On-Chain Forensics 37

In this week’s report, we will be taking a deep dive into some of the on-chain metrics and what they suggest for the market going forward. Overall, we have seen some de-risking from some of the larger cohorts of investors as we head into a more tumultuous economic environment.

TLDR

- The Exchange Net Position Change shows that Bitcoin is still being quietly accumulated in the Spot markets whilst Ether is neither being heavily accumulated nor distributed - but it has just come off the back of a distribution period.

- The number of wallets with 1, 10, 100, 1,000 and 10,000 Bitcoin have decreased in number, suggesting a risk-off approach from investors.

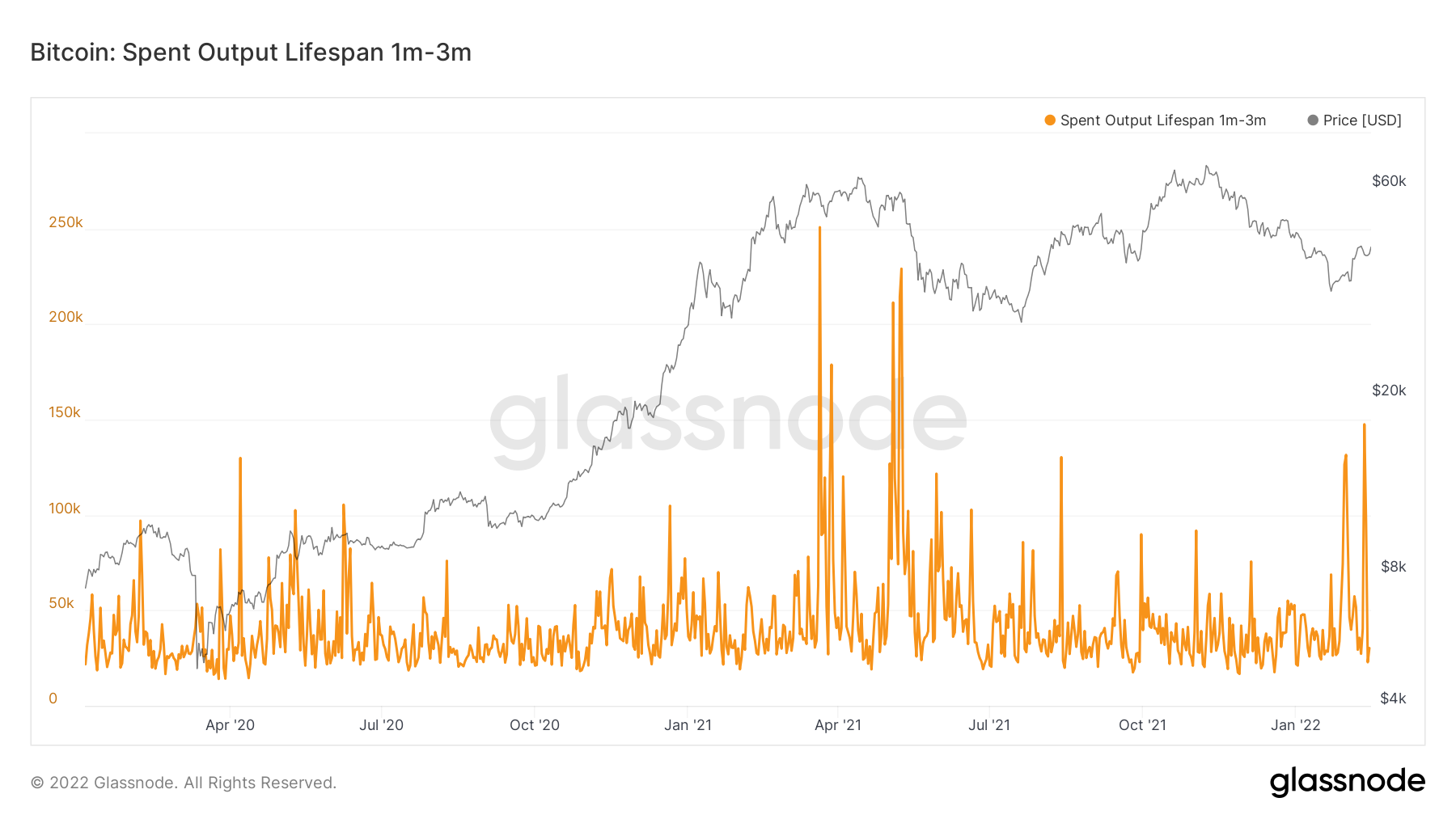

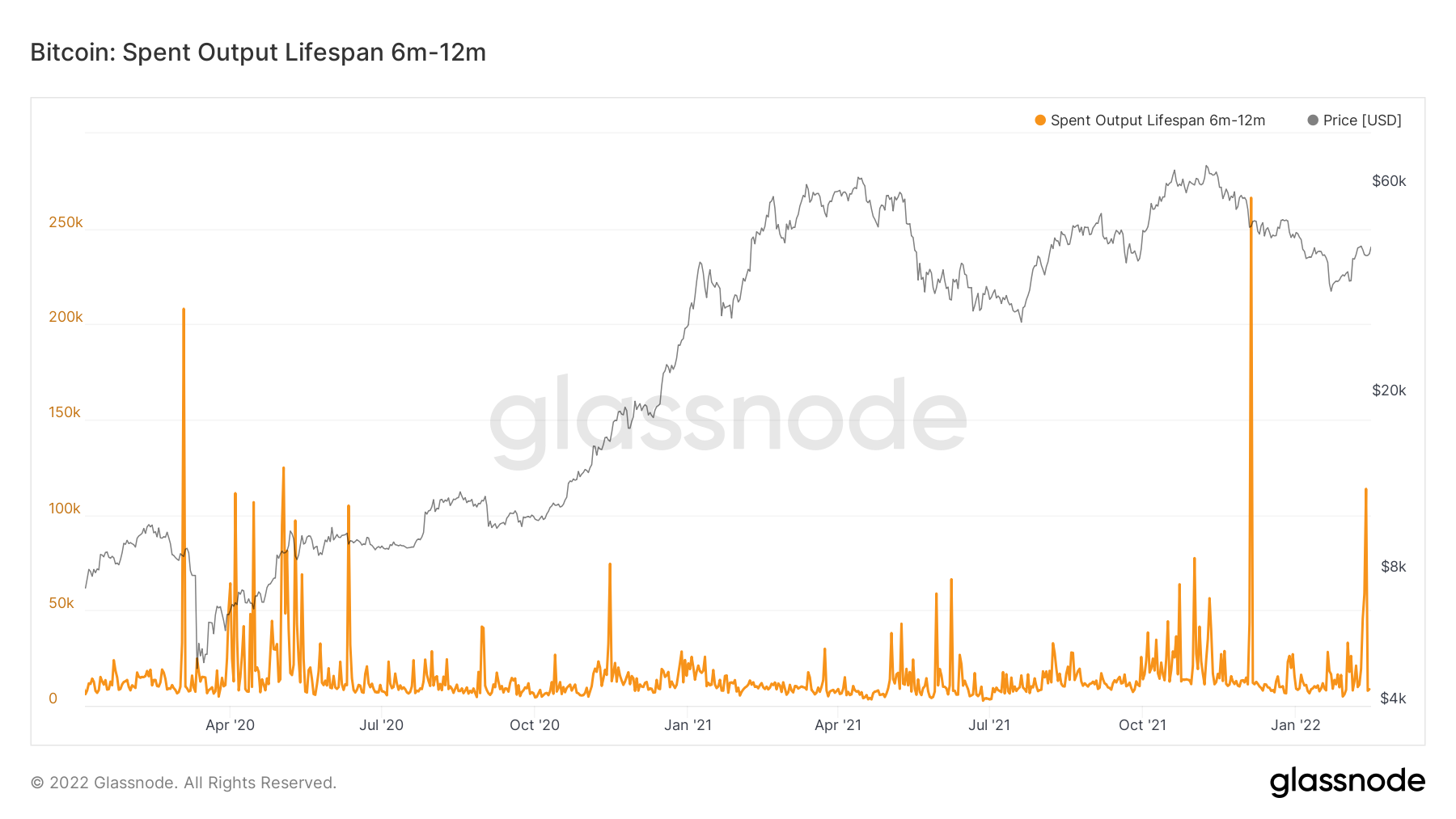

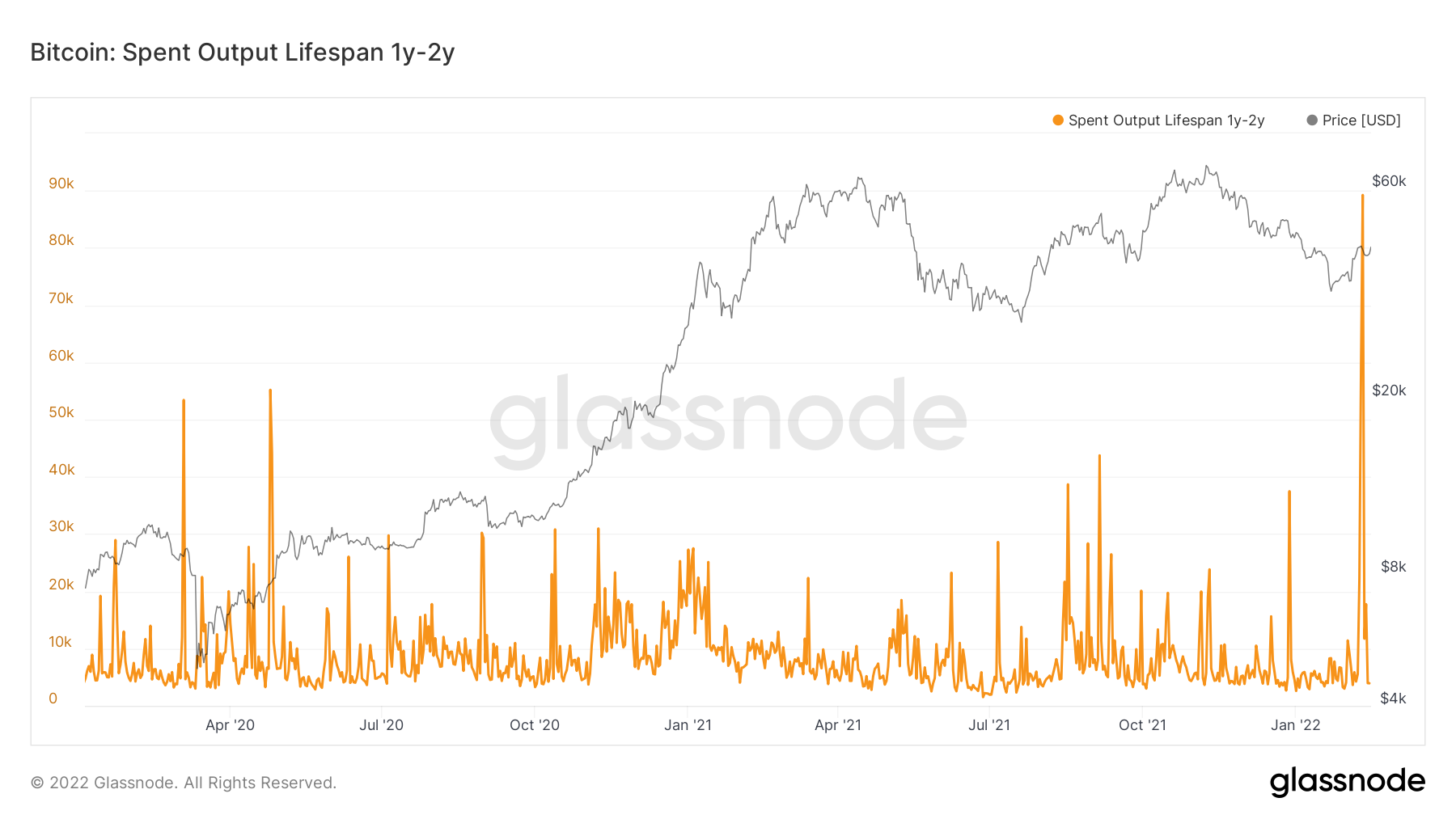

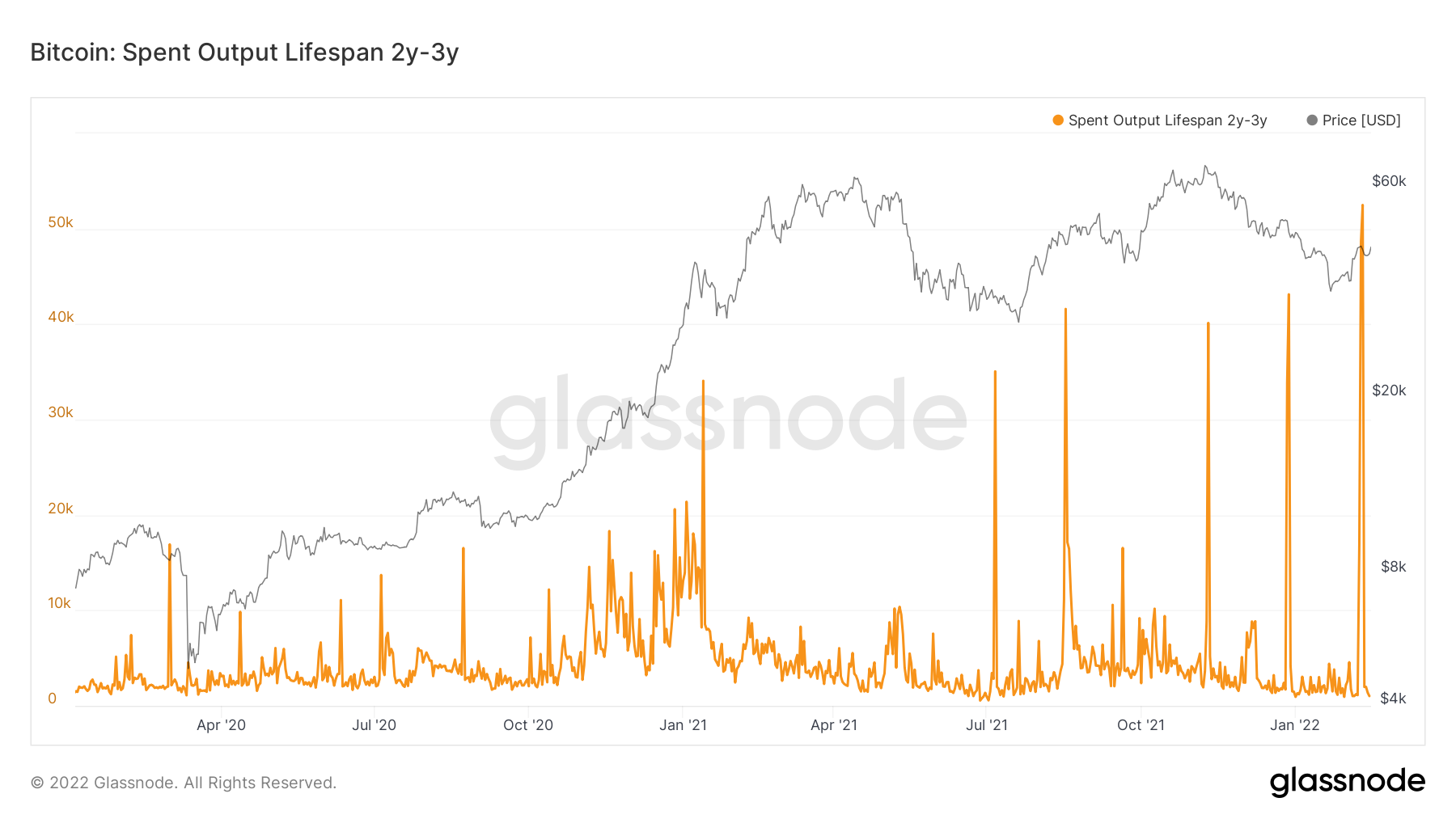

- The lifespan metrics have shown some alarming signals. We’re seeing a lot of older coins being spent into this relief rally (large orange spikes). This suggests a risk-off sentiment amongst investors who have now reduced their crypto exposure.

Metric 1 – Exchange Net Position Change

If we investigate the Exchange Net Position Change, we can see that red spikes have increased. This means that more Bitcoins are flowing out of Exchanges into cold storage wallets each day than the number of Bitcoins flowing into Exchanges (to be sold) each day from cold storage wallets. Overall, this shows a bias amongst investors to accumulate as the number of Bitcoins flowing out of Exchanges is increasing each day (larger red spikes).Bitcoin – Exchange Net Position Change

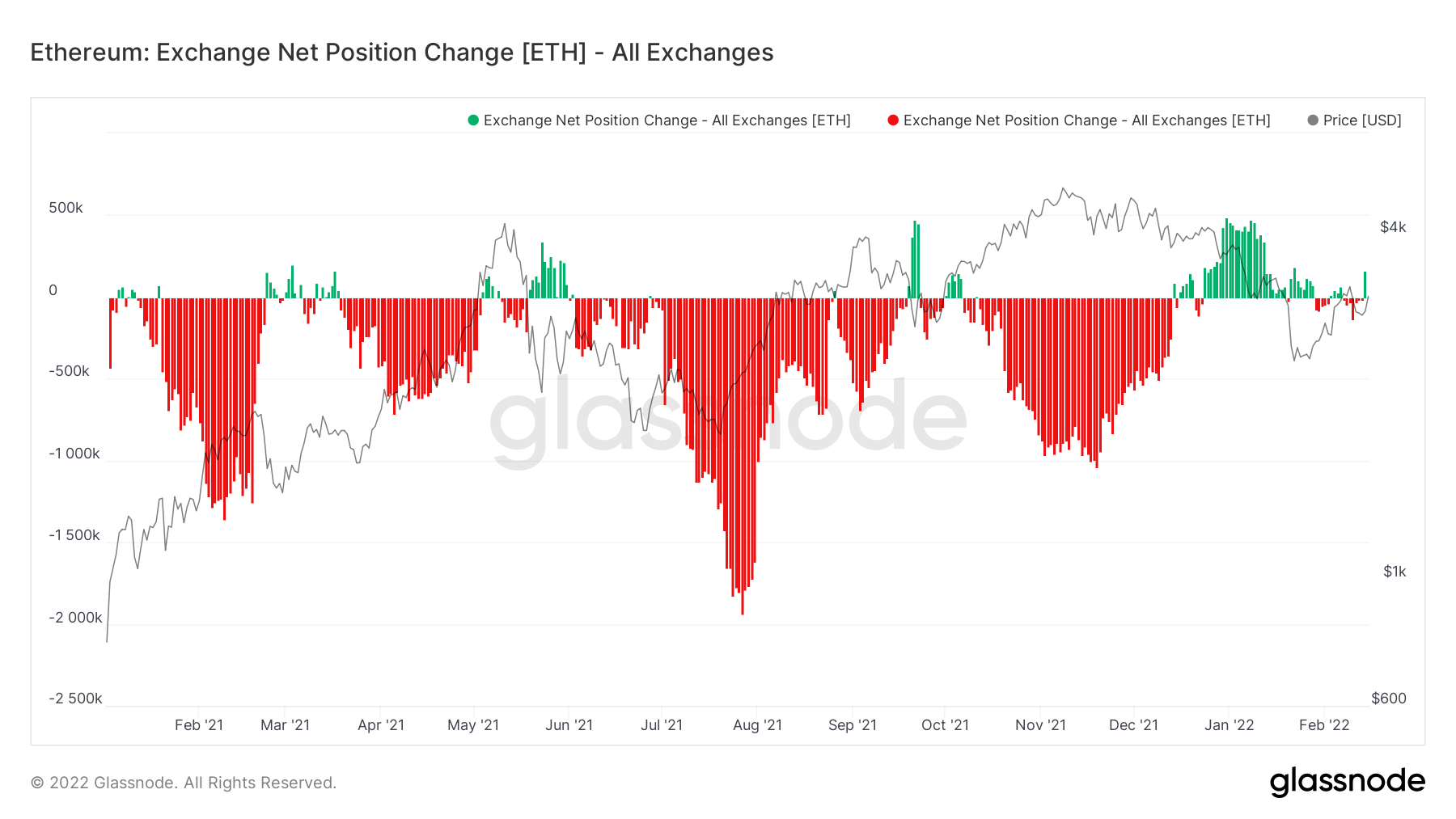

Ether – Exchange Net Position Change

Turning our attention to Ether, we see that the sentiment is not similar. There is more Ether flowing from cold storage wallets to Exchanges than from Exchanges to cold storage wallets (green spikes) as of recent. In recent days, we have seen selling (green spikes) into Ether price increases. This suggests a ‘sell the rip’ rather than a ‘buy the dip’ mentality.

Metric 2 – Addresses

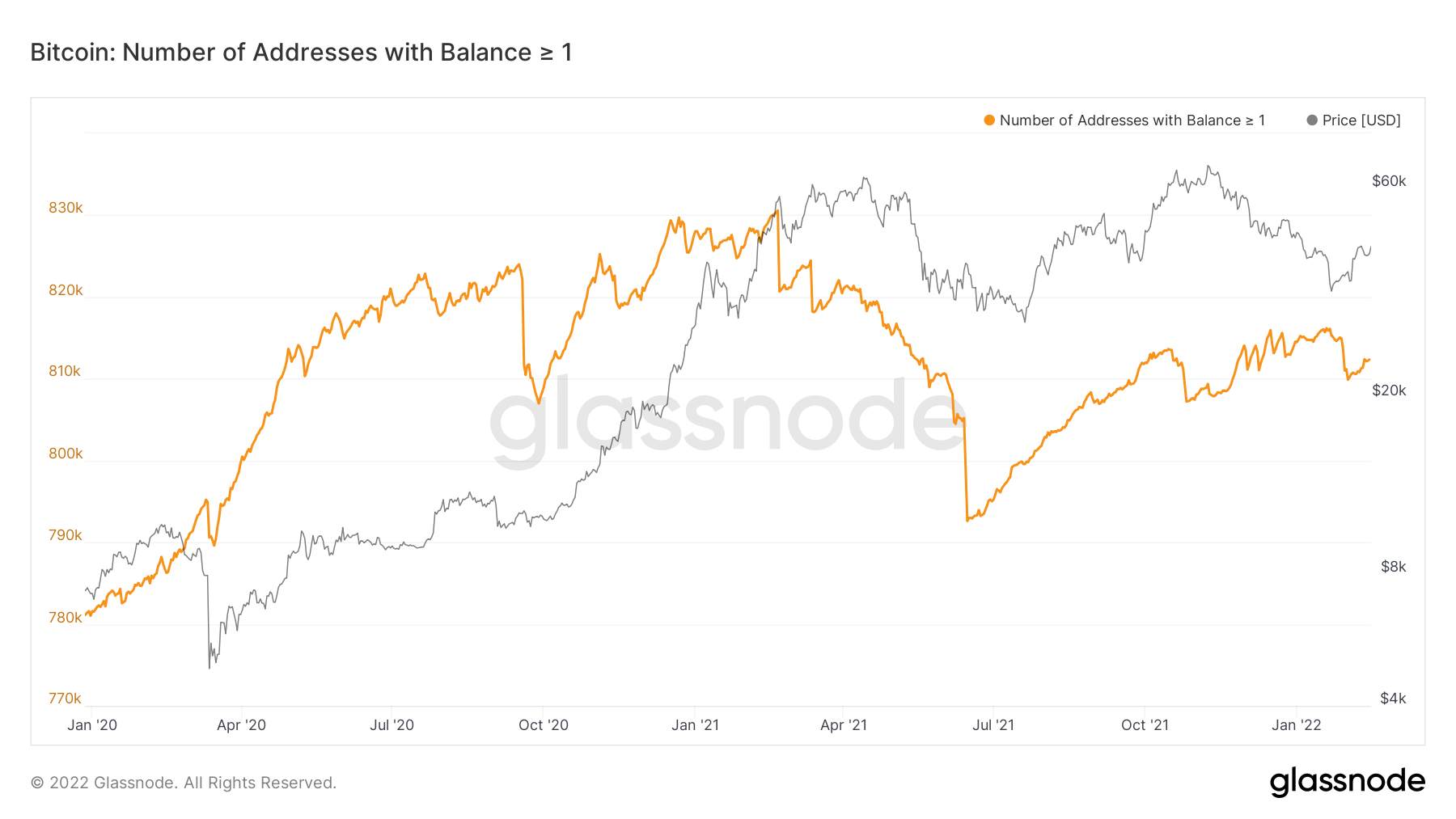

An important set of metrics to investigate is the cohort of addresses. By analysing these metrics, we will be able to garner an understanding as to which cohorts of wallets are de-sizing or increasing their size (in Bitcoin/Ether terms).Bitcoin – Addresses with Balance > 1 Bitcoin

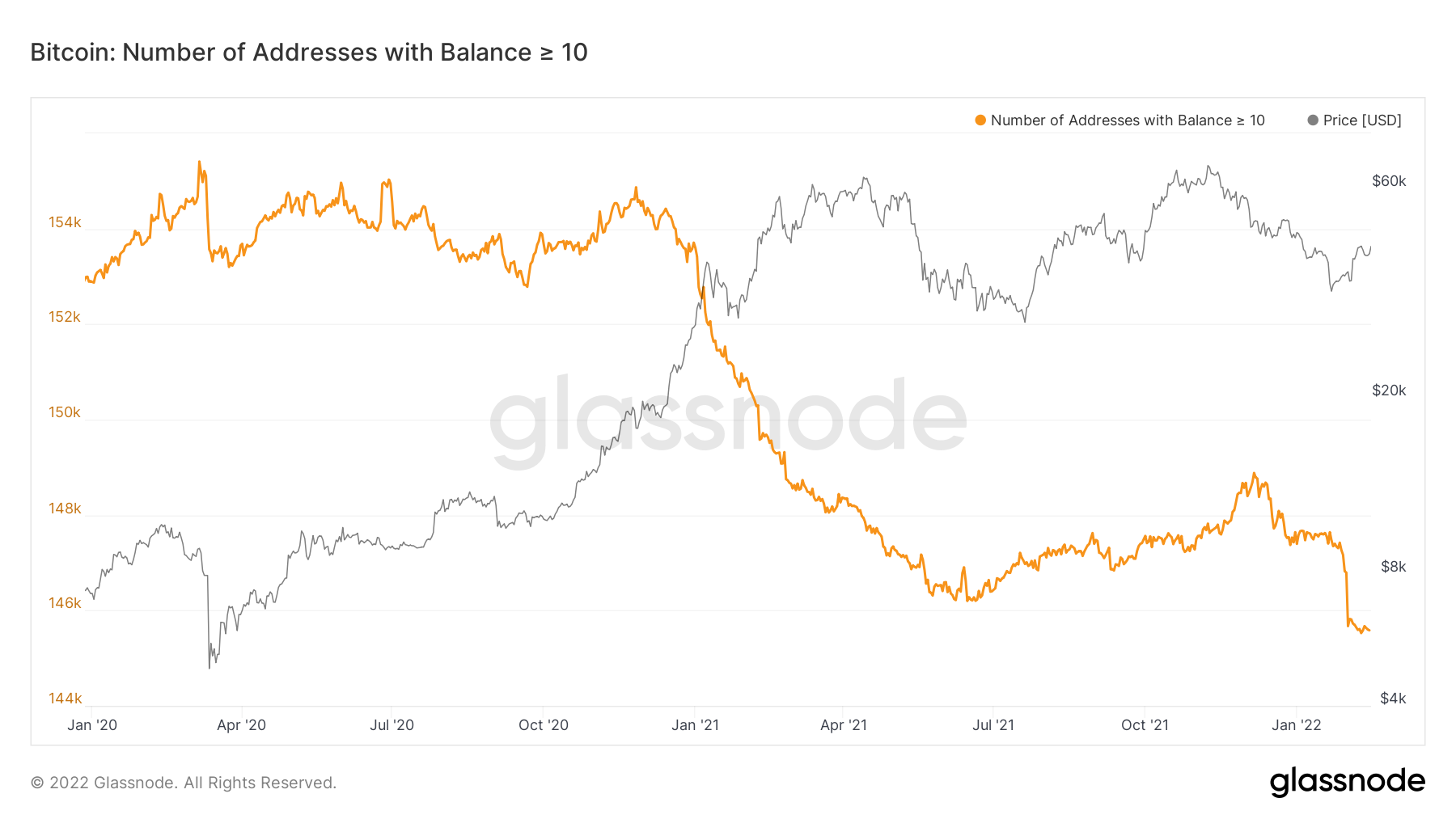

Bitcoin – Addresses with Balance > 10 Bitcoin

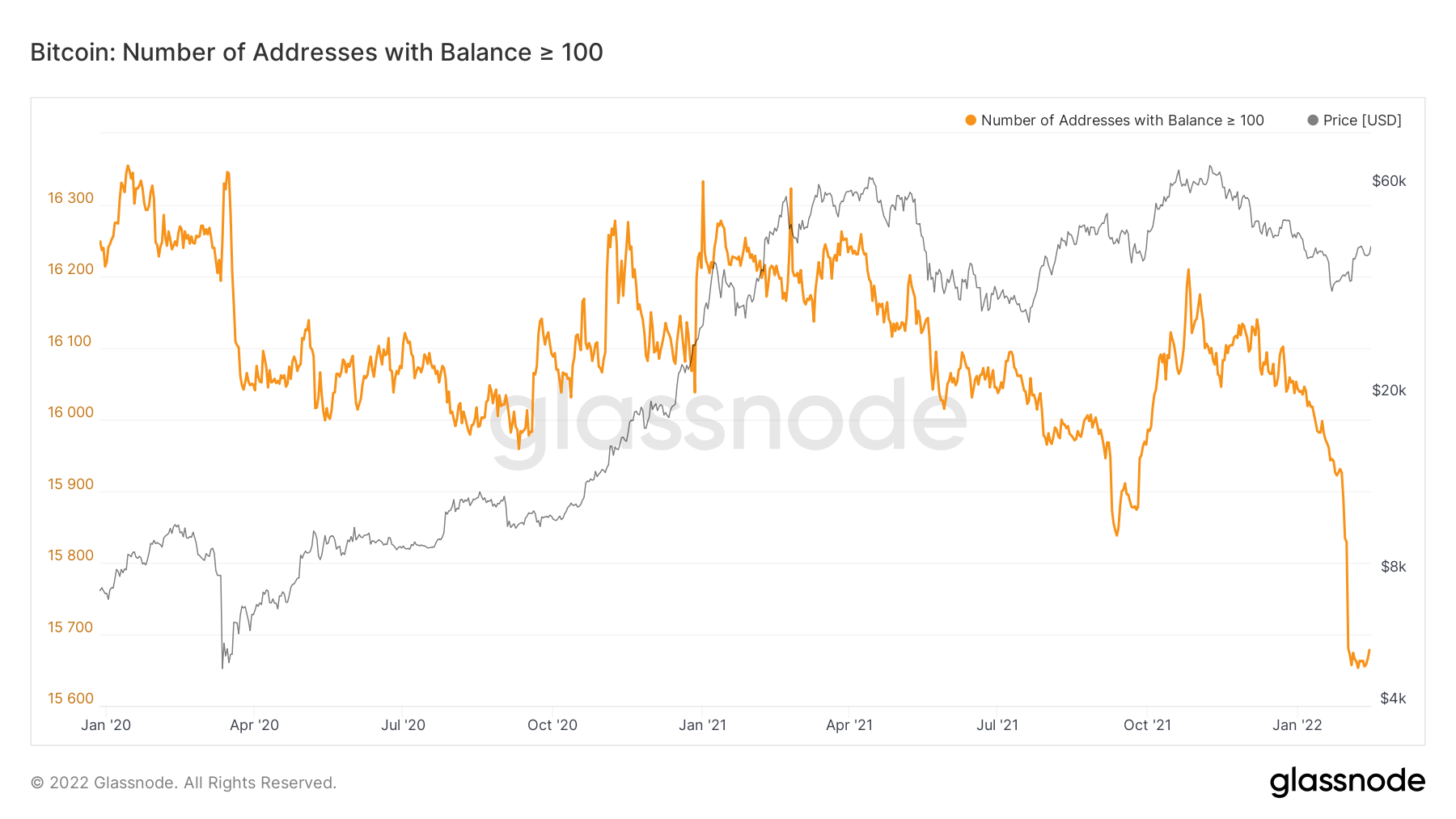

Bitcoin – Addresses with Balance > 100 Bitcoin

Bitcoin – Addresses with Balance > 1,000 Bitcoin

Looking at the above charts, we can see that many of the larger cohorts of wallets have sold some of their size (in Bitcoin) over the past weeks. What we have seen is the number of wallets holding more than 10 and 100 Bitcoin significantly decrease, showing a selling of Bitcoin from these cohorts to reduce the overall amount they own – de-risking.

In the wallet sizes, which are greater than 1 and 1,000 Bitcoin, respectively, we can see declines in these cohorts, but the declines are not as drastic as the other cohorts. Overall, this still suggests a risk-off approach from investors who are decreasing their exposure from the asset class in this more turbulent time for financial assets.

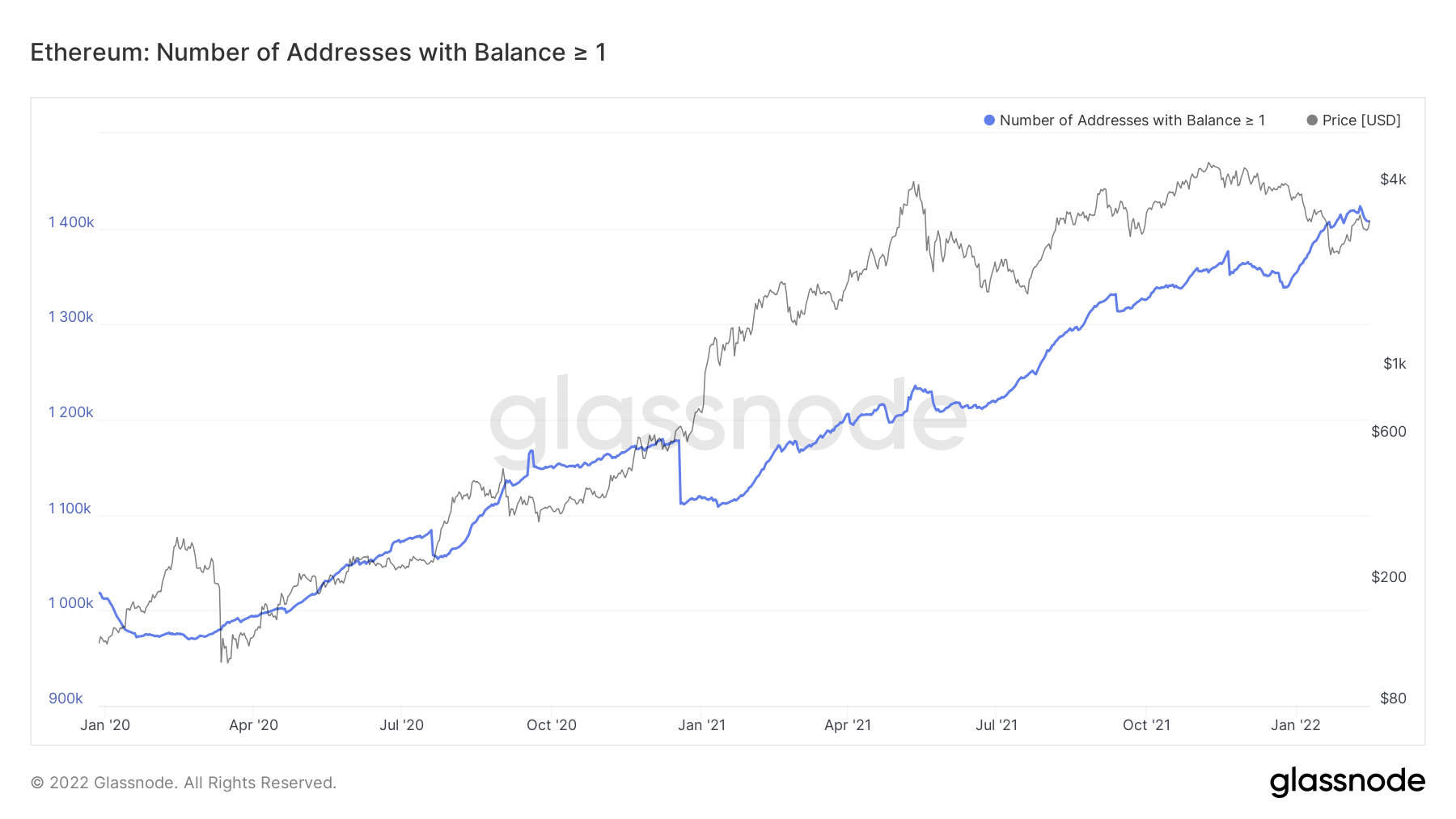

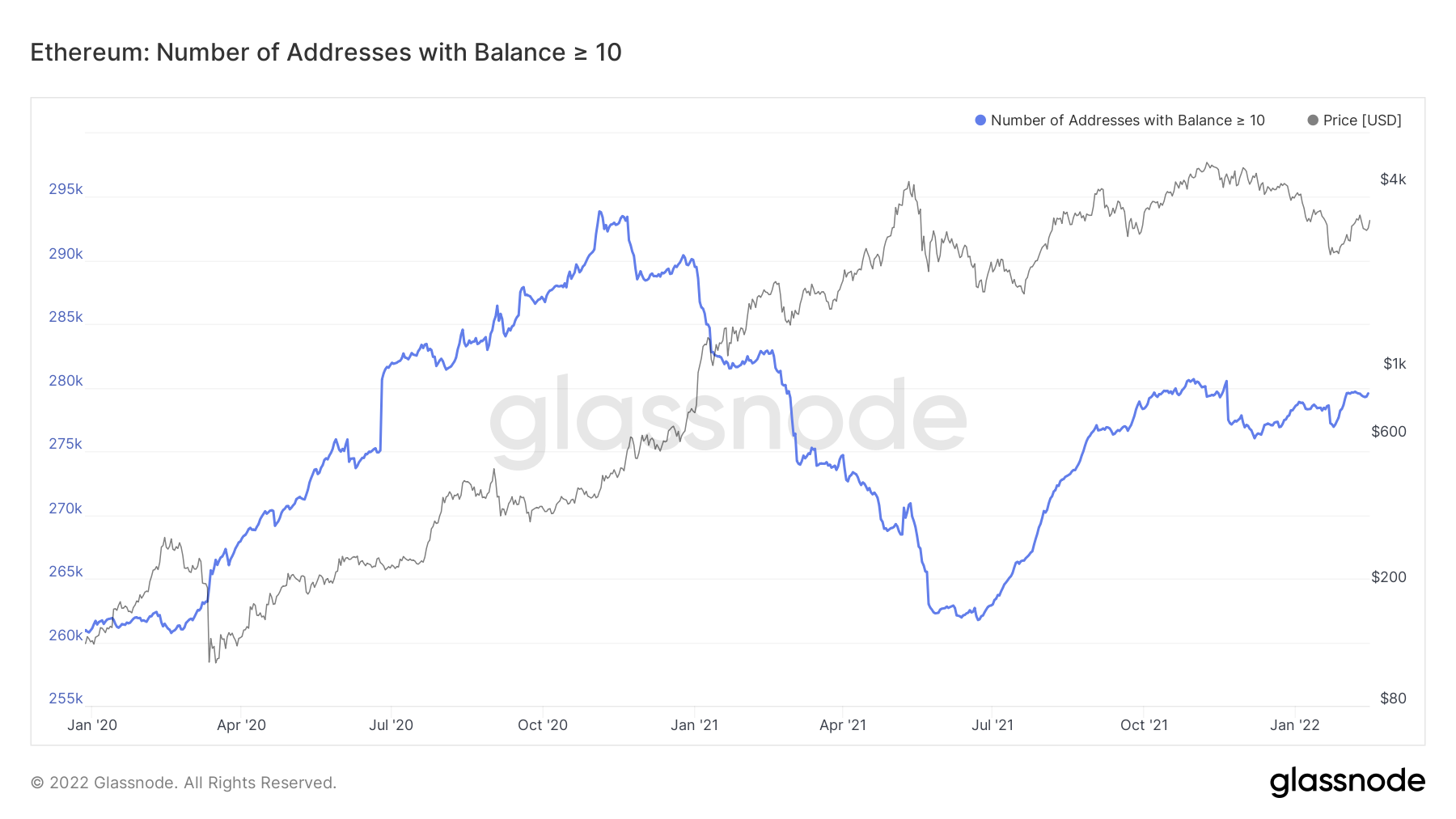

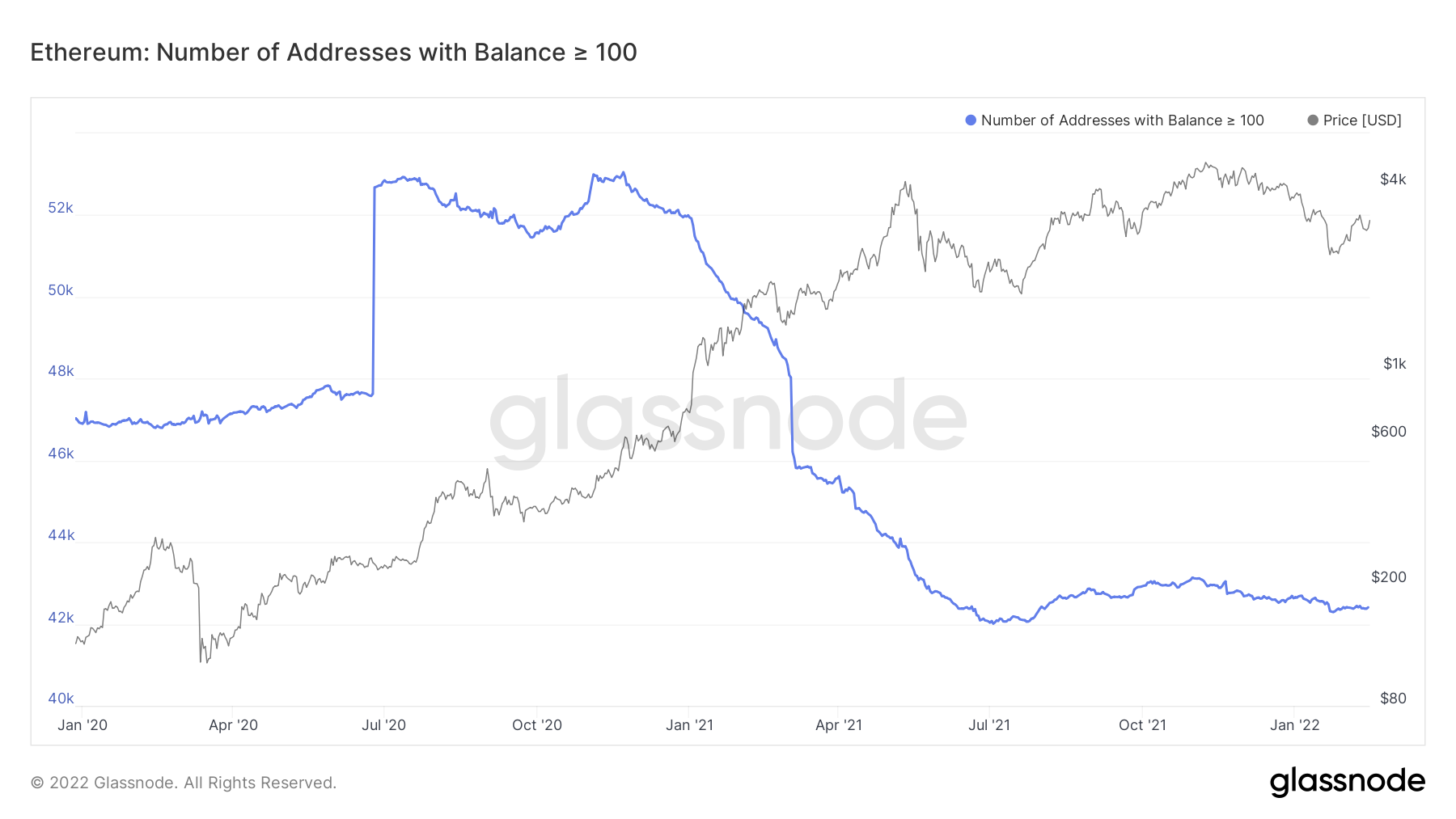

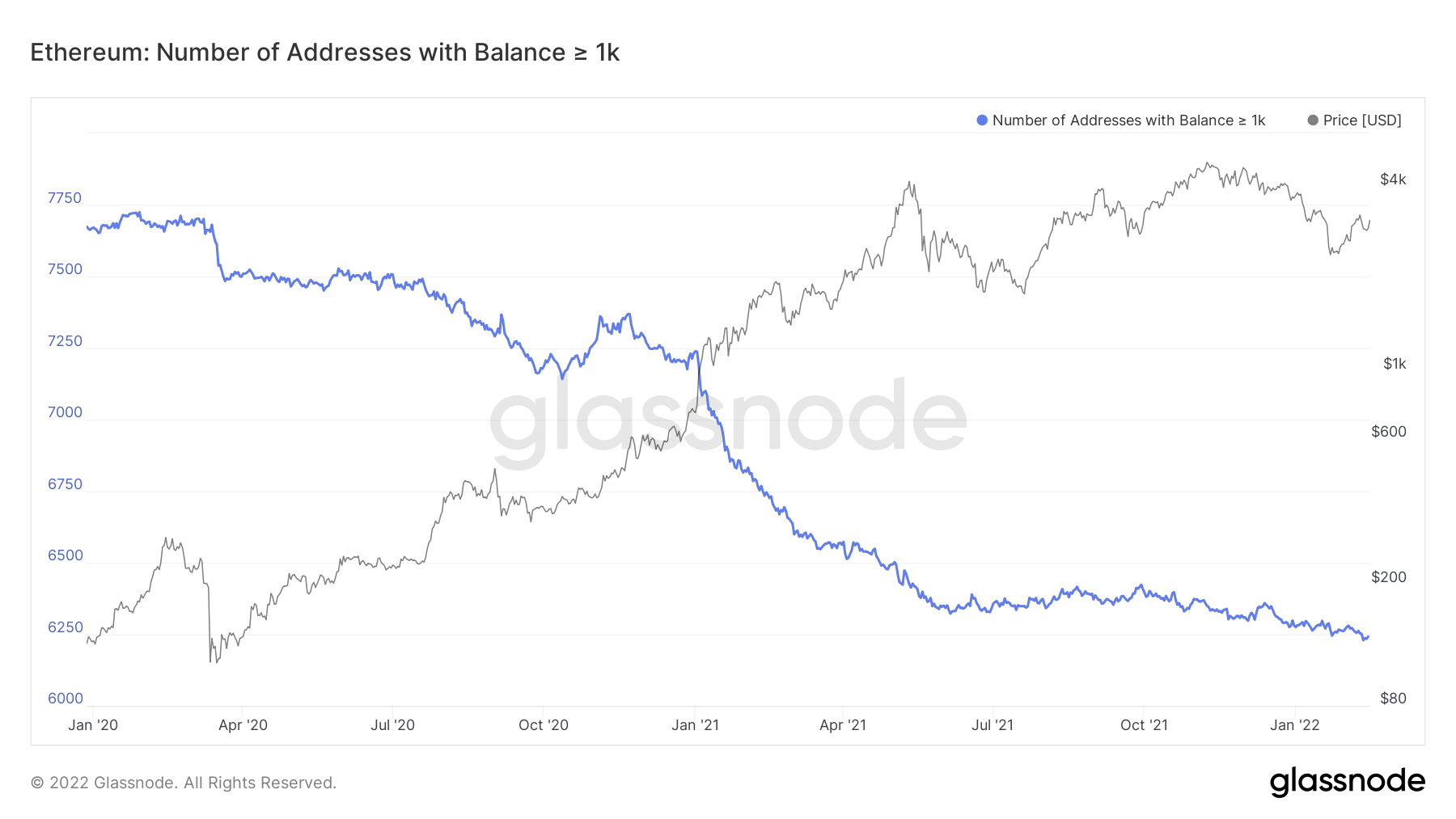

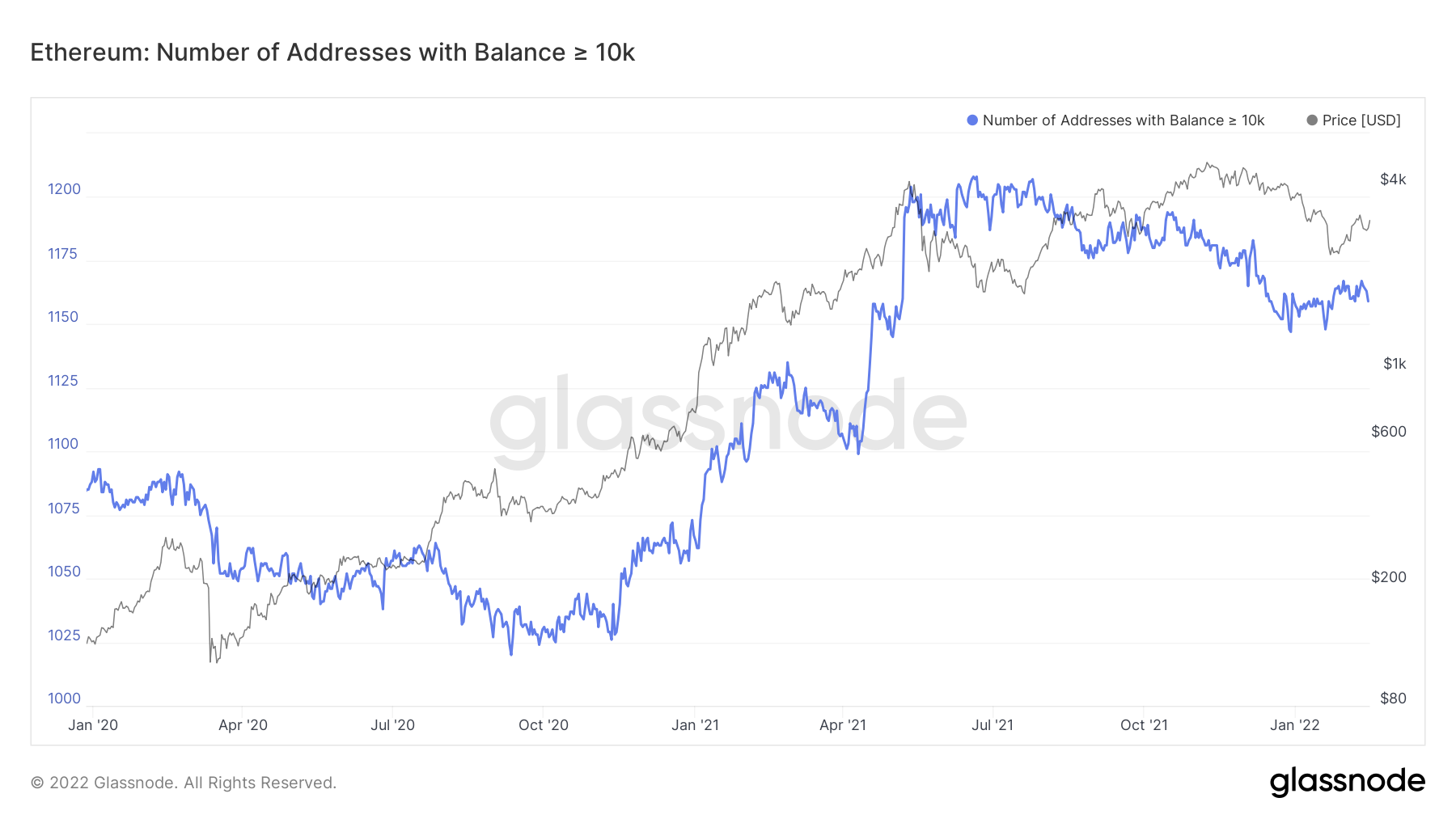

If we compare similar metrics for Ether, we can see that a different picture is painted. In most, we see the number of wallets with 1, 10, 100 and 10,000 Ether either increasing in number or flat-lining. The 1,000 Ether wallets have seen some declines in numbers, but this is the only cohort of wallets that have.

Ether – Addresses with Balance > 1 Ether

Ether – Addresses with Balance > 10 Ether

Ether – Addresses with Balance > 100 Ether

Ether – Addresses with Balance > 1,000 Ether

Ether – Addresses with Balance > 10,000 Ether

Seeing the 10,000 Ether wallets increase in number into this price increase is a positive sign to see. However, this Ether metric is notorious for cloning price. For instance, if the value of Ether increases, the number of wallets with a balance greater than 10,000 Ether also increases and vice versa. So, essentially, it is a metric that is closely correlated to price and, therefore, is not a great indicator for predicting the next price movements.

Metric 3 – Lifespan

The last metric we’re going to cover in this week’s report is the coin lifespan. A bullish trend will see young coins not having any significant trend in particular, but it will show older coins are not being spent and rather held onto. A bearish indication will be if older coins being spent—the larger the orange spikes, the greater number of coins sold. The cohorts are listed below.Bitcoin – Spent Outputs 1m-3m

Bitcoin – Spent Outputs 3m-6m

Bitcoin – Spent Outputs 6m-12m

Bitcoin – Spent Outputs 1y-2y

Bitcoin – Spent Outputs 2y-3y

Looking at the above, there are some significant concerns. Firstly, the long-term coins aged between 1-3 years old have seen huge levels of selling, in fact, the largest amount since 2019. However, this behaviour is not solely exclusive to this category. We can see many of the other cohorts have also seen large amounts of selling.

Conclusion

For the first time, we will end with a conclusion rather than a summary, as a summary would not do the above justice.Currently, we are seeing Spot buying remain strong as the Exchange Net Position Change still shows net outflows from Exchanges indicating buying of Spot Bitcoin is still positive. However, we have seen significant de-risking from current investors; hence the lifespan is seeing huge spikes (investors selling large amounts of their coins). To match this, we are seeing the number of wallets holding more than 10 Bitcoin but less than 1,000 Bitcoin decrease (suggesting investors are selling some of their supply). But, the wallets with more than 1 and 1,000 Bitcoin have not seen significant declines. This suggests the larger wallet holders are de-risking, but the smallest wallets are the cohort that is looking to add. The 1,000 Bitcoin wallets are in the majority just sitting tight - not taking any drastic decisions with the increased volatility all markets are seeing.

Overall, it can be said that investors are mostly de-risking from risk-on assets ahead of what looks to be a tumultuous economic environment over the coming months. Larger investors are sitting on their hands and waiting for more clear signals before increasing their exposure to risk-on assets (crypto).