Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your entire responsibility and yours only.

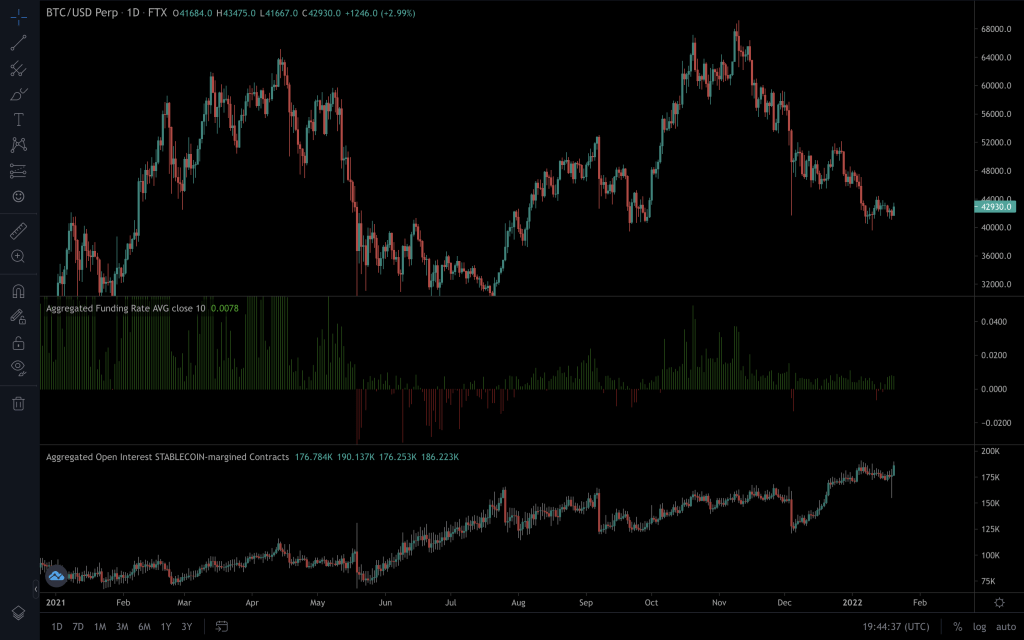

Funding Rate and Open Interest

For the most part, we can see that the Funding Rate has remained relatively steady and positive. Coupled with the positive move so far today, we can see that Open Interest has seen a significant increase back up to all-time highs. This suggests that the next move in Bitcoin will be relatively quick compared to the recent market movement.

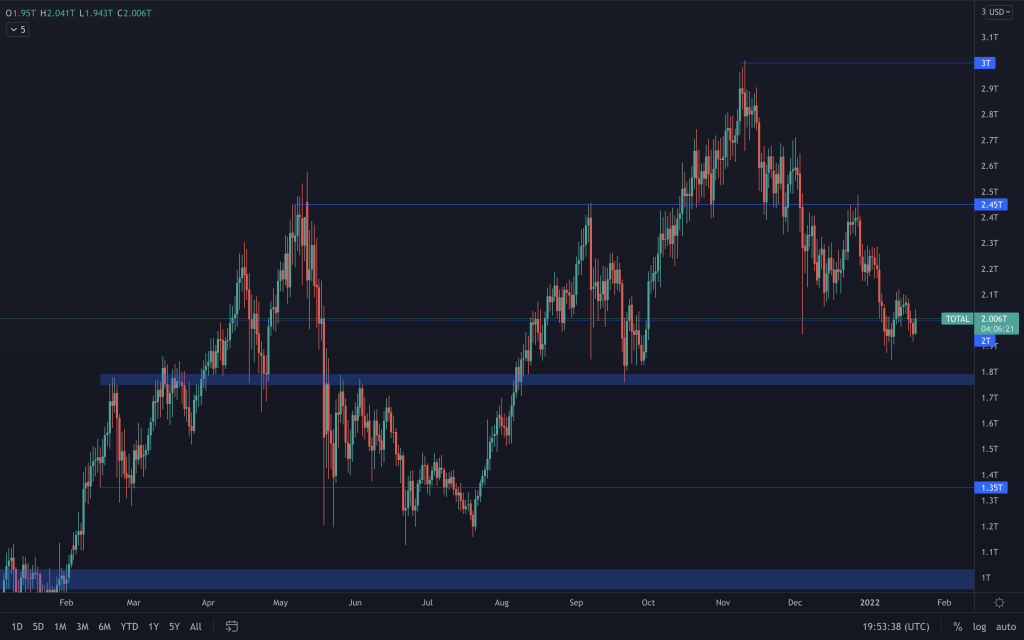

TOTAL MCap

The Total Market Cap shows a continuing formation of lower-lows and lower-highs, and nothing has really changed up to now. It closed above the $2T level on the weekly timeframe where it's been chopping around for the last two weeks. To give the highest probability of upside from here, $2T would need to be maintained as support come the weekly close.

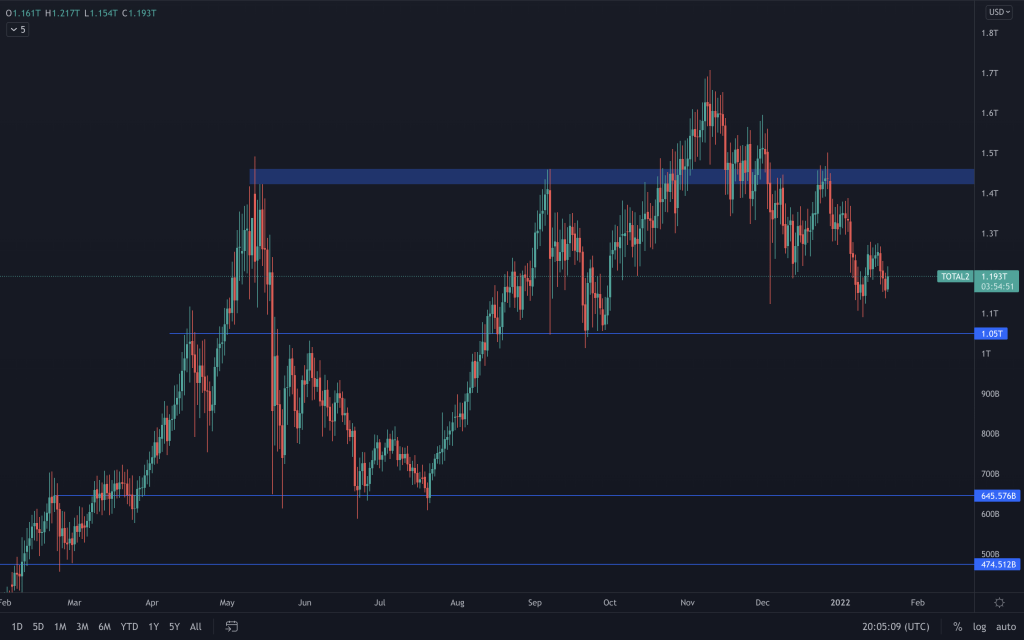

Altcoins MCap

The same is also reflected in Altcoin's Market Cap. The bearish market structure remains intact, and the only concern would be if the $1.11T (weekly support) were to break.

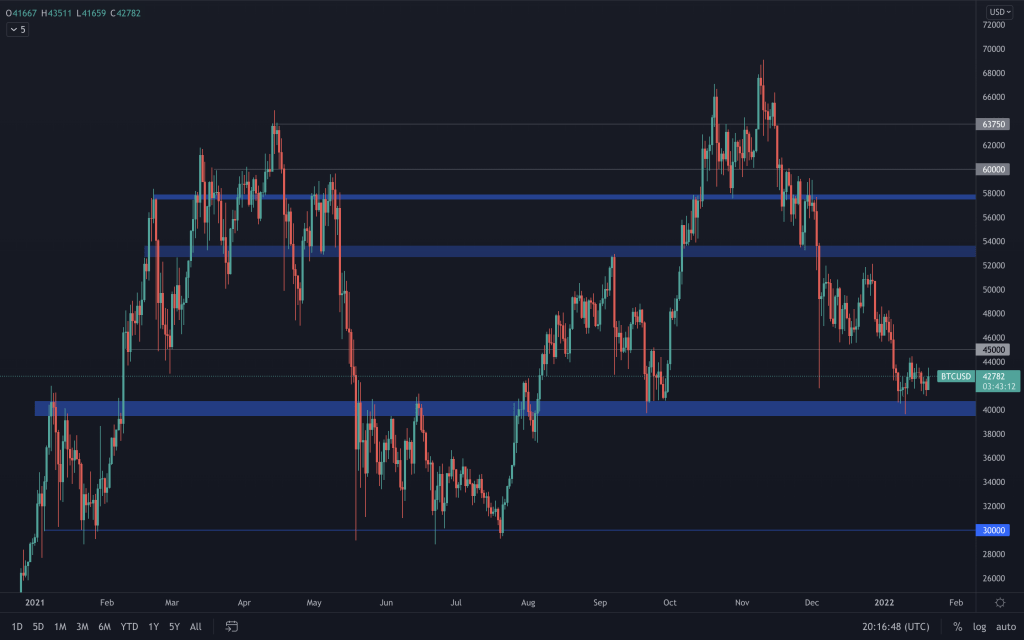

Bitcoin

We've seen support at $40k tested for the last two weeks. We await to see if Bitcoin tests the $37k-$38k area (should the Total Market Cap test $1.8T) or if bulls have the strength to push it back above to reclaim $45k. Of course, if the former were to happen, we wouldn't want to see a weekly candle closing under $40k.

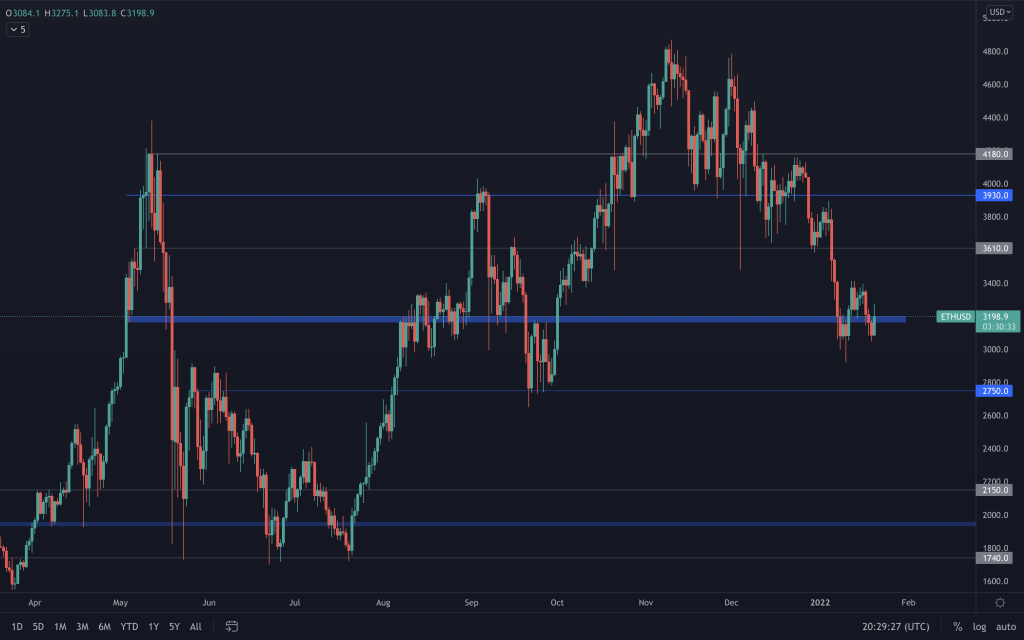

Ether

ETH has been mimicking Bitcoin's price action and finds itself hanging around the now resistance at $3,200. Its bearish market structure remains intact, leaving $2,750-$2,800 as a possibility. For ETH, with it at its current price, our interest only lies in a reclaim of $4,000.

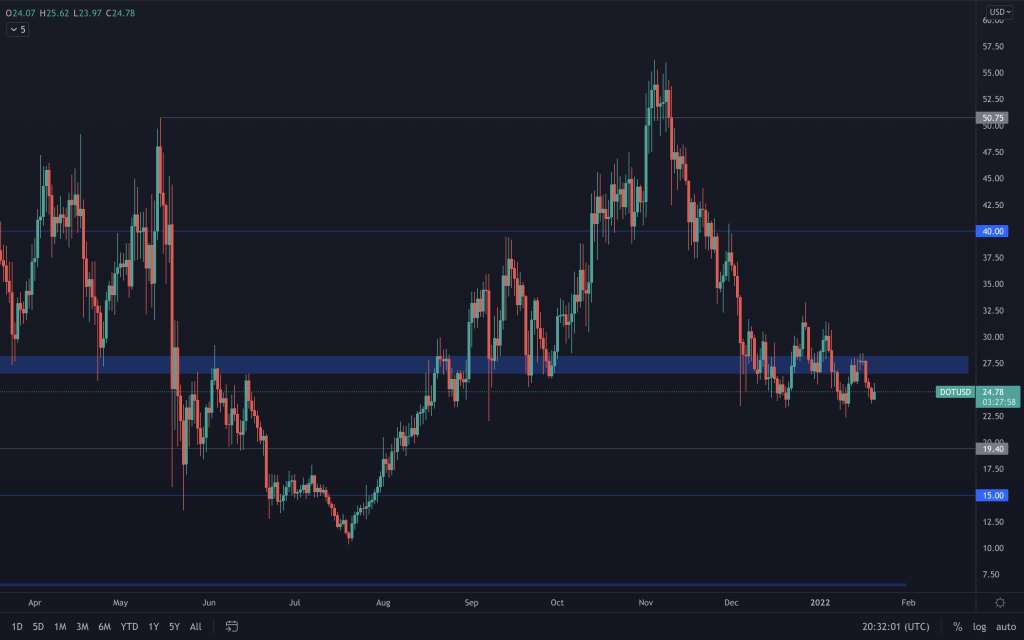

DOT

We can see that it is still chopping around the liquidity area, which is resistance for the time being. Whilst that remains a resistance, it still leaves $20 as a possibility.

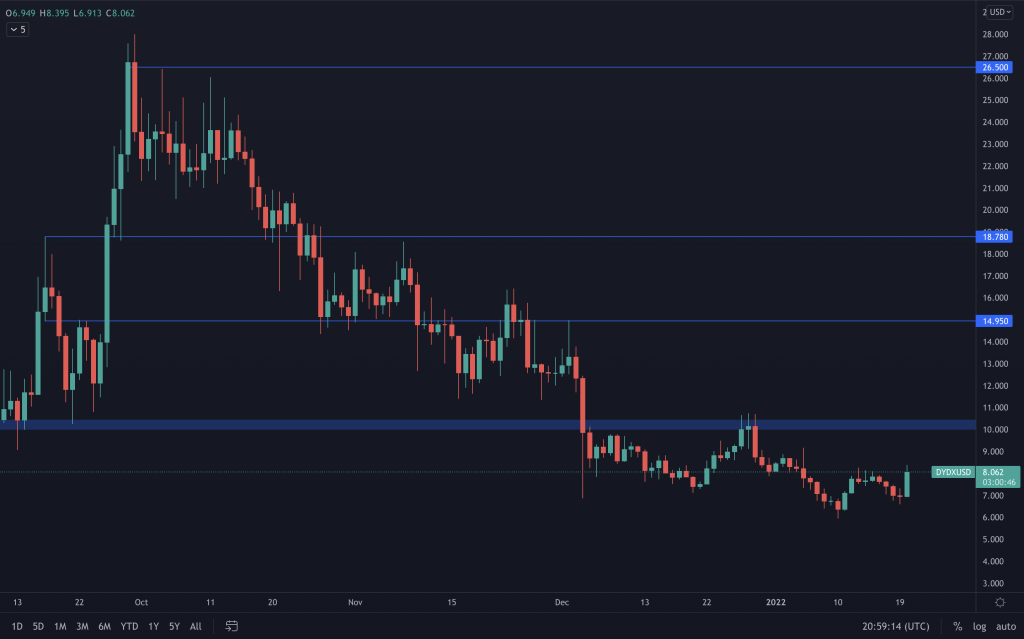

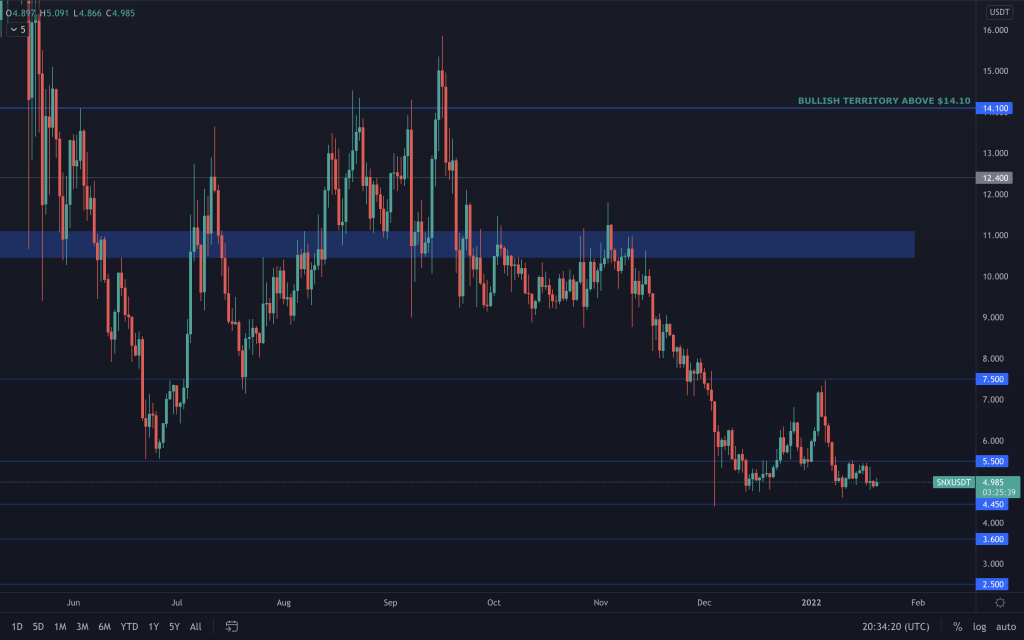

SNX

Since being rejected at $7.50, SNX also flipped its $5.50 support into resistance. It has just been moving sideways within its range for the last 12 days.

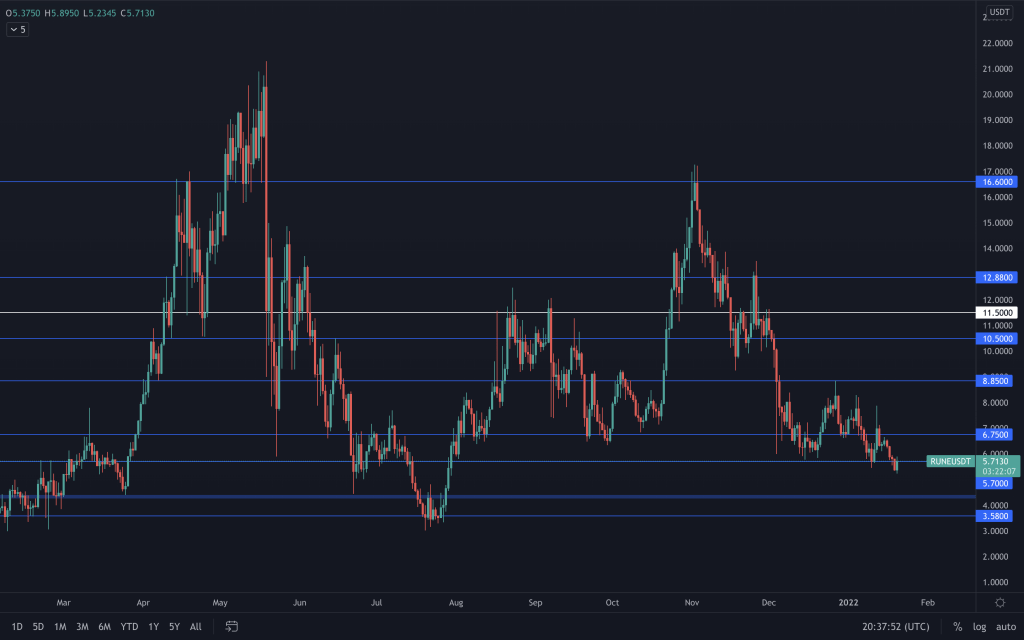

RUNE

Last night RUNE closed below $5.70. From a daily perspective, if it can reclaim this level by the weekly close, great. If not, then not only is the door open to $4.40, but we could see it go as low as $3.50.

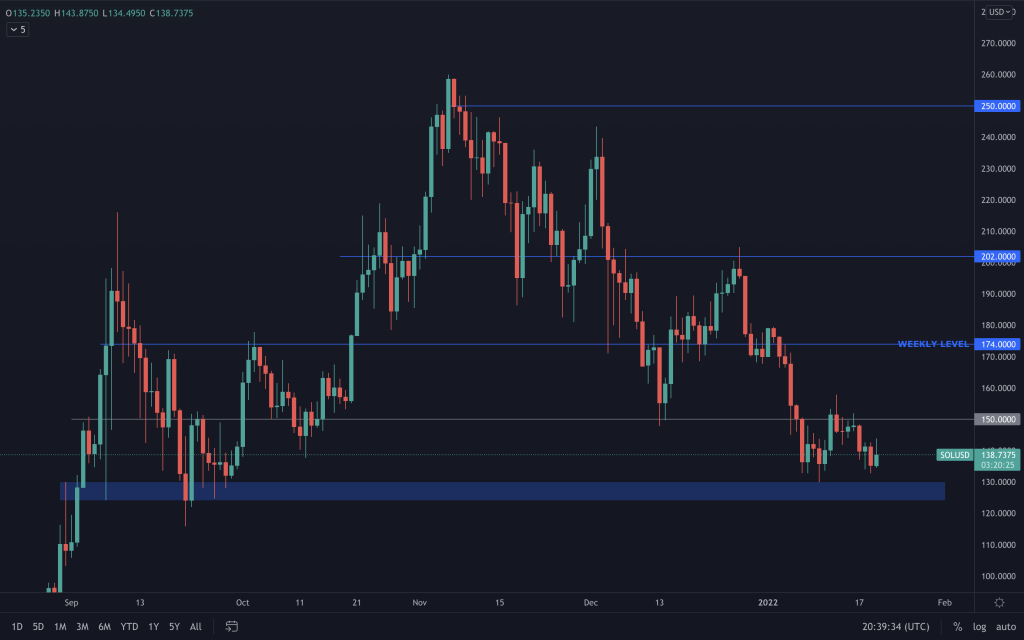

SOL

SOL still finds itself within the $125-$150 range. Currently, our interest lies in reclaiming $175 on the weekly timeframe (or $200 on the daily).

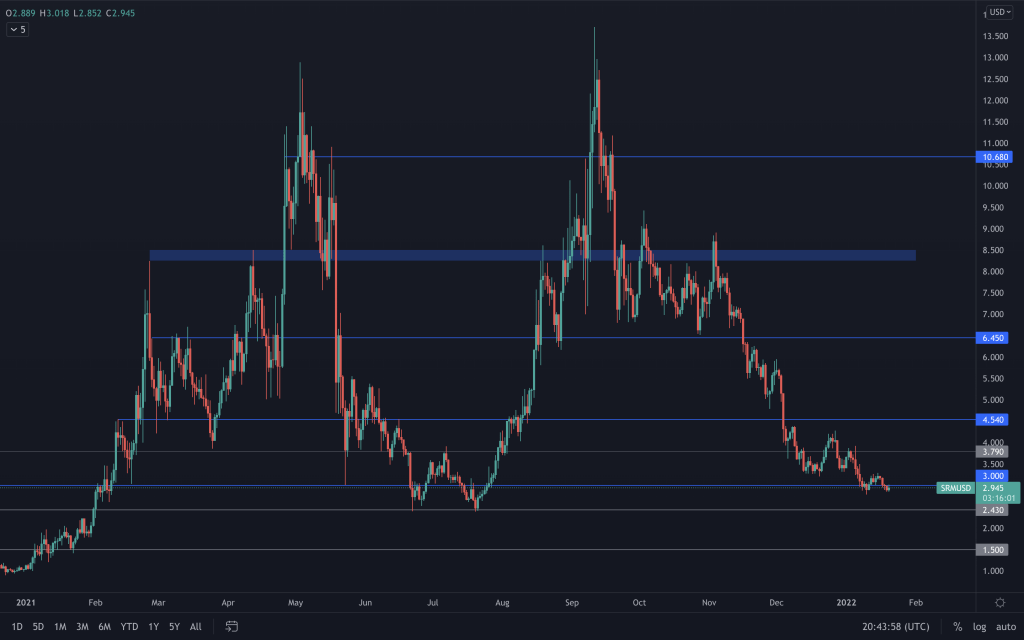

SRM

SRM closed below $3 on the daily timeframe, and support is underneath at $2.50 (rounded up). As you're all probably aware, we've been expecting a bottom for SRM anywhere around here down to around the $2.50 level.

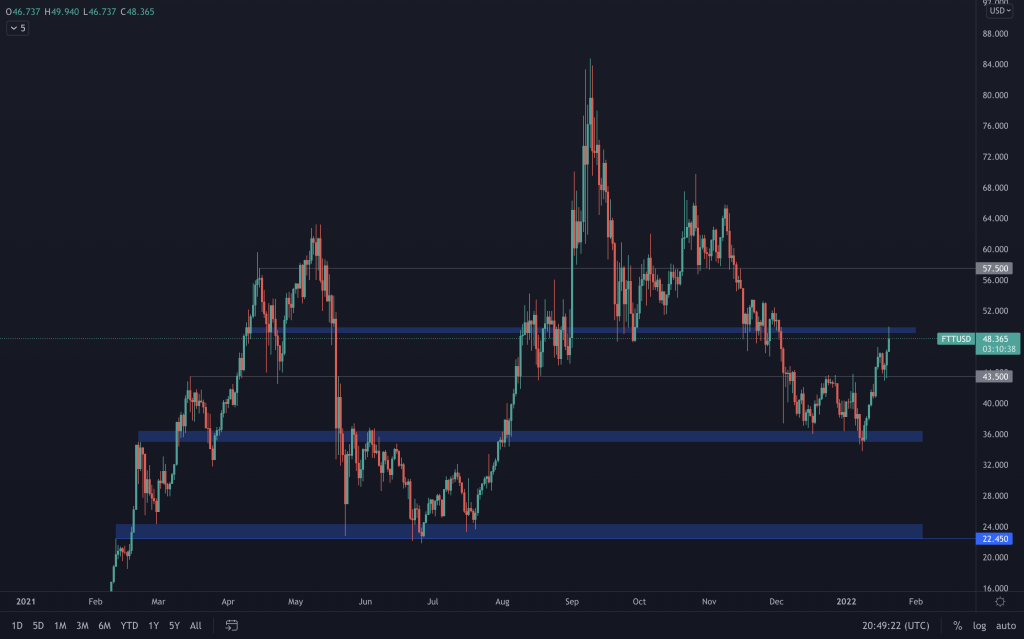

FTT

FTT has seen a strong rally upwards since touching the lower end of its range and again from the intermediate support. FTT closed above the intermediate level at $43.50 (both on the weekly and daily charts), the price then came down to retest it and carried on up towards $50. Should it be able to reclaim this level, then it puts a move up towards $60 on the cards. But we expect it to continue ranging.

MINA

MINA is in the never-ending range that is $3-$4. We're awaiting a breakout to see where it is likely headed next.