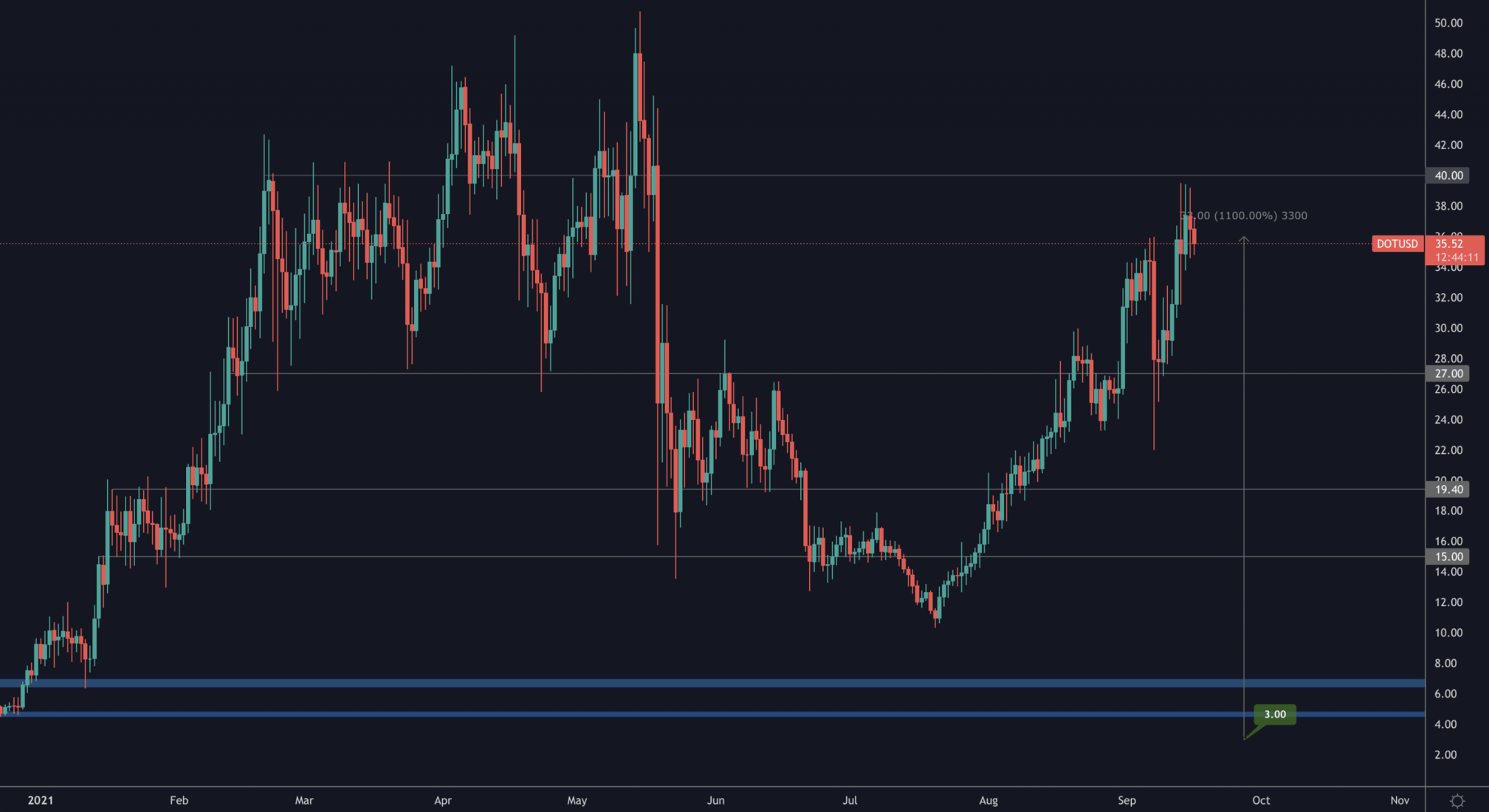

DOT

DOT keeps registering higher highs and higher lows - denomination of a bullish market structure. From here, $40 is resistance but a reclaim of is likely based on fundamentals (parachain auctions).

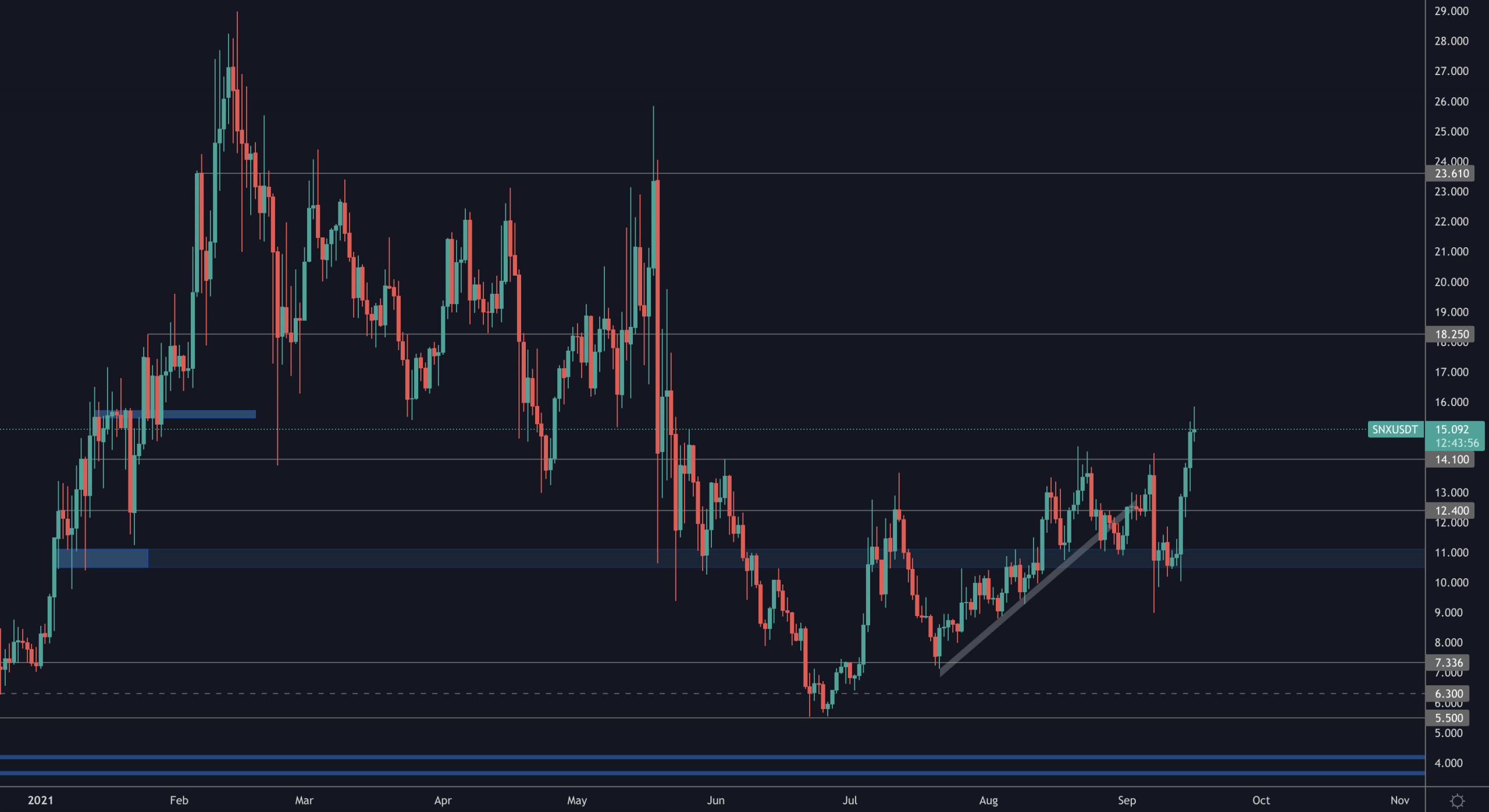

SNX

SNX finally broke through $14.10 which now changed the market structure from bearish to bullish and the next target sits at $18.25.

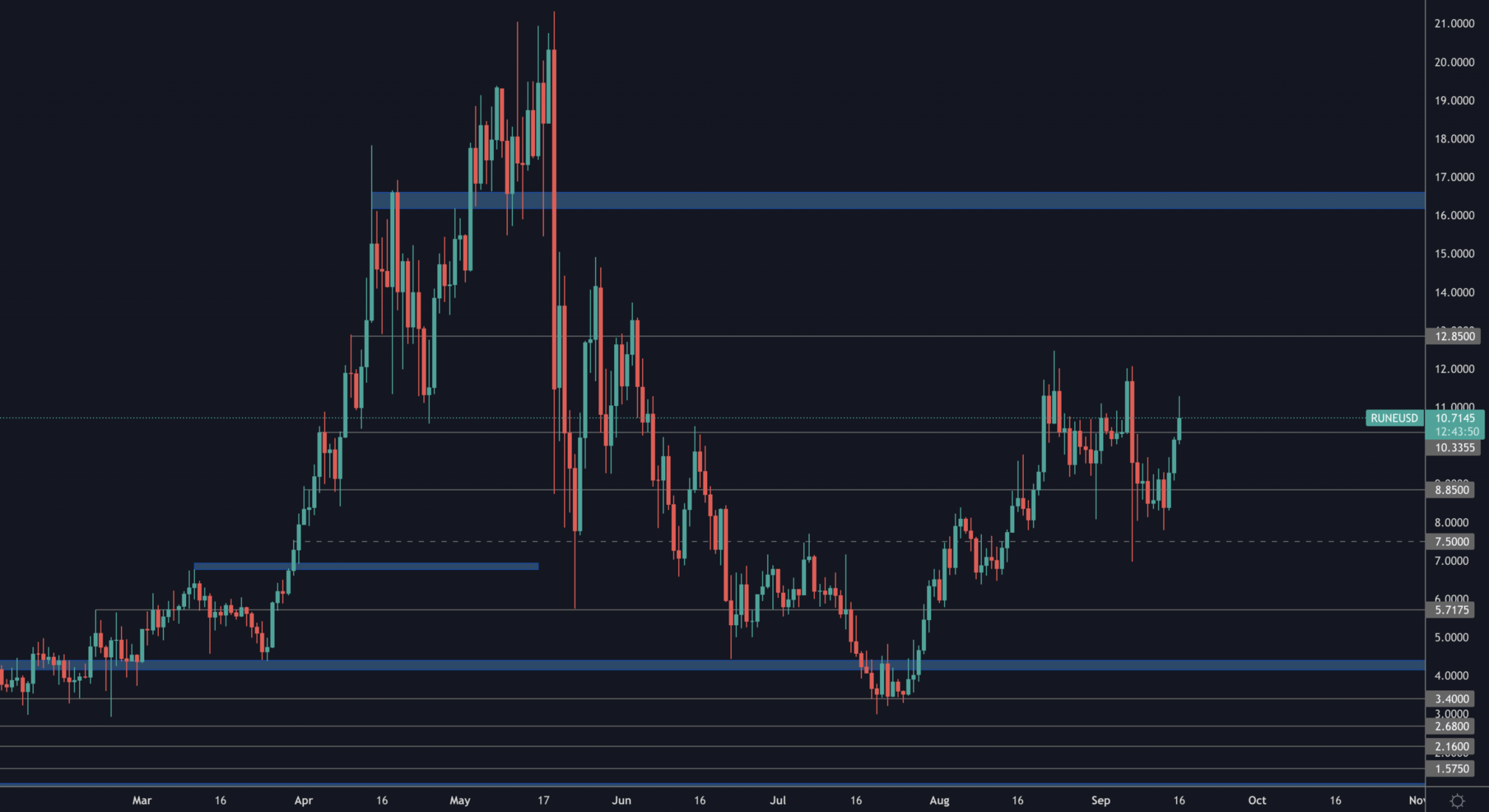

RUNE

Invalidation of the double top formation. If we see a reclaim of $10.35 on the daily timeframe then it'll be $12.85 time.

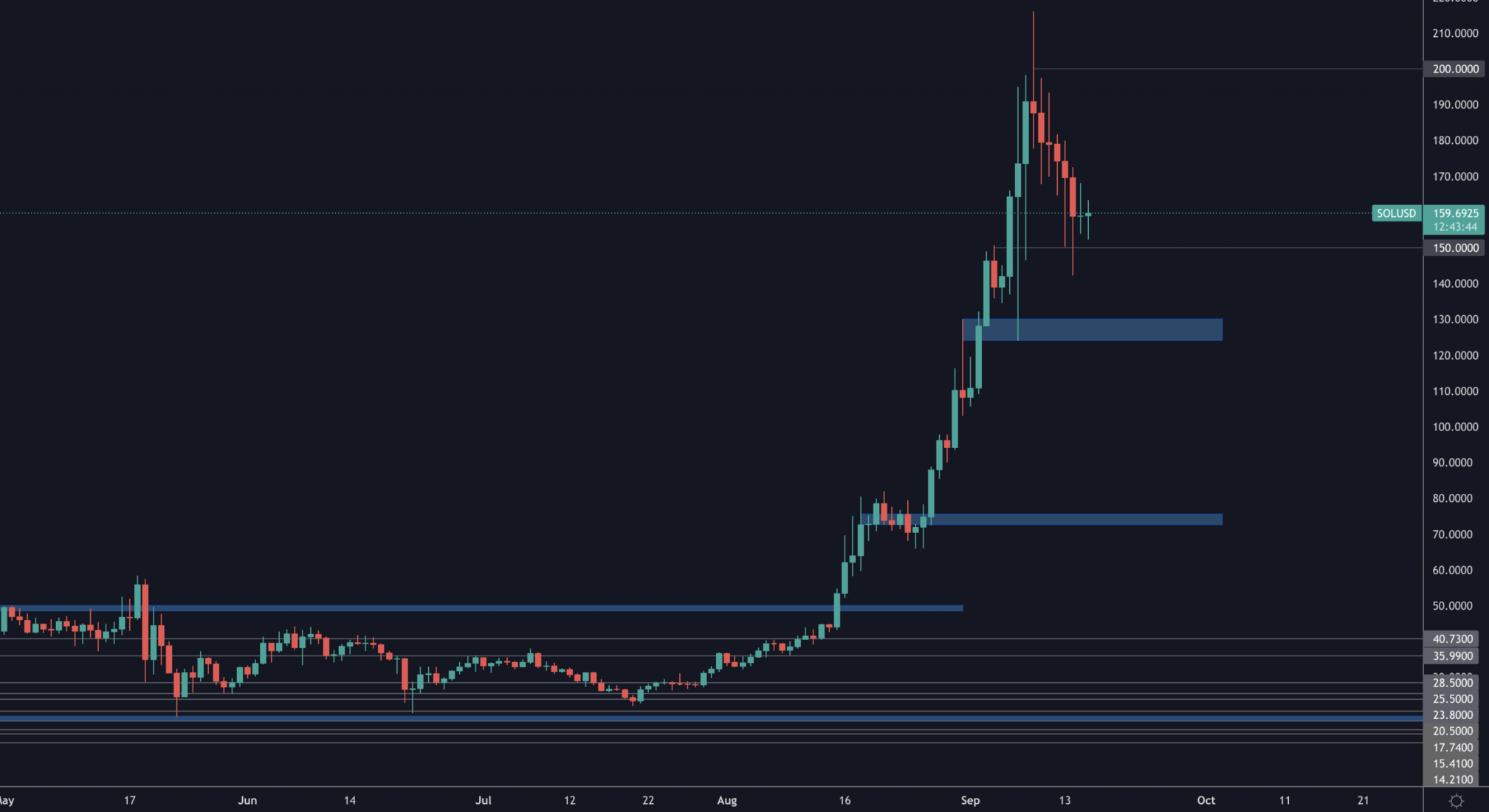

SOL

SOL ranging between $150 and $200 with the uncertainty pushed by the network halt a couple days ago - not uncommon in the novel technological world of blockchains.

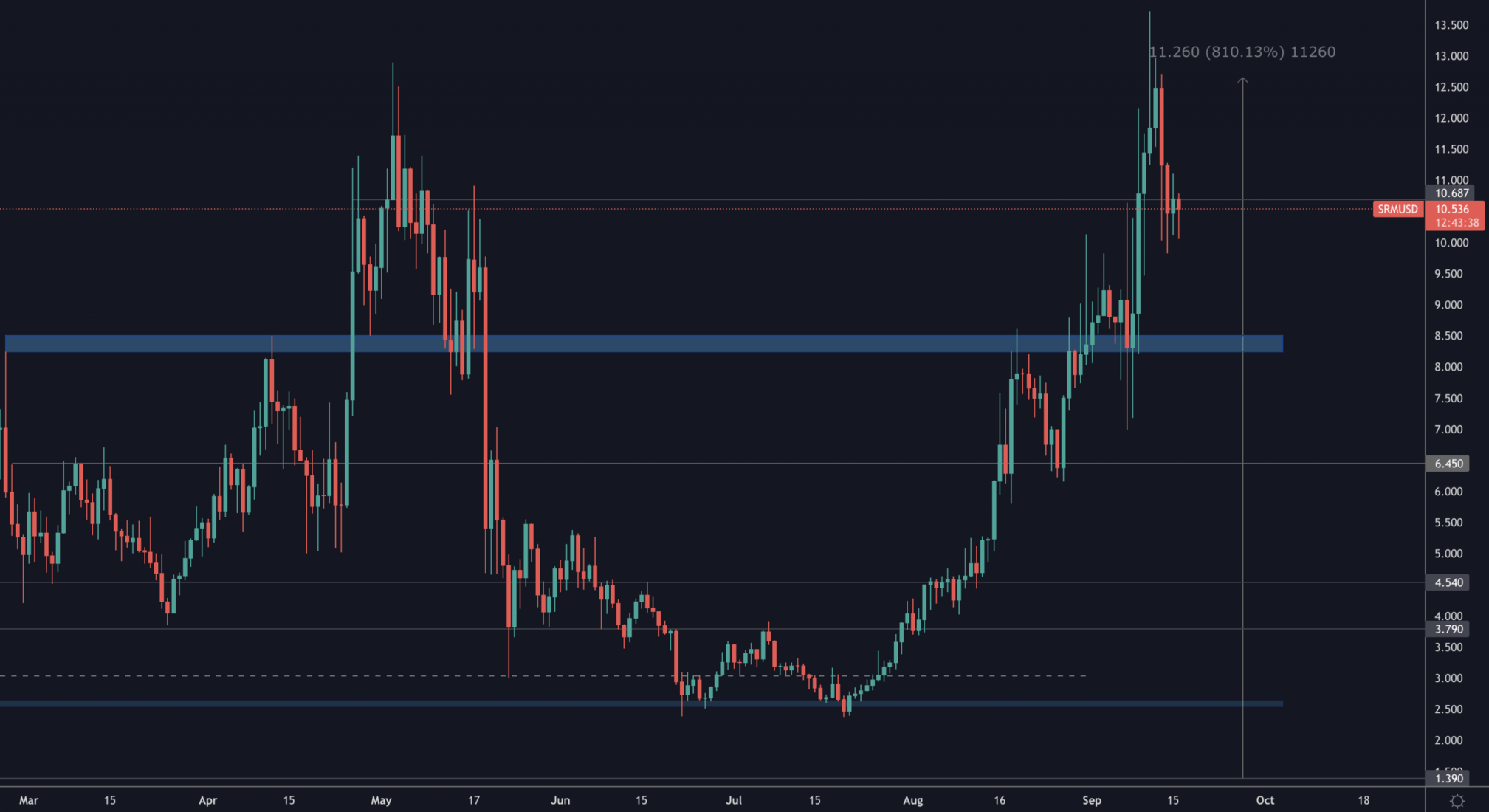

SRM

$10.50 must hold on the weekly timeframe for further price discovery with $15 & $20 targets.

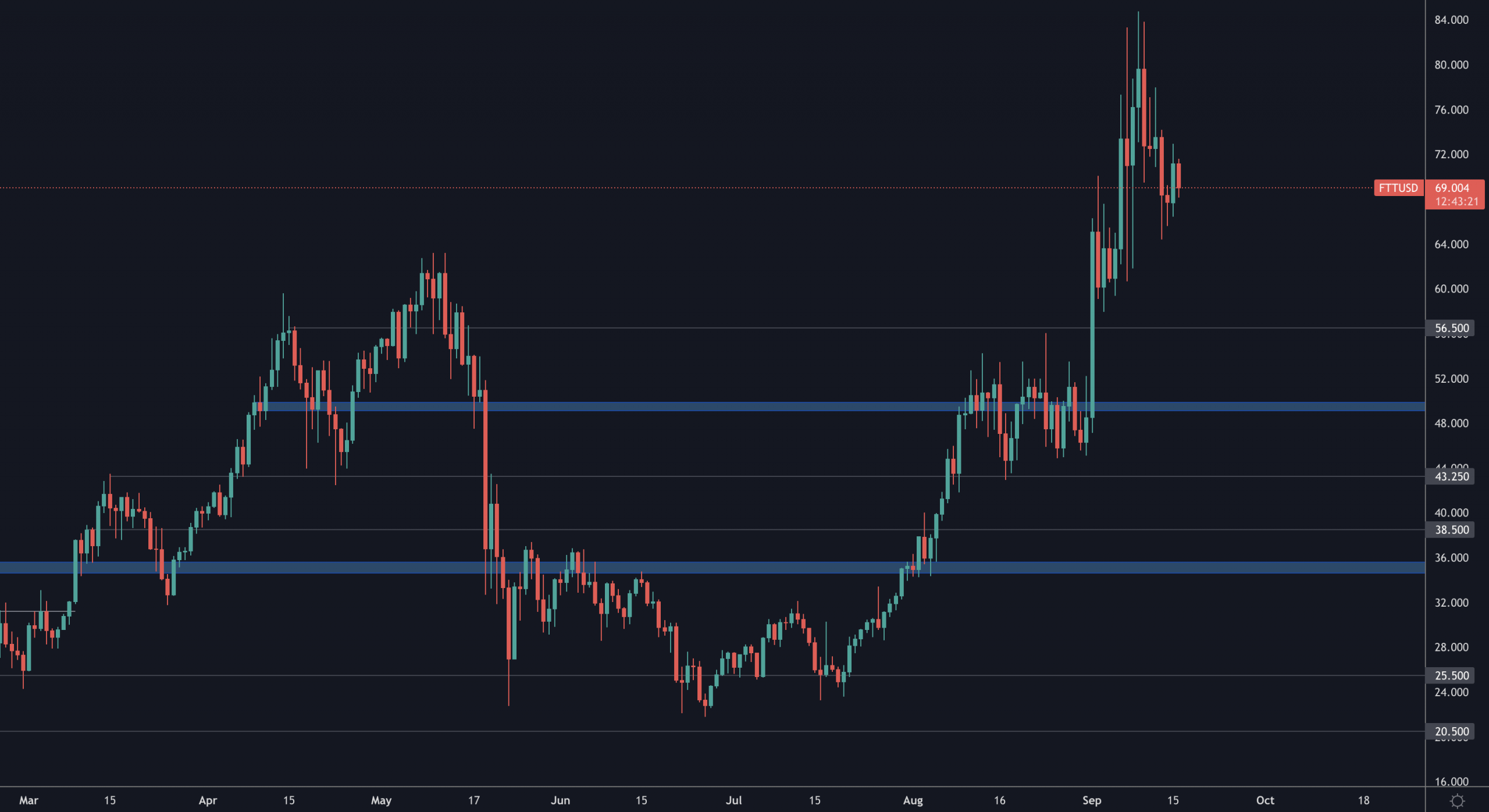

FTT

Very simple: $60 holds = price discovery with a $100 target.

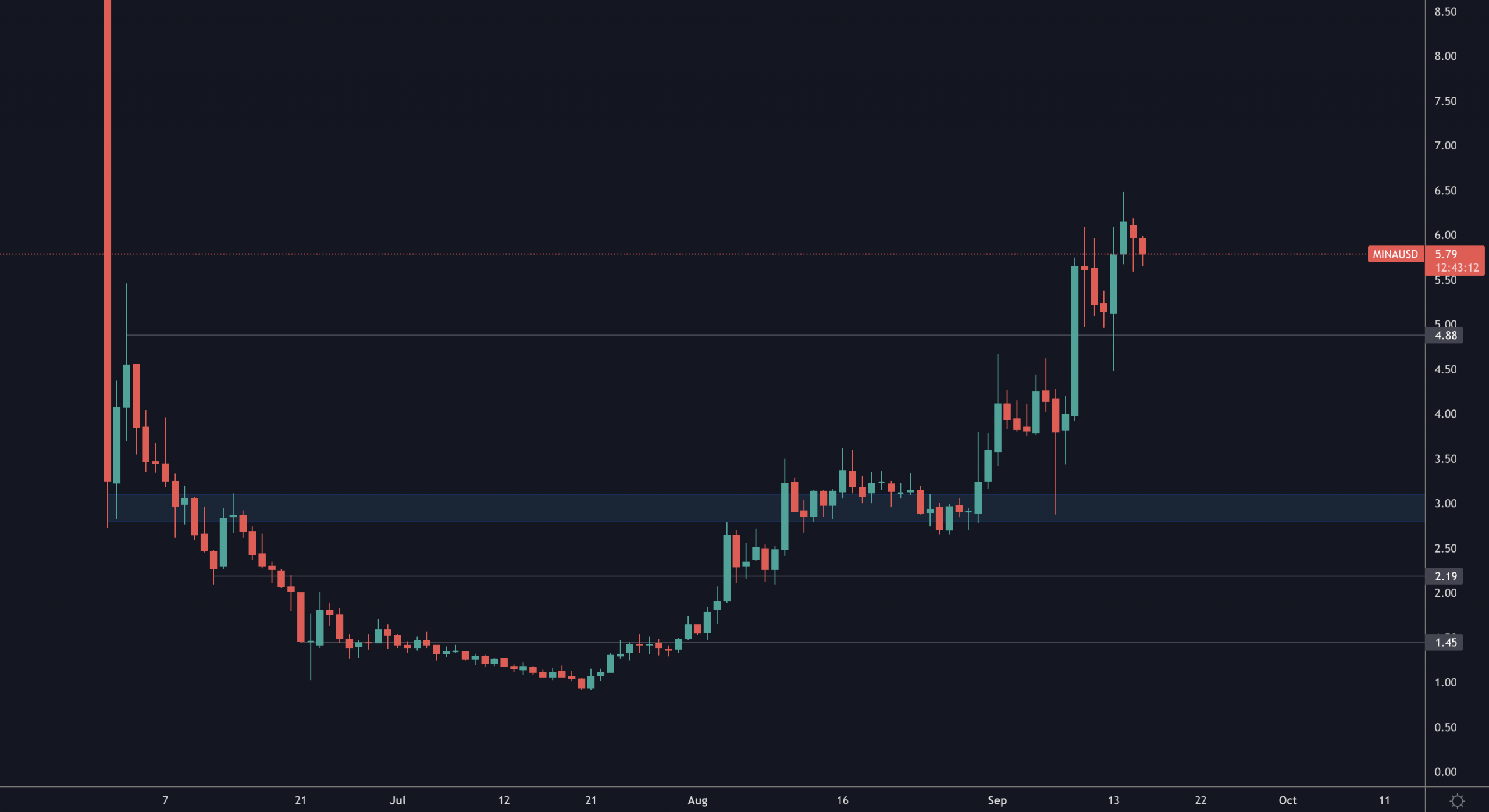

MINA

Higher highs and higher lows + support at $4.88 with a $10 target.

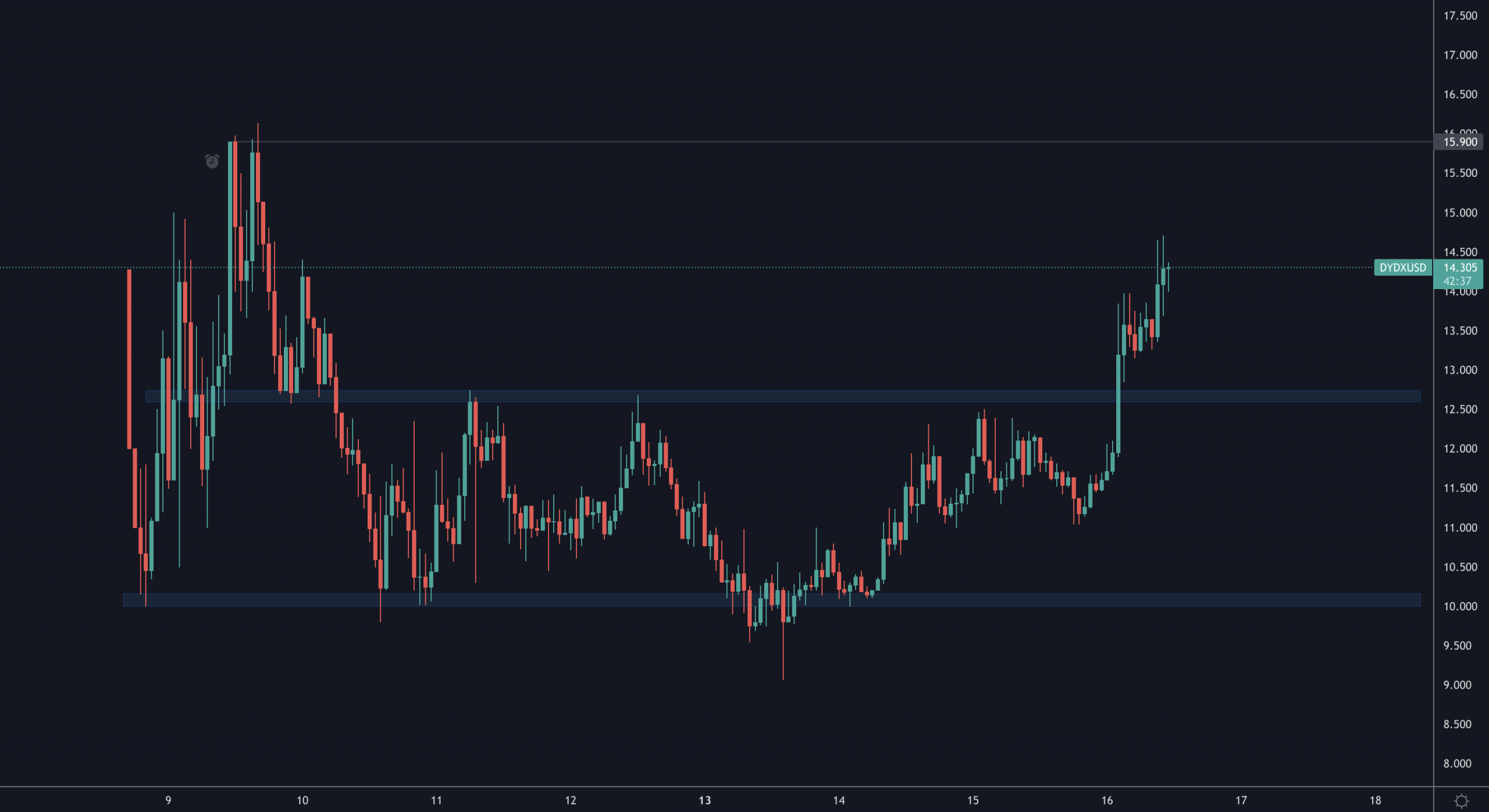

DYDX

Breakout from $12.75 with a target of $15.90 now. The latter is the last line the sand before price discovery and a re-rating.