On-Chain Forensics 28

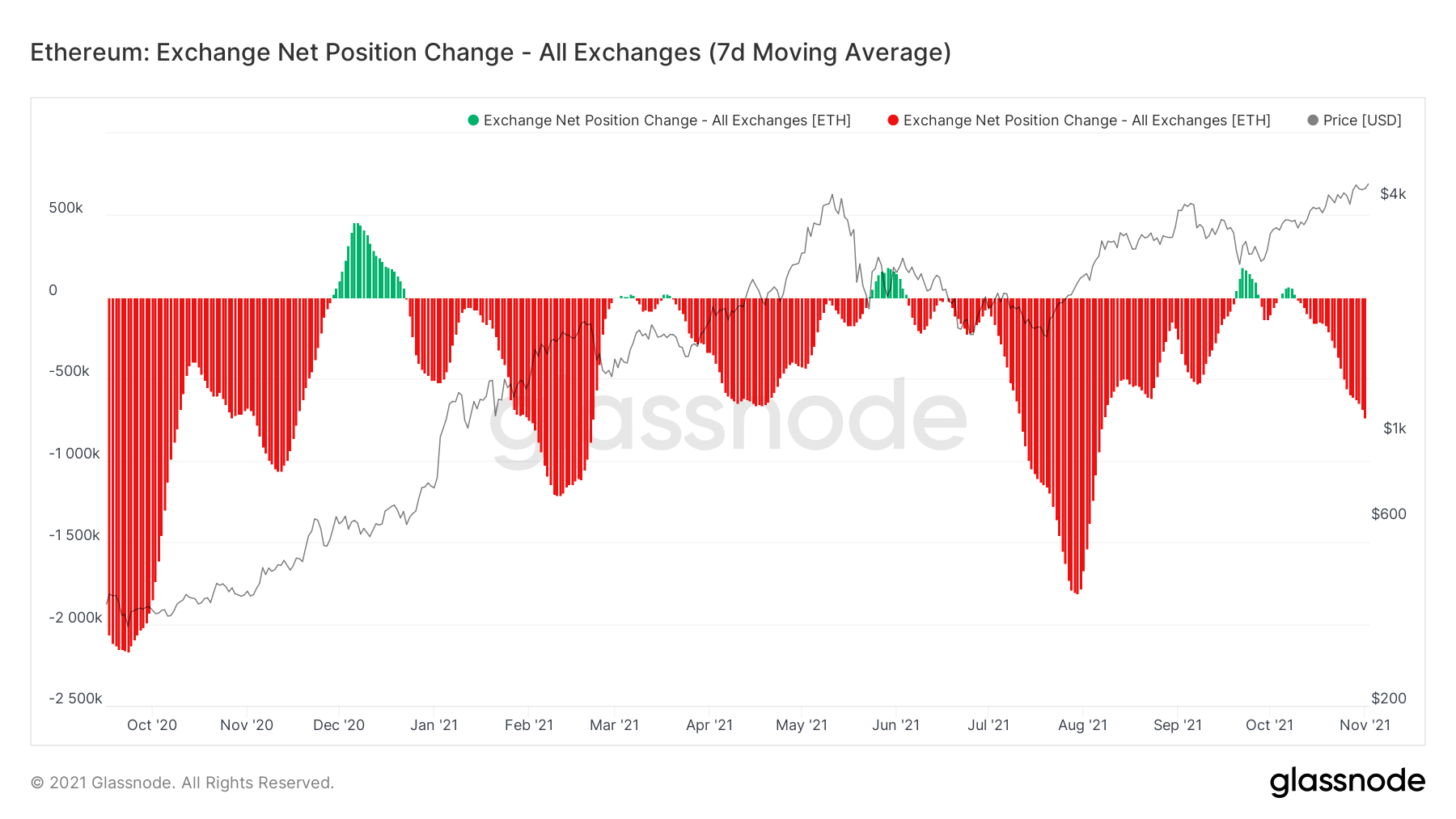

If we look at the Exchange Net Position Change for Ethereum, we can see an even more bullish picture than Bitcoin. ETH has been getting accumulated on the way down and now on the way up as well. It seems that investors are willing to pay whatever price in order to get their hands on ETH so far.

TLDR

- Both BTC and ETH are being accumulated. The only difference is BTC is getting accumulated on local dips whereas ETH is being accumulated on the way up (i.e. vertical accumulation).

- Exchange supplies keep dropping for both assets, communicating further bullishness from investors. We’re also seeing more inflows into the ETH2 Deposit Contract.

- For the most part, investors are still hodling on to their coins.

- The SOPR suggests that investors are not looking to sell their holdings anytime soon and are looking for much higher prices to do so.

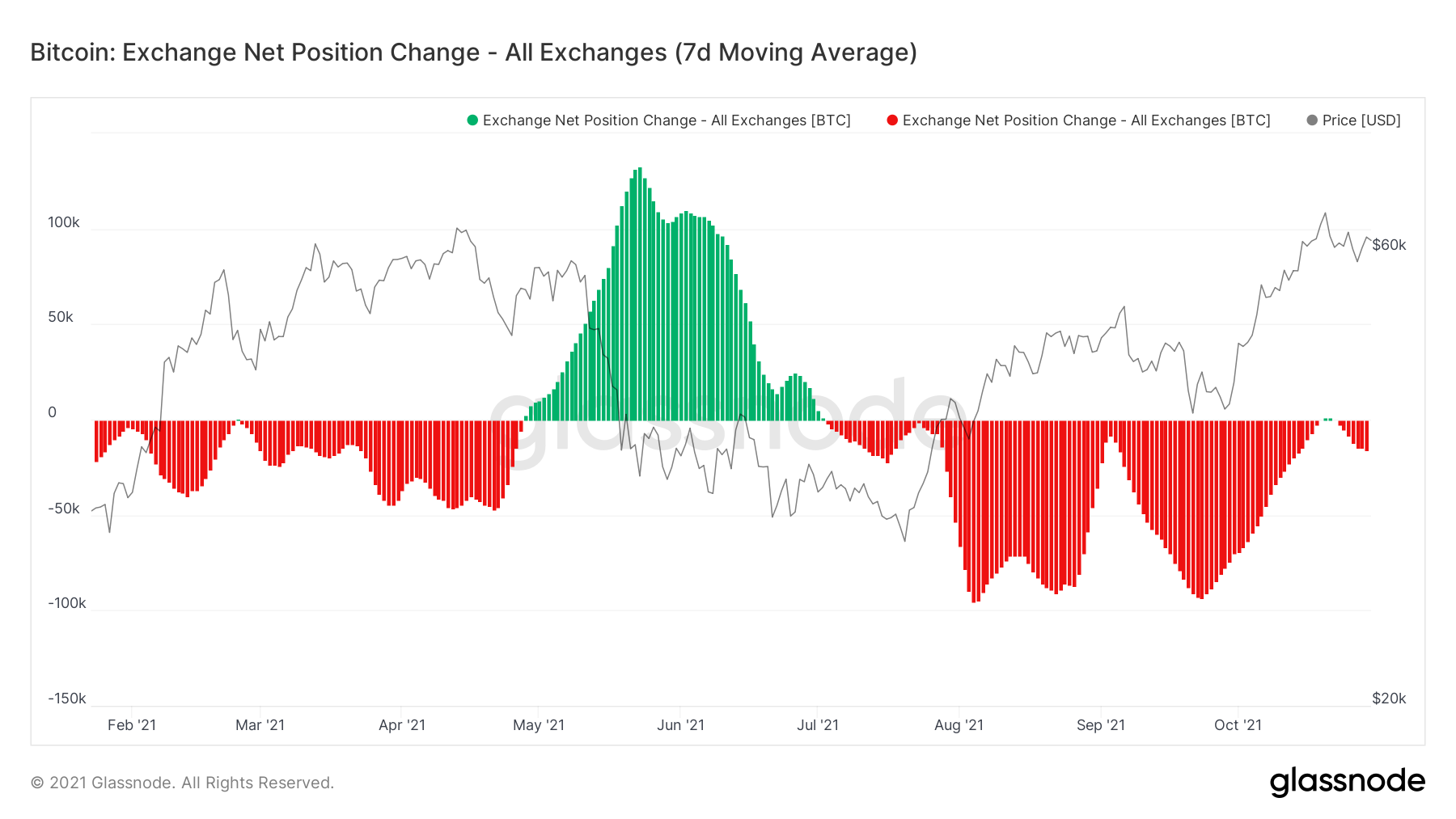

Exchange Net Position Change

We can see from the Exchange Net Position Change for Bitcoin that since the drop down to $30,000, there’s been continuous accumulation shown by the red spikes on the graph.

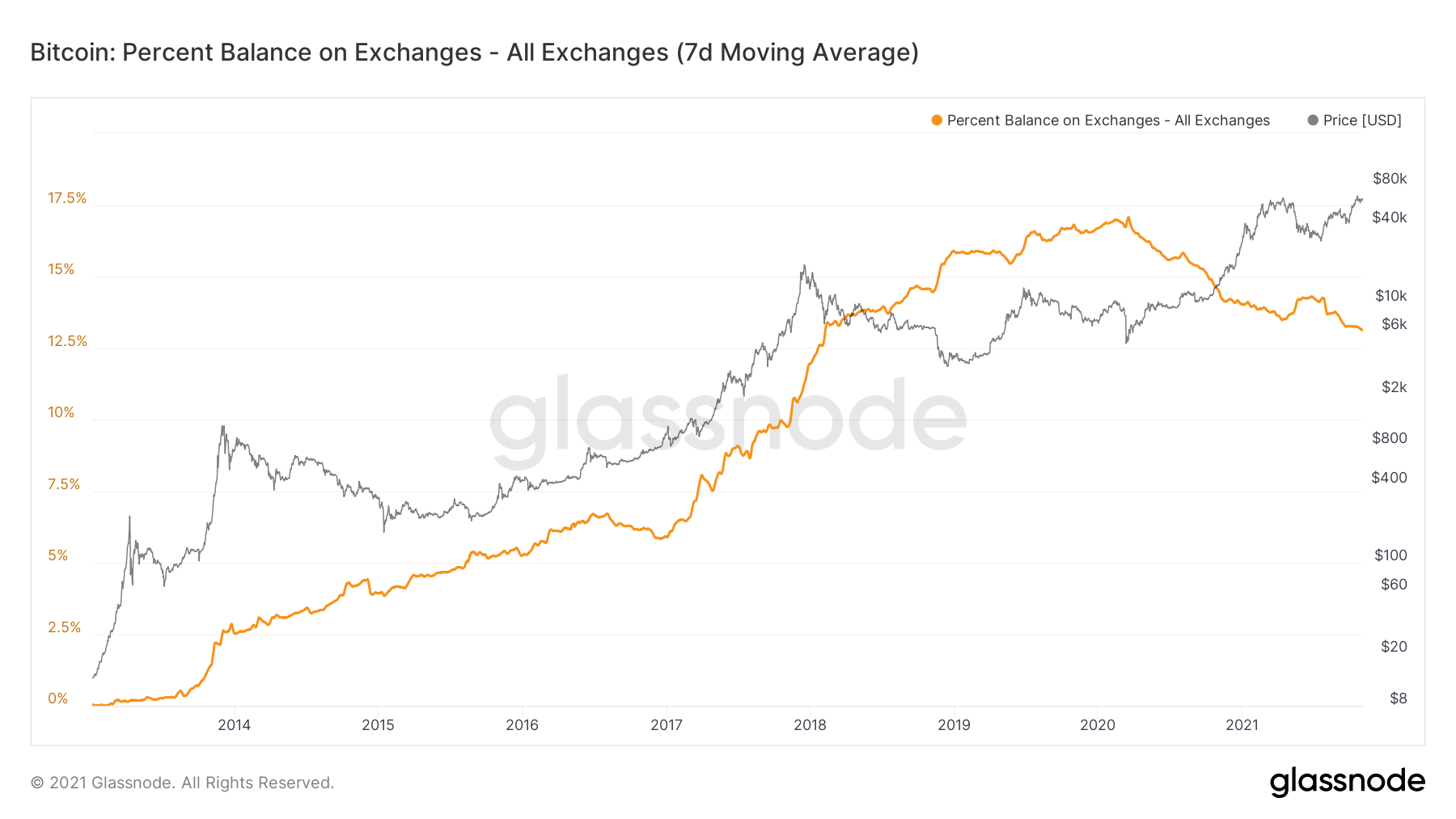

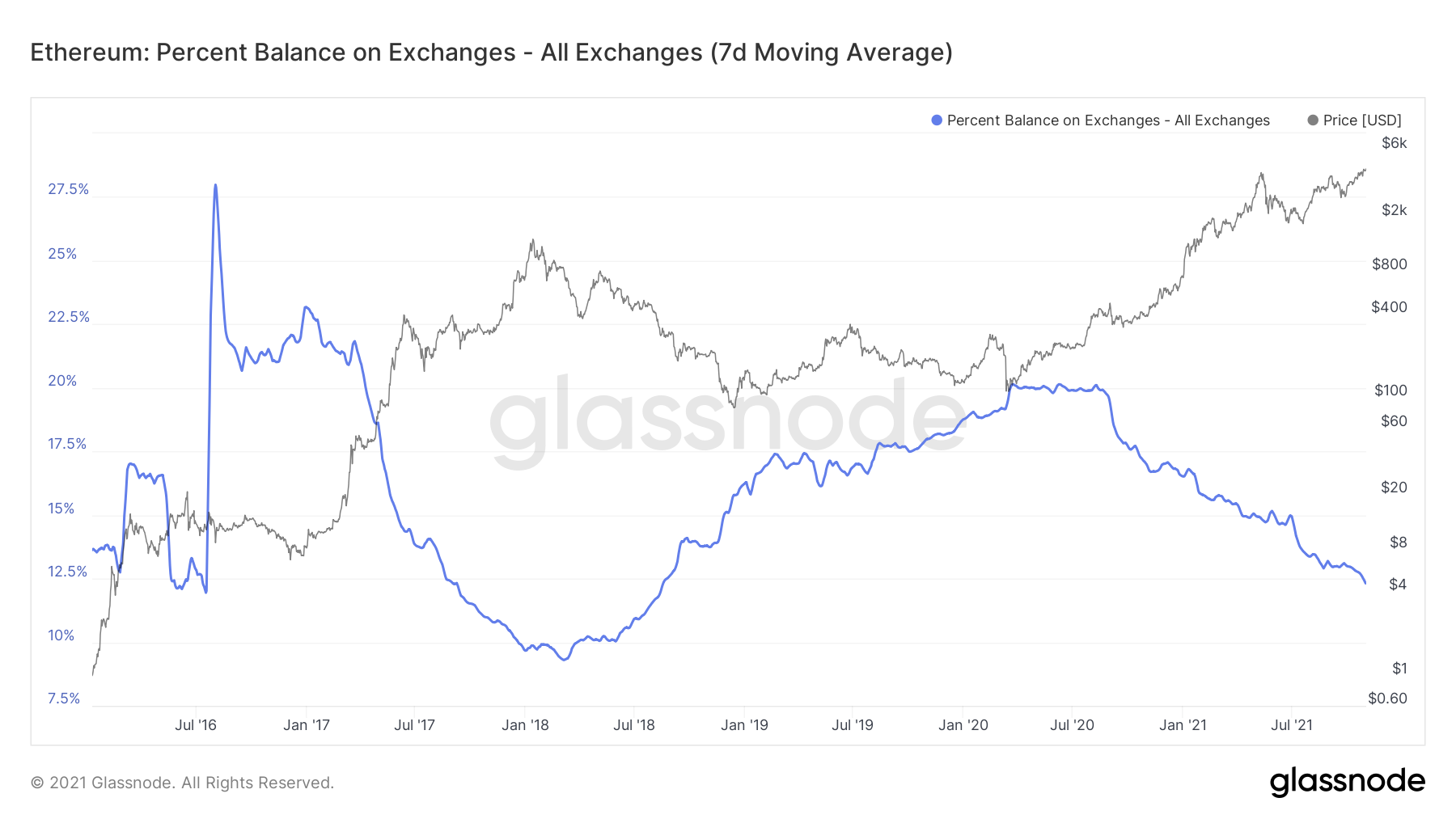

Exchange Balance (%)

The Exchange Balance for Bitcoin has been uptrending for the strong majority of its existence. That trend only changed in March 2020 as more supply was getting bought up and taken off exchanges.This shows an overall willingness amongst investors to accumulate Bitcoin, hence we are seeing less and less of the circulating supply being available for purchase. If the Exchange Balance begins to uptrend, this may be an indication to analysts that the Bull market may be coming to an end.

If we look at the Exchange Balance for Ether, we can see that again, it paints a different picture. In Bull markets, Ether is accumulated by investors and the amount of circulating supply that is on Exchanges is down trending. In Bear markets, circulating supply of Ether on Exchanges is increasing (up trending).

Currently, the circulating supply of Ether on Exchanges is down trending – a bullish sign.

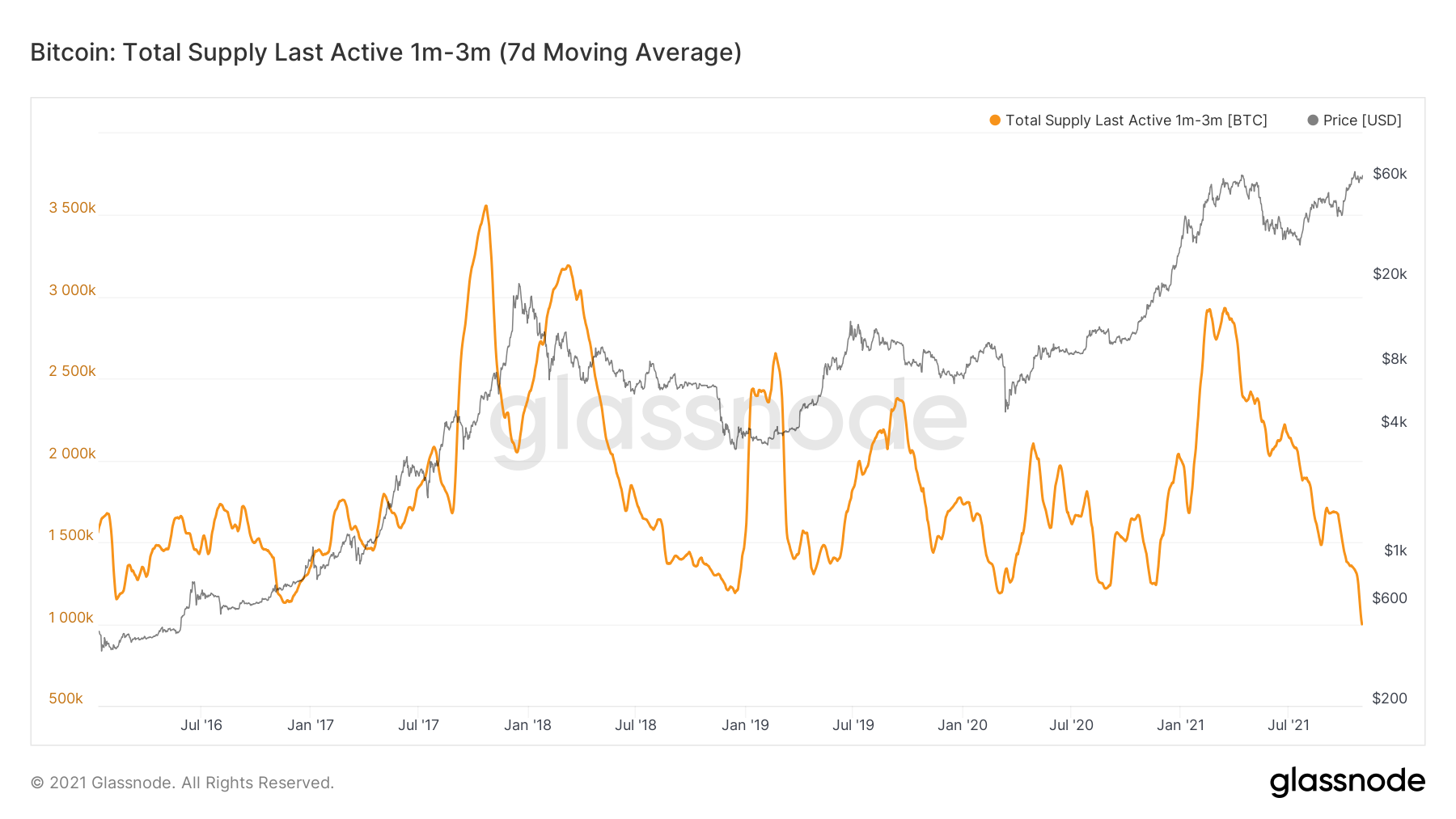

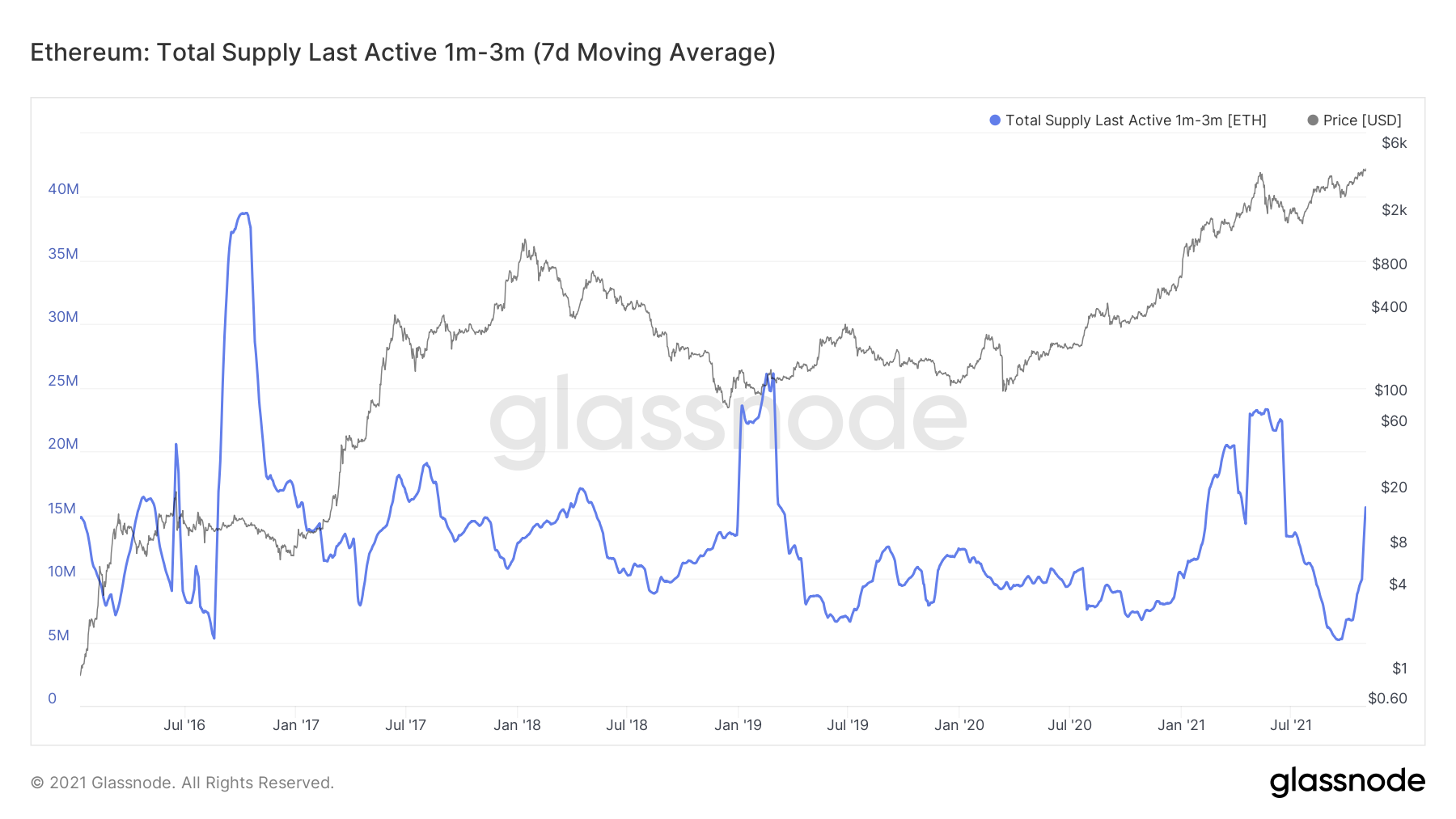

Lifespan; 1-3 Month Old BTC/ETH

If we look into the shorter-term cohorts for Bitcoins (coins Aged between 1 – 3 Months), we can see an extreme willingness amongst investors to hold onto their Coins (shown by the down trending Orange line). The reasoning for this may be that Bitcoin has just reached new All-Time-Highs, and after the pullback, investors expect higher prices to sell their Bitcoin/Ether into.

For Ether (Coins Aged between 1 – 3 Months) we can see that there was a real willingness to move Ether, hence we see the significant spike. This may be due to some investors booking profits, or it may be due to investors wanting to deposit their Ether to the ETH2 Deposit Contract for example.

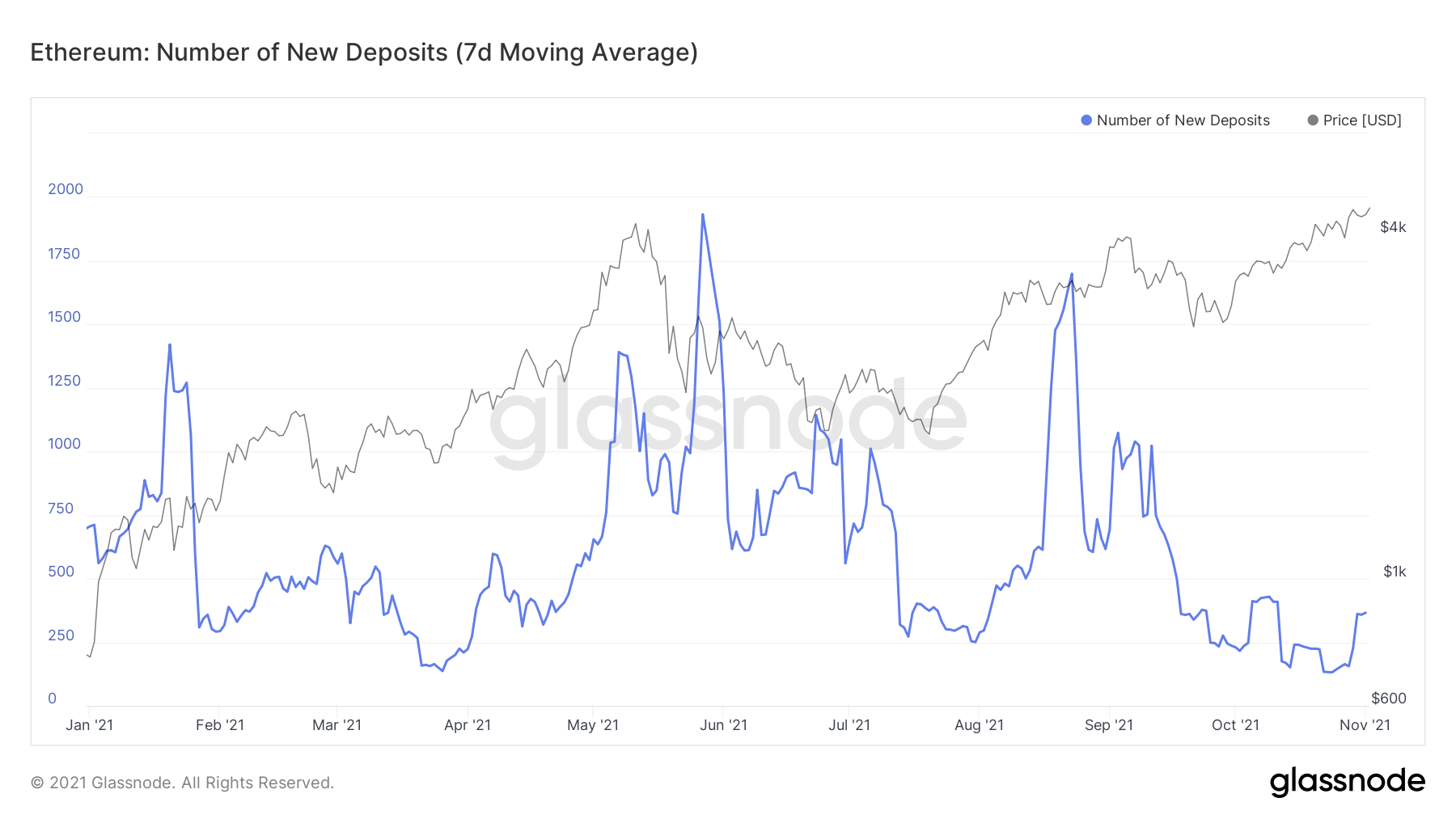

If we look into this below, we can see that recently, there was a slight spike in ETH2 Deposit Contract – New Deposits. This may be the explanation for the significant movement of Ether we have seen but yet we have still seen more Ether leaving Exchanges than flowing into them (as shown in the Exchange Net Position Change) so the movement may be counteracted by the longer lifespan addresses.

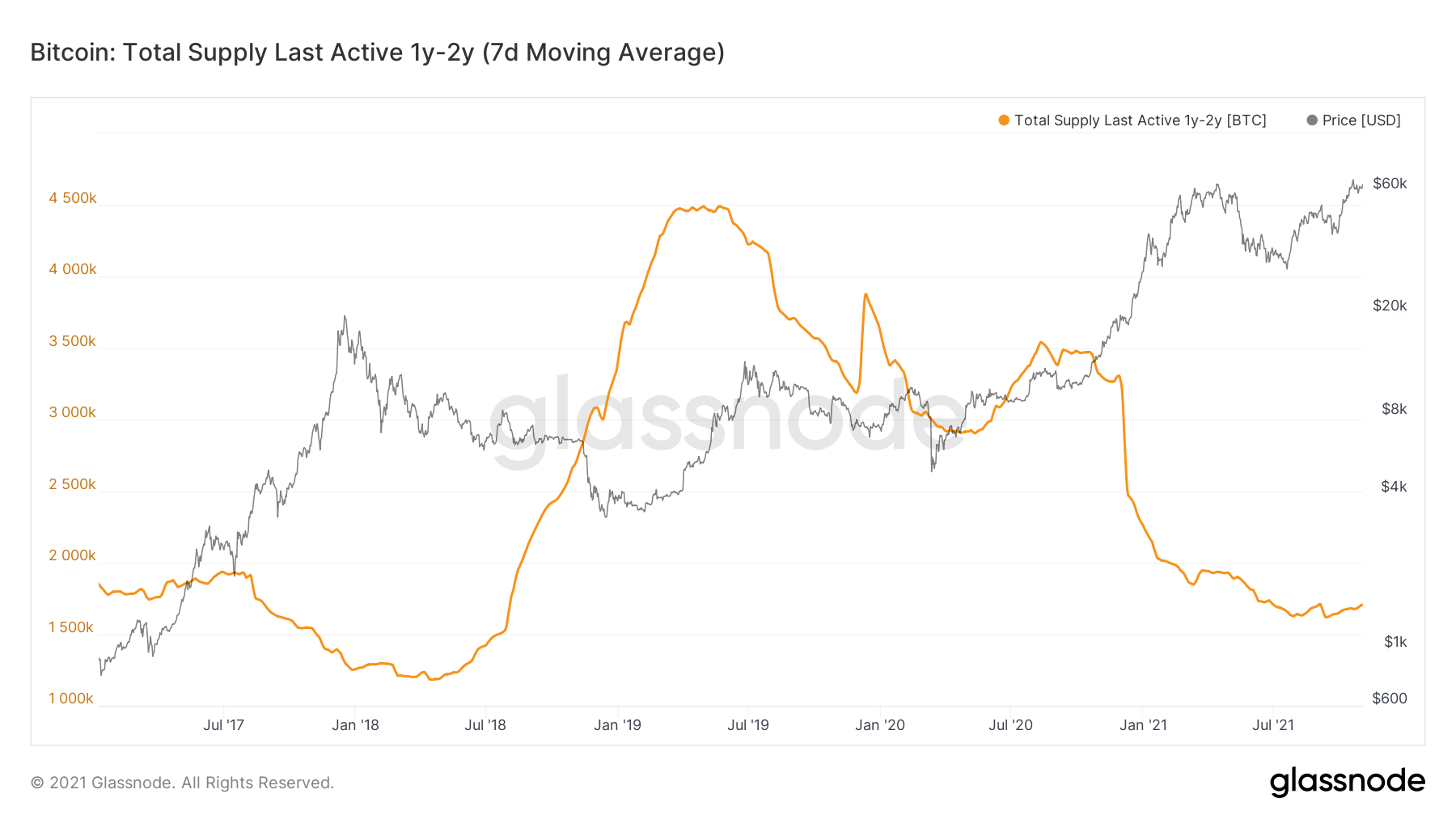

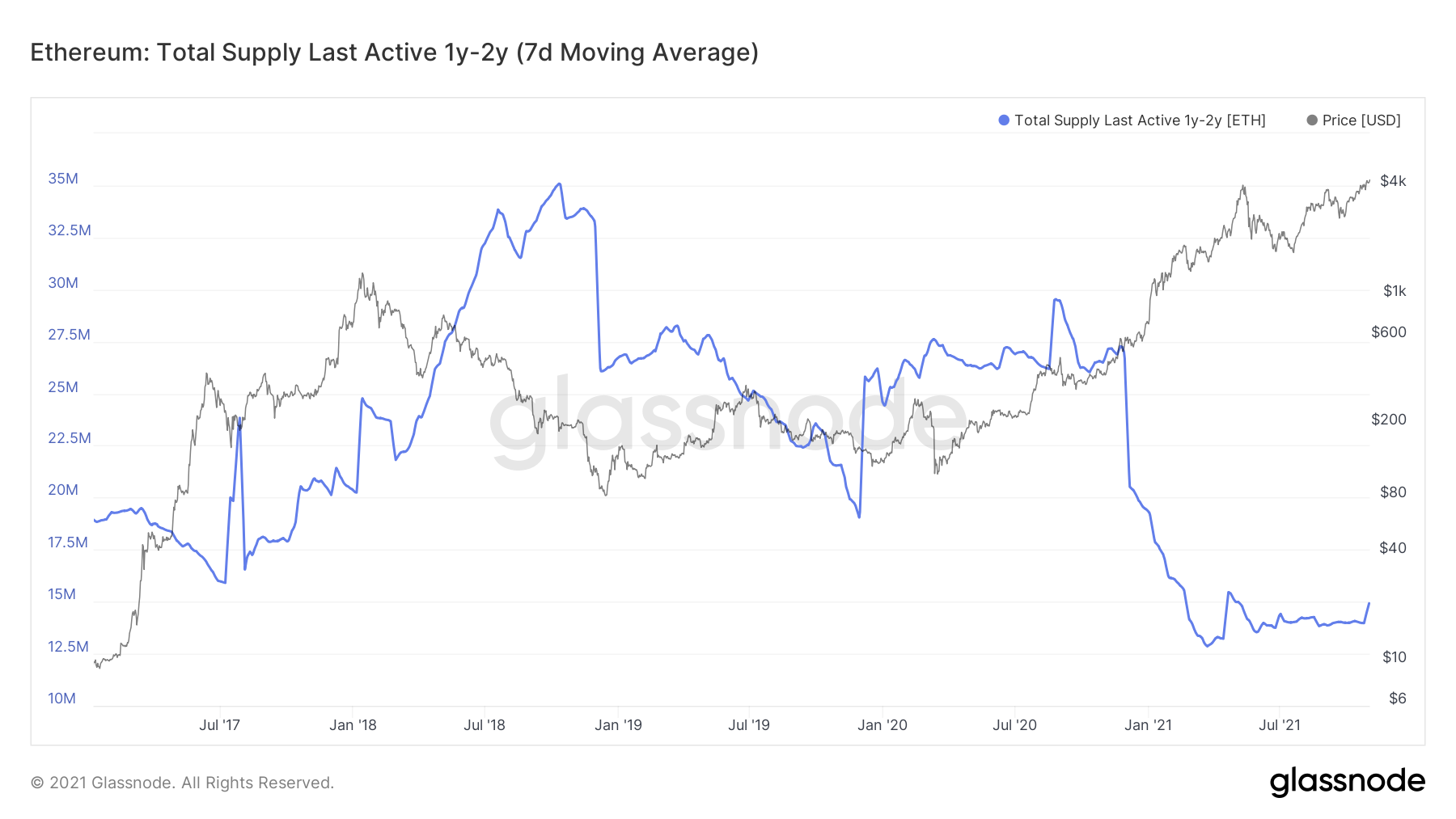

Lifespan; 1–2-Year-Old Bitcoin/Ether

If we now look into the older cohort of Bitcoins, we can see that at the All-Time-Highs, there was very small selling that can honestly be discounted given its size.While still in a downtrend, we’re seeing a deceleration here. If the orange line starts outright uptrending then we’ll have to see whether it is the market being overextended or capital being rotated elsewhere.

For Ether, we can see that the Blue line has been ever so slightly up trending and has now begun to turn upwards. This shows a willingness amongst the older cohorts to become more active with their Ether into new All-Time-Highs, either through profit-booking, staking, moving onto other chains or diving into DeFi.

As we have highlighted already, most likely to deposit their Ether to the ETH2 Deposit Contract, as ETH was accumulated into the new all-time highs, not sold into.

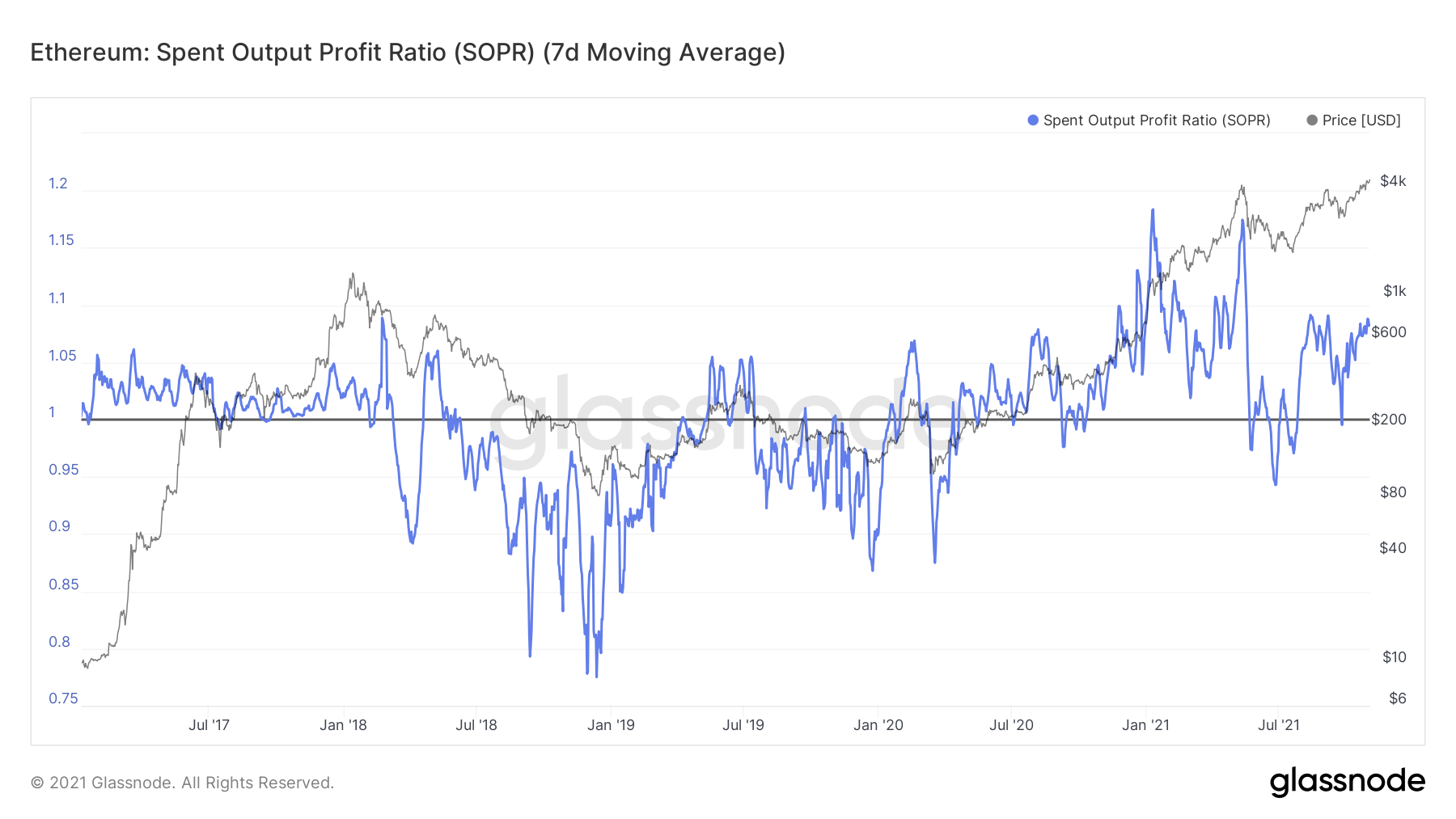

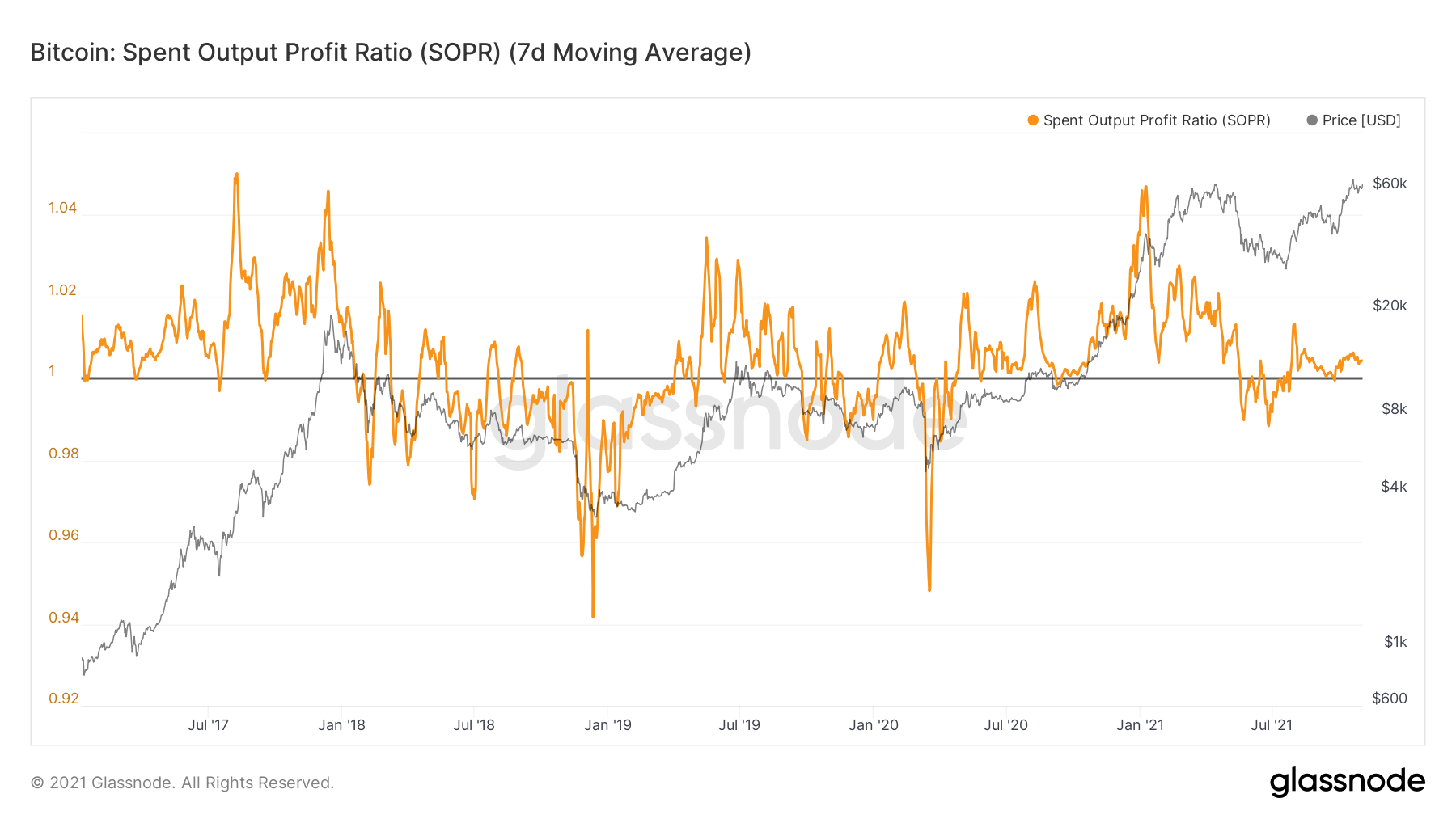

SOPR

The SOPR allows analysts to see if the overall market is in a profit relative to its cost basis i.e. are UTXO’s valued higher than what was paid for them?We can see with Bitcoin that the SOPR bounced well off of “1” line. This shows a willingness amongst investors to hold their Bitcoin and to not sell into losses. Considering the ATH was broken just over a week ago, profit taking has been relatively low, and it looks similar to that of an early bull run.

If we look into the SOPR of Ether we see that the graph is very similar to that of Bitcoin, just more exaggerated. This shows great health for the overall market and indicates that investors are happy to hold their Bitcoin/Ether and wait for higher prices.