Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Funding Rate has returned to 0.01%, indicating an even balance between Longs and Shorts.

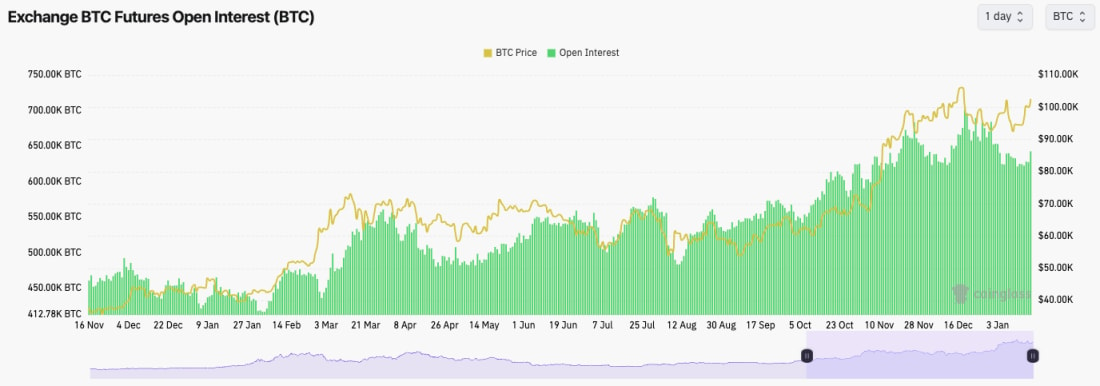

- BTC's Open Interest has kicked up slightly from the lows in the last 24 hours, but not in any meaningful way. This indicates that the recent rally is more Spot-driven than leverage-driven. This is positive for the bulls.

Technical analysis

- BTC wicked into the $90k's and has bounced aggressively, breaking through a number of key horizontal resistances @ $95,700 and then $98,900.

- Price is now breaching the prior local high of $102,600.

- What's also positive is that the price has seemingly broken out of the local downtrend line. We need to see how today's Daily candle closes, but so far, it looks good.

- The RSI is also breaking out of the downtrend line and coming from a middle territory, still with some way to go before it becomes overbought.

- On the RSI though, we do have to be careful of any potential hidden bearish divergences (lower price highs, higher highs on the oscillator). We'll monitor this.

Get the latest Bitcoin price prediction. Dive into our detailed analysis to stay one step ahead!

- Next Support: $102,000

- Next Resistance: $108,000

- Direction: Bullish

- Upside Target: $108,000

- Downside Target: $102,000

Cryptonary's take

Overall, it's a really solid move. Mostly, this has been driven by hype/positivity around Trump issuing pro-crypto Executive Orders on day 1. It's also been driven by the positive inflation print (less inflation than what the market expected) we saw on Wednesday, plus some dovish FED speak from Waller (granted, he's about as dovish as they get, so take it with a pinch of salt).It's possible the rally will continue into Monday, despite the price being at a local resistance of $102,600, but it has smashed through the other resistances so far. In my opinion (Tom's), Trump will likely have to over-deliver next week for this rally to really continue into a multi-week/multi-month rally into new price highs.

However, if Trump drops a load of overly positive (more than what the market currently expects) pro-Crypto Executive Orders, then it's possible we will see $108k early next week.

Ultimately, I think a lot of next month will depend on what Trump does next week. If he heavily over-delivers, that is what would invalidate my thesis for lower. However, the weaker inflation print on Wednesday has also helped me invalidate my prior thesis.