- Recently, markets have had greater certainty over possible macro headwinds, however, a 50 basis point rise may be on the cards at the next FED meeting in April and this could come as a shock to markets.

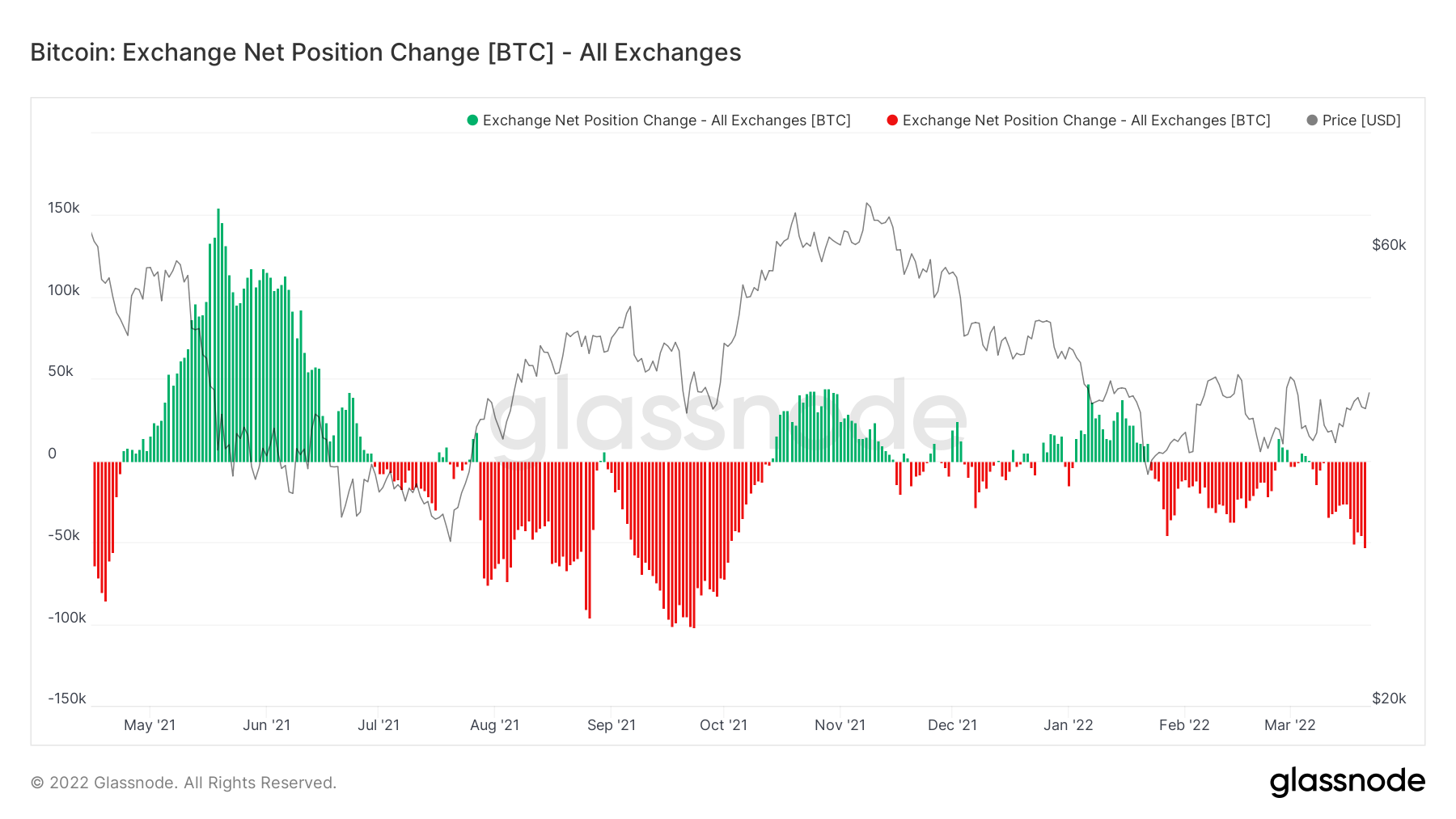

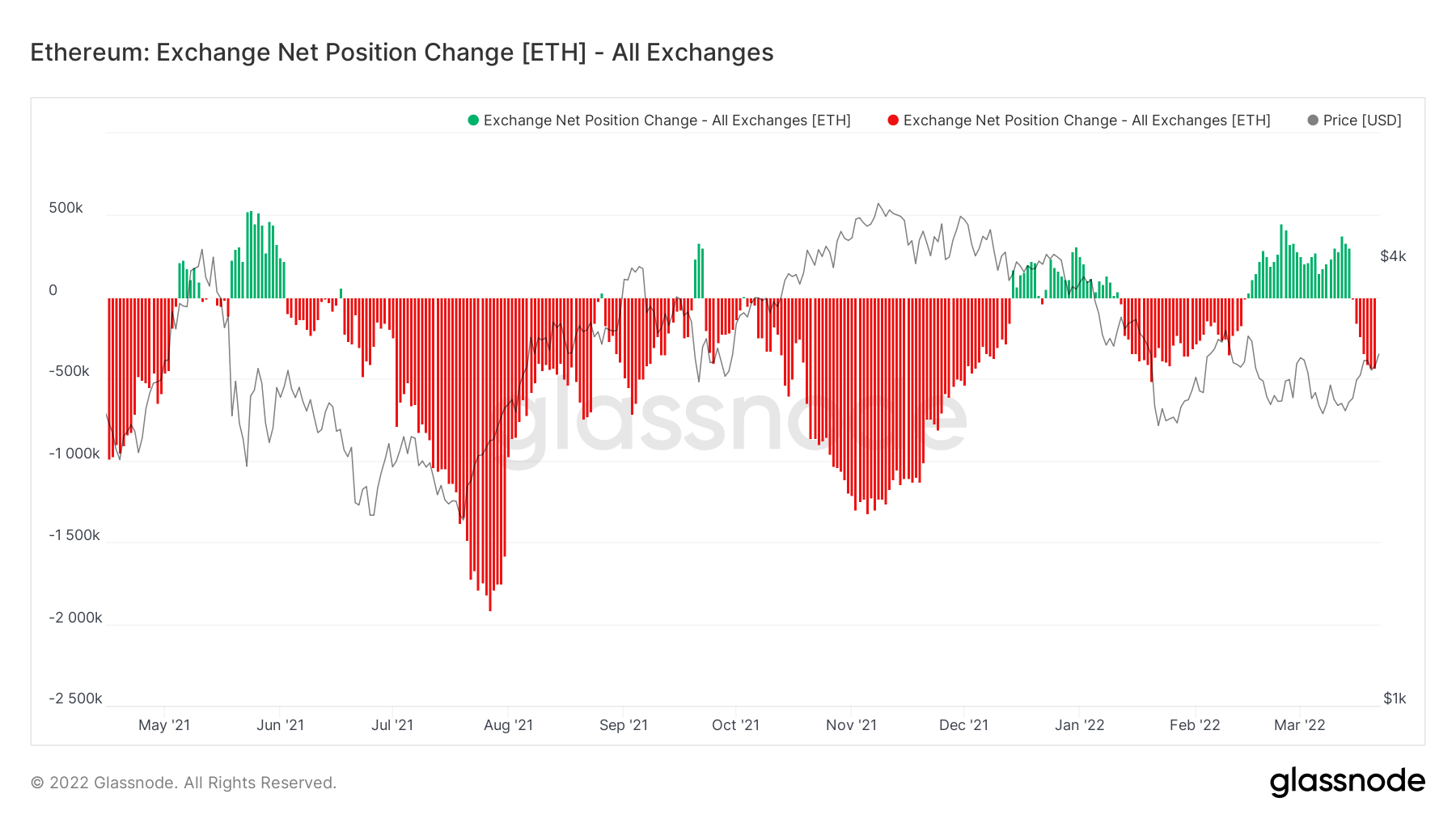

- The Exchange Net Position Change for both Bitcoin and Ether is looking much more positive, we’re seeing more considerable outflows which suggests accumulation may be beginning to increase.

- The largest Bitcoin wallets are the 1,000 Bitcoin wallets, these have increased in number over the past week or so, suggesting accumulation amongst this cohort (historically the most profitable cohort) may be increasing.

Macro:

We will begin this week’s report by assessing some of the macro changes that have occurred over the past week. Firstly, FED Chair J Powell, adjusted interest rates to 0.25% from 0%. We also had the Russians and Ukrainian’s suggest they may be coming to some sort of deal in their negotiations. This was all positive for markets as the FED didn’t throw out any surprises whilst the war may come to a peaceful solution. However, since last week, FED Powell came out on Monday and hinted that the FED may be looking to raise rates at the next meeting and possibly by 0.5% rather than just 0.25%. He also mentioned that the FED may look to start reducing its Balance Sheet and announce this at an upcoming meeting. Of course, this is bad for markets. However, equities and crypto have rallied in the past days, but this rally may be short lived, particularly as the May FED meeting approaches.

Metric 1 – Exchange Net Position Change

As usual, the first metric we will look into is the Exchange Net Position Change for Bitcoin and Ether. This metric for Bitcoin is improving on a daily basis, we’re now seeing net outflows continually increasing with more than 50,000 Bitcoin per day net leaving the Exchanges. This may be a sign that investors are beginning to accumulate again.

Bitcoin – Exchange Net Position Change

If we now turn our attention to Ether, we can see that the Exchange Net Position Change metric has improved considerably. We are now seeing net outflows again, even though the number of outflows is not huge, the fact we’re seeing some outflows is more positive.

Ether – Exchange Net Position Change

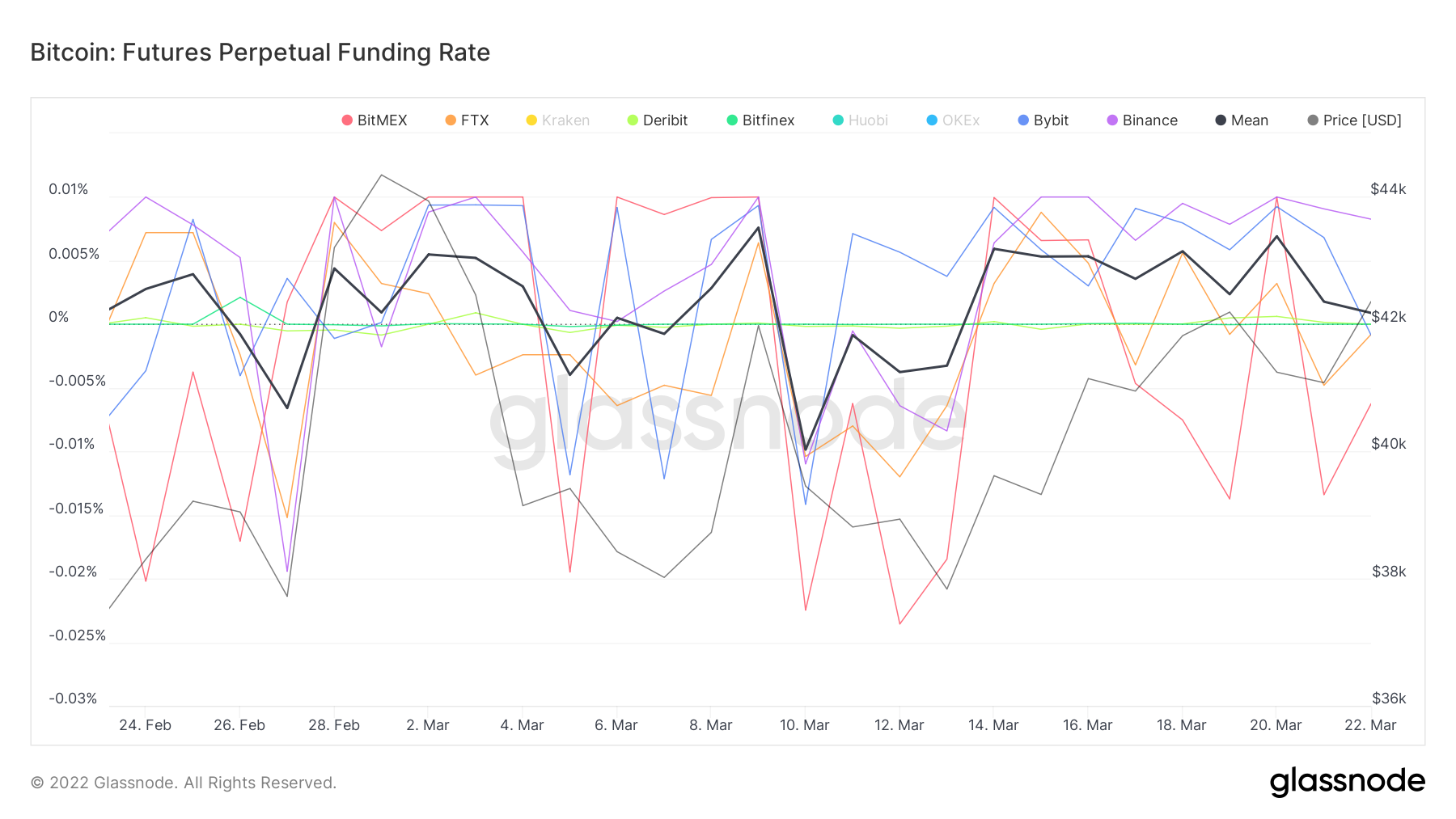

Metric 2 - Futures Perpetual Funding Rate

We will now look at a number of metrics to assess the possible volatility ahead. We can see below that the Futures Perpetual Funding Rate has been relatively stable over recent weeks with the most significant peaks being 0.01%. This is a usually a healthy rate for Perpetual Futures contracts to be trading for. In Bull markets when there are times of fomo, we can see funding rates between 0.03% and 0.08%, so a 0.01% funding rate now is quite healthy.

Bitcoin – Futures Perpetual Funding Rate

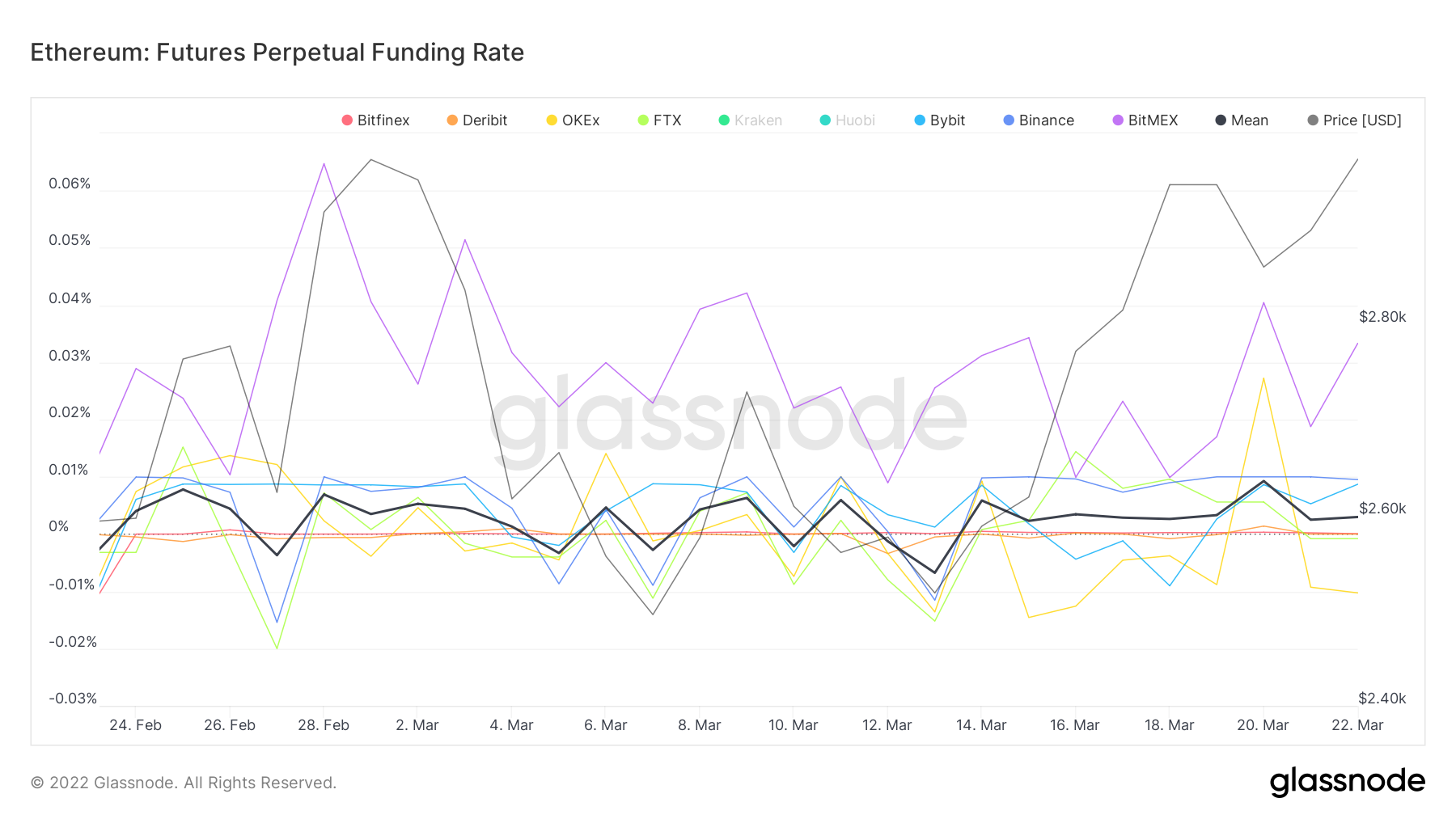

Ether – Futures Perpetual Funding Rate

We can see above on the same chart but for Ether that funding rates have again been relatively healthy also. There is one exception to this, for instance the funding rates on Bitmex were considerably greater than on other Exchanges. For now, this is not too troublesome but something to take note of.

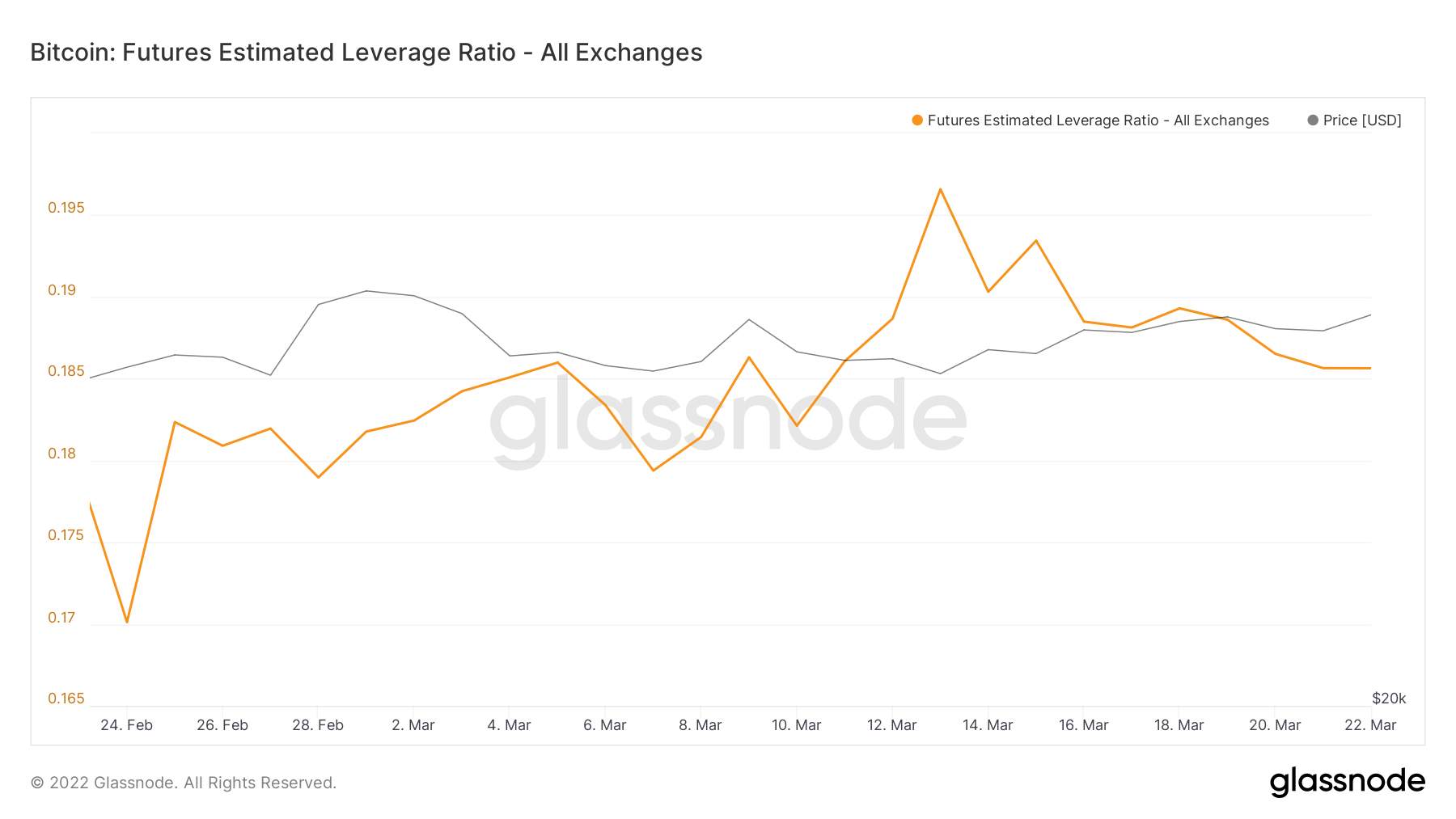

Metric 3 - Futures Estimated Leverage Ratio

The third metric we’re going to look at is the Futures Estimated Leverage Ratio. This is defined as the ratio of the open interest in futures contracts and the balance of the corresponding exchange. An overheated futures market can lead to volatile price moves. A healthy market is a ratio under the 0.2 mark. We can see in the graph below that recently we were approaching this mark and have now come down from it slightly, again a positive sign but if we see this rise further, we may see a more volatile move in the markets.

Bitcoin – Futures Estimated Leverage Ratio

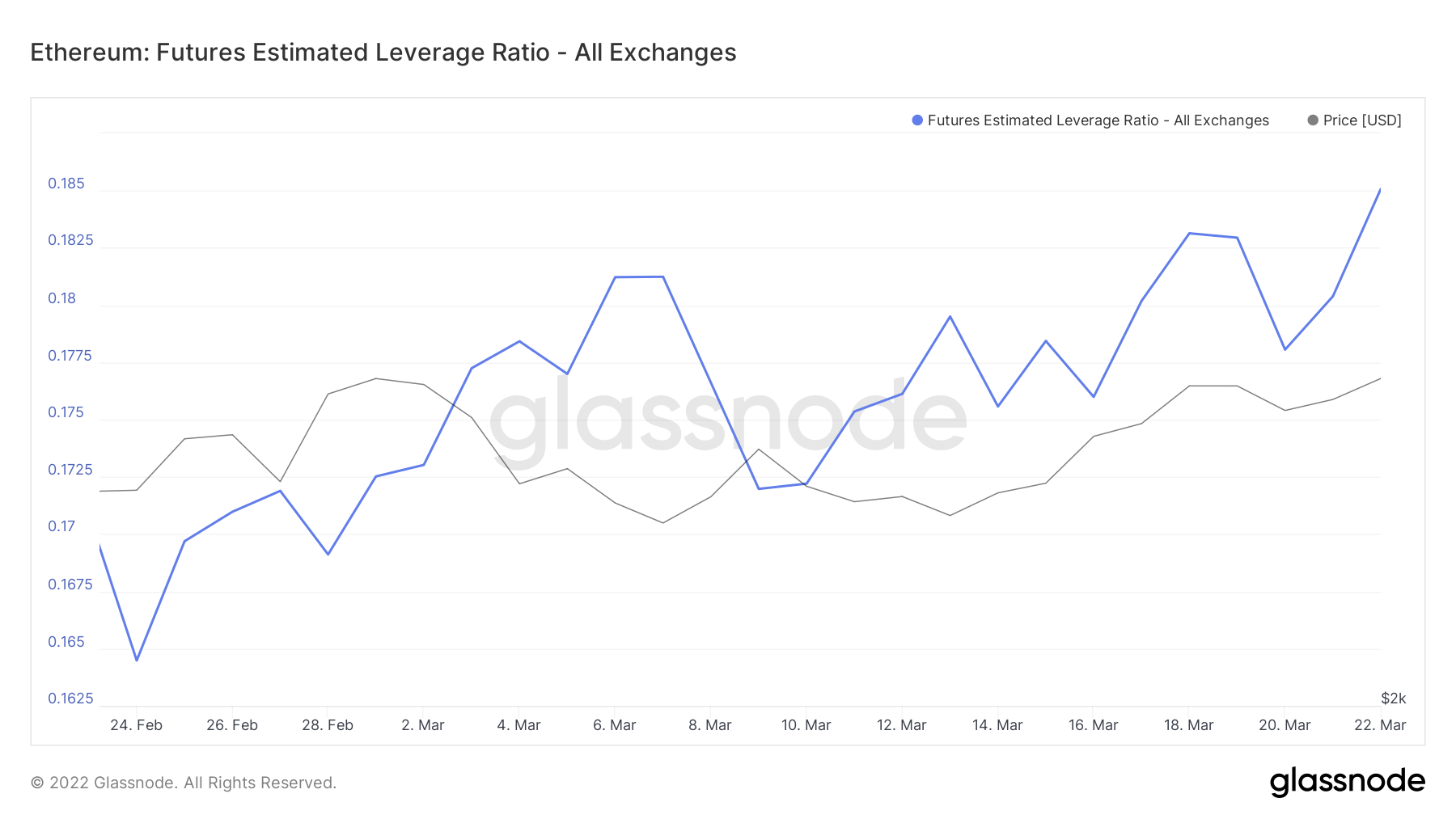

Ether – Futures Estimated Leverage Ratio

This metric for Ether is showing a clear uptrend but as of yet we have not come close to the 0.2 mark, so for now, the market still looks as if it’s in a healthy position.

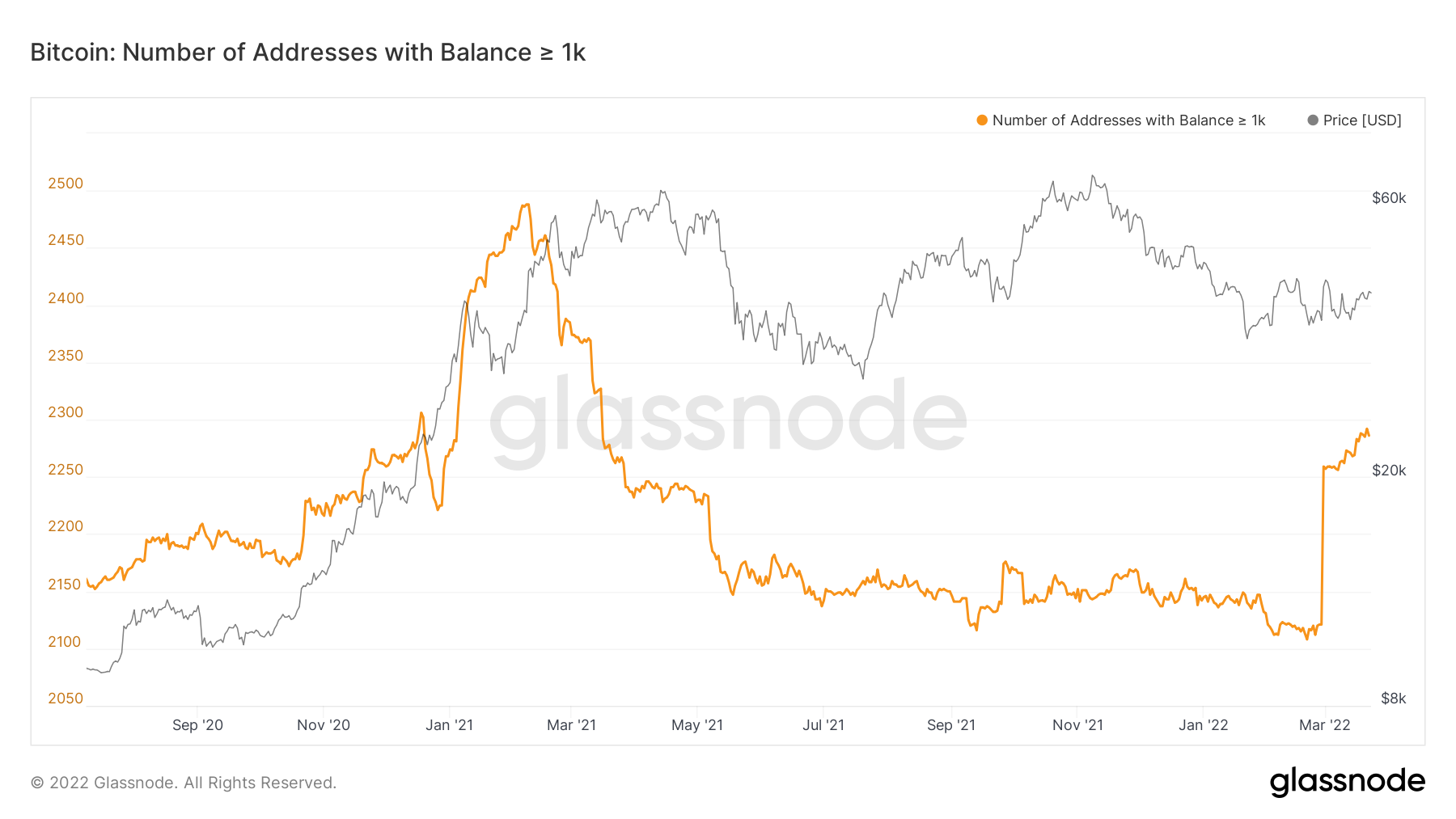

Metric 4 – Addresses

In most reports we cover the addresses to assess what different cohorts are doing; accumulating, distributing or just doing nothing. Over the past week there have not been too many changes, the smaller wallets are still accumulating, and the larger sized Bitcoin wallets are seeing some small increases but nothing major. However, the Bitcoin wallets containing more than 1,000 Bitcoin (Whale cohort) have seen some slightly more significant increases this week (number of wallets up by 2%). This suggests that some of the larger wallets are beginning to risk back on, however it must be mentioned this is not with any major size but it is noticeable that these wallets are on the rise.

Bitcoin – Wallet Balance > 1,000 Bitcoin

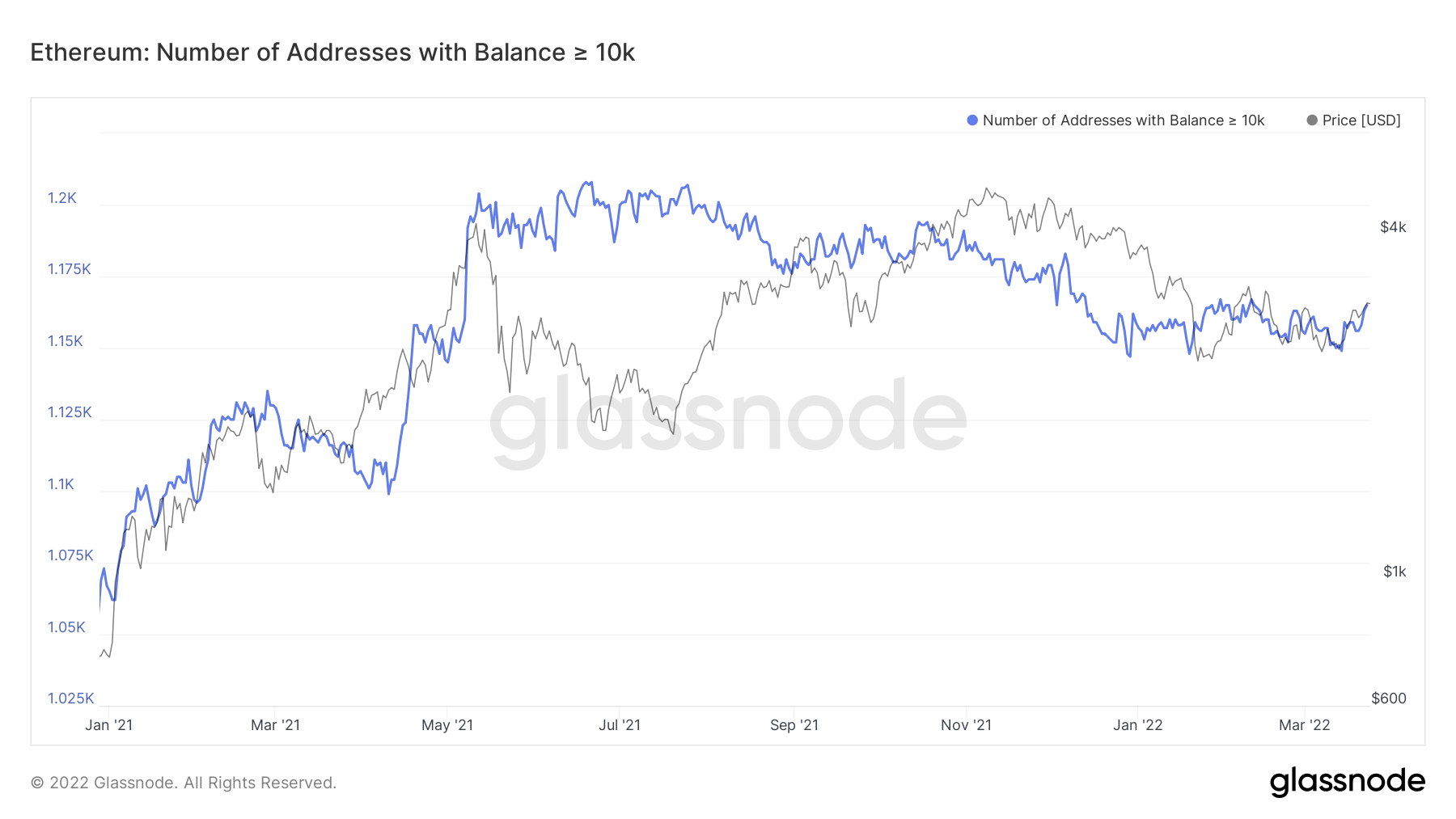

In order to look at the similar version of this metric for Ether, we must go one cohort of wallets higher, to the wallets holding more than 10,000 Ether in. We can see below that the downtrend seems to have been halted for the time being, but the number of wallets is not really increasing, rather flat lining. So yes, this is more positive but not something we feel should be a huge risk-on indicator, but it is important to watch this metric over the coming weeks.

Ether – Wallet Balance > 10,000 Ether

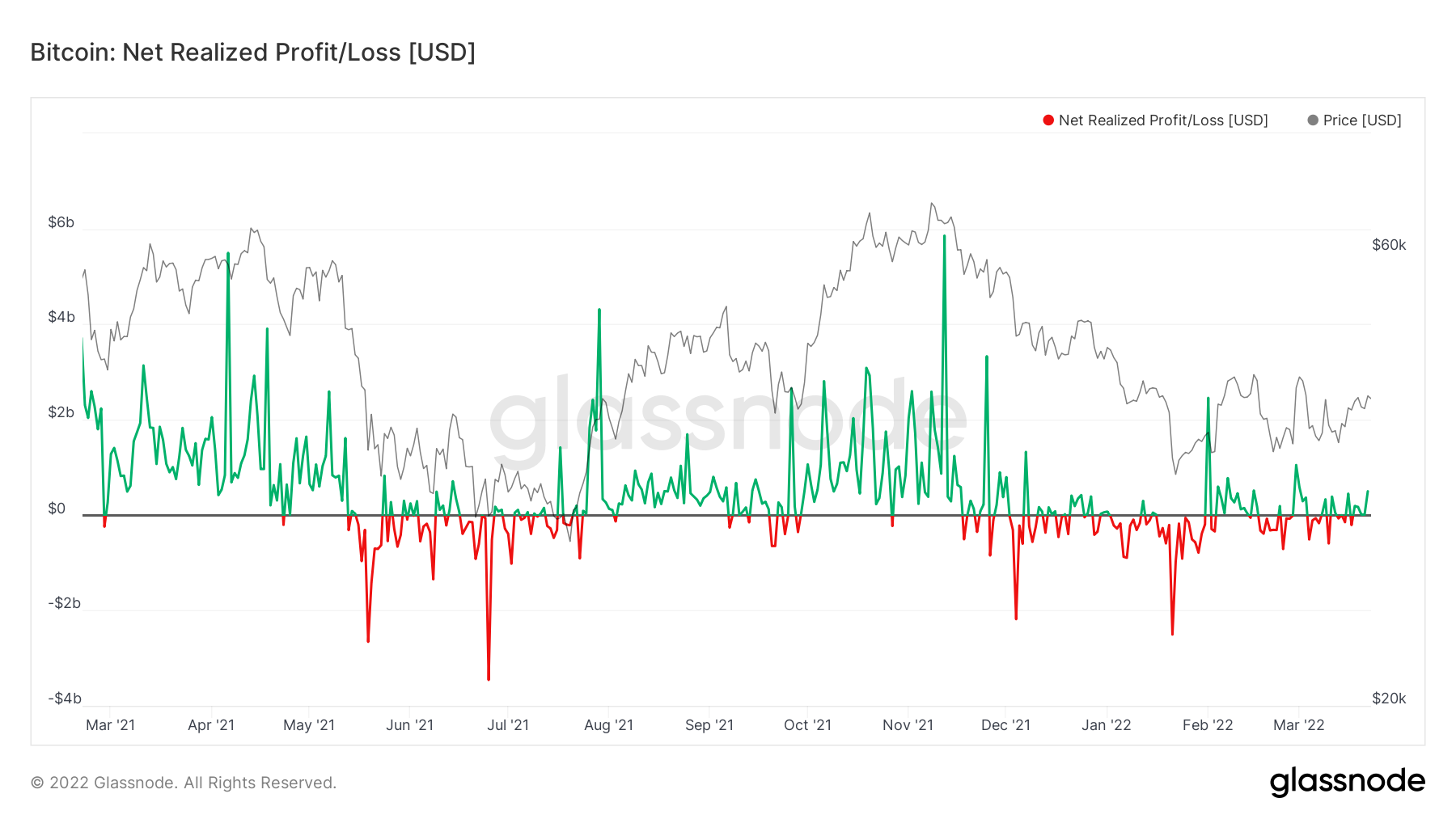

Metric 5 – Net Realised Profit/Loss

Looking at the Net Realised Profit/Loss, we can see that the green line bounced off of the black horizontal line and has spiked up even if not with any great size. This suggests that investors were not willing to sell their coins in a loss as prices went down this time and had enough conviction to hold and wait for prices to go higher. Again, this is another important metric to track as we want to see if this sentiment amongst investors continues.

Bitcoin – Net Realised Profit/Loss

Summary

Some of the more core metrics we regularly cover have begun to look more positive over the past week or so. The Exchange Net Position Change is seeing more meaningful outflows whilst the number of largest Bitcoin wallet holders is increasing, if even by only a few percent. For now the signs look more positive, but price action will depend on the Russia/Ukraine war and the FED. If bad news from the war comes out (unexpectedly worse news than normal) or if J Powell is more aggressive in his rate hikes at the next FED meeting in May (some are suggesting a 0.5% rate rise may be on the table, taking us to 0.75% interest rates up from 0% in just two months), then this could negatively affect price action.