As geopolitical tensions rise, coins like Mantra, XRP, TON, LAYER, and ADA face intense volatility. The charts are speaking—will the market take note?

OM:

Technical analysis & market mechanics

- Mantra dropped 10% on tariff escalation, tagging and reclaiming local support at $6.1270.

- Price is now back to pre-tariff structure, but with added macro uncertainty.

- Local resistance sits at $6.5350, acting as the first point of rejection.

- Additional resistance levels are $6.85 and $7.130, ideal for tiered short entries if the price gets there.

- Mid-term support sits at $5.75, established after the recent sell-off reaction.

- Long-term support remains at $4.41, a key structural base.

- From the $9.10 high to $4.41 represents a 50% correction, still structurally healthy.

- RSI ~46, neutral - no edge in momentum, allowing for both continuation or correction.

- Next Support: $6.1270

- Next Resistance: $6.5350

- Direction: Bullish

- Upside Target: $7.1300

- Downside Target: $4.410

Cryptonary's take

Mantra has reclaimed local support at $6.1270, but the context has shifted - tariffs and macro uncertainty now weigh heavily on the market. Structurally, a move from the $9.10 highs down to our long-term target of $4.41 would represent a clean 50% correction, still well within a healthy retracement. Given this setup, we prefer being short at the key levels of $6.53, $6.80, and $7.13 rather than chasing upside. Price has returned to a key supply zone without the macro backing to sustain continuation.What's next?

The next big opportunities are emerging in XRP, TON, LAYER, and ADA, where relief rallies may signal key shorting zones. We’ve identified perfect execution points with downside targets ranging from 30% to 50% on each asset. Stay ahead of the curve!

XRP:

Technical analysis & market mechanics

- XRP has set a new lower low at $1.62, now acting as mid-term support.

- Price is trading within a clear bearish descending channel, reinforcing downside continuation bias.

- Local support sits at $1.78, the last defended area before the breakdown.

- Local resistance is at $2.00, aligning with the top of the short-term relief zone.

- Short-term relief rallies are expected toward $2.00, $2.12, and $2.24, which will serve as short entry zones.

- Target to the downside is $1.30, in alignment with the lower boundary of the descending channel.

- RSI is around 30, slightly oversold - backing the chance of a relief bounce into resistance is likely before continuation lower.

- Funding rate is flat, indicating no clear long or short bias from positioning.

- Open Interest is tapering, currently around $3.7M, suggesting a cooling in speculative positioning - ideal for mean reversion setups.

- Next Support: $1.6200

- Next Resistance: $2.00

- Direction: Bullish

- Upside Target: $2.230

- Downside Target: $1.300

Cryptonary's take

XRP appears to have found a local bottom around $1.62, setting the stage for a relief rally within its broader bearish descending channel. Given the oversold RSI and tapering open interest, we're anticipating a short-term move to the upside into our predefined key levels: $2.00, $2.12, and $2.24. These levels offer clean opportunities to fade strength and initiate shorts.We remain firmly short-biased with XRP - this move higher is viewed as a temporary rally before a broader rollover, not a reversal. Our conviction is driven by the overall weakness in risk assets and the expectation that markets are likely to set another lower low before any meaningful long-term continuation. The target remains $1.30, which aligns with the lower boundary of the channel and prior demand. We'll let price come into our zone and execute with discipline.

TON:

Technical analysis & market mechanics

- TON traded down into local support at $2.90, as anticipated.

- RSI is around 38, not oversold but near the lower bound - supportive of a short-term bounce.

- Local resistance is $3.10, acting as immediate overhead pressure.

- Key resistance zone is $3.50-$3.70, where prior supply and pattern structure align.

- Short entry levels are $3.53, $3.636, and $3.79 - tiered to fade strength into resistance.

- Target to the downside is $2.00, in line with broader bearish structure and key support.

- Next Support: $2.900

- Next Resistance: $3.530

- Direction: Bullish

- Upside Target: $4.080

- Downside Target: $2.000

Cryptonary's take

TON has reacted cleanly to our $2.90 support level, forming a potential short-term bottom with signs of relief building. But this bounce is not a trend reversal - it's an opportunity. We are preparing to fade strength into the $3.50-$3.70 zone, scaling shorts at $3.53, $3.636, and $3.79 and leaving some bullets in the chamber for any further upside into $4.08. The $2.00 target remains firmly in play, representing a full structural retracement and the likely point of sentiment reset. This is not a long setup - we remain short-biased and will only act once the price trades into resistance. Let price come to us - the structure is clear and the execution path is defined.LAYER:

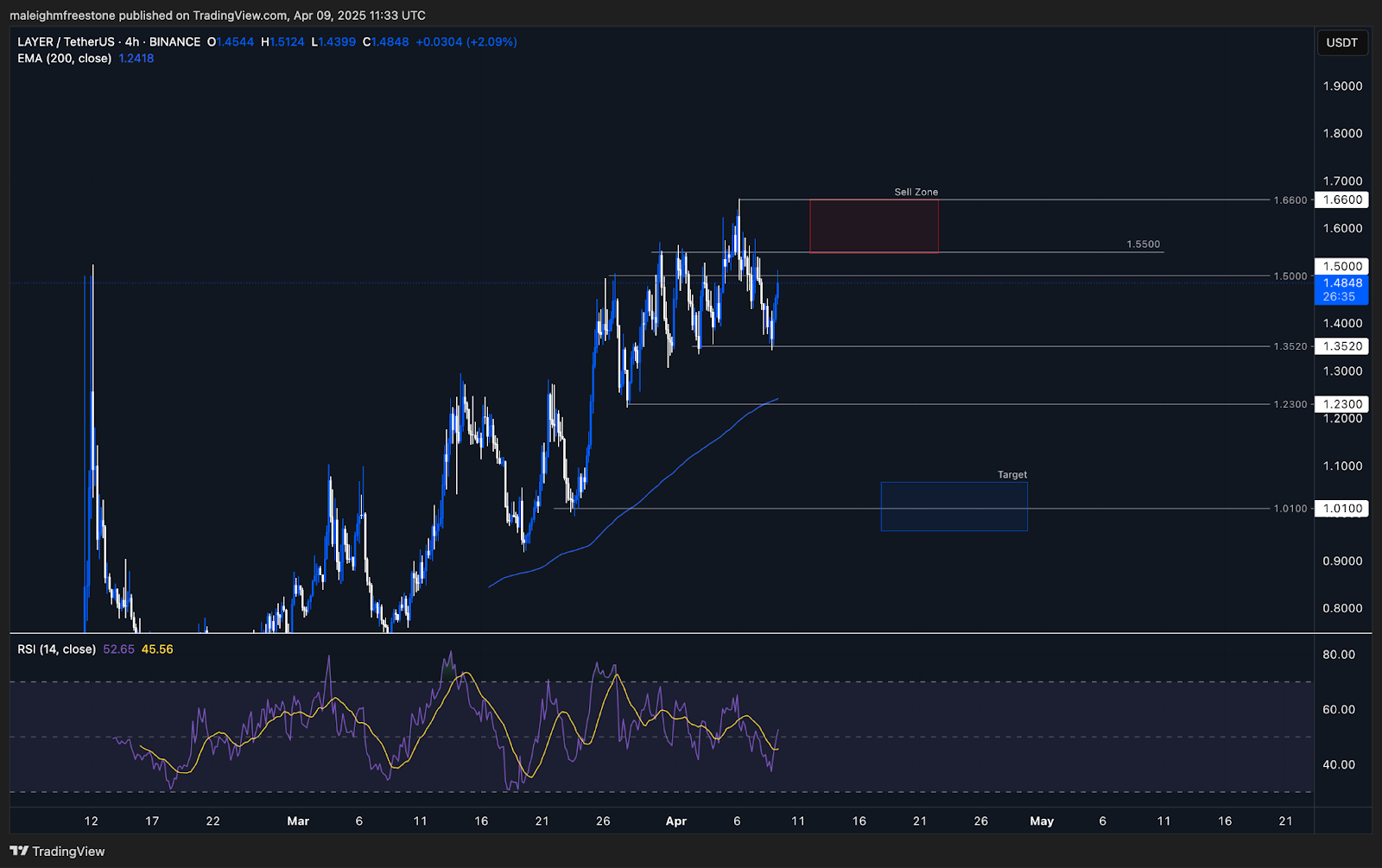

Technical analysis & market mechanics

- LAYER is still trading within a bullish structure, consistently forming higher highs and higher lows.

- Recent 4H price action shows exhaustion, with a head-and-shoulders pattern forming around the $1.66 all-time high.

- There has been a minor breakdown in bullish momentum, suggesting a potential local top.

- Local support sits at $1.352, where the price recently bounced.

- Local resistance is $1.50, the first area of potential rejection.

- From $1.35 to $1.50, the price has already bounced ~11%, showing relative strength and resilience.

- RSI touched the lower bound (~50) and has now pushed back toward neutral - still room for a further upside relief

- We are monitoring a potential relief rally into $1.550 and $1.660, which would align with fading strength.

- Key resistance remains around $1.66 (ATH) - exhaustion here could provide the short trigger.

- Structurally, a healthy 61.8% retracement from the Feb low (~$0.60) to the ATH would take the price to $1.01, aligning with psychological support and fib structure.

- Next Support: $1.3520

- Next Resistance: $1.500

- Direction: Bullish

- Upside Target: $1.660

- Downside Target: $1.010

Cryptonary's take

LAYER has held its bullish structure impressively but is now showing the first signs of buyer fatigue at the highs. With a head-and-shoulders forming at $1.66 and early weakness in momentum, we're preparing to fade strength into the $1.55-$1.66 region. We are not calling for a trend reversal - this is a tactical short opportunity into a high-probability retracement.We remain short-biased on relief, looking to play the move down toward $1.01, which represents a textbook 61.8% fib pullback and a key structural support from the February trend origin. Given LAYER's relative strength, we treat this as a lower-risk, trend-fade setup - small size, clean, clear invalidation with stops above all-time highs at 1.8000, and clear structure.

ADA:

Technical analysis & market mechanics

- ADA sold off sharply, giving a clearer structure and highlighting weakness.

- Local support has formed at $0.515, the recent low from which the price has started to stabilize.

- RSI is around 33.14, placing it in the lower bound territory, suggesting room for a short-term bounce.

- Local resistance sits at $0.60, the first key area where sellers may re-engage.

- The next resistance is $0.682, providing the second level to build short exposure.

- Long-term support zones remain at $0.40 and $0.30, where we anticipate the price to ultimately retrace toward.

- Structurally, ADA continues to look choppy and messy, but the recent breakdown strengthens the bearish case.

- Macro weakness and tariff-related risk-off sentiment add pressure, reducing the probability of sustained upside.

- Next Support: $0.515

- Next Resistance: $0.600

- Direction: Bullish

- Upside Target: $0.74800

- Downside Target: $0.4000

Cryptonary's take

ADA has broken down and found support at $0.515, with an oversold RSI and a weak bounce structure. We anticipate a relief rally into resistance, but view it as an opportunity to position for further downside. Structurally, the chart remains bearish and disjointed, and we do not see fundamental strength or momentum that warrants a long bias. In the current macro context, ADA remains overvalued, and any bounce is likely to be short-lived.We're preparing to short strength into $0.60 and $0.682, aiming to capture the next leg down toward the $0.40-$0.30 zone. This is a low-risk, high-reward setup with a clean invalidation level and strong alignment with broader market weakness. ADA's lack of sustained demand post-sell-off reinforces our conviction.