Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

Funding Rate and Open Interest

From the chart above, we can see that the Funding Rate has once again turned negative. Ideally, we would want to see the funding rate turning negative for a sustained period, as this can suggest that we may be nearing the bottom.

Although we have seen a small number of positions closed, Open Interest remains near the all-time highs. This points towards the next significant move that Bitcoin makes being relatively quick.

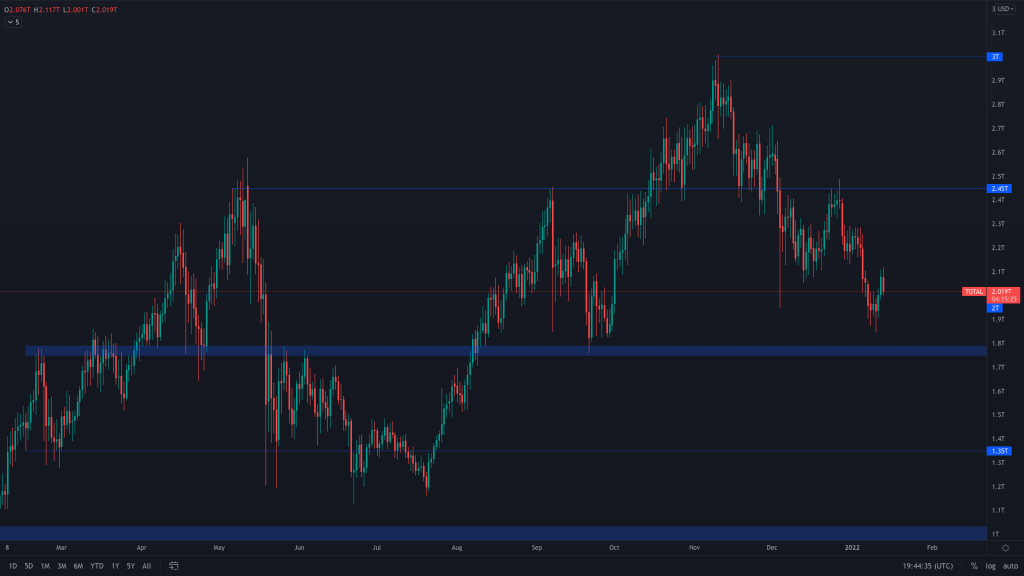

Total Market Cap

We have seen the continuation of lower highs and lower lows since reaching the all-time highs. Currently, this market structure is intact and has not indicated otherwise. Right now, we'd put a higher odds of the total market cap reaching $1.75T-$1.8T than a reversal from here. However, we will always continue to watch out for anything that suggests otherwise.

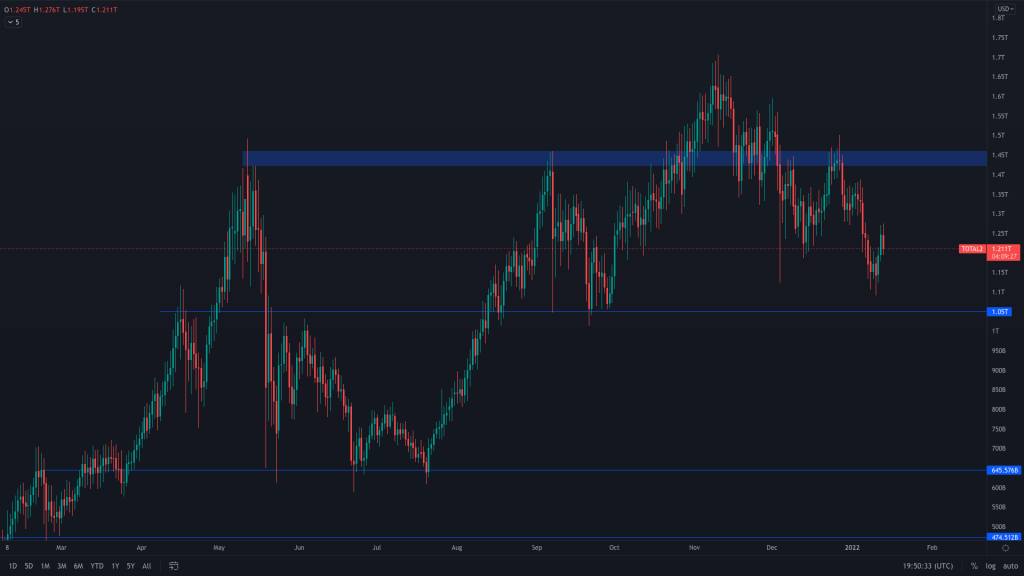

Altcoins Market Cap

The same can be said about the altcoins market cap, where we have continued to see the market move downwards. Should the Total Market Cap move to $1.75T, we will likely see this reach its support at $1T.

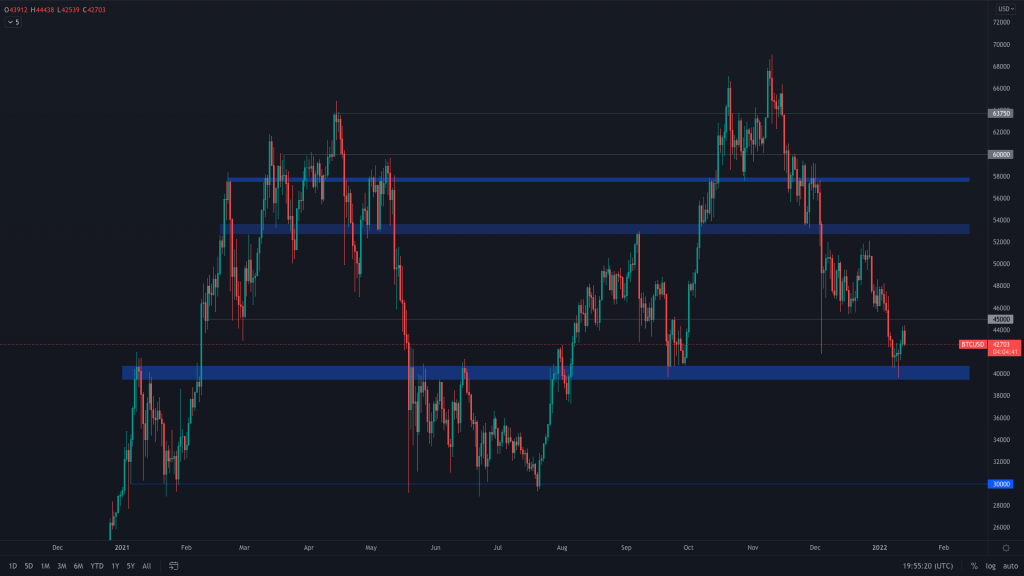

Bitcoin

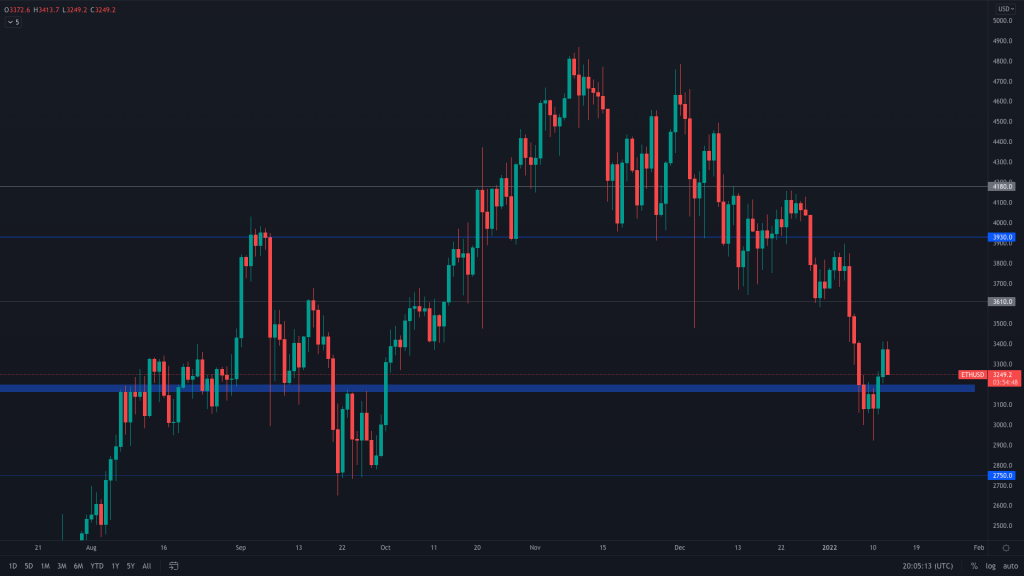

ETH

Ether remains in the $3,200-$3,600 range after making a solid move back into it two days ago. We'd expect it to continue to move up to $3,600 over the coming days. However, with the market being choppy, any sudden downward move by Bitcoin could easily see this support lost.

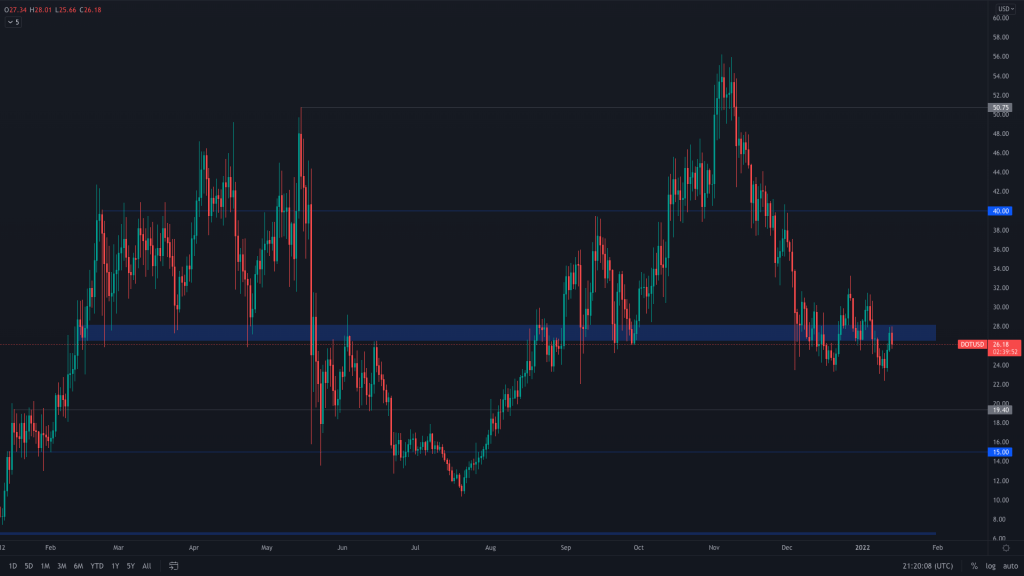

DOT

DOT's price action has been extremely choppy and indecisive around this liquidity area. We're back to testing the liquidity area as resistance but in a lower high/lower low structure. $20 is still on the cards for DOT unless we see a close above this region.

SNX

We've seen a significant rejection from $7.50, and we're still expecting further downside unless we see a reclaim of $5.50.

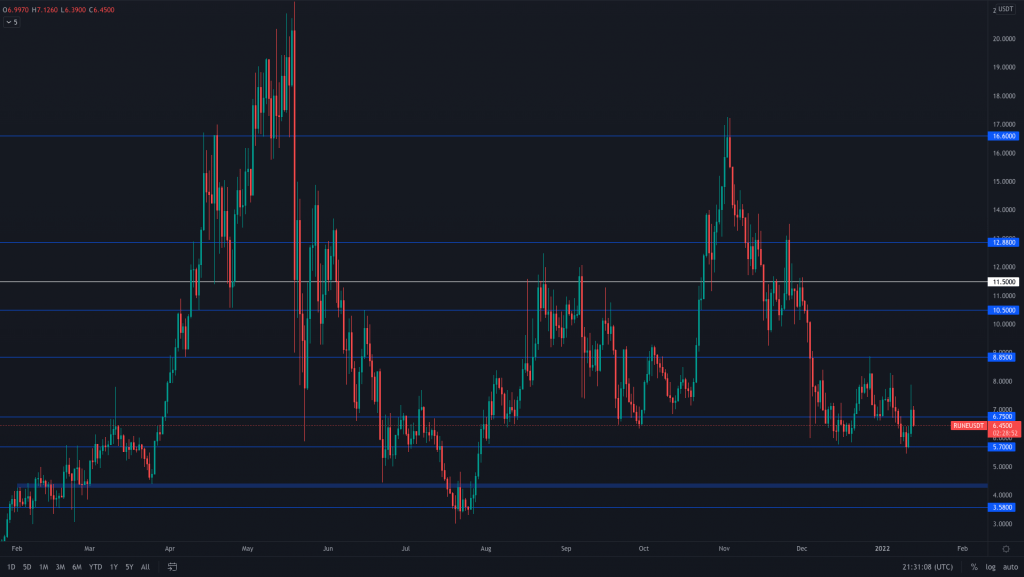

RUNE

We saw a closure over $6.75 yesterday, but we may not see this level respected with tonight's closure. We'll have to wait and see. But, should we close below $6.75, we may well see the price push back down to $5.70, and we will have to see how well that level holds with the price here, making lower highs and lows too.

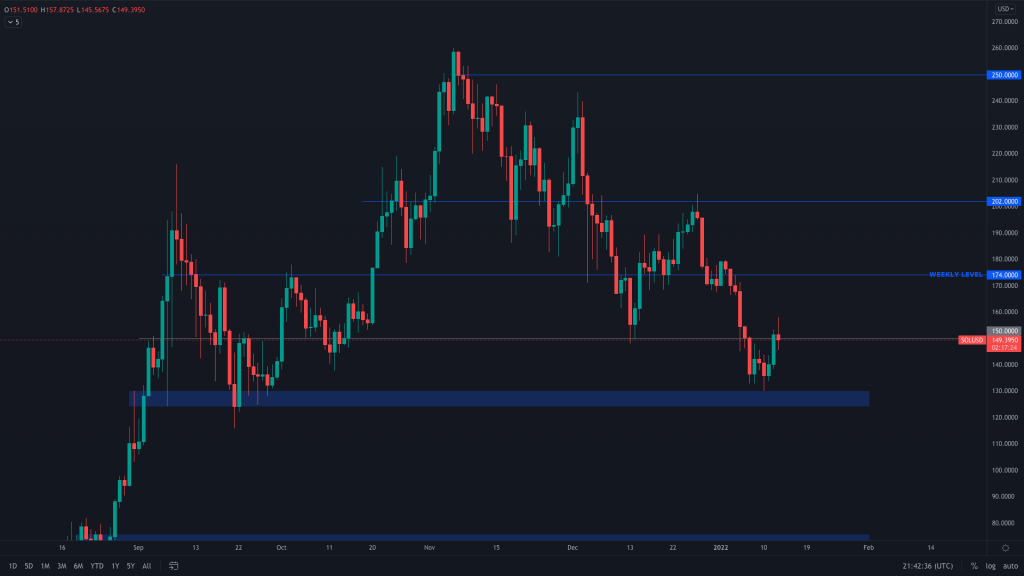

SOL

SOL moved up into the $150-$174 area yesterday. Our interest only lies in SOL closing its weekly candle above $174 to give it a chance of reclaiming $200 on the daily timeframe. Above $200 is where SOL would become bullish once again.

SRM

SRM is still moving downwards and currently sits within the region where we expect a bottom to form ($2.50-$3.79).

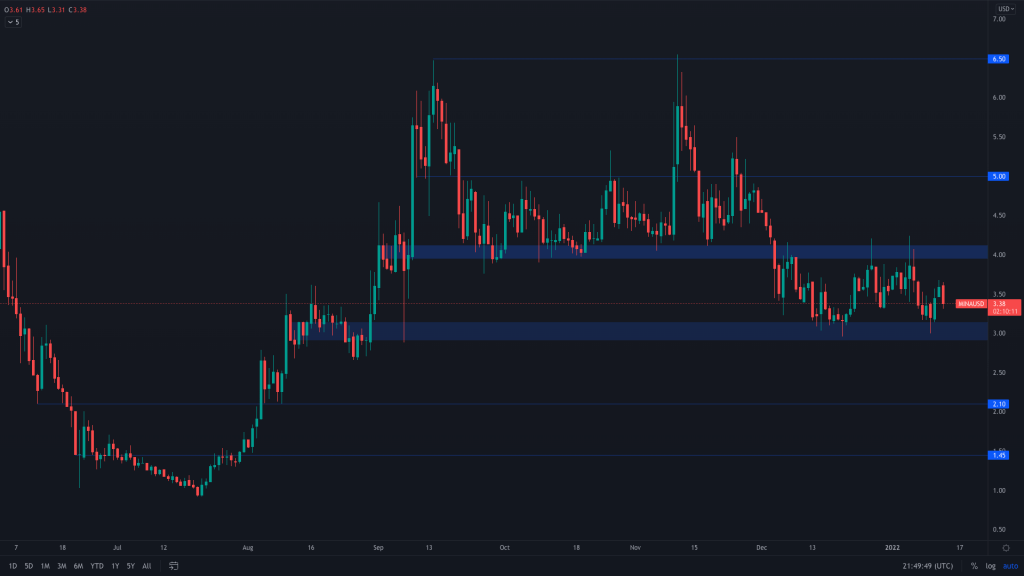

MINA

MINA remains within the $3-$4 range that it's been in for a while. We await a breakout to see where it is likely headed next.

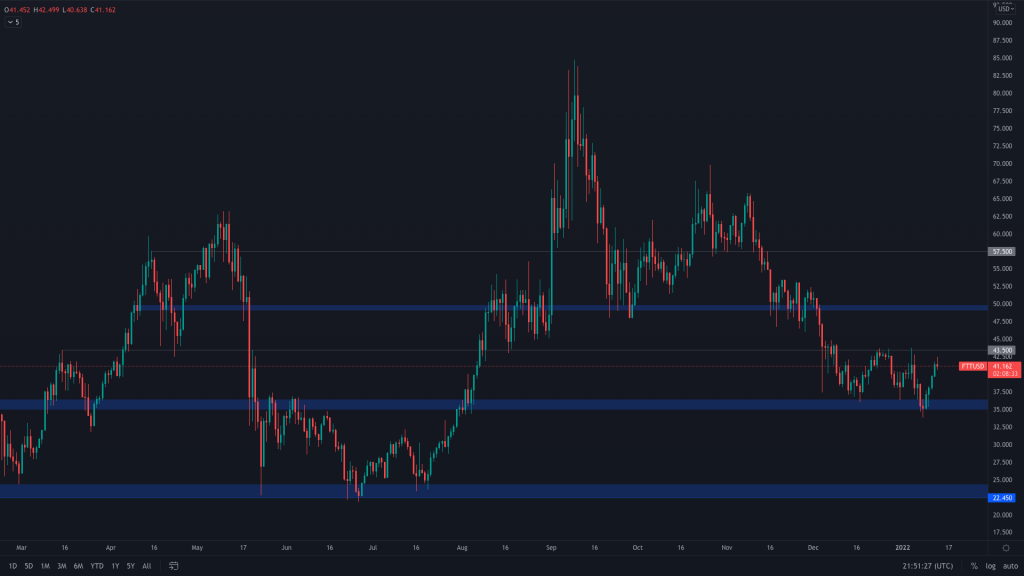

FTT

FTT also remains in its range - $35-$50. It will likely stay here for some time. FTT has recovered pretty well after each Bitcoin dip.

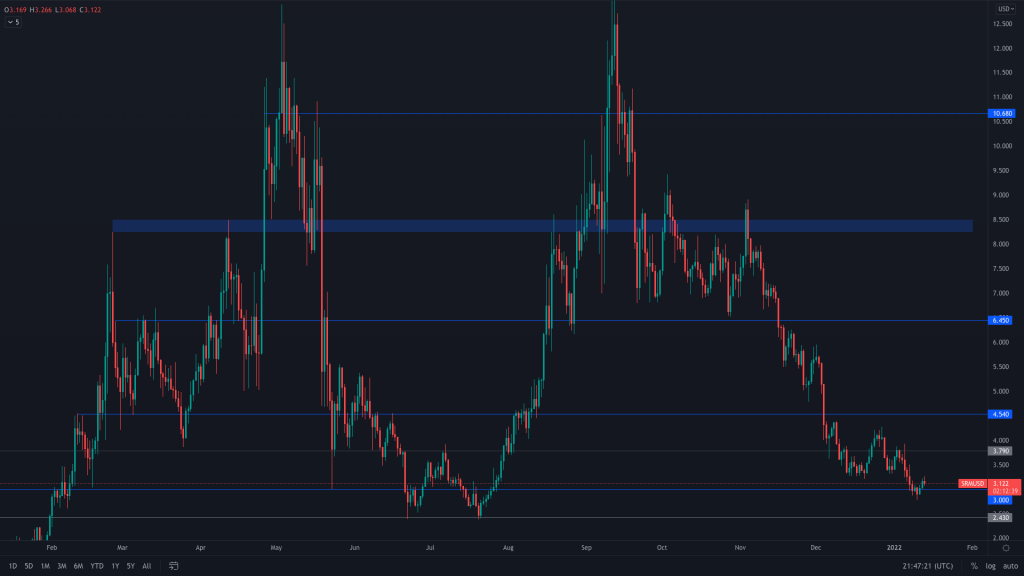

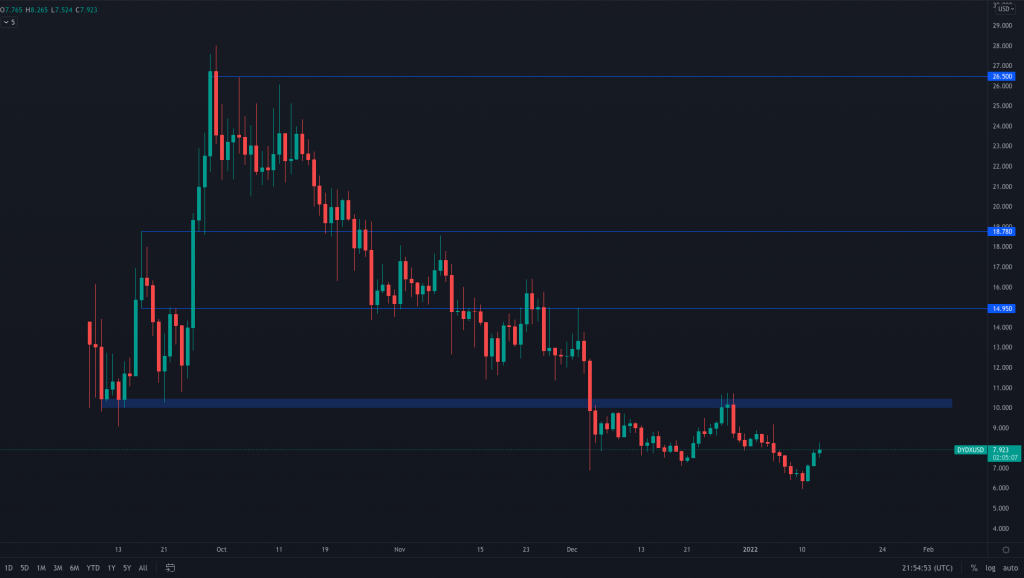

dYdX

We've seen a nice little recovery from dYdX over the last couple of days. Unless $10 is reclaimed, we still predict a bottom between $3 and $5.