- The geopolitical headwinds look as if they may be beginning to wind down. This is positive for markets assuming there are no alarming changes.

- The Exchange Net Position Change for both Bitcoin and Ether indicates increased accumulation over the past week.

- A spike in the Coin Days Destroyed graph was investigation worthy, but fortunately, many of the wallet cohorts holding older coins have not sold, the anomaly being the Spent Outputs > 10 years. This is not a huge concern and can be taken as an anomaly.

- For now, sentiment and market conviction is positive and this may result in higher prices. However, with the FED meeting fast approaching in May, words of an aggressive Balance Sheet reduction may see liquidity in risk-on assets dry up and push prices lower, i.e., the positive prices we’re currently seeing may be short-lived.

Macro:

In the past week, some of the key macro headwinds have begun to unwind slightly and we are beginning to see more positive outcomes. The Russia/Ukraine war has seen peace talks finally progress and both sides now seem to be willing to do a deal. This is of course positive for markets and can help to push a risk back on narrative for riskier assets. However, it must be mentioned that just because peace talks are under way, doesn’t mean a deal will be done, but at least for now the signs are more promising.

The next major economic headwind is the next FED meeting which is in May, so we effectively have reduced headwinds between now and May. Perhaps this is why we’re seeing risk on assets perform well as sentiment shifts back to a risk-on environment, even if only for the near-term.

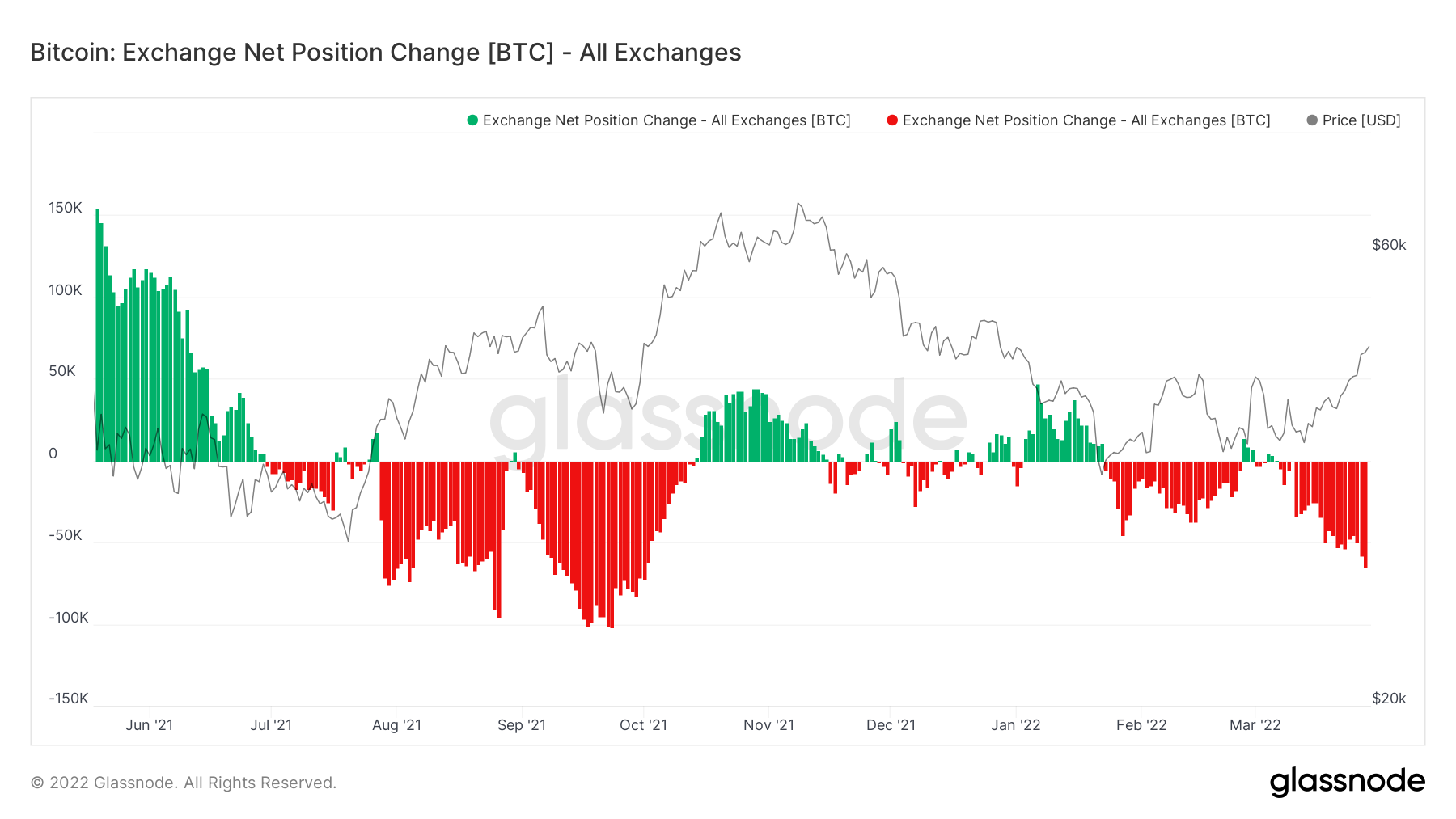

Metric 1 – Exchange Net Position Change

As usual we will begin this week’s report by looking at the Exchange Net Position Change. This metric tracks the net inflows or outflows of Bitcoin’s into or out of Exchanges from cold storage wallets. We use this metric as it almost acts as a summarised metric of the full on-chain data, but to fully understand it we need to look under the hood more to assess individual metrics and the meanings of these on the Exchange Net Position Change. We can see below that the Exchange Net Position Change for Bitcoin shows increasing net outflows of Bitcoin from Exchanges to cold storage wallets. This is a positive sign and means that investors have been accumulating.

Bitcoin – Exchange Net Position Change

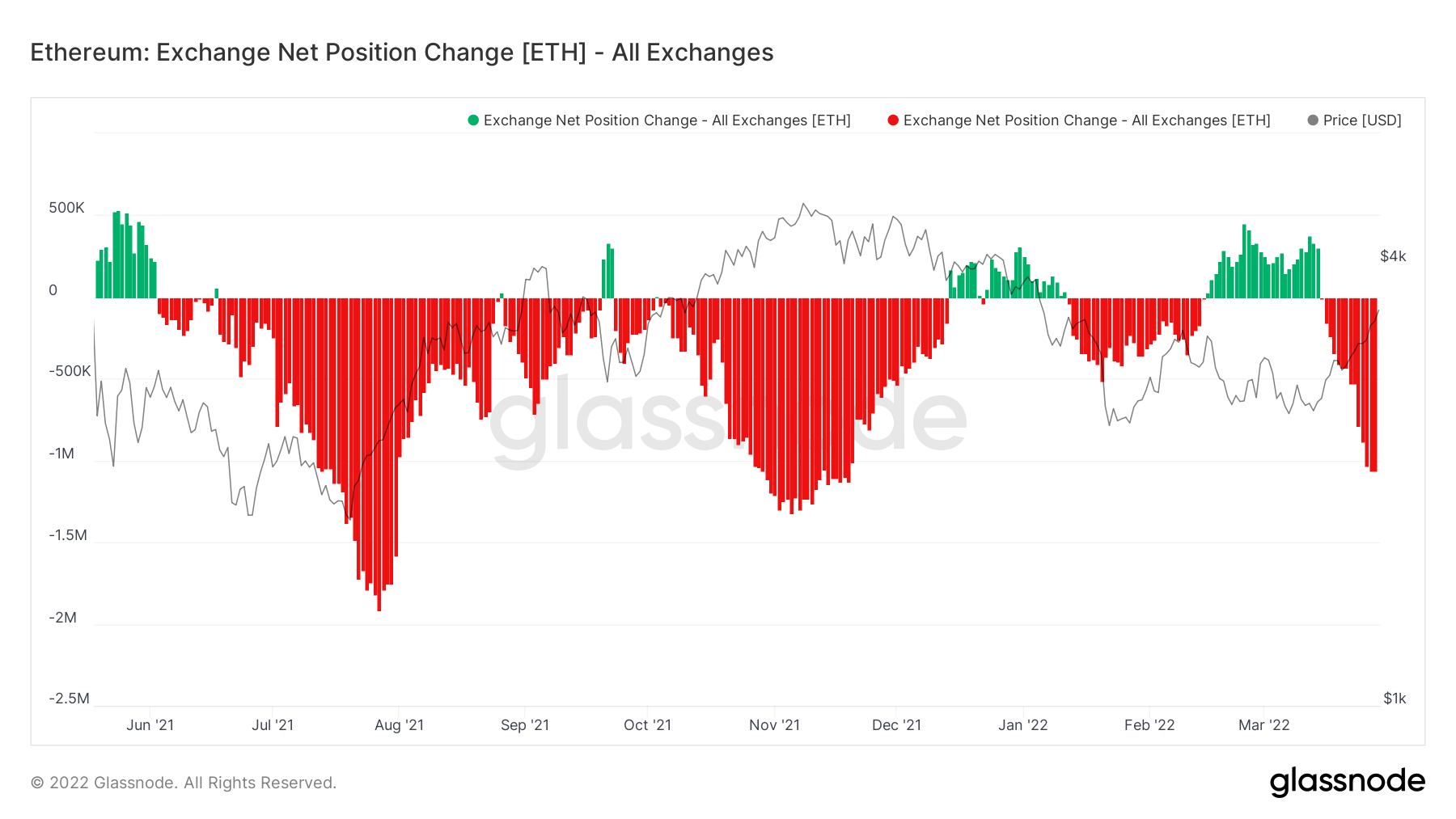

The Exchange Net Position Change for Ether is also showing net outflows of Ether from Exchanges to cold storage wallets, with a net withdrawal amount over the last few days of 1 million Ether per day leaving Exchanges.

Ether – Exchange Net Position Change

Metric 2 – Large Wallet Inflows

If we take a dive into our second metric, Large Wallet Inflows, we can see that recently there have been a large number of Bitcoins being bought (represented by the large blue bubbles) at the range-bound area of $37,000 - $45,000. Notice that these bubbles still remain, we have a 226k Bitcoin purchase back on the 28th Feb which still has not been sold and reflects strong sentiment from the buyers to continue holding……for now. Something to certainly keep a watch of.

Bitcoin – Large Wallet Inflows

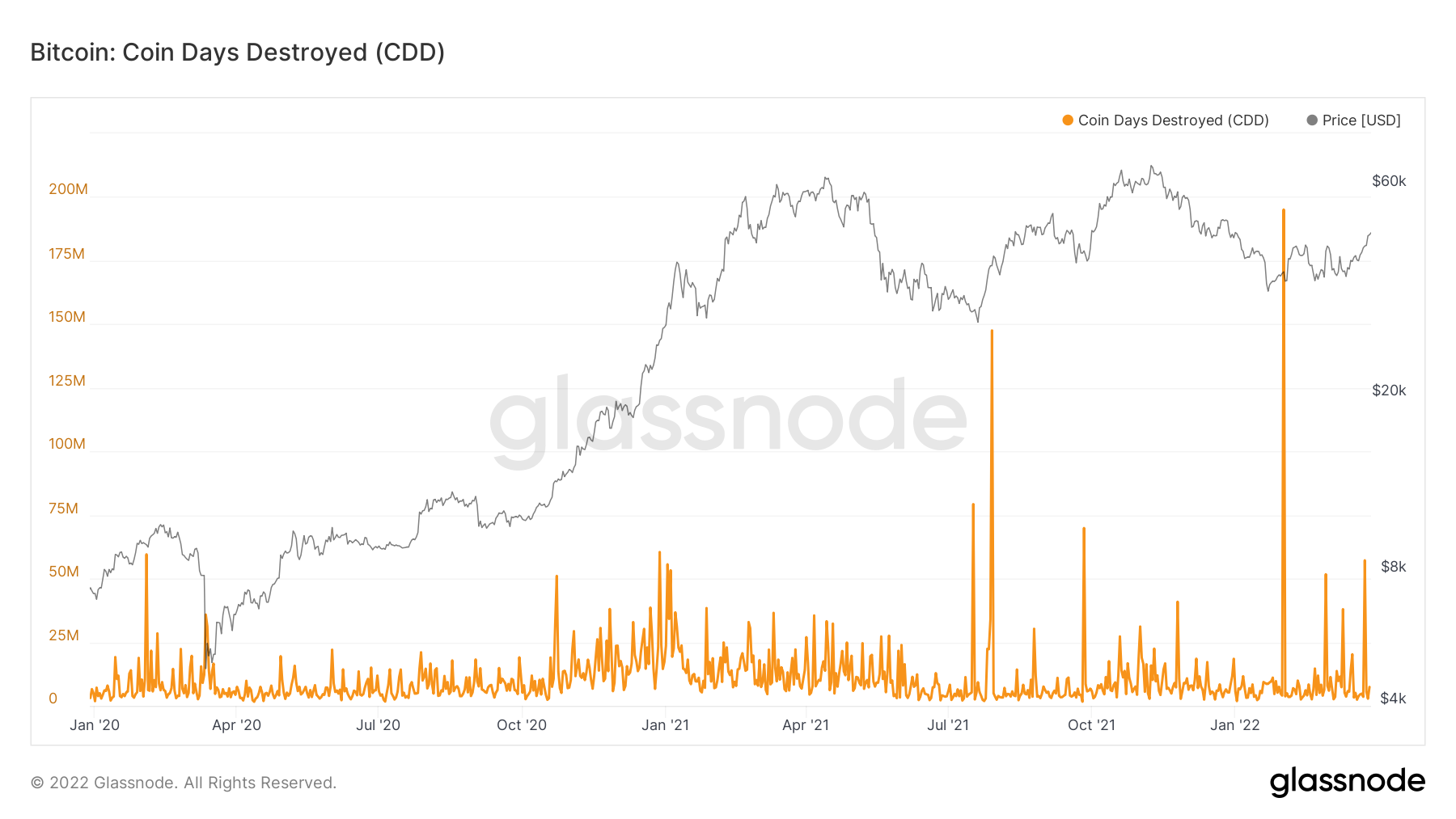

Metric 3 – Coin Days Destroyed

The Coin Days Destroyed metric shows if older coins were spent. We track this as we ideally want to be seeing the long-term investors not selling their coins, ie, we’re looking for little to no spikes (orange line) in this metric. The Coin Days Destroyed metric is calculated by multiplying the number of coins in a transaction by the number of days it has been since those coins were last spent. We can see on the below metric that there has been a slight spike in this metric. The size of the spike does not cause great concern but it’s important to understand which cohort of selling this was produced by.

Bitcoin – Coin Days Destroyed

It should be noted that on this metric for Ether, there is little to no spike, so no further investigation needed for Ether.

Ether – Coin Days Destroyed

Metric 4 – Lifespan

In order to understand the spike on the Coin Days Destroyed graph, we need to look into the wallet cohorts to see which cohorts are responsible. Now, looking at every cohort of wallets, there was not a reasonable spike on any, this includes; Spent Outputs 1 month – 3 months, Spent Outputs 3 months – 6 months, Spent Outputs 1 year – 2 years, Spent Outputs 2 years – 3 years, Spent Outputs 3 years – 5 years, Spent Outputs 5 years – 7 years. Then we reached the greater than 10 years Spent Outputs, and there was a slight spike.

Bitcoin – Spent Outputs > 10 Years

Notice on the above metric that in recent days, we have had a spike on this metric. This is of course the metric that accounts for the greatest weight in the Coin Days Destroyed metric as it represents the eldest coins. The fact we have seen very little to no spikes on all the Spent Output metrics from 6 months old all the way through to 7 years old, would suggest that we should not be too worried and that the above spike may just be an anomaly. However, it is important to continue assessing these metrics as we would not want to see other cohorts of wallets have a spike in selling, as historically they are the most profitable so therefore a bull market would see them accumulating and hodling rather than selling.

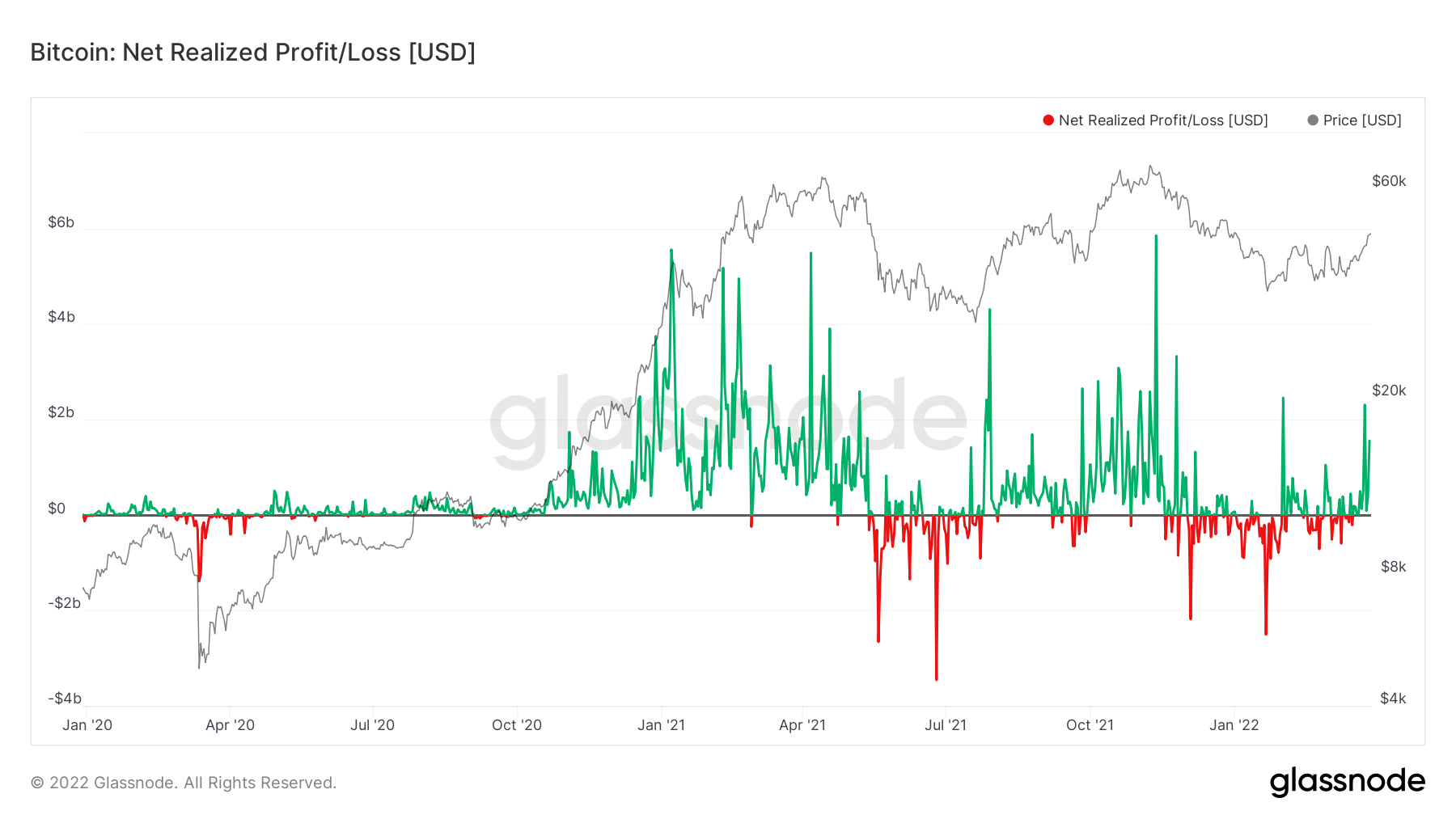

Metric 5 – Net Realised Profit/Loss

The Net Realised profit/Loss shows the amount of profit or loss being taken in the market. We can see in the below that profit taking has increased quite significantly. It is also important to note that there was a bounce off of the 0 value. This indicates that investors are willing to hold their coins and wait for them to return to a profit rather than selling at a loss. This potentially shows a shift in investor sentiment and that overall market conviction looks to have increased.

Bitcoin – Net Realised Profit/Loss

Summary

It is clear that over the past week or so investor sentiment has shifted to having greater conviction in the market that higher prices are on the horizon. For this reason, we have seen investors accumulate in greater amounts in comparison to prior months and we are seeing less selling from the older cohorts of wallets (with the exception of the Spent Outputs > 10 years – an anomaly). However, with the next FED meeting in May, it is expected that interest rates will rise by 0.5% and there will likely be a plan put to the market of how the FED will reduce its Balance Sheet (this will be explained in a macro report in the coming weeks). But all-in-all, a reduction of the Balance Sheet and a sharper rise in rates will likely see market liquidity reduced and therefore risk-on assets such as crypto, may struggle to get a bid. So, for now, we look good for continued higher prices, however, this may be short-lived and we may see the tide begin to change towards the very back end of April/early May in anticipation of May’s FED meeting.